Bring back the condo conversions: Los Angeles apartment to condo conversions pick-up steam, just like it did in the last housing run.

Time to slap on some new paint, lay down some hardwood floors, and haul in some granite countertops because it is time to convert that funky apartment building into a condo project. Los Angeles and San Francisco are seeing a rise in apartment to condo conversions as the market is ripe for the picking. Given the massive amount of investor buying many first time buyers with a deep desire to own are now opting for condos simply because they are being out-bid on single family properties. Condo prices are surging yet many do not realize that condos come with added costs like HOA monthly dues for example. The prices of condos in markets like Pasadena and Irvine are once again reaching levels last seen in the peak of the housing bubble. So it is no surprise that some are running the numbers and are being tempted to turn that apartment complex into a condo project. The wild prices are back and we’ll head to Pasadena for this article.

Pasadena condo love

175 South LAKE Ave #401

Pasadena, CA 91101

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â 721

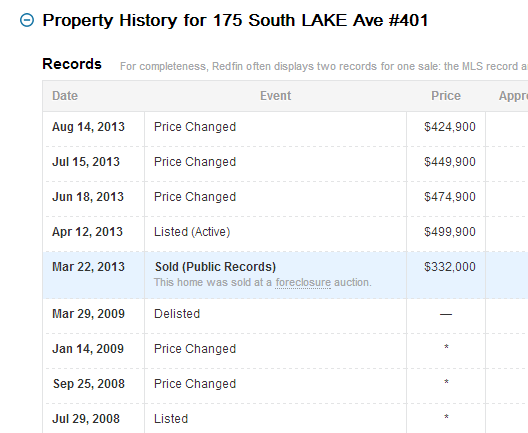

The current list price is surprising given the size of this place. 721 square feet for $424,900? Yet this home looks to be another flip with your typical bells and whistles. Wood floors, stainless steel appliances, and granite countertops! Check, check, and check. Yet in the heat of a mania timing is everything and now with a couple of years of banana like appreciation, the market doesn’t seem to be biting on everything like an untrained puppy. The price history tells us the story:

So what happened here? It looks like the place was purchased for $332,000 back in March of this year (as a foreclosure). It looks like the place was listed less than one month after the close for $167,900 more than it was purchased for. Seriously, what can you do to a 1 bedroom 1 bath 721 square foot condo that can justify a $167,900 gain over a few weeks?

Of course, the market didn’t bite. So in June, the price was dropped to $474,900. No takers. One month later in July it was dropped to $449,900. Still no action. Now it is priced at $424,900. Is this a good deal? It is still priced nearly $100,000 above the March purchase price. Did all the upgrades cost $100,000? I really doubt that.

Back to condo conversions

Of course, in California real estate is a trendy industry and the disaster of the bubble is now fully forgotten:

“(LA Times) If someone can start selling condos in the city successfully, I think others will start to follow suit,” Ronin said.

The gated complex lined with brick roadways features 67 units with one-, two- or three-bedroom lofts. The rent starts at $4,000 a month and can go up to $5,500, said Amir Haber, who co-owns and manages the property.

Universal Lofts is a certified live-work property, which means that residents need a business license to live there, Ronin said. The lofts can be used entirely as office space or can double as a residence and a home office.

About 95% of the complex is occupied, and Haber said the vacant lofts are for sale. The asking prices range from $900,000 to $1.3 million.â€Â  Â

While some are heading back in with these projects this example is for a high-end location. We’ll have to see if this trend becomes more ubiquitous in the market. Of course as the Pasadena condo shows us, markets can turn quickly and it is highly unlikely that an investor would purchase this place since rents would not come close to covering the carrying costs. In places like Irvine, HOA and Mello-Roos on some condos are off the charts.

Is this merely a sign of a tipping point or does this run still have a full gas tank ahead?

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

76 Responses to “Bring back the condo conversions: Los Angeles apartment to condo conversions pick-up steam, just like it did in the last housing run.”

Been laying back and just reading the comments lately. Pretty thoughtful arguments on the bear and bull sides for housing, both of which run through my head as well. As ever, I see no clear winning argument for the most important issues which I think would be timing of the crash if there is one and how far down things would go if a crash occurred and long the crash would last before stabilization/a floor is established. I think most bulls would be happy with small returns going forward or even a 10-20% dip as long as things then stabilized in a reasonable amount of time with small returns thereafter because a 10 year time horizon. Many bears seem to smell 30+% declines starting with the QE taper (which fwiw is only an announced ‘slowdown’ of purchases; it can still come back full bore or more) with little hope for future home value increases for the reasons we’ve discussed as naseum by now on these boards. Personally I don’t get how anyone can predict this stuff with great accuracy. Too many competing macro and micro factors, each of which is too hard to predict. I’m still sticking with my theory that geniuses are the lucky ones anointed after the fact.

A few people called the last Bubble pop accurately, I remember well because I read their blogs daily for a year or two prior to the pop and they had the ring of truth, they were http://thehousingbubbleblog.com and http://oftwominds.com/blog.html … I’m sure there were many others too but that is who I was following at the time (and still do)…served me well at the time as I sold my house quickly in spring 2007 based on what I’d learned, had a solid offer within a week by “discounting” it $10K or so, felt (correctly as it turned out) that the pop was imminent. Tried to buy again in 2011 (to live in the house, NOT as an investment) but it was hopeless as I was competing w/ 100% cash flippers and speculators where I live in northern Calif. Now waiting for Bubble 2.0 to pop and am convinced it will happen before too long based on what I read here and elsewhere, we shall see…

What would cause the bubble to pop this time around? It would have to be high interest rates and we all know the Fed has already discussed they won’t do that anytime in the near future. And we now know they will do whatever they can to artificially manipulate the market so that natural market conditions will never be in play. I’m afraid to tell everyone this but if you haven’t bought by now, you’ve missed the boat. If prices do go down, it will only go down equivalent to the amount of interest rates going up so in the best case scenario if it goes down 20% in price, that would’ve been the same price it was last year. Chances are if you didn’t buy last year, you’re probably not going to buy when prices go down either.

