Economic and Housing Tsunami Approaching: Stage Two of the Housing Collapse has arrived to California and This Time it will be much Worse.

The economy is once again in full delusional mode with consumer confidence earlier in the week hitting an all time record low and GDP contracting. But guess what? You wouldn’t know that by looking at the stock market. The S & P 500 for the week is up 8% and there has been no good news at least in terms of the economy with companies announcing layoffs on a daily basis. This jump is simply the market jumping off a technical support level and folks jumping back into the shark tank even though every fundamental indicator is blinking red.

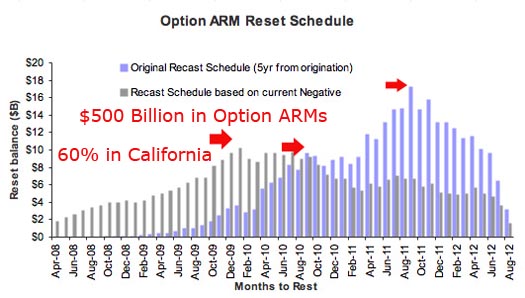

In today’s article I am going to talk about the oncoming tsunami that I have talked about months before but now, the time has arrived and politicians are desperate. This massive second round is the $500 billion in pay option mortgages that are now recasting in major numbers. The full speed will be entered in early 2009 but we are already going to see some major pain. There are 10 reasons why California will not bottom out until 2011 please read this important article. You think things are bad? The Governator is calling a special session next week because we already have a short fall in revenue. What a stunning shock.

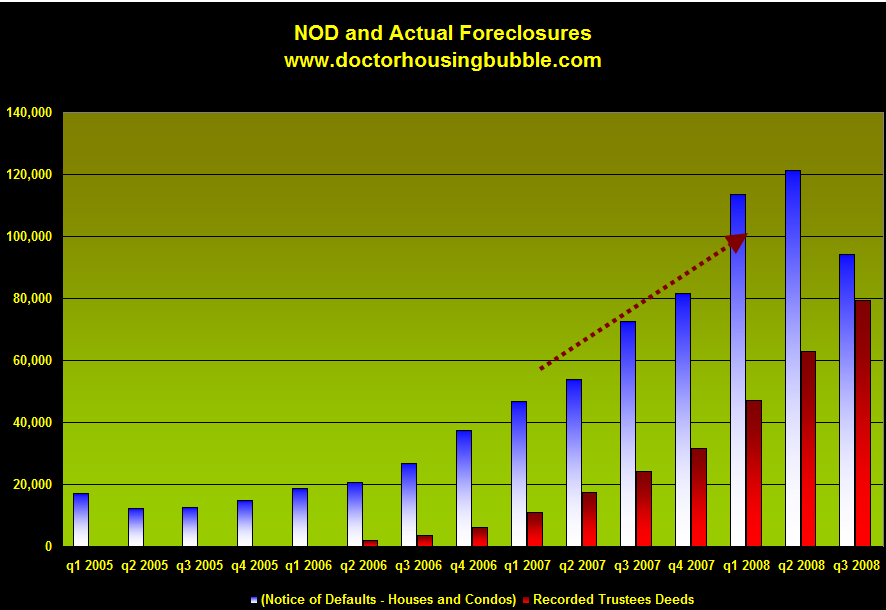

First, let us dig up the third quarter notice of default data and also foreclosure data for California which I have been tracking for years:

*Click to enlarge if you dare

This to the untrained eye looks like a major turning point for the market. Notice of defaults (NODs), the first stage in the foreclosure process actually decreased for the first time since the second quarter in 2005. This is fantastic news right? Actually it is once again the government trying to sweep the actual problem under the rug while not really confronting the real issue. The recent big drop in notice of defaults has to do more with legislation signed by the Governator, SB 1137 which requires lenders to meet with borrowers prior to filing a notice of default to go over the options available to avoid foreclosure. So this is simply a reflection of lenders retooling and meeting the new law. Here is a sample conversation between a lender and borrower, let us listen in:

Lender: “Hello Mike. Thanks for coming by the office to discuss your current options.”

Lender: “Hello Mike. Thanks for coming by the office to discuss your current options.”

