Santa Monica and the condo alternative tiny home: The real estate spin machine is out in full force.

There is little arguing that Santa Monica is prime Westside real estate. Some would like to believe that somehow Pacoima, Compton, or Lawndale are somehow new prime markets but there is little dispute that Santa Monica is fairly elite when it comes to SoCal housing. I enjoy Santa Monica and given prices in the market, I’m sure many feel the same way. But for those not in the area, they might find real estate prices downright insane in this niche market of California. California has an affair with boom and bust cycles when it pertains to real estate. We’ve had a nice run and now the euphoria is wearing off. I’ve noticed though that in Santa Monica and Pasadena, I’m seeing the term “condo alternative†popping up more often. Usually the condo alternative title is used on an ultra-tiny property with an ultra-high price. Tiny flips are easier to rehab and turn around simply because of the size of the property. There is only so much you can do with a place the size of a dorm room. Let us take a look at a condo alternative in Santa Monica.

Not a big home, not a condo, a condo alternative

Leave it to SoCal to put a spin on everything. I think people have forgotten that mortgages like the option ARM were forged in SoCal spin machine. It was anything but an option and more like a ticking financial time bomb that played into the 7 million completed foreclosures since 2005. Let us move along and ignore those people and focus on the new get rich trend.

I found this property to be a typical hot market HGTV inspired box:

1319 Chelsea Ave, Santa Monica, CA 90404

2 beds, 1 bath, 720 square feet

I love how the spin starts from the first line:

“Great condo alternative! Charming 1929 cottage with modern renovations on lovely tree-lined street??..all in the heart of Santa Monica!â€

Condo alternative? This tiny 720 square foot place was built in 1929 when the Great Depression was being born. Modern renovations simply means you are not heating your home with coal or drinking water out of rusty pipes. You better hope you have modern renovations.

This place has also fallen into the rental property market based on the history here:

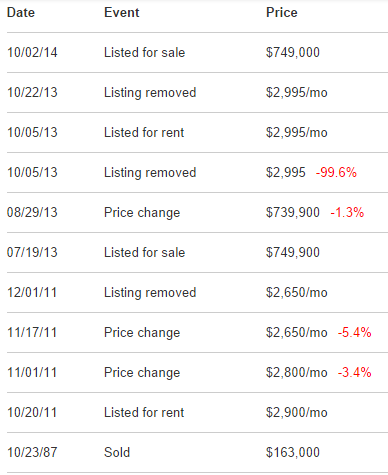

It looks like it may have been rented at $2,995 in October of 2013. Makes sense, one year later, that folks are moving out. This is one of those things that amateur landlords don’t account for. People take off. I would imagine that those able to qualify for a $3,000 a month rental actually have the financial flexibility to pick up and leave.

It looks like they tried to sell in 2013 for $749,900 and then dropped it to $739,900. No cigar. They are giving it another go at $749,000 again.

You’ll also notice if you go back that they tried to get $2,900 in rent in October of 2011. It appears that they had to drop the rent down to $2,650 before it was rented in December. Rental markets heavily depend on the economy and it is naïve to think that we are recession proof. Just look at recent history and you’ll see many economic dips and booms (i.e., Great Recession, tech bubble, early 1990s, etc).

The condo alternative is targeting the young professional couples looking to act like the big players but not rich enough to crack into the million dollar market. I think many younger Californians are tech savvy and realize how insane some of these prices are and some realize they are in employment sectors that burn brightly for a short duration and may then fizzle out. You see this in San Francisco as well. There does seem to be a good amount of people opting to rent with solid incomes.

So is this condo alternative worth $749,000? From a rental perspective for an investor, absolutely not. So it should be obvious why investors are largely pulling away from California. A flip? You can see what happens when markets stall. Maybe a condo alternative is exactly what you are looking for. Plus, you also get a nice red front door. That certainly makes it worth it.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Santa Monica and the condo alternative tiny home: The real estate spin machine is out in full force.”

I’ve walked by that house many times. I saw it for sale last year, considered it, but decided it was too little house for too much money.

It’s only technically on a tree-lined street. Yes, the street has trees. But “tree-lined” conjures images of a lush, verdant, slow-paced, QUIET neighborhood.

