Flip this shack: Eagle Rock and other hipster areas. Flipper activity reaching a fever pitch in certain Los Angeles neighborhoods.

Flipping activity is getting so out of hand that you can practically see which properties are going to end up as flips right when they hit the market. Some of the hottest neighborhoods in Los Angeles are those that attract the hipster crowd. We’ve featured flippers in Silver Lake and today we will feature a home that just hit the market in Eagle Rock, another bastion for flippers and hipsters alike. The rush to flip is bringing back some fond memories. What is making this market even more dramatic is the drastically low inventory and the renewed belief that housing prices only go up. In fact in a recent survey, missing out on future home gains is the top concern, not our ridiculously high debt, or massively indebted youth, or even an older generation that will cause a rise in healthcare expenses. No sir! The real concern is about missing out on those juicy gains on hipster neighborhoods! Today we’ll pick out a home that is still for sale in Eagle Rock but you can rest assured that it will go under as a flip shortly.

Hipster neighborhoods reign supreme

8 out of 10 of the hottest real estate areas are found in California. Take a look at this:

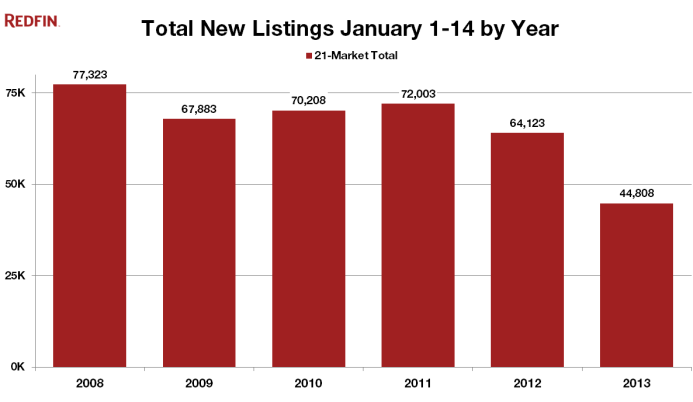

What does the above tell us? A massive drop in listings, a big jump in sales, and prices are going gangbusters. You’ll notice that Eagle Rock makes the list at number four. Listings are down by 54 percent, sales are up by 44 percent, and price is up by 11 percent. The above chart highlights trends for 2012. This shrinking inventory is more exaggerated in California but nationwide we see a similar pattern:

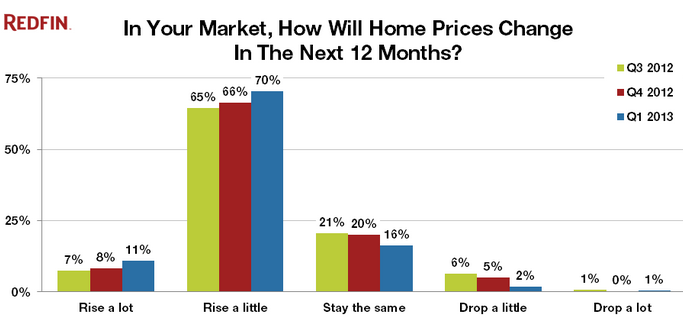

That is a massive unprecedented decline in inventory. Why is this occurring? First, you have the expectation now that home prices will only go up:

Next, you have banks continuing their leakage of distressed inventory. We’ve also highlighted that the more expensive the neighborhood, the more likely you can buy time with your home in the foreclosure pipeline. That is the current backdrop of our housing market. So let us examine Eagle Rock much more deeply since this area seems to be a magnet for the hipster aficionados.

Eagle Rock flipper candidate

4924 Wiota St, Eagle Rock, CA 90041

Bedrooms:Â 3 beds

Bathrooms:Â 2 baths

Single Family:Â 1,162 sq ft

Lot:Â 7,840 sq ft

Year Built:Â 1912

This home hit the MLS on January 23, only a couple of days ago. So why is this a candidate for a flip? Can it be the awesome photos of garbage bins in the back?

