The contradictory nature of our housing market – Investors skew down payment statistics. Four years of home sales in SoCal dominated by distressed properties. The over reliance on real estate for wealth.

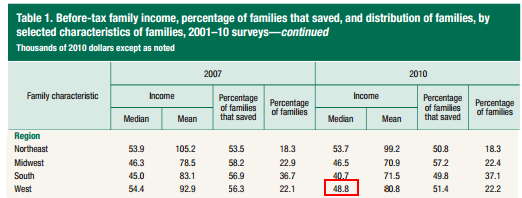

Throughout the year I have seen a few sources point to data showing how the typical down payment has moved back to the proverbial 20 percent down level. Many of these reports fail to account for the incredibly large number of investors buying property. Many will purchase a home with all cash or will use investment loans that require typically 25 percent down. Do you think that will skew the data? Of course and never had we had such a giant segment of the market being dominated by investors. Then you find many in higher priced markets like Southern California relying heavily on FHA insured loans where only 3.5 percent down is required (the typical FHA down payment is 4 percent). Earlier in the week the Fed showed how the typical American family saw their net worth fall by nearly 40 percent from 2007 to 2010. A big reason was the inflated value of housing and how reliant we are as a nation on home equity to boost our bottom line. Remove that paper equity and you take household net worth back on a trip to the 1990s. The housing market continues to crawl in uncharted territory with mortgage rates at record lows yet the economy is simply meandering by (i.e., $16 billion California budget deficit).

Clearing out excess inventory

Without a doubt the market is clearing out excess inventory albeit at a slow pace. We can look at markets even here in SoCal where short sales dominate the sales activity and are being priced to move. Yet you have those that are underwater (1 out of 3 in California with a mortgage) who simply sit in their homes continuing to pay their mortgage on their inflated asset. It is amazing the length of time that distressed sales have made up over half of all sales. I was digging through my data and found that for SoCal, since the summer of 2008 distressed sales (foreclosure resales and short sales) have made up roughly 50 percent of all sales each and every month. Four years where troubled properties have been the majority of the sales market.

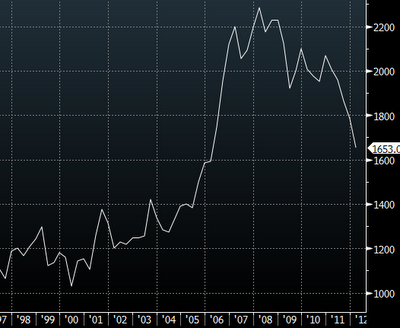

You can even see that vacant homes for sale across the nation are being worked through the system:

*Vacant homes for sale

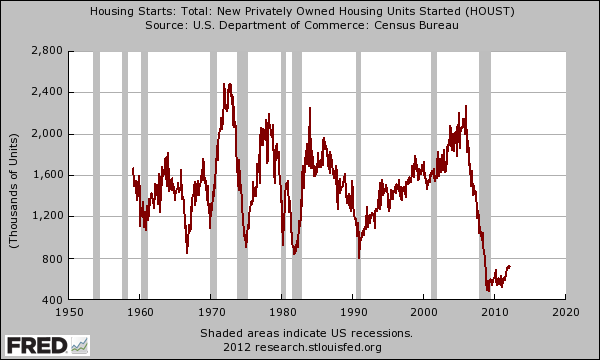

As we work through the excess inventory we are seeing some action with housing starts:

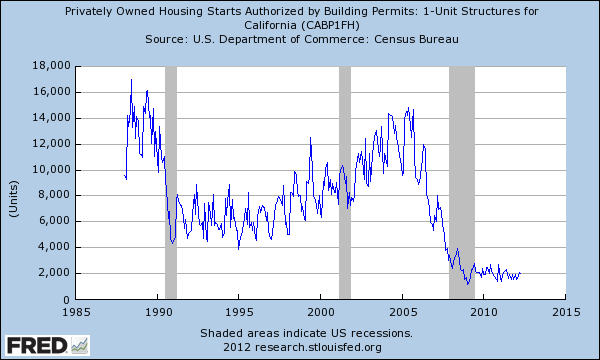

As many of you are fully aware, location does matter in real estate and single family housing starts for California have not improved:

So you likely can take away from this that nationwide homes are moving at a brisker pace to the point where home builders are actually going back into the market. In California with a big backlog of shadow inventory and inflated prices relative to incomes, home builders are largely absent from the single-family market.

