Down payments, stricter lending, stagnant wages, and massive pipeline of distressed inventory – 5 reasons why 2011 is not the time to buy real estate in California. Even FDIC Chairman Sheila Bair supports 20 percent down payments.

It should come as no stunning surprise that nationwide housing is taking a turn lower yet again. California real estate is going lower faster and deeper and will face challenging years ahead. The California housing market is already seeing the pressure of bigger down payments and more stringent lending requirements. The biggest critics about these changes are typically those who derive a commission from making loans and are also the people who made out like criminal bandits pushing waste like Alt-A, subprime, and option ARMs onto the public. If the mortgage market is now dominated by taxpayer backed mortgages then we should not repeat the blunders of the last decade. The down payment is a necessary first step and ironically will help bring in more affordable housing since people will actually need money to come to the table instead of a whim to purchase a home because they saw an episode on HGTV and tossed their bucket of popcorn. I usually get elaborate e-mails about people looking to buy in California. My response? Wait out 2011. Let me give you five reasons.

Reason #1 – Down payment requirements

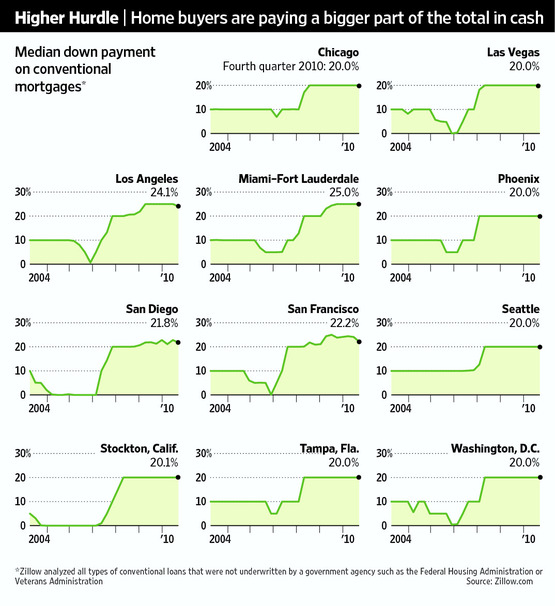

Source:Â WSJ

Most in the industry understand that sizeable down payments are a must for a stable housing market. They serve as a counter-balance to greedy and shady operators that make their living off churning home sales instead of letting people establish roots and building communities (and equity for that matter). Wall Street is the puppeteer and banks are still trying to figure out ways of unloading giant globs of toxic mortgages onto the market. The shadow inventory is trickling out. A larger down payment in many California communities spells immediate price corrections. The head of the FDIC realizes this is important:

“Federal Deposit Insurance Corp. Chairman Sheila Bair told an industry conference last month she supported minimum 20% down payments.â€

Now doesn’t that make sense? If people actually have the financial discipline to save 20 percent then it is likely they have more of a buffer to ride out any storms in housing. Plus it is a lot harder to walk away from 1, 2, or even more years of savings. If you look at the above chart many areas in California went down to virtually zero down! That is absolute madness and FHA insured loans only require 3.5 percent and are raising insurance premiums on buyers. Now why would insurance go up? Because they are a bigger risk but who really cares when you can pump out loans and shovel them to the taxpayers? We already know default rates on FHA insured loans are soaring. Last year nearly 40 percent of loans in California were FHA backed. This is insanity for a loan designed to help “lower income†areas and make housing an affordable option. Yeah, like option ARMs were for doctors and aspiring actors with large off the books income that would come in once Transformers 10 came out on DVD.

Bottom line a larger down payment makes long term sense but means lower prices for California real estate.

Reason #2 – Income and wage issues

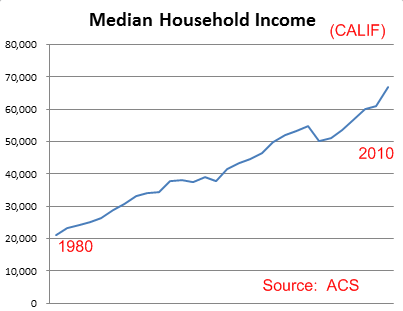

Source:Â ACS

I always find it fascinating how every discussion of a near bottom never even bothers to look at income of people actually buying these homes. This was one of the main gaps that we saw when the bubble exploded. Very few actually examined the income of those buying these homes with toxic mortgages. After all, lenders didn’t bother so why should the media? So even today, we don’t see widespread analysis here even though this is one of the most important factors.

An economy with good wages will likely have stable home prices. Right now we are trying to have stable home prices on the back of weak wages. In 2007 the median household income in California was $67,000. The current median home price in California is $239,000. This ratio of 3.5 seems reasonable but this median price is being dragged down by areas in massive distress and the large number of investors buying properties. The mid-tier markets have higher incomes but ratios that are completely disconnected from reality. These are coming back in line with more shadow inventory leaking out but there is no rush to buy in these areas.

Bottom line with a 23 percent unemployment and underemployment rate there is little reason to expect wages will shoot up anytime soon. If wages were going up solidly we could at least justify prices in some areas. That is not the case.

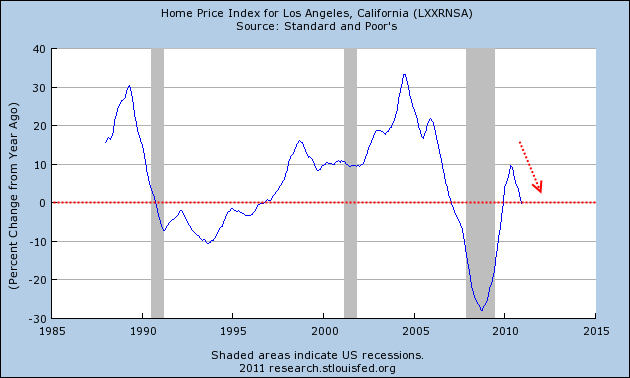

Reason #3 – Prices are falling yet again

Home prices are moving lower yet again. The double-dip is fully here. We talked about this many times with Southern California (with over half the state residents) went negative year-over-year last month. I hesitate to call this a double-dip because this almost assumes we had a solid move up instead of a hocus pocus potion solution that merely boosted prices up on pure fumes and pulled in more hungry home buyers. This was done via tax breaks and artificially low rates courtesy of the Fed. It would be different if prices shot back up because unemployment dropped significantly and good paying jobs were plentiful. Last I checked the state still hasn’t settled on how we are going to deal with the $26 billion deficit.