Or would you rather see it in the front?

The two main reasons this home is a prime candidate for a flip is that it is in a flipper neighborhood and the current listing price is $329,900. Given the current market, it is easy to see that this home will sell for higher than this. Add a little bookmark for this home and check back in the middle of the year and you can rest assured that it will be back on the market and the sale price will not be $329,900.

It’ll be interesting to see who buys this home. My bet is that it will go to an all cash investor and flipper. This home has hipster rescue written all over it. Now how wealthy is this neighborhood? Scouring through tax data we find the average adjusted gross income to be $53,647 for this zip code. However like many of these flipper neighborhoods, the hipsters are taking over pushing prices up and leveraging up on flips with delicious low down mortgages courtesy of the Fed.

Any guesses on what will be the winning bid on this place?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

47 Responses to “Flip this shack: Eagle Rock and other hipster areas. Flipper activity reaching a fever pitch in certain Los Angeles neighborhoods.”

Here’s Vanilla Ice weighing in…stock markets up, housing market’s up, “there’s no better time to get in than right now!”

http://www.tmz.com/2013/01/26/vanilla-ice-real-estate-tips-video/

Immediately after that quote he qualified, “…if you can buy a home cheaper than you can build it, it’s great.” I don’t see the problem there.

Vanilla Ice may be onto something here. What he doesn’t say is that the government and other PTB won’t let these markets fail anymore as witnessed from the last 5 years. Politicians love healthy housing markets and stock markets, when you can cook the books and make absurd policies to further your cause…why wouldn’t you?

It will all come crashing down one day (but not anytime soon). So get on with your life and look after number one. TPTB have made it very clear that future generations just don’t count, so quit worrying about them. Reading all the history books won’t help you here…it’s called learning on the fly and looking after yourself and your family. More people on this blog need to start that!

I don’t know what I like better about this link. The Maxipad ad before it or Vanilla Ice’s opinion on the Housing Market?

I grew up in Highland Park and Eagle rock and I can see the attraction. Both of those towns are a poor mans Pasadena

101% – quaint, savage land between Glendale and Pasadena…

Awfully popular here to disparage “hipsters” and “hipster neighborhoods.” Sure, for the 50-somethings on this board, it’s easy to mock 20-30 somethings taking non-conformity to an extreme, while ironically needing to fit in with their peers. They “see” something in these areas that boomers don’t, or have forgotten in their middle-age haze. But, are they so dumb when it comes to being agents of gentrification? Take Santa Monica and San Francisco, two of the original hipster (formerly known as “hippie”) Cali communitie.. Look at how those idiots who bought there ended up!

The only thing they “see” in these neighborhoods are cheaper options aside from total crap holes like South Central.

Hipsters are largely driving the consumption side of this trend and the doc is the only source of RE information I know of that’s bringing any light to it. I’m in the Hipster age group and the ridiculousness of the ironic mustache crowd isn’t lost on me. What’s even more absurd is extreme leveraging in order to enslave oneself to a lipstick on a pig house in a marginal neighborhood.

in nay event, it’s not the hipsters driving up prices. It’s their parents giving them the DP money….

You make great points. SFR’s were great investments back in the day, but to be a landlord in SF or SM…rent control.

As a former “hipster” (haha) back in the day, living in a gentrified neighborhood, my experience; great when single, young…once our daughter was born, old house no longer felt charming, safe…weird homeless guy who knocked on our front door asking for money stopped being funny. Lots of odd noises at odd hours, transients. Used condoms in the gutter. The charm wore off for us, we left. Many of our friends had the same experience. Yes, homes in the old hood still command a sweet price. It’s very important buyers research any neighborhood before buying, make sure it’s a fit.

That’s just it, when you don’t have kids, those area’s seam alright. A lot of young couples don’t even think about kids, but when a child comes along everything changes.

The first kid is what makes you think about school districts, parks, the kind of people in the neighborhood and the safety.

