Real Homes of Genius – Welcome back Culver City. $749,000 short sale for a two bedroom and one bath home. Let the bubble reign supreme in West Los Angeles.

The housing madness is back permeating throughout the Westside of Los Angeles. Culver City is back on the radar for having a home built during the Great Depression selling for a price that is even higher than prices seen during the peak of the bubble. It is an interesting market in the sense that sales are not all that high relative to the action on the price front. Much of this is low inventory low interest rate fueled mania in SoCal. The Fed and banks are milking this for everything they got and QE3 is there to provide the fuel. Whenever the Fed gets involved however you can rest assured the market is going to overheat like an old Chevy on a blistering hot day. The movement in prices is dramatic in nearly every corner of Southern California. The only issue is that household incomes are not moving up. Today we salute you Culver City with our Real Homes of Genius Award.

Culver City Great Depression Style

I’m sure it is every aspiring millionaires dream to purchase a Great Depression built home. Today we saw this gem pop up on our radar:

4174 Mcconnell

Culver City, CA 90066

Beds 2, Bath 1, square feet 1,001

The ad is welcoming enough:

“This is a Spanish-style 2 bedroom 1 bath in Culver City. Has a detached garage with a long driveway and spacious back yard. Nice little house for a first time buyer.â€

I’m not sure what counts as a long driveway but it doesn’t look like it in the picture above. Also, this is a nice starter home for a first time buyer. The only thing that makes this anything but a first time buyer home is the price tag. The current list price is $749,000. For that price, you even get a MLS photo with this in it:

Is this starting to sound familiar to you?  Westside housing is like trying to time a jump on a roller coaster. There is nothing that can justify this current price and this is very similar to what we were seeing during the boom times.

If we look at the price history we find some interesting data:

Sold (Aug 31, 1993):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $215,000

Sold (Aug 01, 2008):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $669,000

Listed (Aug 30, 2012):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $749,000

They probably thought that August was a lucky month for this home. Alas this is listed as a short sale. As of July a notice of default was filed and payments were behind by over $30,000. The current mortgage balance is $606,000. You figure the cost to sell this place and it is likely the lender is trying to break even with that 2008 price. In this delusional market, anything can happen.

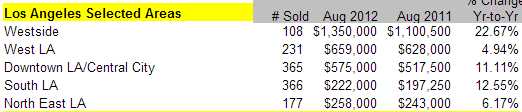

This isn’t a unique case here:

This entire region is in a mania. Keep in mind that household incomes are stagnant even in these mid-tier markets. Let the QE3 times roll. Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

33 Responses to “Real Homes of Genius – Welcome back Culver City. $749,000 short sale for a two bedroom and one bath home. Let the bubble reign supreme in West Los Angeles.”

Yes, this is dillusional, but if you really want to see dillusional, look at house prices in Toronto, Canada. Go to mls.ca and plug in C9 or C10 and you will see many overpriced homes.

Hi Elizabeth, just wondering how the prices are in the York & Peal regions. In particular Mississauga, brampton & the communities along the Hwy. 7 transitway.

I’m curious about this Canada post. My cousin is trying to sell a house in the nice (but apparently not nice enough to attract new buyers), part of Vancouver. If anyone has additional information other than what has been posted on this site I would appreciate it.

I posted this house this morning on Dr. HB’s previous article.

It is so underwhelming to witness our trajectory back to the $500k minimum buy-in to the low rate/high price market.

This Costa Mesa fli(pos) aka “Real Home of Genius” just sold for $366k a month ago today.

http://www.redfin.com/CA/Costa-Mesa/862-Senate-St-92627/home/4564290

Nice time for the owner/investor to make a cool hundred gs? Will someone put 3% down and take out a 485K loan to buy this half a million dollar gem? Really? Are there really folks out there who see this as a long term value play? Are they buying into the myth of urgency? Buy! Buy! Buy! or be priced out forever!

I would love to see the 15 year sales history on this Costa Mesa castle.

Thanks for keeping it real in this frothy mess Dr. HB!

This Costa Mesa home is move in ready, so I have no doubt someone will bite quickly. The seller is probably a contractor, put 30-40k into this place and will earn 50-100 grand with this transaction.

