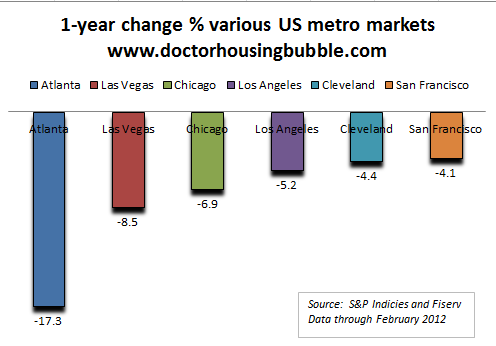

The crashing US housing metro areas – Atlanta home values crash by 17 percent in last year and Las Vegas continues to move lower. Chicago, Los Angeles, and San Francisco continue to make post-bubble lows.

US home prices have once again made a post-bubble low in spite of all the artificial intervention and massive bailouts to financial institutions. The bottom line unfortunately is that US household incomes have been strained for well over a decade. You can slice it up by nominal or inflation adjusted data but household incomes have been moving in a negative direction during the 00s and continuing into this decade. Keep in mind there is a massive pipeline of problems still in the housing market with over 5.5 million mortgage holders in some stage of foreclosure or simply not paying on their mortgage. This is more than a housing crisis but a crisis of quality job growth. At the core, that is truly the problem. There are markets in the US that are still correcting severely even after record breaking declines from their peaks reached in 2006 or 2007. Some of these markets are approaching two lost decades which seems stunning but again, this reflects weaker household balance sheets.

Correction still hitting major metro areas

While the US housing market overall did make post-bubble lows, there does appear to be some bottoming out in certain areas. For example, Detroit saw year-over-year prices move up by 1.5 percent. Then again, the median home price in Detroit is in the $60,000 range. But overall the correction seems to be continuing as the large shadow inventory works its way through the market.

When looking at the hardest hit areas, it is interesting to see a mix of low price metros and two very expensive metros taking the biggest annual declines:

Atlanta was absolutely slammed in the last year. Home prices have fallen by 17 percent only in the last year driving home values back to 1997 levels! This is for a very large metro area plagued with massive numbers of foreclosures. Atlanta was the only large Case-Shiller tracked metro area to have a double-digit annual decline. The second biggest hit came to Las Vegas. I’ve talked about this market in the past and cautioned people from diving in before doing careful due diligence. The market has fallen another 8.5 percent in the last year bringing the total decline from the peak to a whopping 61 percent without even adjusting for inflation.

You also see a handful of large mid-tier markets with Chicago, Los Angeles (including Orange County), and San Francisco falling yet again in the last year. For real estate in California, the economy continues to be weak and mid-tier home values are still inflated relative to local area incomes. The mid-tier markets are taking the biggest hits. For example with L.A. the mid-tier is down over 5 percent for the year but interestingly enough, the high tier has made a new post-bubble low.

The weakness is being driven by the large number of distressed properties being sold. Even though foreclosure sales are trending lower, this is being over shadowed by a larger number of short sales being ushered through by lenders. In other words, properties are exiting quicker from the system but they are still distressed. Lenders have a front row seat to what is going on and essentially what they are saying with a swarm of short sales is they believe home prices in the intern will be going down. Why else would you want to exit at this moment if you believed home prices would be soaring shortly? Bank balance sheets are still inflated with poor performing properties and what the Case-Shiller report shows is there is likely to be little support for higher prices anytime soon.

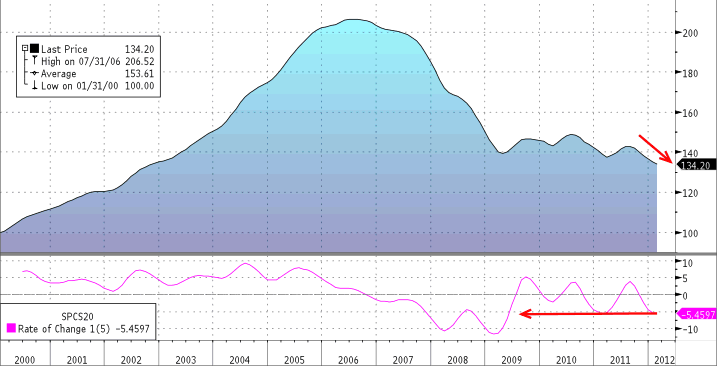

Take a look at the nationwide data here:

Source:Â Zero Hedge

If you look at a chart like the above, what is the major impetus to rush out and buy in 2012? The trend to the contrary is showing weaker prices and lenders are openly discussing that more shadow inventory will be leaked into the market. Certainly short sales are not going to prop prices up. Here in Southern California, the number of MLS short sales is growing and this has been a big story for 2012. I also realize that some folks think they are going to get a Beverly Hills property for $200,000. That is not going to happen. The biggest long-term driver for housing sustainability is going to be local area incomes and prices in places like Corona Del Mar for example will remain high for the average person because people do have high solid incomes in these markets. A $4 million home going to $2 million is not exactly going to open the floodgates. Those that pretended and over extended will be washed out of the market in the next few years but make no mistake, there are pockets of high priced housing that justify a high price simply because local incomes are able to support prices. The mid-tier markets are the areas that are subject to the biggest shocks in the next year or so. The issue is that many in mid-tier markets somehow believe they are in some of these tiny luxury markets (they are not).