![]() Borrower: “No problem. So what can you do for me? Can you hook me up with a 2% mortgage?

Borrower: “No problem. So what can you do for me? Can you hook me up with a 2% mortgage?

Lender: “Not quite. We first need to look at your budget and loan and see what we can do. How much do you make and what is the loan balance?”

Lender: “Not quite. We first need to look at your budget and loan and see what we can do. How much do you make and what is the loan balance?”

![]() Borrower: “Yeah, I make $60,000 a year and my current mortgage is $500,000 at 6%. Can you like drop it to $250,000?”

Borrower: “Yeah, I make $60,000 a year and my current mortgage is $500,000 at 6%. Can you like drop it to $250,000?”

Lender: “Not really. So let me get this straight, your net monthly income is $3,582 and your current mortgage PITI is $3,517?”

Lender: “Not really. So let me get this straight, your net monthly income is $3,582 and your current mortgage PITI is $3,517?”

![]() Borrower: “Exactly! See why I need the loan modified down to $250,000?”

Borrower: “Exactly! See why I need the loan modified down to $250,000?”

Lender: “Well I’m not sure how you’re making all your other expenses with that stunning $65 a month surplus. From what I’m seeing, you’re pretty much screwed.”

Lender: “Well I’m not sure how you’re making all your other expenses with that stunning $65 a month surplus. From what I’m seeing, you’re pretty much screwed.”

![]() Borrower: “Hey! I thought this new legislation was supposed to help me.”

Borrower: “Hey! I thought this new legislation was supposed to help me.”

Lender: “It is. It required us to meet with you and make a good faith effort. We did. I have good faith but I can’t walk on water and there is no way this mortgage will work out.”

Lender: “It is. It required us to meet with you and make a good faith effort. We did. I have good faith but I can’t walk on water and there is no way this mortgage will work out.”

So there you go. Many lenders hold these craptastic mortgages on their books and so far, no viable mechanism is in place to get these horrifically toxic loans off the books. The capital injection into banks is actually for new lending but guess what? Banks are hoarding the money like rotten stinky squirrels. And to be honest, they should be doing this! Even though the government is screaming for them to lend, it doesn’t matter if you don’t have a qualified market of borrowers to lend to. The only way banks can start lending again is if they once again ignore any standards and start giving money to people making $14,000 a year a $720,000 mortgage. I don’t see that happening.

So the drop in NODs is simply this playing out. But foreclosures are still screaming upwards as you can see from the chart above. There is no stopping that. All the NODs that have been issued in months past are now beyond this legislation and given the process can go from 6 to 9 months, we are simply seeing the backlog starting to hit the data.  We will continue to see this. After all, someone that lost their job can’t make a $1,000 payment and let us forget a 3 or 4 thousand dollar payment.

Median Price VooDoo

I’ve been seeing a meme going around with some mainstream media articles talking about the median price caveat. What is their current argument? Well, since most of the sales in California homes are distressed and many are previous foreclosures, the prices are now much lower thus skewing the data much lower. Well no crap! Why weren’t they putting these caveats when the prices were appreciating 25+% year over year? The same logic cut this way as well. They want to have it both ways. The median price is a good indicator because many of these pundits live in bubbles hoping that tiny niche markets start seeing prices drop. Well guess what? The vast majority of people are buying and living in other areas aside from Santa Monica or Newport Coast. So looking at these tiny markets is pointless.

This is a common problem. Many of the pundits keep saying that the prices are falling hard because the few sales that are occurring are in the most distressed areas with the biggest price cuts. Well guess what? This is the market now. People in “prime” areas can remain as delusional as they like but that will not move homes. They can pine for the economic heyday of bubble prices but it doesn’t mean that day will come again. That is fine, they will be stuck.

In addition, the median price reflects the bulk of sales. So if most sales are foreclosed properties well guess freaking what? That is the new market! Try asking $1 million for your 500 square foot Culver City Real Home of Genius shack and see if it sells.

