Nearing $1,000 per square foot in Culver City: Would you pay $900,000 for 920 square feet? Or you can buy a fixer upper for $325,000 in the same zip code.

Some people are looking at cashing in their housing lottery ticket. While many are hunkering down preparing for the rental apocalypse, some are gearing up to capitalize on the crap shack hungry lemmings ready to bite. I remember during the days of the last housing mania getting e-mails about Culver City being the next Beverly Hills. Culver City is not Manhattan Beach or Beverly Hills. I think people need to actually look at the property before making that kind of assessment. I saw a property hit the market recently with a list price of nearly $1,000 per square feet. The house is nothing special and of course with some nice Photoshop filters and some HGTV inspired ideas, someone is trying to cash in big. 920 square feet for $900,000 – or you can drive down about one mile in the same zip code and pickup a fixer upper for $325,000. Rehab work takes time but are people seriously that lazy to leave this much money on the table?

The fixer and the upper

Culver City home values are back to mania level prices. If you missed the last bubble, fret not because here is your chance to get in again. Or did you miss the boat forever and are priced out for life? The first home we’ll look at takes us to the 90230 zip code. The place is listed at 920 square feet.

Take a look at the place before the upgrades:

Source: Â Google Street View

11117 Barman Ave, Culver City 90230

2 beds, 1 bath, 920 square feet

You will also get the nice cable television inspired upgrades.

What is the price?

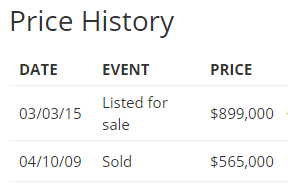

The place last sold in 2009 for $565,000. The current list price is $899,000 or $977 per square foot. If you are willing to roll up your sleeves, you can get a better deal by doing some work here:

11873 Jefferson Boulevard, Culver City 90230

2 bed, 1 bath, 722 square feet

If you grab a dictionary and look up crap shack, you are likely to see a place similar to this. Even the ad understands this pig needs a lot of lipstick:

“Two bedroom / one bath original condition – NEEDS WORK Hardwood floors. Detached 2-car garage with alley-access.â€

“NEEDS WORK†is in all caps so you can get the point. If this isn’t enough, the shovel and ladder inside might be:

This place is slightly smaller at 722 square feet but you still get 2 bedrooms and 1 bath. Also, you are only paying $325,000. Compare that to our first property coming in at nearly $900,000. Same zip code, same Culver City. Or is one mile too much for the gentrification police? Go to Home Depot, turn on the cable tv, and save yourself some serious cash here. Rehabbing is not as difficult as it appears and certainly not with these kinds of price differentials. Some people are trying to go out fully on top. Can’t blame them.

The housing market is still bananas but what more do we expect from California? Seeing prices near $1,000/per square foot in Culver City sure seems to throw up some alarms.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

87 Responses to “Nearing $1,000 per square foot in Culver City: Would you pay $900,000 for 920 square feet? Or you can buy a fixer upper for $325,000 in the same zip code.”

Id rather live in hades

Now if Howard Johnson’s would build a restaurant in the neighborhood and offer fried clams and their 29 flavors of ice cream, I might consider it…

It may be the same 90230 zip code but it is NOT the same Culver City. The Jefferson crap shack is actually located in the city of Los Angeles (zip code 90230), and provides access to the less than stellar schools of the Los Angeles Unified School District. The fixed-up crap shack on Barman (also in zip code 90230) is located within the boundaries of Culver City and will provide access to the better rated schools in the Culver City School District. Those are the facts and schools are a major consideration when choosing a home.

Be careful when picking up the info sheets at open houses: many times, you will be told to “Check With City” about schools that service the area — realtors often do not have this information handy just like they often don’t know that extra rooms have been added to a home without permit. Remember “Check with City.”

A slightly less stinky turd still isn’t worth the spread differential regardless of the “facts.”

If the assigned schools are “not academically performing” you can invoke the “No Child Left Behind Law” (NCLB Law) to transfer out of your assigned school into a “academically performing school”. You can also transfer out of your assigned school district into another district with “academically performing schools”. You must do this in February during open enrollment periods, before the upcoming school year begins. Special Education services must be provided in the district you reside, unless the District does’t offer those services (e.g. braille or sign language). Then you can transfer to another school district with the specialized services your student requires.

So, I would buy the $325K house, do a reno, and then transfer out of the crappy home school into a better school either closest to the home, or closest to a parent’s workplace. Home schooling is another option through the CA Dept of Ed, and online virtual schools are also another option. Private school is not always better, because those teachers are not required to possess a valid CA Teaching Credential (Birth-8 or K-12), as well as, many do not possess Special Education certifications and clearances either. Plus the tuition is a mortgage payment on a house you never live in! Just research schools in the “up-and-coming neighborhoods” first to see if there on the Federal “naughty list”, then inquire at the local school district to identify the academically “performing schools” list. Then call those schools for their “intra /inter-district transfer” policy which will to help narrow potential homes/neighborhoods.

@Facts and Feelings, Culver City is a city with an aging population. Unlike Los Angeles Unified, Culver City USD does not have enough city resident students to fill its classrooms. So CCUSD allows parents who work in CC to put in applications to get their nonresident children in CCUSD schools.

The burnt-orange front lawn really adds to the curb appeal! Seriously though, the only reason I can see someone buying this for $1k a foot is for the school district. It would be perfect for a dual income one child couple that can’t afford a $1M+ house in other Westside areas with decent public schools, of which there are few.

