Credit Crisis Part Deux: The Noise in the Housing Attic.

I think the best way to discuss the “reemergence” of the credit crisis is to remember a childhood story. Remember that time your family was throwing a party and you were concerned about crazy grandma going off on her usual rants? You thought carefully about what you were going to do since you wanted to have a pleasant evening but you also wanted to be cognizant of lovely grandma’s feelings. And suddenly a light bulb ignited over your head with the solution. Lock grandma up in the attic. Sure she wouldn’t be happy for a few hours but the guest will have a great time!

During the evening, the guests hear faint sounds emanating from upstairs. You quickly turn up the music and chatter louder to drown out the noise. The guests slowly ignore the sound yet you can still hear the noise because you know what lurks in the attic. As the guests leave, they are oblivious to the situation and leave with a grand smile on their faces. You run up stairs and open the attic door to be confronted by a furious grandma. This was expected and you knew once the party was over that reality would need to be confronted. Good times.

Well given what is going on with the current credit market, it is safe to say that we’ve locked up our own credit grandma in the attic trying to enjoy the party while ignoring the faint sounds in the background. Grandma not only is angry but has been training in mixed martial arts while being in the attic and is going to open up a can once we let her out on the first unsuspecting soul that opens the door.

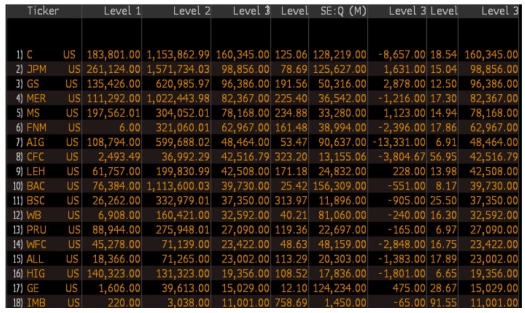

Ever since we locked Bear Stearns away in the attic, a collective sigh of relief was heard across all the financial markets. It seemed as if the Fed some how found the panacea to this credit debacle. Unfortunately all it did was prolong the misery that would need to be confronted. If we really want to see what is in the attic let us take a look at some of the Level 2 and Level 3 assets of the largest financial firms:

*Hat tip to Anon Reader

From this list we can see the attic of debt still not accurately being reflect on the balance sheets of many companies. The fact of the matter with the Bear Stearns deal is that essentially this problematic debt was shifted from one institution to another; except it had a back stop by our own Federal Reserve. We saw similar problems hit the BofA and Countrywide deal when BofA mentioned they may not back up some of Countrywide’s debt:

“(Bloomberg) Bank of America Corp., the second- biggest U.S. bank, said it may not guarantee $38.1 billion of Countrywide Financial Corp.’s debt after taking over the mortgage lender, fueling speculation that Countrywide’s bondholders face renewed risk of default.

“There is no assurance that any such debt would be redeemed, assumed or guaranteed,” the Charlotte, North Carolina- based bank said in an April 30 regulatory filing, adding that no decision has been reached….

Countrywide’s $1 billion of 6.25 percent notes maturing in 2016 traded at 90.25 cents on the dollar yesterday with a yield of about 7.9 percent, according to Bloomberg data. The debt traded as low as 46 cents in January, with a yield of 20 percent, just before Bank of America announced the purchase.”

From what we are seeing we can expect to see many of these shotgun weddings in the next year with the unique caveat of firms picking the meat from the carcass while the U.S. Taxpayer is relegated to the role of being a vulture with only bones and guts to devour once the best parts are gone. Either way, the rules from FASB 157 or the fair value measurements is also putting pressure on the market. This is part of where we get the entire mark-to-market idea but there is a slight issue here as well:

“This Statement clarifies that market participant assumptions include assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value (such as a pricing model) and/or the risk inherent in the inputs to the valuation technique. A fair value measurement should include an adjustment for risk if market participants would include one in pricing the related asset or liability, even if the adjustment is difficult to determine. Therefore, a measurement (for example, a “mark-to-model” measurement) that does not include an adjustment for risk would not represent a fair value measurement if market participants would include one in pricing the related asset or liability.

This Statement clarifies that market participant assumptions also include assumptions about the effect of a restriction on the sale or use of an asset. A fair value measurement for a restricted asset should consider the effect of the restriction if market participants would consider the effect of the restriction in pricing the asset. That guidance applies for stock with restrictions on sale that terminate within one year that is measured at fair value under FASB Statements No. 115, Accounting for Certain Investments in Debt and Equity Securities, and No. 124, Accounting for Certain Investments Held by Not-for-Profit Organizations.”

