Crash! The Housing Market Free Fall and Client #10 Contagion. Lessons From the Great Depression: Part VI.

Last week was one of the most volatile stock market weeks in many years. The market went off its medication and was up and down like a pogo stick. When volatility is this high, you are either going to see a break through upward or a severe correction to the downside. Given that market psychology is radically shifting and the wealth effect has much more of an impact on behavior, the consumer is becoming tapped out even though Wall Street is having a hard time understanding why consumers no longer want to continue on the human sized hamster wheel. If you want to see the eradicate waves in the market last week we need only look at the daily numbers for the DOW:

Monday: Market down 153 points –

Tuesday: Market up 416 points (largest one day increase in 5 years) +

Wednesday: Market down 38 points –

Thursday: Market up 49 points +

Friday: Market down 194 points –

For the week, the market is up 57 points. All that and the market barely moves up 57 points. But this doesn’t highlight the entire story. For the week, the Fed on Tuesday announced that it would be exchanging mortgage-backed securities for Treasurys and extending terms that would allow payback in 28 days instead of overnight. The market of course rallied on this since it was viewed as a full on bailout but the rally didn’t even last one day. Soon, the news again of write downs was hitting the market. The market had a few days that would have been severely negative if it weren’t for the Federal Reserve bailout plan version 5.0. But on Friday everything came crashing down with the news that Bear Stearns was being bailed out by JP Morgan/Chase and the Federal Reserve. The significance of this event is that nothing of this kind had ever been taken on by the Federal Reserve since the Great Depression. Suddenly we are making lots of comparisons with the Great Depression.

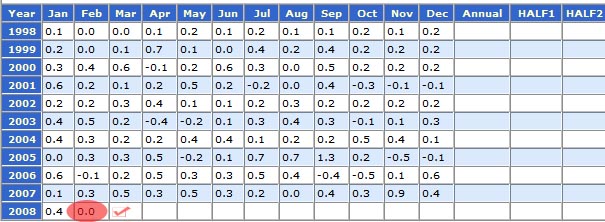

Early Friday, the CPI came out flat and defied any sense of logic for 95 percent of the population:

Oh really? I guess folks from the BLS don’t shop, use gas, need healthcare, and go to school. But aside from that, inflation was 0 percent. Since March 4th, crude has gone from $98 a barrel to $110 a barrel, an increase of 12 percent in 10 days! An ounce of gold went from $958 on March 4th to $1,004 an ounce, an increase of 4.8 percent in 10 days. Meanwhile, the US Dollar Index went from 73.947 to the current 71.93, a drop of 2.7 percent. At the minimum with the dollar declining, the average American family lost purchasing power. Yet the absurd notion of hedonics simply does not reflect the majority of families consumption behavior. I discussed this thoroughly in a past article examining a hypothetical budget for a family (The Invisible Mortgage Hand) and it caused a stir with readers. The premise of the article was that credit was being used as a bridge for the lack of wage growth and also, the increase in consumer prices. Now that credit is in shambles and risk is increasing, lenders are being more stringent about their lending standards. Now you’ll have to fog two mirrors for a loan.

Lessons from the Great Depression – Crash!

Today I think it is appropriate to look at the actual crash of 1929 and how it unfolded. The importance of this post will examine the multiple interventions that entered into the market trying to prop it up while the market steadily unfolded for four years before bottoming out. When we look at a number such as 1929-1933, we seem to compartmentalize that these four years somehow went quicker than our future four years of say 2008-2012.

Try to imagine for a moment, how 2012 will look. Does this seem like tomorrow? Does this seem like a quick turn of a chapter? Of course not. So when we examine the crash of 1929, we realize that the market declined both abruptly and quickly at times but took years. It wasn’t for lack of intervention or from motivation. There were those perma-bulls back then that couldn’t foresee a world without new credit devices that emerged during the early part of the century. This is part VI in a series which I think is incredibly important. We have been here and keep in mind Ben Bernanke is a student of the Great Depression and believes that one of the primary causes of the Great Depression was lack of vigorous intervention by the Fed at that time. He will now be able to put his theory into practice.