Anyone being honest with themselves would conclude that $1000 per square foot for a shack in one of the lesser flat land neighborhoods is a sure sign of a bubble! Those paying those prices, will get hurt badly! What remains to be seen is how the nice zip codes will hold up. As long as Chinese buyers, with lots of cash, keep making junkets to L.A., they might keep the nice zip codes propped up. But at some point, who wants to live under a medieval feudal system, which the L.A. area is becoming, if it isn’t already there!

I’ll guess the 325K listing will induce a FlipperFeedingFrenzy.

I’ll also guess it will be flipped to Hipsters who may wax ecstatic about the “culture and texture” of their new ‘hood, only to find one day returning from the farmers market/art show their Suburu and pricey vintage Hi-Fi equipment have disappeared and their vegetable garden trampled…however, Hipsters forgive burglars because as Hipsters grew up as Privileged Elite, burglars obviously needed/deserved the stuff more, Hipsters felt proud to Do Their Part.

Hahaha

Classic

You might be right about the Subaru, Hi Fi gear and sustainable garden, but most of the Hipsters I know are outcasts from the mid-west, not from privileged families.

A lot of older folks can’t distinguish between the hipsters who are rich and the ones who are not. There definitely are some rich hipsters, at least in the main “tech-hub” areas.

both look like junk , go up to ventura county and we have excellent schools, so excellent it’s like private schooling. You can buy a nice 5 bedroom 3k sqft home for 800-1;2 million, and it’s safe here compared to most places, 30 miles up. Both those homes are a joke, I’d not spend 300k on either. we are in a bubble with these numbers. FORGET ABOUT IT !

Well, the $900,000 first example still needs more work done! You need to put those iron bars back on the windows in that neighborhood don’t you know?

Culver City schools may be better than LA unified and may be considered good schools by local standards, but they are definitely NOT good schools by any means. If I had kids, I’d either put them in private school or move to a state with good schools.

There’s no inventory anywhere. Opportunists are selling crapshacks at a premium everywhere in California. this is nuts, I’d like to see and end to this…

How long can there be no inventory? how long can this craziness go on? Why are people so confindent buying crap for a lot of money? are they afraid to be priced out forever or is it the high rents?

I worked briefly for the Culver City school district. Thoroughly mediocre.

The best things about Culver City are its relative safety and central location, but near 7 figures for an upholstered refrigerator box? Insane.

“How long can there be no inventory?” I’ve been asking the same question for more than a year. In many areas there seems to be more For Sale signs, and spring usually brings an increase in listings. This could be the year we see the end of low inventory and prices drop.

If you’re going to play with photo filters for listing images, at least make the lawn some shade of green and not orange.

The reason for the high price is the proximity to the Playa Vista area and Silicon Beach hi tech companies. Also along Jefferson are many entertainment / media companies. Im not saying its worth it, but someone is giving the list price its best shot to sell to a young couple pulling in $200K / year.

Exactly. Jobs and incomes do indeed matter. These examples are the future evidence which will be on full display when dot bomb 2.0 blows up.

Those overpaid programmers will be making 60K soon. The student debt bubble is starting to rear it’s ugly head. LA has no bread and butter industries. It’s all tech and movies financed by people who are nearest the fed faucet printing billions a year. Trickle down means some people drink deep while others suck on moist earth.

Why This Tech Bubble is Worse Than the Tech Bubble of 2000

http://blogmaverick.com/2015/03/04/why-this-tech-bubble-is-worse-than-the-tech-bubble-of-2000/

While I agree with Mark Cuban’s conclusion (there is a tech bubble)… I don’t exactly think he’s someone I’d trust. He’s the next Donald Trump.

There’s no doubt there is a tech bubble but your conclusions about “overpaid programmers” is completely false. SoCal is the new silicon valley for web startups and the demand for developers that can code the newer javascript tech stacks is going to skyrocket. I know a ton of guys that make more than double your 60k figure WORKING FREELANCE, so you clearly don’t have a clue what you’re talking about. Sure the investors are going to get burnt but the developers will be coming in hordes, making over 100k easily.

Nasdaq’s return to 5000 has those Silicon Beach Hi Tech Companies looking quite frothy… This whole thing is such a house of cards. One wonders what we’d be reading now if the internet had existed during the S&L/Defense Spending bubble of the 80’s.

I don’t know, I have an IT friend, CEO rather, that plunked down almost two million for 1800 square feet in Venice, by the canals last month. I’m quite sure most of it was cash, if not all. I don’t his finances that well, lol, I’m just sayin I grew up with the guy, extremely middle class childhoods, and now he is doing very well. I know for a fact he paid 100% cash for his SL63 AMG, I was there. Myself, I barely get by around here, but I do know that there are just so many people with so much money, and then quite frankly quite a few without as well.

This is a weird place. You need over a Mil to buy into a (established) place, that your neighbor may have paid well less than $100k for when the area “wasn’t so cool”.

I remember when Culver City was mostly industrial. Wish I would have bought then. I like Culver City but think these prices are ridiculous and traffic there is abysmal. Culver City is quickly becoming a privileged place to live. Recently I read an article talking about gentrification and lack of rent-control in Culver City forcing the lower-income residents to migrate elsewhere. I believe that’s the goal of the politicians that hold power there. Send all the trash to LA county and elsewhere.

Kitchen of the fixed up Barman Ave house: the whole wall is white subway tile… ugh… I hope this trend dies quickly. Subway tile is cold, plain, sterile. Looks like something out of a 1940’s hospital. I mean geez, we ripped out 1980’s white square tiles from kitchen and bath counters, now we’re supposed to put plain white rectangular tiles back in?