The problem with using fair market risk assessments or valuation is that these institutions actually have to have an idea of the fair market value of their assets. Are you kidding me? These are the folks that bought up all the asset backed crap and now we want them to accurately asses a Real Home of Genius in East Los Angeles? Well we already know that we are witnessing the steepest housing correction ever, even worse than the Great Depression in terms of its speed of severity. We can only take a wild guess at what is lurking in those off balance sheet accounts but I think we can all hear that faint echo in the attic of what we can expect.

Many experts are expecting $400 to $1 trillion in credit market writedowns before this thing is over. As of April of 2008, we’ve had a total of $231 billion in credit writedowns (a bit higher given the additional writedowns in the past few months). Since people are now liking this thing to a baseball game, I see it more like game 1 of the NBA Finals. We’ve finally narrowed the field from 16 teams to 2. Now we find out that only one can stand and it isn’t going to be debt. Here is the list of writedowns as of April and all figures are in billions:

| Firm | Writedown | Credit Loss (a) | Total |

| UBS |

38 |

38 |

|

| Merrill Lynch |

25.1 |

25.1 |

|

| Citigroup |

21.4 |

2.5 |

23.9 |

| HSBC |

3 |

9.4 |

12.4 |

| Morgan Stanley |

11.7 |

11.7 |

|

| IKB Deutsche |

9 |

9 |

|

| Bank of America |

7.3 |

0.9 |

8.2 |

| Deutsche Bank |

7.4 |

7.4 |

|

| Credit Agricole |

6.5 |

6.5 |

|

| Credit Suisse |

6.3 |

6.3 |

|

| Washington Mutual |

0.3 |

5.5 |

5.8 |

| JPMorgan Chase |

2.9 |

2.1 |

5 |

| Wachovia |

2.9 |

2 |

4.9 |

| Canadian Imperial (CIBC) |

4 |

4 |

|

| Societe Generale |

3.8 |

3.8 |

|

| Mizuho Financial Group |

3.4 |

3.4 |

|

| Lehman Brothers |

3.3 |

3.3 |

|

| Barclays |

3.2 |

3.2 |

|

| Royal Bank of Scotland |

3.1 |

3.1 |

|

| Goldman Sachs |

3 |

3 |

|

| Dresdner |

2.7 |

2.7 |

|

| Bear Stearns |

2.6 |

2.6 |

|

| ABN Amro |

2.4 |

2.4 |

|

| Fortis |

2.3 |

2.3 |

|

| Natixis |

1.9 |

1.9 |

|

| HSH Nordbank |

1.7 |

1.7 |

|

| Wells Fargo |

0.3 |

1.4 |

1.7 |

| BNP Paribas |

1.3 |

0.3 |

1.6 |

| DZ Bank |

1.5 |

1.5 |

|

| National City |

0.4 |

1 |

1.4 |

| Bank of China |

1.3 |

1.3 |

|

| Bayerische Landesbank |

1.3 |

1.3 |

|

| Caisse d`Epargne |

1.3 |

1.3 |

|

| LB Baden-Wuerttemberg |

1.3 |

1.3 |

|

| Nomura Holdings |

1 |

1 |

|

| Sumitomo Mitsui |

1 |

1 |

|

| Gulf International |

1 |

1 |

|

| European banks not listed above (b) |

8.4 |

8.4 |

|

| Asian banks not listed above © |

4 |

0.7 |

4.7 |

| Canadian banks excluding CIBC (d) |

2.4 |

0.1 |

2.5 |

| Totals |

206 |

25.8 |

231.8 |

So as we look at the amount of off balance sheet debt, the magnitude of the contraction in housing, and finally the faltering impotence of the Fed we now know that reality is setting in for our summer superhero Joe six pack (J6P). We are now seeing the inevitable consequence of locking up grandma U.S. Dollar for too long in the attic; now we are seeing the vengeance on energy prices, money destruction with writedowns, and the overall general malaise in our markets. But fear not! Unemployment and inflation is under perfect control according to government data. Pay no attention to rising fuel, higher grocery bills, ever more expensive healthcare, and a steadily increasing education bill.

