The hidden cost of easy financing – the cost of big debt and the future of the young home buyer. Mortgage rates nearly twice as low compared to student loans.

Nothing in life is free and going into deep debt to finance your current lifestyle rarely ends well. There seems to be a current narrative that completely disregards the challenges faced by younger Americans. The obsessive focus by the Federal Reserve on housing is tragic since the Fed was instrumental in laying the foundation for the housing bubble in the first place. They were also obsessed with low rates in the early 2000s. It appears that no lessons were gained from that period and like the Great Depression, a cultural amnesia has taken place. The Fed has a bloated balance sheet of over $2.8 trillion and will smash that sucker up as they begin buying $40 billion in MBS per month. Yet what one hand gives out, the other takes away. What about the future generation (aka your children) that will be contending with a vastly more expensive education system and fewer options for a secure retirement?

Public education in California

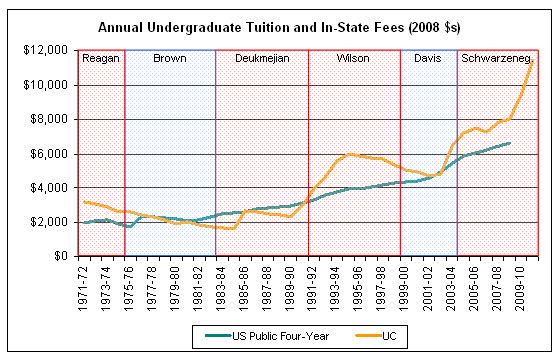

The two main higher education institutions in California are the University of California and Cal State systems. Both have seen their tuitions soar upwards starting in the 2000s. Keep in mind this happened during a time when household incomes went stagnant. First, take a look at the UC:

The chart only goes out to 2011. Current tuition and fees are now over $13,000 (or over $52,000 for a four year degree). Back in 2000 when household incomes were the same, the annual tuition was around $4,000. The state of California has shifted its priorities and has continually run budget deficits since the economy went off the cliff in 2007.

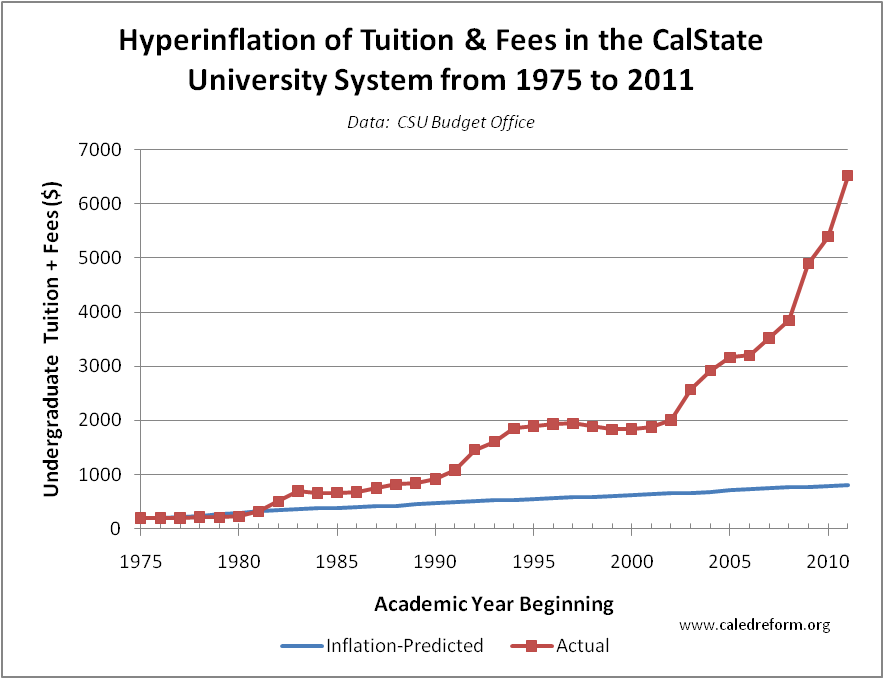

The Cal State system has seen a similar rise in fees:

Source:Â Cultural Psych

Back in 2000, the annual tuition was less than $2,000 for a year at a CSU (less than $8,000 for an entire four year degree). Today it is over $6,000 per year (or over $24,000 for a four year degree). As we initially stated, everything comes at a cost. Some naïve readers seem to think the Federal Reserve has the money to bail out the housing market. They do not. That is why their balance sheet is above $2.8 trillion and will grow larger. We continue to deficit spend as indicated by our $16 trillion national debt. This debate has been going on for ages. The only difference now is that it is obvious what group is largely shouldering this burden. Younger Americans. This is the hidden cost of everything. If the Fed is going to blow $480 billion in MBS purchases over a 12 month period, there are many other areas that will aid the employment market in this country much more than funneling even more resources into housing.

