Retracing the housing bubble in Orange County – Is real estate still in a bubble in Orange County? The $1 million median home price prediction of 2005. Costa Mesa lists 8 foreclosure on MLS while 313 homes are in the shadow inventory.

I was having a conversation with a colleague in the real estate industry about the ubiquitous access of real estate information available to the public. This easy access to home sales data and tracking historical prices without going to the county registrar is so common today we take it for granted. You would think that access to information would cause people to make wiser decisions but that is not always the case. In fact it can be argued that this access to information accelerated the mania by encouraging the herd to look at rising prices on a daily basis. They would pull up data and see home prices rising on a monthly basis. How often would you hear, “in the last year, my home went up X thousand dollars†as if this was somehow normal? In this line of reasoning, more people had quicker access to view the massive rise in home values and those who were skeptical, would likely punch a few keys on their keyboard and verify this data point. If access to information made the bubble grow faster, will it make the bubble pop that much deeper? I wanted to do a historical examination of a mid-tier city in Orange County, Costa Mesa. We are such forward looking creatures that when we look at the past data we understand why it is so crucial not to forget history.

Orange County median price will reach $1 million?

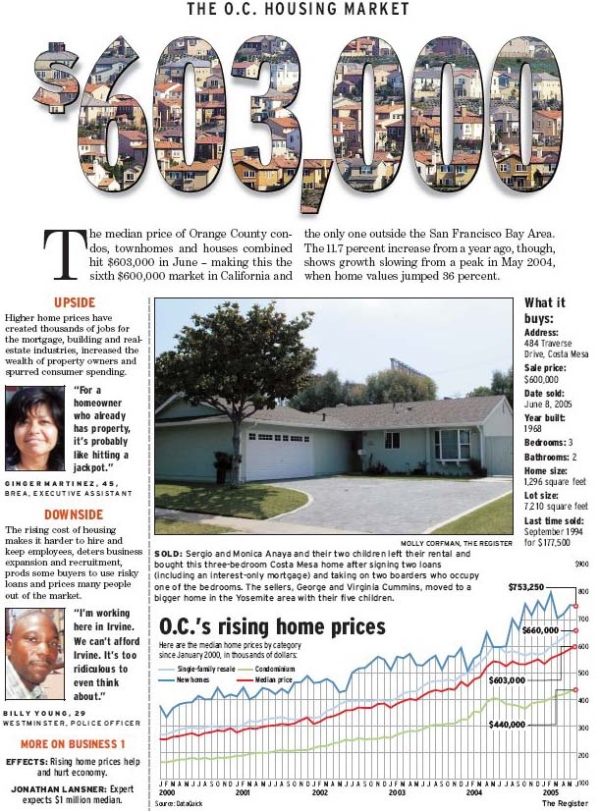

The headline above might seem a bit hyperbolic today but this prediction was made back in 2005. Someone sent an article from the O.C. Register going back to July of 2005 at the height of the bubble. I think it warrants close examination and would be useful to update where things stand today:

Source:Â OC Register

The headline is unmistakable. Orange County hit a median price of $603,000. The chart in the article has an unmistakable trajectory rising up. Even at the lower left hand corner we read:

“Expert expects $1 million median.â€

If you look at the below mania chart and simply took it for face value this might make sense but certainly incomes weren’t rising this way. And the proof of this was right in front of their faces even in this article! You have one person saying:

“I’m working here in Irvine. We can’t afford Irvine. It’s too ridiculous to even think about.â€

This coming from a Westminster Police Officer. The mania was in full bloom at this time. Let us examine the cover house on this article:

“SOLD: Sergio and Monica Anaya and their two children left their rental and bought this three-bedroom Costa Mesa home after signing two loans (including an interest-only mortgage) and taking on two boarders who occupy one of the bedrooms.â€

This is simply more glaring proof of the bubble even within this article. Purchasing a home for $600,000 with an interest-only mortgage and taking on two boarders. Would this end badly? Take a wild guess. Now, how about we look at some actual proof and fast forward:

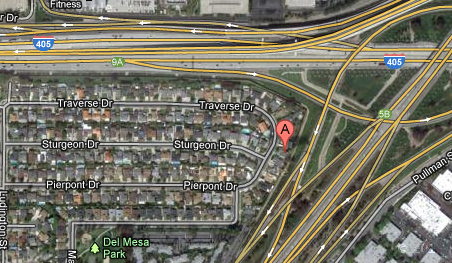

Costa Mesa is a mid-tier city in Orange County. There is nothing extraordinary about the area and certainly not warranting a $600,000 price tag for the home above. You might notice something creeping above over the tree in the picture. What is that?

