Fed and CPI missing housing inflation yet again: The CPI is completely missing the increase in housing prices.

The most widely used measure for inflation is the Consumer Price Index (CPI) put out by the Bureau of Labor and Statistics (BLS). Nearly a decade ago I discussed how poorly a job the CPI did in measuring home price increases while they were happening. In fact, during the raging housing bubble the CPI only measured moderate increases in home prices. Why? The measurement looks at something called the owners’ equivalent of rent (OER) that essentially considers what your home would rent for versus your actual housing payment. So you could be paying $3,000 in a mortgage, taxes, and insurance but the actual rent would be something like $2,000. That is a massive differential. In the LA/OC market, this measurement did a horrible job. The argument of course is that rents eventually catch up and we are seeing some of that now. Yet Fed policy and other government decisions are made on the basis of the CPI and miss big changes by years. The latest CPI report is now showing this inflation creeping in but of course, it is late once again. And this is important to address because the largest component of the CPI is housing costs.

The problem with the CPI and housing

Housing makes up over 40 percent of the CPI tool which is a by far, the biggest component. So wouldn’t you want this instrument to accurately measure home value changes? We now have plenty of tools that can give a better indicator of home price changes like the Case-Shiller Index. There has been large pressure on home prices recently thanks to many years of slow home building and a lack of inventory. We also had the interesting phenomenon of investors diving into the market since the crash and being a dominant force.

First, it might be useful to look at how the CPI is composed:

Even looking at three categories in housing, education, and healthcare we know that costs are soaring. Yet the overall CPI has showed only tiny increases in prices. This is completely off base nationally and doubly so in bubblicious markets like California where people need to move into apartments with roommates as if they were crowding into clown cars to make the rent.

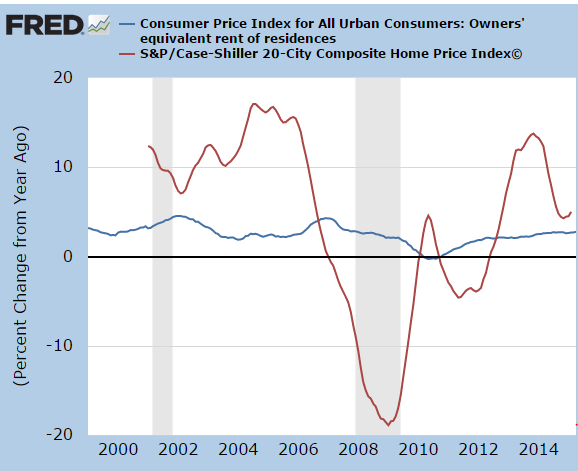

Housing is a whopping 42 percent of the CPI measure. Most people in the US own their homes (not in places like L.A. County). The measure looks at the nation overall. If you are trying to get a good measure, why not look at the Case-Shiller Index? Instead, it looks at what you could get in market rents for your home (and this indicator is weak at turning points as well). Just take a look at the OER component versus actual home price changes:

So from 2013 to 2014 home prices went up by double-digits but the OER went up 2 percent! The biggest component of the CPI is totally off base. Take for example this snapshot:

November 2013

Case Shiller Index y-o-y change:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 13.7 percent

CPI OER y-o-y change:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2.3 percent

Even during the crash the measure was off:

February 2009

Case Shiller Index y-o-y change:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -18 percent

CPI OER y-o-y change:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2 percent

You might as well set the OER at the proverbial 2 percent and forget it. How useful is that? Sure, it serves the Fed’s purpose of keeping monetary policy lax and money flowing. Yet this also fuels the mad speculation we are living through. Housing bubble 1.0 was a nationwide affair while housing bubble 2.0 is being driven by investors. In the end prices are going up for unbalanced reasons. Rents are going up strongly while wages are stagnant. What this means is more money is funneled into the banking, financial, REIT, and investor class. Not a good thing in our consumerist economy.