There was a period in the 1960s/70s when “all white” was considered futuristic and desirable.

Films such as 2001: A SPACE ODYSSEY, THX1138, and Woody Allen’s SLEEPER all depicted future furnishing as starkly minimalist, with lots of cold steel, hard surfaces, and sterile white.

(In the 1990s, ABSOLUTELY FABULOUS satirized that trend, with their “white box” episode.”)

The sterile white design trend gradually gave way to the wood paneling in the 1970s, and then the exposed brickface walls of the 1980s (such as the work by Charlie Sheen’s designer girlfriend in WALL STREET).

As soon as one design trend saturates the market, the home improvement industry tries to convince everyone to once again redo their homes with their next design trend.

Roger that. One trend that must be long in the tooth are stainless appliances. Here come the refrigerators in bright colors (http://bigchill.com/shop/refrigerators/original-big-chill-retro-refrigerator/). Bring back avocado? LOL…

You’re interesting with this stuff, soal. (AbFab; “Come on Pats we’re going shoppin” – just rewatching that episode now.) Interesting how during each phase, many buyers think they’re being “individual” going with the latest trends. Although no one forces anyone to buy anything to chase the latest trends, to get into debt, and I respect those who sell and close deals. We make our own decisions.

RSpringbok, I see one of those refrigerators is black.

In the latter 1980s, an article in TIME magazine covered the sudden design mania for black. People were buying everything in black — dinner plates, coffee cups, cars, furniture, carpeting.

That was about when computers — which since the early 1980s had all been beige — began to be made in black. PC manufacturers seemed to think that consumers expected computers to be in a correct, “professional” color. Maybe because computers were both expensive and for serious business use? For a while that serious color was beige, then black.

Apple’s success is largely due to pioneering design trends. Countering the stodgy, cookie-cutter PCs, Apple introduced colorful MacBooks, with whimsical names like Strawberry, Blueberry, etc. Apple showed that you can sell a serious, expensive product in colorful, whimsical designs.

I assume the late 1980s/90s originated the phrase “—- is the new black.” Everyone knew that black was the “it” color, so much so that the next “it” was always compared to black.

JOSIE AND THE PUSSYCATS (2001), which satirizes all manner of corporate marketing, is full of people saying stuff like “pink is the new black” and then “green is the new pink” etc. to the point of shallow absurdity.

just testing…1st comment.

I live in ladera ranch, ca.

As a new crapshack owner, and first time buyer, I can attest to the effort involved in renovating a house. I thought it would just be some paint and renovating a couple bathrooms. But it was much more – HVAC, electrical wiring and 200 AMP panel upgrade, major plumbing fixes. Then I found I couldn’t stand other things so I renovated the kitchen, re-sanded the hardwood, drywall, installed new hardwood over the white tile floors, 13 new windows, ficus trees, siding, stucco, light fixtures, switches, door handles, hinges, wall and door trim…pretty much every inch, all in 3 months. If I could do it again, I would have paid more up front for a finished “flipped†house or just stayed in my rent-controlled apartment in Santa Monica. Upside is the house looks pretty amazing now and I could sell it easily $100K+ over what I’ve invested + purchase price. While HGTV shows make it look so easy and cheap, it’s a full-time job to manage a major renovation. Researching, negotiating, shopping, planning, designing, managing, dealing with contractors, random workers in and out of your house. All of this was completely foreign to me but I immersed myself in the process, and spent a lot of time at Home Depot.

What is your time worth?

My time is worth more than overpaying for these house prices; both overvalued refurbed crap-shacks, and do’em-uppers. My time and the fruits of it, is invested in cash/alternative.. six-figures, waiting for better real estate value to occur, and all the real-estate cheerleaders of “how much it’s gone up by”, or “how much it’s worth”, to be smacked down by a crash.

…keep on waiting!!!….

Ficus will mess up your foundation and walls, turning your recently renovated crap shack back whence it came. That, or requiring further expensive maintenance. I had my two ficus executed as soon as I saw my side patio lifting …

OC housing news blog made an interesting point that jobs that baby boomers are vacating aren’t being filled, whether it’s high level position that triggers internal promotions, thus vacating a low level position, or simply re filling a low level position.

Can anyone give examples, either you’re a BB or know of a BB’s former position at a company after retirement, and if that position was filled, or not (causing a net negative job at the company). Thx.

The chinese will buy. Any million dallor crap shacks are better than those apartments that cost about the same amount. They all want their kids to go to school here and public schools are free here. so its all worth it to them.

Culver City is actually a city? Who knew?

Use cheap debt to get asset prices up, improve balance sheets and make people feel wealthy so they spend in hope of curing flat wages.

Of course flat wages with high asset prices courtesy of cheap debt is what hurt their balance sheets, made people feel poor, and stop spending in the first place.

Rather than manipulate asset prices…just maybe we should consider concentrating on job growth, incentivising businesses to create jobs and hire – as opposed to tax and redistribute – and get more people employed.

Civilian employment to population was 63.4% in 2006, it hit 58.5% in early 2010 and currently stands at 59.3%. That’s the real employment picture in this country. A mass of baby boomers didn’t suddenly retire in 2007-2009 (at least not by choice or Florida housing would have been fine) and a lot of those jobs are far lower paying than the ones that were lost. http://research.stlouisfed.org/fred2/series/EMRATIO/

There is something I am not understanding here.

