3 emerging economic trends – Buy for less at the Beverly Connection? Consumer prices going up in nearly every category year over year. Home-debtor epiphany.

The economic crisis is changing the way people confront reality. Some are taking the new era of finance in stride while others try to cling to better days filled with easy flowing debt. Those days are long gone at least when it comes to the typical American consumer. Banks are betting taxpayer money on the stock market and doing extremely well with all the enormous volatility. It would seem that banks have decided to forget about all the toxic residential mortgages on their balance sheet and took a giant broom to sweep under the rug trillions of dollars in commercial real estate. On the flip side you have many homeowners unable or unwilling to pay their mortgage but enjoying the new short-term freedom of having no housing payment. It feels as if someone had pushed the big red reset button on common financial prudence.

I’ve noticed a few trends here in Southern California emerging from this crisis. The public seems oblivious for the most part that the state is facing a multi-billion dollar deficit. Most have a sense that the economy isn’t healthy yet many are trying to spend with substitutes trying to keep the pretense going.

Buy clothes for less in a million dollar zip code

I don’t have an enormous wardrobe but do like buying good quality items that I can wear for a long time. Why buy a cheap $5 shirt every month when you can get a good one to last you a year for $40? A store that has good quality discount clothes is Ross. I expect to find this store in most middle-class neighborhoods. Having a Ross at the Beverly Connection threw me off but more so all the traffic. Keep in mind this zip code has a median home price of over $1 million. The motto of Ross is “Dress for Less†and apparently this store was filled with foot traffic.

The California housing market might be in the toilet but there is no reason to dress like crap because of it, no matter where you live. I find trends like this fascinating. This Memorial Day weekend turned out to be a bust for the box office with movies having their worst holiday performance since 1994. Yet Netflix is pulling in solid revenues as a cheap economic substitute. Instead of buying that Calvin Klein for retail, why not get it at a discount? Instead of watching a $15 movie, why not pay $9 a month and watch all the movies you want at home? People are clearly voting with their wallets for cheaper alternatives.

Consumer prices still going up

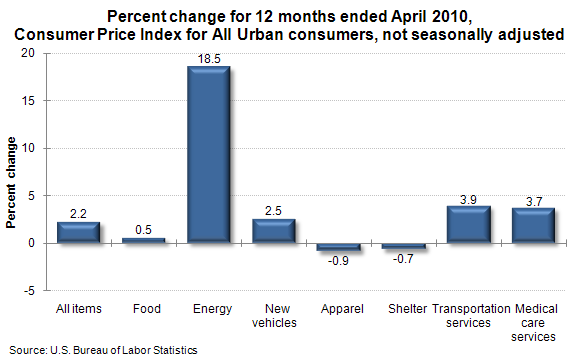

Notice how the cost of fuel at the gas pump is still over $3 here in California? Energy costs increased over 18 percent on a year over year basis as of the end of April. Virtually every category except apparel (hello Ross) and shelter (hello California housing bust) have actually increased on a year over year basis. This is why most working to middle class Americans feel the pinch on a daily basis. Many fill up their cars on a weekly basis while paying electricity and gas bills each month. This is felt on a continual basis. We all eat on a daily basis and food costs have also gone up. Rents at least in California have fallen over this time. It is an interesting dynamic that the biggest ticket item in homes has fallen yet every other category seems to be increasing. Since owner’s equivalent of rent is a large item on the CPI this has kept the overall rate of inflation low over the past year.

The massive amounts of toxic mortgages in the state has clearly impacted home prices. Home buyers are no longer capable of pushing home prices higher with exotic loans. Since consumers are clearly pulling back it should be no surprise that the biggest purchase most will ever make is being more modest as well.

What do you call a homeowner with no equity? A renter with an albatross

Source:Â oftwominds

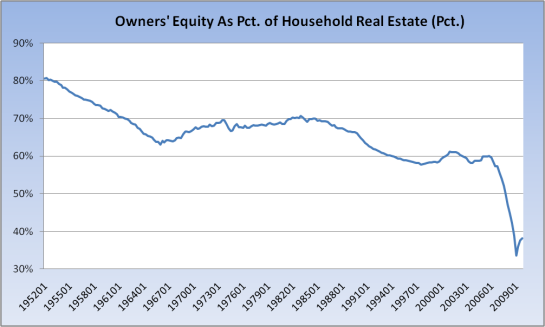

It is a stunning fact that today there is more mortgage debt than actual equity in residential real estate. In fact, we didn’t cross this point until 2006. For over 50 years this had never happened. American homeowners actually had more equity than debt. Even during the massive housing bubble from 2000 to 2007 the mortgage equity withdrawal machine allowed Americans to tap into their homes and treat them as some sort of makeshift ATM. The above chart clearly shows this trend.