Instead, that house is in mid-city, a half block north of busy Santa Monica Blvd. A half block from a laundromat, tavern, and strip mall. And the house faces a parking lot and school playground. Lots of noisy adolescents screaming and playing hoops all day long.

Of course, some parents may like that, provided the school is good. I don’t know if it is. It’s also a block and a half from St. John’s Hospital, for those fearful of having a medical emergency.

There’s NO GARAGE. As the description says, the garage was converted (without a permit) into another room. Is that included in the 720 square feet? If so, if you should reconvert the room into a garage, you’d have even less living space.

I’ve seen an SUV parked in the driveway. But the driveway wasn’t long enough, so the SUV blocked the sidewalk. Is that risking a ticket?

I saw the current residents entering the house — a young couple with a large dog. Or maybe one was a guest?

If you look at Google Street View, the house has a Dark Grey Door, though it’s had a Bright Red Door since last year, when it was first listed for sale. Apparently, the Red Door didn’t help sell it.

Red doors are VERY ‘Chinese’ — as exactly that tone of Red is considered to confer life. (Think new-borns/ long life)

Whereas, Gold is considered to confer good luck/ wealth.

These two get entirely over done in the Forbidden City, becoming garish in the process.

Obviously the metric that counts is the lot — and its zoning.

Based upon your information, this puppy is zoned already for something much bigger. It would seem that any developer would also have to have adjoining plots.

The general public/ small property owners usually believe that a developer can sweep down from above and buy up such plots — at will — to craft a viable higher use property that justifies their own selling price.

This is a fantasy. My old billionaire real estate magnate was NEVER able to aggregate small plots. Surprisingly, the hang-up is not the money. The killer is that the various owners have their own schemes and time-lines. They, invariably, move their expectations to the Moon when they believe that they’re holding a critical piece of the puzzle. But, they never are. The deal collapses, instead.

Once the aggregation is abandoned, their price expectations go right back to where they were all along.

The general public just can’t wrap their minds around the fact that there are gazillion other properties on the market. No aggregator can self-justify turning this or that plot into a Lotto payout.

Such schemes do make for great fiction writing. Famously, in “Chinatown” the evil villain is able to dummy purchase staggering tracts of farmland without ANYONE getting wise. As IF! No scheme could be more absurd. Every real estate agent ever born tracks such transactions, so too, every banker/ loan officer.

And it’s as common as dust for real estate agencies to monitor the tax plots — open records, every one, — ALL the time. Using dummy fronts just doesn’t ever work. All that matters is the turn-over and the tempo. The names don’t even count.

@ blert. Red doors are VERY ‘Chinese’ — as exactly that tone of Red is considered to confer life. (Think new-borns/ long life) [..]The general public/ small property owners usually believe that a developer can sweep down from above and buy up such plots — at will — to craft a viable higher use property that justifies their own selling price.

They, invariably, move their expectations to the Moon when they believe that they’re holding a critical piece of the puzzle. But, they never are. The deal collapses, instead.

[..]Once the aggregation is abandoned, their price expectations go right back to where they were all along. The general public just can’t wrap their minds around the fact that there are gazillion other properties on the market. No aggregator can self-justify turning this or that plot into a Lotto payout.

_____

Hi blert – I didn’t understand all of your main post, but good stuff above. Good call on the red… you may be on to something there. There was a HSBC commercial on English TV, in 2012 about ‘red’ often being considered lucky in the Chinese community, and no doubt other combinations of symbolism such as life etc. The word ‘garish’ was also in my mind when looking at that door…

http://www.youtube.com/watch?v=cT8L1Gms07Y

Complacency is the word I use, for how so many Vested Interest think the ever higher inflated values are locked in, together with all their reasons why they think it’s only ever higher prices in the future. It’s what drives prices so high before they crash.

Then again, Disney did acquire the land for Disney world in Florida.

Martin

Disney did not aggregate small plots to do so.

They aggregated major parcels… and in a pretty undeveloped stretch of country.

IIRC, Disney had to get some of the land re-zoned, to boot.

The parcel at issue is almost certainly zoned for commercial use — based upon what’s across the street and to its left and right.

Strangely, that status makes it untouchable/ unworkable for any developer: It’s too small on its own, up-zoning is out of the question, school proximity eliminates many possibilities, … the sins are endless.