You may have also been seeing that some big media papers are cutting staff. Why? They can’t cut it like many other businesses in this market. In addition, they have lost large audiences to blogs and other sources since frankly, blogs have gotten it right and they have not. Why would you keep reading an “expert” that missed the biggest economic calamity of our time? I think many people have reached this conclusion and are going to the new experts thus diluting their market share.

Pay Option ARM Chart

Take a long hard look at the chart above. Since 80% of people on pay option ARMs make the minimum monthly payment, many will actually be recasting months before their scheduled date. Why? Many of these loans have caps that once they reach a certain balance (i.e., 125%) they will recast. This is why these loans were simply the most idiotic pieces of crap ever engineered. I hesitate to call this engineering since it was a hackneyed and pointless loan that served no purpose except to exist in a bubble market. They have no place in a stable housing market. Critics that argue otherwise are ignorant of human nature. If banks that made these loans collapsed completely on their own stupidity so be it. No problem. But now that this mess got to this point and the American taxpayer is on the hook up to $1 trillion and bailing these same people out, there is a need to reexamine whether we should ban these for life especially if they are asking us for the money.

That is why there is a need for regulation. This free wheeling crony capitalistic model is coming to a spectacular end. Even Alan Greenspan the maestro of much of this easy credit admitted his “model” of the world didn’t operate quite as he expected. Sorry Alan, the ideal world of Ayn Rand’s Atlas Shrugged doesn’t really exist. People will not go off in their own self-interest and by everyone pursuing their own greed create a better society. What does happen is greed exponentially grows to a point of circus like spectacles and finally implodes with epic consequences.

There is now talk of new bailout version 5.0 for home buyers with loan modifications. Senator John McCain came out earlier with the most absurd idea of buying up $300 billion in loans at face value. This was the dumbest knee jerk response ever. This will never work and was a political move for someone so behind on every issue of the economy. Why is this so absurd? It completely allows lenders to walk off unpunished and forces the government to pickup the pieces with the borrower. After all, the math looks like this:

Lender:Â $500,000 note

Borrower:Â $500,000 mortgage

Lender to Government:Â $500,000 note

Borrower:Â $500,000 mortgage

The only one that benefits is the lender. The borrower still has that face value mortgage. If we are to rework the note it will come 100% at the taxpayers’ expense. If an idea like this went through all the above pay option ARMs will be launched onto the taxpayers books and who is going to oversee that ethics are taken care of here? The same folks that clearly had no discipline or ethics in the first place? Frankly, I’m glad that the majority of the population is seeing through the crony capitalistic model. They may not be completely comfortable with a new paradigm but certainly this current model is flawed to the nth degree. This tsunami is coming no matter what. The important thing is who is in place to oversee the process. This has the potential of sinking the entire economy for a decade.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

31 Responses to “Economic and Housing Tsunami Approaching: Stage Two of the Housing Collapse has arrived to California and This Time it will be much Worse.”

Those that stayed away from the Kool-Aid, stayed out of debt, and have been saving cash will be rewarded. It’s gonna be Sweet.

JC: Somehow, I don’t share your faith. I did all of the above, but of course now my savings (at least part of them) have been lopped by the stock market declines, even though I invested in areas I think are short on capacity, e.g. energy, agriculture, and rail. Plus, it seems inevitable that at least some homeowners will be bailed out, or at least filing BK will lose its stigma. Why did I bother renting a rathole for the last 6 years? I should have lived large on the beach for my mid to late twenties and then skipped town.

WNBC-TV reported today that the job losses could be good for the ecconemy & the ressession my end sooner & be milder than first thaught. WTF, whose kidding who.

Until the masses understand a key concept, they’ll be fleeced and enslaved, ad infinitum.

Key concept: positions of power, particularly high-level positions with no real accountability or personal liability for failure (e.g., high-level governmental offices / appointments, and an expanding range of corporate positions today) inherently attract individuals whose brains are naturally “wired” for highly effective deception and manipulation.

Such individuals fall into the categories of “sociopaths” and “psychopaths.” Just as there are many more flavors of ice cream than “plain vanilla,” there are many more variations of sociopaths and psychopaths than people commonly realize. Read chapters 3 through 6 of “Political Ponerology” (see ponerology.com) for a relatively good introduction to such variations.

