Engineering high prices with low monthly payments – Fullerton California pending home sales. Examples of how low interest rates are pulling in current buyers.

Home values in the Southland are now up on an annual basis across all counties. The SoCal median home price is now up over 8 percent on an annual basis. The best performing county? Riverside County with prices up over 10 percent. The real test will come as the typically slower fall and winter seasons hit. So far the low inventory and incredibly low interest rate has definitely had an impact on home values. Many people that are buying this summer realize that fiscally the US has some major challenges coming in 2013 while the state of California has its own budget battles ahead. In spite of that the belief that the Fed will backstop the housing market and the tempting allure of low rates has shifted some momentum over. I wanted to take a close look at the city of Fullerton in Orange County.

Fullerton pending sales

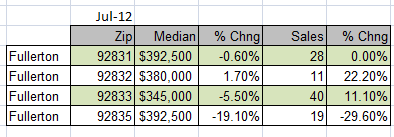

I found it interesting that Fullerton actually went against the price rise trend in Orange County:

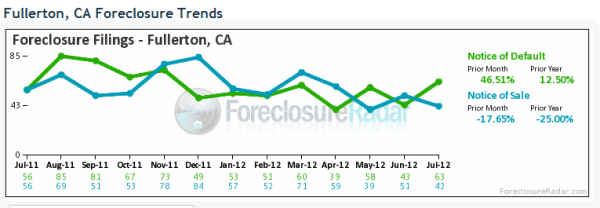

Each zip code had a median price under $400,000 and for Orange County, you would expect to have a feeding frenzy. What was also interesting is that notice of defaults still remain elevated signifying that many households are unable to pay their mortgage:

Notice of defaults jumped from June to July but this can be from banks taking action on homes since the market is more prime for sales. The lowering of the inventory pipeline is occurring. It is useful to see what is actually selling in the current housing market:

1330 W Southgate Ave, Fullerton, CA 92833

3 bedroom, 2 bathroom, 1,296 square feet, Single FamilyÂ

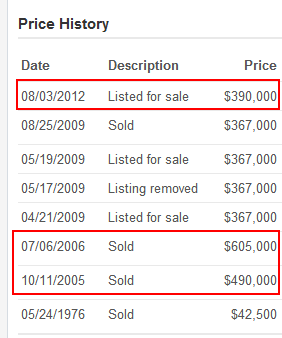

The above home has 3 bedrooms and 2 baths and is currently listed as a pending sale. Looking at the sales history sheds some important light here:

This home sold for $605,000 back in 2006. The current list price of $390,000 is a 35% drop from the peak price. With low interest rates someone can buy with a 5 percent down payment and come out paying a monthly PITI of roughly $2,122. A slightly bigger home a couple of blocks away is renting for $2,200 a month. So a $20,000 down payment and you are close to rental parity here. Sounds good right? This seems to be the Fed’s plan yet for those buying, the upside seems to be limited given the major issues facing the state budget and national economy. For those staying put long-term, a low down payment mortgage seems like a low risk option (of course the default rates are soaring and this is a cost that will be shouldered by the public).

At the upper-end of the market, let us look at a pending sale:

1225 Crestview Dr, Fullerton, CA 92833

4 bedroom, 3 bathroom, 1 partial bath, 3,350 square feet, Single FamilyÂ

The above home sold for $1,313,500 back in 2005.  Today it is listed at $899,000, a drop of 31 percent. Seems like Fullerton has a peak drop similar to the nationwide figures in the 30 percent range. It is interesting to see that defaults are still healthy in these markets even as lending standards have tightened up. Since many loans have shifted to FHA insured loans in the last few years, it only makes sense that these loans are souring as the overall economy is still trying to find its footing.

The goal from the Fed’s perspective is to keep prices high because banks are then able to keep more collateral on their balance sheet at inflated levels. In reality, a buyer is better off purchasing say a home at $300,000 with a higher rate than say a $500,000 home at a very low rate. This is essentially what the battle has boiled down to on the housing front. It has worked so far in 2012 but does it have staying power?

The above pending sales in Fullerton get a glimpse as to what is moving in the market today. Are the above sales priced too high, low, or just right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

85 Responses to “Engineering high prices with low monthly payments – Fullerton California pending home sales. Examples of how low interest rates are pulling in current buyers.”

I think they are too high for the current job market. It is always better to have a lower balance and the resultant lower taxes from the lower prices. The current prices make little sense, in this economy. Lets see how it goes-the mortgage market can’t go any lower and unless politicians grow a spine and engage in some protectionist policies, the job market will continue to suck.

Rents are high enough now and interest rates are low enough, that if someone wants to live in a house there’s a good chance that their PITI will be the same amount as their rent. This is a powerful incentive to purchase. Especially among first time buyers.

