Real Homes of Genius: Culver City home for sale at $925,000 or available for rent at $3,795. The distorted Los Angeles housing metrics point to further price adjustments.

It is hard to persuade some in California that they live in cities that are still very much in housing bubbles. We can’t paint with a giant brush across the state because some markets have adjusted and have adjusted significantly to counter any imbalances in the market including the Inland Empire. Yet when the mainstream media talks about the “housing bubble†popping it is usually referred to in the past tense. Many that live in places like Culver City or Pasadena think that the storm has pass and endless home price appreciation is only a few sunny days away. We can’t blame them. It is a fairy tale that has a mass appeal. It lured an entire nation into an epic housing mania. It is hard to reverse this psychology when you still have many people paying inflated prices.  But only because someone will buy today at some inflated price doesn’t mean that trend has staying power.

Today we are going to look at two case examples right here in Southern California between a bubble city and one that has popped. Today we salute you Culver City with our Real Homes of Genius Award.

Buy at $925,000 or rent at $3,795?

It is rare to find any city in the United States that didn’t have a taste of the housing bubble. Some dabbled in it. Some indulged in it. California as a state gorged itself on the housing mania and is now paying the price of relying too much on a bubble for the source of economic growth. Some cities especially many in the Inland Empire have corrected and are showing signs of more affordable home prices. Yet affordability also relates to the local area economy. Take a look at Detroit and home prices there. They are cheap but for a reason and this can be explained by economics. If you ask people in Culver City to justify home prices you will get some emotional response that has very little connection to market fundamentals.

For example, throughout the country a really quick and dirty rule of thumb is a home is a good deal if it sells for 100 times the monthly rental rate. For example, a home that rents out for $1,500/per month is a good deal at $150,000 or less. As investors, you look for these kinds of disequilibrium. A good investor would look for an area where rents were high relative to home prices. For example a home that would rent for $2,000 selling at $150,000. These deals were hard to find prior to the bubble and once real estate got juiced, many forgot about the basic fundamentals. We are slowly going back to them.

Take for example this Culver City home:

This is a really nice home in a good area. The home is currently listed at $925,000. This is a 4 bedrooms and 2.5 baths home listed at 2,341 square feet. This place was built in 1950. Now we are seeing more of this trend where homes are listed for sale but also for rent. Let us look at the rent details:

The monthly rental rate is $3,795. You might look up at the home sale listing and see the monthly payment at $3,766. Keep in mind this assumption is based on a 20% down payment ($185,000) and a 4.56 percent 30 year fixed mortgage. That is not going to happen so this figure is much too optimistic. I’ve talked with colleagues in the industry that have stated jumbo loans are between 5.5 and 6 percent with near perfect credit and a 20 percent down payment. Keep in mind the estimated monthly payment does not include taxes and insurance that will run you another $1,000. So let us run the numbers once again:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $185,000Â Â Â Â Â Â Â Â Â Â Â Â Â (20%)

Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $740,000

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $5,201Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â (30 year fixed at 5.5%)

The carrying cost is very different from the “best case†scenario presented online. If you were to buy this home with a 20 percent down payment, your monthly net cost out of pocket to service all your home needs would be over $5,200. Your rental cost is $3,795 a difference of $1,405. By our simple rule of thumb, this home price is too high. Culver City still has many homes valued at bubble level prices. Now if we used the simple rule of thumb we would do the following:

$3,795 x 100 Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â Â $379,500

This seems so far off from the current asking price that some will laugh. Yet in some areas of California this kind of metric is appearing. Let us take a look at Hemet for example.

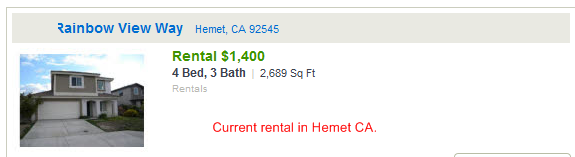

Here we have a 4 bedroom and 3 baths home listed at 2,689 square feet. The place is currently up for rent for $1,400 per month. If we use our quick and dirty analysis we would find:

$1,400 x 100Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â $140,000

Think we can find a similar place for close to this price point? Yes we can:

We find on the same street a very comparable home. The above is listed as having 6 bedrooms and 2 baths and is listed at 2,389 feet. It is a short sale and is currently listed at $150,000. This place is actually selling for less than the sale price in 2000 ($173,500). Hemet is 96 miles away from Culver City but they might as well be worlds apart in terms of real estate valuations. It would be one thing if the market in Culver City was able to support a $9,250 per month rent on the above place. But clearly it cannot. Why? The market is saturated with rentals and prices are just too high

“(Lanser OC Register) Veteran Orange County apartment owner and manager Ray Maggi says this the current rental market “is the worst I’ve ever seen†for landlords.