Low rates except for the young

The current low rates have benefitted large banks the most and also current homeowners. Yet many younger Americans do not own property. Many are carrying large student debt burdens as noted by this year when we passed the $1 trillion student debt loan threshold. Many unsubsidized government backed loans carry an interest rate of 6.8 percent which is nearly twice as much as the current 30 year fixed rate mortgage. So what is being saved in one area is being ignored in another. Do not think that these hikes in tuition are being shouldered with part-time work (it will be a challenge to earn $13,000 as a student and do well academically in a field like engineering). It is amazing how some that got their degrees decades ago have forgotten how to actually use inflation calculators and figure out that today the true cost of education is much higher in a much tougher job market for the young. Back then, you could pay for your education mowing lawns. How many lawns would you have to mow for $13,000?

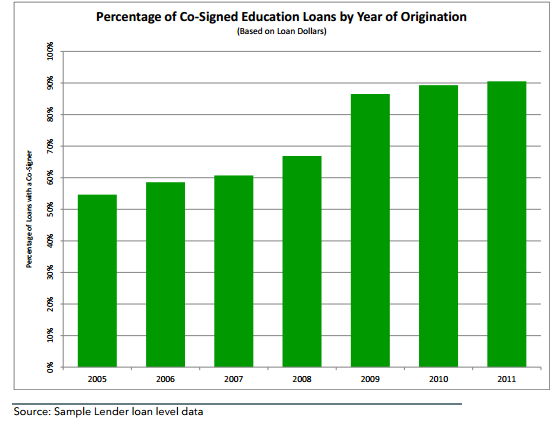

So what are parents doing? The number of loans being co-signed has shot up:

It is amazing the number of people that mortgage up to their necks and are now sending their kid to a private university with annual tuition of more than $50,000 per year! Some have to send up to two or even three kids. Do the math here and you realize that some did not clearly think about the end game. And you see this in the comments with the rush of buying now happening in areas with good schools. Why go after good schools if you do not have the end goal of sending your kid to a good college? What will the cost of college be at that time? Can the above trajectory keep up? The name of the game is leverage up and hopefully you can service that massive debt.

Think tuition can’t go any higher? Think again:

“(LA Times) — Most UC students will get a breather of at least four months without a tuition increase. But then, all bets are off.

That’s the result of a UC regents vote Wednesday freezing all undergraduate and some graduate school tuition as part of a funding deal with the state Legislature. If Gov. Jerry Brown’s tax hike measure on the November ballot fails, however, the regents warned that tuition might rise 20%, or more than $2,400, and that course offerings and library hours could be significantly reduced soon after the election.â€

Is it any surprise that home buying among the young has fallen dramatically? For those that do end up buying, many dive in a low down payment FHA insured loan since they are strapped for cash.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “The hidden cost of easy financing – the cost of big debt and the future of the young home buyer. Mortgage rates nearly twice as low compared to student loans.”

Yet people are clueless as to why tuition keeps going up. The students protest but don’t know who to go after. They go after the Board. But what about the rest of the perpetrators? Their loving teachers have a grin on their face as they come to class. They know they’ve put one over on the students. The administrators try to keep their salary increases covered up for as long as they can.

Your joking right? The reason for the student debt bubble is the same as the housing bubble. It’s all about the Notes. It’s how the banks create money. Amazing how many people have no idea how the biggest robbery ever perpetrated is done! Truly astounding how the banksters have orchestrated their damned for years and years and still the majority of people are clueless as to how it works. The teachers…. lol too funny. Try Googling “Money as Debt” and watch a little Money 101 lesson that should start you down the rabbit hole of truth about how it all works. Happy trails.