Seems like our government has their own method of putting things off the books. If you hear that creaking door sound you may need to look up because grandma debt just got out of the attic and the party is still going on.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “Credit Crisis Part Deux: The Noise in the Housing Attic.”

“Bank of America Corp., the second- biggest U.S. bank, said it may not guarantee $38.1 billion of Countrywide Financial Corp.’s debt after taking over the mortgage lender, fueling speculation that Countrywide’s bondholders face renewed risk of default.”

This idea is ridiculous. There is no way BofA can buy the good and abandon the bad. Debt + Equity = Assets. Until the debt holders get their crack at the assets, there is nothing for the equity holders. This is true even if a new buyer (BofA) jumps in at the last minute.

If this were to happen, corporate debt would cease to exist.

I am dollar cost averaging into financials right now. Tiny portion of my net worth, but it will pay big time ( i hope) in 3 to 5 years!

I would buy some bank stocks too IF I could see another Fed action on the horizon to juice them back up again but I don’t. Rate cuts? We are at 2% so there isn’t a lot of room left and they are plenty low enough to let healthy banks thrive. The spread between the cost of money to a bank and what they can lend it at is quite healthy. The problem is banks are capital poor and consumers are debt rich. Yeah WAMU e.g. could make a lot of money writing new mortgages but how many credit worthy customers can they find who want a mortgage? No one will buy the mortgages save the GSE’s and even they are more cautious now and require hefty fees to underwrite loans. The game now seems to be to get rid of your riskiest borrowers before they burn you. No more automatic increaes in your credit card limit or 84 month auto loans. In fact I expect a huge

increase in auto loan defaults and just what are banks going to do with a 4wd Chevy Silverado that gets 10 mpg or a luxury sedan with the same fuel economy with the added bonus that it requires premium gasoline or diesel. Even the well to do are beginning to flinch at the cost of operating a gas guzzler. For those not so well heeled I suspect the repo man will be the better solution. Finally even the big loan syndication deals that were so profitable maybe drying up. There are other sources of capital in the world today and paying a middleman to put together a loan for you when you can deal directly with the lenders is becoming more common. In short the banking model that worked for so long maybe losing its wheels.

Why go long in Financials, when there is so much to be made short? Or as Christopher Thornburg has stated before about Real Estate (not an exact quote) “Why buy now, when one can wait a year and buy for 20% less?”

When the Financials can’t even really come to grips with their hopelessly worthless (or greatly reduced worth, or “Marked to Market”-all is ok worth) who would want to purchase something that contains so many potential negative suprises? Don’t pull that thread, or the whole sweater will come unraveled!

Watch the Bear Funds, like SKF, SRS kick butt as the financials and real estate companies are forced to take more write downs. Since BS was rescued, there hasn’t been a failure………. YET!

How to enjoy this market (besides popcorn… Neil) Check out the Bear Funds…… Gold hits a new high, I buy the Bear Gold fund DZZ and make money as gold slides back down. (No offense to the bugs out there, but the gold bubble will end the same as the tulip, tech, and credit bubbles) Same with Oil…….. Hits new all time high and runs up big-time in one week, buy DUG. Sure I am still long in some big stable dividend stocks, but nothing like a little “hedge”. Added benefit is that, unlike going short, these funds also pay a small dividend too.

Waiting for the EURO Bear fund. Being that they (EU) are as overextended as we are (maybe even more), I don’t see good things for them as a whole. Why not profit from their currencies return to the mean?

Another good post Doc… thanks. Unfortunately, most of this is way out in the stratosphere for me. Having said that, I depend on my instincts to spot smart people that are willing to tell us the truth ( A very unique combination I admit). Richard Fisher, the president and CEO of the Federal Reserve Bank of Dallas in his latest speech lambasted what amounts to all of America for our greed and complacency regarding our future and more so, the future of our children. His entire speech is, posted on the Federal Reserve Bank of Dallas Web Site for those that want to take the time to read it.

Marc Faber got his head handed to him trying to buy Texas banks during the oil mess during the eighties. You do not know the banks books. But we do have ideas on first and second mortgages.The banks are barely holding on now. What happens to their debt as house keep falling in prices. A lot will not make it a year from now.

What I can’t figure out is why the Countrywide bond holders don’t take 90 cents on the dollar. With all the loans in California real estate, do these bond holder really think that real estate prices are going to go up. B of A is hinting big time they don’t like the original deal.

nice post!

esp liked: “…we can expect to see many of these shotgun weddings in the next year with the unique caveat of firms picking the meat from the carcass while the U.S. Taxpayer is relegated to the role of being a vulture with only bones and guts to devour….”

your ending paragraph gave some real chills – grandma’s loose!

nice work!