Here is some interesting data on California:

Owner-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 6.9 million

Homes with a mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â 5.2 million

Underwater homes:                      1.768 (million) – 34% negative equity

Renter-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5.2 million

California is a big renter state. What many are finding out is that owning a home with no equity is worse than renting. 34% of California mortgage holders are in this position. I actually see this position below renting because you have little power of mobility. You can’t sell unless you come with money to the table or strategically default. If you rent, you stay for your lease and then move. Many are waking up to the mobility provided by leasing. People forget that California has a large renting population (43%). This is based on 2008 Census data and I can imagine this only increased when data is released for 2009 in September.

Some areas like Stockton California have negative equity rates of 65%! Negative equity is the number one reason in predicting future foreclosure and it should be obvious why. If you had equity, you would simply sell the home. Clearly that is an option many have now lost in this current crisis.

Part of what made housing such a viable option in the past is the desire to grow equity in the home. This was achieved through paying down the principal on the loan. With option ARMs and interest only loans this was an afterthought. Paying down principal was secondary to appreciation and delusional appreciation pipedreams. Instead of earning equity through saving and actually paying down the principal the new equation bet on pure appreciation. This was purely speculation and if this were in some high flying stock sector we could sit back and discuss the giant mania with little repercussion to the real economy. Instead, we turned the number one asset for Americans, the home into one giant money piñata and beat every nickel of equity out of it. And we wonder why people living in million dollar homes now need to buy discounted clothes?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

31 Responses to “3 emerging economic trends – Buy for less at the Beverly Connection? Consumer prices going up in nearly every category year over year. Home-debtor epiphany.”

Another great article, Doc. Keep up the good work!

I don’t like the idea of using the CPI as a measure of inflation. I like the Austrian metric better: inflation = increase of the money supply + credit. Last I read, the money supply and credit are still contracting.

~

I think what we’re seeing is increased demand for energy or decreasing supply which is spilling over into the other sectors. Transportation depends on energy prices, as does food (to a degree). Also, energy companies in some counties are government-owned and prices are going up because governments are adding fees in an effort to make up budget shortfalls.

~

Medical care service prices are probably affected by the demand side also: we have an aging population and the younger generations are increasingly obese.

~

Everyone go long on insulin.

The commodities market has been driven by speculation and the chinese, lately. If the PRC goes into another recessionary decline, I would bet oil and all other commodities head down. Western nations have been decreasing their oil consumption steadily since 2007.

I think walkaway is a poor term given the fact that these folks are doing the opposite, staying put! Walkaway from the payment and stay in the home is not a little rumor anymore, it is mainstream media and I hear about it all the time. That together with principal reductions by lenders to deadbeat borrowers makes me wonder who is running the show.

No one is, least of all the clown in the Whitehouse.

Pundits talk about the light at the end of the economy tunnel….it’s the unemployment train!

Nice to see you branch out from housing and talk a little about inflation and other economic trends.

People are only staying put because the banks refuse to kick them out. Some are dying to move on with their lives, but the banks just won’t auction their homes and you are on the hook for the property until they do. I think the negative equity situation will improve pretty rapidly over the next couple years as we experience 6-7 million foreclosures. Once all these homes resale for prices that are reasonable the market will normalize and hopefully banks will require a 20% down payment for at least the rest of this century.

You have to laugh to keep from crying.

ALL THE LEAVES ARE BROWN….& THE SKY IS GREY…

Doc, you forgot to mention the nice SUV Escalades, BMW’s, etc that you see at the local McDonald’s ordering .99 cent cheeseburgers after a long day of shopping at the discount clothing stores.

After all, you have to buy a nice set of wheels to go with THAT OVERPRICED

CALIFORNIA H-O-U-S-E-!

All together now…1&2&3…All the leaves are brown…& the sky is gray…Stop into a church y’all and pretend to prey for a turnaround SOME DAY!!!

That was my first clue how bad things were in 2008 when I saw a fabulous babe in a new BMW parking at our Walmart. I wanted to tell her that Lord and Taylor moved downtown and this was now a Walmart, but there’s really nothing funny about it. I’m on the front lines with F-500 clients, universities, municipalities–none of them are seeing green shoots. Budgets are cut to the bone, projects cancelled, staff cut. I also have freinds in architecture and construction. Architiecture is dead and contruction has turned into renovation, remodel, add-on. Anyone who thinks this is over and the V-shaped recovery is underway is either lying or delusional. I wish it weren’t, but my contact is with a lot of people, and I just haven’t seen it yet.

I couldn’t agree more about jobs–jobless recovery is no recovery. I’m tired of all that talk about jobs being the last to recover. It’s June 2010. 16 months of this was over a long time ago.