This home literally is in between two major traffic sections including the wonderful 405. Of course if someone is paying $600,000 you would expect much more. The home details are as follows:

484 Traverse Dr, Costa Mesa

Beds:Â Â Â Â 3

Baths:Â Â 2

Sqft:Â Â Â Â Â 1,296

Year built:Â Â Â Â Â Â Â Â Â Â Â 1968

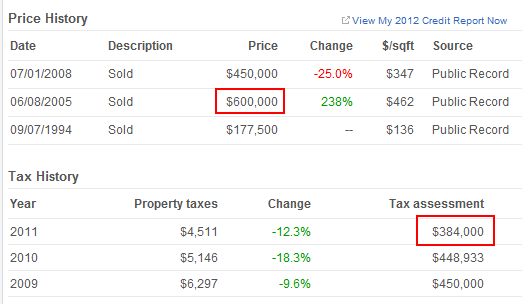

Now that we can fast forward six years into the future, how has the home performed?

Apparently this home never hit the $1 million median price and actually went into full reverse. This for an area where households pull in $45,000 to $60,000 a year depending on which of the two zip codes you look at. The home likely ended up in foreclosure and sold in 2008 for $450,000. Dig deeper and look at the tax assessment. In 2011 the place was assessed for $384,000. That is a price point $66,000 below the 2008 purchase price which had already dropped by $150,000 from the 2005 sales price. Costa Mesa and other mid-tier markets are places were the shadow inventory is going to be an additional drag on prices.   Â

The MLS lists 8 foreclosures in Costa Mesa. How many places are in the foreclosure pipeline? 313!       Â

You tell me if Orange County is going to hit that median $1 million price in the next decade. For those keeping score, the latest median price is $388,000. It always helps to keep things in perspective especially when the shadow inventory is immense in mid-tier cities in Southern California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Retracing the housing bubble in Orange County – Is real estate still in a bubble in Orange County? The $1 million median home price prediction of 2005. Costa Mesa lists 8 foreclosure on MLS while 313 homes are in the shadow inventory.”

So is that a freeway overpass support in the picture or a power line pole?

I think that is the back of a freeway sign. A really large multi-lane sign. It makes sense since this is the backyard of a big freeway interchange. Lots of traffic, lots of pollution, lots of noise, and lots of accidents.

It’s the structural framework for an overhead freeway (405) offramp signage.

We call those homes “fwy homes” and in our area (east Ventura County) many of these homes are priced higher than quieter neighborhoods. They upgrade them galore, nevermind being within 100 yards of a fwy increases your risk for cancers. They can keep their granite, my husband and I work hard at staying healthy.

Add, the noise makes opening a window or enjoying your back yard impossible as well. Why bother owning?

Yet I see these dolled up dogs go out to what I call “interior buyers”. We bought beautiful interior homes before, even one with a master bdrm fireplace and a deck with a view. No privacy in a two story jungle (and we had a wide lot but two story jungle.) The quality of the location and lot makes the experience. You can’t change them. I wish stupid buyers would just go away.

The good doctor again points out the idiocy of more bubblicious days. As a long time home owner and potential move-up buyer I’d like to thank DHB for reminding me to remain on the sidelines for the last few years. That said, while nominal prices have a little ways yet to fall (and will likely bounce along the bottom for years to come), it’s looking like the largest declines have already occurred in most markets.

Given that, I was hoping the doctor might address the economics of the move-up buyer. Assuming said buyer has enough equity to sell his/her home it would seem that fluctuations in housing price have little impact on the advisability of a move up purchase. Any loss incurred from future declines in the price of the move up home would be largely offset by declines in the equity of the existing home were the homeowner not to move.

I’m hardly saying that the market is healthy, but I do wonder if the situation has progressed enough that it is now reasonable for homeowners with equity to again consider moving up.

I take it math is not your strong suit.

I’ll make it simple for you.

Bubble price $200k house moves up to Bubble price $400k house.

Difference is $200k

Post bubble (or pre bubble) $100k house moves up to $200k house.

Difference is $100k

Well Jeepers I guess that Caltech math degree wernt good fer nuthin after all. But if you must put actual number on things I have a house currently valued at ~$400K and am considering moves into homes worth ~$500K. Assuming the bulk of declines have already occurred and I risk a further decline of 10-20% that would put my risk at roughly $10-20K amortized over several years – an amount less than my daily fluctuation in net investment worth. But maybe since math evidently isn’t my strong suit you could enlighten me as to where my additional risks might lie.

It appears you were able to answer your question for yourself. Perhaps you should have presented some numbers in your original post.

Given that ‘most’ markets have already gone through the bulk of their declines, it really comes down to where your home is and where you want to live when you trade up. There are still neighborhoods out there that have more downside. You’d need to move in comparable neighborhoods where both your neighborhood and the new one have had similar slides.

That is the rub – and the thing that makes me hesitant. Price declines have been non-uniform and have tended to hit less expensive homes first. This would tend to disadvantage move up buyers. But I am hoping that by concentrating on areas that have suffered declines similar to my current neighborhood I can minimize this risk.

Wow, this reminds me of my ex-Brother in Law, who bought a move up house in 2001 for $300,000 in Corona, CA. He was always bragging when I visited from Pennsylvania about how his house was worth, 500K then 600K then 700K and how he had everything planned to retire early when it hit 1 Million.

My last visit in 2006, he had charts showing projected increases and rate of returns and how it was now worth $843,000 and at this rate in early 2008 it would be $1 million..blab..blab..blab

Funny how I haven’t heard from him in ages and I follow house sales on his street now going for $260K, $270K etc

Let’s see 843K to 265K is a 68.5% drop. Oh well easy come, easy go!