Quit frankly, I don’t think banks are to blame. It’s the govt. Anytime the govt subsidizes anything, this is what happens. Housing, student loans, etc. There will be a very small subset of people who the program was meant for, and then the larger slice of pie are the greedy who want to exploit it simply because it’s easy money. Easier than working.

Well, the govt has to be influenced by various groups in order to make decisions. The financial sector is very influential in govt. It is not coincidental that the financial sector gets a piece of all the action while off-loading much of the risk. Like a GSL. And for the loans the govt has not backed-up, they have the Fed to bail them out.

Of course, it’s the banks. Or any other entity that usurps the government’s responsibility to its electorate. Just Google “government capture.” Case in point: http://www.economist.com/blogs/democracyinamerica/2010/12/rigged_revolving_door

Don’t think for a moment it matters which of the two main parities is in office.

I agree that the prospects for future generations in this country completely suck, the Fed has made it clear that it’s every man/woman for themselves from here on out. It’s no longer a question mark or secret of what the Fed is trying to accomplish…either take your chance and follow the piper or take your chance by yourself and stray off the path.

If you have a 20% plus down payment (DTI < 25%), stable employment and plan on staying in the area for at least 7 to 10 years…it's probably in your best interest to buy now. Good luck everyone, waiting for a normal market to return has turned into a fool's game!

Several problems. On the average, Americans move every 5 years so most will not stay in that house for 7-10 years. Second, when they sell they will be hit with 8-10% selling costs (commissions, fees, house improvements, etc). So their losses are already built in the day they buy the house since house prices are certainly not going to rise for 10-20 years. Third, when interest rates regress to the norm (7-8%), house prices will drop significantly making it even harder for those folks to sell.

Once again this myth of 8-10% commission costs is brought up… Real estate agents are fighting over each other for clients… You can sell a house for 2% commission now… Times have changed, if i were selling my home now i would negotiate a 2% commission MAX!

If wages determine home prices… Then low inventory determines low comissions… Due to more competition for fewer sellers.

@ Lady. Regarding Americans moving every 5 years…if that truly is the case then nobody should ever buy. You do remember that one can rent out a property if forced to move for whatever reason. I got a good chuckle reading “when interest rates resume to the norms of 7 or 8%.” Hate to break your bubble…not anytime soon if you’ve been paying attention to current events. The Fed calls all the shots and low interest rates are here to stay for the forseeable future.

Like I said, it makes sense to buy if you have 20% plus down and your PITI is less than rent for a 1 bedroom apartment in the same area. Do you think rents will decline significantly in the near future? Nobody knows how this will all play out, today’s monthly payment is something you have control over…future rates, home prices, rents are all unknowns.

oh yeah, long-distance landlording is a blast, and guaranteed to cover your PITI – just ask our current drop of accidental landlords. LOL!

The Federal Reserve is a private corporation which requires all nationally chartered banks (Wells Fargo, Bank of America, Citigroup, Goldman Sachs, Chase, U.S. Bank) to become members of the Fed by purchasing non-transferable shares. These private banks also get to select the board of directors for their regional Federal Reserve bank.

So, take a guess why the Federal Reserve is obsessed with the mortgage market, and why they are transferring crap MBS’s from member banks to the Fed’s balance sheet…

The Fed is essentially taking on the roll of the “Bad Bank” and thus has created a debt jubilee for its members. Buying up all their garbage loans at face value. Wouldn’t we all love this deal!?!?

Exactly. I would love to gamble grotesque bets with OPM and keep the profits and pass all my losses off to the US taxpayer. Iceland fired their government, arrested the banksters that robbed them, and their new elected government told the banks to shove their fraudulent loans based on over valued underlying assets up their arses. Now only a year or so later, Iceland’s economy is doing great. If Americans had a clue how the banksters did this perhaps we could do the same. But when half the country still blames the borrower because that’s what they heard on tv, we don’t stand a chance. Most Americans don’t even know where money comes from or what gives it value. Ignorance will be our undoing.

It is somewhat of a tangent to the topic, but surely you have all heard a little about the Illinois teacher strike. I think they just settled for a 16% raise over 4 years. Without knowing the details, I’m not sure if the new salary structure is reasonable compared to peer contracts, but it seems rather generous to me, given the state of the economy.