I think the one caveat that many miss on the “rental parity” (aka rental parody) is the time commitment to the monthly payment. I am currently renting a $3000 a month overpriced 3/2 next to the beach. I can commit to $3,000 a month for the next 12 months in the current environment. I cannot commit to $3,000 a month for the next 360 months in the current environment. Forget all the other hidden costs that the rental parity crowd seems to overlook; I am not willing to commit to 30 years of an inflated payment even if we were at true rental parity.

If history is an indication.. $3000 a month will be about the same as $300 a month in 30 years…

I remember my grandfather describing out cheap everything was when he was growing up..

Do you really believe the dollar is going to be worth the same or more in 30 years?

Locking in a 30 year-fixed mortgage at $3000 will feel like your paying $300 a month in 30 years… Probably will feel like $1500 a month in 10-15 years.

Yes, there is a 360 month commitment to lock in a $3k/mo mortgage.

But what do you think your current $3k/mo rent will be in 180 or 360months? How about using the inflation calculator you used down-thread to guess based on historical inflation?

THAT is the advantage of locking in during rental parity.

GenY & MB

I have two words for you, depreciating asset… You assume that the asset will keep up with inflation. As I have stated in my prior posts, I am not convinced that our current macroeconomic circumstance will lead to housing keeping up with inflation going forward.

However, I think you both missed my real point regarding how employment opportunities to make a $3,000 a month payment are becoming harder to find. If I lose my job tomorrow I could make it till the end of my lease no problem. The problem starts when we talk about till the end of a 30 year mortgage…

What?,

Who cares if it’s a depreciating asset or not… The fact of the matter is.. Do you really think $3000 will have the same buying power in 30 years as it does today?

Borrowing money on the cheap now.. will have benefits in 15-20 years if history repeats itself.

I have been renting for the last 3 years, 2100 a month in a 550K house as it sits today.

Since I have been here the landlord has spent 4K on a heating cooling system, 400 on a refrigerator, 800.00 on a stove, 200 on a toilet, 500 on various leaking faucets, approx 400 total on annual spot termite treatment, 200 to fix the fence in the back yard and I know the house actually needs to be tented but they are waiting til I move some day. The carpet is now some 7 years old and it needs to be replaced.

I know as a homeowner, you have these costs and more. Those weekend trips to the nursery always added up and God forbid a remodel job.

People always tout, yeah, in 30 years I will have no payment. True, but how many people live in the same house for 30 years and without refinancing?

This house I am renting today, if I owned free and clear would be spending 600 a month on property tax and 150 a month on property insurance and at least an average of 200 to 400 a month on maintenance when you consider remodels, roofs, termites, paint and the works. So, I currently pay rent of 2100 dollars a month on what would cost me 950 a month to 1150 a month if I owned it free and clear. Oh, did I mention as a renter I can pick up and move?

The only way it makes sense to own today, at these historically high prices is if going forward, home prices rise FASTER than inflation going forward. With interest rates at historically low levels, causing prices sub 700K to get back to peak prices, I really doubt housing prices will rise faster than inflation for years to come. However, if you do want to take that bet with someone else’s money, like the FHAs, there is little risk, but I certainly wouldn’t risk my own money!

What?

I didn’t realized homes only became a depreciating asset recently. My assumptions that rents will keep up with inflation is based on years of historical data.

If you’re forced to move in 12 months, you’re right, 95% of the time renting is the way to go, but you’re the one that brought up the 360month commitment. But history has shown, if you can commit long-term, buying is the way to go because you can lock in your payment long-term.

Ok GenY,

I will give you a basic econ 101 lesson. Interest rates (i.e. cost of money) include what components? Answer: Anticipated inflation + default risk + interest rate risk + cost to borrow. Now, what do you think will happen to interest rates if we have higher inflation? Do you think increased inflation would have an impact on monthly payment? Then higher inflation begets higher interest rates begets higher monthly payments begets lower available money for principal. Now what is principal again? That’s right the price of the house! This is exactly why inflating our way out of the current problem is not going to work…

I have stated over and over that the Fed can only spark currency devaluation in our current economy due to the slack in the labor market and globalization. The Fed cannot spark wage inflation. Without wage inflation we start to crowd out local expenses (housing and services) with expenses for items that we bid for globally (food and fuel). It is no surprise to me that oil is around a hundred dollars a barrel and food costs continue to rise.

MB,

Yes, buildings are a depreciating asset the land is not. This is not new to finance. Maybe this is new to the RE industry. And when you say history, what history are you talking about? Many pick convenient starting and end points in history to argue their point. Tell me what history you use to make the statement “But history has shown, if you can commit long-term, buying is the way to go because you can lock in your payment long-termâ€.