As I mentioned, the OER even does a bad job measuring rent changes:

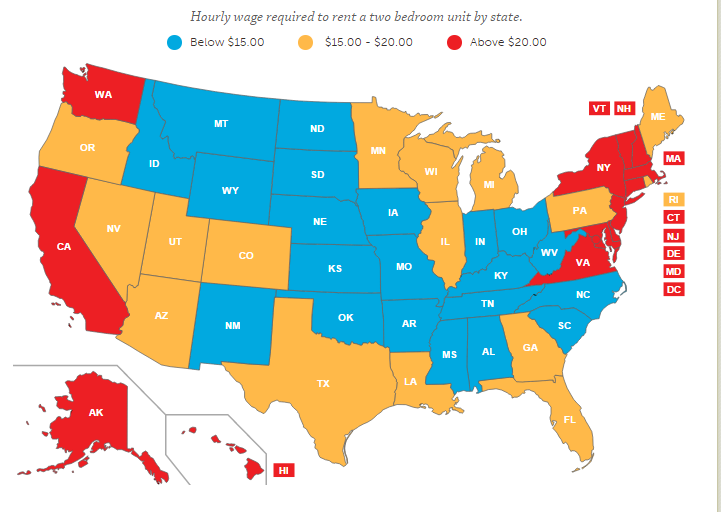

In many areas, people can’t even afford the local area rents, let alone buy. This is why we have 2.3 million adults living at home with parents in California. So of course the Fed continues to push forward with negative interest rates and continues this current trend. They keep talking about rate hikes but this has been going on for two years – like the boy calling wolf, no one is really listening anymore. In many ways, the Fed has backed itself in a corner. Yet they are using the CPI as reference that all is well on the inflation front. Just look at your monthly bills and see how accurate this. Better yet, take a look at your budget from 2000 and see where things are today.

One thing that does happen though is that rents do increase after a boom in home prices but lag the trend by a few years. That is why the recent CPI was a “shock†because now the rental increases are filtering into the CPI after a few years of solid price gains in home prices. The reality is now filtering even into juiced up metrics. Just take a look at the Case-Shiller annual changes versus the OER index changes. One looks like a boring flat line and the other looks like a wild tech stock. Easy money in the housing market is definitely the name of the game.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “Fed and CPI missing housing inflation yet again: The CPI is completely missing the increase in housing prices.”

It’s a double-edged sword. I think the government’s interest is to keep a conservative outlook on the housing aspect of the CPI. We know housing is a necessity, however the market is widely speculative and manipulated. From the government’s perspective, large swings in the CPI can greatly affect the cost-of-living adjustments. The CPI is a compromise that serves the interest of government, not the people.

That’s a good point because OER prevents morons in SoCal using their home as a speculative vehicle from influencing liabilities impacted by the CPI.

Heh…

Good one.

However, this means that the timing of the inflation measure is off, even if averages over very long periods turn out OK. Inflation is currently considered *the* most important measure for policymaking, so policy can be severely off. This can really hurt the economy overall.

The housing bubble and aftermath are a great example. If house prices had been a significant part of the CPI, inflation would have been much higher during the bubble and lower (probably outright deflation) during the Great Recession. That would have made the Fed raise interest rates during the bubble – ending it earlier, and reducing its severity – and then encouraged more stimulus during the bust, which would have tempered that too.

So while the *average* of policy was what it should have been, more or less, the timing was terrible. Less accommodation during the bust didn’t reduce the severity of the bubble, but just added more waste in unnecessary unemployment to the overbuilt McMansion waste of the boom.

I’m just prole a trying to read up on this stuff. I had no idea they computed housing costs in the CPI like that. I can understand they would want to dampen out large swings, but sheesh. At least now I know why when they say inflation is low it frequently does not feel like it.

It looks like control loop with too little P and Igain, and maybe a dash of D.

The investment expense (earning power) of the

equity held in a property (or what’s released from

that property from its sale and thereby made

available for deposit in an interest bearing product

(CD, for instance) compared to (the cost of) rent,

after taxes, of course, is one primary decision making

tool for buying v renting.

The very arresting of the business cycle itself,

so as to provide TBTF with an alternate portfolio,

insulating their collateral from the market,

apart from what the Fed has purchased not at

market value (and sold back at market value,

including for renting, including establishing a new

rental profit cente,r living alongside concomitant artificial

bubbles in real estate and bonds,) has caused a

the picture of galloping rents, with major owner-managers

riding the coattails of TBTF affiliates.

Those who sold the bubble who’re disinclined to simply

then repurchase it, or to chase it into the bond market,

with ZIRP, and 0% returns on equity freed from sales

from the 2008 bubble, which activity was opposite the

colossal failure of TBTF in ending up holding massive

volumes of overvalued collateral, spectacularly rewarded by the Fed,

now, in addition to underwriting the banks’ “loss sharing,” including

holding unqualified buyers’ feet to the fire, while the banks

avoid risk taking responsibility, are now among those getting

soaked on that rent, which by this column is under-, or not, reflected

in the CPI, in addition to getting no interest income on their

equities while the banks get free reserves.

