Culver City home enters the $300,000 price arena. Foreclosure tipping point in prime Southern California cities. Some banks moving ahead of the California housing correction. Real Homes of Genius.

I tend to believe that financial markets just like fads or trends have tipping points. There is always a mixture of factors that come together to push something into a new trend. It looks like certain mid-tier California markets like Culver City are starting to see some of this behavior. Culver City now has a flood of condos on the market selling in the $100,000 range which only a few years ago would have seemed nearly impossible. Yet as we now know with the California budget once reality hits prices have to come in line with revenues or cuts have to be made. Now these examples are becoming more and more common and I believe we will see a price correction in many of these markets in 2011. This is similar to the Beverly Hills home on the market in the $500,000 range. Today we will look at a home, an actual single family residential in Culver City that has cracked the $300,000 mark.

Culver City and crossing the $300,000 milestone

11541 Braddock Dr, Culver City, CA 90230

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Square feet:Â Â Â Â Â Â 873

Many of you know that I have tracked Culver City extensively. I feel this is a city where there is just enough income to snow people over to thinking that homes should be selling at $600,000 to $700,000 without a deeper analysis. It is a carefully orchestrated veneer but what more can you expect from an area that caters to entertainment and glamour and glitz? Now many of you in the Westside know that many of the people driving around with leased cars are merely faking it until they make it. That is not only common to Los Angeles but other areas of the country as well. Yet Culver City has started facing some cracks in their housing market and this is being reflected in home prices.

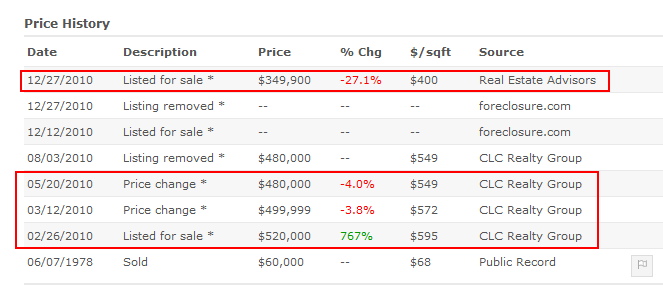

The above home popped up on my radar because of the current listed price. I remember seeing this home pop up for sale back in February of 2010 for $520,000. This wasn’t a stunner because this was common for the area even after the California housing bubble burst in spectacular fashion. Yet the bubble bust was definitely not equally distributed. Many have been left asking when will the full correction hit universally across the state? And that is the stubborn fact that not all areas are created equally. Beverly Hills will never be affordable to the common person. That was the case in 1997 and remains the case in 2011. A $5 million home is still out of reach for most even if it drops to $3 million. But many homes in Culver City do not cater to the extremely wealthy. They target the working professional family and income for these households is probably less than the foreign cars in their driveways would signify. The above home came on my radar because it dipped into the $300,000 range. Let us look at the listing history:

This is an interesting case and you can see the $520,000 listing from a year ago. It looks like the home was foreclosed and the bank put it on the market for $349,000. Now many are going to criticize the size of the place or say that it is overpriced and that is likely the case. The point is I have not seen a $300,000 single family home that isn’t a tear down in Culver City in ages. This might be an anomaly but tipping points always have to start somewhere. The condo market in Culver City has weakened incredibly and many places are selling for $200,000 and even in the $100,000 range.

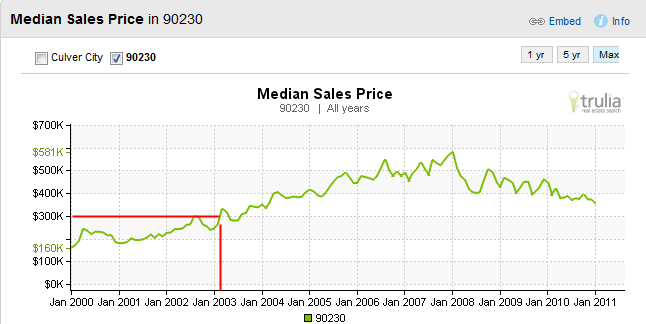

If we look at the price history in this zip code we can see that this is a trend reversal:

The last time the 90230 zip code was in the $300,000 range was back in 2003. You can also see that this place was likely an attempted rehab and sell:

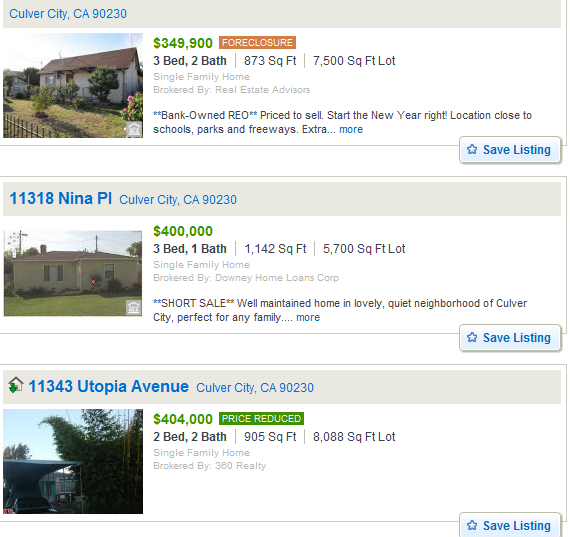

You can see a unique modern edge here so some money went in recently to fix this place up. And given that the last sales price occurred back in 1978 this was likely a HELOC machine before it foreclosed. And for those of you who think there are many homes like this on the market think again:

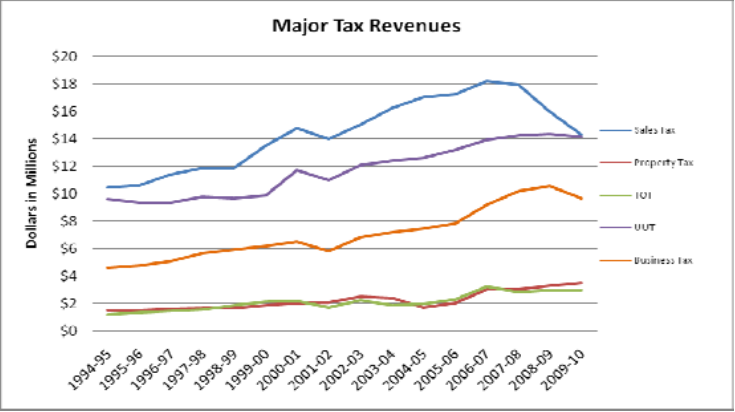

The next cheapest single family home on the market is priced at $400,000. And if you think this is some odd occurrence know that 34 homes are listed for sale in the 90230 zip code but 145 homes are in foreclosure, have an auction scheduled, or have a notice of default filed. In other words, the pipeline is full and the tipping point is getting much heavier to hold back. Can it be that this bank is merely jumping ahead of the curve and trying to get out before the correction hits further? I was also interested in seeing where the city of Culver City pulls revenues from:

Source:Â Culver City

By far the biggest revenue source is with the sales tax and this has declined sharply. However property taxes have been on a steady rise so it benefits the city to have higher home prices.

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “Culver City home enters the $300,000 price arena. Foreclosure tipping point in prime Southern California cities. Some banks moving ahead of the California housing correction. Real Homes of Genius.”

$100,000 condos in Culver City!? Where? Show me.

The internet is your friend:

http://www.redfin.com/CA/Culver-City/6050-Canterbury-Dr-90230/unit-F112/home/6651182

Very rough part of Culver City on the border of very colorful parts of LA… might as well pay $50k less and live in Inglewood proper instead of this place here. I didn’t know it myself, but there are some seriously wretched parts of Culver City and Santa Monica that you wouldn’t want to live in. And yet, sub $200k is a pretty interesting sign for things to come.

Doc – $349,000 for a 873 sq. ft. shack built in 1924? No thanks, I keep my money in my pocket. The place looks like it should be TNT’d (if you know what I mean).

Doc, you seem surprised that “bargains like this” are appearing on the market. I’m flabbargasted at this. There should be thousands of homes like this for sale at a similar price. Take note of this Doc: It’s the poor fools who buy garbage like this at these prices, who will realize in a few short years just how badly they got burned.

This shack is no bargain. No bargain at all. It’s a RIP OFF. Don’t buy into the hype. I work too hard for my money to spend a small fortune on this demolition material. My Pa used to say ” a fool and his money are soon parted.” How true.

Amen, brother, speak truth to the Kali cultists. That pile of crap is worth 85k, tops, and it always will be.

what the hell is this “Amen, brother, speak truth to the Kali cultists”?

Are we into religious bigotry now? I thought this was a real estate blog.

Religious bigotry?

LOL

You gonna play the race card next?

Californians are just being called out on their geocentric attitudes.

I don’t think he said it was a bargain. Those who have been paying attention (such as the author of this site) have a good sense of fundamentals and value.

What I read is the point that, if you had talked about a 3/2 selling for $350k here 2-3 years ago, you would have been relegated to the asylum. Now it’s finally starting to be reality.

While it may be overpriced, I think it’s listings like this that are simply the stone that helps “unstick” the stubbornly sticky prices in these mid to upper-mid level communities.

I say, “great”. The sale will be the first of many comps that will help prices revert to their fundamentals sooner.