Lessons from the Great Depression Series:

2. Lessons From the Great Depression: A Letter from a former Banking President Discussing the Bubble.

3. Florida Housing 1920s Redux: History repeating in Florida and Lessons from the Roaring 20s.

5. Business Devours its Young: Lessons from the Great Depression: Part V: Destroying the Working Class.

With each subsequent rate cut, the market is losing more and more faith with the Federal Reserve. I think the Federal Reserve realizes that there is only so much more room before they hit a zero percent interest bottom. The bullets are running out and soon, a new weapon will be needed.

Crash!

I am a big fan of Frederick Lewis Allen who has written extensively on the historical, social, and economic circumstances of the early half of the century. For those of you who want to see where we are heading we need to have a wider scope than just the last few decades. It doesn’t seem that people much care about history yet are willfully accepting to repeat it. This is a chapter titled Crash! that gives an amazing account of the days and time surrounding the crash of 1929:

“Early in September the stock market broke. It quickly recovered however, indeed, on September 19th the averages as compiled by the New York Times reached an even higher level than that of September 3rd. Once more it slipped, farther and faster, until by October 4th the prices of a good many stocks had coasted to what seemed first-class bargain levels. Steel, for example, after having touched 261 3/4 a few weeks earlier, had dropped as low as 204; American Can, at the closing on October 4th, was nearly twenty Points below its high for the year; General Electric was over fifty points below -its high; Radio had gone down from 114 3/4 to 82 1/2.

A bad break, to be sure, but there had been other bad breaks, and the speculators who escaped unscathed proceeded to take advantage of the lessons they had learned in June and December of 1928 and March and May of 1929: when there was a break it was a good time to buy. In the face of all this tremendous liquidation, brokers’ loans as compiled by the Federal Reserve Bank of New York mounted to a new high record on October 2nd, reaching $6,804,000,000 — a sure sign that margin buyers were not deserting the market but coming into it in numbers at least undiminished. (part of the increase in the loan figure was probably due to the piling up of unsold securities in dealers, hands, as the spawning of investment trusts and the issue of new common stock by every manner of business concern continued unabated.) History, it seemed, was about to repeat itself, and those who picked up Anaconda at 109 3/4 or American Telephone at 281 would count themselves wise investors. And sure enough, prices once more began to climb. They had already turned upward before that Sunday in early October when Ramsay MacDonald sat on a log with Herbert Hoover at the Rapidan camp and talked over the prospects for naval limitation and peace.

Something was wrong, however. The decline began once more. The wiseacres of Wall Street, looking about for causes, fixed upon the collapse of the Hatry financial group in England (which had led to much forced telling among foreign investors and speculators), and upon the bold refusal of the Massachusetts Department of Public Utilities to allow the Edison Company of Boston to split up its stock. They pointed, too, to the fact that the steel industry was undoubtedly slipping, and to the accumulation of “undigested” securities. But there was little real alarm until the week of October 21st. The consensus of opinion, in the meantime, was merely that the equinoctial storm of September had not quite blown over. The market was readjusting itself into a “more secure technical position.”

It is clear from anyone that has studied the Great Depression, that not one event collapsed the market. It was like a tipping point that finally capitulated the market downward. Interestingly enough, a financial group had collapsed in England and also, a public utility company was allowed to split up its stock (doesn’t it seem familiar that these two parallel with Bear Stearns being bailed out and also, the proposed splitting up of the monolines?). Either way, the market in early 1929 had already had a few incidents where the market declined only to be propped back up by massive speculation. The speculation was so spectacular that even at the last minute, investors were still pushing stocks up. And of course, it almost seemed unfathomable that the market would collapse. Even the prophets of Wall Street couldn’t envision such a scenario:

“In view of what was about to happen, it is enlightening to recall how things looked at this juncture to the financial prophets, those gentlemen whose wizardly reputations were based upon their supposed ability to examine a set of graphs brought to them by a statistician and discover, from the relation of curve to curve and index to index, whether things were going to get better or worse. Their opinions differed, of course; there never has been a moment when the best financial opinion was unanimous. In examining these opinions, and the outgivings of eminent bankers, it must furthermore be acknowledged that a bullish statement cannot always be taken at its face value: few men like to assume the responsibility of spreading alarm by making dire predictions, nor is a banker with unsold securities on his hands likely to say anything which will make it more difficult to dispose of them, unquiet as his private mind may be. Finally, one must admit that prophecy is at best the most hazardous of occupations. Nevertheless, the general state of financial opinion in October, 1929, makes an instructive contrast with that in February and March, 1928, when, as we have seen, the skies had not appeared any too bright.

