Culver City welcomes back home flippers – A 791 square foot purchase that brings back the HGTV days to life. How to double your money in 6 months.

Psychology is such a powerful force in real estate that it cannot be underestimated. The will to turn a profit for very little work was at the core of the housing bubble. Most people love a get rich quick idea. This is the fuel that keeps the lottery industry and casinos humming along. Most of the housing shows have subtly shifted to the insane Canadian housing market but what is comical is that the cable shows go out of their way to obscure the city name (and country for that matter) thinking most Americans would simply miss the fact that everything is taking place in an entirely different part of the world. Ignore those funky looking “dollar bills†folks. Yet I’ve been seeing a lot of action now of flippers edging back into the market. Today I wanted to provide you with a taste of a very successful flip in Culver City.

How to double your money in six months

Square feet:Â 791

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Undisclosed

Culver City, CA 90230

I wasn’t able to track down the address on this place from the initial listing but we know from the ad and the pictures that this was a fully remodeled place:

“Fully remodeled house with front/back yard and plenty of fruit trees. The upgrades include copper plumbing, new roof, new hardwood flooring, new kitchen, fully remodeled bathroom, new windows and doors, freshly painted.â€

Someone has been paying attention to their HGTV 101 lessons. Hardwood floors and nice lighting. From these pictures, you wouldn’t know this is a 791 square foot home in Culver City. They also did a good job in the kitchen:

Yeah baby! Granite countertops and stainless steel appliances. This tiny place was done right but more importantly, whoever picked up this home got a crazy low price in October of 2011:

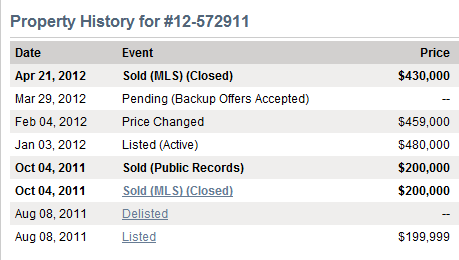

I dug a little bit deeper into the history of this home and actually found it:

List price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $200,000

12137 Culver Drive, Culver City CA 90230

Square feet:Â Â Â Â Â Â 791

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

From the ad:

“This is a lot value only. The house is not in livable conditions. It’s a tear down with major structural damage and water damage. The buyer to hire a general contractor and check with the city of possible code violations. The property is located in the City of Los Angeles with a Culver City Zip Code.â€

A lot depends on how much it cost to repair the place and bring it to its current condition. Ultimately, they bought the place for $200,000 in October of 2011, did a complete remodel on a 791 square Culver City home and sold it for $430,000 only a couple of weeks ago. So on paper a $230,000 profit was turned but of course you need to factor in repairs which seem to be high on this place. Overall, I think these flippers did very well but it tells you something more about the market. People are driven by visuals and have a hard time understanding the math.

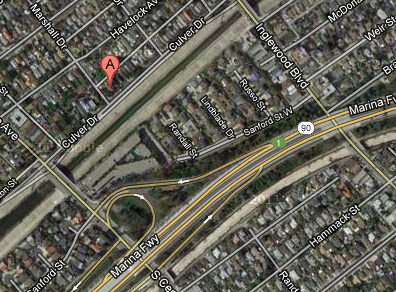

This place is very close to the freeway:

The fact that flippers are back in the market should tell you something. Mid-tier markets are still overpriced. I’d be curious to know how this place was financed given that FHA insured loans are now much more expensive than they were only one month ago. I doubt someone with a large cash pool bought a 791 square foot pad near a freeway. The winners here are clearly the low-ball investors. Take a lesson from them and that is you win by purchasing real estate at lower prices.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “Culver City welcomes back home flippers – A 791 square foot purchase that brings back the HGTV days to life. How to double your money in 6 months.”

DR HB, ANOTHER GREAT ARITCLE. In my area (Ventura County) the flips have seemed to have slowed down. Word from the REIT is that the auctions have been dry for cheap homes. The banks have been playing hardball, so I’ve been told.

That kitchen is nice. HGTV has been pitching just paint the cabinets white, and I’ve seen a lot of overpriced “just do the cheapest “lipstick” homes lately to back it up. Fwy homes are dreadful. Remember guys, cloud cover or morning dew is the best time to hear the real noise of the backyard and interior with open windows. They can keep a traffic noise home. No acceptable lifestyle, and lung cancer risk. No thanks.(100 yds within a fwy, but I bet it’s more.)

I have seen many flipper homes on the market, and they are always there. Buying a home to flip it takes expertise, capital, and resources. If someone standing on the steps of court house pays cash to buy at auction, and fix the house. He or she is entitled to earn a profit for their capital and work. Most of these flipper houses are orchestrated by real estate agents as they have the connections in the business. Also the market is dysfunctional. Just like the HFT in the stock market.