Prices are also moving lower thanks to shadow inventory coming into the light. Distressed inventory as expected sells for a much lower price and drags local area comps. Case-Shiller tracks repeat home sales and is a much more stable indicator but even looking at monthly median price drops we are seeing significant changes and it helps to see trends on a micro level. Los Angeles County is down 10 percent in only a few short months. Expect more of this especially with tighter lending.

But is this bad? Is it such a bad thing that home prices are lower and people don’t need to leverage their entire life on the back of a mortgage? It is nonsense and a California obsession that needs to end and it looks like it is. The notion that housing is the easiest way to riches and you can flip your way into prosperity. Innovation is in places like Silicon Valley, not strip suburban sprawl out in the desert.

Reason #4 – Repair and energy

In California the notion of staying put for decades in a home seems foreign thanks to the last decade. The housing bubble has psychologically altered how people view housing. Many see the first home as a “starter home†followed by a “good school home†finally to “king of the hill†home. Each step was created by the bubble equity from sitting only a few years. Yet that game is now largely over. Many of the homes in more established cities are very old and need thousands of dollars of repair and upkeep. Since it is likely appreciation will move slowly (or lower prices for the next year) people are going to likely need to stay put. Flipping won’t be such a big part of the market anymore.

In regards to energy, more people are likely going to opt away from the cheap price regions of the desert and will likely rent or find alternative housing closer to work. Oil is not going to get cheaper anytime soon and the trend is not promising to say the least. A world created on cheap fossil fuels is now being put to the test by over 6 billion people who all want cars, refrigerators, and things of modern life.

California is likely to take a very different shape in the next decade because of this so those investors out in the desert need to gear up.

Reason #5 – Massive distress pipeline

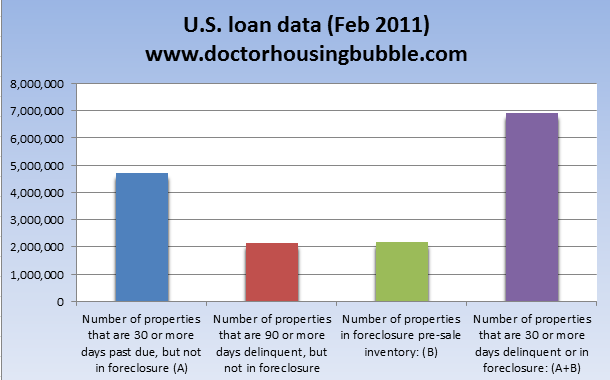

Source:Â LPS

Do we even need to mention the large number of homes in the foreclosure process in California? This is the shadow inventory that is now trickling out. In the US nearly 7 million homes are either in foreclosure or have missed at least one mortgage payment. We ran our own analysis for California and find anywhere from 550,000 to 700,000 homes in one of these stages. The MLS lists 286,000 homes in the foreclosure process. How many others are not making payments and simply do not show up?

We know banks are moving on more homes and we have even seen sizeable price cuts in short sales to get properties to move. It seems like banks are moving on some places realizing prices are not going back up. In the end there is little reason to buy in California in 2011 unless you are okay with seeing your home value drop to more reasonable levels with the passage of time. You are likely to over pay but again that isn’t likely to stop many who just need a piece of the pie.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

95 Responses to “Down payments, stricter lending, stagnant wages, and massive pipeline of distressed inventory – 5 reasons why 2011 is not the time to buy real estate in California. Even FDIC Chairman Sheila Bair supports 20 percent down payments.”

No kidding! This little gem a few blocks from me just came on the market. So. Pasadena still has a ways to go I think.

http://www.redfin.com/CA/South-Pasadena/1511-Marengo-Ave-91030/home/7007773

Notice yet another 2006 closing date. Anyone taking odds on this being a pay option ARM with a 5 year reset? I’m guessing the clock is ticking. I wonder how long it will take before their asking prices starts chasing the market down.

I bet you are right on the money!

I’ll vote for an option ARM with a 5 year reset/recast too.

I’d be willing to bet that many of the 2004 purchases that are on the market are 7 year resets.

2015 bottom at the earliest IMO.

What’s funny is that they convinced the IRS to lower their valuation to half of what they paid, see 2009 Tax data further down on the page… so they obviously have not completely missed that the bubble has burst…

IRS? You mean the LA County Tax Assessor. It could also be that this property qualifies for the Mills Act, reducing the property tax burden on historic properties (appears to be a California Craftsman, I think the listing said 1911?).

The last few recessions were cyclical and most people do not understand that this one is structural. We got a ways to go down yet before stabilization is reached.

These condos in downtown L.A., under $200K….HOA fees are $560!!

http://la.curbed.com/archives/2011/02/price_sheet_for_downtowns_santee_village_kicking_around.php

Put a coat of paint on a dilapidated industrial building in the slums of downtown LA and you’ve got the perfect example of lipstick on a pig.

Maybe Banksy will tag the building; urban pioneer Hipsters ignite a bidding war for the units.

Another great analysis, Dr. HB.

Remember folks, trust this guy – he’s a doctor.

Constructive, thanks.

@CAE- this is true. This is structural. Companies are creating jobs -tons of them- just not in our country. China just became a bigger automobile market than us and I think I have to agree with the doc about oil.

We have to do something . If not, we only have to look at the rust belt cities and their economy when the structural changes of manufacturing got shipped offshore. Today the median price of a Detroit home is $6,000 ! Either we have to figure something out or maybe the dollar will crash to even out the imbalances-then we might be like Zimbabwe -paying millions of dollars for a loaf of bread. not very unlikely-considering that many are now talking abut not raising the debt ceilings ad thereby trigerring a national default. That has never happened before. Who knows how it will end?

So what DO you recommend for those of us sitting patiently on the sidelines with sizable down payments in hand?

Let it sit in our regular savings account with an abysmal interest rate and wait in the bushes for the right moment to strike? Park it in a Roth? Make a pillow out of it?

Nothing is risk free, but in a similar situation I’ve parked money in an array of Muni Bonds, Commodities and (god help me) an S&P 500 index fund. None are for the faint of heart these days, but the array has served me decently well through the last couple of years.

The DR. is right on. You can look to Vegas and Phoenix to see where this is going…down…down…down! The silver lining is the opportunity to buy back in at unheard of cash flow. I’ve been purchasing property in metro Phoenix, I think it is safe to say who cares if it’s the bottom when you can pick up 30% cash on cash returns coupled with very positive cash flow. I’m saving up for when this opportunity appears in SoCal, I’m guessing this time next year.

Cash is eroding due to inflation. Perhaps putting it in: Gold & Silver either physical or ETFs such as GLD or SLV.