I have some friends that bought a house in Silver Lake when they had no kids. They loved the trendy stores and cafe’s, but once they had kids things changed, they realized the schools were lousy, but then it was too late, the house was underwater, the wife lost her job and they were stuck there with a lousy school district. To make matters worse the kids were getting bullied in the grade school because they were one of the few White kids in the school.

We use to live in LA, I have to say most of it is a terrible environment for children. The parks are lousy, the air is bad, sexual imagery on bill boards and advertisements are everywhere and getting your kid into a good magnet or charter school is a full time job.

Moving out of LA and into a decent suburb is one of the best things we’ve done for our family.

Further to your point, Greg; even if you don’t have kids, it’s smart to factor in the things that people with kids appreciate when making a buying decision. Why? Because some day you will want to sell. When that day comes, you’ll want your property to have the most appeal possible. Appealing to potential buyers with kids helps to increase the demand pool for your property.

Look what I just found: http://www.homepath.com/financing.html

The government is now into bulk lending to LLCs at the low, low rate of 3%. I’m sick to my stomach. I’m waiting to buy my retirement home in North San Diego County and have $150k cash to put down but I’m being priced out of the market by my own government. They are now helping the REITs take over housing in the U.S. The government has become the predatory stalking horse for private mega-corporations.

I see your Wiota and I raise you this Norwalk ;)…

http://www.zillow.com/homedetails/20851406_zpid

This is what irritates me most. I want to be the one getting the house for $280 and doing the remodel, so I can live in it (assuming the structure is good and the flipper didn’t hide all the mold and such).

That Vanilla Ice video posted above is wonderful, thanks so much. Even though I’m a 50-something boomer and so it’s possible I didn’t really get it, man.

But through my middle aged haze, I know that if you buy that video, or a house on loan at these prices, you are hardly non-conformist. You’re conforming very nicely and just the way they want you to.

Martin Armstrong shows that this real estate bounce should go to 2015. That sounds about right to me since it is not employment nor wage supported, but rather interest rate and supply constriction driven.

http://www.youtube.com/watch?v=j29hSszTz88

As a ready, willing and able home buyer, I hear about all these predictions: ‘just wait till 2015….’ ‘by 2016 then this or that will happen….’ I dont really see the point. Of course it is a personal decision. I am paying $1500 per month rent and my fed withholding decreases by $700 per month as a homeowner. That equals $2200 a month equity building if I put that towards a mortgage. $2200 per month for 36 months = nearly $80K. And here is my prediction: by 2015 there could be entirely unpredictable other factors that will continue to drive home appreciation. If home prices wash out at a 5% net gain between now and 2015, I am still ahead. Good luck to all.

I stand corrected in my prior post it is $2100 per month, not $2200 per month. But the essence of my post remains.

QE abyss, I’m confused with your numbers. The only equity you will be building is paying down the principal. For a $2200/month mortgage (30 yr. fixed @ 3.5%), that’s a little over $700/month. No equity from all the other expenses: mortgage interest, property taxes, insurance, maintenace, etc.

I do agree that it is not a bad time to buy based solely on monthly payments (which 95% of the people out there use as a metric). I highly doubt your monthly payment will change much for the forseeable future. Interest rates might go up, home prices may fall but monthly payments will likely be the same. I highly doubt we will see another 20% decrease in any decent area based on what transpired in the past 5 years. If you have 20% plus down, excellent credit and a stable job and you plan on owning your house (either living or renting it out)…it might be worthwhile to start looking.

Rent cost is fixed to the contract whereas owning can require unexpected outlays that a renter isn’t on the hook for. When the rent contract price changes too much in an unfavorable direction, the renter can contract somewhere else.

Putting a lot of weight on tax incentives is not wise because the government has, can, and will change the rules of the game when it suits their needs, not ours.

When you decide or need to sell (and you will), everyone has their hands out for a piece of the pie so there goes some of that equity. If you’re lucky, you either buy low and sell at a momentous top in a short period of time or stayed in the place for many years so there’s enough principal pay-down left over. For a lot of people, shit happens and the timing creeps up on ya.