The lesson remains: retail SFH lots are ruined for developers 97% of the time. The exceptions are those which are large enough and old enough and close enough to downtown.

Converting a house into a boutique business — like digs for an attorney or accountant — does not qualify as redevelopment… just re-purposing.

The property cited is an ideal example of insane pricing, as no-one can get any utility out by usage, and the market has run out of greater fools.

Perhaps you remember the “Santa Monica Distress Monitor†which ceased when the blogger bought in Culver City in late 2011 — which was about the same time other RE bloggers in New Jersey, Portland (OR), San Diego, and Seattle were also finally buying. Thanks, Doctor Housing Bubble, for continuing to be here as a forum for all things housing. Here are some takeaways for me:

*When you learn of bearish bloggers buying, don’t wait hoping for even more price decreases. Take the plunge if you can — don’t wait any longer for the ultimate bargain.

*I was spreading the mantra that you should focus on neighborhoods you like, and buy a home when you see inventory decreasing AND prices increasing for about six months or so. You then will not be buying at the bottom, but at least you’ll know that things are probably not going any lower for some time.

By the time this set of circumstances arose in the Spring of 2012 and I was ready to take the plunge, the inventory was so low and the prices had risen so much, that I could not compete with the new world of cash buyers. I’m comfortable in my rent-stabilized apartment, but I sometimes have these woulda’coulda’shoulda’ moments when I remember such places as:

1514 Maple, 2/1/, 935 sqft home, 6,300 sqft lot

Sold 9/23/11, $675,000

1037 Hill, 3/1, 1,286 sqft home, 3,000 sqft lot (at busy corner with 11th but still livable).

Sold 2/10/12, $600,000

Even if prices go down again, I don’t expect we’ll ever see these $600K type prices in Santa Monica again. And, when the prices do drop, rest assured that the “ALL CASH†crowd will rear its head again.

That’s probably why they added the question marks – “lovely tree-lined street??”

Truth in advertising, right there.

S.M has a pervasive smell of rot like a garbage dump. Would not live there even if half off.

“There is little arguing that Santa Monica is prime Westside real estate.”

Sigh, of course there will be arguments. This is the LA hater board, after all.

Condo alternative? Check out the “mini compound” on 514 Idaho Ave. that sits on an expansive, uh, 3,000 square feet. That’s the lot, not the mini compound’s square footage. Apparently it just went into multiple offers so expect it to go for more than asking.

Condo alternative? LOL. Those crazy priced shacks.

Last year I paid for my heart-broken* sister.. who works/lives in London England, (*relationship breakup – her fiancee didn’t want to be tied down.. gave up humble dreams of buying a house together, and has since become a property-investor since at silly price, expecting his investments to treble in value when he retired) to go on a vacation/holiday, with her best friend, to the US, where they spent 7 days in Santa Monica. I arranged their SM stay, finding them a micro apartment/studio to save a bit of money.

‘We receive international visitors from UK, Europe, Russia, Canada and Australia.’

1411 7th Street 90401 ‘Biella’

(Hmm I can no longer find any Listings for this short-stay property – maybe the owner, who bought it in 2009, has smartly sold up into the bubble.)

Pic taken on the day they were checking-out, after their 7 days in SM.

Face obscured for sister’s friend’s privacy reasons only.

http://oi62.tinypic.com/smy1c6.jpg

Regardless of what you may read in the newspapers, there is massive Vested Interest wealth in Europe/UK and elsewhere. Who would have realized a painfully bubbled out London would now see house prices/apartments go up another 25%-30% in value since 2007. Even doubling in prime London since 2007. Global trillions of QE, ‘It’s not earning anything in the bank’ – everyone rich on paper, but no one has any money.

We also need reality to hit some very complacent non-US older Vested Interests who have done very well out of decades of house price inflation, and reflation.. many of who have doubled down into real estate in recent stimulus years at crazy prices. Margin calls, end of easy money.. some will be forced to sell, including perhaps their US prime investments bought at topped out prices in the hunt for yield/capital appreciation. The only thing in real short supply, is cash money/savings, but so few people realise it. Fire in the hole, real estate is going down in prime markets.