I am also interested in what skin you have in this game. I know that GenY just made a recent purchase and is arguing out loud to convince him/herself that it was the smart thing to do. Are you a RE agent? Did you just purchase? Are you an “investor�

Solid thinking “What?”

An American moves on the average very 5 years is the last number I read from 2008. It might be 4 now when you consider the massive demographic shifts occurring due to job losses, health issues, etc. Locking oneself into a 30 year obligation for such a high amount does not seem like a good idea when faced with these historic facts. What do you do in 5 years when you must sell?

The New York Times reported last year there is over a 109 months supply of houses on the market (that number does NOT include the Shadow inventory). The numbers point to a very long term regression to the mean which signifies continued lower prices. The price decline will accelerate when interest rates regress to the mean and/or more discipline is injected into the market with such provisions as 10% minimum down instead of almost zero now.

What! You are so correct!!!! But this will never convince the “I’ve got to get in” crowd. With the advent of Visicalc-Lotus123-Excel, the on paper, looky! comparison, just wins over every time. They ignore real costs of up keep, the hidden interest with the measely write off benifits, the initial escrow costs, the umpteen refinancing costs, on and on.

If it was so great for the “older” crowd, that is always a certain portion of homeowners, locking in that great old price, why do I keep reading about “near retirees” underwater? it is unbelievable to me, but true. They have essentially nothing.

if you buy the cheapest home that you can, pay it off quick, and try not to spend too much on refurbishment, it can be a cheap rent.

I’m jealous of you, we just spent a few thousand replacing our interior doors and frames and getting a nice paint job on them in our house we have owned for 14 years. $ 3,000 later, they are prettier, but this never ends!

I’m not sure tomes are better, we just drove through a ritzy neighborhood with acre lots, it was so full of dead lawns, I was shocked, it looked like a barrio.

Martin,

Everything you listed tallies up to $6500 in expenses.. And every expense you listed, if the job was done competently, should last 15 years MINIMUM!

So your talking $434 a year in expenses if you spread it out over 15 years.. Or $36 a month. I’m sure there will be more expenses.. But they don’t go on forever.. Knock out the big expenses.. like a new Roof.. you can buy a $20K roof that would last you over 30 years in CA… NO PROBLEM. The weather just doesn’t beat up a roof like it does in other parts of the country…. even a brand spanking new roof works out to $55 a month over 30 years.

Sure it’s expensive.. But if you stay in your home long enough it almost always beats rent..

GenY,

I believe that cradle to grave employment is at almost at myth status at this point. I have changed jobs and locations roughly once every seven years. A very small percentage of home/debt owners stay in a single residence for 30 years. Most home/debt owners will have to move for one reason or another, so the “long term” argument is moot. The average stint in a house is around 7 years if memory serves. I would love to see the math that shows that someone who bought 7 years ago would be better off today than a renter…

What?,

Fortunately, the homes that most people buy include “improvements AND land” And taken as a whole, historically the home (which includes both portions) do not depreciate.

If someone were to purchase a land-lease condo in say… Marina Del Rey, yes, they would see the depreciation you’re talking about.

GEN Y,

You can keep dreaming. An actuary worth his weight in peanuts will tell that your average cost to own for repairs is 1% best case 2% worst case. Here is a link from a bank on what a home owner should be prepared to spend.

http://www.bankingmyway.com/real-estate/home-equity/estimating-annual-home-maintenance-costs

The link says 1%. So on the example I gave, this 550K house has an annual repair bill of 5500, not the 430.00 a year you claim. If you are a handyman type and do all the work yourself and you do things on the cheap, you could probably get away with .5% annually instead of 1 to 2%. I don’t know how old you are but your refusal to accept the true coast to own indicates you must be on the younger side. Life experience will teach you that 1% is not out of line when it comes to owning a house.

I don’t know where you bought your house but there are lots of areas, in fact most areas where buying right now makes all the sense in the world but there are a few exceptions, mainly coastal California where interest rates have given birth to bubble #2. Going forward there is no way in the world coastal ca. real estate will keep pace with inflation .

I have been saying it and I will keep saying it, an improving U.S. economy will mean the death of the latest bubble. With a national median home price of less than 200K a rise of 3% in 30 year rates will be no big deal and is just back to normal but it will mean devastation in coastal California. The FED will not worry about California if the rest of the economy is OK, guaranteed.

If you bought in one of the areas where the bubble was flushed down the toilet, good for you. On the other hand if you bought in an area where the movie “Return of the Blobble” is playing, well, if you are only risking FHAs money your loses will be minimal when you walk.

Again MB,

What history are you using when you say “historically the home (which includes both portions) does not depreciate”? I believe that most of the appreciation would be in the land based on the tear down frenzy that occurred in the past 10 years. The cost of a tear down and waste removal is quite high and many paid seven figures for crappy houses on the west side only to tear them down and fill the entire lot with a McMansion.