There are MANY MANY things you can do with it if you research ALTERNATIVE investments, which is pretty much how the wealthy invest, some of which actually take advantage of the current real estate downturn. Although I am definitely NOT that wealthy, here’s a short list of some of the some stuff I have done over the past 3 months alone, all of which are relatively low-risk (if you put the correct downside risk mitigations in place):

– Hard Money Loans (Single Family): Can earn 16-28% annualized with relatively low risk.

– Business Bridge Loans (Collateralized): Can earn 35-60% annualized with relatively low risk.

– Commercial Real Estate (Canada – NOT here!): Can earn 12-13% cash flow + 4% mortgage paydown + 3% annual appreciation = 19-20% annually

– Mobile Home Notes (Cross-collateralized): Can earn 35% cash-on-cash annually for 5-6 years.

– ATM machines (Cross collateralized) – 30-45% cash-on-cash annually for 5-10 years.

– Etc, etc, etc (the list goes on…)

These are actual investments that I have made over the past 3 months alone as a “passive” investor, most of which are actually managed by someone else who is an expert in the discipline and all of the returns I mentioned above are net to me (the investor). You just need to network, put the effort into it, and you’ll find it. Or just contact me and I’ll partner with you! Finding these is a team sport – it’s all about networking with other investors.

Good luck to everyone,

Investor J

Holy Cow, those are some returns! Thanks for the tips, I’m looking to invest some inheritance $, not a heck of a lot, but some is better than nothing.

Investor J, I’ll bite. How exactly are all of these managed – via a money manager/certified financial planner/investment advisor who actually finds these? Or you/your contacts/network find these and somehow have your money manager move the money to them?

I have 80,000 cash in money markets waiting for an opportunity

Native Pasadenan / Foolio,

Please understand that I am not trying to sell you on anything – just pointing out what is out there while we all wait for this mess to filter out of the system. I am a full time investor who has built a network over the past 9 years in order to find these and, thanks to cash flow, I left the corporate world in 2007 and I hope not to return. Unfortunately it takes a while to build a network so it honestly won’t happen overnight but anyone can do it if they’re willing to put the effort in and it’s definitely worth it in the long-run.

And these are NOT managed by a money manager, etc. Frankly they are almost the antithesis of traditional stocks/bonds, as they are known as “alternative investments”. These are all individual investments that are offered by “syndicators” (aka people who are operating them). It’s almost like you’re hiring and making a bet on a specific syndicator who is experience in a certain asset class, as they have full control. They aren’t allowed to publicly advertise for investors due to SEC/FINRA regulations (which is NOT a coincidence, as I am sure the government/corps wants to keep everyone’s money stocks/bonds), so they are very hard to find, which explains the need for networking and which explains why investing is a team sport. BUT, once you create the network and start to find them you’ll never go back to rolling the dice on stocks. Given my focus on cash flow, I have essentially rolled over from the uncertainty of stocks to a much more certain monthly cash flow from a diversified portfolio of alternative investments from which the cash flow can be forecasted annually within a reasonably tight range. And I have been very lucky to weather the storm over the past years better than most due to my cash flow focus. I have nothing left in stocks – it’s just too much of a gamble and, as you can see from my previous post, the returns I can get by putting in the effort to find these opportunities is far better than the long-run historical average return of the stock market.

Not sure if Dr. HB will let this part of the post through but you can find one of the public networks I co-founded on Meetup dot com if you search on the term FIBI (aka For Investors By Investors). We now have 9 chapters in SoCal, most of which are in Los Angeles. I manage the Cash Flow Investors Unite chapter, as well as 2 others (Investors in Real Estate and Businesses and Commercial Real Estate Investors). Feel free to send me an e-mail through the Meetup system or feel free to come to one of my meetings, as I would be happy to meet you and I would be glad to discuss.

Good luck to everyone,

Jeremy (Investor J)

Investor J,

I checked out that site and it looks interesting. I tried to search for you but couldnt locate your profile. Is there an easier way to get in touch with you?

Socaldan and everyone who replied to me,

I’m trying to avoid posting my e-mail address (to avoid spam) and my username on Meetup is not Investor J – sorry for the confusion. You can access my profile on Meetup via the following link and then send me an e-mail. Sorry for the hassle:

http://www.meetup.com/FIBICashFlowInvestors/members/4090069/

Good Luck To Everyone,

Investor J

Invester J. I could not help myself on this one. The age old adage that “when something seems to be too good to be true it often is,” just flashed before my eyes, along with all sorts of other red flags. You are talking about Madoff types of returns, I mean even he can only give you returns in the 20% range, and here you are offering as much as 40% return without lifting a finger. Judging by your sales pitch, I doubt that you are dumb enough to let your money be handled by someone else without know ALL the details. If this is how you like to invest, I have a wealthy but imprisoned Nigerian Prince I like to introduce you to and I’ll only take a 10% commission.

Investor K,

I understand your suspicions, as some of these numbers are very high. Ask yourself why Hedge Funds can yields these types of returns and you’ll begin to understand how the very rich invest and why the top 1% are increasing their share of the wealth so rapidly. I am NOT in the top 1% but I am what is considered an “Accredited Investor” (you might want to research that if it doesn’t make sense to you). I’m not trying to sell anyone anything – I am simply a full-time investor sharing what I am currently yielding to help open others’ eyes as to what is out there. And frankly all I want is to find the best opportunities out there, which is what I search for full-time. And I didn’t find these things in 1 month or even 1 year. It took 9 years of building a network and education to understand what’s out there. All I know is that stocks and bonds have permeated into everyone’s default thought about what to invest in so that Hedge Funds and the wealthy can enjoy the real returns, like those that I mentioned in my post.

Because I’m going to proceed in good faith that you’re not just running around on the Internet bashing people, here are a few quick thoughts few you:

1) Research the difference between annual return on investment (ROI), annual cash-on-cash return (COC), internal rate of return (IRR), and amortized vs non-amortized investments. Also, research Self-Directed IRA and Solo K accounts. Until you understand ALL of these, you won’t have a full understanding of the returns I posted, which means that your concern about a “scam” would be invalid until you have the full understanding.