Sorry to repost but the information is not really getting out anywhere else and the analysis is so pertinent. I posted the following on the last thread toward the end—-

—-

http://mhanson.com/archives/1674

Have any of you read Mark Hanson’s latest blog post? This guy has been in the industry for decades and was way out in front on the last major turnover in housing. You might remember him from the Mr Mortgage videos on YouTube. Really compelling stuff at that link.

—-

There was a comment which interpreted Mark’s analysis of a 10% to 20% decrease to mean a drop to 2012/2013 prices in Los Angeles. In the interest of clarity, I think that’s oversimplifying and concluding something from the message that’s not necessarily present.

Mark predicts a 10% to 20% loss for organic prices and that they are already down. He qualifies in other areas of the post what he means by organic and how the publicized headline numbers aren’t currently reflective of those decreases. He also claims that he thinks the drop will be more at the high end. He doesn’t define what high end is.

It’s not certain that we can so easily surmise a return to 2013 or 2012 prices in any particular region based on Mark’s analysis. He doesn’t make that specific claim and his guidance on this topic is fairly general, as it should be.

Furthermore, the word crash seems to be bandied about around here by some with differing perspectives quite often. Mark addresses that—-

—-

“Remember, house demand and prices didn’t crash at Peak-Housing 2007, they simply re-attached to what end-user employment, income, and mortgage credit could support when all of the exotic credit went away. The same thing is happening at this Peak Housing event, as new-era all-cash spec-vestors and foreigners go away.”

—-

We last got a taste of what end-user employment/income support is like back in 2009 just before the tax-credit program. With some markets being distorted by stimulus over the past couple of years, who knows what end-user employment/income would support? If we look at it objectively, the emotionally charged word of crash has no helpful place in the discussion.

Dan,

Thanks for posting this. I caught the tail end of him on CNBC in the last week but had to leave for work and didn’t see his piece on video on their website later as they usually do. I thought his commentary was spot on with regard to investor impact on housing and the expected result of their departure.

Oh crap … I would of loved telling my friends,”we live in Santa Monica” (it sounds so sexy) but out of my league price wise.

Just for completeness, at the time of booking, I saved an archived page of that rental listing, and have uploaded it to some spare webspace.. FYI. Info/pics of everything, including same red sofa/couch.

http://www.casino.ms11.net/Santa Monica Vacation Rental – 1 BR Luxury Apt. Downtown Santa Monica – Walk Everywhere!.htm

Oops: link not working.. maybe this, final attempt.

http://www.casino.ms11.net/Santa%20Monica%20Vacation%20Rental%20-%201%20BR%20Luxury%20Apt.%20Downtown%20Santa%20Monica%20-%20Walk%20Everywhere!.htm

Sorry Doc; you don’t have to authorize those entries I made with broken links.

Just to prove I am not making it up, here’s at least one pic from the listing, via google cache (please work!!):

http://webcache.googleusercontent.com/search?q=cache:-tsyoNX-hVYJ:www.vrbo.com/421051/reviews/write+&cd=2&hl=en&ct=clnk&gl

That rent is way too high. We rented in Santa Monica a 3 bedroom 1 bath home for $3,400/month and rents have not gone up. In that area anything over $2,400/month is insane. At that square footage people would be nuts. Also looking at the ratio of price to rent, which is what we did, why would anyone buy?

For the record Santa Monica really is a wonderful place to live with excellent air quality and public transit. The things that drove us out of CA had more to do with the high taxes and nutty politics than anything else. The Insane cost of living was too much as well. In order to make enough to afford those rents the amount paid in taxes is criminal. My husband makes less than half of what he did in CA and we have a very nice home in a neighborhood similar to Santa Monica paid for with cash. The weather is just not worth it to us.

We are high tech, but I am seeing tons of film industry moving here. CA seems to forget it competes with other states.

Liz- your post is almost exactly, word for word, why my wife and I will be leaving Santa Monica. I am a programmer in the high tech industry but we are in the same situation as you- the sacrifices to quality of life and the ridiculously high rents here in Cali just aren’t worth it to us anymore.