Let me guess, you are in the RE industry. Not many outside the industry would use the “improvements AND land†phrase.

What?-

“What history are you using when you say “historically the home (which includes both portions) does not depreciate”

How about C/S for the since 1970? Is the statement “US Real Estate has appreciated in value since 1970 true for false?”

“I believe that most of the appreciation would be in the land based on the tear down frenzy that occurred in the past 10 years”

Again, why are you making the distinction between land and improvements? When the typical homebuyer makes a RE purchase, they buy both the land and the house. The point is, when homebuyer sells 15 years later, C/S would show the next purchaser paying more.

Not that it matters, but I’m not a RE agent/nor do I have a license.

@Martin

I agree with your logic but I am not convinced that we will see a real economic recovery anytime soon. I am also not convinced that even if we had something that appeared to be a recovery that the powers to be would have any incentive to take their foot off the stimulus gas…

Your 1-2% of cost of the home as rule of thumb for maintenence is so illogical its funny.

Why would a bubble home in CA… Say in Brentwood or Santa Monica, that is 1600 sq feet and cost $1,000,000… cost 1-2% to maintain a year?

In reality… That 1600 sq foot home will cost the same to maintain as the same 1600 sq foot home in Texas selling for $100k.

You can’t have it both ways! You can’t claim bubble CA homes have 2% maintence costs based on their “bubble” prices. You may pay a little premium for labor in CA… But you can buy all the materials and parts to repair a 1600 sq foot home anywhere.

So tell me again how a million dollar home in santa monica the same size as in Texas cost so much more to “maintain”. Sorry land value costs nothing to maintain… And that is the difference.

NOT A SUCKER…..

So you don’t die of laughter, I will explain it to you. If you buy a 1600sq foot house in Texas for 125K, your annual repair cost is likely to be higher than 2%.

If you buy a 1600 sq. foot house for 1 million in California your repair costs are likely to be lower than 1%. It is sort of an average, which I am rather suprised someone can’t figure out. Most people who buy a 1 million dollar house will have nicer finishes that cost more to replace/repair but still the cost to repair as a percent will be less. People who live in California will pay 20% more to have the same item replaced as compared to Texas, if not more.

If you are still dieing of laughter, most people buy in the mid range in most markets. From my own experience `1% on a 500K house is not out of line.

I know a guy selling a house worth around 8 million dollars ( he bought it for 10 and refuses to accept he took a bath) and he said according to his records, over the life of the house, he had an average monthly maintenance cost of 22K, excluding taxes. So, if you are too busy laughing, that means as the house becomes more and more expensive the percent to maintain the house drops, and in the above case it is something like .3% a year, but it is an extreme example. So, NOT A SUCKER, that would conversely mean that the cheaper a house becomes the higher that percent moves up.

I

Well, the first 10 years of the 30 year loan are paying off the interest. Then the rest actually pays off the debt. So it’s almost like you’re paying for an option to buy 10 years in advance. The two big questions are 1) Will RE prices rise by year 10? 2)What will the purchasing power be of the USD in 10 years?

Depends on the interest rate.

At 3.75% after 10 years, you’ll have paid off 20% of the principal.

Well, let’s see what the current value of the house would be based on the 1976 sale adjusted for inflation.

Year Rate Price

1976 5.8 $42,500.00

1977 6.5 $45,262.50

1978 7.6 $48,702.45

1979 11.3 $54,205.83

1980 13.5 $61,523.61

1981 10.3 $67,860.55

1982 6.2 $72,067.90

1983 3.2 $74,374.07

1984 4.3 $77,572.16

1985 3.6 $80,364.76

1986 1.9 $81,891.69

1987 3.6 $84,839.79

1988 4.1 $88,318.22

1989 4.8 $92,557.49

1990 5.4 $97,555.60

1991 4.2 $101,652.93

1992 3 $104,702.52

1993 3 $107,843.59

1994 2.6 $110,647.53

1995 2.8 $113,745.66

1996 3 $117,158.03

1997 2.3 $119,852.66

1998 1.6 $121,770.31

1999 2.2 $124,449.25

2000 3.4 $128,680.53

2001 2.8 $132,283.58

2002 1.6 $134,400.12

2003 2.3 $137,491.32

2004 2.7 $141,203.59

2005 3.4 $146,004.51

2006 3.2 $150,676.65

2007 2.8 $154,895.60

2008 3.8 $160,781.63

2009 -0.4 $160,138.51

2010 1.6 $162,700.72

2011 3.2 $167,907.15

If my math is correct, this house will have the following real increase in value:

$390,000 – $167,907.15 = $222,092.85

I believe this equates to a 132% real increase in value. I guess the first question is what improvements have been made to this house and do they equal 132% more benefit. The next question is has the real wealth in this neighborhood increased 132% since 1976. I think this is a great example of the math not really panning out. The only reason this house can list for $390,000 is the artificially cheap interest rates along with a good deal of artificial stimulus (over a trillion a year of deficit spending). Take away the artificial stimulants and this house wouldn’t sell for $167,907.15 in the current market.