I understand why a young family would prefer a substandard SF house to a condo… to a point. But I do not understand why they would accept such a sacrifice in quality and neighborhood just to have a ratty patch of land and a crappy, tiny house in a marginal (at best) area with bad schools, just to have a SF house, when they can buy spectacular condos in better areas for rather less money.

For example, I see a number of dazzling condos in Pasadena, which, though it might have “problems”, is a beautiful community with a lot of charm and a high level of culture, while Culver City, from everything local posters are saying here, is a post-industrial semi-slum with zilch character and horrible architecture. I saw a couple of gorgeous condos, each bigger than this house, in a beautiful newer building with reasonable HOAs, in Old Town Pasadena, that seem, even to my Midwestern eyes, to be priced right at between $500K and $750K. They have more living space than these miserable hovels, they are absolutely beautiful with many amenities, and you are spared exterior upkeep. The major loss, really, is just a basement and your own garage in which to stuff a bunch of belongings you really have no use for and ought to unload, anyway.

So tell me, which is a better place to live, Pasadena or Culver City? Sitting here in Chicago, I really do not know. All I see is a charming community with the usual problems of an aging city, vs a place that never was much more than a dormitory for industrial workers, that has deteriorated into a slum. Is Culver City closer to jobs? Are the schools better? Is living in a trashy hovel so much better for your kids than a sleek condo?

The answer is HOA. They are very high and they can get higher. You don’t have a fixed cost for housing and for the most part you don’t have control over increase. Some associations use kickbacks for hiring certain subs. You might as well rent and you’ll be better off. Condos do not have the land appreciation to make up for the structure depreciation. For that reason, they are the last to increase in nominal price and the first to drop in price. Most condos do not have a garage. You have to deal with potential noise level from the neighbors on the left, the right or up above. The very high end are better built but for most condos tha is the case. These are facts which keep a lid on the value of a condo.

Why no land appreciation? The condo owner owns a fractional piece of the land, right? And nobody has been able to explain to me what happens when the structure has to be torn down. What’s the condo worth then?

bjk, condo BUILDINGS do have land appreciation. But such appreciation is far less valuable to condo owners than it would be to owners of a SFR.

This is because if your crapshack’s land appreciates, someone will pay that higher price so they can tear down the crapshack and build something new on the land.

But if a condo building’s land appreciates, so what? Individual owners cannot tear down part of the building to rebuild on their sliver of land. They don’t even own a part of the land — they own a percentage of an UNDIVIDED WHOLE.

If the building is torn down and the land sold, then sure, each owner gets a percentage of the sale price, minus expenses.

I’m not sure how one decides when a condo building is sold and torn down. I’m guessing a super-majority vote is required, either by law and/or by the CC&Rs.

I’ve read that one of the differences between a condo and a townhouse is that townhouse owners DO own the land under their buildings. I suppose it’s easier to tear a townhouse without the other owners’ permission, provided it doesn’t harm the structural integrity of their units. (Though there might be covenants that restrict that right.)

But even if you could tear down your townhouse, it wouldn’t make economic sense. What could you build on some land wedged between two townhouses, but either a smaller house or another townhouse.

HOAs can go higher and likely will, but so will taxes- which are much higher per sq ft for SF houses- utilities, and every other cost associated with hone ownership. My taxes are only $1400 a year, vs the $3000 a year they would be in a comparable bungalow.

Rents will go higher, MUCH higher, too. The rent for the 4 room 1 bed I formerly rented has already risen higher than my monthly cost of ownership in this condo.

Face it, as long as we live in an economy driven by insane government monetary policy that is designed to inflate us out of our lives and induce us to assume more debt, we the non-rich are in danger of being inflated into to dirt-floor-hovel poverty, if not total homelessness.

Neither are good places to live. I have relatives who live in Pasadena and friends who live in Culver City. Neither of them work close to home. Both groups have long commutes and spend insane amounts of money on putting their kids in private schools because the public schools are terrible. I’m not sure where CA ranks exactly but public education in SoCal ranks down there with Mississippi.

I own a small two bedroom condo in Glendale that I bough in 1988 and take the bus to work in (fake) downtown LA: a bunch of overpriced low occupancy buildings that do nothing more than serve as backdrops for every stupid movie set in NYC.

Laura Louzader: I think many people like to be able to do what they wish with their house/property and not have to get HOA permission to do that. Also, you typically pay more in HOA fees on a condo than you would pay in maintenance and gardening for a SFR.

That being said, I agree with you, I’d rather have a condo. I really don’t like big yards (too much work to maintain) and I don’t like worrying about exterior maintenance and gardening (I’d generally rather pay HOA fees and have someone else deal with that).

There are some pretty nice condos you can buy in Newport Beach for $750k or less. I recently looked at a 1,600 sf, 3br, 2-car attached garage condo there, associated with 10-rated schools, for $750k. Granted, that is still an exorbitant price for a small condo, but it’s 10x nicer than the $900k crap box shown in the article here. If you don’t want to live right near the beach, there are much cheaper condos, too (cheaper, but still very nice).

When I lived on the beach in the Marina, I used to go to Culver City a lot because it was cheap – and therefor – was able to sustain startup restaurants, bars, and shops. They would pop up every week. This of course among the shittiest of shitty crappy, outdated, laughable shoddy strip malls, buildings etc. Most of culver city still looks like that, but there are pockets of interesting restaurants and bars. Thats’ what people are trying to work on. Downtown Culver is pretty nice. Most of Culver city looks like Guatemala city or Manilla in terms of shoddy architecture, crappy stucco apt. buildings name things like Capri or Villa Amalfi. Seriously that part of LA along with that stretch of Venice, Washington and Jefferson are where you can still find crappy run down beat up shops that sell vaccuum cleaner parts. You get the picture. That said, I do like the Downtown some of restaurants, bars, and shops dotted throughout.