2) I have a very simple example of a 20%+ ROI that I have achieved that perhaps you and likely many here can relate to, given that we’re on the Real Estate topic. Ask any foreclosed house flipper how much they can make in a year if they flip JUST 2 (and some can do 3) houses in a year in a non-volatile market (ie. NOT Calfornia) and you’ll hear 20%+ ROI all day long. I have achieved 28% by investing with a house flipper in TN. I guarantee you that many people reading Dr. HB are achieving the 20%+ returns doing exactly this. But, of course, that MUST be a scam because the return is just too high…

3) I have an MBA from The Wharton School. I am not telling you this to make it sound like I am “smart enough” to find these returns, as that’s not true or relevant. I am telling you this because the network that I can access because of my MBA partially explains how I can get access to some of these. Investing is a team sport and it’s all about networking – and if you don’t have the network then I suggest you spend the effort to build it, as networking yields great returns (literally).

4) Final Comment – It’s sad that so many people don’t know what’s out there, which is specifically why I posted my returns, as you helped to make my point. Stocks and bonds are not the only and, in many cases, not even close to the best things out there to help build wealth. It’s just sad that the system is rigged to allow the Fidelitys of the world to advertise to everyone and to control our 401Ks, while the operators of the types of opportunities I mentioned are NOT allowed to advertise them publicly. If you don’t believe me then research Private Placement Memoradum requirements for the sale of securities (PPMs) – Reg D 504, 505, 506 – all of the rules are in there. They allow the Goldmans of the world to market and broker these opportunities to their high net worth clients, while leaving the rest of us with stocks and bonds.

That’s all for now. I didn’t mean to go on but, as you can see, you reaction is particularly frustrating to me because all that is standing in-between people like you and the opportunities that I find is education and networking. And, until you understand that, you’ll go on thinking everything is a scam and you’ll enjoy 1% in your savings account and 8% in the stock market (approx long-run historical average of the stock market), while the banks, hedge fund, and wealthy continue to increase their share of the wealth at your expense.

Good luck to everyone,

Investor J

Investor J,

Thank you for your reply. I will educate myself on these investments that you are mentioning. Sounds kinda like venture capitalism, no? Anyways, I hear what you are saying about different opportunities abound, however, you have to admit that it is the person managing the investments that will make the money not the investments themselves. On a interesting note, I’ve always been told that the game for the ultra-wealthy is wealth preservation, not wealth creation which is what you are talking about. Anyways, I’ve enjoyed this conversation very much. Hope you have great returns this year.

muni bonds are a horrible choice right now as states and local governments are insolvent and going bankrupt. neither are commodities (if you’ve been keeping track recently). Gold/silver will always be a hedge in my eyes than an actual investment. I’ve recently opted to put money into 10yr treasury notes, and plan to hold for another year or two. I don’t see the market getting that much better from here on out. The notes’ value will hold or go up over the next couple of years as the market adjusts/corrects. No guarantees for the near term ( < 6 months), so don't do it if you want to pull out in the very near future.

Thanks for the advice!

Gold/Silver has a hedge?!? Gold and Silver are in a bull market since 2000, up over 800%. Don’t believe the banker propaganda with fiat currency. The bond market will implode.

Gold is currency, that is my stance. Gold as an investment vehicle will incur a greater risk than a couple years ago. I think gold is blown up as a lot of that demand comes from investors who want to make a quick buck. If you know what you’re doing, you can certainly use gold as an investment vehicle, but for someone who has no clue on when to hop in and when to get off the train, this is not a great investment idea.

I have been reading your blog for quite some time and support your premise where you believe the market is going. Yet in East Long Beach up to the Lakewood Village area where I have been looking for about a year has a surprisingly robust sales history with modest pricing depreciation. Many homes I look at have pricing that I think is simply out of line yet those houses are moving, leaving me in my Apt. Hopefully the double dip you predict will be significant so I can be happy with my decision (or attempt) to delay a home purchase. Unfortunately my spouse has a different outlook that has nothing to do with economics.

Mike S,

The beach cities will be last to fall. They have come down just slightly, but typically these folks are more well off and can weather the storm longer than the folks out in the IE who were vaporized rather quickly. Don’t listen to people who say that beach cities are immune to market dynamics because of their high demand and lofty personas. They will decline just as everywhere else has. Just be patient. At the very least, prices will decline once the interest rates and minimum down payments increase. (Because, as the doctor says, high unemployment will create a static wage environment.)

Totally Agree! It all comes down to how much of a markup people are willing to pay for a premium area. If historically a beach close location has cost double of the neighboring city and the neighboring city drops by 50% the markup is now 4x. Many buyers with limited resources (so almost everyone) will rather opt for the bigger place in the neighboring city than pay the 4x markup in the beach city.

One of the most annoying phrases I keep hearing (usually from realtors) is “RE is local” – that is complete BS in my opinion. RE prices are very connected. You can’t have one area tanking without the neighboring areas being affected, sooner or later.

Mike, you have to keep in mind that Lakewood is the single area of LA county with a supply of homes under $450K, many under $400K, that is an ethnically diverse area, safe neighborhood, ok schools, etc. Literally no where else in LA like it. I believe La Habra and La Mirada are close, but neither has easy freeway access like Lakewood does. Everywhere else of similiar pricing and neighborhoods is either an outlying area, or is a predominately latino neighborhood(Whittier, West Covina, etc).

I believe Lakewood will ultimately fall around 20-25% more, which is quite significant, but only once the other similiar areas break out of their bubbles. And ALL similiar areas remain stubornly entrenched in a bubble…Burbank, Culver City, Pasadena, even the areas of Long Beach bordering Lakewood to the south.

Saving my cash, (not in the euphoric stock market-see Mish), and waiting. Lets not forget all the boomers who have nothing for retirement who will soon need to sell the only asset they have, they’re home. Of course they can always be defrauded in a reverse mortgage scam.

Thanks for mentioning repairs. As I last posted, the only homes in Burbank (Beverly Hills of the Valley) under 450k are total fixers. This is just the begining of the pipeline of overextended underwater squatters who will wholly neglect upkeep. Better have 30% down in the bank. 20 for down, and 10 for basic repairs.

What’s wrong with selling one’s home and moving to something cheaper?

What’s wrong? You can’t sell for what you owe in most cases….and even if you could you really can’t find ‘cheaper’. It costs money to sell, to move, and to rent. You may have to move again if you rent, and you don’t get a tax dodge to rent….and rent isn’t cheap even in high crime areas. So if you in a purchase that you can afford to pay….pay what you agreed to pay.

Mike S – just be patient.. Those people buying are going to be a bunch of sorry suckers! Most of them have homes that they get other suckers to buy and then they foolishly overpay for another house. It’s insanity and in a few short years those people will all be walking around with big capital L’s on their foreheads – “L” for loser!