Indeed, this is EARNED profit (if any). I consider this case REHABilitation, NOT flipping. I have done the former, never the latter. I always leave the neighborhood improved. I’ve lived in 2 of my projects. If peeps can’t spot the slap-dash “lipstick” jobs, you can bet a Real-tard will be right there to rip them off.

In this particular case, the neighbors should erect a small shrine to the rehabber… and consider implementing something called “Code Enforcement”. ;^)

agreed. the world “flip” puts a negative connotation because in this case the “flipper” added value to the property and the rest of the neighborhood

Define, “fixed.” In my estimation, they did the bare minimum. What you are seeing is a veneer of newness. The cabinets are cheap, (Ikea grade garbage designed to look fresh and clean to the undiscerning and credulous), the floorboards look like laminate, the granite/stainless rage is right up there with the formica/avocado colored appliances rage of yesteryear and the structural integrity has more than likely been approached with the least amount of effort (liquid wood anyone?) required to pass muster with the code inspector. It’s the same garbage it was before, but now it is fresh garbage.

I watched a new flipping show Saturday night starring the guy from Survivor, Russell Hantz. This is possibly the worst flipping show I’ve ever seen. Russell admits he knows nothing about flipping houses, but since he was such a great “survivor” that this should be no problem.

Only, it was nothing but problems for he and his brother, who is ten times as dumb as he is. I don’t know if this show represents the beginning of a new round of flipping shows, or if this guy threw out one hell of a pitch to the brass at A&E and they ate it up.

http://www.nola.com/tv/index.ssf/2012/04/survivor_weasel_russell_hantz.html

It will be my extreme pleasure NOT to watch this show.

“stupid is as stupid does” Go for it Cali, $550 a sq. ft. for a glorified apartment. Your monthly payment, including all the BS (mortgage alone $2000), on a FHA would be close to $3,000 a month. But it is all yours, and when the riots start you will be just peachy…

Doc, technically this house is not in Culver City jurisdiction but in City of Los Angeles neighborhood called Del Rey, although it shares a zip code. This small pocket west of 405, south of Culver, north of 90, and east of Centinela, is a mostly latino neighborhood with narrow lots and very narrow streets. There is also the Mar Vista Gardens housing project that has some heavily tattoed residents. Del Rey had a lot of gang activity, Venice 13 and Culver City Boyz, battling each other, although it has calmed down last 10 years.

About a year ago, a friend of mine was visiting someone in that neighborhood. When they tried to leave, all the tires on their car has been slashed. This place may be west of the 405 Freeway, but the area is definitely not safe.

$544 per square foot!! Unfreaking believable! House looks nice but for that price it’s just ridiculous.

You have to applaud the flipper for the flip. The flipper must’ve found a buyer who thought the real estate market is bottoming out and if they don’t buy now they will be forever priced out of the market.

Between January and April, the flipper did cut the price by $50K, or about 10%. So for a mid-tier area, there was clearly no bidding war going on. That being said, I am familiar with the area and the area is the bottom end of the mid-tier areas. Culver Drive is a medium heavy traffic street, not as bad as Venice Blvd, but definitely busy especially during morning and evening rush hour.

Well, we all know what they say, there’s a sucker born every minute.

Interesting that this article is here now. I am seeing a number of houses listed these days that are clearly flips. Last sale in the fall of last year with current price 10s of thousands and as in your example into six figures higher. Pasadena Weekly lists sales for surrounding communities. Prices are all over the map. Some sell for way more and some for less than bubble era and earlier times. Several have the last sale date often within the last year garnering 10s of thousands in gross for the flipper. Occasionally you’ll see one selling for a loss on the flip. I find it frustrating as someone looking to buy who would rather pick the upgrades myself and do some work with the heavy lifting going to a contractor. The flippers have an in with banks and realtors and get the deals. I would only buy your listed house as fixed up for the 200K Oct price. Not worth over 400K.

I could not agree more, I hate the white washing and the qucik and dirty flip. Especially in a character homes, they remove all the character to make it a cookie cutter with granite, that tiresome travertine and the same old Home Depot cabinets.

Yes, the Home Depot special. I usually tell whoever is around that “It looks like Home Depot pucked”.

Crude be factual.

I’m still waiting for the avalanche of houses to hit the market now that the banks are free to process their foreclosures and get those REO’s out there on the market. Trickle down is now at an extreme and the retail real estate market it eating it up. If anything, this will fortify the banks methodology of keeping inventory as low as possible for as long as possible.

CAE

I drank that “the shadow inventory” kool-aid for a long time. Then I read about the bulk REO for rental deals, and I lost hope of any real choice. This market is rigged for sure.