The detached home vs. condo argument is a long standing one. Generally with a condo your are giving up some freedoms and privacy in return for less upkeep and maintenance. Along with condos come HOA rules and fees. I never met a HOA I didn’t like. Believe it or not it is more difficult to qualify for a mortgage on a condo then a similarly detached home, because of the HOA fee. Also, condos generally appreciate slower and depreciate faster then detached homes. I’m not saying that condos aren’t a viable option or even preferred by some people, but personally I think that owning a home with actual land free from the tyranny of some self-important HOA board is a more attractive option.

Me too… houses vs condos, although I want prices to fall (not appreciate).

Perhaps not justified, but I have deep rooted fears. I like to have more control. Don’t want to be caught out with loopholes or bending of clauses to be hit with huge fee hikes or other costs.

http://www.dailymail.co.uk/news/article-2979546/Linda-Evangelista-legal-battle-1-5million-bill-replace-leaky-Manhattan-condo-roof.html

[If there are any humanoid aliens monitoring the internet – like from The Culture – with spaceships housing millions of people in absolute luxury, I officially request asylum. Beam me up.]

Hunan, as the owner of a 20s-vintage condo with a rather high HOA (that includes heat, a big item here in Chicago), I’m familiar with the terms of condo ownership. While it might be harder to get financed because of the HOA, it is not hard enough IMHO, because THE worst aspect of condo ownership is the ease with which defaulting and delinquent owners can inflict horrendous financial damage on paying owners.

When I was looking to buy in 2013, I researched each building I was buying into for foreclosures in process, and loans too large for the current market value (and therefore likely to default). As it was, in 2009-2011, Chicago had so many really huge, new high rise buildings that were loaded with so many defaults, that you could not get mortgages on their units. Nothing damages a condo association like a large number of defaults, especially when the association needs the cash flow to pay the heat and other utility bills. The loss of thousands of dollars each unit in unpaid assessments is a financial disaster for an association, which is why it is very important to get to know your association very well before you buy. Dig through the records on every unit and make sure you know how much reserve the HOA has, and what repairs are coming up.

You need to know how the association is governed. Are there effective financial controls in place to protect the owners’ funds, for example? A good association has a 3rd party financial management company to which HOA dues are paid, and which writes the yearly budget to be approved by the Board, and writes checks for the bills. All expenditures should be seconded by at least one other board member, for small expenditures, and by law in most states, all major expenditures and improvements must have the approval of two thirds of the owners.

And control over your unit is another major drawback. This varies from one association to the next. Many are very, very restrictive. The association must, of course, pass on any interior alterations that may endanger the structural integrity of the building, and might be able to control purely aesthetic decisions if the building is a historic landmark. Some associations allow pets, other prohibit them. Make sure you know and can live with the rules and restrictions before you buy. I personally demand a lot of control over my unit, and my board will restrict only alterations which are structural in nature, and must pass on any electrical or plumbing work, or renovations involving those things. Plans must be submitted and city permits are required. That’s all we ask.

The best part is that the expense of really major repairs is shared- my portion of our roof tearoff and replacement was much cheaper than a similar job for a small cottage of equal square footage would have been. I also like being able to share the expense of having the snow shoveled and the lawn cut. Security is another issue- an apartment far enough above grade that no one can climb through windows is much easier to secure than a little bungalow, without resorting to bars on the windows.

It’s been said that condos combine the worst aspects of homeownership and renting, with the benefits of neither.

As with a rental, condos offer no privacy and no control. You’re sharing walls, and in some cases, washers/dryers. You’re subject to others’ rules — things you can’t put on your balcony, or do in your car space, or when to use the washer/dryer (7 a.m. to 10 p.m. in my building, provided no one else is using it) etc.

But unlike a rental, condos have all the burdens of homeownership. You must pay to maintain your unit, including pipes (those not within the walls). And you’re anchored to your condo. If you want to move, you must sell it.

Like a SFR, the condo owner must pay to maintain the unit, and is anchored to it. But you have none of the freedoms of a SFR.

I own a condo, and though it’s in Santa Monica, I’m looking to switch to a SFR, even if I must move to a cheaper area.

Laura, knowing a HOA’s rules will only protect you so far, because the HOA can always change those rules after you buy your condo. HOAs are always creating new rules, and new fines.

BTW — It’s my understanding that under California law, if a HOA restricts an owner’s right to rent their unit, the new restriction only applies to units purchased after the rule was adopted.

Pasadena is beautiful but I prefer Culver.

Culver City is quaint, clean, has a trendy downtown with great restaurants, bars and shops

Sony studios is there, around Culver hotel the area still has the character of the old movie days

Central, easy to get to LAX or major freeways

Metro train stop, can get to Santa Monica west or to downtown LA east

Safe, good schools, very walkable

Many beautiful homes surrounded by mountains and a bike bath a few miles from the beach

Lots of parks and great hiking up to the scenic overlook, amazing views of LA

New shops and restaurants sprouting up as well as more condos

Art district, tech industry, media

Industrial section is a small part of Culver City and those buildings are quickly becoming trendy office parks

@iGirl. I get that you are apparently a somewhat desperate homeowner praying for appreciation, but this b.s. about ‘surrounded by mountains’ is the worst kind of nonsense ever. Seriously…that’s ridiculous and I probably hike every other day in LA; I like Culver City and lived nearby for almost 15 years. You may be absurdly describing the oil drilling rigs in the hills along La Cienega and the little tiny piece of new urban park, “mountains”, but jesus…calling it surrounded by mountains is really taking the b.s. cake! All you have to do is look at Google Earth to see the scarred post industrial landscape and drilling rigs!