A look into the actual words spoken by Greenspan during Congressional testimonies, and the timing of Greenspan’s pronouncements (e.g., in relation to the dot-com economy’s productivity, or the advantages provided by the trough of mortgage products offered during the housing bubble) provide evidence that Greenspan is almost certainly a sociopath.

Ayn Rand’s key personal flaw, and the central advantage Greenspan exercised over her and her cohorts that allowed Greenspan to effortlessly discard (and make policy decisions diametrically opposed to) Randian concepts such as personal integrity and objectivity, was the Randians’ inability to discern the machinations of sociopathic individuals and their natural ability to manipulate others – even, and often especially, intelligent (vs. street smart) others – for their own amusement and profit.

Sociopathic and psychopathic individuals have entrenched themselves in high-level positions within the U.S. political and business power structure. The sociopaths and psychopaths are more than sufficiently clever to corrupt or compromise others that might oppose the expansion of this power structure.

If you rely upon mere words or pronouncements, you will be repeatedly hoodwinked and fleeced. The aforementioned types of individuals are recognizable by their deeds and behavioral patterns.

I understand how pay option arms work, my question is regarding the reset which occurs when the loan hits the cap. Let’s say it is 125% of the value of the loan. How does a declining market effect this process?

Does the bank reappraise the property and use the new value to accelerate the reset of the loan.

Thanks,

Chris

Dave – It is unfortunate that those of us that stayed out of the market and lived within our “middle class” socal means have not become more powerful in this present market. If we were wise “we” could demand affordable prices (even in “middle class” socal areas) – since the banks are finally (I hope) giving loans to truly qualified buyers. My small family has also been waiting over 6 years to buy a home in an area which represents our education and income demographic – we are not willing to compromise.

JC: Somehow, I don’t share your faith.

I got out of the stock market a year ago. My cash holdings are looking good… for the moment. But what if inflation rages? How about hyperinflation? Will the dollar collapse? Will my 401K (also in stable funds) become worthless? How about my pension, although that is still 15 years away, at least. This is what keeps me up at night. I actually did something I’m both glad and shocked about–20% of my liquid assets are now in physical gold and silver. The US debt does not look servicable.

The Government is not doing diddly to help the peeps – they are happy to take our tax money and give it to prick MBA’s who only got where they are becuse their families are connected, not because they were the best students, or the brightest execs.

People need to quit trashing people who are facing foreclosure – not flippers and speculators – regular people who depend on the advice of LO’s and Brokers.

So a grocery clerk goes to the bank to get a loan, the bank tells them how much they will qualify for, then the borrower goes out an buys the house.

Are you telling me a grocery clerk has to go get an MBA to make sure the MBA at the bank is doing their job and fulfilling their Fiduciary duty?

The borrower did not set the terms of the loan to screw themselves over – the bank screwed them over and sold the risk of the loan to other in MBS in the derivatives market.

Also, the clerk might have had 20% to put down, but the bank talked them into investing it – offering them a lower rate on their first mortgage to do it (-.25%) – then sold them an 80/20 piggyback that they would never be able to refinance out of.

Their investment is gone in the stock market crash, and all they wanted to do was buy into the American Dream that the Gov and everyone else was ramming down their throats.

Sorry, the blame is on the banks.

Their job is to mitigate losses and abate risk, not the borrowers.

Read this:

http://tinyurl.com/58kwxc

Dr.,

I agree with everything you say. However, it is evident that the govt. is going to stop at nothing, including a $500billion bailout for homeowners, to prevent more foreclosures, and to keep home prices from falling any further. Can they prevent it? I don’t know, maybe for awhile, but for how long? What do you think? Frankly, I’m mad as hell, the blatant unfairness of all this makes me sick. Yes, I am one of those who was prudent and chose not to get greedy. Looks like I was the fool…

The recasting of ARMs in California is a wakeup call. Yet here in Santa Monica, people are still delusional about it being immune. You can bet, they will be the ones most affected by the RE declines in 2009. Denial is a funny thing.