I’ve watch a few HGTV shows (online) to get the jest of them. I am so happy we got rid of TV 20 years ago. Even our buyer’s broker quotes that time waster HGTV as some sort of real estate guideline venue.

I hate most flips. Yeah, I love some of the finished product, but most are an expression of someone’s elses taste for a ridiculous profit, and they seldom address the “bones”.

Flippers are a menace to us value buyers, who want to reflect our own taste, at a reasonable cost. We’re looking for a home, not a “showplace”. Been there, done that.

Real estate investors are now in a feeding frenzy. It has become clear that inventory will remain very low while interest rates are at rock bottom levels as well. This makes it a sellers market as most home owners are underwater and cannot sell into this market.

Banks control inventory and they cannot afford to sell very much at any given time. This is probably how it’s going to be for years down the road.

Looks like the flippers made some money on this, but they also put a bunch of their own money into fixing this dump. Turning a crack house into a pottery barn special takes some dollars. I can only imagine the cosmetic stuff was by far the cheapest to fix. New plumbing, electrical, hvac, roof, structural issues, probably mold abatement can really add up.

So some fool paid 430K for a sub 800 sq ft place right next to the freeway. What will this place be worth in 5 years? 500K, 600K…I would guess 430K or less. We won’t see any meaningful appreciation for years to come.

One pricing reduction and a three-month turnaround isn’t bad for this area. I’m glad to see the ‘flippers’ made a profit, even in spite of their near six-figure remodeling budget.

The key, obviously, is not to pay too much for a property to begin with. Generally, I’ll have to find a seriously-distressed property that nobody else wants to touch before even making an offer. Otherwise, there are too many HGTV-trained ‘experts’ out there to compete with–they tend to over-inflate the price if it’s only a paint-and-carpet remodel…

Wow the original listing for the home was pretty blunt – tear it down and start over. Rarely do you see such an honest description. The remodel looks great, but I doubt it was torn down. There is probably water damage hiding behind the shiny new appliances and backsplash in the kitchen. Hope they got a good home inspector!

Exactly what I was thinking…

you got it, I bet if you looked at the bones of this home it is a walking bacteria farm. I bet the realtor choose the home inspector (wink, wink).

Have a look at the pictures again. Look at the height of the gable over the 82″ tall door of the original garage/apt. Now look at the height of the gable over the new 84″ tall garage door. Notice the extreme difference in height of the compared gables.

This home has new trusses probably with the 13 1/4 inch energy heels. I’d wager this home has one foot of blow insulation in the attic where for 100 years previous it had zero . I see new energy rated windows and doors installed. this reconstruct is probably tested and certified to be energy rated of which the new buyer may enjoy a government subsidy.

They took the whole roof off this house. This home was opened to the blue sky. In my mind if I’m going to tear the structural top off the sucker I’m going to take care of it all. Mold / termite / rot abatement at this stage is cheap. You remove the effected wall or floor members and into the dumpster with the rest of the crap and replace it.

From the pictures alone I can see what they have done. I’d imagine that they did more than I have mentioned, but I can’t certify on what I can’t see without an onsite inspection. A guess would be that the exterior walls were inspected for structural integrity, insulation value , a vapor barrier and electrical systems integrity. The foundation and the floor systems inspected and found or rehabed sound as well.

It’s obvious from the picture that this flipper cared enough that the trusses were structural and have an energy heel that will facilitate a full fluffy foot of insulation from outside of framing to outside of framing with a 6 mil poly vapor barrier. If this flipper cared to do this much he probably covered the rest of the issues.

But if you can’t see these things for yourself. Hire an inspector.

Dr. Love you blog but must take position with Matt. This is not “Culver City” but the city of Los Angeles. This home is not in the Culver City school district, which helps to drive up the prices on these simple “Vet” homes. Yes, it is now the season of the flip. With a few years left to go on our bubble it is great investors are diving in. We just want to make sure when they purchase in a Short Sale they purchase as a natural person. Banks hate investors.

$$550/ft in the Barrio?!! Plus taxes and insurance?? Come on Man!! What kind of household income does that require? I’m from LA, (East side), and people/buyers are their own worst enemy. Fear must be driving this purchase.

$555/sqft for a 2×1? Pfft! Try $799/sqft.

http://www.redfin.com/CA/Santa-Monica/2343-Oak-St-90405/unit-3/home/6766112

Price it like it’s 2005! You know what they say, “location, location, location.” Lol…”All of the comforts of a house without the expense!” Wait, this isn’t a SFH? lol…

I feel so badly for people still playing the RE games in SoCal. To pay over 400K to live in tiny house in a marginal neighborhood is unbelievable to me compared to what lifestyle that money would buy in other parts of the US, but it seems weather, surf and ski, celebrity culture, etc. are worth the struggle for millions, and they stay, proclaiming they could never live anywhere else. I’ve met many nice, educated, interesting people elsewhere, and no, everyone is not a redneck, racist hillbilly once you leave LA, honest and truly.