Oh and by the way, if you think you’ll just rent the place out as an accidental landlord, just mosey on over to thelpa.com forums for a dose of how fun the landlord game is.

I’m not trying to convince you to wait on buying. What I am pointing out is that a simple monthly payment comparison is bullshit because life isn’t that easy.

If you keep hearing wait but you feel like you gotta scratch that itch, go ahead as no one here will be stopping you.

I watched a little of the video, enough to tell me he is nothing but a fortune teller and should be ignored. I only look at FACTS and judge whether a financial decision makes sense, based only on facts.

345k. Back on the market in three months for 475k.

I dig the size of the backyard.

You’re probably dead on both of these, but I would wager that post reno / flip it will sell for over your projected asking price of $475k and do something closer to $515k.

We’ve been waiting to buy since 2003. Thought the market had more room to adjust so been looking and doing research but haven’t bought yet. Ran in to a couple guys while playing golf last weekend. They are involved with bulk purchasing foreclosed houses by thousands and renting them out. They make corporations out of those entities and sell stocks of those companies. Not much room for regular people like me to buy a reasonably priced homes it seems. Spotted a 4 bedroom single family home in Garden Grove in a reasonably nice area listed for around $450k. The current owner bought it in Oct 2012 (that is 3 months ago) for around $350k, did some remodeling and now it’s on the market for cool $100k more. Now I know what Robert Kiyosaki meant when he said making money is a team sport. Me trying to buy a house is like an amateur golfer competing against pro golfers. Sigh….

All those renters waiting for rock bottom prices missed the chance again to own a home. Prices are accelerating up and won’t be coming down till the next crash. Timing is everything when buying a home. It’s never going to get so cheap that everyone will be able to live in their ideal prime area. If you are still waiting for 1960’s price structure to come back it won’t. Gotta deal with the what we have now and get into the game at the best possible time. It’s not to hard to look at a trend chart to see what was on a downward spiral, reverse and now on it’s way back up. I do believe it is the time to buy now…not a year or two from now when prices further adjust up.

The housing market has rebounded, although it’s being driven by animal spirits and the Federal Reserve’s attempt at stabilizing asset prices and creating a “wealth effect.” Most people won’t do the research. If they did they would be mortified as to what the Federal Reserve Bank is trying to do with the support of Government housing agencies.

Sure, you can buy a house, and you’ll probably see some appreciation in the short term. Ridiculous interest rates, instant equity, flippers making tons of money etc..

Over the long term, history paints a very different picture. Every Government attempt to stabilize asset prices has led to an over correction in asset prices.

So if you have nothing to lose by all means jump in!

Darn. If only I had asked you sooner what to do with my life, I wouldn’t have missed “the bottom.” Hilarious that anyone thinks they know what the bottom will be. In the late 70s, my Dad bought a place in a nice ‘hood but chose a variable rate (10.25…people today don’t realize it wasn’t that long ago that rates were sky high…and it can happen again). Unfortunately, rates climbed to 18 percent…and lucky for him the house appreciated over that time of rate increases, so he could keep taking out 2nds and keep up with the higher payments (they didn’t have what we have today in terms of being able to “re-fi”). He was forced to sell some time in the mid-80s because it was just too much debt burden – and he was able to clear enough money to buy a place in a different part of LA. The point I’m making is that no one know what a “bottom” looks like, and no one really has any idea what rates can and will do 5 years out. Did anyone 5 years ago predict that rates would be down around 3 percent? All those RE cheerleaders at 5-6 percent saying, “rates can’t go much lower or else it would be free!” Now it’s half what it was, and yes, rates may even go down to the 1 percent or lower rate. If you want to pretend that the inflated values (IMO) of homes right now are “good deals,” well, go for it. Based on my salary, I should be able to buy a decent place for about $500K IF pricing was based on rational fundamentals (i.e., having enough money to pay for everything else. So, the 800K homes in my ‘hood would have to fall 300K for me to buy here, for me to feel like, “yeah, based on my income, that is about right for my budget.” Yet there are no homes at $500K anywhere I would prefer to live. And it’s not a case of “champagne tastes, beer budget.” I was able to live in a beautiful ‘hood in another over-inflated area, Wash. DC (suburbs). Now, I have been priced out of the ‘hoods where my salary used to be average. My Dad used to pay 10 percent of his salary towards a nice 3BR, 2BA home in a great So. Cal. beach community, great schools, 8 blocks from the beach (spanish style stuccos). Not any more, those babies are a million and up. So, for people like me who believe in not overextending the budget, the prices are going to have to come way down to meet me where my salary is, where fundamentals say I should be buying price-wise. I have no idea if that will ever happen…but one thing I do know, I wouldn’t want to be on the short end of the stick one day after having paid way more than my budget says I should pay for a house. And it’s totally fine with me. Would love to buy, but not at these prices.