If he’d had a crystal ball he could have sold that house in 06, held the cash until the crash and bought Ford stock for less than $3.00 a share and become a multimillionaire and bought whatever the heck he wanted. I wish I could flip hindsight to foresight. Truth be told if I put all I had in Ford when it was recommended to me I would have ended with a net of 1.5 million. Ain’t dreamin’ fun. In truth I wish they would let the market correct via no more bailouts, no bulk investor sales and correct to mark to market so I could buy and we could see our jobs and economy bounce back.

Never, ever buy a home near a public school, a municipal park, a major freeway…or a huge electrical transmission line.

Can you tell us why? Actually I think buying a house near (not next to) a school or a park is a good idea. That way my in-laws or my parents can send the kid to school and take him home without driving and they can kill some time going to park. But I’m definitely would like to hear the reasons why you think it’s not a good idea. Maybe I’m missing something!?

I think if you have kids, it’s a good idea. Not the freeway part though 😉

By ” near ” I mean in close proximity, like bordering these public places. K thru 8 is often a situation of morning student drop offs and afternoon pickups and the congestion and driveway turnarounds of parents hurrying to/from work. Also, some of the little kiddies who walk have a bad habit of littering your lawn or cutting through your yard. High school proximity is the worst…..weekend noise from sports events is just one issue. Teen reckless driving is another issue. And check with the local police stats on daytime burglaries in the immediate area of a high school…..you may be surprised.

Public parks draw strangers… most are good family people and well-behaved, some are not, especially after dark. In a less public suburban environment, residents keep an eye out and make note of unusal activity by persons they don’t know or look suspicious in the area.

Finally, the makeup of a community’s residents can change, often dramatically quicker than you think. And schools bus kids from other communities.

That’s my 2 cents, for what it’s worth, on living “too close ” to public facilites.

It’s nice to be in close proximity to a school. However in today’s world, little Johnny and Sally generally don’t walk, ride their bikes or take the bus to school. So what you have is hundreds of luxury SUVs dropping/picking up the kids from school. Good luck trying to get out of/into your neighborhood when the roads are backed up. Don’t believe me, go down to your local elementary school on Monday morning.

Good points. I didn’t think about traffic or crime rate though. I guess I’ll be looking for properties at least 10 blocks from schools then.

A lot of boomers don’t have much savings. All the crap they used to brag about like sending their kid to a fancy college and their wonderful house or houses have all flopped. A college grad is lucky to work at mcdonalds and most houses have been winterized by the banks. It’s time these middle aged people wake the hell up and it seems when they do wake up it will be to late. They might have nice clothes, but that’s not gonna get them far when they’re forced to get creative just to get food.

I would like to get shadow inventory by zip code for the Coachella Valley and wonder if that is available from you?

Thanks for any info.

Vic

The source for shadow inventory information through out the southland would be very interesting to look at

$605,000 under the over pass on the freeway, kids with ashma, brain disorders, why this is the Republican utopian dream that is OC. Besides OC boasts Zimmerman, the Eugenics practioner. Just think of all the Pell Grant money he saved OC taxpayers

Whatever lenders will lend, some people will borrow, and that will be the price. Actual ownership is not an option for most folks when a few people have unlimited funds and enjoy hoarding property.

I say ouch because I believe you are right. 10% unemployment means 90% have jobs and with low interest high earners can take 3- 4-% off bubble highs and perhaps some equity and pay the asking rates for the minimal inventory leaked to the market.

Dr. Housing Bubble greeat article! Do you think Thousand Oaks, Oak Park, Westlake Village area is still in a bubble? We have started looking but homes are being taken up so fast. We looked at a house the other day and before we had a chance to think about it, it was sold in two days. Sold in 2006 and have been waiting to jump in, do you think now is the right time for this area? Thanks in advance!

We’ve been looking in the same area and homes are moving fast. Unfortunately, many are still priced way too high. As the Doctor pointed out in a recent article, the high traffic may be due to the FHA loans with little down required. We’re going to sit out another 2-3 years. In the meantime, rents are coming down – now under $2K for a 3Bd 2Ba house in a very reasonable area in TO and Newbury.

We need a 3BR/2BA as well, but how can you afford rent of $2000, or even $1500? See my post below (sorry for the spelling in it, I was in a hurry) rent would eat up 1/3 of my take home income if it was $1500 per month. We make $100k pre tax, you must make good money to afford that rent?

And Bank of America now wants to get into the Landlord business:

http://www.latimes.com/business/money/la-fi-mo-bank-of-america-foreclosure-rent-20120323,0,1148527.story

This is going to eventually kill their balance sheet. Short BAC anyone?

Dr HB, thanks for reporting on Costa Mesa. As a resident of CM, I have never understood how home prices can remain so high, when this area has so little to offer. The schools are terrible, unless you can get zoned into the Newport Beach schools. Even so, prices are way too high for those small lots and 1970s stucco boxes. Incomes don’t support the prices, but now it makes sense with the large shadow inventory. Any house priced reasonably in CM is immediately snatched up, and the wishful sellers sit around wondering why their houses aren’t moving for $600k.