And the ‘bike path’???? There is one narrow little finger that is technically Culver that stretches towards the beach along Washington ending at Lincoln. Use Google maps. That area isn’t really walkable that’s the area near Costco – not very pedestrian friendly.

The downtown part of Culver City that you say is quaint and like an old movie set is almost 6 miles from the beach along trafficked Washington Blvd or there’s a path along Culver Blvd. From there, it’s a busy long ride down to even get to a view of the water. That’s roughly the same distance from the water as other “quaint seaside communities” like Inglewood, Hollywood Park, Century City and Carson.

So really….like Culver City all you want (I do too) but please dispense with the bs happy talk. It’s false, misleading, and garbage.

SomePeople CallmeMaurice: “calling it surrounded by mountains is really taking the b.s. cake!”

I’ve another nomination for the B.S. Cake. At least two realtors have told me that Woodland Hills gets “cool ocean breezes from Malibu.”

Fact is, there are NO ocean breezes from Malibu because the Topanga mountains block any breezes coming from Malibu. Indeed, Woodland Hills is aka Woodland Hells because of its scorching 100 degree plus summers: http://www.laweekly.com/news/why-is-it-always-hottest-in-woodland-hills-4648335

@sonofalandlord. Yeah man, it’s absurd. Totally useless to any real discussion. I used to play soccer on Sunday mornings in Woodland Hills and surroundings. At the field at 11 am it would be 103 degrees. We would bet the lunch check on the temp. back in Santa Monica. Usually it was around 73 due to marine layer. I don’t think any of that ocean breeze was getting over the mountains. As I said earlier…I hike 3/4 times a week in the mountains – often in Topanga. It can be drizzly, cool (68 degrees) on PCH and Topanga and 90 degrees at Topanga state park. Marine layer usually dissipates around Fernwood entrance to town.

By the way, here is Google Earth link to the ‘mountains’ quote ‘surrounding’ Culver City:

The Beautiful Culver Mountains

These are adjacent to downtown Culver.

Can’t wait until the market turns, and Doc is reviewing some fairly decent homes . These horror crapshacks, and hipster tiny-homes, all at insane high prices… it’s just too depressing.

Bring on the inventory. Bring on the pulling of some market triggers for more owners seeking to cash out on these insanely high low-mid-high prime area valuations. Don’t the banks want to write new mortgages…? Currently scraping multi-decade low applications. All that homeowner/investor equity on mega-high valuations is little use to the banks.

I’d demolish this thing, go to Home Depot and buy four back yard lawn barns fit them together covered by a couple rolls of 16 mil visqueen for the roofing and list the attached “4-plex” for $2 million. Blert would love it.

Ok, so the condos don’t compare…… how about SF houses in Los Angeles 90036 zip code? Is Culver City a better nabe for raising a family (public safety, schools, commutes, local amenities) than 90036? I ask because I see the following lovely homes there, that strike me as terrific bargains compared to the CC dumps.

This one is 2000 sq ft and is distinctly not a dump… and it is priced at $677 a square foot, much cheaper on a per sq ft basis that the Culver rat holes:

http://www.realtor.com/realestateandhomes-detail/608-N-Mansfield-Ave_Los-Angeles_CA_90036_M22682-50428

Or THIS beauty, with its beautiful vintage details and great architecture, including a spectacular tray ceiling in the master bed:

http://www.realtor.com/realestateandhomes-detail/342-N-Citrus-Ave_Los-Angeles_CA_90036_M22417-17077

These are gorgeous older homes of one of the best eras for home building ever, the 20s and 30s. You can’t beat the quality of homes built in that era. These places have also been tastefully rehabbed. If you’re gonna sign your life away and enslave yourself to a 7-digit mortgage, you at least want something you can enjoy living in. There has to be some joy in it, or it’s not worth it.

Thoughts?

Here is one in the same price range as the CC places, but with over twice the space, over 2,000 square feet.

Place needs some work, notably gutters and probably the roof, also needs some cosmetic work inside, and complete redecoration. But it still has a lot of attractive architectural features and the work looks like it could be done for less than $30,000. All in all, a very attractive, roomy, livable house. Looks like the surrounding neighborhood is attractive, though the bars on the windows make me wonder about it.

http://www.realtor.com/realestateandhomes-detail/842-S-Citrus-Ave_Los-Angeles_CA_90036_M19784-41416?row=1

Paying 900K for this little shit box is definitely not a good idea. For that amount of money, there are many better alternatives. I still notice that good properties priced accordingly tend to sell very quickly. This is definitely true in the upper tier areas. These folks did VERY well in the past few years. Will we have a correction? Sooner or later, but nothing like the blowout we saw from housing bubble 1. The recent buyers have all been very qualified and the rent vs. buy equation has tightened up significantly. All my 2 cents of course.

I don’t know if it’s all in my head, but i’ve noticed a substantial price jump in San Diego County over the last few months. Places as far north as Vista and East near La Mesa are now going for $425,000+. Keep in mind these are more modest 3 bed 2 bath houses on small-ish lots that need some updating. Previously I was seeing these places for around $375,000. You can’t even touch San Diego city at this point for less than $475,000 unless it’s an absolute dump.