The really big story here, however, is the part that got just a tiny mention in the news. If I read it correctly, they decided NOT to tackle the thorny issue of the teachers’ retirement system, including the delicate issue of pension underfunding. Now if you have been studying state government budget woes, and especially state pension issues, you would know that Illinois is even worse off than California. There is no way in hell anyone in Illinois is going to get their full pension, unless they are already 75 or 80 years old.

This is just some more can kicking. I wish I knew how it was going to end. It is just really hard to see the economy doing much better until the deck is reshuffled and we start over with a new financial system.

(more OT re: can-kicking)…Same goes for this phoney “financial cliff” storyline that the media is running with right now. It’s phoney not because the short-term consequences won’t be severe for our economy if the two sides can’t resolve the punt from the phoney debt ceiling debate from last year. The ownership class (who controls everything) KNOWS that such scare tactics help to keep us, the citizenry, on our heels, waiting, hoping for our elected leaders (dutifully in the hip pockets of the same ownership class thanks to things such as Citizens United, repeal of Glass-Steagall, etc.) to do something about it, i.e. make the tough, responsible decisions to keep our republic solvent and viable for future generations. There will be a huge build-up about the catastrophic consequences, followed by can-kicking semi-plan to not solve the problem but to keep us all dependent on these “leaders” to come up with some future plan. Meanwhile, the ownership class gets richer and less-dependent on America and Americans to bolster their largesse. George Carlin was right. Nobody notices and nobody cares.

P.S., Oh, anyone notice that the Dancing with the Stars guy got an Emmy last night!?!

I’m guessing the “fiscal cliff” will be dramatically avoided in the “final hour”, like a telenova, setting up photo ops/speeches for politicians tooting their horns about “working together for the American people”, blah blah, blah. Just print more money until things improve. I’d guess approx 20% of the American public is even aware of a “fiscal cliff”, most don’t know, don’t care. The media has decided Obama will be relected…I’m not a fan or Romney or Obama, but the media bias favoring Obama is so obvious its laughable. Might as well watch Dance with Stars, or HouseHunters, see a woman pout and question the integrity of the Realtor who would showing her a house lacking granite countertops/stainless steel appliances. Visit a local coffee house, watch a fretting hipster blog about global warming and human rights on his/her electronic device produced at FoxConn in China. It all makes perfect sense.

Well, as an Illinois resident I can tell you what the locals want to know. Why is Rahm on the TV, 2-3 times per hour, every day, on every channel (cable included) ‘explaining’ the resolution of the matter? For the past week. In the 3rd most expensive media market in country. But he won’t tell us who is financing this massive media spend.

Perhaps if our bankster friends and their management buddies would care to be even a little bit honest with the public, we might be more inclined to believe what they’re saying.

Quick note on the UC price history chart. I was a full-time, undergrad, UC student from 1980 to 1985 and I remember not paying more than about $1500 a year for ‘reg fees’. That’s what they call tuition at the UC system. Actually, I think it was more like $212/quarter.

Yes, and where is the money raised from fee hikes going? Into the pockets of who?

more on UC fees:

I was a UCLA undergraduate from 1982-1986. I think my fees were $250 a quarter and they were paid for with grants. I went to UCLA for my MBA, graduating in 1988. I paid $2,000/year and it was paid for wiht a fellowship. Today UCLA MBA is around $50,000. I currently advise some students and they DO NOT BELIEVE ME when I say what I paid. It is such a statement about our culture. These kids have done everything right and we are screwing them over so rich people can get their tax breaks extended forever. Take me back to the 80s!

I have a bachelors of pharmacy degree. I took 2 years of pre-pharmacy classes (physics 1-2, calculus, probability and statistics, economics 1-2, biology 1-2, chemistry 1-2, organic chemistry 1-2, psychology, and a bunch of junk i’m forgetting – history, philosophy, a couple music classes, jazz history, etc..) then 3 years of pharmacy school (5 semesters of school and 1 semester of externship (i.e. free labor for hospitals)). My school was so cheap that when i graduated in 1998, I had 3K left over in my bank account, and zero student loans – zero debt. I worked crappy jobs in the summer to pay my tuition, between semesters. Currently, I don’t work full time, but the other full time guys at my job make about 120 to 140k per year.

Compare that with today’s USC pharmacy students: The school is so competitive that the 2 year, pre-pharmacy regime i went through no longer gets you into school. Current students must complete a 4 year undergrad degree in biology or chemistry or math, etc., to even be considered for pharmacy school.