Anything with at least 1500 sqFT listed under $500K on Redfin will have hoards of vultures lurking around the windows the day it goes online. The sketch factor is high in the neighborhoods where homes are offered at those “bargain basement” prices. I call them bad bet hoods.

Price increases will not happen without income increases. With the additional large student debt loads and credit cards etc, I don’t know who I am going to sell my house if I decided to buy today.

For example if I buy a home for $500K X 1.02^20=$742K/4 = $186K income needed to service projected home in 20 years. Is that going to happen. Not likely, especially if they stop giving away 3.5% down payment loans. That is assuming a 4:1 ratio between price to income (more likely in OC than other places around the country).

In addition to low income projections, if you buy today, you take equity and interest rate risks and have to deal with a potential flood of foreclosures and selling to a more indebted social group plus competing with baby boomers to get rid of your investment if you have to sell. Looks like a mountain of negatives and very little positives except that I can paint my walls whatever color I want.

Could you please do an analysis of the housing market in Castro Valley?

Always remember the basics……Income x 3 = how much you can afford. Simple and easy to remember !!!

Speaking of orange county, here is a $37m Newport coast foreclosure going into a bk auction!

http://www.auction.com/luxury/California/luxury-auction-asset/1310793-2114-One-Pelican-Hill-Road-North-NEWPORT-COAST-CA-92657-X006?utm_source=iContact&utm_medium=email&utm_campaign=X-006&utm_content=

wonder what loss they are taking here, wow!

Could someone please point out what we are doing wrong? Looking at rents and mortgages in the IE for a decent 3br/2BA place to live, the monthly nut on these places in astonishing. If you go over by Victoria Gardens, all those master community apartment homes are $1700 to $2500 per month. Google Lewis Apts and their website comes up, search 3BR for yourself. The $1500 apts are dated and have more “lower income” clinetelle, although $1500 is 1/3 of our monthly income so I don’t know how all these trashy people afford to live in SoCal.

3BR homes for rent in good areas of Rancho, (north) Fontana, Upland…are $1700 to $3000 as well. I don’t want to leave myself an easy out here, but I am from St. Louis, and rent to incomes in the Midwest is much cheaper there than it is here. I can’t seem to live ina decent place in SoCal, and still afford toys and having fun all the time like I used too. And no, this is not spoiled brat stuff, I was never spoiled. I always earned my paychecks, 2 jobs if I had too. Back in the day, I could buy stuff to tune up my Mustang, classic Chargers, go to the bar, go out of town for the weekend…now I’m a renter, in debt over $10k, and need to move to a 3BR because we have another baby coming.

Mortgages are in the neighborhood of $1300 to $1500 for a $200k house, but jobn security is questionable.

We make $4300 per month, take home after insurance and 401k. We spend…

Rent – $910

Utilities – $600 (including cell phones)

Car Ins. – $200

Car Pay- $250

Credit cards – $300

Gasoline – $450

Costco – $400

Stater Bros – $350

Church – Private Amt.

Miscellanious – $500 (Car wash, 7/11 coffee, eating out, nails/hair etc)

Those numbers are not 100% perfect, but they are close. As you can see, I don’t have much left. And our Net Income is about $100k per year, like I said our takehome of $4300 is post all deductions. There was an article on Yahoo about how $100k a year is not much anymore, and that is true when you see me and live in SoCal.

How can I afford $1500 or $1700/mo rent? My car is paid off and gets 30 MPG, I commute. Her car is a lease payment, for 3 more years. We try to only buy food on sale, and in bulk, but food prices have gone up a lot. we eat out about 3 or 4 times a month, our only luxury.

Advice please!

I’ll try to help.

Many are looking for a “one shot fix” to make 25% go away, BUT IT DOES NOT WORK THAT WAY.

Let’s leave the Rent, Car Payment and Ins alone assuming they truly fixed costs.

Credit cards–try to get a lower interest rate card to transfer the balances to. Check Bankrate.com for info. This can cut $20-$40/month. Also find a free checking account, another $20-35 per month off.

Gas–that’s a tough one, Arco and Costco are best, you can probably save at most $40 using these two sources.

Utilities–tough also, but cell month-to-month plans can be had for $40 per month.

Stater Bros and Costco–I’ll tell you what helped us 25 yrs ago as young marrieds..sit down each Saturday morning with the grocery ads and make a menu for the coming week, then go shopping for that menu–and only for that menu. I guarantee that this will cut $100 of the food bill.

Miscellaneous–

Forget the car washes–decent exercise + assume 1/car/month = $50

Hair–go to Walmart. Yeah, I know what you are thinking. Since the downturn, many salon employees have moved to Walmart because it gives them a guaranteed income. When I was working I got mine cut every 4 wks for $35. I now go to Wallyworld every 8 wks for $20. So let’s say that’s another $25/month.

Coffee at 7/11: I am a coffee snob, but I always make coffee at home [Peets] for $0.30 per day. Even paying $1/ cup at 7/11 is still $30/month–so that’s another $20/month.