I agree with stealthcat in that the Doc isn’t saying saying that this is a bargain. He called it a tipping point. It’s the cliched straw-breaking-the-camel’s-back. There has been a major psychological barrier in accepting pricing regimens that make sense against economic fundamentals. Given the current state of the market, $350-ish for a house in a neighborhood with household incomes in the $70,000-80,000 range makes sense on paper. The payment schedule would be (barely) affordable. By no means does that make this house a bargain. But it does show that (a) prices are continuing to come down and (b) it’s finally progressing to the areas where prices have been stickier than the commonly regarded subprime neighborhoods.

Funniest part is, that $350K house looks a lot better than most of the other Culver City shitboxes the good Dr. has covered in previous visits to Culver City, particularly the $500K and up ones close to the same size!

Thanks Marc for the “Internet is your friend” comment/info. Amazing. Click of the link! Amazing. An 779 sq. ft. condo for $179,000??? Notice the very first sentence of the listing says “FIXER UNIT.” If you study the pictures carefully, you will see that this is true. INSANITY IS EVERYWHERE. THE HOUSING MARKET IS SCHIZOPHRENIC! The link says it has been on Redfin for 119 days. I hope it’s on Redfin for 119 YEARS, because this is just complete insanity. Just say “NO” to this housing market insanity!

Maybe it has granite counter-tops, doesn’t that make it 200k automatically? Maybe it’s walking distance from a noodle-house or a falafal shack? Maybe we can walk to the Jazz Bakery (oh, that closed, and besides, that’s waaaay north of this is). What does mold removal mean? The great thing about 779 sq ft is I can cook and urinate standing in the same spot, maybe that’s how the mold got there. Anyway, I offer 29k for that dump. Cool pad if you’re from Shenzhen and live 5 to a 10×10.

uburoisc for president! Let sanity rule!

Good spot Doc! RE is always priced at the margin and even if this isn’t in the best location within that ZIP its an indication of trend, just like on the way up!

Unfreakinbelievable

$350k for that?

That would be $35-50k in the midwest.

Yep, but you are a native Californian, you probably don’t want to live in the mid west…I sure as hell don’t!

Porno Tribe?

I’ve lived all over the country. The midwest really isn’t that bad (I thought it would be worse than it actually was). California (and other high price locales) is home to some of the most geocentric people in the U.S.

It’s worth a premium, but not as much as people are led to believe.

YMMV

The premium price is related somewhat to the work opportunities, safety, and city responsiveness. The same house would be less in Inglewood, and a lot less in South Central LA or Southwest LA. $200k in southwest. I think it’s not worth $300k, but $250k would be a little less than rents there.

This is off topic but since I read your blog religiously I know many of the readers are realty savvy. Can some one help me with this question…

I’ve been down in the Needles-Laughlin-Bullhead City area for about about two weeks trying to buy a foreclosure before the realtor pirhanas get their hands on all of the good ones. Is it against some rule or law not to present offers to a bank or the seller? How would a bank even police this? I’ve had a great couple of weeks trying to buy a foreclosure, offering well over the asking price and not even getting a response. Having realtors tell me it sold in one day or there is a “deal in the works” and not even taking an offer. I might need to get a realtors license to understand this. I talk about it here…http://thecivillibertarian.blogspot.com/

I don’t know about Nevada/Arizona law, but a real estate agent has fiduciary responsibilities in California. Thus, if you have a realtor who will not present an offer in California, then they are violating their fiduciary responsibility. Just like a lawyer is obligated to present a plea deal or settlement to their client, even if they attach a memo saying they don’t think you should take it. However, in practical terms I don’t know what you really do about it except find a realtard who will actually present the offer, or perhaps find out which bank owns the place and present your offer ex-parte via fax 😉

Is it possible he could also contract a real estate attorney to make the offer to the bank for him. Also, my understanding of California law is that purchasing real estate does not require an agent. Many people (my brother in law has done it in Virginia and I believe Colorado) sell homes by owner. Given that banks contract with realtors to list the properties for them can he not walk into that realtors office and hand them the offer? Spell check want’s me capitalize realtor. I am not just as I will not capitalize salesman. Ooops, I checked and just like Kleenix Realtor is a trademarked term for members of NAR. So where you see the word Realtor misspelled above please substitute real estate professional.

Morlocks and Ferengi running wild everywhere you look? Buying your future home with money ‘you’ (government) gave them? Maybe you can rent it from them if they ever need to show some income. Right now their busy laundering the cash. Don’t bug them.

I think this is nothing but a cordinated scam between realators, banks, and marketers who parlay homes. They adverstise one home tell you it is sold whether it has ir not them add you to the marketing list and try to up sale you.