Also in the last decade some clever administrator found a way to make some extra cash: add one extra semester of classes to the bachelors degree and add one extra semester of externship (free labor) and call it the Pharm D program (doctor of pharmacy). And here’s the kicker: the bachelors degree is now gone. It’s Pharm D or nothing when one enters pharmacy school now.

So, what once was a 5 year program from start to finish, is now an 8 year program (and there’s no guarantee that after completing one’s undergrad that they’ll even get into pharmacy school – pretty much you need a 4.0 in your science courses at high marks on the preliminary tests just to be considered). Extra cash for the school. Let me be clear – this extra degree doesn’t translate to higher pay in the real world. Employers only care if you passed your state board test and currently have a license to practice (though it is easier to get a clinical job if you did the new program). The pay is the same regardless of the degree.

So the USC student interns at my job often complain that they owe 200k in student loans (there is a steep tuition premium once one is accepted to the school of pharmacy – they might as well just go to medical school). So not only do they loose 3 years of real world work (due to extra schooling now required), they are stuck with loans that are as big as house payments.

I was talking with one of my interns the other day. He used 6k from his student loan to buy a Rolex watch. Sound familiar to the HELOC guys, using pretend equity to buy a Mercedes? He said he knows he’s either going to be in debt the rest of his life, or Obama is going to forgive his debt. Either way he’s gonna have fun and make irresponsible financial choices, like his watch, given the two seeming roads in his future: massive debt or massive debt forgiveness.

Tom, the cost for the MBA at UCLA is about $71K (http://www.anderson.ucla.edu/x40908.xml) now and when I attended an info session, they quoted $106K. I was looking at applying to broaden my horizons into the business sector (already have a MS in Bioengineering with a steady job) and seriously gave it a second thought. I have no desire to take on any more loans than I already have from undergrad (Grad was covered by working as a TA).

If you want an interesting take on the Education Bubble, this is a great documentary (its about an hour long, but will open your eyes):

http://www.youtube.com/watch?v=Ww4m8GUK69E

@WestCoast:

That movie is a bit sensationalist. There may be a pharmacist in AL that is making $18/hour but that is several, several standard deviations away from the mean. Here in CA, $18/hour is what a pharmacy technician makes. In 1998 I made $30/hour. In 2012 I make $62/hour, except when I work 12 hour + shifts, then the last few hours I make $93/hour and there are also overtime situations where I’m getting $124/hour but those have become rather rare, after the economy went downhill in 2008. 10 years ago I worked in rural settings, and the work environment was so poor that there actually was a huge shortage of workers. I would go into a pharmacy that hadn’t been open for 2 days because no one wanted to work in such a poor environment. I won’t attempt to explain the level of stress and anger one chronically accumulates whilst working that type of job, other that to say those few people that tolerated it were given 30K signing bonuses for a 1 year, full time contract (and a lot of my schoolmates would go back and forth between employers just to get the extra 30k per year). And even after employers were throwing in an extra 30k per year, they still couldn’t find enough people to cover all the necessary shifts. So take that into account when that movie says that there was a fake pharmacist shortage.

OK, here goes…I will say you are lying if you tell anyone I said this, BUT 😉 I think Real Estate being set up for another fall…first the current situation: every listing sells in days if properly priced and many of them are going to investors…FAR too many for all cash (my inner lender talking) and there are rehabs being done at an amazing rate, so the #1 way to grow your business today is get hooked up with some investors with cash who are buying fixers and turning them…I know two agents who have over 30 listings from groups like this and they generate a HUGE number of buyers…honestly, they don’t have a great system of capturing them…they are too focused on the listings. We are trying to help them with that.

Back to my original macro-comment. There are literally MILLIONS of homes in the ‘currently foreclosed to 90 days late’ category with no help in sight for the job market or income growth. People will continue to do short sales and hopefully with the new short sale rules they will go a little faster. That said, I see 2013 as a pivotal year both for real estate and the country. If Obama wins, (which seems surreal to me that he even has a chance) the markets will react VERY negatively…if Romney/Ryan are elected, there will be am immediate bounce, although more from a psychological boost of hope…NOT the Obama kind…REAL hope, but even that will not stop the financial crash that is coming. I see RE taking another 20%+ hit as the ‘real buyers’ (you know, people with a down payment and a JOB) disappear. At least they can rent from the investors…who will see some positive cash flow with their really low payment…unfortunately it will cost $10 for a loaf of bread and gas will be at $5+ a gallon, raising the price of…well, EVERYTHING.

