Real Homes of Genius – 916 square foot home selling for $510,000 in Culver City bubble market. Imagine having a second mortgage 3 times the size of the original mortgage! Shadow inventory galore in Culver City.

The California housing market is still overpriced in many pocket markets. Speaking in general terms, home sales have collapsed because demand at current prices is simply too low. Unless the cake is further sweetened with tax credits or low interest rates courtesy of the Fed, there is little to get buyers to move off the fence anymore and eat some more overpriced housing pastries. The response from many in the industry is simply to lower interest rates or more tax credits since they ascribe to the “money grows on trees†world of real estate finance. If you haven’t noticed, places like Greece and Ireland can reach peak debt situations. The Federal Reserve is pushing us closer and closer to that position. Aside from these global issues, does anyone even realize that California has a $25 billion deficit for the next fiscal year and $20+ billion deficits until 2016? In other words, more taxes and/or spending cuts. And this is good for home values how? Today we’ll go on a little journey of Culver City and find some other housing nuggets of an ongoing correction.

The short sale experiment

4160 HIGUERA ST, Culver City, CA 90232

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 916

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1922

This home was originally built in 1922 before the Great Depression. The home is 916 square feet and sold for $689,000 in 2005. You would think that half a decade would boost prices since real estate only goes up right? Well let us look at the action on this place:

Price Increased: 09/11/10 — $560,000 to $585,000

Price Reduced: 09/14/10 — $585,000 to $560,000

Price Reduced: 11/04/10 — $560,000 to $510,000

Here we have a $179,000 price cut over 5 years. And what was up with the price increase? If the home were to sell today at the current price it would be a 25 percent drop. I’ve found this pattern repeating over and over. For whatever reason, banks are now dropping home prices on short sales from their peak sale price by 25 to 35 percent. The range seems to pop up over and over including in cities like Pasadena.

Is the above home affordable? At 916 square feet you will be paying $557 per square foot so it still seems inflated for such a small pad. Interestingly enough this home sold during two bubble peaks:

July 1991:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $250,500

October 2005:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $689,000

How much lower can this Culver City short sale go?

The big ATM

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,104

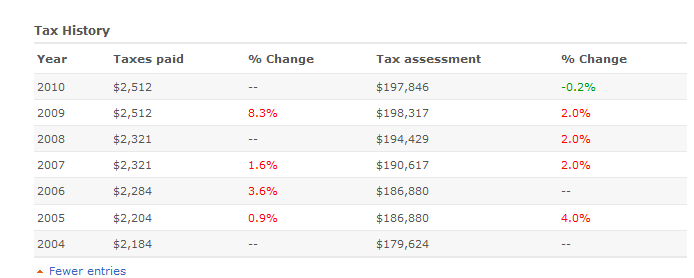

The above is an interesting home. This is a typical refinance machine home. If we look at the tax assessment data we can clearly see this:

This home which is bigger than the 916 square foot home is being assessed under $200,000 while the 916 square foot home was being assessed at $716,000+ at one point! But when you can tap into the equity machine you can screw the taxpayer on being bailed out and also, on your taxes. Take a look at the action on this place:

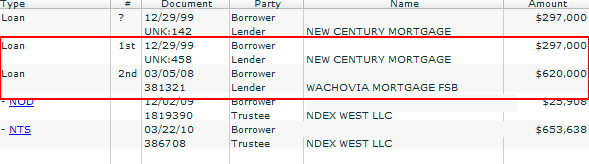

New Century made mortgages on anything and everything. Wachovia was another “sophisticated†option ARM superstar. Combine the first mortgage of $297,000 and the second mortgage of $620,000 and this home has $917,000 in loans secured. Yet it is only paying taxes as if it were valued at $200,000! This is an example of how screwed up the entire California housing market still remains. The home is listed as bank owned by Wells Fargo since they inherited the Wachovia junk portfolio. Yet I don’t see this home listed on the MLS. The sale date was September 20th so it should be plenty of time to put it up for sale. Looking on the MLS Culver City shows only one sad foreclosure. Yeah, we all know the shadow inventory is where the real problems are.