The last teardown sale in the most desirable section of Santa Monica (North of Montana, 90402) dropped 20% from what was the “percieved” value. What is truly amazing is, the rate of change or VELOCITY in the areas now being affected.

http://www.westsideremeltdown.blogspot.com

In ATLAS SHRUGGED, Miss Rand took care to make the important distinction between Free Market operations and Crony Capitalism- a distinction that the anti-free-market thinkers are failing to make in blaming Free Market capitalism for this debacle.

This country has never been a Free Market. NEVER. Our economy has been driven by policy and law since the inception of the republic. First, we started off with slavery in the south and laws elsewhere that excluded entire segments of the population from participation in the economy above the bottom levels. Then, as we industrialized, our government partnered with crony industrialists to steer the economy by overreaching policies whose consequences cascaded and amplified down through decades, with social and economic dislocations that were greatly magnified by our government’s ability to back policy with massive allocations of tax monies. Would our slavish auto dependence and the overpaving of the US, with all the economic and social consequences of that (destruction of our cities, devouring sprawl, slavery to the ME oil cartel) have happened without the heavy hand of the government and the allocation of a major portion of our tax monies backed by policy? Same with the financialization of our economy over the past 25 years in conjunction with policies and programs to subsidize sprawl building and housing by means of countless government agencies and programs- HUD, FHA, FNMA, GNMA, and all the other federal, state, and local programs that subsidize builders and buyers, have the implicit or explicit guarantees of the U.S. and/or local government entity so that lenders will lend on any terms safe in the knowledge that they will be bailed out of their bad decisions. This debacle has been setting up for many years, and on the way to its explosive end, has caused many dislocations in the economy and damage to individuals, as the real poor are priced out of any kind of housing in cities, settled homeowners are being blown out by inflated tax bills, and almost everyone, including renters, is paying 40% more for housing than they did 6 years ago- and it was front to back the creation of our policy makers, who decided that they were going to make debt creation the centerpiece of our economic policy.

As Ms. Rand stated, capitalism demands virtue, and our government’s interventions in the economy over the past 100 years, and especially the past 15 years, have removed the other side of the equation by removing personal responsibility, and have skewed and corrupted the markets with homebuyer programs, various indirect and direct subsidies to developers and lenders and buyers through their agencies and programs, not the least of which is the implicit guarantee of rescue when things don’t work out. Believe me, greed would have been tempered by consideration of the probable consequences a long time back, and lenders would have pulled in their horns when the defaults started spiking in 2002-2003. But Greenspan, who started out as a Keynesian and reverted to it and its emphasis on monetary manipulation almost the minute he finally parted ways permanently with Rand and her little “collective” back in the 60s.

The free market did not fail, government policies and interventions did, as they always do, and as they will now. This bailout effort is only their effort to correct the problem they created by doing exactly the same thing that made the mess to begin with , which is to underwrite bad decisions with easy money and more lax lending.

I was prudent too. I didn’t refi, I didn’t speculate, I don’t have a mortgage, and I’m one of those wierdos that own free and clear. These banks are now doing everything in their power NOT to mark these assets to market. That is the real crime. Inevitably, they will have to, and unless the fed can manage to inflate asset values magically again, they’re toast. I’m thinking zero interest rate policy, literally.

http://mises.org/story/3165

The Myth that Laissez Faire Is Responsible for Our Present Crisis

RL, be patient – -there is a quiet majority out here in the OC who are waiting this downturn out. Like you, many of us have lived within our means and have been waiting for the housing market to become more affordable for us. We have been working hard, saving, and have not been fooled into buying in this overpriced and rapidly declining market. Of course most of us didn’t want such a catastrophic mess to be the open door for us, but with the deck stacked against us by the greed of lenders and RE agents (among other guilty parties), and through the use of fraudulent and crazy risk loans, we were forced to the sidelines until the house of cards fell in. I firmly believe that in a year or three we will have the opportunity to buy houses in the neighborhoods where we now rent, and the people who played by the rules will be vindicated.

Paisano1:I understand people are hurting, but in your example the loan should never have been given thus the house should not have been should. Now the market is doing what the market needs too, which is take the house back. The worst thing is not losing your house. In most cases that’s the best thing in the world. It will cause a chain reaction and prices will go lower because of supply and demand. The grocery clerk will be able to get back in at a cheaper price and will have less stress for the payment. Thus, extenting is life because he’ll not have the added health problems from the stress. But it needs to start with one and it is starting now.