South Bay Hombre wrote that he’s going to be short gold because it’s in a bubble akin to credit & tech (& presumably housing). No comparison, with all due respect. Credit, we don’t need to be told, has exploded over the past 25+ years. Tech was up thirty-fold from 1982-2000. Housing likewise. in many places, through 2005/6. Gold, conversely, has slightly more than tripled in eight years, and is the same price as it was in January 1980. Some bubble.

If you think them writing down their assets is bad, how about the way they are writing down their LIABILITIES????

From Bloomberg:

Merrill Lynch & Co., Citigroup Inc. and four other U.S. financial companies have used an accounting rule adopted last year to book almost $12 billion of revenue after a decline in prices of their own bonds. The rule, intended to expand the “mark-to- market” accounting that banks use to record profits or losses on trading assets, allows them to report gains when market prices for their liabilities fall.

The new math, while legal, defies common sense. Merrill, the third-biggest U.S. securities firm, added $4 billion of revenue during the past three quarters as the market value of its debt fell. That was the result of higher yields demanded by investors spooked by the New York-based company’s $37 billion of writedowns from assets hurt by the collapse of the subprime mortgage market.

“They can post substantial gains as a result of a decline in their own creditworthiness,” said James Cataldo, a former director of treasury risk management for the Federal Home Loan Bank of Boston and now an assistant professor of accounting at Suffolk University in Boston. “It’s completely legitimate, but it doesn’t make sense by any way we currently have of thinking of net income.”

Here’s how it works, according to Richard Bove, an analyst at New York-based Ladenburg Thalmann & Co. A company decides to designate $100 million of its subordinated bonds as subject to mark-to-market accounting. The price of the bonds drops to 80 cents on the dollar from 100 cents. So the firm books $20 million on the “presumed savings that you have on your liabilities,” Bove said.

“In the real world you didn’t save a dime,” he said. “You still owe the $100 million. It’s another one of these accounting rules that basically takes you further and further away from reality.”

The Federal Reserve, Federal Deposit Insurance Corp., Office of the Comptroller of the Currency and Office of Thrift Supervision objected to the rule before its passage, saying in a joint 2006 letter to the FASB that it would “have the contrary effect” of increasing a bank’s net worth at the same time its “financial condition is deteriorating.”

If this doesn’t tell you everything you need to know about the shakiness of these comapnies, well, I don’t know what will.

More collapses are on the way. Does anyone else think Lehman doth protest too loudly?

It’s interesting to see CFC and IMB are the only two companies on the list whose level 3 assets exceed their level 2 assets. IMB has 3 times more level 3 assets.

Moral of the story: If you don’t agree with the market, just say you can’t determine a price…

Changing the price of gasoline on a daily basis now and no,

it is not going down…

Don’t know anymore whether there is an end in sight.

I see the poor little independent gas station owners faltering already.

Who’s your grandma! LOL

Anybody who thinks that the prices at the pump will drop to $1.50 where it was in 2001 have another thing comeing. The days of living in the burbs & depending on a car for transport are quickly comeing to an end. People will have to adapt to a new reality & i don’t mean what is on tv.

Now how does this play along real estate lines, lets compare 2 ajoining New Jersey communities in Bergen County.

Ridgewood-has a dence walkable downtown core with apartments & offices above the shops, along with single family homes within walking distence. Supermarkets maybe reached on foot but arent going to eat your gas tank if you drive. Public transit is plentyful with numerous options, a large bus station with a park & ride lot serving the region as well as Manhattan. If you wish you could also take frequent train service on the Main/Bergen lines to either Hoboken or Secaucus & with an easy transfer you can reach New York pritty easily. The rail & bus stations are a block & half away from one another making transfers effertless.

Paramus-the entire town that we see today was based on car dependence & sprawl, as a result walking around is nearly imposible if you need to go shopping or just want to go crosstown. There are 3 divited highways , 4 east/west, 17 & 208 north/south. This design prevents any pedestrian movement between the different sections of the community. On the plus side there is plenty of bus service to New York but not as much service locally as there should be.

I can’t believe that the fuel costs are having such a massive impact on the world, when will they stop?!

Leave a Reply