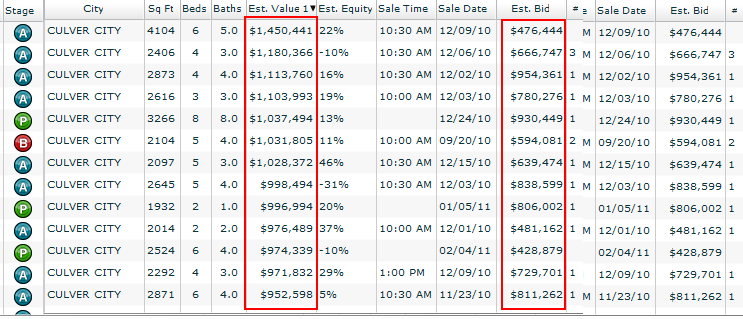

Culver City has 179 homes listed as bank owned, have active notice of defaults filed (aka folks not paying), or are scheduled for an upcoming auction. Yet the MLS only has 1 foreclosure listed! Talk about a giant hidden inventory here. And the foreclosure that hits the MLS is a tiny lower priced home. The big foreclosures are sitting in the shadows. Let me give you a quick preview:

Nothing to see here folks. Just more banks gone wild behavior and taxpayer bailouts. And you wonder why home sales have collapsed?

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

52 Responses to “Real Homes of Genius – 916 square foot home selling for $510,000 in Culver City bubble market. Imagine having a second mortgage 3 times the size of the original mortgage! Shadow inventory galore in Culver City.”

Thanks so much for this terrific post, as well as your entire blog. I am so glad that someone is finally making sense.

Regarding distressed sales, yesterday while I was looking at my local listings and realizing how many of them were short sales, it hit me (why did it take so long?) that there’s another factor at work here: time to close a sale. Because short sales take so long to actually happen, many buyers aren’t interested in getting involved in them. Same with foreclosures, I’d imagine, although those go faster, don’t they? So even if a buyer can get a loan, or even has the cash to buy outright, it’s virtually impossible to actually close on a sale and take possession of a house. No wonder nothing’s moving.

In addition, when you buy a foreclosure, you get the house as is. No disclosures. The bank takes no responsibility for any hidden defects. So you’ve got to have nerves of steel to buy a foreclosure. Again, a demotivating factor for serious buyers who want to buy a house to live in.

It’s amazing that any sales are happening at all.

And, Paula, don’t forget the recent disclosure about broken and corrupt chains of title. How’s you like to find out in a few years that you don’t actually “own” that foreclosure anymore?

Oh Mike, we bought our SS 8 months ago still waiting for the deed. Title yes but no deed. Law suits abound!

I rent. I am a person too.

Josh. You are a smart person.

I know exactly how you feel.

California has a $25 billion deficit because houses are still overvalued. As prices for houses drop further, the deficit will increase even more because Californians will have even less money to spend and the government will collect lower taxes for the cheaper houses. Good luck California.

@NickHandle: That’s why Prop 13 has to get flushed down the f***ing toilet. It’s welfare in a different form.

If I buy a car & can’t afford to maintain it / use it, I have to sell it. Why is it that people who move into homes, and then run into trouble (either because of retirement, or raising home values) get a free pass? If a rising tide lifts all ships (home values), then it shouldn’t be a problem. Granny can sell her 900 sq ft shack for $650K and move into a retirement home. It’s not my job to subsidize her lifestyle of bingo and Marlboros.

I saw a house that was selling for 1.2 million dollars. In my opinion was definitely priced to sell and could fetch much more. This was a real mansion and not some cheaply made modern McMansion garbage. It was currently valued for tax purposes as being worth 120 thousand!! *That* is Proposition 13 for you!!! A factor of 10! Yes if the house is sold it will revalue for tax purposes, that one house is not the problem. The problem is houses just like this can be inherited and continue to be valued at being worth 1/10th of their market value indefinitely. Welfare of a different sort indeed.

After flushing prop 13 down the toilet, what would you replace it with? How much property tax “should” granny pay? Is your delusion that everybody is rich and should pay taxes that far exceed what you pay? Do you believe in roaylty and are part of the ruling class? Pretend to Hate the rich while punishing the poor? Please repeat first grade math class, then propose a feasable solution.

How dare those homeowners keep their own money! What an outrage!

How ’bout teachers pay something for medical insurance? How ’bout public “servants” not retire at 55 with 90% salary? How ’bout STOP SPENDING OTHER PEOPLES MONEY LIKE IT IS AN UNLIMITED RESOURCE?