I feel like we’re in full on bubble territory at this point. I make north of $100+/year and have 20% down even at these inflated prices and still can’t make the numbers work for buying. That’s with having 0 debt and excellent credit as well. How the hell are others buying at these prices?

IMO Northern San Diego county is the place to be. You can still get a 2,000+ sq ft home on a nice size piece of land for under 500K. The weather is even better there. The only problem is where are you gonna work? The commutes are hell.

If prices are popping in sub-prime areas, the end is nigh Kris. Back in 2004 when I lived in SD, I noticed Rancho Santa Fe sales come to a halt, then move its way down the price chain – got out at the top in Cardiff. There were still bidding wars in 2005 in areas like North Park though, giving bubble heads ammo for why housing was still a great place to be. This downturn will be different in that a lot of foreign money was used and a lot of cash buyers participated but the decline will happen regardless. I continue to follow the area a little even though I moved out of state – to a much better one – 8+ years ago and all the building in east/north county has moved a lot of demand forward IMO. Keep saving so your loan amount will be smaller – let the vampires go elsewhere.

Kristopher, if I remember correctly you were very young (in your 20s). Instead of focusing on your forever home now, why don’t you buy a nice townhouse/starter home. If you are at rental parity, buying makes sense. Live in your townhouse/starter for the next 10 or so years, then upgrade to your forever house…and keep your first place as a rental. I had the opportunity to do this when I was your age and passed up on it. That was a huge mistake. Collecting a rent check for coastal California property for the rest of your life is not a bad thing at all.

You’ve been going back and forth on buying for a few years now. Had you done so, you’d have some nice appreciation and more importantly you would have paid down several years of principal at insanely low rates. Just something to think about.

I am seeing some shocking prices going pending. These prices are far higher than what we saw back in 2007ish. Some examples:

https://www.redfin.com/CA/Manhattan-Beach/316-4th-St-90266/home/6712355

https://www.redfin.com/CA/Manhattan-Beach/328-6th-St-90266/home/6712204

https://www.redfin.com/CA/Corona-Del-Mar/308-Poinsettia-Ave-92625/home/3256411

Just a few years ago, these places were in the mid 1s. Shocking.

Jesus christ, $3M+ for a box in Manhattan Beach, some smaller than many condos, with no ocean view, no land, and neighbors right on top of you in all directions?! That is crazy! I’d definitely rather rent.

i believe Jesus Christ was actually homeless not sure about Mohammed.

Although it’s become fashionable to call Jesus “homeless” and Mary a “single mother,” neither is true.

Nothing in the Bible suggests that Jesus was ever homeless. Joseph was a working man. He had a home. Jesus was born in a manger only because his parents were away from their home town, and all other rooms in Bethlehem were rented out.

Jesus worked as a carpenter until age 30, so again, he had a home and a business.

For the last three years of his life, Jesus lived on the road. He either stayed as a guest at believers’ homes, or he rented lodgings in the towns he stayed at. Yes, he and his group had money to rent lodgings. The Bible states that Judas carried the group’s purse.

So no, Jesus was never homeless.

Nor was Mary ever a single mother. She was already engaged to Joseph before Jesus was conceived, and Joseph married Mary before Jesus was born.

Manhattan Beach must be one very coveted neighborhood for these little nothing houses to fetch more than $500K, let alone $3M. For $3M, I see many beautiful homes in neighborhoods like Los Feliz and Hancock Park. Knew a woman who lived here in Chicago’s uber-trendy Lincoln Park, who moved to Hancock Park, and she told me it is an extremely desirable neighborhood.

Here is a listing that is in the same price range with those Manhattan Beach places:

http://www.californiamoves.com/property/details/3876059/MLS-14-778895/206-S-Rimpau-Blvd-Los-Angeles-Hancock-Park-CA-90004.aspx?SearchID=44041541&RowNum=9&StateID=9&RegionID=4&IsRegularPS=True&IsSold=False

Nearly 2800 sq ft with a huge, beautiful lot and pool. Looks to be in perfect condition.

Now, I’d want more for my $3M if I had anything like that kind of money for a house, but, then, I’m a Midwesterner. Still, Los Angeles seems to have many lovely neighborhoods that are close to the “action” and are loaded with lovely, architecturally significant homes for anywhere from $1M to $3M. Are these neighborhoods any worse than Culver City, or for that matter, Pasadena?

I am STUPEFIED looking at these Manhattan Beach listings. I wouldn’t even live in these tiny, ugly little houses. I mean, sure, I’m looking at these horrifying prices with Chicago eyes, but it seems to me that Los Angeles has plenty of lovely neighborhoods where you can score a gorgeous home for these prices. I mean, $3 M plus for these shanties.

Knew a woman here in Chicago a couple years back, who moved from Chicago’s uber-trendy and expensive Lincoln Park neighborhood to a veritable mansion in the Hancock Park area of Los Angeles, for the same money.

Well, I came across this, and now I’m in love:

http://www.californiamoves.com/property/details/4147028/MLS-15-818501/8142-Laurel-View-Dr-Los-Angeles-CA-90069.aspx

Now, THAT is something I would actually pay $3M- plus for, if I could pay anything like that kind of money for anything. Is this the Laurel Canyon area? It looks like a beautiful neighborhood. Why is Manhattan Beach considered to be so much better that people will pass on this for a shanty in MB?

Laura, the people who are buying these MB shanties will not be living in these tiny, ugly houses either. The bulldozer will show up shortly after escrow closes and a new McMansion will be built. You are only paying for the land value. This is happening on virtually everything street in the south bay beach cities and I don’t see an end in sight.