Taking a hit to your wealth

While nationwide it was reported that Americans lost 40 percent of their net worth from 2007 to 2010, homeowners on average took a $70,000 hit to their bottom line:

Home owners net worth

2007 net worth $246,000

2010 net worth $174,500

How can that be positive for the prospect of higher prices? It really isn’t and that is why home prices are still at post-bubble lows. Just because inventory is low doesn’t mean the economy is improving. It simply means that many are underwater or choose not to sell their home at current market prices. It is obvious that demand here in the US is for lower priced homes even with historically low interest rates. It is hard to say it with a straight face that a 30-year fixed rate mortgage is in the 3 percent range. Yet household incomes have been hit very hard:

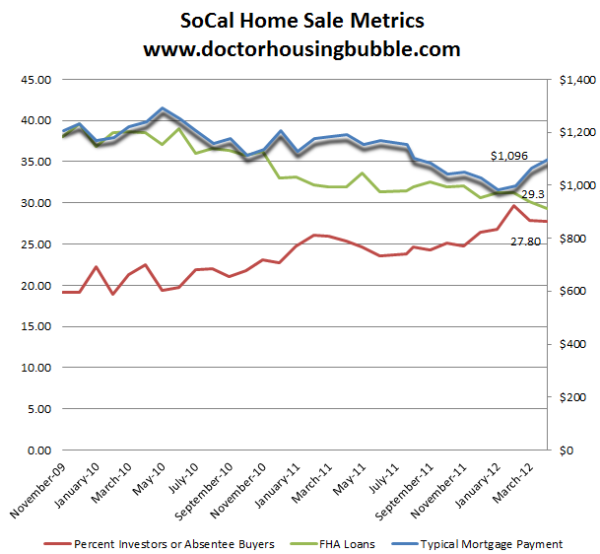

In the West, median household income has fallen by over 10 percent from 2007 to 2010. One of the arguments being made in support of housing making a big turnaround is based on the low number of homes being built and also, the slow clearing out of distressed inventory. There is no disputing that this is happening. Yet to say this will boost housing is a stretch as we are seeing with lower household income figures. Even looking at SoCal, what you will see is the dominance on low down payment mortgages and investors:

Investor/Absentee buyers and FHA figures are on the left and the typical mortgage payment is on the right. Even today, investors make up a large part of SoCal home sales and FHA insured loans are still at 30 percent of the market. In other words, nearly 60 percent of all SoCal buyers are purchasing homes with 4 percent down (the typical entry point for FHA) or are buying homes as investments. What this misses is essentially what was reported in the Fed study this week. Household balance sheets have been crushed. Interest rates at comically low levels still cannot boost this market because the buying power via income is simply not there. If 20 percent down for owner-occupied buying is common it is certainly not the case for SoCal.

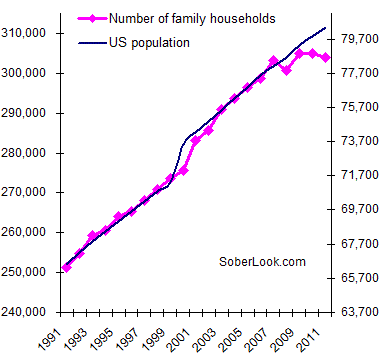

Household formation has taken a trip down a new path recently:

The number of US households by family usually kept track with population growth from 1991 to 2007. Yet as you see above, that recently changed. You have young Americans moving back home even after going to college delaying household formation. Many are saddled with enormous levels of debt rivaling a mortgage in many communities. This trend goes against the argument that there is pent up demand for home buying. This suddenly becomes an argument of what comes first, the chicken or the egg? I tend to side with the idea that housing will improve and grow if incomes (i.e., quality employment) improves. Recent data suggests that many of the good paying jobs that were lost via the recession have not come back and many of the recently added jobs come from lower wage fields. In other words, demand for lower priced housing either via rentals or home purchases is the trend even as we add lower paying jobs.

It is interesting to see the mini bidding wars here in certain areas of SoCal. This reminds me of the burst of activity generated by the tax credit a few summers ago. This time around the demand is being driven by insanely low interest rates and the perception that inventory is “running out.â€Â The sense I have gotten from many of those buying is that they are planning on getting back on the property ladder treadmill.  “We plan on living here for 5 years and then we’ll sell with the equity we gain and move into our dream home.â€Â Of course many don’t even bother running the numbers that their first few years are largely interest payments and there is little evidence suggesting prices will zoom up. We’re already seeing some of the steam pull back and we’ll see if this market has any legs once we enter into the fall and winter season.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

79 Responses to “The contradictory nature of our housing market – Investors skew down payment statistics. Four years of home sales in SoCal dominated by distressed properties. The over reliance on real estate for wealth.”

NBC nightly news just reported that housing values have stopped falling, so we should all be better shortly.

And I am sure those 12 million underwater loans will fix themselves.

Housing values have stopped falling because the banks are not releasing the the REOs and/or are not moving forward with the foreclosures! Hence the lack of homes on the market is fake, because in reality there are PLENTY of homes that could and should be available if the banks either released them onto the market or complete the foreclosure and release it on the market. It’s all manipulated for the banks favor.

What is keeping the prices so ridiculously high in the Sherman Oaks, Encino, Studio City area? Are the realtors part of a scheme or something? And why are idiots buying at these prices? Help, I want to buy there and have been waiting seven years with barely a budge in prices. Will I have to go to my grave before I see a decline. Sad as hell, and not going to take it anymore…

Please elaborate on what exactly you mean, Ev. If you have been waiting a long time for a decline, perhaps the location you like is simply beyond your means. I’m all for fair pricing, but I’m not for handouts. Bad economy or not, some areas are just plain not meant for some people. Wait, let me add to that…some areas are not meant for some people at their current income levels.