Inflation rates from the following site:

http://www.usinflationcalculator.com/inflation/historical-inflation-rates/

And then factor in the fact that this house is that much older, which normally means things are at the end of their life: windows, flooring, sills, plumbing, etc. Sure, cosmetic things might have been upgraded. And w/ low or zero down loans, the HO’s are underwater the day they close. JMHO

Thanks for the hot link. very useful link. I find your number makes much sense.

The problem with California greed-estate is just that, too many forces pumping up the numbers like a political campaign. The reality is the the old, old rule of thumb number of 2 to 3 X Annual income should be the magic number for buyers.

I done it using the super high multiples and lost my A*s and I did it using the old old magic numbers and 16 years later with all the ups and downs of being self employed, I’m paying down the mortage and I haven’t been kicked out in the street.

What’s so magical about 1976? Why not go back to 1950s? cause that would throw off your math and make the home look a lot more affordable.

You’ve got to be kidding me. Did you actually read the article? The data DHB gave on the first house included the sale in 1976 for $42,500. I come from a world where I start from what facts are available and make a determination based on these facts. I try not to make up facts. The math is plain and simple. You are not making your generation look all that good…

What, based on the math you provided that if the house is selling at 390K, why is housing a depreciating asset? What’s the alternative? gold?

The central issue is that paper money loses value (purchasing power) over time, and we are getting paid with paper money. You will be paying the banks to deposit your money there.

Pete,

The building portion of what you call a house is a depreciating asset for the simple reason that use of this asset is not indefinite. There is something called useful life in the accounting world which is based on the fact that the building will eventually need to be fixed/replaced. The land portion of what you call a house is not a depreciating asset because use of this asset is not limited by time. There are some cases when land is depreciated like when it is mined but that is not the case with a house.

The last thing I would do is give investment advice in today’s economy. I am not clear what useful value PM’s have when push comes to shove. I am very concerned about wealth preservation at this point and I have no good advice other than find a way to invest in food and fuel. These are useful assets that will most likely keep up with inflation. I am still unclear how to cash in on this but am open to feedback…

See my other comments why I believe that housing will not be the inflation protection it once was.

You seem to missing a small problem. Real wages have actually fallen over the last 30 or so years. How does that add up to continued price increases in homes? Did you somehow miss the bubble? What if you were renting in 2006-7 instead of an idiot buying? Would you be better off now? The wages in California do not and will not support the current price of real estate, much less in the future. Believe it or not, there was a time when California real estate was very close to the US mean, about 40 years ago.

If you expect the same type of California home “appreciation” windfall over the next 30 years, go for it. That means an average house will cost 2 million. That also means a brick layer will be making $300,000 a year and gas will be $30 a gallon.

Who is the target of this comment? I agree with everything you said. I also am old enough to remember when California real estate was cheap. Many houses in the valley where on huge lots because land was so cheap. This all changed in the mid to late 70’s.

Those prices for the 2 described above seem high still

I’m for letting the market decide what happens not the Fed

That way things will get a whole lot better sooner

Dave Kenny For President.

It would get real bad at first Dave. When the economy goes south people get spooked and shut their purses. This makes things worse. But that’s natural, and natural is ok.

Washington with stimulus is trying to create a bottom somewhere higher than the bottom. Everybody wants the Hemorrhaging of equity to cease.

Why are they loosing equity? Because everyone lied about the value of collateral they all used to secure the loans. They are loosing what they never had. They cry like babies over the nothing they didn’t have and now claim to be lost. How do you loose what you never had ?

You have heard of liar loans. It’s a whole damn liars economy.

It’s lose not loose. Loosing is what a nut does when you turn it counterclockwise. OK?

The problem is those houses are old, ugly and still expensive. Sure you can work in the film industry and afford one. But why come home to a crap hole! Yes, oh boy I want to work for a rotting box like that. And when the old city plumbing gives out at the street add another 25000 to your expenses. Been there, done that and now I live nice in a modern apartment in a comfortable location. Sorry but I don’t smoke that CA drug.

If your worried about a $25K repair that happens to such a small percentage of homes that it doesn’t even make the news… Then go ahead don’t buy a home.

If it really were a big problem, you’d see entire neighborhoods having their front yards dug up because all the those 1950s neighborhoods clay plumbing systems would give out at the same time.