I feel the same

I have something you bulls on California real estate might want to think about. There are millions of Cali boomers who are going to retire in the next ten years. They are just starting now. The only boomers who can remain in Cali and their current home are the ones who have a fat, juciey, defined pension, mainly from the state. Those with savings are totally screwed by our friend Ben. The later will have to sell their homes and leave. The problem with the winners, it that the only way the state can afford to pay out the ridiculous pensions is if they tax the remaining few workers to hell and back. For example: to pay out a “modest” state pension of $50,000 a year today takes around takes around a million and a half dollars cash at a very optimistic 3% return. Since these people are retired they are not longer contributing to the pension fund, so by reducing state workers, the state is actually making the situtation worse. Can’t win for losing. I know, just buy Apple and watch it go to $1,000. What could go wrong with that?

Prop 13 taxation protection and 3% re-fi interest rates have mitigated the selling pressure of the boomer flight hypothesis.

Oh, and since most boomers haven’t saved enough for retirement, even if they downsize they’re highly motivated to keep their prop 13 lottery home as a cash cow rental.

if they haven’t saved enough for retirement, how will they afford a second home?

I’d bet dollars to donuts that the property tax increase caps will be slowly deconstructed in due time.

Jeff, most of these boomers have seen their home purchase be similar to winning a lottery ticket. With likely little if any mortgage left and Prop 13 protection, I highly doubt they will be under pressure to sell. And we’re making blanket statements here. I would be willing to bet that certain areas (westside, south bay, coastal OC, etc) have more financially savy owners who did plan for retirement. As we’ve seen, these areas seem rather bulletproof…they are just too desirable and there will always be buyers for any sellers.

@Jeff,

I agree with you on the millions of baby boomers getting ready to retire.

There is another aspect to these soon to retire baby boomers. When you are younger, investing in the stock market for the higher yields is what many financial advisers recommend. As people get near retirement, the recommendation is to transfer their assets to bonds for wealth preservation. This is exactly what we are witnessing today. And this is a major reason interest rates are incredibly low.

As these baby boomers retire and start drawing down their retirement funds, the bond market will see interest rates rise. This will push up interest rates on mortgages as well. The bond market has had a 30 year bull run which ties in nicely with the baby boomers age group. As interest rates on mortgages go up, home selling prices will go down.

None of this will happen overnight. It will be a relatively slow process, much like the proverbial boiled frog anecdote.

I guess at $85 a foot in the “Racquet Club” with pool in Los Angeles can happen. It just takes a little change in DEMOGRAPHICS. There must be some hipsters out there who can turn this around.

http://www.zillow.com/homedetails/155-Racquet-Club-Dr-Compton-CA-90220/21005352_zpid/

If you look at the crime statistics you will see that Eagle Rock, has 29 violent crimes and 350 property crimes in the last six months alone.

Eagle Rock High School gets a score of 5 out of 10 on the school rankings.

