Shopping with $1 million in Culver City: gentrifying out the baby boomers and those unable to keep up with the Joneses.

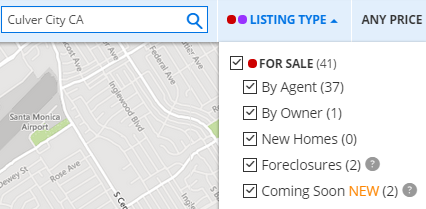

The story of 2015 continues to be one of a stalemate for the SoCal housing market. Prices in some areas are near or even higher from the previous peak. Yet inventory remains low and for many, prices are still beyond their reach. Investors are still a big dominating force in the market. Flippers are out in full force trying to squeeze out profits in every corner of the market. It is always amusing when you hear about people “missing†the market. First, this tends to come from folks who don’t see themselves as speculators. Yet somehow, they feel that they missed the boat on the big equity jump we have seen in the last few years. However, to unlock that equity would mean leaving said area. In other words, you could have easily speculated and bought Apple stock on margin as well. You are simply timing the market. There is nothing wrong with that but please don’t try to position yourself as a non-speculator. What about the 7,000,000+ people that lost their homes to foreclosure? We usually don’t hear from those once they enter a financial grave. Call it selection bias. Just because you live in your speculation vehicle doesn’t mean anything new. Culver City is a prime spot for house lusting shoppers. Zillow has 41 homes listed for sale. What is also interesting is that the city has 33 pending foreclosures. There is no incentive to rush these out to market. Low inventory, low interest rates, and a high number of house lusting buyers and you got yourself a nice speculative market.

Shopping with $1 million in Culver City

A million dollars doesn’t go so far in California’s heated housing markets. It certainly doesn’t go far at all in the insane Bay Area. I think it is worth noting that in some markets, the big drive up has been pushed by investors, flippers, and high income households leveraging low interest rates. Most of the drive up in prices has come from pervasive speculation.

Take a look at this home:

4353 Tuller Ave,

Culver City, CA 90230

4 beds, 2 baths, 1450 square feet

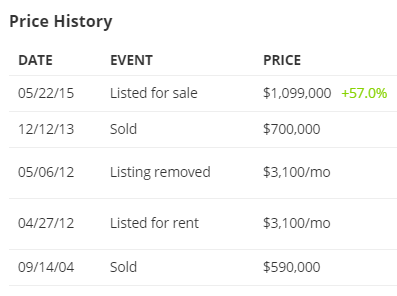

This place looks like it had a lot of work done to it. It is very telling when we look at the price history here:

This is one great thing about Zillow. You can track the action of a home over time. First, it sold for $590,000 in 2004. In 2012, it was listed for rent at $3,100 and looks like it rented quick, for one year. It then sold for $700,000 in 2013. It is now listed at $1,099,000. Keep in mind this place was rented out in 2012/13 for $3,100 and now the list price is $1,099,000.

The market is tight in Culver City. Zillow has the following listings:

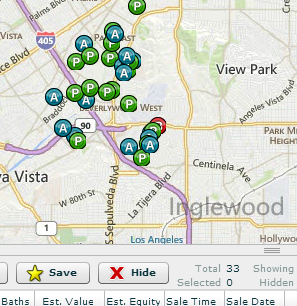

When I search for active foreclosures, I find the following:

You almost have as many pending foreclosures as actual listings. No rush for the banks to get these out to market. Right now, if you want to play you have to pay. Take a look at this immediate area in terms of rentals:

There is a home nearby but it has 3 beds and 2 baths but is much bigger at 1,770 square feet and this is renting for $3,900. You also have a 3 beds 2 baths place listed at 1,633 square feet for $3,695 one street over. Sure, you’ll get rental breakeven points with a big enough down payment (try $219,800 without factoring closing costs or anything else).

I’ve said this before, you can reach a rental equivalency with any property so long as you have a large enough down payment. No one missed anything here. If you truly are buying a home for the long haul, 30 years will pass by. But can you swing that monthly nut for 30 years or are you looking for a big jump in appreciation? Just look at the price history on this place over the last 10 years and then you will see how boom and bust the California market is. When you see things like this you start to understand how we have 2.3 million adults living with their parents in California, unable to rent or purchase a home.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Shopping with $1 million in Culver City: gentrifying out the baby boomers and those unable to keep up with the Joneses.”