Do you really see this happening anywhere in So Cal except maybe the one friend of a friend you heard it happened to?

Actually $25k repairs are pretty common when you have to put a new roof on.

The vast majority of people working in the film industry can barely afford an apartment, let alone a house. I wouldn’t at all be surprised if a huge portion of houses going up for sale in LA are from people in the industry who can’t find a job anymore. I know many long-time, talented entertainment veterans who’s salaries are have been cut in half and are barely making it. And frankly, would probably earn more money if they took some regular administrative job. Only a small fraction of people (namely, “stars” and big-time directors), make huge amounts of money.

I actually think this would be something interesting to examine: the impact of the crumbling LA entertainment industry on the housing situation (if there is one, of course). Obviously, it’s not the biggest industry in all of LA, but I imagine certain areas have a more concentrated amount of professionals than others.

LaDeeDa, agreed, however, many entertainment people have already lost their homes in the hollywood hills and burbank, they were short sales & foreclosures 2 years ago. LA jobs and lack of jobs cannot support house prices. Many sales in my Westside neighborhood are forgien all cash buyers. We sold our home over 3 years ago, happy to rent and will not buy in this way overvalued housing market. Condos prices went down alot, though most the crappy California construction conods have big special assessments due to low HOA’s. 838 Doheny condos in West Hollywood has a $120k assessment currently, Century Hill, a $45k… the list goes on.

Those houses are old ugly and still way overpriced. Work hard, live in a crap hole, no thanks.

Prices are determined by who’s in the market for what’s available. There is a huge difference between 1) real people who have to put in time for wages that go towards mortgage payments, 2)individuals who borrow but ultimately won’t pay back, and 3) entities that have the legal right to coin money and credit and can buy, hire and hoard as they please.

What no one really discusses it what this health care law will do to the individuals. It will bankrupt California (although it can’t declare bankruptcy) but this will hurt the overall economy. Money being taken out of the economy to pay the fine or insurance plan. I wouldn’t buy a home right now, there are too many unknowns.

If you think Obamacare is going to have a material effect on housing, you have been watching FOX news a bit too much.

I don’t watch FOX news. Sorry.

If prices drop another 5-10% this fall/winter.. I’m fine with that..

The sub 3% interest rates that are put in place before next spring buying season will recoup that lose.

I bought this past year and I’m fine with an up and down market that basically flatlines for 5 years or so. I’m paying down my mortgage to the tune of $7000 a year and increasing each year.

So a flat market in this all-time all high rental environment makes owning a sub-4% mortgage fairly stress free.

I have been reading this blog for many years and love it and admit I have the itch to buy early next year when I get my bonus. I honestly can’t tell from any indications whether or not another drop in housing (more than a few percent) is coming within a few years or not in selected neighborhoods. This is not a sock puppet post but I am seriously thinking of buying. I grew up near the beach and do have an emotional attachment to the Westside or general surrounding area (Lawndale to the South, Santa Monica to the North, mid LA to the east). I am paying $1800 rent for a 3 bedroom has in Pasadena right now but don’t want to buy in Pasadena or anywhere east of LaBrea. I am self employed and also receive capital gains from shares each year which equals another 2-3 months salary at the end of each year. I cannot afford any beach cities, or Culver City but want to live within a 15 minute drive of the beach. I have no debt whatsoever and a credit score of 780. I will live in LA my entire life. I am 50 yrs old. First time buyer. My monthly take home pay is $5500 and willing to allow the mortgage to be about 50% of my monthly take home pay. I also qualify for an FHA loan. I can plunk down $80K downpayment.

This leaves me looking for a decent westerly neighborhood in Inglewood, Hawthorne, Lawndale or edges of WLA like 90035 or 90034 with home prices in the +/- $400K range and can plunk down a 20% downpayment. Or I could buy a $500K home with FHA loan. Or??? I will need of course to do some research on the PMI with an FHA loan as I hear to disappears when LTV reaches a certain amount.

When I use the NYT or yahoo ‘rent versus buy’ calculators they typically calculate that at the end of 15 yrs I will save $50K – $100K+ buy buying versus renting, assuming a $400K house with a modest 1% annual home value appreciation rate and 2% interest savings on my money. Of course, since I plan to live in LA my entire life, let me assume I will live in it 25 years or more, not 15. Am I missing something (other than doomsday economy) or do I meet some of the unique conditions to be a homebuyer now?

Thoughtful replies appreciated.

Not if you’re intending to pay 50% of your income for your mortgage, that is just asking for trouble.

I am in the exact same shoes as you financially, except 10 years younger.

Are you OK with living here: “decent westerly neighborhood in Inglewood, Hawthorne, Lawndale or edges of WLA like 90035 or 90034”

For the rest of your life?