Another thing Mikee – the man who calls himself president said in his 2010 State of the Union address ” That’s why we’re working to lift the value of a family’s single largest investment – their home.” So there you have it – the frontman for the big banks saying we are working to keep housing prices high! This is insanity! This makes homes more expensive / less affordable for families, and it’s not the job of government to do this. But in the end it’s like trying to hold back a tsunami. It won’t work. So be patient, Mikee!

Wow, NAR overstating house sales? How surprising. NAR has robbed itself of all credibility, and the current chief economist gots to go, just like the previous one. Common, a miscalculation in inventory? Where’s your QA group? Oh right, your QA only catches errors when your model spits negative housing data.

http://www.calculatedriskblog.com/2011/02/real-house-prices-fall-to-2000-levels.htm

@ Native Pasadenan

Hahaha. That price is ludicrous. It sold for $355,000 in 1997, now it’s on the market for $858,000. They’re smoking crack. Whoever buys that home for that price is going to be in for a world of hurt in a few years when the house is underwater. Who says it’s a great time to buy a home? Not in South Pasadena. Ridiculous.

I know! And it’s right across the street from an elementary school…noisy! But great if you have little kids, I suppose. Hella expensive. I’ll keep an eye on it, since I drive by it every day. It will be interesting to see IF it sells, and how much.

I have two little kids and I would never live next to a school. Yuck! I want my home to be quiet, and so will the people who eventually buy it from me. Location is everything!

It’s so fascinating to me to have watched Foreclosure Radar, Realty Trac and other sites for over a year now, and to notice that the short sales and REOs are always located in the worst positions on the street. They back up to a noisy road or a school, they’re on a busy corner, a T-Bone, or the very end of a cul de sac with headlights shining into the house at night.

I checked out the Marengo listing, looks nice – but not 2006 prices nice.

Also, on the right side of the listing all the news articles for LA real estate are doom and gloom headlines. Anyone looking on Redfin for a home will quickly decide it might be prudent to wait until, until the real estate headline perk up a bit.

“tsunami” is not a bad analogy, but that big wave of cheap homes may never roll in due to the advantages the bankSters have by getting FED.Bolsheviks.gov to connect a shop-vac to YOUR wallet (see Japan):

1) Their carrying costs are close to ZERO–virtually all lenders are stiffing the HOAs, forgoing lawn care, pool care, even property taxes in some locales! Once they do let it come on the market, they force the hungry and desperate llisting Real-tard to spruce up the place on their own dime! HARDBALL baby!

No one in the “civilian” world (i.e. moi) has this luxury! Thus, the slow dribbling of inventory can continue indefinitely. OF COURSE this is dragging on the REAL (productive) economy, and JOB GROWTH, but NOTHING is more important than the crony banks! GRRRRrrrr!!! This standoff DEFINES the Japanese zombie economy.

2) Their cost of CAPITAL (Fed discount window) is also near ZERO–complete fantasy land shyt! Again, courtesy of YOUR wallet, and YOUR jacked-up credit card fees.

3) Due to FASB “leeway”, Duh Banks get to carry these Loo-HOO-zer assets on their books at the peak bubble values! This is the most perverse DISincentive to unload inventory in known history!

4) Duh F.I.RE. “industry” seems to have crafted a prosecution-proof KICKBACK scam to “record” high selling prices, even in this down market. Here in FLL, I see them CLUSTERED in one bldg/development/small area… e.g. deepwater condo sells for $440k in 1998, insane $1.0M in 2006, then a NON-credible $950k in 2010… I’ll see 4 of these in a bldg. w/ only 32 units… uh-huh… must’ve installed new countertops… 🙄 NO, that extra $400k is getting rebated to the buyer’s offshore account… somehow… or simply “forgiven” once the transfer is recorded… still nosing around. (As you can imagine, no one’s talking… ;’)

In FL, I’m seeing more and more distressed homes which ARE paying their prop. taxes, yet have been in the foreclosure (court) process for 2+ years. Not sure how they decoupled their taxes from escrow, but obviously the county tax collector is happy to abet that process, and the squatter gets to eliminate the threat of a tax lien foreclosure, which, as you would guess, is a lot more “expeditious” than what Duh Banks have to go through…. game on, gaming the system…

Robert Shiller believes there will be another 15-25% drop in home prices. He is one of the only ones who have been right about the whole housing mess. The latest Case-Shiller report shows YOY prices dropping for the 6th consecutive month. Government bump is over and we are sliding downhill again.

Be patient and wait for total capitulatuion. It’s coming.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Just to add fuel to the fire – Redfin just published an article that pretty much says the opposite. Not sure who to believe.

http://blog.redfin.com/blog/2011/02/the_double-dip_probably_stops_dipping_in_march_feb_roundup.html

hehe… i wouldnt believe the redfin article. i went on several tours with them. none of the agents i’ve spoken to believe things are getting better. their own business has picked up, but their overall opinion still remains the same (a steady decline).

Redfin’s optimistic outlook sounds more like a marketing strategy to get people in and buying now that their business is picking up. I’ve noticed that redfin requires pre-approval in order to make tours now. This would naturally explain their 54% increase in signed offers since they’ve weeded out people who otherwise would not have qualified or were not serious enough to make an offer.

LateSummer – Shiller is no genius. Any reasonably intelligent person could see the blood

What’s remarkable about Robert Shiller is not his perspicuity, but rather, his veracity. He told the truth when many didn’t – and continues to do so. Unlike his partner-in-subprime Karl Case, Shiller is no shill for the real estate industry.

LateSummer – Shiller is no genius. Any reasonably intelligent person could see the bloodbath that was coming in the housing market. The bankers had an orgy by throwing meat (loans) to the piranhas (homebuyers) all the while laughing, knowing that they were driving home prices into the stratosphere, and knowing that many poor fools would be later losing “their” homes. So, I don’t buy into this Shiller guy being an “expert.” He seems like an average Joe Shmoe.

I think that 15-25% additional price drop is way to conservative in many areas. In my humble opinion, housing could be in for a bloodbath like we have never seen before. Referring to my above comment, you see the A-holes in government and banking have been artificially propping up prices (to save the banks , no less). This could all come shooting right back like a boomerang. Also, when the rest of the world decide they do not want the U.S. dollar anymore, interest rates will skyrocket, and housing prices will come plummeting back to earth like a meteor.

We would love to see a 15-25% decrease in Orange County… but we’ve pretty much lost hope of it ever happening here. Well-located properties that have been tastefully upgraded sell in days, weeks at most, at still-inflated prices. ($250-$300/sq ft.) The rest is crap– we’ve looked. A lot.