This is what you can buy up north in the dry part of Washington, in the wine country:

http://www.wallawallarealestate.com/residential/404coyoteridge/404coyoteridge.html

And we are talking about a brand new house in one of the most expensive developments with view to die for and very mild winters

Just curious where do you live now? That sounds like a great move. I have done some travelling and have found many great alternatives to CA myself.

not many other states have beachfront property facing west

I’m a rental property owner, very hands-on in terms of management and am in my second decade of this business. I’m quite familiar with west side rent prices and trends. None of those rent listings made any sense to me given the limited details, so I’m inclined to not believe this property has ever rented for anywhere near $3,000/mo. We don’t know if and when the property was rented and we also do not know the terms of the rental agreement (which includes price) because (short of the owner chiming in) there is no centralized source for such data. Many times I wish there were so I could better size up my competition. Of course it could work against me as well. This is one of the areas where the SFH rental business is way behind the technology curve. We’re simply left with our specific knowledge based on experience and word of mouth. That’s mostly why official indexes of asking rents are to be taken with a few grains of salt.

As for Santa Monica, I find it peculiar that you stated air quality as a positive attribute. Just this morning I was driving northbound on Highland/Vista del Mar in the South Bay and visibility was decent but there was an ominous looking smog blanket that just perfectly held stagnant in the horizon in the distance around the Santa Monica mountains wrapping down toward the South Bay. It’s hard to describe it but I now wish I would have pulled over to take a picture. It really was a stark visual of just how bad the air quality is. Frankly, I don’t see how anyone could attribute good air quality to any part of the region unless Shanghai sets the bar.

You forgot to say it has a 1651 sf lot. There’s no way to make this property anything but a cramped little nightmare.

what is a 1651 sf lot?

Holy crap shack !

My GARAGE is 300 sq.ft. bigger than this house and my entire new energy-star home cost less than half the price of this ‘ charming cottage ‘ . Please tell me the faucets are gold plated and you are steps from the beach for 3/4 million !

So what do you think is next for so many of the Tiny Old Houses in the Westside?

The land is worth more than the house?

Is it time for re-Zoning?

we may be looking at an new polymorphic form of gentrification

Housing To Tank Hard in 2014!!!

All metrics have Tanked! Price to follow soon!

I agree with your logic Jim, but pricing is like water, it is going to run wherever it wants to.

“… pricing is like water, it is going to run wherever it wants to.”

Totally retarded comment. Water doesn’t run anywhere but where topography, gravity, etc. drive it. So in this case your first statement is correct in that prices ARE like water in that the ancillary factors of interest rates, availiability of credit, incomes, psychology, macroeconomic factors, etc. will drive prices much as physics drives water.

Most here will empirically argue that they will be driven down over the next few years by these factors.

….EXACTLY CORRECT ….

This spike in escalating home prices was due to temporary lack of inventory,

but the prices and sales are declining slowly.

Once the reductions TAKE HOLD .. the price reductions will escalate …. WHY?????

Because the REAL ESTATE SALES PEOPLE (Agents/Brokers)

MUST MAKE A LIVING .. THEY WILL TELL THE SELLERS ANYTHING …

†Sorry — I can’t get you Top Dollar for your house… Sales are DECLININGâ€

What the R.E. Agent/Broker is really saying is :

†I really need to SELL SOMETHING, I have bills to pay and I need to make

a quick sale on your p.o.s. House — I need my money FIRST … You can take

your FANTASY PROFIT that we promised you when you signed the Listing Agreement

and just “eat your heart out†….. TOUGH LUCK FOR YOU…. I NEED MY COMMISSION,

IT’S TIME TO DISCOUNT YOUR damn PROPERTYâ€.

*** AND THAT IS EXACTLY HOW THIS WILL PLAY OUT.****

Just go back and take a look at 1991 to 1996 California R.E. Statistics,

I lived through it and bought a house at 75% discount. I saw how

desperate and hungry the Agents and Brokers were — THEY ONLY CARED

ABOUT THEIR COMMISSION….. REALITY RETURNS TO US AGAIN.

@Paul.

It will be good if Realtors begin hardening their attitude towards sellers. Realtors have forgotten how to be hard. They need their commission, and better to sell a few houses a month at lower prices, than low volume zero-one-or two a month. “If you want to list it with us, you will have to lower your asking price by $150,000”. That sort of attitude is required.

I wonder what that was like, when you were perfectly placed to buy at value back sometime in 91+ into recession. You must have felt good for yourself and family, vs all the others who had paid silly high prices in the boom-bubble years just before it.