I have an a similar example in San Clemente:

http://www.redfin.com/CA/San-Clemente/118-Avenida-Trieste-92672/home/4995572

Contractor purchased this for $419 in May, put $100k in improvements into it – without doing anything on the outside (house is still ugly) – and now listed it for $775k and already is in Escrow after 12 days, probably not for less than $750k. This guy easily made $200k+ in 4 months.

In the world of flipping, you only make money if buy at the right price. Whoever bought this place and flipped it did it right in spades and will likely make a quick 100K. 4 bedroom, 2 bathroom 1800 sq ft move in ready 5 minutes from the beach in OC for under 500K…easy money! That’s what no inventory and low 3% interest rates do.

It shows pending as of Oct 12th. Yike.

Probably multiple offers and sold over asking. With these low rates come super low monthly payments. That is what people are shopping for.

How is this a “short sale”? “A short sale is a sale of real estate in which the proceeds from selling the property will fall short of the balance of debts secured by liens against the property and the property owner cannot afford to repay the liens’ full amounts, whereby the lien holders agree to release their lien on the real estate and accept less than the amount owed on the debt.” They owe $606K, and the list is $749K. The actual selling price would have to drop below $606K to be a short sale. What’s the deal?

You may have forgot that seconds don’t always show up in the data. I see this all the time with short sales priced way above the original mortagage.

Who gave this guy a second loan or HELOC after 2008???

What?

This house was last sold in August 2008, at the same time the banksters crashed the market, so I highly doubt there were second loans given on this house from then on. House prices took a dip from 2008 to just recently in Culver City. So Nor Cal may have a point that this is not a short sale. It should be a foreclosure.

Heh, using PropertyShark and NETR, you can find the owner and get tons of info. They owed $606k since back in 8/2009. The NOD from this year says they owe $30k. It’s infuriating what these people do…while the rest of us responsible ones get screwed.

I live in So Calif. Westside is known for hipsters that want to be cool. This westside dump is considered a ‘charming bungalow’ West LA is known for crime, queers, sex perverts, druggies, and narcistic phonies. In their quest to be hip, they exhibit their own stupidity in all things financial. These prices fit in perfectly with their perceived trendy lifestyle.

Nice and PC. I take it you aren’t the listing agent.

You’re an idiot. Everyone knows Silverlake is where all the hipsters are. I live in Palms, and the hipster ratio is pretty low compared to Silverlake or Downtown L.A.

I can’t really speak to how many gay people live around us, but I don’t care because I’m not a bigot. Also, I never realized our neighborhood full of “sex perverts” or “druggies” guess you lear new things everyday.

So true. Most hipsters think the Westside is uncool. It’s not quite the dump that DTLA and environs are, so therefore no ironic factor in living there. Unfortunately, the hipster set has been encroaching upon pockets of the Westside. Venice and Sawtelle come to mind.

And, who uses the word “queer” these days? This guy’s probably got some kids on his lawn to go yell at.

Gay dudes = Increased property values

So, if it was sold in 2008 for 669K and now is up for sale at 749K, why is it called a short sale? One of those figures has to be a misprint.

Wow, do you have any more axe leftover?

Unsure what you mean, please feel free to elaborate.

That reply was meant for unclevito as he obviously has some axe to grind.

I am monitoring prices in two places to commute into the Bay Area from,

http://www.redfin.com/city/8716/CA/Hollister and http://www.redfin.com/city/7521/CA/Gilroy .

What’s very telling about these markets, is a 70% drop in YoY inventory but only 5-10% increase in price per sq. ft. (more popular metro areas like San Jose +20% price on -50% YoY inventory).

If such a ridiculously low inventory ONLY boosts prices by that amount, on low and dropping interest rates toward 3% … there are not many tricks left in the bag for the government or the banks to play. There are two scenarios I see; what I hope for in 2013 is a loosening of inventory which would happen if the current squeeze is mainly election related. Alternatively, if this inventory level drags out for a few years we won’t get much recovery at all — I believe recovery only comes from the crossing of supply and demand to generate volume, meaning the price MUST drop more.