I guess what I’m saying is that those sites may have proven correct, but it doesn’t automatically make them geniuses. Lots of people have predictions and after an event happens, you pick the winners and then they look correct. With enough people making predictions, and a finite set of outcomes (bottom is x month in y year or just z year) there will always be someone guessing right. Its about timing and depth and longevity of the down, not just things that go up, go down, if you are a long term holder. And also being able to buy something desirable in the future when you want to (as you said it was hard buying anything good in the down years). IMO, no one can predict and properly weigh/combine factors such as unemployment (real), inflation (real), interest rates, changes in foreclosure laws state by state in terms of them changing and the dates thereof, HARP, QE infinity, China’s numbers, wars, political outcomes in the US and abroad, other countries printing money and timing thereof, the ability of vested interests such as the rich and banks to maintain the status quo, tax changes, global purchasers of real estate, lumber prices, etc. I mean I also think CA and a few other places housing has to go down, but getting the date of the top or bottom right and extent of the decrease is not easy. There isn’t even one person on the planet that can say with 100% accuracy today that if we start tapering under QE that Summers probably or Maybe Yellen won’t reinstate it if the bottom starts falling out (which it should have a long time ago already).

Bluto, I think most people with above room temperature IQs saw housing bubble 1. There were several years of 20% plus appreciation which was clearly unsustainable. Additionally, everybody had anecdoctal evidence of people buying who had absolutely NO business purchasing a home (no down, stated income, suicide loans, etc). The rent vs buy equation wasn’t even close, the carnage that ensued was pretty evident.

Fast forward to 2013 and another impending crash is much more difficult to predict. Anybody who bought in the last few years was likely very qualified (cash, large downs, even the 3.5% FHAers likely have 20% plus equity at this point). The rent vs. buy equation has tightened up significantly where renting is an option most don’t want to pursue. I think we will have very low inventory for an extended period of time (this will keep prices elevated also). The move up market is dead, people will stay in their homes for a LOOOONG time. I hear the “incomes have been stagnant for over a decade” all the time on this blog…if this is really true, people will stay put in their house for an extended period of time. I highly doubt we will see a massive increase in rates in the near future (they are already close to 5% and there has been no drop in home prices). If rates spike, prices will go down…but your monthly payment will also increase. Potential buyers likely will still be on the hook for higher monthly payments than buyers from the 2009-2012 vintage who took advante of low 3% rates. And I see no drop in rent prices anytime soon. When you combine all these points with a fed that is trapped between a rock and hard place regarding constant stimulus and I honestly don’t see a big drop in prices, especially for any desirable part of coastal California.

Just my two cents of course.

Prices falling 20% from here sounds about right. Remember, the recent price rise does not come from free market forces. It comes from the Feds lowering interest rates and from the banks pushing loans aggressively again and choking inventory.

If interest rates rose to 6% and all foreclosed properties were put on the market right now, prices would fall more than 20%. Every time the Feds start to step back from their life-support intervention, the economy shivers.

No income growth in the last 6 years. Baby boomers retiring and downsizing their lives. Most of the new jobs are low-paying retail, healthcare, and temp jobs. Kids are graduating from college with $30,000 in debt. 20% of homeowners are still underwater.

Are you cheerleaders really saying it’s a healthy market out there?

Of course the market is artificial. I mean the oil market and commodities markets are manipuated too. I think we all are starting with that premise. Just playing devil’s advocate, but do you think a 20% decrease in home prices would cause mass panic for recent homebuyers, many of whom who bought even a year ago in CA in 2012 and are up over 30%? Those that bought 09-11 are up even more. Those that bought in early 2013 are up almost 20% already. Also, what if your premise is 100% correct, but your timing is off. What if we don’t get to 6% rates quite as fast as you expect to? I just don’t know how to predict the true end of manipulation or i guess when manipulation changes, because it never ends. Once again, I wouldn’t touch CA right now, but I’m smart enough to admit I don’t have all the answers and I consider myself informed on the market. I’ve been a bear for over a year (or more accurately ive been a bear since the fake recovery because I don’t think we ever saw the real down we deserved) thinking the CA market had to top by now and start going down. My buddy, equally educated, told me I was wrong because QE can’t end bc the govt is trapped and the market would still have room to run because banks would lower their lending standards/bring in more buyers. So far, he’s been right and is sitting on monster appreciation in a 2mil plus house that he mortgaged on an interest only loan (at 20% back in march (people with proven incomes are not having problems getting loans) and I’m the guy who moved to Texas feeling priced out of CA.

In my opinion I think QE was used as a way to convince people or direct the focus back on the FED for us to believe the market will not recover without them. All that really helped prop up homes was the restricted inventory and low interest rates which is fine but the QE is really making everyone all convinced that the end of the world is hinged on the FED’s printing press. QE will end and likely there won’t be a crash, but maybe a slow selloff in housing prices and proabably the stock market as well since the FED is basically say that the economy needs to find it’s own footing which I think these recent home buyers are expecting to go on forever. I am beginning to believe the flippers and investors are the new section 8 voucher recipients living on high priced homes that need that stimulant to keep them staying put in these places. If the QE stimulus stops will they lash back?

Are the current cash buyers small investers buying one or two units or a few units at a time? Or, are they huge investors buying dozens of units in huge blocks? It must be the former because with the drop in new mortgage loan apps, the large investors must be seeing that the individual home owners – the ultimate buyers – are already starting to leave the market on the reacent spike in mortgage rates.

You get (1) a bunch of new buyers into the market, (2) combined with quick, temporary and unsustainable spike in values created when the banks hold inventory off the market, (3) and the Fed whispering that they may slow or stop their Quantitative Easing (QE), suddenly investors think that housing prices can never go down. What short memory they have.