Maggi, a past president of the Apartment Association of Orange County, says in his three decades in the rental game hasn’t seen as harsh a mix of falling rents, empty apartments and rising costs.

Contrary to popular belief, we don’t make money with 90% occupancy,†he says of current historically high counts of empty units across the county that run roughly at 10 percent vacancy.

Maggi notes a 96-unit complex he’s owned in Buena Park since 1978 as a good market gauge. Before this slump, he never started a month at this complex with more than 10 vacancies — and now he’s got 14.

“Lots of hard times,†he says explaining why it’s so hard to fill up apartments.

High unemployment means that many prospective tenants are either doubled up with roommates or have moved in with family members. With landlords fighting for a limited number of customers, the winner is the renter. Last year, landlords usually offered free months of rent as lures for new tenants. This year, Maggi says, more landlords have simply slashed rents to meet tight-fisted renters who have plenty of choice.

Making matters worse for property owners is that a growing number of tenants aren’t keeping up with payments. Charge-offs have roughly tripled to nearly 3 percent of rents due.

“It’s a tough road out there,†Maggi says.â€

The rental market overall is tight across Southern California. These hybrid homes for sale/rental are good indicators of any market price imbalance. The sale price is the optimal dream point while the actual market rent is really what someone can support in the current market. Culver City has enormous disequilibrium. We don’t even need to look out of state to see a more sensible market. What justifies this massive price discrepancy? Better schools? If that is the issue then just rent in this area. Sense of homeownership? Is it really worth this big of a price gap? Clearly these kinds of bubbles don’t last long. The $925,000 home sold for $185,000 back in 1993. The rate of inflation from California from 1993 to 2010 is 53 percent according to the California Department of Finance. As we have seen through many studies, real estate over the long run tracks the general rate of inflation. So if that is the case, this home would have a value of $283,000! But if the place can yield $3,795 a month it clearly has a value of at least the 100 time multiple.   You can judge for yourself whether some cities are in bubbles. I think the data speaks rather clearly. It is a great time to rent.

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

43 Responses to “Real Homes of Genius: Culver City home for sale at $925,000 or available for rent at $3,795. The distorted Los Angeles housing metrics point to further price adjustments.”

Great post, Housing Bubble M.D. I especially like the quick and dirty 100x rule of thumb measure for rent vs. owning. I know it’s not applicable to every situation, but it’s a nice way of reminding myself to keep waiting it out.

I live right next to Culver City and this mentality of “prices will come up” is so prevalent. I can’t wait until reality finally rears its head here. Thanks to you as always for the prescient info.

It is even worse in nor cal Los Gatos area. The house I rent for $3500 would probably sell for $1.2m

Agreed, great post Doc.

I saw some article over on Business insider showing housing supply at levels near the peak of the bubble. Who has $3,700 a month to pay in rent? I suppose somebody who nets $150k a year might be willing to pay that amount, but are there that many people like that out there right now?

Renting is where it’s at right now. You run almost no risks and someone else has to do all the maintenance. Rents have definitely dropped and you can easily talk landlords into lowering their prices just by reminding them that we’re in the middle of another Great Depression and private sector wages have stagnated for at least a decade. If we’re not making more money, they shouldn’t be either.

Paying less for rent is all about knowing the market and knowing what they’re up against.

I live in the San Francisco area. Three homes on the same block went on the market in Feb.

Of the two identical models, the one with the remodeled kitchen sold in 7 days.

The other home,after 2 months, reluctantly lowered the price by $10,000.

(on a $750,000. home- big whoop!)

Long story short – the other 2 are still for sale, and owners refused to lower the price further.

People seem to have the mental capacity to try and create their own reality.

After years of looking to buy, we settled on a rental. I can not tell you how happy we are with this decision. We have a terrific house, we get to keep our saved down payment money, paid gardener and pool service. And when a pipe burst two days after we moved in the landlord had to foot the $5000 dollar bill. I love our new life in our new house and feel totally relaxed. Whatever happens in housing now, we feel protected.