Some forecasters, to be sure, were so unconventional as to counsel caution. Roger W. Babson, an investment adviser who had not always been highly regarded in the inner circles of Wall Street, especially since he had for a long time been warning his clients of future trouble, predicted early in September a decline of sixty or eighty points in the averages. On October 7th the Standard Trade and Securities Service of the Standard Statistics Company advised its clients to pursue an “ultraconservative policy,” and ventured this prediction: “We remain of the opinion that, over the next few months, the trend of common-stock prices will be toward lower levels.” Poor’s Weekly Business and Investment Letter spoke its mind on the “great common-stock delusion” and predicted “further liquidation in stocks.” Among the big bankers, Paul M. Warburg had shown months before this that he was alive to the dangers of the situation. These commentators — along with others such as the editor of the Commercial and Financial Chronicle and the financial editor of the New York Times –would appear to deserve the 1929 gold medals for foresight.”

It is often sited that no one really foresaw the crash of 1929 but there were a handful of people that were echoing a warning cry. But how many people listened? Even the predictions were slightly modest from the bears yet they were still not given the time of day. But of course you had your perpetual housing bulls:

“Professor Irving Fisher, however, was more optimistic. In he newspapers of October 17th he was reported as telling the Purchasing Agents Association that stock prices had reached “what looks like a permanently high plateau.” He expected to see the stock market, within a few months, “a good deal higher than it is today.” On the very eve of the panic of October 24th he was further quoted as expecting a recovery in prices. Only two days before the panic. the Boston News Bureau quoted R. W. McNeel, director of McNeel’s Financial Service, as suspecting “that some pretty intelligent people are now buying stocks. “Unless we are to have a panic-which no one seriously believes-stocks have hit bottom,” said Mr. McNeel. As for Charles E. Mitchell, chairman of the great National City Bank of New York, he continuously and enthusiastically, radiated sunshine. Early in October Mr. Mitchell was positive that, despite the stock-market break, “The industrial situation of the United States is absolutely sound and our credit situation is in no way critical. . . . The interest given by the public to brokers’ loans is always exaggerated,” he added. “Altogether too much attention is paid to it.” A few days later Mr. Mitchell spoke again: “Although in some cases speculation has gone too far in the United States, the markets generally are now in a healthy condition. The last six weeks have one an immense amount of good by shaking down prices. ….. The market values have a sound basis in the general prosperity of our country.” Finally, on October 22nd, two days before the panic, he arrived in the United States from a short trip to Europe with these reassuring words: “I know of nothing fundamentally wrong with the stock market or with the underlying business and credit structure. . . . The public is suffering from ‘brokers’ loanitis.”

In these types of situations, be careful who you listen to. The CEO of Bear Stearns as early as 2 days before his company was bailed out by the Federal Reserve had this to say:

“New Chief Executive Alan Schwartz appeared on CNBC Wednesday to allay fears that the firm faces a liquidity crisis, a perception heightened by the Federal Reserve’s decision on Tuesday to loan up to $200 billion in Treasury bonds to primary dealers, a move that would allow Bear to swap some of its mortgage-backed securities for more secure debt.

“Our balance sheet has not weakened at all,” said Schwartz, noting that Bear’s $17 billion cash position was the same as it had been in November. On Monday, the company posted a similar message on its web site: “The company stated that there is absolutely no truth to the rumors of liquidity problems that circulated today in the market.”