Sometimes my hope is tested.. sometimes lose focus and can’t actually see that moment where I (brothers and sisters) buy a house. Partly because of repeatedly seeing VI rig the market with ZIRP, QE, loan-modifications, moratoriums and so on. If I knew free markets would be so bent, I would have bought over 10 years ago.

However I agree with you, realtors need to sell, banks will want to lend eventually because that is where the immense profits are, and they are in a much better financial reserve position to lend against future crashed prime real estate. All those individuals who think they have high equity in prime, or own outright, at silly high values.. that’s no use to the banks. The banks will want fresh debt against prime homes. Banks are not there to smile and be happy for outright owners/equity rich owners, and congratulate such owners for their house prices gains.

Brain,

Nihilist below does not agree with you that banks want/need lower prices on houses. Actually they proved many times that they want exactly the opposite. Sometimes it doesn’t work the way they want and they come up with a different trick because they have the power and own the government (both parties).

You have a totally opposite view than Nihilist, but I tend to agree with Nihilist based on my observations so far (how banks acted).

To: Brain Of England

Q: “I wonder what that was like, when you were perfectly placed to buy at value back sometime in 91+ into recession. You must have felt good for yourself and family, vs all the others who had paid silly high prices in the boom-bubble years just before it.”

A: I had NO idea what I was doing. I was young (34), naive and believed whatever the R.E. Broker told me, since it was my first home purchase. All I knew was that I bought a 2500 sq.ft. in the foothills for $230-K and “it had to be worth more than that.” For awhile, it was a Money Pit, but I corrected all the defects. Despite all the repair costs – the market value grew “reasonably”, and NOT because of speculation.

It will fetch almost $1-million from some poor desperate “sucker” – HOWEVER this old house is not for sale.

WORD OF WISDOM: BE SKEPTICAL OF ALL R.E. Agents/Brokers/Escrow/Loan “people”. These people are NOT DOING YOU ANY FAVORS… NEVER WILL EVER.

They WANT TO GET “PAID” … SIMPLE AS THAT.

” BUYER BEWARE” —

– DO YOUR RESEARCH … You will ALWAYS Find ANOTHER DEAL…. (fact of life)

I heard an interesting explanation once for why toddlers resist being potty trained. All their lives, living in a wet diaper is all they’ve ever known. They’ve gotten used to it so it’s their ‘normal’. I think many of the buyers for places like this only remember prices getting higher and can’t imagine things any other way. If you want to buy in CA, this is just the way things are. It might not be comfortable – it’s just ‘normal’.

Toddlers LOVE having their butts wiped by mom.

That’s it.

The typical mother fails to comprehend that getting fresh diapers is the high point of any toddler’s day.

Rude and cruel mothers potty-train their rug rats in no time flat.

Tender, loving mothers have a heck of a time.

,,,correction … It has only been a few years since the Economy collapsed.

MOST PEOPLE do NOT have the money to purchase any home and not anywhere .

This spike in escalating home prices was due to lack of inventory,

but the prices and sales are declining slowly.

Once the reductions TAKE HOLD .. the price reductions will escalate …. WHY?????

Because the REAL ESTATE SALES PEOPLE (Agents/Brokers)

MUST MAKE A LIVING .. THEY WILL TELL THE SELLERS ANYTHING …

” Sorry — I can’t get you Top Dollar for your house… Sales are DECLINING”

What the R.E. Agent/Broker is really saying is :

” I really need to SELL SOMETHING, I have bills to pay and I need to make

a quick sale on your p.o.s. House — I need my money FIRST … You can take

your FANTASY PROFIT that we promised you when you signed the Listing Agreement

and just “eat your heart out” ….. TOUGH LUCK FOR YOU…. I NEED MY COMMISSION,

IT’S TIME TO DISCOUNT YOUR damn PROPERTY”.

*** AND THAT IS EXACTLY HOW THIS WILL PLAY OUT.****

Just go back and take a look at 1991 to 1996 California R.E. Statistics,

I lived through it and bought a house at 75% discount. I saw how

desperate and hungry the Agents and Brokers were — THEY ONLY CARED

ABOUT THEIR COMMISSION….. REALITY RETURNS TO US AGAIN.

DHB librarian here…please search “golden sarcophagus prop-13 fancy feast-eating reverse mortgage in the making no-retirement having I’ve got mine so screw you Boomers.”