Not sure if it got missed in all the news coverage but the California unemployment rate is back up to 11 percent meaning the underemployment rate is above 21 percent:

If you want to see leading indicators for solid potential growth look at unemployment but also the quality of jobs being added. No use in having everyone working at K-Mart and trying to buy a $500,000 home. The crashing markets of Atlanta and Las Vegas simply show that economic growth is not able to support current home prices even in cheap metros. The lower prices in Chicago, Los Angeles, and San Francisco reflect the correction in the mid-tier markets. What impact will 5.5 million distressed and foreclosed properties have on the market going forward? So far, it has been to push prices lower which isn’t a surprise.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

90 Responses to “The crashing US housing metro areas – Atlanta home values crash by 17 percent in last year and Las Vegas continues to move lower. Chicago, Los Angeles, and San Francisco continue to make post-bubble lows.”

“Then again, the median home price in Detroit is in the $60,000 range.” Some of the Cadillac SUV’s made in Detroit are $86,000 dollars, but the average house in Detroit is much less. This makes about as much sense as a $500,000, 600 square foot, house in Compton, in 2006, but in the opposite direction.

I’d say it makes a whole lot more sense. Detroit is a city in decline. Its population today is less than half of what it was 50 years ago. Just by supply and demand, we would expect housing prices to be low. But take into consideration high unemployment, high crime, high corruption, high taxes, etc., and there is nothing but downward pressure on the market.

I tried to look up some stats to really illustrate the point, but I’m not so sure I’m reading them right. BLS shows about 810,000 members of the Detroit-Liviona-Dearborn labor force, of which of 720,000 are employed. (in other words, U3 of 11%) However, wikipedia shows the Detroit metropolitan statistical area as having a population of 4.2 million. I expect the BLS area must be smaller than the whole MSA. I have a hard time believing there could be an 80% non-participation rate. If it is accurate, it’s amazing there’s a housing market at all.

The Mexicans went back home, and the housing prices are collapsing. California is a separate economy from the rest of the country. No future in California.

They left Arizona too, but the housing prices are recovering nicely here… in some areas.

I don’t think the Mexicans had as large of an impact as you might think…. the bigger issue is that some percentage of Mexicans were “lier loan” users to the max…. I see that often in Arizona… nothing was correct on their deeds… mostly stolen identities… from kids and dead people…

Just FYI – San Francisco has not hit a new “post bubble low” as you indicated. Today it is at 124.6, whereas it hit 117.7 in early 2009…

Speaking only from recent experience, we sold our condo here (in Chicago) at a price relative to 2002 levels – fortunately, I bought the place on spec back in ’98 and held on for dear life. But we wanted to move and couldn’t wait any longer, so after watching further price declines in 2009 – 2010 we finally spit the bit out and conceded the obvious. Even still, we had to suffer through three price reductions before we found a buyer, and our initial asking price was very conservative, owing to recent sales of similar units in our neighborhood. The last few months of showings were pure torture, as it was quite obvious that a burgeoning inventory of distressed properties were finally hitting the market and having the expected effect.

Chris Thornberg says the housing recovery is upon us. I know he’s been doing work for Paulson lately. So maybe there’s some influence there. Eventhough the banks can keep inventory low, it does not mean employment is rising. If you read this article, they’re really saying it’s all supply/demand that going to push up prices. So I guess it’s investor driven.

Thoughts?

http://www.latimes.com/business/realestate/la-fi-housing-forecast-20120425,0,3386170.story

Thornberg is back to his UCLA Anderson ways. He was objective when he first started Beacon, and it is my opinion he went back to being bought and sold.

Due to continuing falling house prices, every day there are thousands of “homeowners” that bought in early 00’s and ones that bought in 2009 to present, that are now going into negative equity territory. This will freeze even many more “homeowners” that have jobs, to stay put, and therefore cause much less inventory and potential move-up buyers in the housing market. The Banks and government are so desperate with 3.5% downpayment on loans up to $625,000 for 10 year interest only, and the shadow inventory is frozen with only the worst properties adjacent to freeways are leaked out like a drip to the MLS market.

We are experiencing the most massive financial bubble in the history of the world unfolding like a slow train wreck since 2006 that will cause such a negative hatred towards housing as a long term investment for the next generation.

Let me define “move-up-buyer” as Ponzi-scheme participant. You ever hear of the book “The millionare next door”? I aint read it, but the idea that we need to keep upgrading, from the 3 series, to the 5 series, to the 7 series BMW, is as unsustainable as our national debt.

“The millionare next door†That book was so full of “chit” in so many ways. My take away after reading it was, that the author wanted joe6pk to feel about about being average. I get what you’re saying surfaddict, nevertheless. We were move up buyers and pocketed nicely during the bubble. We were rare. We could pay off our McMansion, or sell it and find our toe-tag home and pay cash.Our McMansion wasn’t “us” so we sold it (regular sale) and have been waiting out this nightmare bubble, finally home shopping for the past 3 years.

Today, I had the pleasure to meet a very cool mortgage broker who filled me in on who the buyers are out there (at least in her practice). She said everyone is going FHA with a minimum FICO of 560. WTF! She agreed that house prices are still to high, and FHA truthiness deal breakers are questioning lending on such out of whack prices. She was a breath of fresh air in the REIC.