WTF!

JRS, there are many exceptions in Prop 13. For instance, if the person selling the $1.2 million house is over 55, he/she can apply the Prop 13 tax rate to a new property they buy, as long as the new property is less than $1.2 million. So the tax revenues will not increase.

A reasonable property tax is legit, and Prop 13 is not reasonable.

Land is a public resource, even if it’s privately owned. It’s not like someone created land – it was here before we were! Thus, anyone on land clearly owes some land tax. Additionally, they gain benefits from government services that heavily benefit landowners: streets, sewers, utilities. These things must be paid for.

I don’t agree that taxes should be based entirely on market value. The market fluctuates year to year, but people live in houses for half a decade to a decade or longer. Taxes should be based on a formula that takes into account things like living space, lot size, usable land, access to service, market value, and so forth, averaged over a decade or so. You can add caps and floors – prop 13 had some good ideas.

As far as taking money from old people – how about we create a housing system for older people. If someone wishes to avoid rising taxes, they can live in government housing, and it’s not based on need. Anyone old enough can get it, and it’s paid for.

“…why is it that people who move into homes, and then run into trouble (either because of retirement, or raising home values) get a free pass?”

Because they were tricked into buying the home for the price they paid by fraud. Fraud at every level of the deal, from the appraisers and inspectors to the realtors. I have been a broker for over 30 years and quit working in real estate in 2005 when this kind of fraud was already running rampant through the system. I wish more power to those who were scammed by their realtors and mortgage brokers.

Hey JK2001, are you saying that non-landowners don’t benefit from street lights, sewers, and utilities every bit as much as landowners do? I’m not so sure such a sentiment can be rationally justified.

That said, while I like the idea that Prop 13 limits the rate of increase of taxes, it would have been far more wise to have tied it to perhaps the CPI or some similar measure of economic growth rather than arbitrarily picking 2%. That limitation is a key factor in what allowed the California bubble to grow to 10-15x local median incomes rather than the 6-10x most of the country saw. Now we see where it led: we are still the highest taxed state in the union and while grandmothers might not be getting kicked out their houses, young families are rarely able to afford to own their. Is that really any better?

Forget about Granny! Let her live in her house paying super low property taxes.

The problem can be fixed if we deal with commercial property! Commercial property rarely gets reassessed. More than 50% must change hands at one time into the hands of one person for it to cause a reassessment, it is well known and a ridiculously small percentage of commerical property has been reassessed in the past decade.

Disneyland (just one of the many examples) loves the stupid people of California. Under the cover of “saving Granny”, they screw 40 million Californians every year by paying 1978 (or whenever Prop 13 became law) assessments + the annual limit.

Americans are well known for voting against their interests, why should wwe change now?

Renters benefit from utilities, and they pay for them. If property taxes were raised, rents would rise too, and they would be covered. The bulk of the benefit of infrastructure goes to the landowner, though. Imagine if you owned some land – and then they built a road to it, or through it. That benefits the landowner by making it attractive to land developers. Likewise, when they add running water, it benefits the owner the most. Then, when electricity is added, again, the owner benefits. When sewers are installed, the owner benefits because s/he is the *owner*. The renters benefit only as long as they’re renting the property – but as services improve rents rise. Fees and taxes rise too – but I suspect they rise less than the value of rents.

Except that wasn’t how it was playing out when Prop. 13 was needed, And it was needed. At the time my recently widowed mother had three minor children and we were being priced out of our family home. The idea that we should have sold and taken the big bucks to buy another place has a problem. Where? If all of the real estate was being grotesquely overvalued, the only option would be to leave the state, our life-long home, entirely.

And all because of a stupid bubble. The real estate was overpriced then as it is now. On top of this, the state government was taking this rise in values as a new normal they used as an excuse to jack up spending. They did this again during the dot.bomb era.

Prop. 13 exists for good reason. If the voters are too stupid to elect politicians who understand that it was intended to curtail their excesses, you get what we have today. Without Prop. 13 you have gotten the same situation, just a little later. And apparently the voters are extremely stupid in this state. We just brought back the idiot whose policies drove the need for Prop. 13 in the first place. If I had a place to go I’d have already left CA. I’m just hanging around to enjoy the big shipwreck since the Titanic.