Eating out–cut back to 2 x/month; and cook something really GOOD at home on the off weeks; that’s probably $80/month.

So that’s 100+50+25+20+80=$275. May not seem like much, but it is still 3200/yr. Wouldn’t you take a $3200/ yr raise?

Math check…top side (less conservative) savings is $410/month.

Papa to be,

First of all, congrats on the upcoming baby! I hope he/she will be healthy and happy. It is nice to hear that you have the hard working attitude and work ethic that made this country great.

Yes, we are in difficult times. When you increase the money supply by several trillion dollars, inflation becomes a problem. Now when incomes are not increasing in relative terms to inflation, then we have stagflation which is what is happening today. The middle class is disappearing in America.

After looking at your monthly budget, you might be able to save $300-$400/month on utilities, Costco and Misc. Start there…sharpen your pencils. Church…although important for some, could be decreased because your most important duty is the health and happiness of your family. After the reductions, you’re about at $3,300/month about $1K/month below your take home….this is good.

Now to renting another place, if you spend $1,600/month for rent, that leaves you with $300 of emergency funds + whatever you reduce from church donations. Atleast we are still in the black, but really consider if you need that bigger place NOW.

I have not researched the price of homes in Rialto, Fontana, Upland, but assuming you buy a place for $250,000 and have the proper 20% down, then you’re cost of owning is about $1,550 (including, tax, HOA, insurance) plus you’ll probably get some taxes back from the mortgage interest deduction and the deduction for your new kid. Don’t forget you’ll be paying a little more for maintenance though.

I am not advocating buying right now especially in higher priced areas like OC or LA or close to the coast, but in some areas in CA it could be cheaper than renting. Like I mentioned before, you may have some interest rate, equity, shadow inventory political risk in buying a home and I don’t know how secure you feel about your job.

At an income of approximately $75K/year buying a place for $225K is not over-reaching and the potential risks are minimized because the place is already cheap. Now if you make $75K/year and buy a house for $500K, you will be making a big mistake. I am not sure if you have the 20% down required as well and I don’t know how secure you and the misses are about your jobs. If I were you here’s what I would do:

1. Tighten up your budget and find $300-500/month in savings. I am sure you can find it.

2. Pay off that credit card with your extra savings. I am sure that rate is higher than you’ll get with your cash or the market right now.

3. Monitor your budget monthly (spreadsheets, i-phone apps whatever).

4. Suck it up for a bit and don’t move to a more expensive unit until you can afford to buy one.

5. In a few years, you may have enough money to buy you’re own place, but make sure about not buying more than what your income dictates. No $500K homes on $75K incomes please. That was so 2005. Actually 2005 was stated income and $800K neg-am or interest only loans.

6. Think of other innovative ways to make money or save money. Have a little side gig of something. The days of working somewhere for 10-20 years are over.

My wife and I are thinking about having our first baby so I might not be too far behind you and I appreciate your desire to provide for your family. Good luck.

You’d have to cut out the church (guessing this saves you about $300?) and why on earth are your utilities $600? I’ve never had an electric bill higher than like $120 thought that was a 2-person household. Is that really how much it takes to cool a home in the IE? If you could cut utilities to $300 that’d let you jump to $1500 in rent.

Sadly $100k just doesn’t go far in LA. I make $120k and I’m STILL considering moving away because I could have a much higher standard of living elsewhere aside from the weather. I know I sound spoiled, but I do have a technical degree and in any other place I’d be living very well off, while in LA I live in a crappy apartment because I don’t want to throw away $2k in rent so I settle for what I can get for $1200. And I can’t even buy a townhouse or a condo that’s not from the damn 70’s. I work in Santa Monica so that leaves me with few options if I want to commute less than 45 minutes.

Papa — it was a mistake to move to SoCal — the place is still way overpriced. I’m still in my boring midwest home — double the size, and half the price. 401K is maxed out, money goes into the savings account every month. I guess I just slow, I don’t see how the weather makes up for the still silly high prices, super high density, air quality, and vast array of other issues. I left 20 years ago, and have not regretted it for a second.

First get a hose, then make coffee at home, get haircuts 3x a year etc etc. All those things add up and especially if you are spending $500 a month. I live on a lot less than you do. Turn lights out when you leave a room, turn your thermostat to 68 degrees, don’t let water run down the drain – turn it off . Watching TV with the room lit up. Turn off some of the lights. Of course get low watt LCDs. Don’t drive to the corner;, walk if you can to the store too. Get a bike. My utilties bills are a lot lower than most people’s and I don’t suffer one bit. Save the savings for a night out and good meal. It’s easy.

Many people already gave you very good tips and advice. You can easily cut $300 just from your utilities. We don’t have cable, no i-phone, no data plan, and we only have basic cell phone plan $80 for both lines. If it’s not because I have dogs before the marriage, we’d just rent a $1200 2 bedrooms condo other than a $1700 house. We don’t usually go out to eat. Our only luxury is annual oversea trip. It’s not because we cannot afford it. To be honest with you, we are making $200k. People with our income will most likely commit to a $700k house purchase with 2 luxury cars. We are renting a house in a semi-ghetto area and driving a 6-year Honda and a 11-year SUV. We are currently saving at least 40% of our bring home money. We are still in our 30’s and we don’t own a house in US.