So much for not having a weak balance sheet. In 2 days Bear Stearns lost 40 percent of its market value. In these times, even those perceived as experts have a motivation to keep the pretense up that all is well. Clearly as CEO, one is to expect that you would have a better sense of your company’s situation. I still think we have yet to see the break point where the market trends fully lower. During 1929 the moment came in late October:

“The next day was Thursday, October 24th.

On that momentous day stocks opened moderately steady in price, but in enormous volume. Kennecott appeared on the tape in a block of 20,000 shares,General Motors in another, of the same amount. Almost at once the ticker tape began to lag behind the trading on the floor. The pressure of selling orders was disconcertingly heavy. Prices were going down….. Presently they were going down with some rapidity….Before the first hour of trading was over, it was already apparent that they were going down with an altogether unprecedented and amazing violence. In brokers’ offices all over the Country, tape-watchers looked at one another in astonishment and perplexity. Where on earth was this torrent of selling orders coming from?

The exact answer to this question will probably never be known. But it seems probable that the principal cause of the break in prices during that first hour on October 24th was not fear. Nor was it short selling. It was forced selling. it was the dumping on the market of hundreds of thousands of shares of stock held in the name of miserable traders whose margins were exhausted or about to be exhausted. The gigantic edifice of prices was honeycombed with speculative credit and was now breaking under its own weight.

Fear, however, did not long delay its coming. As the price structure crumbled there was a sudden stampede to get out from under. By eleven o’clock traders on the floor of the Stock Exchange were in a wild scramble to “sell at the market.” Long before the lagging ticker could tell what was happening, word had gone out by telephone and telegraph that the bottom was dropping out of things, and the selling orders redoubled in volume. The leading, stocks were going down two, three, and even five points between sales. Down, down, down…. Where were the bargain-hunters who were supposed to come to the rescue at times like this? Where were the investment trusts, which were expected to provide a cushion for the market by making new purchases at low prices? Where were the big operators who had declared that they were still bullish? ere were the powerful bankers who were supposed to be able at any moment to support prices? There seemed to be no support whatever. Down, down, down. The roar of voices which rose from the floor of the Exchange had become a roar of panic.

United States Steel had opened at 205 1/2. It crashed through 200 and presently was at 193 1/2. General Electric, which only a few weeks before had been selling above 400, had opened this morning at 315 — now it had slid to 283. Things were even worse with Radio: opening at 68 3/4, it bad gone dismally down through the sixties and the fifties and forties to the abysmal price of 44 1/2. And as for Montgomery Ward, vehicle of the hopes of thousands who saw the chain store as the harbinger of the new economic era, it had dropped headlong from 83 to 50. In the space of two short hours, dozens of stocks lost ground which it had required many months of the bull market to gain.

Even this sudden decline in values might not have been utterly terrifying if people could have known precisely what was happening at any moment. It is the unknown which causes real panic.”

Amazingly, it seems like the fire that lit the fuse was forced selling in October 1929. The current catalyst of this market is the forced liquidation of many companies and margin calls are now starting to creep back into the lexicon of the market. Without credit, the system cannot function just like a Ponzi Scheme cannot go on without new players. Once the buyers (credit) dries up, the gig is up. It wouldn’t be a problem if companies were adequately capitalized but they are leveraged to the hilt and really have no viability without access to credit. That is their mistake. Just like many states unable to save during the good times for an inevitable downturn in the future. Those that claim we will not have a recession need their heads examined. Even after the “crash” the market had a few short rallies until it finally capitulated:

“The New York Times averages for fifty leading stocks had been almost cut in half, failing from a high of 311.90 in September to a low of 164.43 on November 13th; and the Times averages for twenty-five leading industrials had fared still worse, diving from 469.49 to 220.95.

The Big Bull Market was dead. Billions of dollars’ worth of profits-and paper profits-had disappeared. The grocer, the window-cleaner, and the seamstress had lost their capital. In every town there were families which had suddenly dropped ‘from showy affluence into debt. Investors who had dreamed of retiring to live on their fortunes now found themselves back once more at the very beginning of the long road to riches. Day by day the newspapers printed the grim reports of suicides.