Increase your income and you can afford Sherman Oaks, it’s simple.

I myself have surrendered to the fact that affordale housing in SoCal for me is east, as in father than I-15 east. I have also accepted that prospects, when measured in $ per sq/ft, are even better in Phoenix. Or any Midwest city. And yes I’m aware of the weather and less entertainment, still fine though.

P.S. My Midwest roots dictate my finances. I stoutly refuse to spend more than 3X my yearly income on a house, and that’s pushing it because it’s 2.5X out east. That leaves me, in SoCal, with a budget of about $240k, hence being east of the 15. There is nothing for a family in L.A. County for $240k, and even desirable western parts of SB and Riverside County are still higher than that.

Maybe he knows the area better than you and isn’t willing to surrender?

gael, If he says idiots are paying the high prices, and he will go to his grave before he sees price declines, I doubt your statement is valid.

I don’t see prime areas of Manhattan or San Fransisco falling, prime areas of LA are no different. Let us not confuse a distorted market with $125k homes for all.

PHX isn’t abundant in jobs. I’d stick to SoCal even if it’s a hike. At least you know you can find some sort of jobs. The GDP of CA is equal to that of the entire country of Russia. CA’s gdp is 8 times bigger than that of AZ.

And are you saying that’s normal? How can an area as large as Orange, Los Angeles and Ventura Counties not have affordable decent housing for median or even somewhat above median income families be normal? It was never this way my entire life now pushing 6 decades until the recent bubble. I know that is the current state of affairs but I for one will never call it normal any more than I would reverse American history and switch from Pol Pots torture via water boarding to Dick Cheney’s “enhanced interrogation”.

Ev,

At least in Phoenix global investors have made a difference. Basically a rich person

from say, Boston, to pick a random city moves some of his money from a CD which

yields 0.5% to one of the private equity funds. The equity fund buys up properties

in bulk for renting. Then the rich person gets a yield of 6% from said fund. The fund

management keeps a 2 to 3% on top of that. Everybody wins provided the newly bought homes find renters. That is the game provided renting yields a total of 8-10%. A financial planner was once touting me such an opportunity around 2008.

Bottom line, in a capitalist society debt financed investment booms are created. The following busts moves property (think good internet companies in 1999-2002 crash) from weak hands (leveraged) to strong hands (un-leveraged)

Same was done for housing from 1996-2006. The bust now is completing itself in some cities like Phoenix (drop in values of > 50%). Now strong hands from far away places can own property in Phoenix. Common man (highly leveraged) gets screwed and the rich investor gets the property.

Perhaps these private equity types are now moving to Miami, FL and SoCal? Do not have data but seems plausible. This process will continue town by town for perhaps a decade. Also think Japan. Big difference between US and Japan is that they have negative population growth while US grows at 1% a year. So our bust may not last 20 years but maybe 10 to 15 starting 2005.

See link below to understand what I am saying about private equity.

http://www.bloomberg.com/news/2012-06-13/private-equity-has-too-much-money-to-spend-on-homes-mortgages.html

Good luck!

I like stories… There is no “market†in this market… This is a result of a centralized Soviet command economy. I agree that “investors†are taking the bait but this is just what our Soviet state planning leaders wanted. Remind me again who “won†the cold war…

“Everybody wins provided the newly bought homes find renters.”

Yes, well, that’s the key, right? All looks good on paper, but, somebody at the bottom of the scheme has to step up and pay the rents that are needed to pay for the second home and Porsche payments of the financial thieves. I doubt that will happen, especially since UE is still high, young people out of school (your primary rental market) is saddled with student loan debt and lousy jobs, if they have a job, and, last, but, not least, the massive amount of rental homes hitting the market as all of the wall street geniuses and mom and pops chase yields as landlords. RE: Las vegas today – rents are going down, because there are too many rentals on the market, and too few decent paying jobs. Supply and demand, as always.

I live in one of the most expensive and prosperous places in the country, home to the 1% of the 1% (upper Westchester County, NYC metro, two miles from Greenwich, Ct.) and I just signed a lease for my fifth year with no rent increase. You would think I would have been priced out of this market if you use the logic that the very smart MBAs at the private equity firms use to crunch their numbers, but, here I am, shaking my head at the neighbors still trying to sell at ’07 prices as the property taxes go up 8% or more a year. The landlord is so happy to have a check come in on the first of every month with no hassles otherwise. There is more to the business than the spread sheet results, you know.

Those are PRIME areas of the Valley where all the film industry money lives.. Do you really think there should be $200k homes next door to Disney, CBS, ABC studios?.. Why not look into Granada Hills, Porter Ranch, Northridge, Chatsworth, Woodland Hills… sure the commute increases some, but your still 10-15 min from Sherman Oaks anytime it’s not rush hour.