But…but…how can this be happening with Summer of Recovery III right around the corner? The Media and real estate pro-fesh-uh-nuls tell me the bottom is in. Sorry doctor, but you mut be mistaken in reporting these developments because they obviously conflict with officially sanctioned reality.

Great article, DHB! Originally banks dragged their feet on short sales because they believed that the market would rebound and they could get that 2007 peak price. If they are moving the distressed inventory out via quicker short sales, it is clear that they believe the best money is NOW and tomorrow they will get less. Like a train leaving the station, that downward movement in prices appears to be unstoppable. What I think the purveyors of artifice are missing is that our current housing situation is NOT just a result of the shenanigans of recent years, but of a long standing decline that has been going on quietly and slowly behind the scenes for decades. The Truth Will Out.

Well, I think jobs and affordability is the key. The average software programmer in India makes about $1,500 or much less a month. With that, he can afford a maid, a decent rental(though real estate seems to be in a massive bubble there), a driver and a very posh lifestyle. What can somebody who makes 1,500 in Los Angeles afford-health care premium for a family costs that a month. Something has to give and the real estate is giving. But otherwise long term-we have to take a look at globalization and free trade-it is not working in our favor.

Neither party seems to care. Obama seems to be signing free trade agreements with gusto and the republicans are worse. They are just two sides of the same coin.

California’s middle class is making a run for it to other States. Here’s an excellent WSJ article on why this is so…..basically, the State is friendly to the very rich, the very poor and government employees.

http://online.wsj.com/article/SB10001424052702304444604577340531861056966.html

Yes, it is true for me too. I am thinking of moving too. I am in IT and the salary I get is the same in CA or elsewhere-but I could get a house for half or much less depending on the place. I love CA-lived in the bay area first, then Los Angeles and San Diego . But just can’t wait forever. It used to be that companies paid a big difference in wages, due to the high cost of living here-not anymore.

R U movin to India? I bet they have higher doctor to patient ratio, and cheaper healthcare too! I see the map, it looks like there is water all around that place, I bet they got surf!! Let me know how it is, I might be right behind you!!

IT sector is in big metro cities like Bangalore, hyderabad, Mumbai n over there an avg 2 bedroom costs you arnd 300000$ with 11-13% adjustable mortgage rate…India is no more cheap…earning 1500$ wont take u anywhere in metro cities….places which are cheap don”t have IT sector…

Champagne bubbles in Corona del Mar, San Marino, Beverly Hills as the toasts are made. The people who clean the flutes go home to Pomona, Costa Mesa, Santa Ana and watch the bubbles in their beer.

A bit of an exaggeration, but the middle class incomes are getting pushed lower as the cost of a basket of goods, gas, food, entertainment, etc. goes higher.

Those 1500sqft $500K homes in Lake Forest and San Pedro won’t be selling at that pricepoint for decades (if ever).

The wealthy will have the $2mil home enclaves. But the working and middle class will be buying homes in the $150-400K range for a long time to come.

Forget the condo market. It is done.

The only people buying the $500K homes will be the wealthy and frugal (who must have been on the endangered species list for the last 20 years).

Well Dr. I agree on paper, however, the “boots on the ground” are seeing a different story. Do the investors buying cheap foreclosures count in the stats? They would give the illusion of an overall decline, however, these are not “buyers” they are flippers. Burbank is out of control. I now see more inventory, but people are putting dumps on the market at a half million! The rest is highly marked up flip homes or nightmare short-sales. I just about give up.

Be patient my young grass-smoker. When you can snatch up a place for less/near equivelent rent, then you are ready….keep your eye on it over longer timespan.

Great post Doc.

“Keep in mind there is a massive pipeline of problems still in the housing market with over 5.5 million mortgage holders in some stage of foreclosure or simply not paying on their mortgage. This is more than a housing crisis but a crisis of quality job growth.”

Talk about pent up inventory that will come online at some point in the very near future as robosigning and photoshopping mortgage paperwork was just given full immunity. Most likely the banks will keep as much from the market as possible in order to keep inventory tight like we’re seeing in a lot of markets nationally.

I have been hearing about the “tsunami” of foreclosures for years. Hogwash! The banks and crony government will find one gimic after another.

Not gonna happen brother. Don’t hold your breath.

“…a crisis of quality job growth.” Precisely. As I have stated, watch home prices drop until we reach the Reagan/Bush1-housing bubble prices of 1985-1990.

For those doubting the US worker is under attack by it’s own government since the Clinton (NAFTA) and Bush2 (hamburger cooking being labeled “manufacturing”) eras, and is escalating to this day…I offer this scary read:

http//kingworldnews/KWN_DailyWeb/Entries/2012/4/26_Yamarone_-_We_Are_Literally_Witnessing_a_Collapse.html

It will not get “better”, ever, until radical corrections, back to the safeguards of our former pre-9/11/01 False Flag attack republic, are institituted, and those needing prosecution and imprisonment are fully dealt with.

The rot starts at the very top….D.C. is occupied by thieves, con men and sociopaths masquarading as representatives. So is 99% of the so-called “msm.”

Is America an alcoholic, needing to hit rock bottom, or will reasonable men conclude these are times that try men’s souls, calling for extraordinary measures?

Time runs short, we shall see.

Farang,

You have hit this nail on the head, as few do these days. I can’t believe what is going on in the once great land. We are truly screwed and i see no hope.