If we want to get extreme, I’d sell my car and take bus to work everyday and that will save me at least $300 per month (gas, insurance, tickets etc.). We might even move to a 2 bedrooms condo with a small yard and cut out our online shopping addiction further. What I want to say is: if you really want to save more money, there are many items that you can cut out every month. If I were you, I’ll staying in that 2 bedrooms apt than finding a 3 bedrooms house now. Your kid and the expecting baby are still small. It’s okay if they don’t have their own room. It’s better to save now than later. Because when they grow older, there’s more expenses than you can image now.

Also, I wonder how 100k pre tax income adds up $4300 take home money. Are you maxing out 401k contribution? Maybe you should review your pay check coz the number doesn’t sound right.

Then why on earth are you having another baby? Gee I’m in debt, let’s have another kid, honey!!

Dude, I know what you’re going through. My SO and I recently got an apartment in the Bay Area in a decent but not glamorous location. We pay 1700 for a 1 bedroom place. This eats up 40% of our take home. Rental prices are so high that it’s impossible to save for a downpayment on a home, especially with home prices being so high even now. We are looking to leave California in a year or two for good. Some jobs pay well here but not enough to keep up with the cost of living.

You might have to look at your deductions with an accountant. Your take home seems low with a 100K gross family income.

stop having kids – that will save you a bundle

Income x3 was based on historical norms for mortage interest.

Most things in life are just not that simple.

The real figure we are aiming to asses is the Monthly Nut.

With mortgage rates so low, the figure is likely closer to 4x, but still this is not what you should be trying to calculate. Its a dramatic oversimplification.

I recall when my folks boouht a home in 1981, mortgage rates in San Diego were around 15-18%. Frequently a buyer and seller would agree on a price, but the bank loans were so expensive to service, that home price had to be negotiated down so that the buyer could afford to pay the monthly nut.

You must factor in Energy and Gas costs (rising) food costs (generally rising) etc etc. AS well as the mortgage to figure out what you can buy.

Taking short cuts in figuring out the biggest purchase of your life —> PWND by the banksters.

Many factors dictate future home prices. Apparently, almost no one about to buy a home studies those well-published economic and demographic studies. I think the two biggest factors in real life are “my wife wants a home NOW” and “it’s still going to make ME money, where else can I reap all those gains and tax shelters?”. Two huge demographic factors not discussed are the leaping rate of staying single, and the massive financial drain of child support. People who are married tend to be the largest group to be single family homebuyers; the present high divorce rate and single parent rate are massively discouraging marriage and remarriage. (This is a fact, this is not some insult to all you hardworking single and married parents). California laws on child support weaken the financial income of both spouses (thus money to put to a mortgage is reduced) . Also, note the demographic of remarriage and why single women with kids can’t find a man to marry them in most cases: In California, if you marry someone with kids even if you don’t adopt the kids you then have to support them to 21 or more, even if you then divorce the mother. That means that few men want to marry that single mother (fact, almost all child support is paid by men; fact, marriage of women with kids is low and not improving).

I married a woman with two children. And we had another. It is expensive, no doubt, but nice to be part of the entire “clan.” You really do marry the whole family. There can be strength in numbers if you choose wisely.

Got divorced twice. Last time in Ca. Paid 1/4mil in support in 15yrs while ‘homeless, living in an old VW camper, and working 60-70 hours/wk. Learned to like it and actually saved up quite a bit of cash. Think outside the box.

Interesting take that I hadn’t heard expressed before, but one that I have been living. Divorced for 4 years. 2 younger kids in public charter elementary school. Was paying $3,700/mo for spousal/child support for 3 1/2 years. Now, down to $1,550/mo. I make $110k. Of course, lost 1/2 of all my assets from the divorce. My ex certainly in no position to buy (stay-at-home divorcee). I’m now in a position to have 10% down payment in 18-24 months. Renting in the South Bay currently. Would love to buy a 3/2 SFR in Redondo Beach for around $450k (mortgage $405k). I’m thinking 2014. In the meantime, getting killed on federal income taxes.

Classic micro analysis Dr. HB. I have done some “house huntin'” in Mesa over the last 4 years. You happened to choose a house in my one of my favorite zones – I labeled it the “Triangle of Death.” It is smack dab in the middle of the 73, 405 and 55 with close proximity to the John Wayne Airport Runway. Noise pollution can be a selling point right?

I won’t even go into the infrastructure updated that haven’t been done on the from the telephone poles and wires to the sidewalks. I guess you get used to the noise?

A Costa Mesa gem in the “Triangle of Death.” That noise encumbered hovel sits in a Triangle boardered by the 73 55 and 405 freeways just a hop skip and a jump from the runway at John Wayne Airport. It is just white noise though…right?