We Don’t Make Those….

Thank you. Living in the epicenter of a third world conversion, I agree with you. There are parts of the country we would love to move to, but a parental unit is still kicking & *itching, and needs our help. If she “transitioned”, we’d be gone. There are moms, and then there are incubators, like mine.

You sound like a terrific person, Mom is blessed to have you. I know how tough and emotionally draining the RE market can be. Best of luck to you and your family.

We don’t make….

Thanks for the nice compliment. I just sponsored/organized/held a puppet show and talent show (separate days) for some anchor kids with prizes, treats, and time (I didn’t really have) where we are living (while we home shop) and a lot of the kids had no gratitude (complaining I didn’t buy them great toys), so your comment really made me feel good. We need a home. I miss my piano. I was really starting to show progress.

This housing market sucks. Where we are living, I had a dead rat on my car a few years back for requesting the kids pick up their trash. We need a home and this inventory

is just the pitts. If we wanted a two-story, we’d be in it already.

$430k for 791 square feet. Granted, I don’t live in the sunny Californian climate, but I paid less than half that for a house 2.5X as big (and brand new), with a huge yard. And, I have a great neighborhood and superb schools. I don’t understand Californians, I really don’t.

You think Coastal Cali is unbelievable try Manhattan.

What will be the end game for this house. Sub 800 sq ft, marginal neighborhood, next to the freeway, etc. The home sold for 430K. No matter what, I can’t see this place appreciating in value for years to come (probably this whole decade). I sure hope today’s buyers aren’t counting on increased home values anytime soon!

Thanks, I’ll keep renting my 800 sq ft apartment a block for the beach.

The flippers are at it in my neighborhood in north San Diego county. A house in good shape that just needed some updating sold for 320k in December 2011. Someone did about 10-15k (maybe) of remodeling on it, and it just sold last month for 380k. I guess some people are willing to throw 45-50k away to let someone else remodel their house.

SnackyCakes, herein lies the problem. Your average person couldn’t have bought the house you mentioned. I’m sure this was a distressed sale and flippers probably showed up with all cash. That is what irritates me most about this market, your average buyer (20% down, excellent credit, good income) CAN NOT compete with all cash offers for “the good deals.” If you need to buy a house now, you will be forced to pay more and live with someone else’s remodel choices.

Exactly. And then it screws with other comps in the neighborhood because now everybody thinks their house can sell for at least 380k whether it’s remodeled or not. In a different section of the neighborhood there are two identical floor models. One is listed for 290k; the other was recently remodeled by an investor and is listed for 360k. I’m very curious to see what they each end up selling for.

This is absolutely true. We’ve been trying to buy for the last few years. We tried to make an offer on a few reasonably priced properties in OC and most of the time the agent’s voicemail box is full and even when I leave a msg I rarely get a call back only to be told that they already have an offer but feel free to make an offer just in case. I’m tired of waiting but it seems like I can’t buy a reasonably priced home unless I have all the right connections.

The whole market saddens me deeply. I was gave up finding an affordable SoCal home years ago when prices climbed to insane levels. I asked, “how in the world can people afford this?” A few years later I was vindicated, they could not afford the homes they had purchased, yet their mania drove prices sky high and drove me out of the market.

Last month I put a bid in on a property at a condo complex that I have been looking to buy in for years. This unit was a fixer that fell into the sweet spot of my affordability provided I could come up with a 32% down payment since I am self-employed. I had enough to swing the down payment and put 30,000 into a remodel, doing a portion of the work myself. I bid 5000 over asking. Sadly, a flipper bid 6000 over asking and made an all cash offer. Not surprisingly the seller took the all-cash offer. My huge down payment and perfect credit score meant nothing.

In four weeks the unit was back on the market with a so-so cookie-cutter remodel and priced at $114,000 more. They could not have put more than $30,000 into the remodel. That’s quite a tidy profit in one month and once again I am priced out of the market because I refuse to buy a home that is beyond my budget as so many people seem so willing to do. Thanks to the flippers snatching up properties like this for all cash I am still a renter, while they pocket the profits and move onto the next flip. Maybe I’m the idiot? I guess I should be in the flipping business.