Coolidge-Hoover Prosperity was not yet dead, but it was dying. Under the impact of the shock of panic, a multitude of ills which hitherto had passed unnoticed or had been offset by stock-market optimism began to beset the body economic, as poisons seep through the human system when a vital organ has ceased to function normally. Although the liquidation of nearly three billion dollars of brokers’ loans contracted credit, and the Reserve Banks lowered the rediscount rate, and the way in which the larger banks and corporations of the country had survived the emergency without a single failure of large proportions offered real encouragement, nevertheless the poisons were there; overproduction of capital; overambitious (expansion of business concerns; overproduction of commodities under the stimulus of installment buying and buying with stock-market profits; the maintenance of an artificial price level for many commodities, the depressed condition of European trade. No matter how many soothsayers of high finance proclaimed that all was well, no matter how earnestly the President set to work to repair the damage with soft words and White House conferences, a major depression was inevitably under way.

Nor was that all. Prosperity is more than an economic condition; it is a state of mind. The Big Bull Market had been more than the climax of a business cycle; it had been the climax of a cycle in American mass thinking and mass emotion. There was hardly a man or woman in the country whose attitude toward life had not been affected by it in some degree and was not now affected by the sudden and brutal shattering of hope. .With the Big Bull Market zone and prosperity going, Americans were soon to find themselves living in an altered world which called for new adjustments. new ideas, new habits of thought, and a new order of values. The psychological climate was changing; the ever-shifting currents of American life were turning into new channels.

The Post-war Decade had corne to its close. An era had ended.”

It is only a matter of time before the current era of easy credit ends. The question of when it happens does remain.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

23 Responses to “Crash! The Housing Market Free Fall and Client #10 Contagion. Lessons From the Great Depression: Part VI.”

Another eerie parallel from Paul Kasriel . . .

Why did the Fed raise interest rates in 1931

http://web-xp2a-pws.ntrs.com/content//media/attachment/data/econ_research/0803/document/us0308.pdf

The popular mythology is that the Fed was stupid. Kasriel demonstrates pretty convincingly that the Fed in 1931 was caught between a rock and a hard place (sound familiar?). It was either ease in an attempt to revive the collapsing economy or tighten to defend the dollar against the pound – and the bankers0 guessed wrong.

Not that I’m ( quite) ready to ‘capitulate’, I do love your reexamination of the era of the Great Depression. They say that Bernanke, too, is an expert of the period. What is interesting is that, of course, people were the same. Full of the same hopes and fears that we have today. What was quite a bit different was the world.

The United States was truly the economic wunderkind of the world. 90% of ALL the private cars were in the United States. Oil was gushing from the wells in Texas and California. IT meant Clara Bow, as in the ‘It Girl’ . Technology and industrial prowess. Ford was the Toyota of that day. RCA a cross between Intel and Microsoft. Skyscrapers were only found in the US and abroad the only rival to America was a still regnant British Empire upon which the sun never set. All only one human lifetime ago. Today, far from being the ‘world’s only superpower’ the US is just a large country without a central core. Gone is the will to power, the dominance of Anglo Saxon culture that enforced a common heritage upon all.

We may need the shock of a Depression and the Crucible of a World War to reforge ourselves into the America that once was. We may get our chance too.

A very sobering post Dr.

Seriously, how many of us could withstand a REAL depression? We would survive, probably.

I talked to my mom for a couple of hours about this…she was born in ’29. Crazy stories of what her parents did to simply provide for their own in the 30s. Fortunately for them the family was tight and many were farmers, so food wasn’t so much an issue. But they weren’t driving Audis and the simplest of life’s pleasures were treasured.

This may hark back to one of the Dr’s earlier posts where he mentioned the 60 minutes piece about counties that are happiest (Denmark?)….lowered expectations. Not owning a million dollar home is OK. Not driving a new car is OK. Not having a 72″ flat screen is OK..etc, etc.

On an anecdotal note, I’ve just noticed that on one of my kids soccer teams, that many of the parents aren’t showing up to games this year. Seems that MANY are working second jobs now or trying to hang on to the ones they have. Only a year ago they had perpetual tans from weekends at the river with the new boat.