How about a factor of 40 between tax assessment and true value? $240k versus $10Million in Malibu: http://www.redfin.com/CA/Malibu/28730-Grayfox-St-90265/home/6856281

I would never buy a house in CA without prop 13! Without it we would be in so much more sh@t then we’re in now.

the thing you have to realize though is look at those pictures , the sun is shining ! , its the california dream , how can you put a price on that !

Sometimes the price is greater than the value.

The folks complaining about Prop 13 act as if they have nowhere to go and are “victims” of their rising property values. Why do they think it’s fair for new buyers to be stuck with an increased tax burden but not them, all for the same services?

Taxation is inherently unfair, yet they act like they are the only victims…they are not. I don’t have children but I get taxed for schools cheap instate tuition and medicaid anyway. If I have to pay that, legacy property owners can pay for the assessed value of their property. They can always rent, buy in a cheaper area or pay the tax. However, they need to pay their share just like everyone else does.

BTW, there’s a fantastic article on the RE meltdown in Money magazine on Ladera Ranch. Not sure if it’s available online yet…

The money article is located at: http://money.cnn.com/2008/05/01/real_estate/Regnier_Postcards_from_the_Edge.moneymag/index.htm

In my MSA which is Petaluma/Santa Rosa/Sonoma The big shadow inventory seems to be lurking above 400K so I see extreme price compression coming to the market over the next several years with the bulk of homes offered less then 375K but with tight pricing tiers say 350K to 348K being the same as 350K to 400K today. When I first started buying property back in 1976 the market had tight pricing ranges but during the 80’s and 90’s move up buyers began to distort the market with huge down payments so the mid to higher priced tiers became the norm maybe old pricing structure will return. The other issue is that as neighborhoods decline in price fixing up a house can be a huge mistake because the area can no longer sustain the improvement through higher pricing so we may be entering a period similar to the past were folks only maintained the house rather then poured money into various improvements which will have a major impact on the remodel market. Many foreclosure ads tout “bring your tool belt” as if running to Home Depot will get you a great house but it probably will not make any economic sense for the buyers to do significant improvements since they may never get their money out so the banks will have so radically reduce prices on these fixers in the future.

We really should have passed Prop 19. And the state should have backed it and encouraged everybody to smoke pot, and a lot of it. In fact, they should have given us stimulus money for pot. What would that accomplish? For one thing, we would be too stoned and mellowed-out to worry that everything is falling apart. Foreclosure would hurt nearly so much if we could numb ourselves though the process. And it would be good for the government, for we would be happy and docile as we let Wall Street and the bankers complete their transfer of wealth. And our stimulus dollars would certainly support restaurants, the fast food joints, for the entire state to have the munchies day after day, would practically guarantee to save the nachos industry and circulate the stimulus money through all the grocery and liquor stores. I mean what the hell have we got to lose at his point.

I don’t think anyone waited for Prop. 19. Somebody had to be smoking something to spend $510,000 for a 916 sq. ft. house.

Hilarious!

Opiates are the religion of the people. I mean pot is the opiate of the people. I mean, oh forget it, I’m too stoned to care.

Polo, Prop 19 probably would have easily passed were it not for the baggage the bill came with.

What murdered Prop 19 were provisions written it it that would prohibit employers from using marijuana on the job as long as they were not “impaired”. HUH? When you are toking, you are ALWAYS impaired.

People most likely would have agreed to legalize the stuff and let it be distributed on the same terms as liquor, but they were rightly opposed to a law that would tie employers’ hands behind their backs- and CA employers already labor under enough really unfair and oppressive regulations- without having to put up with employees who come to work wasted.

Your legislators need to clean the bill up and try again. Or, perhaps the law’s opponents, who include wealthy drug cartels and growers, got these noxious provisions included with the express purpose of killing the bill.

Nope. The reason it failed was because the anti-19 campaign made a concerted push to kill it. They appealed to Asians and Latinos – immigrants not steeped in 60s pot smoker culture. They spread FUD to stoners, who fell for it because pot makes you suspicious and paranoid of the government.

They also appealed to shame. People are ashamed of smoking pot. They are afraid to tell older people, their boss, or strangers. It’s something not just “shared with friends” but used to cement private, secret bonds. It creates shame.

Shame makes you do something, but then lie about it, and then admonish others not to do it.

I, not being an active pot smoker, found it was easy to tell people to vote for Prop 19. I don’t smoke pot, and supported the law, and told others to vote for it.