@RDRSERG

Don’t say a prayer for me now, save it till the morning after.

Blank-feind is doing God’s work, so He must be punishing us.

Talk about dollar being supplanted as world reserve currency slowed as Euro has stumbled, but Yuan is looking to make a move soon. If dollar not pegged to oil and other commodities, we will not be able to print with reckless abandon.

Despite DOW bouncing off 10k today, market’s still over it’s head. When DOW over-speculates ahead of recovery, there is great danger every time.

Demand is not just want–but want + means.

I hate to be the bearer of bad news, DG, but:

http://housingdoom.com/2010/06/02/fannie-and-freddie-say-it-subprime-one-more-time/

Nice to see someone keeping a close track of the trends. We are located in Florida Tampabay area to be exact. Just thought I would let you know that NOT everyone is in foreclosure We are not upside down on our morgage However my husbands business is marine based annnnddd as you know there is an ever growing GIANT oil spill heading our way. Business has already fallen off and as it continues What then?????? We can’t even make any concrete plans because NO ONE knows what is going to happen. The worst case senerio has us losing everything. The job market around here is frighting, ever since the economic collapse.

I am sooooo sick and tired of reading and hearing stuff that blames just the consumer as if the BANKS have no resposibility in this……

We stand to lose everything through no fault of our own. The fault lays with the relentless GREED brought to us by the BANKS AND BIG OIL!!!!! It sucks to put it mildly.

And no one is going to jail. How can this be?

> If you rent, you stay for your lease and then move.

I have heard that California law allows you to break a lease for reasons such as getting a new job in a different area.

@Judy,

I lived there for years, but I don’t recognize anything anymore, but it’s still very nice there. I truly feel that we are entering an era of darkness. For me, the tragedies are at arm’s length, as is your livelihood at the mercy of powers beyond your control. Although the media always seem to exageratte and your problems won’t likely be anywhere as dire as they portray, you just don’t know and the damage is done.

Good luck. I’d get in line for the BP payout. Even an oil company won’t be able to pay all the damages in this case, I would imagine.

I hate to be the bearer of bad news, DG, but:

http://housingdoom.com/2010/06/02/fannie-and-freddie-say-it-subprime-one-more-time/

Food has gone up?! Are you an iTulip.com subscriber?

Your observations are normally excellent but you are way off on this topic. Every item in my local supermarket has “sale” tags on it. Walmart is always in the news pushing prices down on their entire range. My local KFC has a huge sign “We have lowered our prices!”. Not one restaurant I visit – high end to low end – has raised a single price for years.

This “food is going up” nonsense is always peddled by people that believe we are entering into a hyper-inflationary environment. Regardless of the long term inflationary outcome it could not be clearer that we are currently in a deflationary environment.

If you believe food is going up provide proof. Your housing analysis is untouchable because you provide excellent proof.

I think the Yuan is a non-convertible currency. How would that work as a reserve currency? Does anyone know what would happen in case of a Chinese housing bubble burst? If their government is the one making the loans and they lose some money from defaults and foreclosures, can’t they just paper it over with no repercussions except inflation?

The want + means part is what’s hard to quantify in all of this. I still see people spending $1 Million on homes, overpriced equities, etc. Where is the money coming from? Someone still has deep pockets.

Owning a home with no equity is indeed a bigger liability compared with renting a house. Home owners also have to take care of repairs and maintenance as well. Fortunately home owners needing to move can rely on companies that buy houses regardless of condition and equity.

The housing boom over the past 40 years was a cash cow gusher for American homeowners and by default our GDP but like the death of a close relative that has been sending you money over the years and suddenly dies, leaving their estate to the local dog pound this can be extremely upsetting and difficult to accept. Our prior RE markets is dead and gone but like a religion it has many followers that expect it to return from the dead and again flood them with equity and cash.

Judy if you took out a mortgage within you and your husband’s means, the banks in your case were just engaging in responsible lending (lending reasonable amounts). Neither you nor the banks could foresee a giant oil spill. Of course that most definitely is the fault of BP.

Even people with money aren’t spending it.

I was at the Beverly Center on a summer lunch hour last year, (prime ladies-who-lunch shopping time) and it was so sad. All the over-priced stores were echo-empty with the store clerks looking anxious and lonely. Even the food court was empty! Glad they brought in something that will move goods.

I go to a chiropractor on Rodeo every week, and they have empty store fronts up and down every street. A buddy of mine sells jewelry for one of the highest end stores there, and she says that even her highest-end customers were skipping the jewel-buying for the holidays- it was her worst year ever.

@ron

Are you saying we are running out of FIRE-flavored kool-aid? Indeed. As I mentioned, my company has thousands of clients in business, military, municipalities. Even big-pharma has been putting the cookie jar up on the top shelf. I don’t see how (to borrow from Lewis Carroll) the ‘senses’ takers are green shoots, and evidently Wall Street doesn’t either.