Few could survive a depression without government help. Everything America built and saved over two hundred years has been wasted in a frenzy of spending, credit, war, and arrogance. We are broke. Most of the world hates us. Our own leaders fear us.

Frankly, there are really few reasons why an objective person would want to keep the patient alive. Perhaps the only arguments for fighting to save America are that the present administration will one day die (even if they choose not to leave office) and Wall Street will be reformed by force.

Americans, ask yourself what is really so great about the life you have now? You AND your wife work; you are in debt anyway. You bought a house; the bank owns it and will take it back. You live in a great suburban neighborhood; your commute is two hours each way. You have a 72″ plasma tv; you use it to watch American Idol.

Are you satisfied? Happy? Fulfilled?

Do you know your neighbors? Have you met your representatives to local, state, and federal government?

Do you trust the police? Congress? Bush?

How many friends do you have? When is the last time you had good laugh?

Do you really, really think Bear Sterns is worth your tax money? Lehman? Citibank?

Do you even think voting for a young black man will really change a thing?

Isn’t it time for a revolution?

Yep. Got any great ideas? Nope? Me neither.

We are all very, very fucked.

A great read on this subject is “The Great Crash 1929” by J.K. Galbraith. First released in 1955 Galbraith nails down the events of that period with humor and lots of insight. Also, one of the most successful investors of that period was Jesse Livermore who was one of the main players and a totally interesting character.

“Reminiscences of a Stock Operator” by Edwin LeFevre (1925) tells Livermore’s story and the history of this era just prior to the crash. I understand this book is mandatory reading at certain firms for new brokers….. it should be for all investors.

Livermore actually shorted the market big time just before the crash and made millions and millions. His personal life was a mess, and he ended up committing suicide in 1940.

Worth reading, our present state in simplified manner:

http://www.321gold.com/editorials/harris/harris031408.html

I agree a big bad bear market is headed our way. A Grizz in fact. But I don’t agree with the analysis. This recession/depression will be, for the first time in US history, driven by foreigners fleeing the dollar, Treasury bonds, municipal bonds, securities, and US assets. The best investments today are in commodities and export products.

I’ve been looking for the dollar to melt down so we can all go back to work.

Free trade has not been working for the average American since 1967. To hell with Free Trade. I like the Monroe Doctrine. We don’t need the Chinese, or the Europeans, lets slam the door in this period of US history, and lets all get back to work making American products. We all may be a lot poorer in the short run, but better off over the long term.

Calculated Risk has a fairly well informed blogosphere of commenters. The Sat 3/15 and Sun 3/16 posts contain quite a range of comments, but if I might be so bold as to summarize, the general tenor is: watch out this week in the market. Bear Stearns, an 85 year old investment banking company at the very heart of the brokerage industry, will either be (1) sold, (2) file bk, (3) become effectively nationalized. Then – which institution is next?

The Fed is slated to meet Tuesday but don’t be surprised if it meets Monday and announces some emergency cut, especially if the Nikkei and other Asian markets open down big.

It may seem off-topic – but who here has a garden? What happened to the agrarian economy during the 1930’s? The concurrent ‘dust bowl’ phenomena helped deepen the misery, but at least a fair number of people still grew their own food. What about now, as continued ecological/ environmental degradation and the consolidation of farming into agribusiness makes even more people dependent on distant food sources?

I’m not denying we’re in a crisis, but the stock market crash of 1929 was very different that what we are experiencing now. The stock then clearly certainly “bubble” priced. Our stocks are not (although our homes are – however not to the % extend the stocks were). Our problem has essentially “crashed” the dollar (not the market – yet). This weaking dollar is due to our debt (which you have written well about previoiusly). However this is really a solution to the problem. It will cause us to tighten our belts as we will afford less. However it will spur internal businesses and the weak dollar will allow us to export more and thus make us stronger again.

It is clear we are in a correction, that is exasterbated by our Housing debacle, but it is only a correction (maybe a super-correction), which will point us toward paying our debt.