Doc, the today’s topic is very helpful for explaining the future of the market in Westside, South Bay and Orange coast. Besides that I could never understand why the rental market above $2000 exist, I have no words for $3700…What economic niche it fill when the average mortgage the today’s buyers are committing is $1200/month … I have 130K income and renting for $1300 2bd apartment in west Torrance (excellent schools, but I really mean it not like Culver or Santa Monica…). If the schools are some excuse to be stupidly wasteful why not renting for at least the half of the bill!? What sense it make the buy if the average buyer with its income will never pay it sooner than the full 30 years? Again 30 year mortgage is how different than renting for life? Just 2-3 times more expensive, with the added inherent risks of homeownership!? Foreclosure, somebody!?

On today’s topic, I have few friends (living renting in Torrance), which have opted lately to buy all around the place in greater LA but not here. The reason is the widening gap between normal in economic sense and bubble. I understand the natural higher demand in the center of the metro area, but not at this whacko price/rent ratios…. One guy is moving in Hemet, bought house for 109K cash (which around here is barely enough for 20% down payment), such were selling for 300K in the height of the madness. Another is moving to Cypress , which is still a bubble by any means, but prices have corrected at least in my rough estimate like 30%, which is not the case with South Bay… Those cases are indicative for the future of the still bubble areas – slow grinding till we get there to reasonable price/rent and price/income measures. It will take few more years in my opinion because the economic ignoramuses are very supportive for the government policies and even supposedly doomed idea to prop the bubble prices works. I hope it will all hit the wall soon, if not renting (even for life) is a very reasonable economic choice.

kelmag and PRCalDude,

You are spot on! Combining the outrageous cost of housing with all the other associated costs, like HOAs, taxes, insurance, and maintenance, you have really have to be pulling in some serious cash.

Furthermore, why take on the debt in this economy and the headache of upkeep.

Four years ago we lost the hot water heater at 3 in the morning in the apartment complex I lived in. Wife woke me and I told her not to worry. Called maintenance and the poor guy (really nice though) came up and dealt with it. By 9 (6 hours later), we had a new heater. Later that day, I was in the pool. Nice life if you can get it!

No headaches and no shame with renting. Sure, you might get stuck having to move, but you know what? It forces you to downsize and buy/keep/save only what you really want!

“But if the place can yield $3,795 a month it clearly has a value of at least the 100 time multiple. You can judge for yourself whether some cities are in bubbles. I think the data speaks rather clearly. It is a great time to rent.”

LOL Dr. HB, the thing that’s even funnier than the asking price versus rental price disconnect, is that the rental price is pie in the sky as well. The owner/landlord may ask $3800 for that place all they want, but I would be extremely surprised if they get it in this market/economy…no doubt they will capitulate and rent it for a significant deduction – $3,000 to $3,300 probably

My story similar to Kelmag. I almost made a mistake: buying a townhouse in Highland Park (not a good area). The monthly payment was going to be $1,700 / month, but because we didn’t meet a requirement, then deal fell down.

Shortly after I rented a townhouse similar to the one I almost bought in Glendale (way way better area) for $1,100.

I was talking to the gardener of this townhouse where I currently rent, and he told me that he stopped making payments on his $400,000 house from Palmdale a year ago.

Good job Doc and thanks a lot. I decided to rent after I read this blog.

I wonder what you think of Humboldt County price ratios: I’m looking at a house for sales at $209,000. It’s a 2/1 at 1180 sq ft. Rent on the place would most likely be $1,000 to 1,200, our mortgage payment would be something like 1,400. That’s a lot “closer to earth” than the above listed example, but par for the course in California.

It’s crazy to think, but my parents house outside of Philly (5/2.5, three story + basement and some already repaired termite damage) went for $180,000 three years ago.

Lulz @ the gardener with a $400K purchase in Palmdale…sounds like just another “WTF was everyone involved in THAT transaction thinking” story.

Interesting, however, has Southern California ever met the 100x rule in the last 30 years?