Another scam is banks are setting up shell companies all over the country to buy up the good tax sales. These companies are under banks employees names.

The final scam is buying back or buying other banks forclosures in a shell game to keep prices high. The reason for this is they make more money and if the shadow inventory of homes ever him the market the banks would shut down overnight because all the so called to big to fails are leverage 40 plus to one. The banks are determined to impoverish all the American people.

I would not pay 30,000 for that shack no matter where it is. To many of you need to get out of the herd and buy gold and silver and wait for the banks to collapse which they will

ORLANDO, Florida (Reuters) – U.S. housing prices overall are expected to hit bottom by spring 2011 and begin a gradual rise in 2012, Frank Nothaft, chief economist and vice president of housing lender Freddie Mac said on Wednesday.

“I do think we’ll see these housing prices bottom out, maybe by the spring,” Nothaft said.

Housing prices to hit bottom this spring: economist – Yahoo! News

And in other Pollyanna news: “Sales rose 5.6 percent in November to a seasonally adjusted annual rate of 4.68 million from 4.43 million in October. Compared with last year at this time, existing-home sales are down a striking 27.9 percent, but that month was marked by artificially inflated numbers due to the initial deadline for the first-time buyer tax credit.

And the latest increase brings hope in its wake. “Continuing gains in home sales are encouraging, and the positive impact of steady job creation will more than trump some negative impact from a modest rise in mortgage interest rates, which remain historically favorable,†said Lawrence Yun, NAR chief economist. He added, “The market is recovering and we should trend up to a healthy, sustainable level in 2011.†[Full article here: http://www.realestateabc.com/outlook.htm%5D

On a different note an article in the Washington post: ” The slowdown…. (in foreclosure filings) is not a sign of a strengthening housing sector, according to the California-based firm, which sells foreclosure data. Rather, it’s a consequence of the temporary halt in evictions adopted by some major lenders after widespread reports of foreclosure paperwork errors.

“There’s nothing to suggest that this is a market-driven improvement, especially with that big a decrease,” said Daren Blomquist, a RealtyTrac spokesman.

Who ya gonna believe?

Apparently Lawrence Yun is the new David Lereah, aka Chief ECOno-mist and VP of Snake Oil Sales for the Nat’l Ass’n of Realtards®… as such, he should be good for 18 more months of yuks, giggles, and general schadenfreude, before being tarred and feathered in the wider blogosphere… LMAO in advance.

Thank you!

You don’t really believe this do you? Housing prices to bottom out in the Spring of 2011? Haha haha haha. Tell us another joke Ron.

That’s what all the MORONS in the media, govenment and the banks want us all to believe. An economic depression is starting. Housing Prices are nowhere near bottom Ron.

Any insight into the house at:

5717 EVEWARD Rd

Culver City, CA 90230

http://www.redfin.com/CA/Culver-City/5717-Eveward-Rd-90230/home/8090629

The owner accepted an offer a few days ago, and then now it is relisted? From what I’ve seen it seems to be one of the relatively nicer properties on the market. Are there some issues with the house that others should know about? Or, do you think the people who put down offer encountered difficulty with getting a jumbo loan?

It is going to become even harder to buy a house starting soon. You will need thousands of extra dollars to put down to buy that Culver City shack. Fannie Mae is jacking up mortgage fees this Spring.

http://www.latimes.com/business/realestate/la-fi-harney-20110109,0,6538732.story

Banks seized more than 1 million homes in 2010. That was up 14 percent from a year earlier and the most since the company began reports in 2005.

About 3 million homes have been repossessed since the housing boom ended in 2006, that number could balloon to about 6 million by 2013.

I understand the point the author is trying to make, but I agree with other commenters who’ve pointed out that $369K for that POS is RIDICULOUS. It’s NOT a ‘deal’ by ANY measure, even if it seems to be in the Lalaland irreality of Southern CA RE prices.

In the REAL world, where people actually use THEIR OWN money, it would probably be worth $80K. But since the mortgage loan fraud CONTINUES, this crapshack will probably provoke a bidding war that will ultimately drive its price up into the lower $400K range. Then of course the new buyer will default soon afterwards and it’ll be back at square one.

The U.S. housing market is DOOMED. Why rush in to buy someone esle’s headache NOW when the entire RE Ponzi game of musical chairs has just come to a bitter, screeching halt? No one HAS to buy a house, whereas usually the seller DOES have to sell. Better to sit back with some popcorn and watch the stupid deadbeats (banksters AND borrowers alike) rushing around desperately trying to find a greater fool to unload on.

Mike Litoris, I love the way you depict the situation!