Fiduciary responsibility is the main concern in this situation for assigning blame, responsibility, and prison sentences.

It should begin at the top and work its way down the ladder. It should stop at the level of the brokers of loans. Realtors and buyers are just the final salespeople and dupes. Neither of them know anything about what was done to them. It’s like selling a used car. The Dealer says they fixed it so it will run well. The salesperson just sells what they are given. The buyer just buys what is available.

There is no magic in any of this. Prosecute the perpetrators, let the victimns walk.

You are so…. CORRECT! We all know these types and yet we put up with them and let them get away with …..

I keep my eye on foreclosures on trulia, and I’ve seen a real big slow down the past couple months. No doubt thanks to that new legislation. It’ll be interesting what kind of affect the 3 month wait has. Also, I recall several months ago some lenders were waiting 300 days before acting, giving NODs a chance to live rent free before bailing. So what can we expect next year when the option arms start to reset in large numbers –and lenders have to finally proceed with foreclosures after letting NODs go rent free for almost a year. I expect it’ll all hit all at one time, and force prices down sharply again all at once.

Also with the work out senario you describe, as the months go on it’ll become more complicated. Many people bought homes based on combined incomes, yet many couples are either currently or very soon have to deal with lay offs, and have to deal with just one wage earner. Also I think some of the more hopeless cases are so unwise about money (like the couple recently seen on Oprah with Suzie Orman) that they’ve been racking up credit card debt to try to maintain their lifestyle, adding to their monthly expenses.

To equate Alan Greenspan today with anything close to Ayn Rand’s philosophy is a complete total fallacy. Greenspan has completely betrayed everything Rand ever stood for by joining the Fed. The Fed does not represent anything less than monopoly fascist capitalism which is antithetical to the most basic premise of Objectivism. The foundation of all of our economic woes lies in the grand lie of a fiat monetary system being moral or honest. This is the foundation upon which Greenspan stood and why his betrayal was so immense.

Agreed – there will be pain – but the blame is on the admistrators of the system. yes – the loan should not have been made, but it was the banks who were in the best position to determine that, not some sucker with a lame-assed public high school degree.

They were robbed at the closing, robbed of their payments, robbed of their dream of homeownership, and now they will pay their share of the bailout too.

Thsy lose everything.

How much does Mozillow lose when we get foreclosed on?

How about Kerry Killinger?

Or Jamie Dimon?

Ken Lewis?

Prince?

O’neil?

Fuld?

What is the cost to them when we lose everything?

http://yourmortgageoryourlife.wordpress.com/2008/10/27/no-hope-for-homeowners-foreclosure-prevention-program-falters/

Im getting increasingly angry at articles like these! Why? Because these fear based articles are relavant in CA, AZ, NV and FL in 90% of the cases.

These articles are introducing fear and panic to the entire nation on problems that may only touch on communities in the rest of the nation.

At least put a clarifier in the title of the article….where the most serious problems are….

“I understand how pay option arms work, my question is regarding the reset which occurs when the loan hits the cap. Let’s say it is 125% of the value of the loan. How does a declining market effect this process?

“Does the bank reappraise the property and use the new value to accelerate the reset of the loan.”

There are two things that can stop the option-payment (i.e., lower than interest-only) party:

1. The loan balance growing to 125% (in some cases, 110%) of its original amount;

2. Five years having elapsed from the loan’s inception date.

Whichever of those milestones comes first, it means that the REQUIRED payment will now cover principal-and-interest. No more interest-only. No more less-than-interest-only. The interest rate will continue to adjust (usually monthly) up to whatever its lifetime-maximum is.

As long as the borrower is able to handle the increased payments, then the lender has no recourse to call the loan. But if the borrower is now upside-down in the property (owes more than its market value), then there’s not a way to do a refi or sale–unless the lender agrees to a short payoff.

Response to Tom,

Did you read the Title? This is a Southern California blog. The clairifier is there but you are not.