If not, then wait till an area you are happy with declines, or continue to rent.

Hello ‘same deal’ If I knew an area was going to decline further, such as 90066 or 90064 I would wait. Perhaps I am asking the impossible – is there any certain sign these areas will decline further? I guess no one can answer. thanks

I’d agree with the previous poster and say that 50% of take home for mortgage is too risky.

If you currently derive most of your income from a wage, ask yourself how long you plan on working, and if it’s not 30 years, why would you take out a 30 year mortgage? Perhaps looking somewhere a little more inexpensive and taking out a 15 year fixed would work out better?

You seem to make a good amount of money with savings, so I’m curious why you didn’t purchase earlier in life?

If you’re really set on the Westside, maybe an alternative would be to find a rent-controlled apartment in Santa Monica and rent for the long-term.

MB, you are really uninformed if you believe that you can find a rent control apartment in Santa Monica. The rent control law changed some time ago where new tenants are not covered by the original law. The tenants that are covered by the original law can not sublease as well…

What?-

Before you start calling people “uninformed” perhaps you should do a quick google search. The City of Los Angeles also has similar rent control for older multifamily units, though their rent control board isn’t as renter-friendly as SM.

http://www.smgov.net/Rent_Control/FAQs.aspx

“Beginning January 1, 1999, following most vacancies, the property owner may set the rent for a new tenant at an amount the owner and tenant negotiate. The new rent will be re-controlled and future rent increases during the tenancy will be ”

If a tenant rents a rental building older than 1979 (of which there are many) the tennat may pay market rent today, but future increases will be determined by the SM rent control board.

MB,

I have a couple of questions for you. Have you ever lived in a rent controlled apartment in Santa Monica or Los Angeles? If so, when did you move in and when did you move out?

The reason I ask this question is because I lived in a Santa Monica rent controlled apartment from 1978 till 1985. I moved to a “rent controlled†apartment in LA from 1985 till 1992. The two forms of rent control have no comparison with each other. Santa Monica’s rent control was like winning the lottery and my mother stayed in the apartment until her passing in 2008. There was no real incentive for me to stay in the LA rent controlled apartment because the increase allowed by the LA board was much higher than the rate of inflation and each time you moved the new rent was based on the market rate.

Santa Monica’s rent control laws changed dramatically a number of years ago. I personally know a guy that owns a large number of apartments in Santa. The majority of new tenants do not stay long because the landlords can charge a premium to new tenants because of high demand of the area and low supply (lack of new developable land and the 1978 lottery winners stay put). My landlord friend tells me that most owners hold out for high rents even when there is no one looking at the place. One trick is to offer rent discounts on move in. The lease shows the rent as x dollars a month for 12 months but they offer first month free as opposed to a lower monthly rent.

I am a fan of Google but I am even a bigger fan of personal experience…

What?-

I own multi-family units in SM and West LA and am well-versed in the rent control laws in both areas. I’m aware that West LA has allowed for greater rent increases compared to Santa Monica.

My initial suggestion was that the OP find a SM rental due to the favorable rent control laws and board.

I appreciate your anecdotal story, and while you might believe that your experience trumps googling the actual law the fact is, rent control is alive and well in Santa Monica and benefits many renters.

Obviously rent control laws have had a large impact in both areas, one of which is restricted supply.

The OP stated his income/age/and general love for the Westside and the beach. He asked for opinions about spending 50% of take-home on a 30 year mortgage. Given his age, income and location requirements I suggested he find a rent-controlled apt in SM.

While he might pay a premium in rent for the first 5 years or so, he would have greater assurance that his housing costs would not increase substantially in the next 15-25 years. Assuming he’s like most Americans entering retirement, his income will probably become more fixed, making a stable housing payment (whether it be rent or mortgage) vital.

That was my honest recommendation to him. If he were open to the idea of living in a cheaper neighborhood, away from the Westside, I’d recommend he purchase a home immediately on a 15 year fixed for no more than 30% of his take-home and lock-down his housing payments. Housing may fluctuate up or down, but at some point in life, financial stability is more important than maximizing value or ROI.

If you have another recommendation that you feel would be better, I have no doubt that he would appreciate it.

MB,

That seems to be the period that most use when they say history. Yes, real estate appreciated from the norm since 1970 till today especially in bubble areas. I would expect this to not be the case going forward as it was not the case prior to the 70’s. I think the reasons for this boom have been identified many times on this site and others.