Something’s got to give as rates are rising and there is an enormous shadow inventory.

I hope the Doctor will share some correlation of rent vs sale prices based on actual sales, not wishful thinking ads.

quite possibly im slow but your name is quite possibly

the funniest ‘net name ive ever seen

The bottom line is that the U.S. government is INSOLVENT. And it is insolvent because its entire economy is predicated on artificially overpriced houses that are ABSURDLY out of whack with real wages and earnings, wages which BTW, are still at the same levels as they were back in 1998. Thus home prices would need to go back to 1998 prices in order to adjust accordingly and sales would pick up again. But THAT can NEVER be allowed to occur because the moment home prices DO adjust down to reality the Fed would be INSOLVENT. See the conundrum it faces? Whether it tries to re-inflate the bubble OR allows it to collapse; it’s F’ed!

Do yourself a favor, go ahead and buy a house ..but in ANOTHER COUNTRY!

The US Government is insolvent? Wow, you’re smarter than the entire bond market, which prices the risk of default at close to zero. Housing prices have already fallen to 2003 levels in most places. You think shaving them down to 1998 levels will somehow bankrupt the federal government? That would be the level of government that doesn’t rely on property taxes, but instead on income taxes?

No, your county and state governments are boned, but the fed is in pretty good shape.

The risk of most mortgage backed securities was also supposed to be zero according to many of the same geniuses piling into treasuries now. You don’t really want to rely on their sagely counsel for your financial well being, do you?

I’m EXTREMELY smarter than the bond market. Proven by the fact that I don’t own any U.S. bonds. Gold, silver, foreign stocks & currency ..yes. But not Uncle Sam’s Charmin Extra Absorbent Greenback toilet paper. And I refuse to buy a house at exorbitantly overpriced figures (in THIS country, though I bought a retirement home overseas CASH), so I RENT .. a big house w/a huge yard that the OWNER has to worry about maintaining, not me.

Tell me, how much longer are you going to base your actions on the advice of the same group of “experts” who FAILED to see the RE bubble, FAILED to see the massive derivatives fraud, FAILED to see the rampant mortgage fraud, FAILED to adecuately assess correct credit ratings (think Moody’s & Fitches), FAILED to find Osama Bin Laden, FAILED to uphold constitutional rule of law, FAILED to provide accountability, FAILED to prosecute fraudsters, FAILED to predict the obvious devaluation of the U.S. dollar, FAILED to ensure unprecedentedly massive bailouts would ever be recouped, and FAILED to predict the rise of commodities prices, to name just a FEW failures?

You are quite mistaken.

Going by sound monetary principles you are 10000% correct, but going by the current monetary system, the government holds all the cards.

There was a time that money was money and no one could tell you what money was worth, it was worth what it was worth, but slowly but surely since the early 1970’s the whole concept of money has changed. Money literally is now worth only what others (the powers that be) say it is worth.

The cost of capital for most banks is near zero. They can hold onto hundreds of billions in assets for almost no cost, propping up prices of the asset of the day. Those who have worked hard over the years to accumulate a safety net suddenly find that their years of hard work and savings was a big farce. Our savings cannot buy a decent house because banks can HAVE the same capital instantly at zero percent that you and I spent the last 30 years working for.

If you have two groups of people, those who work hard for their money and those who get their money for free (BANKS), those who get the money for free are much more willing to be loose with it.

In a nutshell, money is only worth what our government says it is worth and at zero percent interest rates, it ain’t worth much.

The federal deficit will be approaching 20 trillion dollars in the next few years. What are the odds the FED will allow interest rates to rise even if inflation were to take off?

Economics 101. The marketplace controls the long yield curve, the FED controls the short yield curve. It was a lie bought by just about everyone til the FED showed whose Boss with QE 1 and 2.

Money is not money anymore. Money is only worth what our Government says its worth.

I am from a time when a bank was stuck with a house, they sold it because it was the smart thing to do. THe cost of capital made it a no brainier.

Trying to figure out how this will play out is nearly impossible, the world has never experienced a period where real money no longer exists. What I do know is that it will end badly.

You are also completely wrong. The US Government (Treasury) is completely bankrupt! $14+ TRILLION in DEBT! Who is our government in debt to? The Chinese, the Japanese, but mostly to the Federal Reserve. Yes our government borrows money from foreign banks and the Federal Reserve to survive. But it currently doesn’t get enough revenue from taxes to pay off the debt, so it has to borrow more money to pay off old debt. Sounds like a dead beat paying off one credit card with another one?

Our government has no power to control the value of the dollar. Who does? The Federal Reserve Bank. How does it control the dollar’s worth? By increasing or decreasing the money supply (and dumb luck IMO).