So do you see this bubble coming to an end at some point? And will Fannie and Freddy, now being covered by the Tax payer via QE get stuck with Notes backed by over valued collateral? In other words, will the new entirely manipulated market continue or do you see points where the Fed might release a little steam and let the real market correct slightly over a long period of time, similar to Japan’s 30+ year recession.

Personally, I think the CPI has been stripped of its original intention and manipulated in order to be a tool to cap increases in government entitlements, Social Security, and pensions. It is a rather useless tool to assess the real effects of inflation and prices, or the impacts of these things on people’s lives!

Bingo…what don’t they (corpacracy) manipulate now is the real question, the libor rig was years..FX years…trade pacts etc..

I can tell my grandchildren that I witnessed the greatest heist of wealth from the masses ever…

Every measure of Economic assessment has been converted to Jonestown flavored Kool-Aid.

Unemployment is an absolute joke of a number, Hookers and blow count for GDP in Europe.

You can go on forever pointing out how nothing adds up.

“Personally, I think the CPI has been stripped of its original intention and manipulated in order to be a tool to cap increases in government entitlements, Social Security, and pensions.”

Boom….any there it is, the truth behind the manipulation of the numbers.

PITI inflation against real median income + LTI factors (X) liquid asset availability

There is a proper algorithm for housing inflation (MI2MP)

Last December I spoke at the BNY Mellon Stock Conference to wall street to show the model here in California where I show 82% of the working population are priced out of housing once you X out the cash buyers and those making 3X median income which is 190K

Housing inflation story the pure cost of shelter has never been properly shown in this country.

Here is the interview with Bloomberg on this topic at the conference

http://loganmohtashami.com/2014/12/04/bloomberg-financial-interview-at-the-bny-mellon-conference-housing-reality/

Curious about your methodology there. If you “X out” the people making N times the median in a population can’t you just choose N so that you can get any level of unaffordability you like. Let’s say you need to make 1.5x the median income to afford a home and I just “X out” all those making 1.5x the median or more – then magically 0% of the buyers can afford a home and we have an affordability crisis.

I’m not saying homes in CA are affordable, but cooking the statistics isn’t the best way to show they’re not.

CAR has this model which I don’t agree with

MI2MP

Median Income to Median Prices in California. That has roughly 68%-71% are priced out and this is coming from the CAR of all people.

However, what I don’t agree with their model is this. Their model assumes everyone in California has 20% down for a home.

So adjust that to new metrics of those who don’t have 20% down

Adding

Higher debt cost

PMI Cost

Property tax impound collection at closing

( Then) adjust that to taking cash buyers and those making 3X median income out of the equation and I am about 12%-15% higher that are priced out of housing California Association of Realtors.

So it might sound a lot but it’s not that much higher than traditional models, this is a reason why I don’t like the national affordability models as well

They assume everyone has 20% down, 740 Fico and a baseline Debt to income ratio factor.

There is a reason why adjusting to population we have had the worst housing net total demand from main street post WWII at the lowest rate curve ever post WWIII

I go into that factor model here with 3 charts to show that this was always about the capacity to own the debt and nothing more.

The Fall of Homeownership In America and The Rise of The Rental Recovery. Someone I talked about coming in December of 2010

http://loganmohtashami.com/2015/04/28/the-fall-of-homeownership-in-america/

Wrong. They may be priced out of the mortgage market but they are in the housing market as renters. If they can afford the rent, they can likely afford to own, if the mortgage money was made available to them. Rents and monthly payments are very correlated.

” If they can afford the rent, they can likely afford to own, if the mortgage money was made available to them”

False logic: Paying rent _this month_ is totally different than paying rent (mortgage), without missing a beat, 360 times consecutively. One time is not a problem, 360 consecutive times are. Missing one is enough to lose most of the capital, so the risk is enormous.

And we already know that incomes are going _down_, not up, with real inflation around 10% and wages stagnant, no raises at all.

Problems with payments arise even in short term, like 5 years: Assuming you can pay same amount after 20 years than now with diminishing income is monetary politics, i.e. hallucination, not reality.

Excellent points. Going forward – Wouldn’t that mean that housing prices will continue to rise over the next few years to much greater heights since the population of renters has gone up by volumes recently? Or what do you predict will happen over the next 5 years?

If I could be dictator for a day I would chop Jerry Brown into little pieces before breakfast and then force all of the illegals to leave. Housing shortage resolved.

if i could be dictator for a day i would kill off all the useless eaters. unemployment, crowding, and traffic all fixed

If I was dictator for life, everyone would be sooo frikkin happy with their lives, the biggest problem would be suicides because they can’t handle too much of a good thing.