I’m a bit of a real estate ‘bottom feeder’ – I seem to have a hobby of perusing the low end of MLS listings in Los Angeles. I’ve noticed that the majority of reasonably priced (I hesitate to call them ‘cheap’) listings state things like: “Cash offers only”, “Building will not pass inspection”, “Not eligible for financing”, “Investor’s opportunity”, or “Needs lots and lots of TLC”. There is rarely a property in this price range that is being marketed to first time homebuyers, or as a straight sale. When there is, it disappears off the active MLS very quickly. I’ve been waiting out the market for about 8 years now and, though there are supposedly millions of foreclosures, affordable properties continue to be in extremely short supply (unless you don’t mind living in Watts or Compton!).

I haven’t attempted to buy anything for a few years, but I imagine there are still bidding wars going on. There was actually one ‘engineered’ by flippers in Highland Park last year. They deliberately listed a remodeled Craftsman bungalow at $100K to get people into a bidding frenzy. I don’t know what that property ultimately sold for, but I’m pretty sure it was nowhere near $100K.

If I had $200K cash I might do the same thing, but how many people have that kind of cash on hand? I just want to buy a simple house to live in and spend my money fixing it up instead of paying ever-increasing rent. What ticks me off about flippers is that they are part of a system that is keeping homeownership unavailable to people like me. Of course, ‘people like me’ wouldn’t be constantly shopping the bottom end of the market if it wasn’t for banks being so stingy about lending to self-employed persons. The amount I pay for rent would easily afford me a mortgage payment on a semi-decent home in an okay neighborhood, but banks never seem to see it that way. I am so sick of being a renter!

I think you touched on a number of issues of this housing market that don’t get discussed much by the doc. Those cash only sales are reflections of dysfunctional market. Under normal circumstances, buying a house for most people requires bank loan. Bank doesn’t want to lend to anyone today, unless the customers have pristine credit history. If you try to get a loan today, the bank needs you to almost get a colonoscopy to make sure you can pay back. They don’t give you a loan unless the house is officially inspected and appraised. This Is a complete system at work. This housing crash is big one, and our government, central banks and all others in power are trying everything to save it. They have succeeded. Don’t forget they make the rules we live by. So the market is not friendly to the little guys, and it never has. Therefore, if you need to buy a place you need to do a lot work yourself, and you will have to get to know the neighborhood and values of the houses.

Good news Pete. I had no idea there was a gold mine in my colon!

I’ve also been told that I’m a “bottom-of-the-barrel” explorer, and when I’ve found livable (but not totally beautified and granitized) opportunities, they evaporate in one day after being listed as a short sale on the MLS or being auctioned off to investors for all cash. Now, with the government planning to sell vacant homes in bulk to investors, those who actually have the 20 percent down and have their stuff in order will have an even harder time purchasing. Cash is king nowadays, and you sometimes wonder — is the cash clean or laundered?

I agree with you completely. The flippers are entitled to make a profit, yet their all cash offers make it impossible for someone on the budget end of the market to step into a home. The system seems tilted against people like myself who have saved for years and have a perfect credit score

Someone asked why people continue to pay outrageous prices to live in California. Because I was born and raised here, it’s difficult to leave friends and family and everything you’ve known. The longer you stay, the deeper the roots you’ve set here. One article about a specific house doesn’t accurately describe the wonderful things about the state.

We will continue to rent until prices are stable. By then we’ll have a sizable down payment and can probably pay cash for a home. Otherwise, we’ll just continue renting and saving for retirement. Sometimes being young and having the ability to move does outweigh being anchored to a home, no matter what the price.

I’m a CA native and I feel the same. There’s no place like home 🙂

I used to feel that way, until I decided that the asylum of familiarity is both a charm and a curse — and not in equal parts.

Southwest tickets are cheap. For what you would save by voting with your feet and buying in a different part of this beautiful country, you could probably afford to visit home every month for a long weekend for the rest of your life. What’s more, your visits would probably be a more dynamic and active experience of the city than how you experience it now as a resident.

Don’t let those State lines fool you…California is really just another way of saying that Westernmost portion of America. There’s a bit of California almost everywhere across this land.

Ah yes, Culver City is the once again the up and coming neighborhood. It is still surrounded by Del Rey, Inglewood, mid City and Palms as far as I remember. But what about the “Art Scence” and all the restaurants, Metro, schools, police, blah, blah blah. Culver City has been and always be for people trying to enter in the Westside Housing Market and nothing more. Only problem is, people getting into it now, will just be trapped in one of the least desirable areas on the Westside for 10 years before seeing any appreciation. .

http://www.westsideremeltdown.blogspot.com

People keep suggesting no appreciation in ten years…that is awfully sunny. I think this place has peaked. There won’t be any appreciation for a lifetime or more.

Where can I find someone to remodel a fixer I actually want to live in once it is complete? I trust contractors about as much as I trust realtors.