Looks like it is happening!!! Bear Stearns sold to JPM for $2!!! per share. Dollar in total free fall. If you’re not watching CNBC now, turn it on. It’s happening.

Expat, man you nailed it on the head. We live in a country of used car salesmen where everyone is trying to make a buck by screwing each other. And the consumer is the ultimate mark.

Watch for the Saint Patty’s day massacre tomorrow on Wall Street. The Fed tonight just lowered the discount rate .25%, JP Morgan is buying Bear Stearns for $2.00 a share, yes that is two dollars, not a typo. The all mighty dollar is down 3% against the Yen tonight. The Nikkei is down 4% as I write this. Gold is up 3% tonight… need I say more to wake stupid ass Americans up? Oh and thanks for reminding me to watch Idol on Tuesday night on my vintage tube TV, paid for with cash years ago. I’m thinking the prices on them 72″ big screens are going to drop so fast, that I will be crazy not to buy one… on craiglist of course. Used and half of retail.

“I am a big fan of Frederick Lewis Allen ”

Always one if my favorites for a contemporaneous view of the period. Are you quoting from “Only Yesterday” or “Since Yesterday” or both? Highly recommend them to those who haven’t read them. Both are available online. Just type in the title and “Lewis” and they will come up in a search, One is at the Univ of VA wesite (think that is right) and the other is on the Guttenberg website. Another book that is one of the best 1 volume treaties on the 1920s-1945 is “Freedon From Fear” by David Kennedy. It is a comprehensive overview with an excellent bibliography. (And of course Galbraith as Curt mentions.)

My degree was the history of the social thought, politics and economics of the 1930s plus pure economics – micro rather than macro. I have never been sold on the theory that ‘but for’ what the Fed did or did not do, the Great Depression could have been averted. First, the Fed had a lot less authority than it does not. Second, interest rates were already at 9% to try to slow the speculation but it wasn’t working. Third, so what if the Fed had offerred to lend more money to banks so they in turn could lend to speculators or consumers or had cut the interest rates? Borrowers couldn’t afford to pay it back without selling off stock or raising their incomes. BTW, incomes were lower then than now. 75% of households had incomes that would be less than $37,000 in 2008 dollars. Like now, incomes had not increased so as to stay even with inflation and households were maxing out credit to buy things like radios (price of a radio then is the equivalent of $1,700 now.) Do you see the similarity of the too-indebted-consumer? Fourth, the US Fed had NOTHING to do with the economic collapse in Great Britain, France, Germany and the rest of the world. Back then, the US Fed did not act in concert with the Bank of England or any other national bank. Something was going on that was far more than the US Fed could have affected or changed even if it had lent more money to the banks. FIfth, the market was pure unadulterated speculation which droves stock prices way past the point of having any rational relationship to earnings or value of the businesses. (Sounds like houses, CDOs, SIVs and mortgage backed securities doesn’t it?) The prices were unsustainable. The Fed could NOT have propped that up. Sixth, manufacturing and business output had been SLOWING for close to 2 years before the stock market blew up. That meant business was cutting back on production which meant cutting back on workers which meant the workers had no income and couldn’t spend which meant business was cutting back more since customers weren’t buying……. The economic collapse started considerably before the stock market blew up – it was just that no one was really paying attention to the signs of economic distress. Seventh, Bernake is a pure macro economist -the sort who says “what do household incomes and the amount people earn and have to spend have to do with the economy? The “economy” is the great gambling casino on Wall St – not somebody going grocery shopping.” Macro-economists have this delusion that they can change an interest rate, alter a policy, wave a magic wand and cause huge shifts in the behavior of people – including Aunt Tilly and Uncle Jake at the grocery store – because everything is rational and logical and controllable. It is far more complex than that, far less rational when dealing with human behavior even about money and far less subject to control and manipulation. (And macro-economists reply that micro-economists never see the big picture. Oh well……)