You two had best be careful, the FBI has put out information that says if any american believes the US had a hand or contributed to 9-11, you are a potential terrorist. They are building a humungous super computer in Utah to record every text, every cell phone call, and all internet searches.

1984 was a blueprint, not just a thriller.

I don’t agree that politicians are to blame. Rather, I’d suggest that the American worker is a victim of his own productivity.

http://www.forbes.com/sites/timworstall/2012/04/27/why-mass-employment-in-manufacturing-isnt-coming-back-its-the-productivity/?partner=yahootix

Another way to look at it would be that the American worker needs to be paid relatively a lot, so companies invest heavily in equipment to make him more productive. While that’s fine, the problem is that companies perversely want to be paid back for the capital investment and seem uninterested in allowing real wages to rise.

In the words of Dilbert’s pointy haired boss, the profits pocket is not connected to the payroll pocket.

The reason those profits are not pocketed by American workers is simple. Over the past forty years they have been taught, cajoled, and flim-flammed into believing that debt=wealth. Our once productive economy has been financialized, and now that governments at all levels are controlled by the banking interests, there is no escape from their scheme. President Andrew Jackson warned us about this danger nearly 200 years ago. I suspect he gets Little more than a brief paragraph in most high school history texts.

Dr HB you’ve done it again. GREAT REPORTING!

In my micro-market east Ventura County inventory is scare under $400K, but I am seeing newly listed stuff come down in price. There is no consistency of price and condition. Prices are all over the place. Flips are getting premium prices, even noise lots with lipstick on the pig homes. FHA buyers are “flipping happy” to overpay for a flip. They know they have little skin in the game. I’ve always wondered how they get that price funded?

A UHS (used home salesperson) told me the auction deals are dead. Banks aren’t selling fixers for a flipper profit margin right now. Great news if you ask me.

I watch an interview a few days back, where an analyst from PIMCO says it’s hard as heck to get a mortgage right now, even with good credit.

I believe sane prices should look like this:

Lower Market (Compton,Lynwood,South Gate,Paramount,Watts,): 50-150K

Middle (Bellflower,Lakewood, La Mirada,Cerritos,Whittier,Covina): 200-300K

Upper Middle (Irvine,Pasadena): 300K-400K

Upper (Palos Verdes,Malibu,Santa Monica): 450K+

I think you’re still about 20% too high

Rational if we assume incomes will grow at 2-3% a year along with inflation. Otherwise that $400k home in Irvine may bedome a prison for someone on a fixed income who hasn’t paid it off as retirement approaches.

I lived in atlanta from 2001-2007 until i moved out to pasadena. We kept our house in Atlanta thinking it was a better investment than anything out here. Really should have sold it before 2009, but luckily the rent provides a good ROI. It is pretty frustrating that prices are still so inflated in LA. We rent a nice place in south pasadena for peanuts compared to the PITI of a similar house.

Incomes in Fulton County, (Atlanta) are very similar if not higher than LA county yet prices remain way out of proportion here. In atlanta the banks the foreclosure process takes 4-5 mo’s on average, and banks move quickly and price homes very cheap. I guess they don’t care since the notes are so low compared to CA homes.

What is happening in atlanta is what would happen in LA without government assistance and banks hoarding the properties. It is absurd, investors buy the few good cheap properties and flip them at near bubble prices to suckers that will soon be needing a govt bailout or short sale. decent home inventory in pasadena area is low this spring due to bank shenanigans and fed driven low interest rates. This is causing 10-20 bids situations on the few decent foreclosures or short sales out there, driving the price back up. They are still selling at a discount compared to last year, but no where near realistic bottom given the local incomes. This market far too manipulated to be calling any sort of price bottom. Hopefully things will change in the next few years.

I am privileged to live and work in Dallas, Texas, as a REALTOR. Times are tough, but values seem to be maintaining here in North Texas. Maybe we are doing something right here in flyover country?

Your state has a cap on the amount of money that homedebtors could borrow against their house via HELCOs, and which prevented as much of a run-up during the easy money bubble days of the early 2000s and has subsequently minimized the impact of the inevitable decline. My folks moved from SoCal to Hill Country in 2006 and absolutely love it there.

BTW, don’t get to crowing too much, since your state’s REALTARD association along with the big banks were actively lobbying to repeal this HELCO limit at the time. Texas has weathered the housing collapse in spite of, rather than because of your cartel.

HELCO = HELOC

It is the sky high property taxes that keep a lid on prices.

I don’t think Texas has anything comparable to Prop 13 that we have in CA. Your yearly property taxes are based on the current market of the house…the way it should be. If Prop 13 didn’t exist, the premium areas wouldn’t have quite the premium they enjoy today.

What does the no income tax in Texas keep a lid on? The overall cost of living is Texas for comps across the board is around 40% of California. California will end up with Facebook millionares and their gardeners. For the first time in 165 years, since the border was created, the outflow of Mexicans is greater than the inflow. What does that tell you about the economy? A statistic no easy to lie about: http://www.pewhispan…d-perhaps-less/

This is the correct link: http://www.pewhispanic.org/2012/04/23/net-migration-from-mexico-falls-to-zero-and-perhaps-less/

I am a perfect example of the sky high interest rates. Due to my age and income, once I spend the cash I have (around 550K) I simply cannot afford to have a house payment above 1400.00 per month.

In my situation, with the large down payment, the principal, interest and insurance is a piece of cake, it is the taxes that is a deal breaker for me on anything above 650K.