Don’t the current interest rates play a huge role in justifying (to an extent) these higher prices? It’s nice to bring up historic home appreciation rates but shouldn’t we also look at historic interest rates which I believe went from 15%+ in the 80’s to the current sub 5% rates. For example: say I purchased a home in 1994 for $250,000 and it appreciates roughly 3.5% a year. The current value of the home would be around $425,000. If I bought that home today with no money down at an historic average mortgage rate of lets say 8.5%, my payment would be $3267 (PI) per month. Now lets assume I drank the housing bubble Kool-Aid and wanted to sell the home today for $625,000. Many would point out that the asking price is way above the $425,000 REAL value based on historic appreciation rates. However, lets say I did manage to sell to someone at $625,000 and they got a mortgage rate of 4.75%, their payment would be $3,260 (PI) per month. It’s essentially the same payment as buying a home at $425,000 using the higher average mortgage rate. So even though the sales prices are way different, the actual out of pocket monthly expense isn’t all that different at all. Of course this doesn’t include property taxes and insurance which would skew the payment by a couple hundred dollars either way but nothing drastic.

I guess what I’m saying is that if we wait for home prices to drop to realistic prices then we are also waiting for interest rates to rise to realistic levels and in the end we may not be saving all that much money on a month-to-month basis. Just a thought from someone recently bought a home and may be trying to justify his purchase. 🙂

Foolio, not all Gardener is created equal, some of my buddy is a Gardener and living very well even though economy stinks, you want to know why, I give him a referal to only the million dollar homes…… Haha, some garderner, I tell you make more money than you folks in year…… Peace

Edy is correct. I live in a million dollar home, and all the gardeners in my area drive pickup trucks with no logo or sign, indicating that they run a business.

All are paid in CASH, so no record of the transaction, and no taxes to pay.

Also, I found out that all the yard sales in a nearby city are run by people on welfare or the unemployed. No taxes.Most small contractors will quote you two prices- one for paid by check, and a lower price for cash.

I believe the cash underground economy is the wave of the future.

Also, many of the people who sell art or food at street fairs routinely only report 50% of their income. Again, a cash business.

I agree with your way of looking at rent vs buying. But don’t you also need to factor in the tax advantage of the mortgage interest deduction when comparing renting vs buying. I still think buying is not the right move right now, but the disparity is not as great as you are saying in my opinion.

These prices are sustainable because there are quite a few people from Asia or Middle East who could buy these houses, just so they could get a toehold in the United states.

I doubt the owner of house will lose much.

@Tyrone – The mortgage interest deduction may offset your property taxes, if you’re lucky, so it’s best to consider that part of the equation a wash.

@Tyrone again – notice that Doc’s calculations are based on PI (principal and interest) only. You will also pay property taxes (offset by mortgage deduction). So forget about taxes in these calculations.

@CalAsian

~

lol. Tell them, “Run – don’t walk – to the nearest house for sale to make a bid above asking price.”

~

DO IT.

Also tell the buyer that if he pays in gold coins, he can get a free toaster as house warming gift.

Oh let the people from the middle east and asia buy a house in the ghetto, which is all many people could afford if buying. The rest of us will continue to rent somewhere nice.

In San Luis Obispo, I rent a house for $2900 that was listed last fall for $1.2 million. Plenty of bubble still left to burst.

Chraze –

>

You wrote “I guess what I’m saying is that if we wait for home prices to drop to realistic prices then we are also waiting for interest rates to rise to realistic levels and in the end we may not be saving all that much money on a month-to-month basis. ”

.>

Yes prices will have to come down when interest rates rise – as they inevitably will.

>

Yes the total payments of low rate/high price vs high rate/lower price would end up about the same..

>

NO – waiting for higher interest rate with the necessary lower purchase is NOT about saving money on your total monthly payment of principal and interest.

>

It is about not getting stuck and ending up underwater on the price you paid when interest rates come down.

>

When interest rates go up (and they will since they are artificially low) the PRICE of that house which you just bought MUST come down. Incomes are not rising so buyers can’t pay anymore. Think of it in reverse:

>

You buy that house now at $625,000 and got a mortgage rate of 4.75%, so your payment would be $3,260 (PI) per month.

>

Interest rates go to 8 1/2%. Now the payment on that $625,000 is $4,805.71 . That is OVER 47% higher than your payment on the same mortgage amount.

>

You want to sell. You have 2 choices. (1) Find a buyer who makes 47% more than you do. (GL!) (2) Drop your price so that someone who is like you and in your income class can buy the house —- and that means a sale price so their mortgage is not more than $425,000.