Look at what you can get in Glendale for over $100,000 less. Glendale is in between Burbank and Pasadena. And this place is close to the 134 and the 2. (And the 5)

How can that other place cost more than this? I don’t understand.

https://www.redfin.com/CA/Glendale/953-E-Glenoaks-Blvd-91207/home/7162186

jt…more then shocking, unbelievable, look we lived shortly many years ago in Pacific Beach we liked nothing plus lousy shoe box houses. Today who knows why folks pay these prices, you make somebody believe what they are seeing is not really what they are seeing then the buyers deserve such a fate to buy a junk house with a bunch of drunken beach people.

I thought prices had reached insane, unsustainable levels last year. Well seems i jumped the gun.

In sleepy eastern Sacramento suburbs I’m seeing new listings in the past 2 months surpass 2005 bubble prices.

Who is buying these? Well i see young couples turn up at open houses… But where are they getting the money to pay for these insanely overpriced huts?

Bigger question for me is why do they feel the need to buy regardless of price?

I grew up in Culver City and my father still lives in the home that I grew up in. He thinks the weather and location is better than Beverly Hills and nice areas of LA. I live in Fresno County and home prices are very reasonable, but there is a real tradeoff. The heat, crime and pollution are terrible although we do not have the traffic, freeway and parking problems of Southern California. I’m now retired and am looking for a house on the California coast, but my home has not appreciated very much in 28 years and it is very difficult to trade my gorgeous 2400 sq.ft. home worth less than $300,000 for a very outdated, small and old home for close to a million. But I am looking as a better quality of life is worth a lot.

You’re retired – and your father is still living in the same Culver City house you grew up in??????? Maybe you’ll be in line to inherit the place… how much is it worth approximately?

It’s all no-inventory and inheritance economy now… very few tempted to sell for absolute fortunes in low-mid-high prime…… younger professional renter savers totally priced out of these areas… in the new e-con-o-mi of worshipping ultra high house prices and lusting for even higher values.

I learned about this from a comment left on one of Doc’s articles a few days ago.

_____

Facts and Feelings

March 1, 2015 at 11:58 pm

Let’s say an adult child lives with parents in a crapshack which could fetch $700K today but which is assessed at a much lower Proposition 13 tax rate because the parents bought it decades ago. With the additional benefits of Proposition 58, the parents can then pass on the shack to the adult child who will acquire the lower property tax basis the parents had.

http://www.doctorhousingbubble.com/california-rental-armageddon-california-rents-affordable-california-moving-out/

Lois,

Unless you’re teaching rhythmic gymnastics in your house, why do you need 2400 sq ft? Offload that ball and chain and rent a little cottage by the beach. You’ll be breathing clean air, your AC bill will be zero and you’ll actually enjoy waking up in the morning. You’ll be happier believe me.

You’re right! Just looked at a new development down the street. $650,000 highest quality construction with 3500 square feet–maybe will bring the comps up in the neighborhood. It’s also hard to leave a lifetime of friendships. Father’s house in Culver City is worth probably around 700,000–needs renovation. Will need to divide property with siblings, but don’t want to think about it now.

Nobody has answered me!! What’s wrong with 90036? Or Hancock Park? Or that little palace in 90069?

Lord Blankfein, even when those little shanties in MB meet the wrecking ball, the owner will have to build his ‘mansion’ on a tiny lot so close to other dwellings that he’ll be able to reach inside their windows. Condo much preferred! I hate the way that neighborhood looks with narrow, oblong, boring houses packed so closely together. If I had the money these folks have, I’d be looking in other neighborhoods.

Trendoid people amuse me.

There are significant differences between these two properties. The million dollar listing is in a prime area of Culver City, Vet’s Park, which is quiet, central, and beautiful. That house is surrounded by upscale homes. It is on a lot twice as large as the other house. And this house is zoned to Farrugut Elementary, an excellent school with a 10 rating on Great Schools. It is walking distance to the elementary, middle school and high school–all terrific schools. It is perfectly move-in ready.

The cheaper house is on a 2500 square foot lot. It is steps from the 405 freeway underpass and is on busy Jefferson . Many houses with Culver City addresses are not actually zoned to Culver City schools (I’m not sure the situation here), which often accounts for hundreds of thousands of dollars in price difference. If this house is in CC, it is zoned the El Rincon elementary, the lowest performing CC school. This house is a tear-down. It is sandwiched by commercial buildings.

I love Dr. Housing Bubble, but if I had taken the advice he/she gives towards Culver City, I would never have bought a house here. Instead, in 2013, I paid $770,000 for a house that I could sell today for $1.3 million. Glad I listened to the logic of location, steady price appreciation (priced didn’t drop here, even in 2008 and 2009), great public schools, new development (a $300 million investment in Playa Vista, 5 minutes from my house), and a strong community vibe instead.

an american sucker born every minute. spot on—-CC is NOT Manhattan Beach, nor the Palisades–who in their right mind other than the stupid would pay 1k per sq foot for a crap shack? It’s a TEAR DOWN. Lipstick on a pig and that home cheapo slap job/cosmetic crap ain’t foolin’ the savvy, just the american imbeciles who are buying into the buy now, real estate is always goin’ up BS from 2005-2006.

The real estate sales shticks with home cheapo appliances, unlicensed cosmetic paint jobs, and cheapo fixtures— trust funders, inheritancers, and dumb as a cluck dual young incomers who are brain dead buy these overpriced homes.

Leave a Reply