“I am a perfect example of the sky high interest rates.”

OOPS, on my earlier post, that should be……..I am a perfect example of sky high PROPERTY TAXES………

LB – “I don’t think Texas has anything comparable to Prop 13 that we have in CA. Your yearly property taxes are based on the current market of the house…the way it should be.”

Not only are property taxes based on the current market value of the house, the rates are very high compared to California. My sister lives in Fort Worth and pays about 4% in property taxes, but property values are much lower than in CA and there is no income tax. Overall, the tax burden in TX is much lower than in CA.

you are right in the middle of the ugliest region in the country

No surf either. My mate wants to drive there this summer. I told her, have fun!

Actually, San Francisco is on a high again due to the booming tech business. Here in La La Land, on the Westside houses are just sitting, the same crap is and has been on the market for months. Most properties are short sales and they are scams, speaking of, great website to report real estate/mortgage/flipping scams.

http://www.flippingfrenzy.com/report_fraud/index.html

I think I need to do my own report.

The house I sold in may 2004, (for a hefty bubble price, I THOUGH AT THE TIME!) for 669K in 92104 would now go for aprox 760K using a comp just across the canyon.

So, the score is……….

I am down 100Kish on my bet housing prices were unsustainable.

My Tax Basis, if I purchased the same house back today, would not be the 3000 a year, but instead, more like 8000 a year.

That is where I stand some 6 years into the “biggest housing crash in history”.

The score pretty much sums up the fact I am an idiot for selling 18 months before the peak.

The next time I hear “when interest rates rise” I think I will scream. Clearly the FED controls the entire yield curve, and they will not allow rates to rise until the housing market can withstand it.

The FED has won and continues to do so, there are just too many lemmings and they still keep coming.

Good post martin, I’m see 04/05 price tags on many houses for sale in the premium areas…like the bubble never existed.

Very few people timed the market correctly. I guess there might be a handful of people who sold at the peak of the bubble in 05 and went all in with gold or apple stock and rented for the next 6 years before buying again.

Then there are the what ifs like you mentioned, could you even buy back your same house today at a higher price and much higher property tax basis. And don’t forget to add in the cost of selling, moving, repurchasing, etc, etc.

Clearly the FED controls the entire economy, housing included. From the past five years, they will do everything in their power to keep home prices elevated. I don’t see this changing anytime in the next few years.

I sold my home in Valencia in 10/2005 (owned it since 1988) and have rented ever since. My two kids went away to college so my wife and I have bounced around from Valencia to Santa Barbara to now the Pine Mountain Club. Would I have done this with kids, no way my wife would have killed me. We will not buy a home in California (my kids are 4th generation Californians) again and will move to Texas in a year or so.

I know what you mean. I sold a house in 92104 in July of 2007 and it’s a little more now than when I sold it. $650K. But my rent has been much cheaper than my mortgage payments were. Of course, no tax deduction for me , though. But I feel better not being an owner of something that is kinda hanging on for the last 5 years.

The MID (mortgage interest deduction) with these low interest rates are worthless to most buyers these days. I was at an open house last weekend, and the realturd was pitching low rates and the tax write off. I had to open my big mouth and give the perspective looky loos a reality check. I explained higher rates and lower home prices were actually a better deal. Less debt was a strange concept to them vs. low interest rates. They were all interest rates sensitive buyers. The govt has brainwashed the masses.

Thanks to all your bright posters. I always learn a lot, and think differently about things reading your posts here. And Dr HB, you’re a mensch.

I wish

The FED is not almighty. They do NOT control the whole yield curve. Especially the long end… I guess they have used up most of their ammo already. Just look at the Bank of Japan and its decades of near zero lending. And the Nikkei index is still way below its peak in the 1980s.

Are you looking at SALE prices for comps? Folks often list a property way higher than it ends up selling for. And it’s hard to compare houses.

I bought a duplex which was built in 2004 and sold for $ 335,000 for $ 112,000 in 2010. Yucca Valley, San Bernardino county isn’t L.A. But trust me, we are way below 2004 prices!! Despite some overpriced listings (which tend to languish until the price is cut).

Babyboomers retiring and buying elsewhere – at some point, supply will creep up again. Not to mention the shadow inventory. Closing, you should adjust prices for inflation. It’s not pretty.

As I said, I am using a comp from across the canyon. I thought everyone understood the word “comp” as a recent comparable CLOSED sale, but my mistake if not making it clear.

My house sold for 669K in may 2004 and a very similar house sold for 760K just one month ago.

I think it is the statistics that are way out of whack. I see median sales prices that would show 92104 is more than 30% off the peak but many of those sales that have ended up setting the “median” were never available to the public. Most of the best deals were only available to those with the right connections.

I don’t get it. You say the FED does not control long rates then use Japan as an example of a countries central bank keeping rates low for a decade and not having the desired result?

Hey, I don’t claim that the FED will get the desired result, I just claimed Central Banks, like Japans, can set long rates.

Lets face it, those with the power are those who have what everyone wants. Central Banks provide bonds with paltry yields, they have the power because on the other end you have trillions of FIAT currency sloshing the globe looking for yield. It is almost comical to think I as a saver can demand higher rates because inflation just ticked up.

Perhaps in a bygone era, when cash was scarce and because of that, was King, I could have had the power to demand a higher return, but not today! THe “Cash is king” phrase is really wishful thinking from the past. Cash gets no return, no respect. Yes, even at 3%, cash gets no return. Interest rate -inflation rate – taxes on interst = yield and today, that is a big FAT negative.