Hello to all,

I have been visiting this blog for several months and I find the information here to be invaluable. This is completely off topic but I do own a home in the IE. Zillow’s price on the property is still almost 40% off of peak in 2007. Do you think it would ever get back to that price ?? If so, how long would this take? I’m seeing some properties similar to mine being listed for 10% over Zillows valuation. Peak price was $297k. Current Zillow valuation $184k. Rents are around $1200. Well established neighborhood. Thank you folks. I am thinking about selling when time is right and rent in OC to be closer to my job.

Unless the rocket scientist politicians that run the IE do a better job of creating jobs then no. Prices in the IE are not going up. The only jobs in the IE are government, cargo/warehousing, food service and outlet malls. 3 of the 4 jobs types of jobs in the IE don’t pay squat.

Forget Zillow valuations. They are garbage. Look at recent sold prices near your home to get an idea what it is worth. redfin.com is very good at showing you the recent sold homes.

Personally, I would rent out your home in the IE, then rent in OC. If you hold that IE home as a rental for many years, it should appreciate, and eventually enough for a down payment in OC. The IE is growing rapidly and it is affordable.

Cal-IE.. Never ever base any decision buying or selling based on Zillow Zestimate. The value can fluctuate dramatically on the same home and like upgrades which means it is useless to the public and should be regulated by the proper agencies.

Always check closed sales in your location and within a two mile radius also look at listings on the market for like homes. 40% off its peak on a house in So Cal seems not right, please check again and don’t leave money on the table, be informed, RE agents and Zillow don’t give a darn if you make a mistake in buying and selling? good luck

You’re the only one who can decide what is the “right time” to sell.

Your metrics sound like they are below the median for IE. You have to figure out what is best for you.

Is your OC job a solid long term thing? Do you hate commuting? Will gas ever be cheap again? Will construction adding carpool lanes to the 91/15 interchange drive you mad?

Have you found a decent place to rent in the OC? Does such a thing exist? $1,200/month in the OC is either very very small or a very lousy location. Too many variables.

I sold my IE house last year and moved to LA. I could care less if I could get another penny more if I waited longer to reach the peak price of crazy 2007. I now go 65mph my whole way to work and back. You results may very.

I missed out. I started looking in 2013 and was outbid several times. I then saw houses exceed 2006 levels quickly. 40 people showing up to look at a condo at 26th and Wilshire on the 1st day. I am convinced that the big real estate investors have algorithms scouring listings within set parameters and when the algorithms find a hit, an automatic offer is made. They do it on Wall St., they do it in e-commerce, why wouldn’t they do it in real estate?

My neighbors, home owners, are so thrilled that prices are going up. They feel so wealthy and they can pull equity (how many pull equity for smart purchases) BUT they admit they can’t sell because — where would they buy here in SoCal?

If SoCal seems crazy, take a ride up to Northern California. That market is ridiculous! My closest friend listed her San Jose, 2 bed 1 bath house for $599k. She staged it and so it looked nice, but there are at least $30k of fixes that need to be done to it by whomever buys it (roof, termites, windoes, etc). She knows this because she got her own inspection done before she listed it. It went on the market and within 1 day she had 3 offers well over ask. After the three potential buyers fought it out, she decided on an offer for $88k over ask (sold as-is and no appraisal). All of the potential buyers wrote her letters about how much they would love cooking in the kitchen on the very old Wedgewood stove. She said, “Do you know how much that old stove is actually worth?” I said, “Yes…it is apparently worth $88k!” And to think, she could barely give the house away when she tried to list it back in 2010. What is wrong with people?

Nothing is crazier than Manhattan Beach in SoCal. Check out this one. 4 Million. 1200 sq ft house. 2400 sq ft lot. Multiple offers. NoCal can’t match this tear down.

https://www.redfin.com/CA/Manhattan-Beach/235-4th-St-90266/home/6712638

What I have learned after spending most of my life in SoCal is buy real estate during recessions. Otherwise you will be screwed financially.