But, since this is a jobless, wage-growthless recovery, there is really nothing out there to sustain a true recovery in the housing industry. So, when suddenly, housing is going up double digits a year and 30-fixed rates jump 75 to 100 basis points, the true home buyers pull back and see little reason for getting back into the market. We have nothing more than the formation of a second bubble.

Scott, I agree with your thesis!! 😉

And yes, in many respects, the fundamentals/situation is far-worse today, than it even was in the lead up to the debacle, in 2007!!

….But, since this is a jobless, wage-growth-less recovery, there is really nothing out there to sustain a true recovery in the housing industry…..

And just think, our twit president just gave a speech in AZ out of both sides of his mouth (as usual) about the housing “recovery” and its inflated valuations from specuvestors AS WELL as how we should keep the poor proletariat in the RE game. The Double Think on display was amazing, even for “That One” 🙂

Its not a recovery. What were seeing is simply a wealth redistribution.

This might also be considered a seniors time to leave unless they saved up enough.

LOFL every 30 days, discount $25K. This asshole is riding the wave down. Just desserts sure are sweet.

?Hu?

Ah, I read the story, now i understand your comment.

All I can say about that condo is ‘wow’…. $400,000+ for THAT?!?! Here in the western suburbs of Chicagoland, Mrs. Weiner and I have been steadily de-cluttering, fixing, painting, etc… in the hope that we can sell our 3,300 sf house on a 1/3rd acre lot in the next 2 years before the bottom drops out. While I certainly would like to get $475,000 for our place, we’ll entertain quite a bit less depending on what the market looks like.

I agree w/Doc. This has all the look and feel of the last housing boom right before it blew up.

Many more people want to live in warm, sunny Pasadena than in cold, miserable Chicago.

And, compared with Hong Kong, this condo is stupidly cheap bargain.

All real estate is local.

Oh please, drop that tired everyone wants to live in SoCal bullshit. If that were the case, the majority of the world population would be here, and not elsewhere. We’ve got plenty of problems and quality of life challenges just like anywhere.

Well Dave, right now, it’s 78 degrees and sunny. Just like yesterday. No forest fires or mudslides either. While I understand your point, $400k+ for a 1 bedroom condo is pretty high regardless of where you live. I love the Midwest. To each his own. 😉

Get millions dependent on food stamps, govt handouts, keep ’em from rioting. Big PR push to legalize pot, keep people stoned, satiated. Hand 20-something middle class stoned kids a bag of Doritos, send ’em back to Mom/Dad’s house; their PT jobs will finance a car and newest electronic gadget. Middle class continues losing FT living wage jobs; slow grind ’em with an eroding standard of living so they’ll grateful for anything. Money continues flowing to the wealthiest class; buying up hard assets, building monster houses for themselves and their dogs, snapping up pricey hipster houses in trendy areas for their adult Rich Kids of Instagram offspring to live, continue the Dream.

Interesting times.

I wonder why more people don’t see this about the pot thing…….encouraged perpetual adolescence

Same reason why they don’t see it with the beer thing.

$400k for a condo in a prime area isn’t surprising , anywhere. I’m sure you’ll find $400k condos in Chicago as well.

True. Chicago neighborhoods like downtown’s Streeterville and Gold Coast, as well as Lincoln Park, Lakeview, and other “green zone” neighborhoods like slummy west town and Buck Town are stuffed with overpriced condos and houses that are being bid up in this “hot” market. But you usually get a much higher-grade condo than this for the money, even in pricey, top-tier Streeterville.

The point is that they were asking $500K three months ago after snapping it up for $330K just three weeks prior. Oh, and it’s 721 sq ft in Pasadena in a condo. Most of Pasadena is good living, but not worth an average 1/1 condo at that price level.

Doc raises a good example with this place.

Hello Doctor Housing Bubble,

I find it interesting to see commenters posting on your blog that there is a new paradigm blah, blah, blah. This time is different because of “insert NAR talking point hereâ€.

You know the first time I heard the term “boom and bust†was not in an economics class rather it was in a biology class. You realize that boom and bust is not an economic theory, it is a law of nature that manifests itself in economic terms. I would never try to predict when and where a boom will occur nor when and how a bust will occur but it is a law of nature no different than gravity. The end result for every boom is a bust.

So I think the real questions are “are we in a boom?†and, if not, “what permanent change has occurred to justify the increases that we are seeing?â€.

I believe that the current boom was created because of artificially cheap and easy financing (starting in the 1987 S&L crisis). The only way for this to continue would be to grow the amount of artificially cheap and easy financing indefinitely while pretending away the repercussions of such an action. Remember that there is another law of nature which states that for every action there is an equal and opposite reaction.

Does this mean that I expect to buy a 3 bed 2 bath 1400 square foot house in Culver City for $250,000 anytime soon? Nope. Do I expect this boom to continue indefinitely? Nope. Do I think that we will see another fall in real home prices in the near future? Yup. Does this make me a housing bear? I really don’t think so. I think it makes me a law of nature realist.

I agree with your assessment. There is a good probability that house prices might go down but even if it does it won’t be to the levels most of the bears on here are thinking. I’m thinking best case scenario 20% which means back to 2012/2013 prices. It will never go back to late 2008/early 2009 pricing so if you didn’t buy then, you’re never going to be able to buy unless you have substantially more cash and income than at that time.

Never, never! So says the crystal ball.