I want to remodel a 1400 sq ft. condo from the ground up. It needs a major renovation but I haven’t a clue how much that will cost.

Find someone through your neighbors’ referrals. If your condo is old, hasn’t any of the other units there remodeled? Ask those owners.

I re-did my entire condo (it’s rented now), about 6 years ago. Kitchen was IKEA cabs, mid-range appliances. 2.5 bathrooms I put in ready-to-go vanities found online and on Costco.com. Laminate and carpet for flooring. If you are very careful and manage the job yourself, hiring contractors for each step instead of hiring a General Contractor, you can re-do a kitchen and 2.5 baths nicely for about $35k or less. I splurged on fancy granite. You can get a basic granite for less.

You can do paint yourself. You can assemble and install the IKEA kitchen cabs yourself for a huge savings, or have their recommended installer do it for you – it takes a day.

Most of all, you need to get on GardenWeb in the home forums and read, read, read to get ready to do this. Remodeling is harrowing and exciting at the same time.

Even worse than the 90, is it is a block from a massive public-housing complex, and the other surrounding structures are pretty grim. You’ve had a couple of places in that neighborhood, one I remember was on Culver Dr, just northeast on the opposite side of the canal. Same situation: Nice place, but same awful hood.

“thinking most Americans would simply miss the fact that everything is taking place in an entirely different part of the world”

I noticed that on that show with the two brothers that flip houses. They never say what city its in, and its obviously Canada with the slight accents and sky high prices. Also everyone is polite.

Lord Blankfein, I agree.

we just want a nice $325k house (3 bed 2 bath) in Ventura county area, maybe a bit dated and run down but a nice start. Instead all there is are a bunch of houses with “updated” kitchens all new appliances, new hardwood floors etc and we get priced out of the market due to all the flippers and people who won’t let go of the $100k they sunk into their over priced house when the bought at the peak. Cant we just have a decent house with an ugly interior to start?

Briannerd & Lord& Heathen

Spot on. We have been looking 3 L O N G freakin years in Ventura County. We just want a fairly priced home without a flipper’s taste redo, and we’ll go what we want at 50% less than they’ll charge, and it will reflect us. I hate flippers with a passion. They don’t add value, they distort the market, and make life hard for us average buyers.

Previously bearish bloggers are now buying. WarchestSM of Santa Monica Distress Monitor has just purchased in nearby Culver City. Also hear that bloggers in New Jersey, Seattle, Portland (OR) AND San Diego has also recently purchased. Hmmm…are these the canaries in the coal mine/the early bird that gets worm that know things that the rest of us don’t? Let’s explore further and discuss.

it all depends on how you view the world. we have 10% unemployed without jobs. there are 90% actually employed, and they have jobs. life actually goes on. housing is different asset class from others that everyone will need one regardless. you will have to pay someone to live in a house, either to a landlord or a bank. the old saying goes ‘there is always value under the roof”. you will have to make your own decision to reconcile the value in your own head and the value out there on the market.

The oft – stated official unemployment rate is widely acknowledged to be roughly half the actual number, due to the high rates of people who aren’t counted in the stats anymore as a result of their dropping out of the labor force altogether, as well as those who are considered to be “underemployed,” aka those who have taken jobs paying much less than what they were previously receiving in compensation. So right now the trendline argues for much more of the same of what we’re seeing right now. There will always be pockets of real estate where the macro factors will not be in play, but in many cases the current market woes will continue until the underlying tenets improve.

Sources for that statement:

http://www.zerohedge.com/news/why-you-shouldnt-trust-tomorrows-bls-number

Pete – “we have 10% unemployed without jobs. there are 90% actually employed, and they have jobs.”

Where the hell are you getting those numbers? Cuz the gov’ment and media told you so? The real unemployment rate is closer to 20% – over 20% in California. Don’t believe me? Try a little experiment. Run an errand to Costco or Target during the middle of the workday – it’s like the weekend down there. You’re better off going in the evening – no one will be there. Is everyone else running errands down there on their lunch too? Doubt it unless they went home first to pick up grandma, grandpa, the spouse and kids.

The early bird gets the worm/the canaries in the coal mine connote two vastly different fates.

The “bears” to whom you refer probably just capitulated to the enormous pressures from their wives or grew sick of the starring contest.

I would say, if you can be patient, then be. Patience in this environment has real dividends.

Remember — the early bird may get the worm, but the second mouse gets the cheese.

If you Google map it, technically it’s pretty much IN Marina Del Rey, with a CC post address. Not a bad area, really. Probably the worst home on the block, due to its postage stamp size. And not up against the freeway – it’s on Ballona Creek. You can take Ballona Creek bike path to the ocean.