Unfortunately, for every non-user supporter, i suspect there were 2 pot users who voted against 19 due to shame.

Prop 19 was a hunk of garbage, mainly becuase it made it a FELONY for people under 21 using cannabis. WRONG, I will not victimize our youth at the exopense of more freedom for myself.

For anyone wanting FACTS and not government propaganda or bias untruths, try Granny Storm Crow’s list…..readily available on the internet. Cannabis is far more useful and truly is a plant of life for the earth, but puritan morality oppresses the “freedom” of America. God gives freedom, evil man oppresses it.

For the ultra religious, try looking up the word “kaneh bosum”, it was confirmed that the translation was incorrect, it does not mean “calamus” it means cannabis. The old testament Holy Annointing Oil called for bushels (sheckels) of FLOWERING CANNABIS.

Too bad you won’t hear good ol Chuck Smith or Rick Warren preach about that.

I once knew a neuro surgeon, and he once said something which I am reminded of now. When I see the above 916 sq ft. shoebox built in 1922 selling for $510,000, I think a person who would buy the house for that price would have (in the neuro surgeon’s words) “schitt for brains.” Schitt for brains! This market is complete insanity! Please, do not be a fool and buy something at these insane, rip off prices.

“schitt for brains” is hilarious except that it seems to me that even at these outrageous price points, if a persons buys today, can easily afford the payments on the price today and the purpose is place to live in desired location, 20 or 30 years from now that person may feel the Genius. Short term however, I think this market could tank another 25% or lower, back to the PRE-BUBBLE prices, Im thinking 1998.

You gotta factor in that a house that old probably has termite damage. Also, bathrooms don’t last more than 50 years, due to water exposure. If the toilet is original… it won’t be for long. I love old houses… but you have to be realistic. Houses wear out. They cost money to fix. If maintenance is delayed, you have to fix more stuff.

$500+ per S/F for a shack in Culver City, what a joke! I will be renting (happily) for the foreseeable future. Was thinking about coming back to CA, but a job in San Antonio sounds a hell of a lot better. Will be back in CA with a fat wad of cash in about 5-7 years, pick up a nice 4/3 in Santa Monica for about $300k. Good luck, will send a postcard from TX.

If there is an erathquake the house will be only $100K by the time you get back.

Hey TexBound, I may join you. Texas is nice. California is going to erupt into a bankrupt, impoverished, crime-infested hell hole. Think Rodney King type riots – actually much worse. And real estate in Californication is going one way, and one way only – DOWN, DOWN, DOWN (INTO A BURNING RING OF FIRE)!

As a real estate Broker in San Diego for 36 years, I can tell you that some property is moving – REOs sold to investors for mostly all cash., Including a growing flipper market. Yes, expect another price hit as interest rates rise with inflation but QE2 may bolster prices for a while as real estate becomes an asset against the falling value of the dollar. Think of the inflation after the Vietnam War and then the interest rate rise during the Carter years. It’s all happening again but this time without Reagan on a white horse to save us. Goldman-Sachs will run the country for the Chinese.

Who are the flippers flipping to? And what are these investors doing with these properties? Are they just sitting on them waiting for prices to go up. If so, they’re in for a long wait don’t you think?

I can’t speak for all investors, but if I find a good deal, I will consider buying. The stock market has ups and downs also, CD’s don’t pay anything, and burying gold in the backyard isn’t a good investment. Real estate is part of a diversified portfolio, even though it is not a liquid investment.

My current strategy is to buy wholesale at the trustee sales, or get a good REO deal, and then fix & flip, or rent it out. Expecting capital appreciation, isn’t going to happen in the near future. The fix & flip strategy is tough in a declining market, and as Dr. HB points out, the California economy, budget issues, and unemployment, all make selling a house difficult. Renting however is working for me, I have a good long term tenant, and am getting 8% ROI (Return on Investment).

As someone who’s been looking to buy in the Sunland/Tujunga area in LA, I can surely confirm that flipping is active and present. The HUGE inventory of forclosures/short sales aren’t even offered to people like me with stable jobs and 20% dwn saved. On many occasions we’ve even offered $30,000 higher than MLS listed prices only to find that the bank simply bypassed our offer and sold it for asking price to a cash investors. 2 months later these same house appear on the market for even higher than our offer. I don’t understand why the banks are playing this way. Anyway, we refuse to support this kind of flipping crap so we’ve practically stopped looking and are just waiting to see what happens. The sad thing is that people are actually buying from these flippers at asking prices.