Obviously, I have a lot of time on my hands and a curious mind. I am not familiar with Pasadena and live over 2,500 miles away. However, I do have the magic Google street sweeper. I took a stroll along Lake St., about a half mile either side of this fabulous condo. I found at least 10% of the commercial space empty, a pawn shop, a gold for cash, a used clothing store, TWO payday loan outlets, a restaurant that has a lunch special for $5.95, a couple of gas stations, a cheap taco standup shack, several oriental nail places, Cabrera’s Salsa Nights lounge (I am Latin so that is a plus along with the taco shack, I guess), a very large building with the letters PCDA displayed (I assume this is some government handout place), lots more Mexican Food places and the most economically promising place of all, a Fire Station where I am sure the average wage is $150,000 a year, retirement at age 50 with 80% of salary. Not exactly the high finance district, excluding the firemen. So what gives with the nearly half-million for a very shitty, little studio? You Cali people have to be totally nuts. Oh, I also saw five people on the sidewalks, a hoodie, a couple of vinos and an old bag lady. If you doubt me, have at it. https://maps.google.com/maps?q=175+South+LAKE+Ave+%23401+pasadena,+ca&ie=UTF-8&hq=&hnear=0x80c2c35dcaa540db:0x7a4a758fcfcb32be,175+S+Lake+Ave+%23401,+Pasadena,+CA+91101&ei=t98SUr7iMaj72QWb0IHYDg&ved=0CCkQ8gEwAA

Pasadena is one of the priciest and most desirable areas out here. A couple blocks north on Lake is the infamous Colorado Blvd, the one the Rose Parade goes down. It is full of a mix of quirky local shops all the way up to Tiffany & Co and Ruth’s Chris Steak House. This is high dollar district were talking here.

The people that work at the nail shops you speak of on Lake Ave, they live down in Highland Park or somewhere much cheaper. Pasadena is chock full of million dollar homes, not just from residents, but from rich people around the world who own second homes.

There are tons of high rise office buildings in Pasadena and neighboring Glendale, full of wealthy corporate bigwigs. Pasadena is also the terminus of the 110 Freeway, America’s first freeway and it connects the area to Downtown L.A., obviously another area full of wealth.

CA is not, by any means, ALL wealthy. In fact there is a ton of poor people. But it IS also full of some of the richest of the rich. If you go back to Google maps, see the 210 Fwy running east/west through Pasadena. After Pasadena, the east/west route becomes the 134 Fwy, then further west it becomes the 101 that runs to Thousand Oaks. But on the map it looks like one long east/west road. Anyway, from Arcadia through Pasadena, Glendale, Studio City, Woodland Hills and Calabasas is there a good deal of SoCal money resides. About 2 miles each way north and south of the road, is all the hillside windy road country of wealth and fame. Then there is even more down in Santa Monica and Brentwood. Orange County has a few areas like Anaheim Hills and Newport Beach, even Riverside has Hawarden Hills and Temecula. But for every rich man, there are probably 10 poor sucking off his exorbant taxes.

Yes, it is impossible to have the true understanding/feel for this area, just via a ‘stroll’ down Google street-view! LOL

I grew up/lived in this neighborhood of Pasadena, K-12 and beyond for many years. It is not a ‘blighted’ area!! 😉

South Lake Ave has always been a great shopping area, since I was a kid, and since the landmark Bullocks, now Macy’s was built in 1948. If you travel up Lake, north just a couple more blocks (south and north of Colorado Blvd.) it is lined with newer office buildings from about Del Mar Ave/Green St. up to the I-210 Fwy.

Going further north, once you approach/leave the city limits and come closer to the unincorporated area of Altadena, it does then, become more spotty.

While I can no longer afford to live in Pasadena, after multiple years in NorCal, and now live in the IE; Pasadena, in the shadow of the San Gabriel range, is still a class-act city, with multiple world-class companies and businesses, Caltech, the Jet Propulsion Lab, Art Center School, the Rose Bowl, etc.., and this is why the price of RE is so high–as it is a desirable community.

Pasadena, will always be a world-class city, and it will always have the appeal it did, in the 1880’s when the residents of Michigan, Indiana, and Illinois, first migrated to the San Gabriel Valley, to escape the winters of the north mid-west. 😉

“……Pasadena is one of the priciest and most desirable areas out here. A couple blocks north on Lake is the infamous Colorado Blvd, the one the Rose Parade goes down. It is full of a mix of quirky local shops all the way up to Tiffany & Co and Ruth’s Chris Steak House. This is high dollar district were talking here.

The people that work at the nail shops you speak of on Lake Ave, they live down in Highland Park or somewhere much cheaper. Pasadena is chock full of million dollar homes, not just from residents, but from rich people around the world who own second homes……”

There are tons of high rise office buildings in Pasadena and neighboring Glendale, full of wealthy corporate bigwigs.

I did not say this area was “blighted”. The businesses I mentioned are there, you can see them. This is a mixed area. It is NOT high finance like NY or even Chicago. Look for yourself, the Cash for Gold, pawn shops and cheap restaurants are there. And, the taco shack and a good 10% for lease signs on buildings.

Pasadena is only “desirable” when compared to some of the ghetto and gang infested neighborhoods that make up most of the inland areas of Los Angeles. Pasadena can be hot, dry and smoggy. The mountains that rise above Pasadena and the Los Angeles basin keep any smog and smoke from escaping. The city lacks enough fresh water for all the people who live there. Pasadena (and the rest of Southern California) must import the majority of their fresh water from hundreds of miles away. Massive amounts of food must be imported into the city from hundreds of miles away on a daily basis. Much of the electric power consumed in Pasadena is generated elsewhere in places like Arizona. Pasadena and the rest of Southern California are disasters waiting to happen if a major calamity. If a major earthquake that disrupted the food and water supplies, things would get ugly very quickly. Oh, but why worry? FEMA will be there to save the day just like they did in New Orleans after Hurricane Katrina? Right?

As you stated in your first post, you are some 2,500 miles away from Pasadena, CA; and the RE [example] on South Lake Ave, as presented herein, by the good Doctor!

My point was, that you cannot possibly understand, or be in a position to comment on, the real dynamic and FEEL of a city, or a neighborhood within that city, having never lived there or at least spent substantial time in the area!

In addition to growing up there, and spending 40 years of my life there, I still visit this neighborhood two or three times a month, as my oldest son still lives in the area.

The quality of life is at a very high level in Pasadena and especially in this portion of the city. This is why the rents are so high and the home RE values are where they are in Pasadena. It is true; however, that since the recession, there is still a higher commercial property vacancy rate—as in many cities of this size.

