Economic Recipe for Financial Success in 3 Steps: Get too big to Fail, Lose as much Money as Humanly Possible, go on Government Corporate Welfare. 3 Big Economic Stories: Treasury not saying who borrowed $2 trillion, Circuit City files for Bankruptcy, and AIG getting bailed out again.

While most people fixate on the $700 billion bailout there should be an intense focus on the other clandestine bailout that is occurring without Congressional approval. The Federal Reserve has already lent out nearly $2 trillion in emergency loans to troubled institutions with little if any transparency. Bloomberg News has recently requested the information be released under the Freedom of Information Act and filed a federal lawsuit on November 7th. The Fed is keeping mum about the information or the lawsuit. Frankly it is absurd that we even have to go through these lengths to find out where the money is going since the tax payers are now standing directly in the line of fire.

The Fed hiding information is like you going to your bank and them telling you, “sorry, we can’t tell you where your money is at.” This is patently absurd and we can all take a wonderful guess as to where the money is at:

Keep in mind that just because these institutions were already bailed out, that does not mean that the money being dumped into them is all finished. In one of our stories today, that of A.I.G. they are already back to the well looking for more cash. Remember that game Hungry Hungry Hippos? The dollar marbles are running out and the hippos are still very hungry. $85 billion just doesn’t buy you what it once did. Now it is a $150 billion gamble. You and your family were holding off that trip to Atlantic City but just to get your rush on, the government is gambling for you.

Auto makers are also begging to be included in the T.A.R.P. program. They are seeking $50 billion simply to stay above water since they are burning through cash like Michael Jordan in a Vegas casino (notice how aptly these casino analogies keep fitting in?).  The deep and profound absurdity of these bailouts is we are bailing out the least deserving institutions out there. Think of the almost comical nature of these bailouts:

(a)Â Get too big to fail

Example:Â Bear Stearns making stupid idiotic bets on derivatives and leveraging to a point that would make Thucydides blush.

(b)Â Lose as much money as possible

Example: Ford and GM are bleeding through money as if it was going out of style. Why? They made huge bets on high margin gas guzzling urban tanks. While the times were good, they were swimming in the profits and even laughing at foreign auto makers for making girlie men cars. Honda and Toyota for example had a fleet of lower priced highly fuel efficient cars. They did well initially when gas prices went up. This absolutely gutted the U.S. automakers. But here is the ironic thing. Gas prices are now back down to about $60 a barrel. There argument about high fuel prices doesn’t hold water anymore. They are now being hurt since consumers are flat out pulling back on purchasing any new cars.

All the automakers are now getting hammered. But GM and Ford have built plants betting on suburban tank drivers going on forever. That game is over. So what happens? We now have to bail them out to retool their shops to get with the freaking program! That is absurd. This is rewarding bad behavior. Why don’t we give Toyota and Honda, who by the way have plants here in the U.S. and provide many American jobs, a handout as well since they actually already have plants ready to dish out fuel efficient cars? Again, typical of rewarding bad behavior and the most extreme moral hazard financial problems we have seen in decades. More of a political symbolism move here.

(c) Apply for Corporate Welfare

Example: Fannie Mae and Freddie Mac. Remember in the oh so distant past when we bailed out Fannie Mae and Freddie Mac and everyone was up in arms because it was the biggest bailout ever known to humanity? That is, until a few months later we went off our meds and got a 3 page letter from Paulson asking for carte blanche authority for $700 billion to lend out to anyone that couldn’t be crammed down into that $2 trillion secretive alphabet soup of crap the Fed is now accepting. See dear readers, what we now have is a bailout blitzkrieg with so many institutions asking for corporate welfare that people are now becoming immune to all of this. Read the bailout bill. The initial bill was designed to buy toxic assets. Now, we are injecting capital. Frankly, this stuff is being made up as we go along. Here is the section of market transparency:

SEC. 114. MARKET TRANSPARENCY.

Within 2 days of purchasing craptastic mortgages, they’ll have to go public in some electronic form. Imagine a Google interface except everything you pull up will be toxic assets. Sort of like looking at the SEC short list except in a searchable format.