At least in the regions within reasonable driving distance of my work, a 20-30% price drop is still needed to reach rental parity (not just mortgage payment = rent, but mortgage payment + taxes + utility cost increase + insurance + commute fuel cost increase + home maintenance cost = rent). Release of foreclosure inventory probably will lead to this sort of discount from current market prices, if only the inventory would be let out.

Well the hispanics with kids will stay since the eastside and South Central are under 300,000.

Look at this house:

http://www.redfin.com/CA/Los-Angeles/3110-Midvale-Ave-90034/home/6752663

Sub 900 sq-ft and they want $729k. That is $814-sqft. What kind of person could buy what is the perfect definition of a starter home in what seems a decent but not great area?

This home is sub 800 sq-ft:

http://www.redfin.com/CA/Los-Angeles/10729-Westminster-Ave-90034/home/6752428

It foreclosed at $453k after someone paid $659k. And it was initially listed for $579.9k now down to $549.9k.

I swear people think it’s 2006 all over again. I feel like a deeper question that hasn’t been answered is why across the country most areas have probably hit the bottom and it makes sense to purchase a house. I can understand New York and San Francisco staying hot because of the tech and finance jobs. But I don’t understand why large swaths of LA are still so expensive, though maybe not 2006 expensive. You really can’t get a starter home for under 500k unless it needs tons of work. Move in ready houses in no frills but decent areas are 600k and up, though it typically closer to 700k.

Wydeeyed brought this up a few posts ago. Even though interest rates are at historic lows, which affords you a higher priced home that home is underwhelming and probably your 3rd choice neighborhood. You get so much less for your money nowadays that it is depressing.

I can’t believe it’s becoming the new normal to accept this. Who are these people buying? I know there are people who sold around the peak and have been waiting to jump back in with their large down payments. Seems like people priced out much of the 2000s are throwing in the towel and just buying. Some commenters are tired of waiting and just want to move on with their lives. Other people must be wealthy and/or supremely optimistic. Those are two things I am not.

I also want to move on with my life. I’m 38 yo DINK and was priced out for years. Granted I wasn’t savvy enough to know that people were buying with nothing down no-doc loans. It wasn’t until I was reading this site did I understand and by that time the peak was reached. Seeing as how 2012 has panned out I am kicking myself for not buying in 2011 with a 3% down FHA loan. I was trying to be good and save that 20%. And I have that now for a 600k home. But I don’t want to blow that much money- all the money that I have in my savings- on a sad shack. And maybe because I am too sensible and don’t take risks, I will lose.

Chin up Forever_Sidelined. It’s smart not to plop $180K into a house. The $600K house should only cost $180K to begin with. I really think the market is really bad and the $40 billion per month that the FED has committed to purchase mortgages can only mean they have to do it to keep it from crashing. In other words, we’ll still see massive drops in prices. At least wait until January, when seasonal pricing is lower.

I’m in the same boat. I have enough saved to put 20% down on a $500K home and still have enough leftover. But that gets me a dump around here. Something’s wrong with this picture.

I think a six figure income is in the top 10% of wage earners. Why can that only comfortably buy a $300K 1 bedroom condo that needs work? ($300K because it’s 3 x income). In the top 10% of wage earners, should be able to comfortably buy a brand new 4 or 5 bedroom. On a $50K salary, assuming it’s your first home, should be able to buy a 3 bedroom that needs some updating. But how can you when those cost $500K+?

Don’t let the idea of home ownership define you. It is not all there is…

Forever sidelined, people want to just get on with their lives so they are throwing in the towel and buying. Yes, nominal prices are still high. But, the low rates make the monthly payment very affordable. As we all witnessed, trying to outlast the Fed is futile. They will make housing “more affordable” by keeping nominal prices high and monthly payments low…that is all you need to know! I would be willing to bet this will not change for YEARS. Now the question becomes are you willing to wait another 5 or 10 years in hopes of things returning to normal? I finally threw in the towel and decided to buy and closed escrow yesterday. My monthly payment is lower than what I was paying in rent for a 1 bedroom apartment. That’s what got me off the fence. Good luck.