VOTE ME, DICTATOR FOR LIFE. I promise this will be true. 😉

I believe we need an asset price index. This is important because real estate and assets are used as collateral for mortgages and loans. Credit creates credit money. If asset prices rise too much annually, inflation is created when too much credit money is created based on the higher collateral prices.

How can we slow down this process without raising cost with higher interest rates, as the Fed does now with monetary policy.

I wrote about this problem in 1982 when interest rates were increased by the Fed to 21% to by a home. In 1979 the annual inflation rate was 12%. To rid our economy of inflation the Fed created the worse recession since the Great Depression. At the time I thought it was stupid to create so much misery to reduce inflation when we weren’t using the correct tool to slow down the economy. The cause of the inflation was the creation of too much credit money in our economy. Why was too much credit money being created in our economy? Because asset prices were increasing too much annually. The same problem we have now!

To stop repeating history we need to enact the “2% Appreciation/Inflation Taxation Policy. “. This tax reform policy would slow down the cycle of higher asset prices and too much credit money being created, which results in higher housing and asset prices, until the Fed creates another recession with high unemployment and foreclosures.

For more information, please read the article “American Dream: Restoring Opportunity For All” and watch the video at http://www.taxpolicyusa.wordpress.com

Sometimes the only way to clean out the system is to flush it with clean water and then suck the dirty water back out.

The only 2 things I can see that will slow down this housing craziness is an increase in rates or a big pullback in China. If those Chinese cash buyers start liquidating their property holdings then we will see a nice correction.

Dan, sorry to be the bearer of bad news. But the housing market is rigged. When prices fall, the government and banks “have to do something”. As long as prices keep going up everyone is happy; the government, the banks and the populace. Because they think home prices going up is a great thing. Try explaining to them the simple logic that as prices go up that means it eats up a greater portion of your income (higher mortgage cost, higher property tax, higher insurance, etc.) and they look bewildered at you. As if it’s a mystery.

I give up. The fact is all of the following markets are in a bubble and the government won’t allow them to correct itself; the housing market, the bond market and the stock market.

And what exactly are they going to do this time?

Agree with the cynicism although the PTB doesn’t have the best track record of preventing asset price crashes, including real estate. Over the long tail home prices barely stay above the rate of inflation. A cynic’s cynic might say that they indeed have something to do with the price deflation parts of the cycles as well.

@nathan118

I agree. Should prices fall despite trillions of $ in ongoing subsides by the Fed and government, it will tell you that even the buying vestige of this echo bubble, the speculators and investors, would have all but lost confidence in real estate. Organic buyers are certainly not going to all of suddenly scoop up overpriced properties.

…other shoe dropping from 2007/2008. This time much worse.

If only the Fed/banks could create more inflation so the value of their houses go up.

Nah…

I just finished reading an article consisting of a debate between two market analysts, Jeff Clark and Harry Dent. The article is titled “Gold: Dead or Alive?”. The two men have a gold Eagle bet on whether gold will drop at any time to $700/oz by Feb 16, 2017. The only thing they seem to agree on is that gold benefits from inflation. If what I’ve seen discussed here is true, then Harry Dent’s deflationary outlook may not be as warranted as he thinks. I personally am in between the two men. I think gold will stay in between $800 and $1400 for the next two ears which means that Jeff wins the gold coin.

I do agree with Harry though that US dollars are a good thing to hold right now, since I think as he does that price corrections in a number of bubble markets are coming by 2019. I think that inflation could take off if we have a recovery financed with government paper. It takes rising wages to trigger an inflationary spiral, but we haven’t seen that despite our current administration’s efforts to produce them. Rising rents won’t do the trick.

42.173% for housing. Is that based on gross or disposable income? Either way, this is not sustainable.

43% is actually not accurate.

For conventional it can actually go up to 49.9% (both housing ratio and total expense ratio)

For FHA; it’s 47% housing ratio and 57% total expense ratio.

The major currencies have devalued in relation to the dollar. The U.S. economy isn’t that strong, hence GDP and trade deficits. The U.S. dollar has appreciated by default.

“”” The U.S. dollar has appreciated by default.””””

Yo Dennis, well-written, but el wrongo, buddy. The US Fed started a world currency war and Field Marshall von Draghi plans on winning it. Winning, being defined as a rapidly appreciating dollar, look for the dollar to go to the moon when Janet hikes and/or we get the Grexit or the Brexit.