I came of age in So. Cal. I went to Culver schools. That was the end of the great period of Culver City in my view over 20 years ago. Houses where overpriced in both Culver City and Santa Monica then and still are today. The properties of the Westside are going to face a major crash far beyond 2011 that is my prediction because the locals and the local economic issues don’t support this let alone the properties themselves don’t look the money in any economy.

Fact Check: The three addresses listed in the blog entry are not in Culver City. They are all in the LA neighborhood known as Del Rey. So no culver city services (Schools Police, Fire, City Hall etc.). Your analysis may be ultimately right about tipping (but this is about LA City on the westside), but the comparison to any statistics about culver city is inaccurate. There are frequently locations identified as the wrong City on the west side. The addressing is purely a result of US postal delivery, just like large portions of what are called Malibu and Beverly Hills are actually in the County of Los Angeles. Watch your analysis and dont get burnt by zip codes. Get a Culver City map at Culvercity.org. Generally enjoy the good analysis in your blog, but dont get ahead of yourself trying to scoop housing market collapse news, small cities in West LA will perform better than LA City proper, but their time will probably come.

“…large portions of what are called Malibu and Beverly Hills are actually in the County of Los Angeles….”

Alll of Malibu and Beverly Hills are in LA County….

I think he means unincorporated areas.

This house on Braddock is in L.A., not Culver City; 90230 is a split zip code. The boundary between L.A. and Culver City in these parts is Sawtelle. Anyway, this is just a minor nit; the point is that even this part of the Westside, right next to a housing project, had silly bubble prices that are beginning to come down.

I like the add for the home on Nina Place. I’m pretty sure it’s less than 500 feet from the 405 freeway, yet the neighborhood is described as “quiet”. Even with the sound wall, the traffic noise is pretty loud.

The entire U.S. economy is “tipping downward”. Cities, counties, states, banks, failed automobile makers, airlines; ALL end-up going to the U.S. government for cash bailouts. Who would be foolish enough to tie themselves to a financial commitment of 30 years when this country itself will probably not be around for that long at this rate?

So liquidate and hold cash until it all shakes out? Cash issued and backed by the very entities that are bankrupt?

Not the best solution either and to be honest I don’t know what is.

Gold and Silver perhaps? Yes, but I certainly wouldn’t want to put all my eggs in that basket either.

“So liquidate and hold cash until it all shakes out? Cash issued and backed by the very entities that are bankrupt?”

Indeed, NOW may be a little too late to successfully safeguard savings & assets. The time to act was YEARS AGO when anyone who was paying attention (it’s painfully obvious now that few Americans were) took notice of the fact that the U.S. government was decidedly embarked on running a Ponzi Scheme economy. I myself woke up to the fact in 2002.

THAT was the right time (if not sooner) to start converting dollar savings into precious metals, invest in solid foreign stocks & commodities, move savings out of the country, and prepare an exit strategy for that inevitable moment very soon to come when the Fed hits the fan.

PS: if you HAD put all your eggs in the metals basket (lol, ANY metal BTW) way back then, you’d be a VERY HAPPY person today. With chances of INCREASED happiness to come in the future!

Well, actually I did put my IRA into gold funds and bought physical between 300 and 350 and silver 5 to 6.

But that was then, this is now.

Take a look at condo pricing in the Marina. I was looking at new condos in Azzura and the other buildings there on Marina Pointe Drive 4 or 5 years ago. What was selling for 800K to 1 million are now available for about half that price. About the same size prpeprty as this CC (or wherever it really is) piece of junk. Sure it’s not an SFR and you have HOA fees to deal with but at least you don’t have a shit neighborhood and a 50 year old junker with lipstickl.

Probably the beginning of a trend and I agree 300k+ houses would have been unthinkable in that region just a few years ago. Now how low will go from here-that is the million dollar question. Japan has not recovered at all. If you look at history, China and India faced corrections that lasted centuries-as in their power waned. India waned so bad that the British ruled them and China was pretty much treated like a vassal state for centuries.

A little difficult to predict and see if we are in a minor dip(historically) or a long term realignment in power/economy/prestige? Like they say, if you are at the top -there is only one way to go.

And what is with the snide comments about kali cultists-as opposed to what, jesus cultists?? Not sure I get that.

Ya gotta love old Al. That previous genius at the FED. This is where the whole story begins. Let’s not forget this one simple truth. How else could people with no job, no income, no assets be able to afford a $500,000.00 loan? Tell me, how could this happen? Well let us all follow the money. First the offshore owned FED CREATES! money out of thin air. This fake money is place on the balance sheet of the US government(tax payer) as debt..fast approaching 14.5 Trillion dollars. This fiat money gets loaned to the Banks at .25-.50% interest via the FED window. Can you imagine getting billions of dollars for .25-.50% interest?