>

COngratulations. When those interest rates went up, the person who paid $625,000 in this example, is now $200,000 underwater……… Buyers just like him/her can not afford the house at $625,000 when interest rates rise – and rise they will.

I have a problem with this 100x rule. I have never ever seen a place in Canada that approaches this figure. I was looking at a townhouse in canmore, AB, Canada.

Here is the detail

asking price

538,000

taxes

2300

rent

1500

I cannot believe that this property would only be worth 100x rent. If it was I would try and buy a bunch of them. Replacement cost is far above this figure, in fact the land is worth perhaps 100x the rent.

There is a huge disconnect here in terms of what an owner asks for the property and what it is actually worth, yes, but it is worth much more than 100x rent. In fact I would gladly pay 200x rent on that property.

My experience is that the residential investor buying property for rental purposes in Calif is negative cash flow . As a group over the past 30 years looked to strong appreciation levels makeing up the difference but how in today’s deflationary RE market how does it make sense to be negative cash flow? The so called investors own a significant portion of Calif Residential RE if the market goes side ways at best over the next 10 years these investors will be significantly under water.

Would not be surprised that if the market continues to correct in its downward path that the RE investor could be a major casualty dumping millions of property into the inventory channel.

Thanks for this one!

We’ve been watching Culver for a while now (4 years) and if you look at the price graphs over the last 10 years, it’s clear that even with the drop in the past 2 years, the prices are out of touch with reality. People who have owned their homes there for a long time have often over-financed during the craze, or they bought homes they couldn’t afford to live in or flip, and now that they can’t sell for the price they paid, they are desperate to rent it out rather than take the loss.

The banks are in denial as well. My father is in real estate, and knows a banker who lives in the neighborhood we especially like. I KNOW several modest homes in the area are on their REO lists (but not on the MLS) and I asked Dad to see if it was worth making an offer within our price range.

No surprise, she slapped it down immediately. I’m pretty sure Dad softened her exact response, but the phrase “She’s positive the Bank would never sell at such a low price” was used (never mind our range was 2x what the 2000 price was for most of these homes). I wasn’t surprised, after all, her home ownership AND job depend on those homes staying inflated!

But we’ll wait. Like you say, there’s no shame in renting, and the prices will drop. Better to rent and stay financially secure than “Drink the Cool Aid” and lose everything.

“Live within your means!”

I’m not a big religious guy, but growing up I remember the pastor saying that and it was directed to a bunch of blue collar people that were farmers and factory workers and teachers etc. You know what? Those same people don’t seem to be having these conversations about how much they will lose on their homes. Their homes were assessed by practical and moral people that realize that value is only what it can be sold for as well as what the buyer can truly afford. So coming from a small minded place maybe I am missing something? Personally, I don’t think so. It’s greed and stupidity. Mostly stupidity.

We as a global society allowed these disasters to happen and it’s not to say the banks and government weren’t enablers to the problem, but we signed the papers without seeing what was going on. That falls on those who actually were stupid enough to believe that a house that was built in 1940 and is in bad shape and an even worse location is worth 450k. They bought it and now they go “well we put all this money into it and it’s going to be worth nothing now? Where’s the justice, don’t let the prices balance!” Well yeah! Looking at the prices and the product, there is a fishy aspect, right!? So when someone bought it, did they not think that as well? I’m baffled by the idea of this happening. One they can’t afford it and two they aren’t buying anything that is close to being worth the money. That is stupidity on the highest level.

We are living in a fairytale world in this city and many others across the world. To believe that I make over 100k a year and I can’t find a home in the “semi-nicer” communities is a tragedy of great proportion. I say this knowing I am fortunate enough to have the living I do, but I make the point of how upside down this market is in our city and state. I would scrape by if I bought a home in most places of LA. That’s unthinkable. We can only blame ourselves. I can’t wait to see the prices slashing like it’s a damn circuit city blowout sale in the coming years.

Actually, for many workers, salaries are going up.

About 14% of workers in CA. are government employees(teachers, firemen, police, etc.)

Another 6% are Federal workers (Postal, IRS, etc.)

Except for brief periods, like now, they get annual raises, and a cost of living raise. Even now, they are being given raises in the future, to make slight sacrafices now.

Over the last 10 years, their salaries HAVE kept up with inflation.