If it makes you fee any better, I bought in Encino, and thought I was getting a good deal, but have seen a 35-40% drop in value from my purchase date. There are homes near me in Encino in the upper 200’s, if you don’t mind not living large. (Incidentally, I was visiting my home state the other day, which didn’t see much of a bubble back in the day – its poverty being its saving grace – and there were billboards up on the main highways and routes advertising HELOC’s for 3% APR, touting the phrase, “Live a little Large”.)

EV, Yes, idiots are buying in Sherman Oaks, Encino and Studio City. The main reason prices are so high in that area of the SFV is not only because of little inventory, but what is on the market is bought up by investors, turned around to flip and put back on the market for a much higher price. These investor/sharks are buying up short sales and REO’s. We have also watched these areas for the past 3 years and see what is going on. We have walked away from multiple offer situations and we are cash buyers, not to flip but to actually own to live in. You are also correct on some realtors are involved in scams. They are in with contractors who give them a kick back. The realtor presents to the seller only the contractors offer, which is illegal, and tells the seller it is the only offer. The whole real estate market is a mess, we will continue to rent on the Westside and most likely not buy again in Los Angeles unless all the scam and greed go away.

I have a colleague from India, who says the exact same thing is happening there. The price of education is shooting up the stratosphere and so is housing. The job market is still robust there, but I wonder if these things are all part of a common cycle?

India is in trouble. China is slowing, because of their #1 export markert Europe. When China slows more, so will Brazil, Australia, and Canada because they export natural resources to China. The global ponzi scheme is collapsing.

Look for Obama to wave something shiny in front of our faces, because it’s election year. Could be payouts. Could be war. I forsee airstrikes in Syria setting up for Iran, leading to Russia jumping in and hopefully not China. We can defeat them all but a war this large and advanced will certainly mean strikes on mainland American soil, something not seen in well over 100 years. I’m not counting 9/11 cowards, nor Pearl Harbor off in Hawaii. I’m talking L.A., NYC, etc…

Wow, paranoid much?

Proven facts are not paranoia.

Speculation about an imminent WW III is.

Mike –

Crash of 1929, Great Depression, currency wars, trade wars, World War…

Panic of 08, Great Recession, currency wars, trade wars…Syria and Iran are not going away, neither is the American MIC. You figure out the end. And don’t shoot the messenger, history is mearly repeating itself and current events are forming future trends.

I see rents falling by about $100 per month, and the price per square foot for home sales up about $10/sq ft. This is “recovery”? This is Obama’s “fine private sector”?

I’m actually sick of hearing the word “recovery”. That implies returning to a state of normal, and a credit financed housing bubble was not normal. We are actually far closer to normal now, than ever before, thanks to credit and debt declining.

This is realityville folks, get used to it.

The good news is that entrepreneurship is up double digits vs. 5 years ago. People are not going to sit back and “take it”, the American spirit is to do something. No jobs? Make one. 62% of all small business is started with less than $5000 so Republican “bank lending” necessity is bullcrap. No Dems or Repubs have your back, only you do.

We will “recover” when WE make it happen, not the Gov. And forget about $500k houses, not gonna happen for an extremely long time. They are not healthy.

It looks like you’ve also noticed that MSM Nightly News broadcasts have degenerated into thinly disguised infomercials for the FIRE economy (and other multi-national corporate and military industrial complex interests).

If you want real news avoid the msm at all costs. Most of their stuff is press releases and the msm are just stenographers who write what they are told to write. Stick with Dr. HB and other sites like this.

I don’t understand what happened to buying a home to live in it. Buying a home to raise your kids, so to stay in the same home for 20years. I can’t stand the idea of a “starter home,” that’s what my 10+ apartments have been. I’m ready to stay put, too bad all these vulchers in the South Bay are keeping prices ridiculous! We have 75K down, earning a $125,000/yr and are still priced out with a 500K budget. So frustrating.

You’re doing great but the problem is, many people make $60k a year. So they gat married, and now they make $120k/yr combined. There is a shortage of homes for that income level, it’s not high enough. I’m in the same boat, and I work for a large South Bay company.

We have a TON of vanpools come in from Riverside, Corona, and Rancho Cucamonga. You have to accept the fact that in SoCal you will have to commute. Or move to another state.

Where in the South Bay are you looking? Forget about RB, MB, HB. Torrance has been creeping down for years (esp. Central and NE Torr). There are small, hidden, “safer” areas in Hawthorne, Lawndale and Gardena, where $500k will get you a nice 3/2.

500k nice 3/2….holy christ.

Hawthorne, Lawndale, Gardena and 500K don’t go in the same sentence. It wasn’t too long ago, maybe 15 years ago that 500K could have got you into Beverly Hills or Palos Verdes. WHAT THE HELL HAPPENED? HAS EVERYBODY DRANK THE KOOL AID AND GONE MAD?

How about this. We remove all homes from the market and let the entire population of the country bid on one remaining home this year. Make it a good sized house too in the 600K-1m range. We’ll get a nice bidding war and the sale will boost the national average.