I think it is [disingenuous], to ‘cherry-pick’ a few lower-end businesses, out of the total ‘bag’ and then use that to make your case—from the other side of the country, and via Google Street-view. Moreover, I am not sure what the hang-up is with the “Taco Shack†reference(s) wherein, I might point out the we do not usually refer to them as ‘shacks’ here in CA; they are more commonly referred to as Taco Shops. Also, this is SoCal, and there is the strongest of Mexican cultural influence, wherein even we guys with blue eyes love our Tacos!!

Furthermore, a really good fish taco is something to behold–if you are referencing the Fish Taco shop at 264 So. Lake Ave, which BTW, has a 93% positive rating at Urbanspoon?!! And since South Lake Ave, is a shopping street, again with a very large (always packed) Macy’s store a block away, there are going to be multiple eateries, of all types, in the vicinity; including, those which (OMG) serve Tacos!! LOL.

I would move back to Pasadena in a heart-beat if I could get into, for the money, the type of home (2800 sq. ft.) I now have in sunny Temecula (92592) with the blue sky, warm days, Palm trees, golf courses, and no snow. Having said that, at least I am still living life, in SoCal, where I feel truly blessed to reside; and anyway, while still less than 90 mins from my home town of Pasadena.

Please, do enjoy your life too, (especially during the winter) wherever you are on the east coast (2500 miles away is close to Pittsburgh, PA); as I sure do, enjoy my life, here in sunny SoCal!

Also, please note, I will now make a point of dropping in for lunch very soon, at that Taco Shop, which you referenced, and I will surely report back on my dining experience–which I am sure will be excellent!! 🙂

———

I did not say this area was “blightedâ€. The businesses I mentioned are there, you can see them. This is a mixed area. It is NOT high finance like NY or even Chicago. Look for yourself, the Cash for Gold, pawn shops and cheap restaurants are there. And, the [taco shack] and a good 10% for lease signs on buildings.

Right, but you have to consider that though nice, Pasadena and the rest of the SoCal economy isn’t particularly strong. Sure, there are companies around, but none that are growth businesses like you see in Texas or Silicon Valley. People do want to live in the LA area but it doesn’t make sense to me why the entire area, not just the tony parts, is overpriced. You can buy a similar-sized condo in the Bay Area, which has a stronger, more diverse economy than LA’s for about the same price. Over the last 10 years, LA has seen huge growth in the # of condos available without corresponding increase in population or income. Why such high prices?

I know that area of Pasadena well, having grown up in a neighboring city and now shopping there frequently. You mentioned a pawn shop within the 1/2 mile distance, but you didn’t mention the Fidelity Investments office on the same block or the Williams-Sonoma store across the street, where a can opener costs $22(!).

I think you need to keep in mind that “about a half mile either side” makes a big difference in places like Pasadena (or LA in general). I know there are pawn shops on north Lake Avenue on the other side of the 210 freeway, but that area is very different (i.e. wrong side of the tracks/freeway). I would never want to live there.

But if you go a mile or so south, then you hit multimillion dollar homes like this: http://www.redfin.com/CA/Pasadena/1188-Hillcrest-Ave-91106/home/7011712

As others have said above, the people who work in the nail salons and pawn shops do not live in the area where the example condo is located. The people who live in that area probably work in Pasadena, Glendale, Burbank, Hollywood, or Los Angeles. That’s why traffic on the 210 and 110 freeways is always crappy during rush hour. This area is in high demand because 1) it’s trendy, with plenty of shopping and restaurants nearby, and 2) it’s within a reasonable commute to LA, Glendale, Burbank, etc., unlike the suburbs further east along the 210 or 10 freeway. A lot of people who live in the condos are young professionals in their 20s. It’s got sort of a college town feel because of nearby CalTech.

Most posts just don’t get it. Sure, CA housing will bubble up too high. That’s CA. Booms and busts, but always new highs. This boom creates tons of jobs, with every cash flipper/remodeler and tons of tax revenues from cap gains to finance CA growth. Most complainers are those who haven’t been smart enough to make money in CA booms, and SAVE to have enough cash for future bargain opportunities like happened abt 2 years ago.

With so many “complainers”, one is left to wonder why you’re posting here.

Yeah, pretty stupid of me. As a private investor, I do want to understand all kinds of thinking. Sorry, if you don’t.

But you’re so much smarter than the rest of us so what’s the point of coming here to get dumbed down?

Even the successful have to look in the mirror on occasion.

Well I DID have money 2-3 years ago and WAS looking. And most of these bargains of which you speak were smoke and mirrors. With few exceptions all the good deals I saw ended up being inside deals siphoned off to the connected few.

Certainly there were some decent properties that an ordinary mortal could buy (as some fortunate folks around here managed to do), but much more frequently I’d show up on the day a house would hit the MLS and find it had already gone pending to someone in bed with the listing agent.

The main effect of the bubble bursting was that the volume of available properties dried up. There was never a flood of desirable homes at cheap prices.

Somewhat true abt being in bed with listing agent, but that is why it is important to have a good RE agent working for you who also knows you can make money for him. Good agents have working relationships with other good agents….nothing nefarious….just the way business works. Integrity is often lost in America. But, it does work. Probably why cash works best during these uncertain times.

Joseph is right regarding having a good RE agent makes all the difference in markets like this. I’ll go one step further and claim you need a good LOCAL RE agent. The local agents all know each other. Listings before they hit the MLS is through word of mouth…only going to the locals. When I bought last year in the South Bay, my agent (south bay only) mentioned most south bay agents only will deal with other south bay agents…out of area agents are essentially put at the back of the line. It’s pretty simple, local selling agent will give first dibs to local buying agent. This favor will be returned down the road, they’ll never hear from the out of area agent again…back of the line they go.