They must have been getting high just thinking about it. Then the used car salesman types (mortgage brokers) are dispatched into the bowels of suburbia. There they seek out the ignorant, naive, desperate and unsophisticated lemmings and tell them we are here to help you live your dream of home ownership. Through skillful and deceptive tricks the hapless new home owner is suddenly almost a millionaire. The result will be hundreds of new, almost millionaires, looking to find that home of their dreams. This false demand causes the limited supply of homes to escalate in price. That is how a dump of a home reaches the price of $500K.

Now we are on the other side of this tragic tale. All kinds of help is there for the Bankers who gambled in this casino and yet there is no help for the hapless foreclosed on homedebtor. He is left to twist in the wind. The bankers “remove” this bad debt from their balance sheets via TARP. Then this useless mortgage paper ends up on the balance sheets of FANNYMAE and FREDDYMAC.

So Please people chill out. This charade is coming to an end. When it does you will be able to buy that dream shack for what it is actually worth for money you actually earned. Is that not a novel idea? My parents first home was in Los Angeles, they paid cash for it after saving their hard earned money. It cost them $4,500.00, and it was a whole lot nicer than that tear down in Culver City.

“A hard rain is gonna fall” Plan accordingly.

If you buy new, even at $350k, you will owe several thousand in property taxes per year. The neighbors who have the same house registered at $100k will pay 1/3 as much as you.

True. But in many cases the owner can ask the city for a re-assessment & reduction which most cities grant. The flip side of THAT is that citiy tax revenues drop drastically when taxpayers start applying for them in droves. This excacerbates other city funded projects and has a vast negative ripple effect on the general economy itself.

This most likly needs to be a cash deal, no fha with the no code rental in th back.

A good cash cow for someone. perhaps positive cash flow on this one?

WOW – the reality is setting in and it does not look nice. The country might be lost due to only one cause: it has been given away to the criminals that run the asylum. The outcome was to be expected…

Doc, something is brewing with the banks. My home just foreclosed on Monday. However, we had TWO short sale offers at the time…one for all cash. The bank refused to postpone the trustee sale, and on Monday at the foreclosure sale, the bank accepted an offer of $278,500. In the abstract, that means little. But, the all-cash offer that the bank ignored in order to foreclose was for $290,000 and the other “solid credit/down payment” offer was for $310,000. My agent said she has had different banks refuse to postpone trustee sales for THREE properties for which all-cash offers were standing, all in the last week. Does anybody have any additional knowledge if the banks have commenced the breaking of the foreclosure dam that the Doc has been predicting?

Sorry about you situation whatdoyathink. In the last 4 weeks I’ve also had a strange circumstance with the short sale process. The place I’d been renting in Laguna Niguel had been listed as a short sale since last July. The landlord had given me notice to vacate but also asked if I was interested in purchasing the property. I said “sure, at the right price.”

Anyway, I put in an offer for $55,000 below list price with 60% down. The bank countered at full list price. I did not respond and went about procuring a new property to lease. The day before I was to sign a new lease they came back with a reduction of $40,000. That was getting close but I was still not comfortable with anything above my original offer. So I’ve been in my new lease about 3 weeks and saw yesterday the list price of my old place is now $10,000 below my offer. Go figure.

Heh, heh, heh… that thar izz some sweet revenge, the kind I’ve savored twice in the past 9 months… and yes, after informing the clueless jr. bankster that my original offer had expired during their long procrastination, and that my present offer was a further $12k below THEIR new (sub-MY-original) offer “due to market trends”, I actually said, “Heh-heh-heh” in response to the hemming and hawing on the other end of the line.

I sign off with “I’m an engineer, my time is valuable; please don’t have anyone else from your bank contact me, until and unless they have the fiduciary authority to actually NEGOTIATE and CLOSE these deals. Thank you for thinking of me… heh, heh, heh…*click* ” ;’)

I think we are witnessing a slightly different scenario.

Helicopter Ben was a student of the Great Depression. He is infusing zillions of dollars into the economy trying to somehow replace the dollars and liquidity that disappeared when the HELOC and refi ATM-ers stopped spending money. Of course it’s not working.

He is afraid of deflation and the banks don’t want to dump the houses. They don’t have to when they have billions of low cost dollars to prop them up.

If they put the houses on the market they will have to be “Marked to Market” as opposed to the “Marked to Fantasy” they currently enjoy as an asset value.

Watch what happens. We are going to have a 1979 type inflation tsunami hit in the next year or two. They will cover their value when the cheap dollars make the house seem really cheap at “only” $500,000.