We’re renting a very cute little house for now, and aiming to get the hell out of here in 5-9 years. If we bought, we’d almost certainly be stuck here for much longer. And for what, the weather? I’ll buy a coat. 😉

Buy a shovel and chains too. Don’t forget bug spray, boots and a 4wd etc.

I’ve thought about it to, and the list goes on and on, then I decide to stay:)

The home prices in the bay area is still rediculous. Unless you are willing to drop half a million for a little fixer upper home, don’t even bother looking. I’m wondering how many household have the income that can afford that kind of mortgage payment…

I guess we’ll be renting for a long time.

I know someone in Marin Co. who bought a $700K fixer. He is the VP of a co. that designs cases for iPods and MacBooks. I guess that’s where the money is these days, go figure!

Native Pasadenan – haha, haha….. I can’t stop laughing. You said “I know someone in Marin Co. who bought a $700K fixer. He is the VP of a co. that designs cases for iPods and MacBooks. I guess that’s where the money is these days, go figure!”

Well, maybe that’s where the money is these days, but not the brains! You’d have to be a moron to pay $700K for a fixer upper! What a chump! Makes me think of a neuro surgeon I used to know who used the term “schitt for brains” (and he said that about another doctor!)

A fixer upper for $700K????? No thanks !!!! I’ll let someone else be taken for the sucker! How brainless!

Got a letter today from our accountant, seems there are several new entitlement assistance programs to pay peoples morgages. the gov bankers are playing games,

anything to keep the bubble going.

I live in England but will return to California or Washington so I watch this blog keenly. Interesting that in England, the realtors get 1.5% of the purchase price. Wonder why they can do it so much more cheaply than US realtors? Also, no such thing as a buyers agent. Only sellers agents so you know going in whose side they are on. In the US, Real estate buyers agent is a euphemism. A buyers agent is incentivized to get the buyer to pay the highest possible price.

Before you rush out to buy in England, consider this. While the realtor gets 1.5%, the government takes stamp tax of 1% up to 250k GBP and 3% up to 500k GBP and 4% over that. In Washington state my stamp tax in 1997 was $18.

We all know that wealth disparity is a trend that has only excellerated during the past recession. This, from an LA Times article:

“The state Franchise Tax Board reports that during the two decades between 1987 and 2008:

Inflation-adjusted incomes of the top 10% of California taxpayers increased by 43%; the top 1% by 81%. Meanwhile, incomes of the lower 60% dropped by around 12%.”

One reason for the disparity in how price contraction has occurred since the RE bubble burst in, say, Inland Empire versus Westside, South Bay, etc.

Hi Petrin,

I’m in the same situation. I have a rental property in Newport, which I’m sure is going to fall some in the next year or so. I sold out of a property that I’d owned since ’99 last year and put all of the money in a few cds making 1.7% (less inflation..not the CPI). I’m reading about other options, but I don’t trust this market at all. It seems like a farce.

Yeah, the older I get, the more it becomes entrenched in me that with the market, if it looks like a farce, it probably is. If it looks too good to be true, there’s a reason for that. Such was the case with the internet in the late 90s (especially here in the bay area), housing, cheap money making schemes you hear on the radio, etc.

Similarly, the more pressing the sales pitch by the seller, the less I trust it. It’s like finding a good lawyer. The good ones don’t advertise, because they don’t need to. The harder they try to market themselves, often (but not always), the worse they tend to be. Beware the lawyer with the full page ad and the billboards feigning sympathy for your plight, (s)he is only out and make money. I could be wrong, but investing seems similar, which is why I avoid “INVEST IN GOLD, BUY NOW!!! HOUSES ARE AT A RECORD LOW, BUY A HOUSE!!!” like the plague. The scam radar is blipping off the charts.

CDs and bonds sound interesting, but the Beck-infused gold market reeks of money making scam preying off of others’ fears.

Most mainstream investment advisers would have steered you towards housing and the stock market during the early to mid 2000s and most would have steered you away from Gold.

Today, most mainstream investment advisers would steer you towards housing and the stock market and will tell you “well, if you feel you must invest in Gold, we don’t suggest more than 5% and not in physical gold but mining stocks”.

It seems to me most of the “Gold” commercials are “CASH for Gold”, people trying to get your Gold in exchange for something that can be printed and is printed at will.

Remember the old saying ” Gold doesn’t pay interest”? Well guess what, neither does a dollar anymore, unless you are a bank loaning it out.

So neither pay interest, one is easily made the other the result of hard labor and limited supply. One is looked down upon by Wallsteet.

Gee, I wonder if Gold will hold its value with trillions of dollars added to the globe every year?

One more point.

You must understand what Beck is pushing. Beck is pushing a company that makes huge amounts of profit from the business of buying and selling gold and silver. They buy gold for a hefty percentage below SPOT price and sell a hefty percentage above SPOT price. They are an unscrupulous middle man which makes them the bad guy, not necessarily the item they sell.

If you educate yourself, you can’t fall victim to paying those ridiculous premiums.

Becks “gold scam” is simply a “scam” about paying more than something is worth and getting less than it is worth.

Some people think buying gold must mean you are a right wing nut case. I am a Lefty and proud of it but that doesn’t mean I think Ben Bernanke and his “quantitative easing” are without repercussion.

Yep, I bought gold in 2002 when Wall Street hated Gold and there was an occasional late night commerical for Gold coins. Now, in 2011, not a lot has changed although I will admit there are more Gold commercials but most Wallstreeters still hate Gold more than ever. And oh yes, lets not forget than now just as Gold does not pay interest, neither does the dollar.

Moved to NYC from CA last summer. Foreclosures in Manhattan are virtually non existent, mainly because most properties are co ops requiring anything from 20 to 50% down payment. Primary foreclosures are condos in Manhattan and 1 to 4 family properties in Brooklyn and Queens where little to no down was required. So yeah, there is a huge connection between defaults and foreclosures.

Good Doctor, while I have followed you for the past few years and agreed with nearly all of your conclusions, I believe it’s time to start factoring in the increasing likelihood/certainty of higher interest rates and GLOBAL inflation in the upcoming few years. The cracks are beginning to show. Buy vs Rent will soon win out in most areas. So far, the only place that makes much financial sense is the Inland Empire, but the rest of So Cal will take a nice hit this year and 2012. Start thinking about buying…..higher mortgage rates are here to stay.

Bondtrader: Price inflation isn’t going to hit the Real Estate market any time soon. The reason for this is due to the lack of Credit going into the Housing market. Housing is mostly driven by Credit availability, not Fed printing. To put it in perspective, physical money is only about 5% of the money supply, with Credit making up 95%.

Superfluous Credit is what caused the Housing bubble in the first place, you might recall.