The most dangerous world-wide threat to any economic turn around is the sovereign debt…entire countries are printing money at record rates…obviously the US, but also japan, China and the EU…none of those pieces of paper have anything behind them…not gold, not production, not tax revenues…because the underlying economies are so weak they aren’t even creating tax wealth…and the socialistic governments (unfortunately including ours) are so stupid and ignoring history, they have their head in the sand about the long term consequences, especially super-heated inflation. That will rub off on us in a thousand ways.

None of this has factored in what happens with a war in the mid-east (think oil prices!) OR (have you noticed) between China and Japan over a few disputed islands…which I believe is the Chinese government trying to take the people’s eye off their dying production…without the US consumers, they are slowing down FAST. The Chinese government is buying gold at a record rate…they see it coming too. What are we going to do about it? That would be NOTHING…they own our debt you see.

I am rapidly joining the camp of the survivalists who say buy freeze-dried food, store fresh water in abundance and LOTS of guns and ammunition to protect it…you will need it when the collapse comes…I am literally doing that in a small scale and planning on increasing my stash.

So, did that brighten your day? I think we have MAXIMUM two years to ride the government created money train, but in the meantime, make sure you are investing protectively to take advantage of the chaos and protect whatever wealth you have. If you want some specific tips, I have a new advisor who I have paid a lot of money to help me through the mine field we find ourselves in…his past performance has been amazing…100% returns are commonplace with what he is doing…and sometimes much more. Rolling the dice, but I am too damn old not to go for it.

Tuition keeps rising and the local community colleges are overloaded with students. At the local CC you can not even get a full load to transfer and they are trying to handle this with priority enrollment. You spend longer at community college which is still affordable but when you try to transfer to a state or uc school they are limiting transfer students in favor of students from out of state who pay more intuition. I hear even once you get in a state/uc school those classes are impacted and a student can’t get all the classes they want because of budget cutbacks-more time in school. Classes are bigger and classes have been eliminated. Less educational choices at a higher cost.

This is class war against the poor and middle class. Forget going to college if you are not willing to take out huge loans at high interest rates. Theses students have to keep taking out more loans for extra years they need to be in school because they could not get all the classes they needed to graduate in 4 years. They can’t work enough to pay tuition. It’s hard to tell kids to take out loans when many that graduate get minimum wage jobs. If you don’t have a degree you can’t even apply for the majority jobs that pay higher than minimum wage on Monster or Career.com. If you don’t have a degree you are killing your chances of getting a better job. A degree is the minimum.

This was not the case when I went to school. I could work my way through school and if I did take out a loan, it was a small one because tuition costs were cheap. People in my age group could get a career/job without a college degree and could work their way up. This is not the case now. If you don’t have a degree you can’t even get someone to read your resume because you were eliminated before you could apply. When I went to school any degree showed persistence and determination that would make you employable in many fields. Now if you don’t get the right degree you don’t have very good odds of getting a job better than Starbucks and there is a lot of competition for those jobs too. The out- look for high school grads and college grads is grim. Heck even masters students thought higher education would give them a leg up and that does not prove to be true either anymore. Who’s going to buy our houses? Foreigners can’t buy all the houses?!

Christie,

You know what your are talking about! My wife is in a masters program for an in demand healthcare degree at a Cal State.. It was super competitive to get into, and they are making her take all these pointless pre-reqs and classes that don’t have anything to do with her degree. Then they limit the credits you can take each semester and try to keep you in school an extra semester… This is while employers are begging for more qualified graduates in these fields.

It’s time schools starting concentrating on graduating students in a timely fashion with less hoops to jump through.

If you think what the California public higher education system has done to students is bad just take a look at what the for-profit college flim-flam boys have done. Their students make up 12% of student population but 48% of all loan defaults. Good work, no? Graduation rates are as low as 15%, college “Presidents” are paid in the millions, stock options available, students with $50,000 in debt, a great business.