Actually Dfresh you’re pretty much the resident douchebag here.

Dropping Asking Prices are strictly triggered by liquidity needs on the part of the sellers.

Since banks are being kept liquid by the government/ Federal Reserve System — you don’t find them flogging their immense REO positions onto the market.

Back during the classic Great Depression, banker did exactly that.

The real estate agent ALWAYS needs the next sale. But, like a stockbroker, he’s actually in no position to control the market. In stock trading, all shares are alike; so no-one regards their round lot as more extra-special than the other guys round lot.

Real estate does not have that property. So sellers convince themselves that THIS particular lot is extra-special. Now all that they need is to find a buyer who thinks the lot is extra-special.

The result is that it takes days, weeks, months, years to unload real estate.

Of course, stocks can be dumping in no time flat.

People in this blog keep wishing for housing to “Tank Hard.” so you can afford your little crapshack in LA. But do realize the effect that would have on our economy as a whole? If housing prices should fall dramatically like in 2007 tens of thousands of people would default on their mortgages, foreclosures would skyrocket, installed government bailouts & safety nets would kick in, and taxpayers would be left holding the bag. Not to mention the jobs and much needed property tax that would be lost to the state of California. Be careful what you wish for.

That’s a very good point. A crash of 20%+ on the westside would surely be a sign of the coming apocalypse.

But if we’re in a bubble, we need it to deflate sooner or later. I read something about Japan’s deflation and one economist said that it’s really not bad what Japan’s going through – their 90’s economic stagnation was just their economy returning to normal. We need a return to normal. We shouldn’t have an economy based on gambling on houses, stocks, tech startups.

Forget Japan, the USA’s 90’s stagnation was a return to normal. Since then the FED has TWICE taken INSANE measures to keep needed deflation from occuring. Post tech bubble/911 with Housing Bubble 1.0, and post that with Housing Bubble 2.0/The Mega Credit Bubble of Death. The 2008 crisis has NOT been allowed to correct. The 2010 run in housing was the start and was probably 10% away from a natural bottom for Housing. The problem was that additional 10% drop would have further destabilized bank balance sheets and since heaven forbid we nationalize the parasitical big banks we got this latest mess. Bubble 2.0 os about nothing more than bank stability. Municipal taxes don’t matter because if your house is cheaper you spend more and sales taxes are far greater than property taxes. The freeze placed on our economy by higher RE prices HURTS .gov balance sheets. Can you imagine the economic activity if housing were 10% below the 2010 trough? There’d be spending everywhere. And crap shacks properly valued would be torn down and new construction in pkace instead of being “refurbished” with granite and steel bullshit to be flipped. This is the Chase/Wells Fargo/Citi/BofA recession, period. And remember who it’s widely accepted are the primary shareholders of the FED who made this madness possible…

Who says we are in a bubble? Everything I have read from economists says the housing market is stabilizing and we are likely to see appreciation of approximately 5% per year over the next few years, barring any catastrophic event. That is normal. The days of insane appreciation are over. Of course there are those sellers currently asking speculative prices of 20% over market, but those are the ones that will have to come down to earth and that is where you will see price reductions. Really, it’s not a price reduction in the original asking price was unrealistic in the first place. For those who think the sky is falling, show me one property today that is selling for less then it did in 2012-2013, or a increase in foreclosures or massive amounts of REO’s and short sales hitting the market. For the market to tank, we would need a massive amount of inventory and I’m just not seeing it, in greater LA anyway.

The smart money says housing to remain slow & steady through 2015. Basically more of the same of what we saw in 2014.

I assume you don’t own any real estate or stocks. It’s real easy to cry foul and complain when you have no skin in the game.

I am actually tired of people listing their last 3 to 4 digits ending in 8’s just to represent the Asian lucky 8. For example… 698,888, 798,888.. Stupid

“All things considered, the third best investment I ever made was the purchase of my home, though I would have made far more money had I instead rented and used the purchase money to buy stocks,” says Warren Buffett.

On a purely financial level, data shows that, over the long term, houses do not return much above inflation, while the stock market generally does. Robert Shiller has collected home price data in the U.S. as far back as 1890. On an inflation-adjusted level, home prices have not risen much.