So until Credit availability starts increasing again, there’s no chance of price inflation in housing. Indeed, with all of the tightening in the credit markets, Freddie and Fannie on the ropes, and the banks not willing to write loans, there will be more bargains out there for quite a while longer. Add into this mix the huge supply of the shadow inventory, boomers downsizing, young people without jobs and a lot of people either trapped in underwater homes, or who have damaged credit ratings from foreclosure, I see no upward pressure on prices at this time. But there is a huge downward pressure.

You can sell your overpriced home in CA., and buy a four year old home in Phoenix, twice the size, for $150,000.

That sounds great! Temperatures over 100 degrees all summer long, and only a six hour drive to the beach!

Ha! I was going to say about the same thing…no thank you! Not to mention the gun nuts!

So CA isn’t necessarily going to be the ideal place, but how is Phoenix going to weather (pun intended) global warming? Hahaha. Are energy prices (for all that AC which will probably become more and more necessary) going to get any cheaper either?

Yesterday I talked to a guy from Pheonix that my company does business with. He said that one of the two largest pool builders in the area went from building 2800 pools a year to 150.

yeah, but there’s one problem with that…….PHOENIX!!!

If your trying to sell $150K in Phoenix, you must be a “local expert” Realtor, not a bad buy if you want to live in it, probably gets you granite and all the upgrades. 150,000 for a single family home your looking at 1200 / month rent at best. You could go to Queen Creek and grab the same house for 60,000 and your rent is $850. I just picked up an 18 unit complex in Phoenix for 267,000…Do the math on that one.

Phoenix,

18units for 267k??? That is insane! Where and how did you find this gem? Wow.

I made the round trip from S.D. mid 2004 to Phoenix then back to S.D. late 2009.

Yes, Phoenix has a lot of negatives but it has some overpowering positives. I chose to move back to S.D. because the housing crash was at hand and I believed I would soon be able to buy a house in 92116 or 92104 for less than I sold for in 2004 but thanks to Washington, it hasn’t happened yet.

If prices do not come out of the bubble, I would chose Phoenix over S.D. The choice between S.D. with bubble prices and Phoenix is clear.

4 months of brutal temperatures and long freeway drives and life long economic freedom or, great year round weather, beaches and a life of serfdom.

I will choose economic freedom any day.

Just checked out some open houses last weekend, and have been surfing Trulia. We’ve been looking off an on for several years, and are in no hurry to buy. I’m actually seeing home prices come down to levels that are reasonable for us. I was surprised to see a few homes drop their prices significantly (about 15%/ around $100k) after only being on the market for two months. And a couple of the realtors were even saying that the price would probably be dropped again soon (perhaps hinting that they would accept a much lower offer) –which is not what I expected from the seller’s realtors. It was tempting, but I’m still comfortable sitting and waiting.

With everything going on in todays headlines, who knows to what level things will slide done even faster, or go up like gas and food.

Where is our country really going, or headed?

You got the stuff going on in Wisconsin, where it seems like it’s going to be played out in most states.

There has to be cuts and a balanced budget. How many of us readers know we have to live within our means and we take responsibility for that. Sure we would like the pricier or larger model car or t.v., extra vacations, extra “toys” but we know what we can afford, we may add alittle splurge, but we know we still can cover it, even if it takes alittle belt tightening.

From what I get from the readers here on the site, we are practical, responsible, believe in truth, intelligent, many knowledgeable on housing data and hard working for where we’re at in our lives.

Dr. HB always mentions of job growth and wages, and to me he has always been on the money. While wall street, the banks and politicians (higher level) live like kings, sound like Egypt, and Libya, we the common folk, probably peasants to them, should be happy to have them lord over us, because they know what’s best for us.

Thank God for a voice of reason, who speaks honestly and tells it like it is, our own friend, Dr. HB

Maybe Oprah should have him on, like she had Dr. Phil, because he speaks the truth!!

Give me some of your thoughts fellow readers!!!!

I’ve been patiently sitting and waiting too- what are your thoughts on San Diego? One of two metros in the shiller index that saw a price increase. Should I ignore that? I’ve only found one listing (foreclosure) that actually corresponds to its true value, I guess I’ll wait and see how it does…everything else is still ridiculous in my opinion but I’m fairly young, has t always been like this here?

San Diego and Washington DC are the only two areas still slightly positive YOY. But prices are still going down. See this interactive chart here:

http://seattlebubble.com/blog/2011/02/22/case-shiller-welcome-back-to-2004-seattle/#more-14536

It’s the best on the net that I have found.

No, it has never been like this before, in most peoples’ lifetimes. Previously, you could count on inflation over the long term to keep prices up. We’d have downturns, but they were due to the normal manufacturing/business cycle. This downturn is due to excess credit, and the last time this happened was in the 1930’s. You won’t see anything like this again, unless you live for a very long time.

Previous downturns were short. This one is still going on.

The reliance on inflation in the past is why people would say “buy the biggest house you can afford and stay there a while”. That worked when the total money supply (credit + cash) was increasing. Now, credit availability is decreasing. You want to be out of debt, and not count on inflation reducing your debt costs.

Eventually, cash and inflation will take over. But not now, nor for the immediate future.

“… and to notice that the short sales and REOs are always located in the worst positions on the street.”

This is obvious “sell the worst pieces and leave the good ones” -policy.

When prices already have gone down, it’s impossible to sell that c**p at all and banks know it.

Unfortunately for the buyer, banks have a lot of time as huge inventory is mostly paid by tax payers (as detailed in comments above), not banks and Obama supports that: No change in near future unless something gives.

China announcing that they want hard currency as payment, not dollars (and selling their current collars) or oil sellers selling oil with euros/other hard currency are two major things that would drop the value of the dollar to zero very fast. Both political decisions.

I’ve noticed the same thing for quite some time now. The banks seem to hit the arterial streets only in my neighborhood. I wonder when they’ll get around to foreclosing on the people who live on the “inner” streets.

If so the discriminatory foreclosure (based on where your house is located on a street) seems like a class action suit waiting to happen.

By the way the IMF has announced it would also like to move away from dollars. What is up with that?

Things are much worse than most imagine. I work at a job making decent money, 100k a year and all of my co-workers making about the same. It seems like every week, another co-worker mentions that they are going to stop paying on their houses and just let the bank take it. They are all way underwater and are now seeing the light that there house will never again be worth what they paid for it. For now, I’m a happy renter with my 20% down sitting in the bank waiting for the right time to enter the market. I would like to buy in Laguna Niguel. I originally had an an expectation that prices here would drop to $170 a sq foot, but lately Ive been thinking I might have to revise that lower. I think this suckers gonna drop hard.

they usually just leave the nets open and enough dorkfish go in for the corndog, then they close the net. Too many corndogs, not enough dorkfish. Our Madoff-Ponzi economic plan is in the final stages. Expect anything, buthe the days of reckoning are here.