Great example. Couldn’t pick a better example of overpriced urbania with all the deficits of the SoCal car culture. I have toured the Triangle of death a couple of times in the last 4 years. I won’t even start on the infrastructure – sidewalks, telephone poles and lines. The neighborhood is tightly bordered by 3 freeways and within close earshot of over 200 flights daily 7am to 11 pm. That one could make the “Real homes of Genius” with a few shady refis. Thanx Dr. HB for reminding my why I got on the sidelines and learned to love my status as a renter.

RentaLurker, sounds like you are pretty familiar with Costa Mesa. I lived there for a short period of time in the early 90s. This is when there were still “working girls” on Harbor Blvd late at night. It’s a strange place that is literally a hop, skip and jump from Newport Beach. There seemed to be a high amount of riff raff, lots of drugs, gangs, the schools sucked and even 20 years ago there was a huge population of Spanish only speakers. Most of the shopping centers are old and it just has a run down, dirty look to it. Triangle Square shopping center never amounted to anything and is just an eyesore now. I would advise people to steer clear of CM at all costs.

Lucky Lord Blankfein,

Everything has gotten much, MUCH worse since the 90’s, if you can even believe that! Currently, 11/14 NMUSD schools w/in the City are on the “IP List” (insufficient progress) towards the Federal NCLB mandates. Most CM school-aged children attend nearby “Blue Ribbon” Huntington Beach School District schools via “inter-district transfers” or attend Davis, CM’s ONLY public magnet school via a complicated “lottery” system.

The Westside Hispanic population exploded during the Bubble b/c day laborers, contractors, gardeners, car detailers, nannies, etc. were doubling-up alleged “family members” in the numerous “downscale” apartments & rental homes (not to mention their garages too!) Unfortunately, Code Enforcement can’t do anything about all the “legal” over-crowding. So, all the CM schools had to absorb the sudden influx of “English Learners”, even preppy Newport Harbor HS is now affected!

Potential CM Buyers: BEWARE! Most of the neighborhood tracts have these crappy apartments strategically built into their communities which is why nobody sends their kids to their neighborhood “home school”. So the majority of CM children go to school w/ their “neighborhood friends” down in HB; creating the same “neighborhood home school” feeling. (BTW, the surge in CM students has kept HBCSD from closing many of their “low enrollment” schools due to HB’s high home prices, transferring is not discouraged!)

Also, the sketchy motels qualify the City for “low income” properties, and are havens to the CA State Prison “parolees”. The motels have contracts w/ the State to provide “transitional housing” for up to 60 days. Then the “registered sex offenders” et al transition into the prolific “CM Homeless Population” (about 65 documented to date) that typically sleep at Lions Park & the library area. Also, the City has the most rehabs/halfway houses in all of OC!!! Approximately 380 according to the City’s very recent “Homeless Task Force” Staff Report buried, I mean, located on the City’s “transparent” website!

And finally, the numerous gangs are still here, and can only be “monitored” by CMPD (for about an hour a day by HB’s “ghetto bird”) due to an ego-centric City Council Member’s (aka: Riggy) hair-brained scheme to eliminate the ABLE helicopter program, and to reduce police officers, including dissolving the specialized Gang Unit! (WTF?) And the hookers, well they have promoted themselves to “call girls” at the finer JWA airport hotels, and the more skanky ones, well, they just blend in so well w/ the muffin-top. stroller-pushing, prego-moms along Harbor Blvd & Wilson St.

Lordy, thx for the memories….

Costa Misery resident, thanks for the very informative update on CM. Sounds like it is MUCH worse than 20 years ago. I agree with what you said, if you are interested in living in that area, look at HB! You will pay a little more in HB for a SFR, but then you don’t have to put up with all the crap you mentioned. Good luck and stay safe!

How about an assessment of housing in San Diego County.

I recently spoke with realtor – 32 years of experience. I mentioned that I see housing going for more than the asking price lately in the Channel Harbor area of Oxnard. She said the investors are bidding the prices up. Now what is the point in that. I would think investors would want the lowest prices in order to make the most profit. Anyone know about this? And it seems the same in northern San Diego county. Very few homes in the low end range. Does anyone know anything about these areas?

Papatobe, you are spending too much on a LOT of things….I don’t make $100K(albeit I’m only a single person)….I gotta say, I do not understand your calculations.

Currently…and I make <$80K right now due to furloughs at my workplace, my takehome is $3700/two paychecks. Thats after taking out $400 pre tax for a 457k contribution. I am taxed on a MUCH larger chunk of income than you are due to you having 3 persons to claim vs my one. So again, not sure why your paycheck is so small. When I'm not on furloughs, I take home $4350 per two paychecks. And my income is still not $100K.

That said:

Rent – $910<——-I pay $1640/mo

Utilities – $600 (including cell phones)<—–This is a preposterous amount. I pay ~$40-50/mo for electric. Water, gas, trash are paid by the building I live in via my rent. Cell bill is $90/mo for phone/text/internet(iphone 4)(I do not need a landline). Cable/internet is $105/mo and that is only because I have the premium internet stuff because I play games online. Pure luxury, and not necessary at all

My savings: $370

Car Ins. – $200 <—– Again not sure why you are paying so much. I realize you have two people. But I drive a luxury sports car. I park in a public lot. I live in a VERY high rate area. My insurance should be through the roof. But its not. $100/mo, but I pay the entire thing at the begining of the year.