Fantastic flip job – kudos to that person. IKEA kitchen cabs for the win!

Also, HGTV has been buying Canadian shows for a long time – they are cheap.

I know this neighborhood and that street quite well. It’s not the worst of barrios but it’s still dumpy and a place like that is out of place. There’s all sort of shady characters hanging out on the street and the bike path across from it after the sun goes down.

It’s not next to the freeway but it is close enough to make for easy access. MdR, Venice and Playa are all very close-by so it is a win for proximity. But still, it’s crowded with low-income buildings and who wants a nice home amongst all of that?

I believe this house is an early sign of where this neighborhood is headed. I’ve been taking note of several early stage gentrification factors going on here in the last year.

You’ll have to add the cost of a burgler alarm service and the high theft insurance that will still happen while the alarm is going off and the cops are minutes away.

Change of subject here: What are your views of the Federal California housing bailout, and it’s effect on preventing more foreclosures?

This pretty much reflects what I am hearing from the real estate investor groups. They are in a feeding frenzy because they have begun to realize that banks will only trickle out inventory for the foreseeable future and most home owners cannot sell due to be underwater on their mortgage. So the investor groups are grabbing up everything they possibly can and either flipping it or renting it out and waiting.

The bottom line is that interest rates are very low and there are fewer and fewer homes for sale. This makes for a sellers market. And that seems to be exactly what is happening. This is the ultimate market manipulation.

Calling this home “next to the freeway” about as disingenuous as saying living in West LA is living “next to the ocean”.

Shows how biased some people are here. I guarantee you can’t even see/smell/hear the freeway anymore from this house than from a house 5 miles away.

The 90 freeway isn’t that busy either… It is on a fairly busy street though. That downside I’ll give you. But to most normal people.. Living just far enough from a freeway that you can’t see/hear/smell it, but can use it to speed up your commute is the best of both worlds.

I looked at a map again to see exactly how close you were to the freeway. It looks like about 1000 ft away from the 90 Marina Freeway. You’re right, that’s not that heavily traveled (probably in the tens of thousands of cars a day).

However, one other thing I did notice was that it is about 1 mile from 405. I would guess that section of the 405 has in the hundreds of thousands of cars pass through everyday. Even being on the correct side of the ocean breeze, no thanks…that’s still too close. I’ll let you guys fight over the next available house in this neighborhood.

This house is .2 miles from the on ramp across the street from an aqua duct or some man made built water structure… I’d prefer to be a few streets tucked into the adjacent neighborhood personally.

I live .4 miles from an on ramp. I live in a quite neighborhood at the end of a cul-de-sac… .4 miles up hill from the freeway. I have zero ill effects and all the pluses of living close to a freeway for commuting.

To each his own…

Yea the 90 is a really nice drive, out across the Ballona wetlands. Not at all a freeway by L.A. standards. The 10, the 405, the 210 etc. THOSE are freeways. Most housing within L.A. is probably within a mile of some real freeway or other.

This home is too close to trouble.

After the Affordable Health Care Act is overturned in its entirety by Scotus, add to that the forth coming acquittal of George Zimmerman, the Baldwin Hills neighborhood along Crenshaw will be in flames from the riots. I saw the agitator Sharpton was at the Christian Center at roughly Crenshaw and Jefferson a week ago. This neighborhood will explode and your property values are going to plummet because of it. It was hit in 92 and when it’s hit a second time investors will flee the area just like they fled Watts and Compton.

This Culver City house is too close to trouble. These buyers bought a product that is way overpriced and headed nowhere but into negative equity territory. And the riots will add one more reason why it was a good flip but a stupid purchase

Flippers are scum.

Why are they scum? This flipper took a tear-down and rehabbed it so that it’s the nicest it could be for the tiny thing it is. A lot of work. Why not get paid for the work? Nothing wrong with profit.

Regular folks could not have done the rehab – no experience and no funds to do it. Plus a buyer would have to live elsewhere while the home was being made habitable. So in this case everyone wins. The whole neighborhood wins. I love it when I see an old home or old commercial building being remodeled in my neighborhood.

yeah i want that shiny piece of crap in a gang infested $hithole hood.

flippers are scum. so are “rehabbers”

I hear those renovation construction sights can be real dangerous. It would be a real shame if something terrible happened to one of those flippers. I’m just sayin’…

I hate flippers too. Along with shady RE agents and scummy mortgage brokers and despicable bankers, you’ve got the disgusting flippers. Get rich quick types looking for easy money. They helped drive the bubble and now they’re back doing it again. Anything to make it impossible for normal working people to own a reasonably priced home. Flippers obviously help to drive up the prices, since all they care about is money. Flippers are like mini versions of Lloyd Blankfein; corrupt, despicable, worthless human beings.