Fred: for sure flip to whom! here is one for you.. back in Aug of 08 I looked hard at a REO that was listed for 372K but figured it would take 150K and much work to make it livable but some flipper bought it!!!@ that price and listed it in Sept of that year for 529K and pulled the listing in Feb 09. I passed by the house today and its empty looks as if nothing has been done!!!!!! here is the Zillow link for backup.

http://www.zillow.com/homedetails/4933-Hansen-Dr-Santa-Rosa-CA-95409/15872589_zpid/

02/24/2009 Listing removed * $529,500 — $339 Point2

09/16/2008 Listed for sale * $529,500 42.3% $339 Point2

08/28/2008 Sold $372,000 -4.6% $238 Public Record

I have been looking since we sold our house in July and have to say most of what is on the market is garbage. These homes are just sitting and when they do sell it is way less than the original listing price. As somebody posted this can’t do anything but drive prices down. I am going to make an offer on a foreclosure that is probably an $825K house (maybe) and thinking of offering $700K. If the bank takes it great. If not, I sit in my rental and try the next one that comes along.

What if I buy that today’s Culver City house with a 3.5% down, 4.15% thirty-year fixed mortgage, then add a second story with 2 more nice bedrooms and 2 more baths? I could rent it out for a full after tax positive cash flow? It would work out that in about 4 or 5 years I would get even before tax positive cash flow. And then just keep renting it out and hold onto it and make a bigger cash profit in about ten years. The extra rooms and extra square feet in desirable CC makes it work, right?

CHRIS: Regarding your response…Teachers can retire at 55yrs old, only when they have worked for 30 years in the profession. In the state of Califorina teachers do not collect their full Social Security benifits. They are not intitled to receive Social Security benifits from their spouses. Teachers on avaerage usally pass away 16 months after retiring..Gee, could it be stress? BTW teachers do have to contribute to their health insurance. We all rememer the “Good Old days in school” When was the last time you sat in a elementary or high school classroom? Go to low income or high proforming schools and observe what the teacher and childern now have to deal with. It’s a different world. When did it become a bad thing to want to educate, inspire and protect the next generation?

Anyone who buys a flipped property is NUTS! I have heard horror stories, now have seen one. A house down the street, siding opened up with insulation exposed and along comes a big rain storm. A few days later siding was replaced.

I know that water saturated insulation can hold water for a long time and in S.D with its humidity who knows how long? Can you say MOLD?

Who knows what expenses are awaiting buyer, hiding underneath that coat of new paint?

People will do unbelievable things for money, not disclosing an issue that won’t be discovered for years is very easy for the money hungry.

Some of these flips are really bad. One just came on the market in Long Beach (90808) that a contractor bought then worked on. Long story short – the living room he built in the “open floor plan” is about as big as a closet in a nice home. I seriously can’t see anybody buying this thing. Although they did do a nice job of hiding the size of the living area in their photos.http://www.zillow.com/homedetails/4752-Blackthorne-Ave-Long-Beach-CA-90808/21184125_zpid/

Flipping is active and rampant in Culver City and in Huntington Beach, too !!

I don’t post here very often, but am an avid reader of this blog.

I’m posting today to respond to the post about getting rid of Prop 13. To which i say, “Are you high off your ass, sir?!”

California has a spending problem. Can you imagine how much more in debt the state would be if EVERY house was re-appraised at bubble values?! The damage was bad enough due to all the bubble sales, it would have been much, MUCH worse without Prop 13.

Wake up people! The politicians will always spend every penny they collect. They don’t think about rainy days…they don’t plan for recessions. They just spend as much as they can to buy votes. And thank god, Prop 13 limits that.

Because you know what? Recessions do happen.

People would rather protect the illusion of the possibility that they may someday be rich, than face the reality that they are, in fact, poor (or maybe just middle class).

Prop 13 is nothing but a way for established landowners to avoid paying their fair share in taxes.

California should lower income taxes and raise property taxes immediately. This will take some of the burden off the middle and working classes, thereby increasing spending and helping to jumpstart the economy, while simultaneously forcing the more affluent to finance the society that has benefited them so nicely.

Leave a Reply