Mission accomplished. Well done Washington – you’ve supported the housing “market”.

Meanwhile in reality land where homes owned by insolvent banks and underwater borrowers with far less income and net worth than they imagined sit idle and everyone hopes it just all works out and goes away so the party can continue. This is denial.

There has never been a better time to buy!!! Affordability has never been better!!! We are at the bottom!!! Take advantage of these historic low rates and lock in for the next 30 years! Quick, buy before you are forever priced out of the market! You should ensure that you get the house by bidding at least 10% over asking price. You won’t be sorry! You gotta live somewhere! Now is the time to move into your dream house!!! Buy as much house as you can get! California is truly different! Blah, Blah, Blah.

You say chicken, I say egg. I believe that the artificially high housing prices in California crowd out other spending which slows economic growth. Home owners could spend on other things like cars, motorcycles, boats, breast implants, etc. when values were increasing and they could take money out of their overvalued property. Currently, we have artificially high prices with no appreciation so there is no money left for other spending. Selling an already built house has little impact on an economy. Building a new house or manufacturing breasts implants has a much greater impact on an economy. I believe one of the reasons that our economy is experiencing little to no growth during this “recovery†is because of the focus on holding up the artificial bubble housing values…

Very astute observation, and I love the sarcasm at the beginning! lol

I have noticed the homes that have recently been remodeled getting snatched up quick. A few of them that I was interested had all the same finishes. When I inquired who did the remodel, it was by the same group of investors.(Small group of 3 guys) I had the feeling they were new to construction.Even with your due diligence, I worry are these even reputable and competent builders in the construction business? I look them up and can’t find a thing on them. Any knowledge on protecting yourself from buying something, not up to par?

Sorry. The new normal in bank owned and short sale ville is “Sold as is”. The existing home sales market is now the kin of the used car market and you are the “up” translated as mark. Enjoy.

We will never buy from an investor. Yes, you can always tell these homes, they have all been remoldeled with the same finishes. We would much rather rent than put money in the pockets of greedy investors. Wish they would get a real job and do something good for society and make a difference. Better yet, many of these investor homes are now sitting….. if they have to rent, maybe they will get horrible tenants !

My theory is many in SoCal receive a govt check every month; many retired fire/govt w/ big pensions living in the beach town where I temporarily rent…so whether the economy soars or stumbles, they receive the same check, year after year. Ditto low income; many receive UE/welfare/food stamps/bennies, same monthly check no matter what they do, or how the economy performs. To be blunt, there’s a big demographic in CA (ranging from wealthy to poor) that receive a govt check monthly to simply exist…sleep, eat, shop, poop…not producing much else (except maybe more kids). The upside? Wealthy pensioners seem to enjoy shopping, redecorating and remodeling, dining out, and the welfare set enjoys big sodas and fast food, providing more $10/hr jobs and “hope” for the next generation; once these kids graduate college they can move back home and start saving the 4% down payment for the 500K box so they participate in the Dream.

Apartment Complex For Sale. Every Tenant is HUd qualified. Guaranteed monthly rent. Plus Plus Plus. Hurry Hurry Hurry. Don’t miss. This one won’t last.

I sell a product everybody needs. And I’m gonna vote for any candidate who will subsidise the persons who buy my product.

Rather than one check for me, I get every one of them.

Bravo! To add that scenario you laid out so well, we also have all the hidden tax from the money printing that goes to subsidize big business and banks so we get screwed from the top as well as the bottom!

Don’t forget all the rich people of America and the rest of the world that buy homes here as 2nd homes, and they sit most of the time. This uses up space that could be used for residents, but it is what is….

It’s not easy to get a government check. People have to jump through very high hoops to get there. But outsiders always say things like you said. Older people have lost a bundle in the financial crisis and now live on Social Security which is not enough to live. Yes these people do contribute to the economy. They have to spend every penny I get and with the multiplier effect actually make their money work better than high end investments. Actually more money for the poor and old could help with a real recovery and get things moving but the greedy and stupid right wing can’t see that. They are willing to sink the country, families, children than allow government – our only hope to boost the economy – to spend any money. Even though when things get better revenues from taxes and individual spending will end the debt and the depression we are in. You blame it on poor people when you should be looking at the financiers and their wild and illegal ride.

Sounds like it is as simple as this:

The evil screw the righteous, and the smart out-wit the dumb?

Time to blame ourselves, and not others for our plight.

The “multiplier effect” is complete nonsense.

Say hello to our 16 billion budget short fall. Guess what’s getting cut on top of the school?

It’s no surprise that the market has taken considerable time to repair itself.. Still needs more time. What, with bailed out banks holding on to bad loans, shenanagans in the market, sweet heart deals to banker’s friends and last but not least, a bubble that “TRUMPTED” anything we have ever seen since tullip time (another bubble of olden tymes). Real question is how could the system allow something like that to happen. Little oversite problem? Adult supervision needed? Little uncontrolled greed? It’s only money, yours and mine as tax payers footing the bill. So in short, I don’t want to hear about bailing out more smucks over bad loans and stoopid over thier heads deals. I pay my mortgage monthly, live modestly and do the best I can. Bleeding hearts in the keepin-up-wid-jones section of the gated nerdistans are not my problema. I’ma progressive, but that kind of welfare state can take a walk.