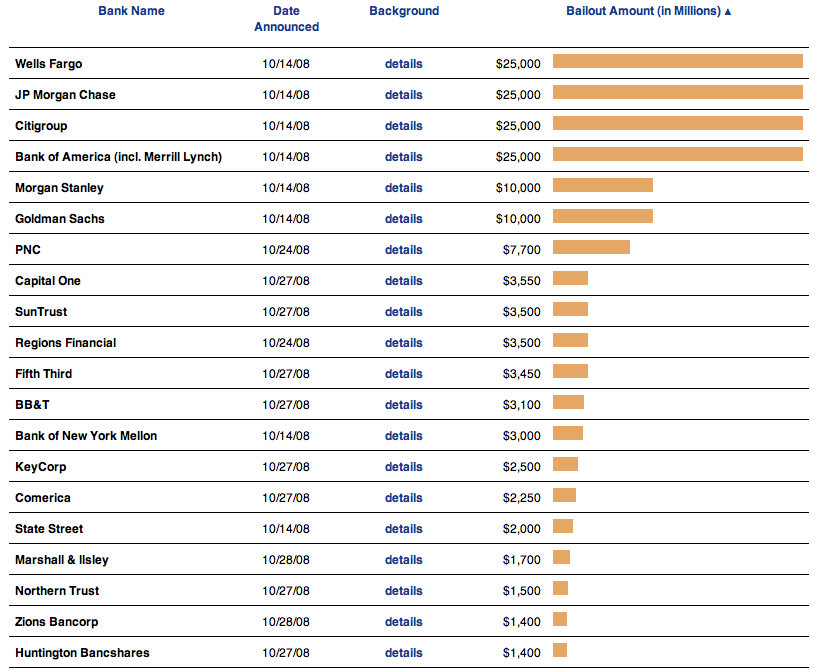

Technically the U.S. Treasury hasn’t bought any toxic mortgages probably because of this reason and is running as much as it can through hidden market actions. The only allocation we have done thus far is dumping money via capital injections to these banks:

Source:Â ProPublic

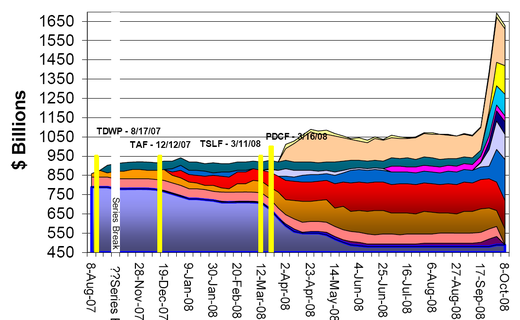

And where is this toxic sludge going? Let us take a look at the off balance sheet security lending:

Source:Â Cumberland Advisors

Let us now focus on Circuit City which only a few days ago we discussed about their closing of 155 stores.

Circuit City just short circuited and filed bankruptcy

Circuit City announced that it will be filing Chapter 11 bankruptcy. That is essentially the nail in the coffin:

The electronic big item store is simply another casualty of the consumerist nation coming to a screeching halt. There will be no layaway program here that can save this beast. I was noticing in some reports that Circuit City was stating that competition from Best Buy was a major reason for their bankruptcy. Wrong answer. Try again.  Circuit City is closing down because people are flat out broke. As in, lint in their pockets. I know people feel freaking wealthy with 10 credit cards but you might as well line your wallet with monopoly money to garner a same effect. It isn’t your money. It is spending today what you will earn tomorrow. And since our economy is laying off people in masse now, many insurers are realizing that some people may have no earnings tomorrow.

Also, to use Best Buy as a measure of comparison isn’t using your noggin since they are getting smacked down as well:

People are grasping at straws here. The reality is, and most people don’t want to hear it, is that we are no longer going to have access to absurd amounts of credit. Why? Because it was a once in a lifetime bubble. For those of you who think credit will flood the streets like a broken fire hydrant in short time ask yourself one question. Would I lend my own money to my neighbor with the new Mercedes? Or what about the person with the new McMansion? If the answer is no, then you have ask yourself why is the government pushing for this?

Welcome to the credit destruction phase of the downturn. People will need to keep that car a few more years and you will have to make due with the flat screen instead of that new HDTV liquid plasma.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

17 Responses to “Economic Recipe for Financial Success in 3 Steps: Get too big to Fail, Lose as much Money as Humanly Possible, go on Government Corporate Welfare. 3 Big Economic Stories: Treasury not saying who borrowed $2 trillion, Circuit City files for Bankruptcy, and AIG getting bailed out again.”