“where would they buy here in So CA,” tolucatom good take. Same in places like Denver where a hot market means what (?) where does the seller end up, renting also at a higher price and waiting for another 2007.

Big concern for all. if you are retiring and looking to cash out and moved to a retirement location than it may make sense, but for the vast majority it is a sell high buy high get caught somewhere down the road for both buyer and seller.

Housing today is like the stock market wild swings and black holes, a very dangerous game to play with so much at stake, the principles of sound investing today is a shell game controlled by the Fed’s who are in the banks pocket. A seller especially better be careful that roof over our head may not be the gravy train it appears, in the long run fix it up and stay put!

Ahhhh. The geniuses in SoCal are starting to realize something I said 30 years ago.

You can’t make money in Residential Real Estate. Because you’d have to downsize or move to Kentucky.

And the special snowflakes that gravitate to SoCal can do neither, because their giant egos won’t allow them to do so (or else they’d already downsized or cashed out and moved by now)….

Many people have a made a fortune in residential real estate over the last 30 years in socal. I’m pretty sure most of them haven’t moved to Kentucky. Just look at the featured Culver City house. If it sells for anywhere near the ask price, that is a whopping profit for owning the house for two years. The lure of large profits in a short time period is simply too tempting to resist.

My folks (boomers in their late 60s) left the Bay Area (Fremont) sold the house we grew up in and moved to a golf community outside of Richmond Va. They love it and have a few family member in the DC area. I have another Aunt in the east bay looking at places in the same area of Virginia and will sell a beautiful home, cash out and move.

The only real hope for us mid-30s people is that more and more Boomers just don’t care about “staying close to family” and move. I have nieces and nephews all over, but my parents now have the money to go visit them in Wa, Va, and NY all the time. They really love playing golf 4 days a week and going to the indoor pool…etc..etc.

When it comes down to there is not a good reason to stay retired in some random suburb in the Bay Area living off a small pension and 401k. It’s not for everyone, but it would seem that a lot of boomers will do this to Virginia, Oregon, Nevada, Idaho, Texas

Kentucky is not the only state to move to. Although it is a nice state, there are plenty of nice places to move to, and inexpensive.

For those who don’t anything besides bubble SoCal, there are many places way nicer, no traffic, lower tax climate and reasonable good weather…..and yes, no hot humid weather, no tornados or huricanes – there I said it before you.

If you can’t find those places, that means you don’t travel and don’t know how to google.

Sssshhh…most places wince when they see a elitist Californian show up, eager to “educate” the locals the errors of their ways, teach them how they can “DO THEIR PART”…

As horrifying as that price looks, 1989 and 2007 were worse.

Using the current listing price (Housing Bubble 4.0), $1,099,000 and a mortgage rate of 4% and a 100% LTV loan, the monthly mortgage is $5,250.

In July 2007 (Housing Bubble 3.0), median home prices in Culver City (90232) was $925,000. Adjusted for inflation, that would be equivalent to $1,056,000 today. Mortgage rates were 5%. So that would put the inflation adjusted monthly mortgage payment at $5,670.

Back in 1989 (i.e. Housing Bubble 2.0), homes in Culver City were selling for $400,000. Interest rates were 8.5%. Adjusted for inflation that would put the monthly mortgage at $5,870 in 2015 dollars.

Of course in 1989 median household income in Los Angeles County was higher than today, $62K in 1989 versus $53K today when adjusted for inflation.

History may not repeat but this looks awfully familiar.

I beg to differ with you I came of age in Culver City and in 1989 you could be a nice house in Culver City for 250K. And that is what they are worth in my opinion today 2017 anything else to me is BS.

Look I own to luxury homes do I need two luxury homes know of course not. I purchase both right price within a year of each other both in prime zip codes but like everyone else, I’m saying one has to go, it doesn’t make sense if I can make a somewhat profit, a killing will not happen anytime soon, according to my research.