Nonsense….I sold my last place in 2007 at a very nice profit and could have put up to 50% down…I made several offers on modest 3/2 houses starting in spring 2011 but all were ignored as I was competing with specuvestors and flippers offering 100% cash, this is NOT a normal or healthy market and is not good for the neighborhoods. By contrast when I bought in 1997 (to live in the house, NOT as an investment) I looked at about 10 houses, made offers on two, one was accepted and I bought my house w/ a VA/GI Bill loan

So. Lake Ave. is a primo neighborhood. Still, I wouldn’t pay that much…

I live in this neighborhood and I agree with all of the posters above. It is one of the top work/life areas in all of southern california. My friends from the south and Midwest who have visited have all been very impressed. Price is definitely high but rent on this condo would be approaching 2k

I’m not so sure I agree with this. i worked in Pasadena for numerous years up until recently. It is overrated. It’s not near a beach. It’s public school system sucks @ss that’s why everyone pays hefty private schools. There’s no quick public transport to get to downtown LA so if you have to drive there it’ll take you still over an hour during peak traffic. Seriously – unless you have some gray hair *or* you worked directly in Pasadena I don’t know why you would live there.

I have found that a visit to the local ER, can give you a pretty good feel for the community, and the type of people who you will be living with. In most of SoCal you will have plenty of time to observe.

There has been a resurgence of the urban and downtown area due to a change in social demographics of the newer generation and the baby boomers. A lot of people want to move closer to the city where the actions are. They grow tired of spending hours in commute and maintaining their SFHs which are located far away in the perceived boring suburban. For them, they choose condos not because they are outbid, but because condos are more hassle free and better suited for their life style. We used to live in a 4 bd SFH and have moved to a 2 bd condo in Downtown Los Angeles after the kids moved out. The price of our 1300 sqt condo is actually more expensive than the 3000 sqt SFH.

It should also be noted that the number of people per household are on the decline. According to Time Magazine, the birthrate in the U.S. is the lowest in recorded American history. From 2007 to 2011, the fertility rate declined 9%. In addition, people who are single are increasing. In 1960, 72% of all adults ages 18 and older were married; today just 51% are. The data is telling us the population is gravitating towards smaller household. The demand for small condos and apartments in the big cities has been following this trend and is steadily growing.

The square footage (~720 sqt) of the 1 bd. condo cited here is actually descent for a young couple or a young professional. As for the price of the condo, it was originally sold at $330k. Assuming a HOA fee of $500, with 20% down and 3.5% fixed interest, when tax benefits of mortgage and property tax is factored, out of pocket expense is estimated to be ~ $1750 per month. However, the $1750 includes a ~$400 pay down to the principle so technically, the premium that goes to waste which is comparable to rent money is ~$1350. The market rent for a newer 1 bd condo located in a vibrant area is ~$1500. If the buyer can come up with the initial payment (20% down + loan + escrow fee) of 72k to buy the property, the premium to own per month is cheaper than to rent so this can be a fine deal. As for the new price of $440k, assuming a HOA fee of $500, with 20% down and 5% fixed interest rate, out of pocket expenses is now estimated to be $2250. When $400 is taken out due to principle pay down, the premium to own is $1850. Initial payment (20% down + fee) required now is $95k and premium of ownership per month is becoming higher compared to the rent. This deal is getting questionable.

Yes, there can be a lot of action Downtown LA–especially in the skid row areas that make up a large portion of Downtown LA (aka Central City East). Los Angeles’s Skid Row has the highest concentration of homeless people in the country. Who in their right mind would want to live in downtown LA? They call it LaLa land for a reason. Some of the most delusional people in the world live there.

All I can say is there are some really misinformed souls in this forum. People actually believe that they can just stroll an area using Google maps and instantly become an expert! By the way, my husband graduated from Cal Tech and we used to live very close to the campus. I didn’t see homeless people outnumbered the Cal Tech students.

A lot of people bashed Downtown Los Angeles have probably never been there, at least not recently. Some areas have been redeveloped to very vibrant and it houses the most expensive condos in U.S. The High Rise Condos in LA live which is next to Staples Center are many times more expensive than this one in Pasadena. Just the HOA fee is $2000 a month. These condo owners are very affluent people, instead of pot heads that some want to believe. People might say I would never pay that much money for a small condo in DTLA; on the other hand, I don’t think a lot of the same people can afford it either. To each his own!

Ruby,

Lay off the adderall girl or put down the crack pipe, wow oh wow, are you for real. Did you not read what Fulano described in the hood there? Hey, at least your close to a payday loan shop in case your payment calculations based on perfection are a wee bit off lol..

In you case you didn’t notice, Fulano lives 2500 miles away and has never been to this area. (And no, Google streetview doesn’t count as “has been there.”) You might want to check your sources before you start mocking others.

I’d say Ruby’s analysis is pretty accurate. Here’s a rental listing from just last month for a unit in the same complex as the example above for $1750 per month: http://www.placebee.com/ca/losangeles/pasadena/3612249

Other examples of rental rates for 1BA/1BD 700 sq ft condos in the area are $1050-$1923, depending on the amenities and age of the building:

1BD/1BA, 770 sq ft for $1675 per month: http://www.zillow.com/homedetails/160-S-Hudson-Ave-UNIT-312-Pasadena-CA-91101/82868702_zpid/

1BD/1BA, 775 sq ft for $1050 per month: http://www.zillow.com/homedetails/295-S-Hudson-Ave-APT-3-Pasadena-CA-91101/2111330909_zpid/

1BD/1BA, 600 sq ft for $1295 per month: http://www.zillow.com/homedetails/160-S-El-Molino-Ave-APT-111-Pasadena-CA-91101/2118386385_zpid/

1BD/1BA, 682 sq ft for $1923 per month: http://www.zillow.com/homedetails/25-S-Oak-Knoll-Ave-396377-Pasadena-CA-91101/2113049834_zpid/

So I’d say Ruby is right: buying at $330K would have been at rental parity at $1750 out of pocket per month, and $440K would be questionable at $2250 per month.

Ruby, 20% of $440k is $88,000! Then add loan fees + escrow fees. I looked at the listing and HOA is $267/month, pretty low (until there’s a shortfall, and they have to raise them).