Yo Ed, well presented but also ell wrongo.

All fiat currency is based on only one metric.

When you go to sleep at night, it will still be there in the morning.

In the not too distant future that will apply to about 2 places.

Russia because Putin is stronk and has what the world needs.

The USofA because we have a bunch of sheep/lemmings that will never change how this place is run and the Bankers can continue as they like.

It is very ying/yang in it’s purity.

Americans sleep well at night because they have no expectation or desire to be ruled otherwise and have extra strength Ambian in Pez dispensers shaped like Kim Kardashian. (warning choking hazard). Ask you doctor about anti anxiety medications to overcome your fear of choking on Kim.

Russians sleep well at night because they know they can’t do anything about Putin so why worry.

The entire planet will rush to the FED and be eternally grateful to get negative 30 year notes, because they will get it back eventually and eventually is a lot better than maybe never.

Yo ImnotPOTUS,

I’m not sure what the argument is because that’s exactly what I’m saying, except for the ruble part. The Fed wants/likes to devalue the dollar, the world reserve currency. The BRICS and the EU don’t like that and now the mission is to send the dollar to the moon and they will have success because the FED, at zero %, can’t do anything about it. The FED is still doing stealth QE but inflation is white hot and they need to raise, raise aggressively I dare say.

EU QE just started and all the BRICS have to do is do their own QE, have the lucky

recipients go into the FX market and sell their own currency and buy the dollar. As far as I can see, it’s game over for US stocks if anything like that is attempted. It may already be going on because the Brazilian currency is in a nose dive vs the dollar, for example.

Yo ImnotPOTUS,

The JPY/USD, japanese yen has now broken the key 30-YEAR(!) support of Y122/$. In fact, 6/2 overnight, the JPY/USD briefly breached 125!

There are too many FX balls for the FED to keep in the air all at once, lol. Sure, they

were able to manipulate the EUR/USD lower, but they took their eye off the yen ball, ha. A new round of currency turmoil is beginning and the FED is encircled (eingekreist) in military terms.

The FED is surrounded, better translation than encircled.

Also, they manipulated the EUR/USD higher overnight 6/2, but from a USD perspective, the dollar was lower vs the EUR, but for just one day, though.

The Chinese investor land grab of the Pacific Rim has only just begun.

Go to the docks in Oakland or San Pedro and see the big container ships coming in from China. American dollars are going out.

Honor those Veterans who died for our freedom this Memorial Day.

And they come right back in from where they originated. We give them our dollars, they give us their labor, they give the dollars back in return for taxable land assets. End of the day, dollars are still backed by the one thing everybody wants – oil. Brilliant scheme if you ask me.

Ca has a lot of immigrants that double and triple up on the housing, yes there are homeless and people in motels. What is interesting is Fox news did a special on people that lived in motels near Houston Texas. It can also happen in other places that are cheaper because people are unemployed or in Texas the tip minimum wage for waiters and waitress is only 2.81 plus tips, which is low if you don’t make a lot of tips.

Dear Doctor Bubble,

I don’t think house prices are even in the CPI. They substituted something else a long time ago (80’s?), something that doesn’t even exist in the real world, what they call “owner’s equivalent rent” lol.

It’s the largest weighted component in the CPI, too. There you have it. When steak goes up, substitute ground beef ha.

San Diego real estate is hot and continuous increase n median price YoY.

Dear Dr. Bubble,

I see you discuss OER referenced above, however, you fail to mention that it’s just something they completely make-up. Since OER is that largest CPI component, the CPI is therefore whatever the powers that be want it to be! How convenient.

Words fail me when I think about this stuff.

The real rate of inflation is averaging over 10% the last 4 years nationwide. The real rate of inflation is averaging 13% in the coastal cities of the most important state, our very own Golden State of California. San Diego, LA, San Jose, San Fran, all above 13% and in fact San Jose almost hit a 14% rate of inflation in 2014!

You can learn about the true rate of inflation here:

http://www.chapwoodindex.com

I posted this very valuable link in another thread and I’ll say it again, a 13% rate of inflation for another 5 years and we here in the Golden State aren’t going to be able to afford to eat. What, and when, does the FED plan on doing about this? In order to get prices back to where they were say 5 years ago, the “geniuses” at the FED will have to generate a negative, minus 13% rate of inflation for 5 years! It will take alot more than the planned .25 or .5 % increase the FED is talking about when they run out of “patience.”

Leave a Reply