The issue is not so easy, many homes listed and what the media says is hot markets doesn’t hold true in many cases. Homes are sitting and buyers are still not qualified no matter, they inquire but can’t get bought to purchase. Cash buyers are picky why not they are in a good position, so if you don’t have everything just right no sale.

In the luxury market especially it takes time a long time, you see folks who have money didn’t get it by making made bad investments, so when you see million dollar sales don’t think everybody made out, most likely the seller wanted out and lost on the sale or maybe broke even, and like the earlier post you better have plan or another house to go to or be left out. That is the only reason why I will sell one of the homes, I got a place, otherwise most likely will never sell again, like many others.

The self congratulatory hubris on this site never fails.

This is how we dooo it.

Yesterday I spoke to Bloomberg Business about the Housing Inflation Story in SO CAL and how the some areas are being helped with the demand from $$$ coming from China

Bloomberg Business Housing Interview: New Home Sales , Housing Inflation & The Chinese Buyer

http://loganmohtashami.com/2015/05/26/bloomberg-business-housing-interview-new-home-sales-housing-inflation-the-chinese-buyer/

In a real live current time example

My parents are selling their home in Nellie Gail Ranch, ( Laguna Hills) CA for 2,000,000

All I have seen are non English speaking Chinese buyers and their next door neighbor’s who have much more new homes … They brought in full offer cash for 2.5 and 2.6 million for both homes

If you are a wanna-be homeowner in Culver City but its out of your price range, come over to Baldwin Vista. The most well preserved mid-century neighborhood in LA. Prices are about 40% less than Culver City. most homes are 3bed, 2 bath on 6,000 – 7,000 sqft. 1.5 miles east of downtown Culver City. Baldwin Vista is bounded by La Brea on East, LaCienega on West, and everything South of the Expo Line….the Expo Line provides a good barrier from the West Adams rifraf. check LA Times crime maps…. crime in Baldwin Vista (and everything west of LaBrea drops significantly).

Anyway, I am not a realtor, I purchased a 1800sqft home in Baldwin Vista for $470K in 2012 and have been quite happy. Prices are now about $600K-$650K.

As with the stock market, you won’t benefit from the paper appreciation until you sell. Unlike the stock market, a house is a lousy investment.

We all know much of the persistent bid across all asset classes comes from easy money policy around the world. Central banks are clearly choosing to err on the side of inflation versus deflation in their decisions so under this scenario. I agree that an investment in a house purchased fully in cash is a lousy investment given the maintenance costs. However, when you combine the tax benefits of mortgages with low fixed financing and the prospect of inflation surprising to the upside, I think this changes the analysis somewhat, especially if we’re talking about an asset most people actually use.

It’s easy to say “why don’t you sell your home in california and move to a cheaper state” when you’re at the retirement age but that’s not really an option when you’re in your 20-40s, still in the career phase of your life. If you are an older person who has decided to sell of your home, what do you do with the proceeds from the sale? Stocks? Bonds? No thanks, prefer real estate in desirable urbanizing locations at this stage of the game.

@Jerrelle:

You really think a house is a wise investment now, especially with a mortgage? What happens in 2-3 years (or less) when we see a scenario similar to 2009-2011? Folks will have fun paying (or defaulting) on their mortgages when the value of their houses is 2/3 or less of what it was.

You mention inflation as a prospective driver of increased home prices- will wages also inflate to support these even loftier home prices? If so, that would seem pretty miraculous.

If someone is buying a home as an investment in the current market (to live in or otherwise), that is crazy to me. Stocks are also a risky bet, but that doesn’t mean real estate is any safer at the moment. I have much of my down payment money parked in CDs at 2%, where it will remain until prices come back to reality. Yeah, it’s barely keeping up with inflation (if that), but I’m also not going to lose it in a risky bet on real estate or stocks.

Successful investors generally buy low and sell high. Now is probably not the “buy low†stage.

B-V is SUPER ghetto!

Just cus the richer gangsta people live in B-V, does not mean they cut all their ties to the streets. I’ve driven through the quiet streets on a weekend night and always see a few pimped out escalades and dark SUVs crusing around, as well as congregations of people “hanging out” in their front yards. Not a safe or comparable place to Culver city if you ask me and guess what, it is priced accordingly!