Remember in the ’70’s you could buy a lot of very nice property in Southern California for under $100,000. In 1974 an Olds 98 was less than $8000. Inflation is a shocker until you get used to the numbers.

All the banks have do do is wait another year and then dribble out the inventory.

They will get their money.

Get ready.

Why are we going to see 79 style inflation soon, if the Fed’s QE is not working? Printing money should cause inflation, but it’s not. We’re still looking at risks of deflation.

A lot of money was “printed” by those HELOCs, and that money continues to vanish, and people are being foreclosed, soaking up the inflationary risk.

They print the money, and it goes down the black hole of the housing bubble…. but that black hole demands to be filled with money, or it’ll suck up something else.

What I remember about inflation was that until the early 90s, it sometimes went above 10%. And since the 80s, it’s been down below 5% most years. Today, they’re working very hard to keep the rate above 1%

Yep, they sure are working hard at keeping it at 1%.

First they flood the media about “we need to fear deflation””Deflation is the boogieman”.

Second, they manipulate the “basket of goods” so that the pre 1990 CPI may be running at 10% right now, but the highly manipulated CPI is now close to zero.

Thrid…the Sheeple believe.

Think about it. A number used for the CPI by our federal government for 30 years, until 1990, says inflation is running at over 10%. Certainnly social security, pensions and federal wages dependent upon COLA couldn’t be a factor!!

http://www.shadowstats.com/alternate_data/inflation-charts

That sounds reasonable, except for the fact that salaries are actually in a falling trend.

@ Michael Hawkins- “They will cover their value when the cheap dollars make the house seem really cheap at “only†$500,000.”

You forgot one thing; nobody will be making enough money to support a 500K house.

I know someone who has a 925 sq ft rental in a new building with all the amenities in downtown L.A. She pays 1100.00/month. The building has a rooftop pool, work-out center and great views. Who would buy when you can rent at that price?

I’m all the way over in FL, but would like to know the name of that bldg… have friends in downtown SD who need to relocate to downtown LA…

So-Fla is top-heavy w/ luxe condos–many waterfront–sprouted during Duh Bubble, w/ all the Faux Money. They too are now rentals, nach.

… though such workout facilities are seldom well enough equipped to drop the gym membership, you never know until you scope it out. And a rooftop pool is always a plus… so long as the pool-man keeps getting paid. ;’)

Thanks in advance, E.M.

Hey Enzo- the apts. can viewed at skylineterraceapts.com. I was wrong, it’s not a roof top pool- it’s a pool with a killer view of downtown. Take a look.

There is not a 925 apt for $1100. The 945 sq ft is $1633.

The cheapest in the complex today is 652 sq ft at $1299.

So $1300 to RENT in a small 1BR in LA, good deal or not?

My friend said she signed an 18 month commitment and was able to get the price reduced from the list. It seems that if you actually go and apply and your profile is strong (credit check, employment, etc) you can negotiate quite a bit lower than the list price.

If you put lipstick on a pig its still a pig.

This is exactly what Culver City is. Yuppie wannabe’s propped up prices in the area during boom years with loan smoke and mirrors. Boosted a city with pockets of marginal “good” areas, and the rest of the population there generalized this to mean Culver City was a desirable area. Only if you cant get into prime areas of LA or arent open minded enough to realize there are more desirable areas that happen to be more diverse as well. White flight is humorous though.

Now reality is setting in showing that Culver City is nothing more than a white ghetto. And sure Culver City school district is a gem….when compared to LAUSD. Its all relative though and still a public school.

Dr. Housing, I would love to see you focus on areas in LA other than Culver City, West LA, and Santa Monica. Those are fine, but there are large swaths of prime real estate in Los Angeles that might open some peoples eyes here that they dont all have to cram into the westside ghetto.

Sorry but I’m finding the word usage a bit confusing here. A $350,000 home is not “in the $300,000 range.” It’s in the $350,000 range. Or it’s in the $300,000–$399,000 range. A $304,000 house is in the $300,000 range. A $350,000 house definitely is not.

In regards to downtown rent, a 1 bd can be had at $1300 a month in the Metropolitan apartments(not lofts), Promenade Towers, or at most of the places on Bunker Hills. Perhaps a large studio(1000+ sq ft) in Historic Core will also go at that price.

Anyway, more relevant to this blog is that I pay $1570 rent. Lets mitigate that to $1500 due to outside amenities provided worth more than $70. Recently a similiar size unit in a comparable building and area sold for $375K. And has $660/mo HOA’s.

So you tell me if the numbers even come close to panning out? (Hint, they don’t). And just for good measure, you’d need to cough up another $125-150/mo for parking at the other building. I dont.

Leave a Reply