They are creating job security for foreclosure buyers at the courthouse steps. We need the housing homers to bid up prices again so realtors can start pricing each new listing 10% over the last one. Plus I need to work for two more cycles then turn the torch over to the kids.

Prices in my area jumped from the low to mid $500’s up to the low $700k’s overnight. I couldnt believe it when the last 3 comps sold for $485k, $503k and $515k and the house next door goes up for $749,950? WTF??? 3 popped for $725k, $715k and $740k with no commission.

Sold a quick flip, wasn’t even a flip cause all I did was change the locks for a quick $131k profit. That made me scratch my head and say wtf?

The animal spirits in housing are whispering, “it’s a great time to buy because interest rates are at historic lows.”

The Bernanke has telegraphed that interest rates will be low for next several years; so home prices won’t be slipping much during this Fed support period. Since the Fed is stoking supply (vis-vis affordability) and the banks have seen the wisdom of command and control inventory management, prices aren’t headed down much for the next couple of years either. In fact, even when interest rates tick up, you better believe another “gold rush” will take place as fense-sitters jump in to stake their claim in the American Dream.

“Nothing to see here, folks” for the next few years. How will with DRB keep us reading?

I’ve been looking around thinking this may be the year I finally but but really nothing has changed. It’s the same sad little century-old boxes for $600k+. I could put 20% even 40% down and pay it off in 15 years, but still I feel like it’s not worth it when everyone else seems to be playing the FHA 3.5% game.

For the areas I would be happy living even a modest home costs $800k, and I’m just not going into that kind of debt. Sorry, So Cal realtors.

In the $600k areas yes some are on nice little streets but the surrounding area is somewhere I can’t imagine settling down. Oh look, a traffic congested street and a Jack in the Box.

Plus I hate the heat so am pretty much stuck on the west side. Except I’m not stuck. Its time for me and my family to move to another part of the country. There are so many places with so much more to offer. And if the weather turns cold I’ll put on a jacket.

Yeah, this is beyond frustrating. I had hope in reading these blog posts 2, 3, 4, 5+ years ago, and nothing has changed except my age and my growing desire to find a place to call home. I’ve told my wife to hold on, the prices can’t hold given everything I have read here, as this site makes me feel informed and smart. Now, I’m not feeling so smart.

With age 40 around the corner, and renting a duplex, the emotion of feeling like a failure seeps in. You could keep up the hopeful posts, but its hard to trust anymore given I am seeing just the opposite of what I anticipated. I keep hearing that salaries aren’t going up, and so home prices cannot keep up. And so I waited on the sidelines to now see houses priced above that from 2006.

And what goes unmentioned here are the private school costs that more than 90% of us face with a min. of $20k/year/kid. So tackle another $240K+ per kid to that housing cost. Wish I had more freedom to just pack up my bags and move…

This gov’t disgusts me, allowing people who don’t earn their money to live in better shape than myself and feeling so bad for them that they bail them out. What happened to personal accountability? What kind of capitalism or democracy is this?

So frustrated…I just feel like getting my piece of shi! house for $850K, plus my private tuitions and sucking it up. Don’t want to wait until I’m 45, or even longer to finally see any turnaround. It’s a sad state of affairs.

-Frustrated.

In these grim times, I’m elated to see the return of RHoGenius, replete with the trademark “Garbage Can Photography”, LMAO! Pole Dancers izz Strippers and RealTards izz SCAMmers, and I can’t believe anyone would enter into business or matrimony with either… but, as predicted by P.T. Barnum, every single minute, someone does! Private sale or you overpaid. RE commissions higher than the down payment–AYFKM?

I’m still working hard to get 9-14% returns on Real (MiMo-style) Properties of Alcoholics here in So-Fla, aka Bubble Zone Dos. Luckily the concrete-intensive Mid-Century build quality here in Hurricane Alley holds up well under the neglect of derelict owners. Lack of seismic activity helps too.

The few purchases by Canadians in 2010-11 that I’ve followed are already underwater, or attempting to “flip the 2012 blip”. One is stalled in reno, so not even renting… WTH? Must be lack of funds ’cause sure isn’t lack of construction labor.

The Tragicomedy proceeds at The Bernank’s pace.

Leave a Reply