Baldwin Vista = Ghetto

This bubble is killing me. I’m in the house price concentration camp, whilst others are having Bubble Party 2.0 LONGWAVE.

What a never-ending trip we’ve got Lord Blankmind getting feathers ruffled by any suggestion that California dreamers looking to cash in on the party are ego maniacs and the baldwin vista guy shilling for his neighborhood for something like the 20th time now. You’d think that if these guys were confident about their bets they wouldn’t need to convince the rest of us to join them.

^^This^^

Just doing my usual public service announcements here. Any and all BS will be called out. I wished I could take a time machine back 30 years to 1985 and buy “cheap” real estate.

Allow me to be the first to call BS on any notion that you’re here to help anybody but yourself.

Pride goeth before the fall.

we probably need to sell our burbank house either this June or next June to avoid capital gains tax. We are renting at a decent profit to renters who want to stay as long as we willl let them. Do you all think our price will be better to go to market in late June 2015 or may 2016. is the potential fed rate hike going to reverse the rise in prices by early next summer? Don’t want to sell as I’d like to move back some time but have a good bit of debt in the house that would go away by selling. Any Ideas?

No one really knows, but, if it were me, I’d sell now. My hunch is that 2016 is when things crumble, and you never know when a good renter that is month-to-month may leave unexpectedly, but, hey, I’m no fortune teller, so take that with a grain of salt.

I heard September 2015 is when everything crashes

Much worse is when a tenant stops paying rent — but won’t leave.

Some tenants, once they decide to leave, will stop paying rent but stay on, dragging out the eviction process for several months, while living for free (i.e., on the landlord’s dime).

This is especially prevalent during economic downturns, when tenants lose their jobs.

This is why professional landlords prefer owning large, multi-unit buildings. Many good tenants are needed to financially offset the few deadbeats every year.

Thanks for the feedback on whether to sell in 2015 or 2016. I have great renters with good jobs who want to stay but if I have to sell (which I kind of do) just want to sell at the right time in the next 15 months

I think the point is that you, nor your renters, really know how stable their job or living situation is, because things can always turn on a dime.

Potential rate hike? Those predictions have been floating around since early 2014. That said, how high can prices go in 2016? I think they will be lower. We’ll see.

Since there is such a high number of foreign buyers, I wonder how the immigration reform effects the housing market? I live in a East Bay town in the Bay Area, patiently saving money for a down payment, now that I have the money I can’t afford anything or better stated I can’t compete with all cash bids,$30000 over asking from non US residents.

This place (in the post) is a pretty nice flip with nice finishes. 1.1 mil in a crap neighborhood, 200ft from the 405 and 1450 sq ft? I just don’t see it happening.

Everything is being disrupted. The seeds of change are everywhere in reaction to the old way of doing business. Uber, AirBnB, Zip Cars, Bitcoin (bye-bye banks). It is now all about the 99% sharing while the 1% derive profits for facilitating it. Why is the homeownership model still so sacred to people? Why do you think it is immune to being disrupted? Unless one could buy in 2011 0r 2012, do you really think you’re going to be able to sell and find as nice a home in a nice area for less than what you sold your home for? Do you really think you’re rich when you look on Zillow and see your house has gone up 35%? That is only real money if you’re willing to sell and move to another state. I tried that. Moved to Portland. Wanted to kill myself after 5 years. Couldn’t wait to move back to LA. I am so much happier here despite that fact I owned there and rent here. A standard of living does not necessarily equate to a high quality of life. Just my .02.

try telling that to the geniuses on this forum who seem to think they are the only ones who can see the high (and increasing) cost of living in LA/SF.

Higher prices in desirable areas is a natural outcome of limited supply and increasing demand. The effect of higher prices has led to people forced into surrounding areas, many which are improved during the process (sorry, I don’t feel people are entitled to live in an area just because they were there first).

Is that it tends to be replaced with other desires in short order. The desire concept is really the last vestige you and other promoters here have to fall back on so you keep slipping it in wherever you can as a backstop. Good luck placing your bets on the desire of others. Detroit was desireable once before.