Read more: http://www.fool.com/investing/general/2014/10/04/what-warren-buffetts-house-can-teach-you-about-suc.aspx#ixzz3FEAZ1lgI

@Toluca, housing prices rising at or below the rate of inflation may be true nationally. The same can NOT be said for decent parts of socal for the last several decades. It has been and will be different here.

I remember when Warren Buffett sold his mansion in Laguna Beach a few years ago. I think he even admitted that he really didn’t understand the housing market here because it was so irrational. If Warren Buffett doesn’t get it, that says something.

As usual, buy what you can afford and buy in the best area you can and plan on staying for a decade or more. Not exactly rocket science we’re dealing with.

Housing to tank HARD soon…2017 would be perfect. 🙂

@Lord Blankfein – Agreed. But I thought is was interesting and germane. I’d never read anything like that from Buffet before. Then again he’s built up quite a mythology around himself — who knows what he’s really like or what he really believes I guess.

It’s the planning on staying for a decade or more part that’s the problem. This ain’t your father’s job market or economic reality. Signing up for a lock of that length of time these days is a limiting move for today’s mobility requirements. Just like signing up for 10 years of student loan debt repayments. Your special case regions are not immune from adjustment in that regard. You’re naive in thinking that past performance will predict the future. We understand that you’ve put all your eggs in that basket so your biased perspective is obvious.

tolucatom….Real estate is all about timing, sure many things over the long run don’t pan out (stocks come to mind) but in-between the long run of anything opportunity exist.

My grandparents home bought for $19k today is worth $249k if held onto. Sure inflation is one thing, selling and coming out with maybe a check for $220k is another, it is still $220k cash in hand (nice to have with bank interest bond to go up), it buys a lot of inflated products?

Money is Made When You Buy, Not Sell.

You are better off getting a really good deal when you buy something.

Personally I prefer stable/flat prices for real estate, because it always puts higher rungs of ladder out of reach. So many upsizers are waiting for values to fall, so they can buy a nicer home. Then of course, all the others who are priced out of starter homes in low-mid prime areas.

My best investment over the last couple of years has been Pilgrim’s Pride.

http://stockcharts.com/freecharts/gallery.html?ppc

I bought at $5.99/share and it is trading in the low 30s right now. Try doing that with real estate these days. I am paying $1280/month rent in Warner Center. I am in a rent control area. The best time to buy in California is after an earthquake. The bigger the earthquake, the better the buy. If I ever buy a home in Southern California, it will be after an earthquake. There are better options for real estate in other parts of the country. Jim Rogers said that the people driving expensive cars in the future will be the farmers. There aren’t a lot of farms in downtown Los Angeles.

Alright Nostradamus, consider yourself lucky you got a five bagger. Here is the million dollar question for you: what is the next five bagger that I can buy on sale tomorrow?

I wouldn’t recommend buying RE at today’s prices, but there were some incredible deals to be had a few years ago. A young kid I work with bought back in 2010 because of the home buyer tax credit and he put a whopping 3.5% down. Dude’s place has easily appreciated over 30% over the last few years. Looks almost like a 10 bagger to me. It’s all about leverage and you aren’t going to see this kind of leverage investing in stocks. Enjoy the rent control and keep throwing those darts at the board!

The printing press will save us/ prices!

I am long ink!

Ca. will always be different and buck trends, they dance to there own tune. A few years ago most Californians wouldn’t be caught dead being seen in a Chrysler dealership.

Today Ca. accounts for a 83% increase in Ram truck sales, a state where gas prices are well above the national average. They are trendy, they buy on emotion and what family and friends view them as is more important then logic, generally nothing rational figures in that state.

So California coastal douchers are all caught up in an image leading to irrational decisions. Problem is that some think that somehow insulates the area from the realities of the rest of the world. The cognitive dissonance these people have is incredible too. People will make irrational decisions and then attempt to justify them by pointing to how irrational everyone else around them are being.

“So California coastal douchers are all caught up in an image leading to irrational decisions”. What an idiotic comment. Half the country dreams of living near the beach, and just because some have made that dream a reality doesn’t make them “douchers”.

@truth, you’re the douchebag.

…. That’s what Calif is more PRONE TO “BOOM AND BUST” HYSTERIA …

This place is already Pending a sale

Leave a Reply