The interest and property tax is deductible per IRS rules on your income taxes. The actual out of pocket cost to the homeowner would be about $3,800 a month (take a third off the interest portion of the mortgage payment and take a third off the property tax). The asking rent therefore matches the out of pocket expense.

Of course, there are maintenance costs that are not accounted for upkeep.

Oops, the biggest monthly drop in sales of new homes since 1963 !!! Sales down 33% in USA, and down 53% in the west !!! Good luck buying!

Kudos to Susan, KC, and others – you guys are spot on in your comments.

BTW, I’m sure everyone saw the report yesterday about home sales “unexpectedly” dipping in May. FLOL, I can’t believe these morons in the media, NAR, administration etc. actually think anyone is buying the “unexpected” part. And today the report came out that new home sales tanked 33% in May – biggest drop on record…right off a cliff! No surprise there as we’ve all said the RE market doesn’t have a leg to stand on without enormous government intervention. No credit = no buyers!

Comment by Miguel

June 23rd, 2010 at 5:59 am

Actually, for many workers, salaries are going up.

About 14% of workers in CA. are government employees(teachers, firemen, police, etc.)

Another 6% are Federal workers (Postal, IRS, etc.)

Except for brief periods, like now, they get annual raises, and a cost of living raise. Even now, they are being given raises in the future, to make slight sacrafices now.

Over the last 10 years, their salaries HAVE kept up with inflation

__

ANd started out lower to begin with 30 years ago when compared to the comparable job in the private sector requiring the same qualifications so staying level with CPI inflation (like everyone else until the past 5 -10 years) means they stll make less with their qualifications. For example:

>

1979-80 Brand new law grad would have made this:

>

Large private firm (the ones you read about in the headlines with the enormous starting salaries) = $27,000

>

Smaller firm (where 80% end up) = $20,000 -21,000

>

Federal Agency = $18,000

>

Education costs to starting salary = 1.75 – 2 times

>

Now it is like this:

>

Mega firm = $135,000

>

Mid-small firm = $55,000

>

Federal agency = $45,000

>

Education cost to starting salary = 1.85 – 5.55

>

_

BTW judges (public employees) even Federal Judges make 1/3rd or less what they would make at a mega-law firm as a partner.

>__

>

And that applies across the board as most public employee jobs require at minimum an Associates (or some college) and typically requires at least a BA and usually and MA or higher.

>

What do you think it takes to get a physician to work for a public agency (like a public university hospital)? Sounds like you want them to work for minimum wage or at least so little as to be in the bottom 80% of households even though the educational requirements are such that they have to be in the top 10 -20% in education.

>

Our local law enforcement agensie now all want, at minimum, an associates in criminal justice and better a BA in the subject. And that is for the entry level patrol jobs. (And most states demand the same of prison guards.) How do you expect someone to pay back $20,000, 30,000 or more in student loans if they get paid the same as pool cleaner? For the payments on $30000 in student loans to only be 8% of gross for the next 10 years, they need around a $50000 income.

>

So either pay it or stop insisting that public employees have post-secondary education to be police officers, EMTs, doctors, teachers, zoning administrators, etc etc etc.

@AnnS

I have family in the medical field. Local gov’ts do need to pay competitive wages to keep these folks, even though the actual wages in gov’t are lower than what a private doctor would make. There was a hue and cry about a medical examiner making 500K a year in my county a couple of years back. This was for someone with 20 years of experience. My family friend who is a private pathologist made this much annually after working less than 10 years out of med school. I don’t think it’s the pay for highly skilled workers, or even their pensions, since there is only 1 medical examiner that is this well paid in each county. I think it’s the mentality that gov’t workers do not need to save any money like the rest of us do for retirement. They spend what they have since the don’t need to worry about retirement. A little financial prudence on their part would help us all. But a lot of gov’t salaries are way over what private business pays, and these gov’t jobs are about being connected, not qualifications. An administrative asst. working for LA county makes something like 50K a year, working 9-5, full benefits, the works. When I started working, as an admin in a small company, I made 24K and had to contribute to my own retirement AND had to work with no overtime until 7-8 each night. Our reality is much different than gov’t workers. I would have killed for that job.