When you’re thinking about rental parity, don’t forget that you have to give up 6-7% of whatever the eventual sale price is to the buying and listing agents. That could be $30,000 or more. That’s one and a half years of rent!

I grew up in West LA / Santa Monica area and moved to Pasadena for most of 2012 before buying a home in Baldwin Hills. Pasadena is nice if you like being close to the mountains and the Arroyo but the heat and smog was too much for me. I guess I am one of those spoiled Westsiders who was determined to buy a house near the beach, and Pasadena is clearly a schlep to and from the beach (no way around going through the valley or downtown LA to get to and from the beach and Pasadena). If you dont care about living near the ocean, then Pasadena is paradise compared to most of IE and San Gabriel Valley. I purchased a home in late 2012 in Baldwin Hills since my parameters were: under $500K, within 15 min of Santa Monica beach on a weekend morning and a neighborhood I could live in the rest of my life…. Anyway, I got a bargain (4bd 2 ba house on 7,000sqft land) for less than the list price of the 1 bed condo in Pasadena (bah!). If any of you on this site are interested in buying for under $500K and within 15 min of the beach, check Baldwin Vista bounded by Exposition on the North, LaCienega on the West, LaBrea on the East all the way to the Kenneth Hahn state park. Not many homes for sale now, but the cleanest and safest part of Western LA in my opinion for less money than Beverlywood or Culver City by far.

Is Baldwin vista a predominantly black neighborhood? I know Baldwin hills is and the crime is higher than average for LA.

Do you feel safe in Baldwin vista?

@ Jacky. Baldwin Vista IS safer than surrounding areas such as West Adams (North of Exposition Blvd), Baldwin Village (East of LaBrea), Jefferson Park (East of Baldwin Village), Crenshaw Manor (East of Crenshaw), but perhaps not as safe as Culver City which is immediately West of Baldwin Vista.

Here is an anecdotal link to Baldwin Vista. http://losangelesrealestatevoice.com/blog/2011/04/22/baldwin-vista-neighborhood-youve-heard/

But within Baldwin Vista, is the Baldwin Hills Village Gardens Homes Association made up of 450 homes that are strictly East of Lacienega, South of Bowesfield all the way to Glenford and West of Carmona Street. This area is safer and you will find no dilapidated homes, no illegal remodels, no litter, no broken down appliances or cars in the front yard, no hispanics with their ongoing yard sale businesses, etc.

If you do a crime map search in Trulia.com and enter in 90016, you will see their is significantly less crime in the homeowners association area.

There are no homes in the association for sale now, but For sake of convenience, I am adding links to homes that have recently sold in the Homes Association. (This is not like a condo HOA, the dues for homeowners in this area are about $200 per year (not per month).

http://www.trulia.com/homes/California/Los_Angeles/sold/3892341-5601-Sunlight-Pl-Los-Angeles-CA-90016

http://www.trulia.com/homes/California/Los_Angeles/sold/3892362-5632-Sunlight-Pl-Los-Angeles-CA-90016

http://www.trulia.com/homes/California/Los_Angeles/sold/3884772-5608-Coliseum-St-Los-Angeles-CA-90016

http://www.trulia.com/homes/California/Los_Angeles/sold/306226-5600-Sunlight-Pl-Los-Angeles-CA-90016

http://www.trulia.com/homes/California/Los_Angeles/sold/538533-5615-Wenlock-St-Los-Angeles-CA-90016

http://www.trulia.com/homes/California/Los_Angeles/sold/3892839-5655-Bowesfield-St-Los-Angeles-CA-90016

I can assure you that it’s safe to be around most black people. Just as it is safe to be around most white, Asian or Latino people.

The link for Baldwin Vista says that probably the most exciting thing about Baldwin Vista is its affordability–mid century small homes start in the lower $400,000 range and depending on view and square footage, they can reach the high $900,000 range. However, the area is cheaper compared to cities on the Westside for a major reason. It is located near high crime areas full of gangbangers and section 8 housing. No thanks.

Geez somebody’s gotta flat out say it, so I will.

That’s the damn hood! Hoody-hood-hood. Xzibit says it pretty good in “Get Your Walk On”

I can drink a whole Henessey fifth

Some call that a problem but I call it a gift

Xzibit make the whole continent shift (hell yeah)

Invadin your territory in a blaze of glory

A soldier story, livin off nothin but instinct

Bi**h ni***z continue to floss and lip-sync

And I’ma just continue to flow, while rockin the boat

Probably smoke three-hundred thousand dollars in dope

Don’t make my desert eagle barrel touch the back of your throat

Always approach ni***z that’s known for killin your folks

Be surprised who could turn around and bust on y’all

Catch your mother or your sister comin out of the mall

Bang holes through they coats and they Macy bags

No retaliation you basically runnin with f***

In these streets, you only good as your last transaction

Funny style, and these ni***z ain’t laughin

Y’all got it all fu***d up in zero-zero

Think life is a video for “Last Action Heroes”

Face the price you pay for the games you play

When it’s all said and done at the end of the day

Truth. It’s ghetto adjacent and that’s why it’s cheaper. The gamble could pay off down the road if the neighborhood changes for the better and the prospect for this area are as good as any other, if not better. The only catch with this sort of gamble is that you have to endure being adjacent to a ghetto area while waiting for it to get better. Meanwhile, you do have a higher risk of riff raff activity – it doesn’t matter how much of an exception the block or set of blocks are relative to the rest of the neighborhood, there’s not much of a buffer.

Condo conversions usually come at the end of rising market. So, we’re a year or two from another “correction”.

Yes, but as you say “usually.” Already, many unusual things have been happening this RE cycle. One is a shortage of supply so soon. But, lots of things different, that’s why I never predict, just react to what happens.

Equities down 6 days in a row after knee-jerk reaction on “dovish” Fed statement. Taper is coming, albeit small, but it’s coming. Can’t QE forever. Interest rates up. More “price reduced” popping up in Redfin using Last 7 Day search query.