Wow, the animosity about flippers…

I don’t know the California market but here in Tucson Ariz, for the most part, those that stick their neck out to buy a distressed property EARN what they make with all the uncertainties of remodeling. In many cases, the investor is just trying to clear 10-15K after all expenses are tallied up.

My husband and I have rehabbed a number of properties that were not financeable due to their condition, worked very very hard, took alot of risks and made a modest living.

We no longer do it after he hurt his back on the job site (again the risks).

I guess the california market is different. I don’t see anything like what you resent in this area, bigwigs coming in scooping up property that otherwise owner occupied would acquire, slapping on some lipstick and reaping huge profits…

I might add that there are title problems with alot of the bank inventory. Yet another layer of risk.

And I might add that after we have worked hard, taken risks which may or may not result in profit, we have produced a property now eligeable for financing and thus most people in the buyer’s market who do not have a chunk of cash to risk.

That’s what 203 (k) loans are for.

Flippers add no value, they only add to the distortion.

And remember that capital gains taxes must be paid on the profit.

Interest rate is at historically low. We just hit a new low again this week. 30yr fix is now only 1% above inflation rate! The inflated house prices do not get deflated quickly because of that. Today buyers don’t think about their future buyers will have to borrow at a much higher rate, hence, the price will need to be lower to be in the same level of “affordability.” Today buyers don’t think ahead about they likely need to sell sooner than plan due to loss of job, long term illness, family situation changes etc. Real estate is a very illiquid asset. It is the best financial trap set up for us. It is very easy to get in, very painful to get out. Especially there is the 3% down payment option on top of artificially low rate. True investors wait until interest goes up just a little bit. Once everyone realizes that the interest rate trend will be going up, house prices will goes down really fast after the initial jumb as everyone starts thinking forward and see the long term reality of real estate.

Think about it, if real estate today was such a good investment, why there is so much involvement from the Fed?

…Gamblers always think that they are investors.

There are four or five small 1930s spanish style homes on Edingburg between Beverly and 3rd that have been completely razed and rebuilt as two story homes recently. Several others under construction. Looks like flippers here as well. Haven’t really seen prices decline much in 90036 or 90048. Don’t understand why since the schools absolutely suck.

Real estate depression? Not here, according to this realtor. Could it be possible around an additional 8,000 homes want to be for sale but the owners need to bring money to the table?

…The inventory of homes was 10,254, which Bauer said was relatively stable, but down considerably from April 2011 when 18,000 homes were available…

http://www.denverpost.com/breakingnews/ci_20548138/consultant-sales-homes-metro-denver-amazing

Flippers should focus flip homes near transportation hub areas, and job centers. As gasoline prices increase, and new development is happening again in the downtown areas and areas adjacent to them, the central core area of LA is becoming more and more attractive. Culver City now has a light rail, and it is near the job center—–WLA and DLA.

Huh…check out the address on Google Maps street view. Almost every house on the block is the same design: garage in front, little house attached to the rear of the garage, almost no yard, almost no set-backs. Some of the same-size houses are nicely fixed up, and one of the lots somehow got permission to have a larger two-story structure. Here, it looks like the buyer yanked the roof and maybe the roof structure, cleaned and fixed the rot in the walls, returned the “extra room” to the garage it was supposed to be (curing the City’s Order To Abate), and then applied the paint-and-pastels treatment. Undoubtedly sold “as is,” given that the earlier seller put everyone on notice of major problems. “Profit” was probably in the $50,000 to $100,000 range for the person or persons in charge. Hard to see how a bank would appraise this for over $400K, but that’s another story.

going back to what the earlier person said about rates going up. Look at Greece. The central bank cannot keep rates artificially low forever. There will come a time when the gov’t has to choose real estate or survival. Right now they can afford to lower the rates to entrap more ‘investors’ into homeownership but when the inventories shore up a bit more and there is less on the banks books, why would they care about low rates or home prices? At that point, they are healthier and they can start raising rates because default risk has subsided… this is all about default risk. They pushed the system to the brink in 2007/2008 and they are resetting it now over these years to get rid of extra inventory. When that is finished, rates go up and it’s even harder to sell because homeowners will be in even more hot water… then they can focus on foreclosing quick and flipping to investors that want all cash offers even at higher balances given the rates they can get from retail homeowners will be closer to 10%.

This poster is very correct in the logic of seeing only what is in front of you. When the rates increase, it will be quick and dramatic and it will happen when the real shadow inventory has been sold off for the most part which could take 10 years… so 10 years of low rates, high inflated prices then BAM, when every qualified buyer is locked in, the rates sky rocket and houses dive in price and then what? Everyone is FUJUCkED

Leave a Reply