Like a mouse nibbling on the cheese at the catch of the mousetrap, “investors” are paying cash for RE “bargains” while mortgage interest rates are at historic lows. We all know what happens to bond values when interest rates rise. But hey, hope springs eternal, what could possibly go wrong?

Just because “investors” are in the market doesn’t mean they are right. I met an “investor” who had 7 foreclosed homes after the bubble popped in the Inland Empire. Most “investors” now are more like that guy than responsible investors who do their due diligence prior to making an investment.

Income as measured in purchasing power has been stagnate to falling for years in the US economy. And now we have huge unemployment in the under 30 crowd. No money, no family formation, no home purchase. It’s just that simple. Demographics are our future. And up-tick in the housing market is pure manipulation by not processing bad mortgages. Thank gawd our banking system is allowed to survive. Thanks for taking the lead , Japan.

It is very interesting how nearly every house brought to market in the Conejo Valley is immediatley “pending”.

I am in the Conejo Valley as well and am watching the market closely. I am shocked how many $500k plus homes are in escrow within weeks. Makes no sense to me, I will just watch from the sideline for now.

I am also looking in the Conejo Valley price range 450k – 500k . Sold in 2006 and waiting to buy, very discouraged, as soon as a house appears on the mls in our price range seems like it is snatched up in a couple of days.

We’re in Thousand Oaks (Conejo Valley) as well. One thing that is bothering us besides no inventory, is the influx of 3rd worlders, mostly illegalls.The pattern is very San Fernando Valley circa 1984, when we moved into this area, away from the invasion.

Now it’s happening here. We live on Erbes, 8-10 to a 2 bdrm is the norm.

There was a meth lab that blew up on Avendia De Los Arboles, killing the illegals and their anchors. I think this house was finally fixed, since it sat all boarded up. This happened a few years back.We’re looking in the rental level housing price range, so that’s a concern we have.

Housing stock around here is older, in poor shape (the bones) and prices are insane.Then to top if off, I now need to run title to understand the owner:renter ratios in a given neighborhood.

I’ve been watching TO for a while too. My impression is that a group of “investors” moved in last fall. Some of the houses they snatched up are starting to reappear on the market as failed flips. I know of at least two flips in my area (91361) that lost money. I think once the word gets out that they’re not profiting the “investors” might exit the market en masse.

Hey Matt and all other Conejo Valley residents. I have also noticed the “FLIPS”. Looks like they are out big bucks. Waiting by the sidelines until Fall. We are in Newbury Park.

Mad as Heck: You are right about the Valley in 1984. I lived in Sherman Oaks most of my life. We moved to Conejo Valley in 2004. We were tired of the police helicoptors waking us up three times a night. Not kidding here. Sherman Oaks was a great place to grow up. The schools were excellent. If you were in the Grant High School area the price of your home increased 10K. Those were the days!

Dr HB pointed out just in case you peasants missed how badly you are losers in the American Society of the Rich: “Earlier in the week the Fed showed how the typical American family saw their net worth fall by nearly 40 percent from 2007 to 2010.”

The figures and full, long, FED report are worth reading, if you care. First caveat: hispanic middle class did much worse in losing net worth even than whites, good thing there aren’t lots and lots of them in Southern California who might buy homes, eh? HOWEVER, the big, glaring giant omission by the FED economists? THEY LEFT OFF 2011! If 2011’s further econonic collapse of homes AND stock market surge helping the rich fantastically, if that 2011 information had been included and the mess that is Atlanta, Minneapolis, other middle and upper middle class real estate homes dominated cities, the loss of value to you middle and upper middle class peasants is astronomical (plus largely middle class student debt growth, etc). Yep, this report’s telling you you’re broke and getting more so, was bad enough, BUT this owned tool of the richest bankers…the FED…left off the 2011 “rest of the story” AND this: any person can draw trend lines. These fantastic economists have NO TREND lines drawn on their charts, isn’t that remarkable?? Wow!! What do you think is happening further in 2012 and 2013?

Oh, and it is good to know the banks are speculating on currency contracts with your deposits (JP morgan) in the billions, rather than making loans here to real businesses that might have real jobs with real wages for real US citizens? Excuse me while I become despondent.

I just wish GMAC Mortgage would stop leaving debt collecting messages on my answering machine for Maria Perez from Canoga Park. If anyone out there knows Maria Perez, please tell her to stop using my telephone number on her junk.