My savings – $100

Car Pay- $250<——This is reasonable. I don't have a car payment…its paid off and the next one I'll buy cash. But $250 is very disciplined IMO. Most people on a six figure income INSIST on $30-40K cars.

Credit cards – $300 <—–No comment. You already know not to do this again.

Gasoline – $450 <—-Live closer to work. This is a ridiculous amount IMO. I get 18 mpg and don't use a car to commute to work. My monthly gas bill is closer to $200. Even with my parents living 40 miles away and my brother living 20 miles away.

My savings $200

Costco – $400<——Stop shopping here. Yeah stuffs cheaper in bulk. But I challenge you to inventory everything you eventually don't use. Cut up your Costco card. Its a huge money drain. Buy in bulk only when you have actual need and will actually consume what you buy.

Stater Bros – $350 <—-This is going to increase once you stop shopping at Costco of course. You may want to consider modifying food expenditures when you can. The total overal cost of $750 between Costco and Stater bros is probably about $200/mo too high for a family of 3

My overall food savings <—-$400/mo

Church – Private Amt.<—- No comment. Its pretty clear you're not out of line here or overall by much.

Miscellanious – $500 (Car wash, 7/11 coffee, eating out, nails/hair etc)<—-Again this is fairly reasonable. Cutting this would probably make you're life more difficult than less so.

That all said, I didn't disclose a few other things about me….I spend somewhat extravegantly at times….I have no issue spending $50-75 on dinner for myself, buying expensive basketball, baseball, or concert tickets, or making frequent trips to Las Vegas. I also save $1000/mo cash.

I am pretty sure you can find that $1000 savings in the areas I mentioned:

Utilities and cell phones, car insurance($2400/year for two people on modest cars is just wacky unless you have some irreversible situation like accidents or DUI or whatever), food costs, and gas.

I don’t know John…we take home about $4300 per month. I put 12% into 401k, the rest is taxes and insurance, and all that.

Our cell phones are $350, and the electric bill can be as high as $150/mo in the summer months with the a/c on. Right now it is only $60. We have a deep freezer that run $15 to $20 of that per month.

There is a recent accident on the car insurance, which is why it is $200 per month.

I can not save on gasoline living closer to work. We are in a child from a previous marriage situation…I commute about 120 miles round trip. I wont give up on my kiddo, can’t happen.

We are pretty good about eating all the food we get from Costco. I will try hitting the coupons harder for other stores and see what happens 🙂

I think I can tighten up a few hundred a month, not going out to eat and shopping better. I guess I forgot all the money we spend on kid activities like sports and stuff that also costs us.

You save $1000 a month? That’s pretty good. We have zero savings outside our 401k. I always figured it costs a lot to live in SoCal. I guess if I can afford a home, then I can. If I can’t, the family will have to deal with living in a 2BR apt 🙁

It would really help you out a lot to start saving money, start with about $500 a month and just find a way to get by on the rest.

Cell phones: switch to the Cricket $40 a month unlimited talk-voicemail-text, and get rid of your landline. You might also want to use the $35 wireless Cricket internet and get the Hotspot so you can hook up all family computers to it. Could cut your communication bills in half.

Are you anywhere near a commuter rail line? If you could cut the driving by half, it would save you a bundle in gasoline.

When my employer cut my hours and pay by 40%, the squeeze was on. I cut out 95% of the “discretionary” spending- entertainment, clothing, eating out. I also finally dropped a very, very bad addiction- tobacco, which freed up about $250 a month.

Start shopping for clothes in consignment shops, when indeed you need them. I purchased a lovely, virtually unworn camels hair coat on Ebay for $36, that would have cost $500 in the stores. Also bought a beautiful, heavy chevron tweed topcoat that retails for about $275 for $20. Almost scored a camels hair from Saks for $100, but someone outbid me by $2 and snagged it. I buy only shoes and purses new because they get beat up so quickly, and have one briefcase-type handbag for daily use, two pairs of pumps, a pair of snow/rain boots, and casual flats. That’s IT. Stay out of the stores- if you spend time in the stores browsing, you will spend, that’s all. I stick with one neutral color and make sure everything I buy coordinates with everything else. Also buy conservative “untrendy” clothes that don’t go out of style.

Cars are difficult, especially if you have a long commute. I can’t imagine a 120-mile commute even though thousands here in Chicagoland have a commute like that.

Saving becomes addictive. Once you start to accumulate, you will just hate to deplete your pile by spending needlessly.

I would like to ask the Doctor and all others to persuasively debate these two questions. Can the Banks with the Feds assistance sustain the slow deleveraging of housing shadow inventory until the point that actual market forces can again viably take hold. Is it within the banks and the Feds current intrinsic capabilities to achieve this?

This home now has a ZEstimate of $513,000, prices have rebounded almost to their 2005/2006 peaks

Leave a Reply