I totally agree with you “Waiting to buy”. The good thing is also that we still have a little time to save even more money before buying. It’s my first time on this blog and I find it quite interesting. Thanks!

Hi,

I have been reading your blog for awhile now and I definitely love having the different perspective. I think Tom has a point in that this is mostly hitting 4 out of 50 states pretty hard. But I also know that money is national and international and with our current interdependent climate we need to be thinking about how the things happening in other states will affect the economy as a whole.

Cheers,

Jeremy

Well this is a Los Angeles/Southern CA area housing blog afterall. I like hearing the local stuff, it might not effect the rest of the country as much but their are millions of people living in just the greater L.A. area alone, and CA has big big problems.

Ben Roberts, you say it more correctly and incisively than I did, thank you.

The existence of the Fed is a violation of free market principals, as is the massive government intervention in our economy (and our lives) at every level, since the late 19th century.

The place of the government is to protect it’s citizens from force and fraud, something it’s been doing a notably poor job of in the past few decades. This not to say that there is not a place for regulation- we need anti-fraud laws and we need regulation necessary to ensure basic safety. But that is a long way and a much different thing than policies designed to skew the market in a particular direction, with the backing of federal monies, no less.

Too many people did not see their house as their home. And this is one of the reasons why we’re in the mess we’re in. Too many houses. Not enough homes.

Finally this! Whom the gods would destroy, they first make mad! And there is much madness in the land. People voting for McCain/Palin tells the tale. Madness and insanity. May we recommend a book called Conservatives Without Conscience, by John W. Dean, former White House council for President Richard M. Nixon. It succinctly shows why the United $tates is in such a mess. The book is shocking and terrifying.

It’s a beautiful day here in Havana! Yesss we have the internet down here… you foolish Amerikan a*****.

One thing that Atlas Shrugged illustrates that doesn’t exist in today’s world is a bunch of large businesses run by their founders, people who have a moral and spiritual interest as well as a financial interest in their company (I know, Rand wouldn’t like the spiritual part).

History shows that the longer a company exists, the farther from it’s founder’s ideals it strays. Hirelings, the people running the corporation, have no blood, sweat or tears involved in the enterprise, only the prospect of that great and grand payday. Rand’s idea of the moral superiority of capitalism can only be realized when the captains of capitalism are in fact moral. Modern business schools don’t churn out morally superior individuals, only shortsighted hitmen who will do anything to bolster their own bottom line no matter the consequences to the enterprise they captain.

Jack Welch has been championed as the epitome of modern day CEO’s. His moniker? Jack the Ripper. Nice. And with the implosion of GE Capital we now have the total annihilation of a once great American enterprise, taken down by the shortsighted leadership of The Ripper. In his quest for short term results he destroyed the long term viability of the business. And his contemporaries have followed suit. Gin up the quarter’s numbers, maximize this year’s results, never worry about the long term consequences of your actions. As the Japanese have said, out businesses look at the next week or next quarter, Japanese businesses look at the next 10 to 100 years. They may not be that far ahead of us today, but that thinking goes a long way toward alleviating the problems of shortsightedness.

Reply to Laura L and Ann Ryand and “free market” capitalism….

I agree with most of what you said until your comments about “greed would have been tempered by consideration of the probable consequences a long time back, and lenders would have pulled in their horns when the defaults started spiking in 2002-2003.”

Sorry, but the lenders did know…and they continued to develop more and more “sophisticated” off the books entities to hide the coming losses and further to falsify their own bottom lines etc. And, with the lobbyists in Washington pushing for more and more laxity, and the corrupt (where you are right) congress and Senate and President and overseers involved…well, we got what we got!

Alan Greenspan is so naive he’s pathetic!

Virtue will never couple with greed. Period.

May I gently suggest that a good book to read is:

“The Roaring Nineties” by Joseph Stiglitz

This argument that this is not “true free market capitalism” is as sensible as a communist’s frequently made statement that the USSR was not “true communism”. I’ve even heard people say that we need to achieve a “true anarchism”.

Reality is messy, and holding on to the pure ideals of youth when you’re in your 60s (or 50s, 40s, or 30s) is folly. You have to develop new, messy ideals that can work with reality as it is.

Leave a Reply