And, as bad as it is it will only get worse. Just in U.S. dollars an additional 2 trillion dollars a year of “king cash” is being added to the sloshing barrel of FIAT currency wanting yield and willing to accept the best it can get. Right now the best is a ten year at less than 3%. In 10 years when 20 trillion more u.s. dollars are sloshing around, do you really think that 3% is going up or down?

Cash is not king and until it can earn at least the rate of inflation, without risk, it will never be.

If you can’t tell, I am very pessimistic. Our perceptions of cash and money are based upon what used to be in a bygone era, for example, wasting cash was an expensive proposition, non performing loans were a costly burden. NOT ANYMORE with zero percent money from the FED.

What will occur going forward must come from our imaginations because we have entered a monetary system right out of Ben Bernanke’s imagination. God only knows how this will turn out and thank God I had the foresight to invest 70K in Gold and Silver back in 2002, it is the only thing that gives me hope any more.

There is only one thing that could put an end to this madness and that is an economic collapse that outpaces the FEDs ability to inflate. That is the one thing that could put an end to this madness and I pray for it every day.

Martin, you provided all good and valid reasons that people hate their cash. It’s rational but they just don’t believe in market cycle. That’s why they are rushing to dump their hard-earned cash into risky and also inflated assets. Real estate in LA is down 5+% each year WITHOUT being adjusted for inflation. They can’t find that number in LA Times by the way, they have to look it up to see the number. That means if inflation is 3%, real estate in LA is losing at the rate of 8%! Cash looks very bad to gamblers but better to true investors. Gamblers also dump their money into stocks, which is also hyped and inflated… By definition, true investors see this is the market bottom of …cash.

Remember gold when it was super low? Everybody hated it. They said it was bulky, not producing income et…. Now they wish they had gone on the opposite direction of the herd.

Japan’s debt is 200% of their GDP by the way. I am not pessimistic enough to say we would get there. Our treasury is still considered safe haven for a reason.

…Gambers always think that they are investors.

Home prices are heading back to 1975 prices in So Cal! Save your money now and you can own a home for cash in 5 years!

I doubt very much that we’ll see 1975 prices in SoCal, though I wouldn’t mind if that happened. Comparing LA/OC to Atlanta, there’s no reason why we should be at that much of a premium. I mean the weather is great, but data is data and affordability still isn’t within reach according to normal price to income ratios.

The long term interest rate is kept so low so the banks can get rid of their bad mortgage holdings. Once the banks balance sheet get back to the normal level, interest rate will be free to rise. That will be when the housing market will nose-dive. Cash will be king then! At this point, everyone hates cash due to the low return on it. Gotta love what everyone hates and hate what everyone love in order to buy low and sell high. We need to keep our cash, so keep renting for now. Dont forget that renting gives us the mobility to move quickly to another location if our jobs disappear overnight. Computers and oversea workers can do almost everything we can do now for a fraction of the cost. It is just a matter of time before that makes even wider impact to our economy – everyone. There aren’t much higher ground left in term of jobs to avoid that reality.

Owning, I can move even Quicker than you, cuzz i dont have to provide 30-day notice, or bow-out of a lease. Who plants these silly ideas in people’s brains?

If you still have mortgage, moving quickly to another area or state would put you in the position of paying rent at the new place and mortgage of the old place at the same time. You would probably prepare the house to sell then. Sellers pay the agents 5-6% of the sold price (not the amount of equity you have.) That is about $25,000 to $30,000 for a $500,000 house. If you had put in a 20% down payment = $100,000, you would automatically lose 25-30% of your hard-earned money each time you move! That doesn’t include the cost of upgrading and fixing the house. People tend to fix, upgrade, or remodel when they move into a different house to fit their lifestyle and taste because they thought they would live there for 10-30 years. They get back only 70% of the cost because what are nice and good for one family doesn’t mean that nice and good for another family. Furniture is another source of losing money. furniture was bought for one place may look terrible or doesn’t fit in the new place. If you rent a smaller place at the new location, you have throw away or sell it for cheap.

Being a remote landlord also has major disadvantages.

…Gamblers always think that they are investors.

Maybe the long term interest rates are kept so low so that the interest payments on the national debt are “affordable”. In that case, they can’t ever rise.

If it is always so great to have interest low, why can’t we keep it at 0% all the time? To keep it below the true market, we need to print more money to buy bonds to bring the yield down. That triggers inflation. If yield of bond is below inflation rate people and other countries governments would dump treasury bonds and buy other assets (gold, stocks, oil, other currencies, other foreign bonds…). That would bring the yield back up. We would then need to print more money to buy more bonds to keep the yield low. It we keep doing that, US dollar would lose its world reserve currency status. We then can’t print money, not producing anything and able to buy stuff from the rest of the world. It would be a hyper-inflation situation. It is really bad situation we want to avoid.

Can’t keep printing money. Can’t keep interest rate low forever.

…Gamblers always think that they are investors.

Maybe the long term interest rates are kept so low so that the interest payments on the national debt are “affordableâ€. In that case, they can’t ever rise.

Please explain how the federal government will be unable to pay interest on the national debt? These payments are made using it’s own currency.