Government workers used to make less money for more benefits because they were the bottom of the barrel in terms of talent and ambition. These were people who were stupid but smart enough to understand that by taking a job with the government they would be taken care of when they retired. Well, because of the unions they now make more money than people in the private sector and will still be taken care of when they retire and still managed to stay just as stupid and just as lazy as they were before.

AnnS

I agree with your comment that purchasing a home now will put you underwater when rates rise…that wasn’t my point. And if your buying long term (10+ years) then being underwater for a while shouldn’t really concern you. I was speaking in regards to home affordability on a month-to-month basis. Basically, if you can’t afford that overly priced home at $625,000 with a 4.75% interest rate now…you won’t be able to afford the same home at the more reasonable price of $425,000 with a 8.5% interest rate. They both essentially have the same payment! And since rising rates will cause falling home prices, people who are currently renting thinking that they will get a better deal (i.e. lower payment) when home prices drop may be in for a surprise when realize the rates they will have to pay.

WOW! This time it took almost 30 comments before the snide remarks started about how “them gub-mint workers and them union teachers” all make enormous salaries, never work, are bums, and certainly don’t deserve to make a living wage, let alone the million dollar salaries/pensions they all apparently get.

~

What’s even more remarkable is that, as of this writing, I haven’t seen anything yet on how the brown horde (“them illegals”) is overrunning the state and buying all the houses so they can manufacture “anchor babies” and then camp out all day in the emergency room for all of that “free health care.” Of course, this is done after a long day of driving the freeways without any license or insurance and running other people off the road for entertainment.

This would be a much better argument if the two places compared were at all similar. I do stats for a living so I realize the numbers can look very compelling, but it’s absolutely necessary to go beyond the spreadsheet to make sure you’re comparing apples to apples and think through the real life situation.

Just to be clear, I’m not saying Culver City isn’t over-priced. I think the point you make about rent payment to realistic PITI argues that eloquently.

What I would like to point out though is that the 90 mile difference in location is a huge difference for anyone living here. Beyond the obvious benefits of living 10 miles from the beach instead of 100, the job market is a massive factor in prices here. Hemet is not only a far out suburb that was cow pasture and farmland not long ago, it is also 10 times further from many jobs and 3-5x longer commute depending where someone lives.

If someone works in downtown LA or the vicinity, the Culver City house would yield a likely 30 min commute (obviously high volatility here given notoriously fickle traffic and route options), vs. likely 2.5-3 hours EACH WAY from Hemet. That’s a pretty huge difference in location, location, location.

Now again, let me say that Culver City property is clearly overpriced in this example relative to rent. But to make that comparison to Hemet is off topic and pretty misleading in terms of rational purchase decision. In 90+% of cases, there is no real choice between Hemet and Culver City without large changes in other lifestyle aspects, namely employment location.

I make a decent living, probably over $370k this year, and if I were in the SoCal market, I’d rent instead of buy. Too much downside to putting down 20%, then paying $6000 PITI on top of that, and biting your nails while you pray that the market doesn’t tank further. If you can find a rental at a reasonable price, take it!

@Chraze – you are accurate to some extent. Prices alone are definitely not an apples to apples comparison. However, you also have to factor in a larger down payment on the higher priced house. 125k vs 85k if putting down 20%. That’s a 40k difference. Then 18750 vs 12750 in closing costs (3%) for another 6k difference. That’s 46k more for that higher price. If you spread that across the 10 years in your example (46000/120 months), that’s an extra 380 dollars a month (and that doesn’t factor in the opportunity cost of things you could do with that money in the meantime). Then add in the extra money for taxes/insurance on the higher priced house, and you are probably looking at 450-600/month more in total. That’s roughly 13-18% more a month. 13-18% more on what is most likely your biggest bill…I think that’s pretty significant.

In addition, if you buy with a higher interest rate, you can always refinance if/when the rates go down. Check out patrick.net to read more on this whole concept.

Obviously, if you can afford what you bought w/o a problem, you really wanted to own now, and you love your house – none of this matters. It’s just information to keep in mind though.

Great post, great information. The market is not rational. The death of the myth of a house being an investment will take a long time. When that myth had life it never took into account the cost to keep the structure alive. Yet that myth lives on.

Good Aricle, Good Information. The death of the myth of housing being an investment will take a long time. Your article points out how irrational the market was, and in some areas, continues to be. Eventually, kicking and screaming, they find out that there is no Santa Claus.

Leave a Reply