No Thanks. It doesn’t sound hip to me when someone is pointing a gun at my head and wants my car. There is a good reason the house is so cheap at $329,000. You can improve the house but you can’t always improve the neighborhood. It’s a tall order and a big gamble.

The internet is not a reliable investment tool, my friend. Those crime stats you quote are bogus. I’ve lived in Eagle Rock for over 12 years — about 1000 feet from this house, btw — and no one has ever had their car stolen at gunpoint. The major crimes here, as in all “good” neighborhoods of L.A., are petty car-break-ins. Those Great School rankings you quote are consistent for all LAUSD non-charters; the district gets dinged, not the school. Check the parent reviews for Rockdale Elementary, which is right down the street — 5 out of 5 from enthusiastic parents, many of whom are hipsters like myself who are sending their kids to local publics because (1) we’re liberal trust-fund babies who don’t know any better and (2) it makes financial sense. As for this house — check the Redfin stats. It’s a foreclosure that sold for over 535K during the boom times, and it’s one of only 5 SFRs for sale in the entire 90041 zip. While that stretch of Wiota isn’t exactly the best street in ER, I predict it doesn’t flip — it sells to a family who can finally afford their first house in a good elementary school district, with the most coveted Montessori preschool east of La Brea a half mile away.

Have any of you seen the show “Property Wars” on Discovery? It is about three investors bidding on houses being auctioned in the Phoenix area and flipping them. I saw a few episodes and it’s enlightening on what’s happening, in the underground. It helps explain why non-insiders don’t get a chance at the good properties.

wall street is cannibalizing main street. won’t be long now…

Tim posed a question nearly three years ago. Back to the future it seems:

Tim

March 7, 2010 at 4:42 pm

I really enjoy this blog and have learned a lot. All the data points make a lot of sense, and I tend to agree with most of the Dr’s thoughts. However, despite all the massive shadow inventory, high rent/buy ratios, unemployment, etc, prices have not significantly come down where I live (Bay Area-San Mateo county), in fact they are flat to 10% up year-over-year on a per sqft basis. I wonder if there is something all of us are missing here. It would suck to one day find out that the theories presented in this blog were flawed for some reason. I would be interested in hearing from other readers if there are any potential flaws in the Dr’s arguments. What assumptions would one have to believe in to buy today vs. in 2-3 years.

Highly desirable areas that have been around at least a few decades have always had the strongest resistance to downward movement. Check the price history for reference of this. And if there’s any kind of well paying industry in the area, then there’s a good chance the prices are extremely sticky.

One assumption is that the market is going to hover around these prices for 5 to 10 more years. Then it’s a matter of if you want to wait to buy, which depends highly on personal circumstances.

On another thread, someone said that they do not panic (something like this). This is sage advice for basing a decision, instead of making the decision based fear of prices going up and missing out on the lowest or waiting because you want to get the best possible deal. Instead, a decision based on asking yourself if this is the right thing for you to do now, given your known affordability and your long term plans instead of what you think the market will do.

Also, this is all a game the Fed and, for their own benefits, financial institutions are playing. They have all the time in the world to play the game. We, on the other hand, have a set lifespan and life decisions to make.

I saw this house the second day on the market and thought it was adorable. As a hopeful first time buyer on a limited budget (max this home’s listing price – forget massive remodels) I am murderously frustrated with the all cash flippers. Not only can I not compete, but I can’t afford the shit they spit back on the market. UGGGHHH

The only way this madness will stop is when the cash flippers get burned.

We put an offer on this home the 3rd day it was out on the market. We bid way above listing and turns out there were 80 offers, about 10 cash and someone who bid $416K finally got it after it fell out of escrow with the first acceptance. It had a 100 year old roof, termites, rotten deck out back. It’s also less than a 1/4 mile from a freeway on ramp and city of LA has a warning for pollution posted on its zoning map. Personally I don’t think it’s worth 416K, good luck to the person who bought it.

Leave a Reply