Thanks DarkAges. Loved your imagery. Chuckling here at the “dorkfish going for the conrndog”.

THIS JUST IN! (some will say ‘What does that have to do with housing.” I say, “It has EVERYTHING to do with housing).

I work at a hospital in Central California. Just last night, I heard that the security guards in the hospital were all going to get “fired” today. I spoke to two security guards last night after work. They have a mandatory meeting at 7:00 am today (it is now 7:30 am in California). They both told me that they are indeed getting fired, and that the hospital is “outsourcing” their jobs – an outside firm will do the security for the hospital. They said they will be allowed to apply for their “old jobs” but will now work for the new security firm, not the hospital. They both told me that they expect their pay and their benefits to be greatly reduced.

Here it is, folks. I have been saying this for the last 2-3 years. Real estate has only one way to go in California – DOWN, DOWN, DOWN. Good paying jobs are becoming a thing of the past. On a related note, the other night I met a transport RN from Stanford (yes, Stanford) and he said that his union “voted to authorize a strike.” He said that in their their new contract, Stanford was trying to greatly reduce their pay and benefits.

This charade called housing is in for a surprise. How can people afford $400,000 (or more) houses, when the pay in California (and elsewhere) is getting slaughtered? Incidentally, Native Pasadenan (above) says some poor chump payed $700K for a fixer-upper! This is all going to come to a grinding halt, boys and girls. Watch and see…. Think Wisconsin or Egypt on a much larger scale.

Hear Here!

There are security officer jobs in Arizona. Housing is a lot less expensive too.

An acquaintance recently got hired by the AZ Dept of Corrections as a correctional officer. He’d been working as a security guard in Tucson for Valley Security.

Took him only 8 mos to go from a new security guard to correctional officer.

~Misstrial

Here’s more of the same:

http://www.shtfplan.com/headline-news/all-2000-providence-public-school-educators-to-get-dismissal-notices_02242011

This story is about 2000 Providence, RI teachers getting fired. The article says, “Simply put: We’re broke! There is no more money!” and, “TWO MILLION people in government-funded jobs are going to lose them. There is simply no way out of this, save one, and that’s the printing of more money to bail out every level of government in the United States.”

Final paragraph says “It’s another Catch 22. Either government employees take the hit now and cut their wages, pensions and even lose their jobs, or, the band plays on until the whole system snaps without warning and sinks like the Titanic.”

A very short, but interesting piece.

But haven’t they already printed boatloads and boatloads of money to bail out the banks? Printing more at this time would just make things worse it is true. I don’t recommend it. I’m just not sure we’re seeing the whole picture here.

We have to endure austerity measure after austerity measure and part of this is because we simply have been living beyond or means for decades and decades. That is true, I don’t approve of deficit spending. HOWEVER part of the reason that the system is so brittle is that OUR MONEY WAS STOLEN outright to bail out the banks. Sure the federal government can’t print money to bail out the states but it was already printed for the banks. Sure the government can’t keep borrowing to fund social programs but this money was already given to the banks etc.. Check out a book titled “It takes a pillage”.

@After the A-Bomb:

Okay, maybe I over stepped on saying it’s a fixer, BUT the roof leaks and they don’t have a/c and only radiant heat! They put 3.5% down on the $709K house…no thank you!

The resident Zeitgeist Watching Punk here.

Time to build into all housing prognostications for the next year to ten what will happen when states succeed in stripping workers of their bargaining rights. This next phase of race to the bottom is going to consume whole generations of potential housebuyers of buying power. Of course from the banksters’ perspective, this will create new opportunities for debt servitude.

But DHB has it right. The age of churn will still work for the elite globalista class. But for most people imprisonment in dying communities will become more and more the rule. The era of predatory lending may be over, but the era of predatory public policy is just beginning.

Dr.HB’s blog should be mandatory reading for anyone thinking of buying. Thank God I did!

We relocated to Manhattan Beach a couple of years ago and were planning to buy a house in the $2 – $3 million range. Thanks to indispensable sites like Dr. HB, Patrick.net, PropertyShark, etc. we decided to rent instead and will continue to do so until this market gets REAL! If/when we buy, it will be with all the cash we’ve saved by not being suckered into paying off other peoples’ debts.

Investor J forwarded me the comments about some of the alternative investments that are out there because we tend to talk about this quite often and educate people on various investment options. I am a CPA and full time real estate investor that invests in the Memphis, TN market (not California due to the risk). I was the one Investor J was talking about above. It is amazing what you can do when you specialize in investment systems. The trick is to make as high returns as possible while minimizing the risk and putting performance based incentives in place. For example, one of the deals I did while taking advantage of this entire mortgage mess goes as follows:

I purchased a property with an all in cost of $70,000 (including renovation, purchase price, closing costs, holding costs, absolutely everything) and the property has an after repaired market value of $125k – $150k depending on the comparable sales that week.

The property rents for $1500 a month and after all expenses nets approximately $1,050 per month after all expenses including the property taxes, insurance, management, repairs, vacancy, etc. If I was to hold my return would be 18%. However, I sold the property to an investor for $112,500 with $60k down and seller financed the remaining $52,500 and am now receiving a $500/month note payment for 15 years fully amortized. Requiring that large of a down payment is what the banks should be doing. My risk is very, very minimal. If the investor stops paying and I have to foreclose it costs me $2k and I am into a $125k property for $12k. And its managed by my in-house property manager. This is how you do proper risk mitigation!

That means I am making $6k a year on my remaining $10k investment ($70k cost – $60k down) which is a 60% cash on cash return. Amazing! And the investor that bought the property is netting $550/month on the $60k down which is an 11% cash flow return. If you include the principal reduction since its paid off in 15 years they are up to 21%+ returns.

Its amazing what you can do by becoming a specialist. Investor J had to do a ton of due diligence on myself and my systems before investing which is exactly what most people do not do and why the Madoff type investments happen. I don’t even know why people reference Madoff when the biggest ponzi scheme in U.S. History was not Madoff but the bank bailout by the federal government.

To learn more you can go to my site at http://www.ocgproperties.com. Thanks to Dr. Housing Bubble for the amazing data driven knowledge provided. Its a pleasure to be able to comment on the blog.

Leave a Reply