Oddly enough, we got tired of waiting for the downturn in LA and moved to Portland last year. My wife and I talk everyday about how happy we are that we made the move. I’d rather live in Portland, even if it was the same price as LA, but I’m thankful that those who need sunshine all year are kept away.

That being said, prices are still bubbly here, so we’re still renting and waiting, albeit renting a lot more for a lot less.

Lets reconvene once you’ve spent a couple of wInterstate there with six straight weeks of rain and noThing but gray skies. Oh yeah. It’s crushing that weather there. Barren of color the place looks like a charcoal drawing 6 moths of the year. No place to go after 9 unless you’re into drinking. Portland only seems like a Utopias during the summer. Highest suicide rate in the country. 70% of the people on psych meds. Keep aware of your moods. Just warning you. ymmv

I grew up in Indiana, which is much nastier than Portland’s weather in all seasons, and I actually like some gloom. In fact, I don’t really like a sunny day to be warmer than 75 degrees. It seems like most of the people that complain about the weather here like the weather of Southern California or the Southwest, which is furthest from my ideal weather. 55 degrees and partly cloudy is my ideal weather, and we get a lot of that here. It’s really no different than many of the major European cities, here.

Thankfully, it seems that people that like this kind of weather seem to be in the minority.

How do you get utopia from this guy saying him and his wife are happy they made the move? There sure does seem to be a lot of people there for such an awfully depressing place.

BTW, at least as of 2011, Portland doesn’t have the #1 suicide rate in the country.

It was #12, behind Pittsburgh, Wichita, Jacksonville, Denver, Miami, Mesa, Albuquerque, Sacramento, Tucson, Colorado Springs, and, at #1, Las Vegas, which has more than double the suicide rate of Portland.

http://www.forbes.com/sites/daviddisalvo/2012/06/08/10-myths-about-us-cities-and-states-debunked/

Portland? We used to live there. The scenery around the city is green and lush–only because of all the rain! Housing is expensive unless you want to live in the ghetto areas of SE and NE Portland. Traffic is horrendous–the roads are narrow and the city is difficult to navigate around in because of the Columbia river and all the hills. Public transit is scary because of all the gangsters, homeless and meth heads who ride it. Portland is dominated by the radical leftists and environmentalists who are always cramming their agendas down everyone’s throats. We don’t miss living there.

Housing certainly isn’t expensive in Portland, compared to Los Angeles. We live in a beautiful, safe neighborhood with great schools, and we can walk to all kinds of things. The equivalent house in LA would be triple the cost. After living in West Hollywood for 15 years, I don’t find the Portland politics to be any more liberal, although that doesn’t bother me, either way.

Portland may not be for everyone, but it’s pretty much my family’s utopia. I ride bicycles all over town, see live music, go to any number of beer/bacon/whiskey/etc. festivals, take my son to a bazillion parks, eat great food, and work remotely from various coffee shops within walking distance from our home. I wouldn’t pick any other city in the country over Portland, but I’m glad that rain and liberal agendas keep people at bay.

SoCal has a big elephant in the living room-an exploding population who consume far more than they produce-homeless, eaters and breeders, low/no income, retired, etc. Add this to a poor job market; few high paying , stable jobs, and competition for sub $15 hr jobs (almost all PT) is fierce as SoCal is awash with retirees who need $, middle aged UE, recent college grads who won’t relocate, can’t leave Mom/Dad, enjoy weather and Disneyland, and illegals, all competing. A human meat grinder; work people to the bone, minute they can’t do work of two people their hours are cut, replaced with a never ending stream of new hires, and so on. Good luck with $15/hr min wage; the grind will become even more intense/vicious.

Of course none of this will effect magical people in wealthy enclaves who bought decades enjoy and can’t understand why anyone would leave Paradise, so carry on.

I wonder if the banks will actually go after people in the FC process after 2.0 pops?