This fellow I follow on youtube, who has good refresher material for calculus/algebra/physics/etc. had a good idea back in 2008: Instead of the government buying a bunch of worthless CDO’s from Bank of America, etc. for 700B, they should have formed new banks, using the 700B as seed money, issuing 300M shares to the public (1 share per person, or better yet, 1 per tax payer). The new banks would have been free of liabilities, thus no fear in buying bonds from them (with further backing of such with a 5-year-limited insurance against loss, by the govt.), and could have kept liquidity going, handing out credible loans to credible causes (MCD or GE payroll, capital expenditure, etc…). Since the new banks would be squeaky clean, they could leverage up 3 to 1, or even 10 to 1, thus turning that 700B into 2.1T or 7T – plenty of liquidity. The old banks would then be allowed to fail, and in turn, kill off the investors who had equity or held bonds with them, who profited from the bubble; the major problem being that some of those folks were probably Congressmen or owners of Congressmen, and pension funds.

Word. But actually do something rational of, by and for the people? That would be a different reality certainly not where we live.

this is an excelent article ,but the main motor pushing housing market is employment.

Other forces like investors are only air building up new bubbles

Well, here we go again. Seems everyone here is frustrated about the economy, including myself. With my 2 cents, I tend to think that our main problem is the stock market. Think about it. What would happen if we didn’t have stock markets? Would jobs stay local? would economies be stable? would business’ be independent of shareholders and more dependent on workers? Banks would go back to being “local” holding all their loans, not selling them on the market. The stock markets have become a giant “casino” and if you have every been in Las Vegas, those casinos were not built on winner’s monies, but loser’s. Only the Casino wins in the long run. Maybe we should just put our wallets back in our pockets and go home.

I sense many people here who are just dying to part with their hard earned money.

http://venice.patch.com/articles/home-prices-in-los-angeles-county-rising

Home Prices in Los Angeles County Rising

“A brighter economic picture, coupled with record-high housing affordability, pushed the spring home-buying season off to a strong start,” said CAR President LeFrancis Arnold. “With a continuing improving economy and interest rates declining to new record lows in recent weeks, we should see a steady improvement in the housing market through the end of the year.”

Does the CAR pay for articles like this to be written? Do you think the entertainer that wrote this would consider themselves a “journalist”?

Entertaining it ain’t. In a chat we a realty agent this past week she related that the Calif Association of Realtors economist’s vision is similar to this blog in a speech the economist said that sales would not really pick up over the next two to three years nor prices rise due to economy and the shadow inventory. But hey, when rates are low and spring is in the air you have to set up your kool aid stand and make dough – so the sales pitch revs up. It will be fascinating to see where all this is come November December. ( No reference to electoral politics intended).

There’s nowhere left to build in cities like Los Angeles… San Francisco, NYC… That is why prices are high and will be the first to recover.

But there are vacant homes, rotting away, the land not being used for anything, maybe whoever owns it is waiting it out to replace it with condos or something.

The population density in Southern California is nothing impressive. It is a tiny fraction of that in New York City. If there is a problem finding space to build on it is out-dated zoning regulations and NIMBY protestors rather than a true lack of space.

When you can’t build out, you build up.

Who wants to live in a hi-rise in earthquake prone L.A.?

Unless you want a society full of fat kids… yards and outdoor play is important. There are already far to many indoor distractions with ipads, internet, video games. Living in a 20 story hi-rise is just going to guarantee your children are going to be lazy and not athletic.

Nooo, you make ’em run up and down alllll those stairs! I swear, have you ever been to NYC, Chicago, SF, or London?

I love your charts. I live in the KC area and listened to a radio program with a relator talking about the metro area and how now is a good time to buy a home and that value is returning to home ownership. He further went on to claim that homestarts would be returning slowly. I called in and asked him if he knew the ratio of distressed properties versus homes available in the area, this being a horrible sign in CA. He and the show’s host made the claim that there was no ratio to speak of. Barring the obvious stupidity of this statement, being impossible… How would I go about discovering these figures myself for my locality?

1% largely recovered because only 10% of their wealth is in housing and the Fed gives them free money to play the China market and etc.

But for family oriented people who has a mother that says that it is time to produce the babies, the housing prices and cycles are irrelevant. There are other things that take priority. It is cheaper to buy than to rent. The kids need a yard, mami says.

Kids don’t “need” a yard, that is part of the manipulative housing BS that people buy into. What about all the kids growing up in apt.s and coops in, say, Brooklyn? Parks are for people! Also, don’t let anyone tell you that you have to have children – – it is YOUR choice!

Rhiannon, don’t get me started on what I think about urban attitudes, trust me you wont like what I have to say. So to retort you, YES kids need a yard. I had one, I grew up in an amazing area with an amazing life, and I scoff at city slickers.

But hey – breaking news – Barrack Obama gunna give amnesty! 800k new future homeowners! Now if only Barrack Obama woulda pay my mortgage, BARACK OBAMA PAY MY MORTGAGE!

My kids NEED a yard… I would say 90% of my fondest memories from childhood are playing games in my backyard… baseball, water balloon games, neighborhood night tag.. playing catch after school in the backyard with my father.

Sorry, in a big city by the time you get all the gear together and drive to the nearest parking, look for parking, … it can eat up hours.