I forgot to add that I had an interesting conversation the other day. One of the high school sports teams was out peddling raffle tickets with their coach – who happens to teach history. We were chatting and I said I had been reading the economic news all day – gotten a bit lost in it. He said that he had heard a major Wall St bank was going under so I filled him in (Bear Sterns.) I finished – paused – and said ‘sorry, that was probably more than you wanted to ever know about it. It is just that my history specialty was the 1930s along with an econ degree’ His eyes widened and he replied “wow – you REALLY will understand what is happening now. I know some but near as much as you will” and called his students over and ask me to give them a quick comparison of the events. When I finished, I spent 20 minutes being peppered with questions about toxic mortgages and what could or should be done, credit card debt, how people managed in the Great Depression, how did I think it would affect us (tourism and cherry farms are the businesses here), and other very informed questions – all from 16 to 18 year olds. There is hope yet if the kids are paying attention and learning from what they see going on around them.

Doc HB, lots of folks over 40 just don’t have the visual acuity they once did, even with glasses. Would you please consider just using quote marks for those long quotes? Having to read long passages in italic makes me a little nauseous—today I literally had to copy and paste the article and make it all ‘regular’ text’ to be able to read it. (These articles are GREAT and I don’t want to miss a word!)

I’m 29 but I still agree with Jes! Anything but italic would do the trick (quotes, underline, bold).

And your blog just makes me sad. It’s sad that you’re right and too many people are too stupid to understand (and learn from) everything that happened in the last 5 years + the next xx that will follow.

I recently read Al Gore’s “The assault on reason” and the saddest (again this word) thing it’s not the fact that all this (housing, Iraq, Bush reelected) happened but the fact that IT WAS POSSIBLE. America learned nothing from the dot com crash, won’t learn anything from this housing bubble and the next “big thing” should be next. What is it? Imagination is the limit!

Watching CNBC all day today and the applause for the brilliant move Bernanke and Paulson did by enlisting JP Morgan to take on BSC while the Fed took on its unsaleable bonds.It sure didn’t impress the markets in Europe or Asia some of which were down 4 and 5%. What seemed to have saved the day was short covering ( nobody wanted to be short the day before Bernanke does another interest rate strip tease) and profit taking in the commodities.I’ll give them credit their timing was perfect. Do the bailout over the weekend before the rate cut. It seems to have worked but nothing has changed. Housing prices are still falling and with them eroding bank balance sheets. The only way ( I can see) to stop the rot is to convince Americans to buy houses at unrealistic prices but we’ve already been there and done that and so that play is used up. Otherwise all that is going on is the Fed stalling for time. In effect trying to keep the creditors at bay with a different excuse, a new stalling tactic , a fresh promise. I can’t blame them of course but with each new manoveur we begin, more and more, to resemble Japan in the 1990’s now to the extent that dollar is becoming the new

carry trade currency and we have a bunch of zombie banks roaming the land unable to die.

I always enjoy your well informed responses to the Dr.’s articles and I note we all read the same authors.

An internet book I recently brought to the Dr.’s attention is “A Bubble That Broke The World” by Garet Garrett which may be of interest to you also.

http://www.mises.org/books/bubbleworld.pdf

I think I’m going to need to start a new series: Real Calls of Genius:

http://www.liveleak.com/view?i=2b7_1205751955

“Don’t sell Bear Stearns!!!”

Good call Jim. What other place should we keep our money?

Dr.H.B.

Before you embark on your new series, you may wish to reference two previous efforts.

1) “The Smartest Guys In The Room”

2) “When Genius Failed”

Perhaps your new effort should include not just Cramer but, also “Goldilocks” Kudlow.

Cheers

And there is the laugh for the day!

Question: “Good call Jim. What other place should we keep our money?” Answer: The National Bank of Posturepedic has a lot to recommend it.

http://www.thedailyshow.com/video/index.jhtml?videoId=164178&title=broken-arrow

Want a laugh?

John B – I’m about a 1/4 of the way through the book. If you subsitute a word here and there, you would think it was written last week. Take pages 23-25. Change the word “bond” to “mortgage securities” and you have it in a nutshell. Not sure how I missed this one over the years – guess too much time with my dry historical data and original source records and not enough with opinion works and theoretical retrospectives. THANKS Ann

Hey Exit, the link you gave isnt working out fine here. its not opening .

Leave a Reply