But, now after years of abuse the federal government is modestly cracking down on them with higher standards, only after their buddies in congress have blocked legislation for years. However, never under estimate the sneakiness of these guys. The latest trick is to buy a non-profit shell college on the cheap and dump the for-profit into it. Kaboom, now you have a non-profit that DOES NOT HAVE TO FOLLOW THE NEW RULES.

I faintly remember an outcry from the public years ago, where one of the LPN nursing schools up my way lost their accreditation, secondary to declining quality of material and testing, all the while the school’s president was making millions. That’s how the media framed it: school looses accreditation; president rakes in millions.

How about making an argument with a real economist and libertarian?

http://www.economicpolicyjournal.com/2012/09/house-buying-tips-from-mel-gibson.html

QEinfinity was the final and nuclear fascist game changer. I have now thrown in the towel and accepted that this is the “new normal” until ultimate collapse. How long until that? It’s futile to even think bout let alone debate…it could be 1 year, 10 years, or 30 years.

All I know is that now it’s cheaper to buy than rent, many people have been waiting since 2004 to buy, and father time doesn’t stop ticking. So you figure out what you have to do, but we are now entering the buying mindset.

Well, everyone is aware California is going from white to Hispanics. Hispanics on the average have less money. Another report by Rice University states that Texas another heavily Hispanic state in 2040 will have a student body around 66 percent Hispanic and only 15 percent white. And the students will be poorer and less money will be around, unless Hispanics stopped being the poor immigrant or slightly less poor 2nd generation both States can be headed for a lot of troubles in the future.

meanwhile back on the Irvine ranch, http://www.shoppingcenterbusiness.com has a wright up on the Irvine company & there development history.

Sorry for the continued post, click on cover story to read the article.

I plan on sending my kids to Canada for college, and no that is not a joke. Even out-of-country rates are attractive there at high-end undergrad schools compared to much of the US.

Tuitions are going up because loans are being made to anybody with a pulse for any degree, even demonstrably worthless ones that have no hope of making much money for the grad. Moreover, now that grads cannot even shed the debt during bankruptcy (a pretty new rule that this country somehow did fine without throughout its history), another motivator.

So basically you’re loaning a huge amount of money to an 18 year old and since most of them don’t care much about the future the scale of that debt is impossible for them to fathom. Add to this the fact that they can never discharge the debt, and finally that it’s all backed by the gov and what possible influence is there to not see tuition rates continue at their hilarious trend?

Jeff Beckman

The private school interests are working on dismantling the primary-secondary public schools too, replacing them with non-profits and church private schools. The business lobby in Colorado is trying to tap into the property tax assessment to fund these schools. Parents with school age children will pay the typical assessment and have it sent to the school of their choice. Meanwhile, the rest of us without school age children will continue to pay the assessment and have it disappear into the black hole of government public schools or treasury of private school owners. Education costs need to be absorbed by the parents rather than the tax paying public. If parents were soley responsible for the education costs of their children you’d be surprised how quickly schools would shape up.

Many of the young folks I know have deliberately adopted the kind of lifestyle and planning I similar to what I saw in northern Europe. They would rather live in a relatively small (and relatively affordable) apartment or condo in the city, drive a small but very techie vehicle, wear expensive clothing, and have lots of good friends. A big house in the burbs, marriage, family, and an SUV or minivan? Pffft….yeah, right, maybe when they’re 45 and ready for it. Which is fine. It’s a lifestyle choice, sort of.

The run-up in tuition is the result of demand. The demand is there because there just ain’t much in the way of economic opportunity for folks under 25. We’ve chosen as a society to extend childhood. The private sector has cut back on internships, apprenticeships, and entry-level positions. State and municipal governments have laid-off teachers, public safety workers, and eliminated maintenance jobs (anyone who thinks that won’t come back to bite us all is living in dreamland). The Federal government has chopped the military to 1/10th of the employment it provided when the Baby Boomers came of age, eliminated many youth and young adult employment and training programs, cut back on training programs like Job Corps.

What has all this been replaced with? Encouraging young adults to go to college and do volunteer work. Teach for America, with a $600 a month stipend, join the Peace corps and get paid ~$5000 per year. But you get student loan forgiveness, right?

We have decided through both our capitalistic and democratic structures to end real employment of people under 25. Whether this will be good or bad in the long run is unknown. But don’t worry. We’re going to find out.

Leave a Reply