The other one’s robbing our senses are the Fox news folks. I like to look at the babes in tiny dresses too, but blaming Obama for everything and trumpeting unfetterred, free-market capitalism as the answer to the world ills it just so obviously wrong. We have to evolve to a system where business and govenment function despite our perverse nature, or we just get recurring bubbles and the kool-aid swillers that make them possible.

We tested Dow 10,000 as a floor for the last time in a while. PPT may be back Monday in the options market, but 10,000 may become the ceiling next week instead of the floor. Although functionally Dow may not be important, phychologically it is the prime median. And in an economy based solely on faith, we gotta keep pouring the kool-aid. There just isn’t another choice.

@LAer

That’s what I thought too (Yuan), but if I read something that makes sense, I have to consider it, cuz I’m no CNBC expert, or even someone that plays an expert on TV. I thought the Chinese pegged their currency to the dollar so they could maintain their unfair trading advantage against us. I guess it may come to this because the Euro is faltering. Funny how the Euro is in trouble because of debt and USD is a safe haven (LOL). If debt were mole-hills, we’d be the Burj Khalifa on Mount Everest with a cherry on top.

@Blurtman

It’s Calvin&Hobbes opposites day: Debt is wealth. Truth are lies. Evil is good. Banks are for doing God’s work. Right is wrong. Rating agencies are for deception.

By the way, Anybody still think Warren Goldman Buffet is still the squeaky-clean financial genius and not the king of the cronies? His ‘Moody’s Blues’ records got a lot of skips and scratches. The guy supposedly does more investment investigation than Satan himself and has no idea his giant holding, Moody’s is churning out AAA for CRAP-CRAP-CRAP. If Poppy Harlow didn’t look so good interviewing him, I turn off the TV everytime that crony opens his mouth with some pithy, midwest banter.

Where have you gone Ferdinand Pecora? Our nation turns it lonely eyes to you…(appologies to Paul Simon)

If 2008 was 1929, 2010 is 1931. We have a long way to fall to get to 1933, oddly enough 2012…scary parallel. Only this time is different. GM never lost money throughout the last depression. They went bankrupt in this one. We were an industrial juggernaught, like China today. Now we’re an industrial-naught. If it wasn’t for defense and that plastic crap they put on everything, we probably wouldn’t manufacture anything except 12-dollar popcorn at the movies. I work some in North Carolina and there are abandoned mills everywhere, while we import from Red China and all the unemployed mill workers are working at WalMarx, selling the good made by the people that stole their livelihood. What a paradox. In the last depression, you could go to California and pick the grapes of wrath. Now Californian’s are leaving for Oklahoma to grow soybeans (I made that up). I don’t know where the masses will go this time. Do we need more Realtors? Home inspectors? Appraisers? Firemen? Mortgage brokers? Hedge funds? Can we do the census every six months?

@Susan

“Even people with money aren’t spending it.”

Haven’t we seen this movie before? Can you imagine where we would be without 40 million on food stamps? (Fox News–“Trust me. I’m unbiased”) Maybe we need to give the rich vouchers for Gucci’s? Nobody has any problem wasting money, as long is it isn’t theirs…

Off topic? No–the point is housing is the grand puba of the virtual economy–propped up and manipulated as a muliplier and accellerator of fiat money flow. It is thought of as a safe, useful investment. It is now a financial weapon of mass destruction. (Didn’t King Buffet say derivatives are FWMD’s?) The intrinsic value of the home is much less than you will pay, by design. It’s a huge risk. You will probably lose everything in the long run. As long as you realize that, it’s of course your choice (probably your wife’s).

I wonder what failed FDR plan they will exhume next to try to keep up the charade. What if they confiscate gold again? Lot of people hedging with that. What if they seize it? There is precedent. Mexicans in internment? We got a precedent for that too.

“We have nothing to fear but populist leaders themselves.”

I suggest hold onto your nuts. Only the smart squirrels will survive the Kondratiev winter setting in. I doubt that mortgage-free living will go on much longer.

Interesting point about clothing/housing. Here’s a more direct indication of the same phenomenon:

I live in Tarzana, “south of the boulevard’, where million-dollar homes abound…

…more and more of them with aging (even rotting) cars, trailers, or boats in the driveway. My favorite is a house (clearly worth 7 figures) with a rusting, dislapidated swingset in the front yard.

Whole Foods just opened a store on Ventura Blvd. But the lines are at the local 99-cent store.

@Greg

“All the vampires walkin’ through the valley move west down Ventura Blvd”

Maybe the Mansions are multi-family condos now…these are strange times we’re living in. We are clearly Free Falling.

Leave a Reply