Wow. Whiskey Tango Foxtrot, over? Who can afford this and what’s the median income around Culver City? Being a native Californian, gone for 22 years and now living in beautiful eastern Oklahoma on a paid for idyllic ten acres with two big finished barns, a one bedroom cottage AND a house as big as Culver City’s (but 900 grand cheaper and 30 years newer), Dr HB always provides articles like this and especially his “Real Homes of Genius” to answer the question I sometimes ask myself, “Now, why did I leave California?” Thanks again Doctor.

Actually admitting that someone is okay with leaving California. Some of these guys have a lot riding on no one finding out that’s possible.

Dude, your reply to Mr. Oklahome is just as much of a chest-thumping “I’m the only right opinion here” opinion as his was.

“Some of these guys have a lot riding on no one finding out that’s possible.”

Yes, apparently Steve does.

That makes no sense.

Doc: You also have a 3 beds 2 baths place listed at 1,633 square feet for $3,695 one street over. Sure, you’ll get rental breakeven points with a big enough down payment (try $219,800 without factoring closing costs or anything else).

Doc, I suspect you mean this 4-bed townhouse place.

http://www.zillow.com/homedetails/11260-Overland-Ave-APT-27A-Culver-City-CA-90230/20430052_zpid/

If I were sat on $219,800 in cash (not bragging here, but I am… many years of saving), when I look at house prices, I do not use any Rental Parity (Parody) calculation. There are too many flaws with that simplification, in my opinion; eg monthly rent matching monthly mortgage payment.

The only way it would make sense to buy is if house prices went from lunatic maniac prices of today, to universe shattering prices in years ahead. Considering I believe we’re near peak of a bubble today, with grinding noises being heard, and the Fed now silently reversing liquidity in the market, and hinting rate rise… it’s

If I required a 3 bedroom+ place in Culver City I would rent the place at $3,695.

Or even this more expensive rental across the way, at slightly more per month.

http://www.zillow.com/homedetails/11931-Beatrice-St-Culver-City-CA-90230/20440158_zpid/

30 years won’t pass by all smoothly and nicely, buying just before years of house price correction. There can be fall out and changes over 30 years too… even just a few years as bubble pops, and money tighter, and you can’t move to a preferred or different area because you would need to sell house in difficult market, rather than just give notice to the landlord as a tenant.

Doc: First, it sold for $590,000 in 2004. In 2012, it was listed for rent at $3,100 and looks like it rented quick, for one year. It then sold for $700,000 in 2013. It is now listed at $1,099,000. Keep in mind this place was rented out in 2012/13 for $3,100 and now the list price is $1,099,000.

So landlord wants to sell.

This is why Rental Parity (after putting your big deposit down) is misleading – the math after you include 30 years of interest rates. Your total repayments. House prices are a matter of opinion, but the debt is real. It’s an absolute priority to run your house buying sums through this calculator.

https://www.drcalculator.com/mortgage/

Zillow has 41 homes listed for sale. What is also interesting is that the city has 33 pending foreclosures. There is no incentive to rush these out to market.

It seems to be indicative of some stress or masked weakness though. I’d like to read some of Doc’s thoughts about this in a future entry. How long have they been pending..? If quite some time, then why the delay. Although a glimmer of hope/concern for future market softening that they are pending at all perhaps.

Some of the US’s biggest banks actually want interest rate rises, and are all positioned for that (see link).

http://fortune.com/2013/06/03/jamie-dimons-5-billion-bet-against-bonds/

Debt can not compound faster than incomes forever – without some sort of cascading event. Houses owned outright are not making banks any money. Cash buyers are a neutral for the banks. They need to write mortgages in volume to begin making serious profits, and that, in my view, needs a correction in prime housing markets.

I initially came back to make a reply to clarify a point made in my main post above. The Fed isn’t technically withdrawing liquidity from the market – but it has begun to significantly reverse it. (It’s complex).

What worries me, is the number of Boomers I know looking to move OUT of California as soon as they retire.

The housing market is completely insane, salaries are not keeping up with valuations and younger generations are by in large saddled with student loan debt. Not to mention most jobs these days seem to either pay crap or require you to move on a regular basis. One company I was with moved to 5 different states after mergers and acquisitions. Why in the world would I ever buy a house?

greedy boomers, shysters, hucksters, and hustlers—why america failed.

Leave a Reply