People are pulling back only because they can’t get cheap credit, or any credit for that matter. It’s absolutely absurd how quickly cars have dropped in price. Just go on ebay and you’ll see 1-2 year old cars that can’t even get bids for 40-50% off the original price. I can’t wait to see how much cheaper they get when I go looking to buy in February/March. Right now cash rules and credit drools.

Agree except for comment on Circuit City. Circuit City bankruptcy was predictable before this credit crisis. Circuit City failed because it did not adapt to change, and had horrible stores in comparison to Best Buy. If you look over the history of Circuit City you would see it had a great business until it got too sloppy and content with just resting on its laurels vs taking on competively its competition which was not just Best Buy but Walmart.

It is a scary time. A tremendous run-up in real estate prices fueled only by free money to anyone who could fill out a mortgage application. Borrowers had access to free money without risking any of their own (ie. 100 financing, 80-20 loans and the neg amortization loans). Lenders telling underwriters that if they didnt approve a loan then they would be fired. Wall Street making money hand over fist with CODs and other exotic financial transactions. A 700 square foot home with no grass in LA County selling for $600,000.

Well as Dandy Don so eloquently sang on Monday Night Football, “turn out the lights the party is over.” Here is the deal. What some of us experienced during the days of free money, nice homes, nicer cars, big boats, and great vacations will be replaced by pain. The kind of pain when you can no longer afford the things you are accustomed to. When you have to make a choice between wanting something and needing something. We will all pay for the party between 2000 and 2006. However, we will get through it. It will be tough.

Oh it was, it was a time of greediness. A time of selfishness. Google the article about the Shallowest Generation. What do you think?

Speaking of AIG… they just pissed off ANOTHER $340k+ on a conference.

http://www.azcentral.com/arizonarepublic/business/articles/2008/11/11/20081111biz-aigresort1111.html

Also, an interesting timeline of CC http://consumerist.com/5082090/timeline-how-circuit-city-came-undone

tony, I’d say trying to blame this on Baby Boomers (or any statistical construct) is misguided.

~

While I think there are some generational or demographic features to HOW the run-up happened this time, and thus the busts, WHY it happened has nothing to do with that. Please let us stay focused on what Dr. Housing Bubble is writing about:

~

BOOMS AND BUSTS ARE FEATURES OF HOW OUR MONETARY/BANKING SYSTEM IS ENGINEERED.

~

There is absolutely NOTHING about this current bust that is unusual. It’s simply the only one most people have experienced or are aware of. I’d guess that those of us who remembered others, or learned about them from people we love, were inoculated against getting involved in more extreme ways. But it’s going to happen anyway, and we’re all going to feel the pinch. Our monetary system is designed for booms, busts, and bailouts.

~

I strongly urge every devoted reader of this blog to grab from their library “The Creature from Jekyll Island: A Second Look at the Federal Reserve.” You will see laid out in the first and second chapters an exact summary of what is happening today, and the book was originally published in the early ’90s. The responses on Amazon.com are interesting (see link below) if you can wade through people’s fixations on their own belief systems (Ron Paul, ancient religious mythos, conspiracy tendencies).

~

Another intelligent observer is Michael Hudson, who has published many articles on the essential nature of the financial system. I’ve mentioned in the past his article on “The New Serfdom,” which is archived at iTulip.

~

And I’ve recommended the documentary “Money as Debt” by Paul Grignon.

~

People of a certain age will try to blast other people of a certain age. Boomers can blame Gen Xers, and vice versa. But we are ALL caught within a monetary system that is designed to do exactly what it does:

~

Concentrate wealth. Print money. Devalue money. Socialize risks and costs.

~

Please, please, please. Let’s not get caught up in the blame game. Let’s use Doc’s infusion of facts, attention, and energy to go out and educate others about grassroots economics.

~

rose

~

http://www.amazon.com/Creature-Jekyll-Island-Federal-Reserve/dp/0912986212

I also agree with all of this except for Circuit City. When they laid off their best and brightest salespeople because they were making too much money last year, I stopped shopping there. I’m sure many other consumers did the same. They deserve to file bankruptcy, considering how they treated their employees.