If it is always so great to have interest low, why can’t we keep it at 0% all the time? To keep it below the true market, we need to print more money to buy bonds to bring the yield down. That triggers inflation.

Creating money does not trigger inflation, spending it can. We certainly have not had a problem with to much money be spent in the economy….

If yield of bond is below inflation rate people and other countries governments would dump treasury bonds and buy other assets (gold, stocks, oil, other currencies, other foreign bonds…). That would bring the yield back up. We would then need to print more money to buy more bonds to keep the yield low. It we keep doing that, US dollar would lose its world reserve currency status.

Lose it to what? The euro? The EC are in much worse shape than the US. The Renminbi? They are still pegging to dollar.

We then can’t print money, not producing anything and able to buy stuff from the rest of the world.

We produce 25% of the worlds GDP with 3% of the worlds population.

It would be a hyper-inflation situation. It is really bad situation we want to avoid.

Can’t keep printing money. Can’t keep interest rate low forever.

Fed controls the UST interest rates, they can set them to whatever they want for whatever length of time they want to.

RE: Fed controls the UST interest rates, they can set them to whatever they want for whatever length of time they want to.

It’s not about what the Fed can set the rates whatever they want; but should/would they do it is the main topic. The Fed wants the housing market to get back to the old peak price, imagine how much cheaper the monthly payment it would be for 0% 30 year-mortgage rate. Why don’t they do it? They don’t do it because they can’t accept the consequence down the road.

As for why and how US dollar is losing global reserve status, you can read these articles:

http://www.ft.com/cms/s/0/23183a78-a0c6-11e0-b14e-00144feabdc0.html#axzz1tPckqnkJ

http://www.commodityonline.com/news/china-and-uae-ditch-us-dollar-will-use-yuan-for-oil-trade-45444-3-45445.html

http://online.wsj.com/article/SB10001424052748703313304576132170181013248.html

Interest rates will never be free to rise again. Do the math on Treasuries and it is obvious that the US govt would implode on anything near 6%. And most of the US as well…..So the Fed will always have to step in and buy when rates start to get near the Danger Zone.

Want to show your math why it makes any sense for interest rate to go below inflation rate?

Who, other than the fed, would buy treasury in that scenario? The treasury would lose purchase power everyday. What it yields wouldn’t be enough to catch up with the rise in price. Government then won’t be able to borrow money. We all know how nasty economy gets if government can’t borrow.

…Gamblers always think that they are investors.

Phoenix hit bottom in September and prices have been slowly rising as inventory of homes for sale is declining. Here is a recent article http://www.azcentral.com/business/realestate/articles/2012/04/26/20120426phoenix-area-homes-prices-up-20-percent.html

Carmen, since you are in the biz, can you explain to the class why inventory is declining? I have my opinion, but I would like to hear a more “seasoned” opinion.

Hmmm, what’s the shadow inventory like in Phoenix? I live here and know MANY people that haven’t made a payment in years and still are living in their homes! That can’t end well…

While that may be true, Carmen, you should also probably note that you’re a realtor working in that region as well.

Phoenix inventory is being held off the market. One (drip drip) home is released to throngs bidding far above any comp. My realtor says ” bid 25% over list, a comp will come by the time we are ready to close”. I had another Realtor emailed me after making a full price offer +10k, told me “We are keeping this open and collecting offers”. 3 weeks later, same home still in the mls, no offers show in the mls.

Yeah, sure.

Investors of today will be foreclosures of tomorrow, keep overbidding bidding boys and girls, seems we have all learned nothing.

http://www.desertmountainhomesonline.com/Blog/contact-us/meet-carmen/

Meet Carmen, nuff said

Looks like a very tight inventory on those multi-million dollar homes in the “Mountain Desert”, what ever the hell that is. Take a look at Naples, FL and you will the see the same or more multi-million dollar homes on the market. Even if a 4 million dollar house comes down 70%, it is going for over a million. Just where is the market for all the millions? Have some fun and look at Ireland, where a 2 millioner goes for 760,000. http://www.thepropertypin.com/viewtopic.php?f=23&t=28162

There is a very limited market for multi-million dollare desert homes, they are not making anymore deserts. Neither Naples or AZ is Malibu. These houses will eventually be abandoned like old ghost towns as the cost of maintaining them will be too high for anyone to live in them, forget the mortgage.

Good luck, Carmen.

Just to provide a counter-voice to DHB, the WSJ is claiming that bidding wars are back due to inadequate supply.

http://online.wsj.com/article/SB10001424052702304723304577366294046658820.html

As much as I know when a realturd is lying. When they move their lips. I know in my micro area of So Ca there are bidding wars. When you go FHA, have very little money of your own on the table, and know you can stop making your payment and live free, why not overbid, pay a few months, and then game the system. WTH, everyone else going FHA has that plan. IIRC from a R E periodical and I believe her as well, FHA’s are in a 35% default right now. Way to go a-holes in DC.

Chicagoland home prices have now fallen around 40 percent since the local housing market peaked back in September 2006.

Yeah, I’ve noticed that the realturds are at it again, “Buy now or be priced out forever!”

I don’t believe a word of it.

Buy a home in Vegas today, not much land left! Phoenix, greatest climate in the southwest, let the bidding wars rage!

I guess you gotta love the desert and shun the ocean.