Open the back door.. let the kids and dog run outside…. talk about CONVENIENT!

Obviously Rhiannon never had kids or wants kids.. and never had a yard growing up. The benefits are way underestimated.

Sorry, Rhiannon had a yard, and she knows plenty of happy kids who don’t have yards currently.

“city slickers”? Now I KNOW you are an uneducated moron. Econ. 101 would be a good place for you to start, PTB…

I don’t know if it’s relevant, but you can track Bakersfield, and with any luck, what happened to them will finally happen with the rest of the state. Their wages are lower, and unemployment higher, than much of the state. The bubble was more generous on it’s way up, and worse on it’s way down.

So, after the pop, they had all this ridiculous property. Garbage listings, at stupid prices. Banks were hanging on to property. People living in a fairytale that their house will ALWAYS increase in value.

Now, there’s a ton of inventory, $/sf are at pre-bubble levels, and the listings are nice. Mowed lawns, no drug dealers in the back ground, they bothered to CLEAN UP, etc. Reality had to hit them harder, and it did. Thus the correction took place before the rest of California. I’d like to be optimistic for the future.

Just to play devil’s advocate here, let me present a scenario. Honest question.

We know that most people jump into investments or jump out at the wrong time, missing the gains and maximizing losses. By the time conventional wisdom says “go” the opportunity is gone. We also know that the government is basically handing out free houses with their 3.5% down payment requirement. So, why wouldn’t a person just buy a place, not their ideal, 30 year nest, I’m going to grow old here, house, and stop renting? Heads the market goes up and you make profit. Tails the market goes down and you lose your 3.5%. But if you buy a house where you can float the payments, it’s a rental opportunity anyway.

Is that really so bad? I mean, banks are playing games withholding inventory, interest rates are manipulated, people are squatting in homes for years. Why not play the game?

Good Article. Almost by definition, there can’t be pent up demand when we are seeing short sales as a dominant portion of the market. That would mean pent up supply.

From 1992 to 1997 there were houses in Santa Monica for mid 200k–lots of them. Even by 1999 when we bought for 240,000 in mid LA the westside could still be had for 300k-400k. Unfortunately things are being manipulated in a major way and nobody knows if that’ll cease anytime soon, but I bring this up to point out that these prime areas are not absurdly high because “land is scarce” or because LA is “all built out”. This was true in 1999 too yet a household income of 100,000k could easily buy a house back then on the westside (and, I suspect, Studio City too). There is NO way these areas would be this unattainable if we had a normal loan market like we did in 1999. You people who keep saying, “hey, LA’s got lots of rich people–your $100,000/yr is nothing in this town” are flat out wrong. Middle class people were still buying on the westside until the loan shenanigans of the 2000s, not to mention Studio City and Newbury Park. I know people in all of these towns. High school classmates bought all over because they were lucky in their timing. Some places have always been rich, true–malibu, Bev Hills, pac palisades, northside sm, hollywood hills, calabasas, cheviot hills, manhattan beach. But this is bogus to claim Studio City, Culver City, Mar Vista, thousand oaks, torrance are suddenly wealthy and 100,000k/yr is a pittance. NO WAY. A lot of people made ridiculous, undeserved money from the bubble. Realtors making 500,000/yr off loans that all foreclosed 3 years later? Maybe this is the big money that’s outbidding everyone lately. If we ever do see 20% down required like we paid, though, most areas in la will return to middle class, no question

About earthquakes and high rises…. I can’t help but notice that in recent (past 50 years) earthquakes in Japan and San Francisco, that the steel-frame highrises held up much better than the 2 and 3 story stucco and brick buildings.

I especially remember the 1989 Loma Prieta quake in San Fran. The destruction and disruption to essential services were catastrophic – I couldn’t call anyone in 415 area code for weeks after- and the buildings that took the worst hit were the low-rise apartment buildings, especially a number of beautiful old stucco buildings. But the TransAmerica building didn’t so much as drop a pane of glass sheathing. Most steel frame high rises are much more quake resistant, with their flexible steel frames, than any low-rise masonry and timber structure. Modern building techniques have drastically reduced the death toll in quakes- the 1755 Lisbon quake and tsunami killed about 55,000 people according to best estimates, while the 2011 Japan quake killed 10,000- mostly from flooding. Loma Prieta killed 63 people throughout the region affected. The 1994 Northridge quake killed the same number.

I believe high rise dwellers would fare much better in a quake than people in the charming old brick courtyard, or brick and stucco SF homes across the street from me. The best thing to be said for the typical SF house in a quake is that you can usually exit quickly.

Perhaps real estate should be actually regulated, such as:

– when you buy a home, can’t change title for two years, can’t be flipped.

– realtors/mortgage lenders should be college educated.

– have to be a US citizen to buy US property.

– anyone caught in real estate fraud can never buy real estate.

So sad what became of the real estate market here. It used to be that buying a home was to live in, not an investment. The good news is there are so many wonderful places other than here to live, with a wonderful quality of life.

Leave a Reply