Best Buy is suffering from the economic downturn and if they fold, that will be why. But in Circuit City’s case, the down was a factor in, but not necessarily the cause of their demise. Circuit City was simply poorly run. Rather than focusing on good prices and good service to produce more sales, they tried to trim out as much money as they could from their day-to-day operations (including the boneheaded move that also killed The Good Guys, laying off all commissioned retail sales positions and replacing them with (entry-level) straight hourly wages). Whether they would have survived even in a decent economy is debatable.

The Fed is stonewalling the information requests because they believe that if we know who is asking for large sums of money, we might (justifiably) think that these companies are in trouble, and collectively pull out. That would drop those companies and the FDIC, the national and global financial network crash would be all but unavoidable. Expect them to continue to keep their mouths shut, the rest of the government will turn a blind eye and ear to their lawbreaking.

It’s not the Fed that causes speculative bubbles. The Fed was not involved in the Beanie Baby mania of the late 90s.

Compass Rose,

I was not trying to lay the blame on my generation or any other generation. Read the article and tell me what you think. I am a bankruptcy lawyer I am in the business of discharging debt and it aint a pretty time. People earning $50,000 a year with $90,000 in credit card debt. It aint that unusual, trust me. My parent’s generation did not have that problem. That is the point I wanted to make.

I now understand that our great financial institutions are gearing up for their end of the year bonuses. Those same institutions who were given bailout monies or risk failing are now issuing bonuses. I assure you that in Europe they are not giving out bonuses to government subsidized financial companies or otherwise.

I thought bonuses were given out to employees based on merit and how well the company did in the proceeding year.

This is insanity. I should have know better when a well-know financier in NYC sold his apartment (in January 2008) he paid $300000 for in the early 90’s for 14 million and then moved he and his family to Asia citing that it was a safer financial place.

That should have been a sure sign for me to sell, sell, sell….

If “It’s not the Fed that causes speculative bubbles,” I guess someone better tell them that. They sure are trying to get this mess reinflated.

I think intrinsically it all boils down to one thing: We don’t know why we are here and what is the purpose for our lives. Reality is far too complex for us to understand–Einstein couldn’t figure it out, how can we? So we just act on our our impulses, react to manipulation, and rationalize our decisions. We just sort of figure that it will work out in the end somehow. But just like the folks standing on the beach while the tsunami comes in, we better get to higher ground before it’s too late.

Doctor,

You mentioned ‘HDTV liquid plasma’. I’ve been preaching to friends that this housing/credit bubble fed new technology. And I’ve felt that the technology gadgets were coming too quickly. Yes, they can be great, but they had a price–that price was future earnings, which won’t be paid, of course.

I’ve heard the expression, “velocity of money”, but how about, the “velocity of technology”. I think the ‘velocity of technology’ is going to slow a bit.

Dr, you forgot step 2. ‘Provide a outsized torrent of campaign contributions to the knocking shop on K street called the US House of Representatives’.

The CB’s around the world will inflate like never before to bring the amount of real (CPI adjusted) debt down and increase nominal asset values. There is no other solution to cure this mess anymore.

It’s interesting that the Wall Street Journal has become an advocate for nationalization, although a purely temporary one. This is a quote from an OpEd in Monday’s paper by Paul Ingrassia:

“In return for any direct government aid, the board and the management [of G.M.] should go. Shareholders should lose their paltry remaining equity. And a government-appointed receiver — someone hard-nosed and nonpolitical — should have broad power to revamp G.M. with a viable business plan and return it to a private operation as soon as possible. That will mean tearing up existing contracts with unions, dealers and suppliers, closing some operations and selling others and downsizing the company … Giving G.M. a blank check — which the company and the United Auto Workers union badly want, and which Washington will be tempted to grant — would be an enormous mistake.â€

Although I’m not sure why it should be returned to private hands, if the government guy does such a good job, and the private sector screwed it up totally.

you’re a great american, dr. bubble.

circuit city had many problems besides the brokeness of americans.

wal-marts ‘category-killing’ entry into the world of high-def tv’s was a stake in its coffin

Leave a Reply