Doc writes great reports on a city and trend or macro conditions. These have little to do individual Situation. Your individual need for housing is very much different from others. You can rent for whole life to save taxes and mortgage interests. That’s not what others will do for their lives. Buy low and sell high, everyone knows that. But thats not what everyone does. Does anyone really know where the bottom is? I certainly don’t. But I know the price came down quite a bit. People tend to argue a lot, but can we agree on that the housing price came down a lot already? If the price of the house has not come down at all, I don’t believe there is value in that house regardless. If the price is down 50%, I would buy that house if I am in the market looking. That’s just IMHO.

Pete,

Tokyo and Japanese prices are down about 70% from their bubble

prices of 1990, a good 20+ years in decline. So just because something

goes down 50% does not mean you will not loose a significant chunk.

Suppose the Japanese case happens here.

Here is a simple math problem: Bubble peak price $500K. You buy 50% below at $250K.

Suppose it goes down 70% meaning after you buy in a few years it is at $150K. For

some reason you need to sell, then you are down $100K.

DHB can only give general data analysis. He cannot talk of individual situations.

By the way, in some cities in AZ and NV prices are indeed down 60% from peak.

Good luck!

I follow the real estate investor forums and chat rooms for CA and they are in a feeding frenzy right now. All convinced that the bottom is pretty much in for CA now. Given the unemployment level, I’d say investor purchases of homes in CA may be 50% of the current market in purchases.

The gamblers’ definition of a market bottom is when everyone agrees it is at the bottom.

The investors’ definition of a market bottom is when everyone thinks it is still going down further.

Even really bad things don’t go down as a straight line. A bunch of gamblers hate their cash position want to catch falling knives do not surprise true investors.

…Gamblers always think that they are investors.

Fold

Do not confuse wishful thinking about home prices with the market. I have been in the home loan business in various positions for almost 35 years, in the LA to San Diego areas, and I think it is useful to compare the last bear market. Prices peaked in 1990 and hit their bottom in 1995, almost 6 years from peak to bottom. There was capitulation then. You almost couldn’t give RE away. We had a bad economy, bad unemployment, an earthquake and the LA Riots (20 year anniversary today.) The memory of super high rates in the 1980s were still on people’s recent memory. There was a high amount of fear.

Today, we are coming down from a market fueled by crazy lending (I personally have never done an Option ARM, Subprime or 100% financing, and no FHA for over 10 years.) The amount of RE insanity that continues is amazing. People are buying vacation homes in the mountains, desert, and Las Vegas, and AZ. Every day I talk with someone wanting to buy investment property. Generally, people are over weighted in RE, and not nearly diversified as they should be. I have seen people who have lost their house and several other properties, declared BK and are still looking for a way to buy RE. No capitulation like in the 90s.

For the low to mid market, houses in the 350,000 to 650,000 range, it is still a struggle for many people to buy. Cost of living is high, and people do not understand how broke they will be with their housing expense. I have worked the numbers for friends/family looking to buy, and asked them how they will like: no vacations, no eating out, no new clothes, no furniture for years. They usually don’t believe me.

Those of you waiting for coastal So Calif prices to drop another 20,30,40%, here is the problem: People living in those areas and wanting to buy have survived this economy to date, have careers or business that are doing OK to very well and they have no fear. Many have high incomes and assets. They are buying investment property and vacation property in large numbers.

The only way for prices to drop significantly is there to be fear caused by some bad stuff, to counter the good stuff of low rates and low prices, and the optimism that prices will soar again. Like the riots, we probably need a big act of terrorism, maybe another earthquake/tsunami, a bug jump in rates, and maybe some major cities like LA to go BK (which is predicted in the next 2 years.) The optimism about RE that I see every day is reality and is keeping prices from dropping more, which can only be caused by major fear at this point.

Look at the charts near the bottom of this page: http://mortgage-x.com/trends.htm. Real estate market has been “blessed” with a new historically low 30 year fixed mortgage rate every few years. That’s how the people in LA appear to survive. It’s not possible to continue the trend as it would hit current inflation rate in 1.3 year and 0% rate in 3 years!

Also see this:

http://www.businessinsider.com/house-prices-have-hit-the-bottom-for-the-fourth-year-in-a-row-2012-4

What a great post by Mark Hanson. Couldn’t have set it better myself – this rally feels wrong: withheld inventory, artificially low rates, artificially low down payments and it still won’t be enough for a stable bottom.

Great post as always Dr. HB. How soon we forget what bidding wars did just 5 – 6 years ago. The Fed is and always manipulates the RE market at the expense of a greater fool. We should have had an “Atlanta” type situation here in So. Calif back in 2009, but the gov’t manipulation has been fierce. Remember “Greenspan the Almighty” and his great ideas? Just more of the same with alot more desperation this time from Bernanke.

Stay the course and don’t take the bait folks. Once the dominoes begin to fall, the truth is revealed.

http://Www.westsideremeltdown.blogspot.com

Just maybe, just maybe, the surge in home buying the last few months was set in motion by the announcement late last year that FHA mortgage premium rates would be rising by more than50% by April 9th ?

I noticed that inventory was dropping by more than 200 each weekend leading up to April 9th and then things kind of stabilized.

FHA buyers sucking up inventory and then non FHA buyers on the fence see inventory decreasing and all of a sudden you have a full fledged frenzy in the real estate markets.

Most of the increase in FHA insurance premiums have now already occurred but another smaller increase in FHA loans takes place June 12th but after that things may cool quite a bit.

Leave a Reply