Party is over. You absolutely and mathematically can NOT build an economy on debt. Only question is how bad and long will the hangover be?

I only do cash, with everything. As for stocks, correction is overdue. As an investor, don’t care what market does…..big drop just a great opportunity to pick up more of stocks I own, great companies with products or services always in demand which pay good dividends and have a history of raising them each year…..so, protection from both inflation or deflation. Plus, low taxes on dividends and long term cap gains if that situation presents itself. Plus, with stocks, can never lose everything as losses can be written off to a certain amount. I like when the government give little guys like me, advantages. Plus, as a capitalist nation, government always favors investors in corps. As for debt good for country for investments, since they return more than the cost.

So true, we’re going through a global trend where capital is far more favorably treated than labor, which is great if you have capital, sucks if all you have is labor.

Long overdue for a major correction. As an investor in great companies which have products/services always in demand which pay good dividends with a history of raising them each year, any ,major drop a great time to buy more of them, divs, profits, even losses favorably taxed, thanks to a great gov’t which rewards capitalism and capitalists like nothings like me. Also, protection from both inflation and deflation.I always use cash, but investment by the US in things which return more than costs, like education, health, infrastructure, etc is wise.

@PapaNow wrote: “…Only question is how bad and long will the hangover be?…”

During the previous RE bubble, 1990-91, when the Federal Reserve stayed out of the RE market and allowed the market to correct itself, by 1996 SFRs were selling for $250K in the mid-tier markets (Pasadena, Culver City, Glendale, Torrance, Burbank, Sherman Oaks, etc), and 700 square foot 1 bedroom condos were selling for $80K, 1000 sq ft 2 bedroom condos were going for $90K. Then again the interest rate for SFRs in 1996 was 9%, and 11% for condos. Again, this is with the Federal Reserve not manipulating the markets, and causing massive price distortions as well as blowing the 2nd real estate bubble in 5 years.

As far as the college town feel to Pasadena, Caltech has around 2,000 students, more than half of whom are postgraduate. It is the most competitive college in the world, you have to be genius level to get in. It is extremely expensive, tuition alone is $40,000 a year. There are more homeless people in Pasadena than Caltech students.

I did not, and I am unable to locate any other member’s comment, which states that, Pasadena had a ‘college town’ feel about it?

My only reference to Caltech, and also the Art Center School, was that the city of Pasadena has within its boundary, some institutions of higher learning, which add ‘value’ to the community. Historically, Pasadena has been a highly cultured city, and a city which has appealed to, and attracted a more educated citizenry over the many decades. I might add also that the community college, PCC, is one of the highest rated junior colleges in the nation. However, having said all of this, Pasadena has never been considered/labeled nor has (from my own unique perspective) a ‘feel’ of a ‘college town.’ (Whatever that has to do with the core subject herein?)

Next, you made a statement that there were “more homeless folks in Pasadena, than there were students at Caltechâ€. Again, I am not quite sure what the [point] was in your comment? However, once again, from 2500 miles away, this is not an accurate assessment/statement!

http://pasadena-ca.patch.com/groups/politics-and-elections/p/number-of-pasadena-s-homeless-population-hits-record-low

As you have stated yourself, in your earlier post within this thread—”obviously, I have a lot time on my hands…..â€

Yes, I would agree with that self-assessment; moreover, I would encourage you to re-channel those negative feelings directed at, a city which you have never visited, nor resided therein. 😉

——————————-

“…..Pasadena, in the shadow of the San Gabriel range, is still a class-act city, with multiple world-class companies and businesses, Caltech, the Jet Propulsion Lab, Art Center School, the Rose Bowl, etc.., and this is also why the price of RE is so high–as it is a desirable community…..”

Sounds like I hit a nerve. I do stand corrected. There are only around 1,200 homeless people in Pasadena. But, with a population of just around 140,000; I would suggest that is a very high number. This is roughly the same percentage as LA. I am not trying to be negative. I think California real estate and its general economic condition are living in a very hyped up dream that one day soon will come home to roost. There is no way this apt. is worth close to half a million dollars in that neighborhood. And, there are many more marginal people in LA County and Pasadena than you might guess. Like I am saying, try a little realism before you dump that kind of money in a market where jobs are tight and certainly do not pay enough to warrant such real estate prices compared to the rest of the country. Its all yours, take it and have fun.

No comment needed:

“According to the U.S. Census Bureau, in 2000, there were approximately 30,000 residents (nearly one of every four residents) who were members of a household whose income was $15,000 a year or less. Of these households, approximately half (15,000 residents) were members of a household whose income was less than $10,000.

The Census Bureau also noted, through the 2009 American Community Survey, that 14

percent of Pasadena residents were in poverty. Sixteen percent (16%) of related

children under 18 were below the poverty level compared with 11 percent of people 65

years old and over. Nine percent (9%) of all families and 23 percent of families with a

female householder and no husband present had incomes below the poverty level.”

http://www.urban-initiatives.org/images/PDFs/Pasadena_2011_Homeless_Count_Preliminary_Report_-_Final_Final.pdf

My hometown, Brownsville, Texas, located in the poorest area in the US, the Rio Grande Valley, has a population 20% greater than Pasadena but has less than half the homeless people.

The point I am trying to make is that California in general is a mishmash of a very few lucky rich people with a very LARGE underclass that is at their doorsteps and a quickly vanishing so-called middle class. In no way is the present or future of California sanguine.

“The city identified 466 people as homeless during the 24-hour count conducted Jan. 24 in Brownsville. It was part of a nationwide event to help identify the number of homeless people in America.†http://www.brownsvilleherald.com/news/local/article_3a7a9ff0-7d68-11e2-89ed-0019bb30f31a.html

re: the 1/1 condo “flipper” above… Wow, not even a bar-island to semi-separate the seen-it-before stainless-puh-leaze kitchen from the rest of the (limited) living space.

Not to mention the problematic resale market motility of 1-BR condos vs. multi-BR… as this flipper is finding out. Ouch.

Leave a Reply