That is really strange because I was born and raised in Santa Monica and have never heard apartment owners nor renters call the current Santa Monica apartments nor any apartments in LA “Rent Control†apartments. When someone from Santa Monica (born in either Saint John’s or Santa Monica Hospital) says “Rent Control†they mean the 1978 law in Santa Monica. I have plenty of friends who own “multi-family†residences in Santa Monica and they never advertise or would claim to be renting a “rent controlled†apartment when they have an available unit. Are you telling me you advertise “rent controlled†apartment available when you have an available unit?

Thanks for revealing your skin in this game. You are a land lord so you have an “investment†interest in property values. You also have an interest in convincing someone that it makes good sense to be a long time renter in a over populated, over rated, over priced location. I would say your view is skewed by your position. I am finance guy who is interested in the economic causes of the current financial crisis.

Why do I insist on separating building from land? Because that is how finance/accounting works. Why does finance/accounting separate the two? Because they are very different types of assets as I explained before. I think my real message is that there is no real economic reason for the building to increase in value. As a matter of fact, the building should decrease in value because it is a depreciating asset that will need to be repaired/replaced sometime in the future. This leaves us dirt (aka land). Now, the real question is, why is the land appreciating in real terms. Has the useful value increased? Has real income growth allowed folks to bid up the scarce resource? Or is this simply a credit/debt fueled asset bubble coupled with a psychological mania? I am trying to determine the cause of the current crisis and identify what we should expect going forward based on the available facts. This is how a finance guy is expected to look at a problem.

I am an economic opportunist that makes rent/buy decisions based on risk and math. I have no emotional attachment to the American dream. I have no dog in this race. How about you my friend? Do you have a dog in this race?

“I would expect this to not be the case going forward as it was not the case prior to the 70’s”

C/S doesn’t show homes appreciating from 1940 -> 1970? Really?

From my experience, when leasing, most young people don’t care that it’s rent controlled since they don’t expect to be living there for more than 5 years. After 5 years or so, tenants in a rent-controlled unit will be more likely to stick around long term as they see the disparity between their rents and market rents.

I’m not delusional enough to think that my anonymous posts on a blog will have any sort of impact on my personal bottom line nor property values anywhere. I’ll have spent more on electricity writing this single post than I can ever expect to get back. As far as bias goes, I’d like to think of myself as unbiased, but who knows? I’m not sure why you think a landlord has any more bias than a renter looking to buy.

This whole rent-control argument is pointless. Rent Control exists in Santa Monica and the City of LA, period. If I were a renter, I’d prefer to live in a rent-controlled unit rather than a non-rent controlled unit. For example, rents have increased substantially in the gentrifying Silver Lake areas. I’d much prefer that I lived in a rent controlled Silver Lake apt than not. If I knew I were going to be living on a fixed income, I’d try to fix my expenditures as much as possible.

I understand the accounting principles that split of improvements and land value. The ability to insure, depreciate, and project requires it to be so. To call it a depreciating asset without qualifying that you only mean the structure server only to confuse since the vast majority of transactions include both structure and land. Of course saying “houses is a depreciating asset” turns more heads than saying “structures depreciate”

To say that I have a dog in this race but you don’t is asinine. One way or the other everybody is paying for a roof over their heads.

From your comments I suspect you’re bearish on housing. Do you also believe rents in LA will be lower in 2025 than 2012?

Yes, real estate appreciated from the norm since 1970 till today especially in bubble areas. The meaning of this is appreciated faster than inflation. Look at any chart showing the cost of housing adjusted for inflation and get back to me.

I am tired of the Santa Monica Rent Control apartment argument and I am willing to bet you are not from Santa Monica nor the West side nor California for that matter.

I assume you are not an accountant nor a finance professional. I think you are looking at accounting from a small business real estate perspective and not from an economic perspective. I actually went to business school, spent 7 plus years in a big six (now four) public accounting/consulting firm and have spent many years in the finance world since. So, I have a handle on this concept but I am looking at this from an economic perspective (yes I was an econ major in college as well).

My point is that we may need to change the way we look at housing in the future where it is more like consumption versus an investment. This is something new in the economic world as well. I did not come up with this concept on my own rather I read writings by a number of economist and I believe this theory may have merit. The economic argument I gave on the valuation of the two asset classifications of a house is not new nor my personal view. This was actually taught in freshman economic classes. Don’t get me wrong, I know that no two economists agree on anything but this was basic micro econ.

I have since moved to NorCal and have no desire to neither rent nor buy in SoCal. It is true that I pay attention to housing market for a number of reasons but I am not trying to convince myself to buy or not buy. I really don’t care if the market goes up or goes down. Would I change my rent/buy decision if the market changes one way or another? Yes! Do I care which way it goes? No! Based on economic principles do I think housing will go up? No! Does that mean that housing will go down? No! If my interpretations of economic principles and the facts at hand lead me to believe that it is less likely that housing will go up than down makes me a housing bear, then yes, I am a housing bear.

I’m curious… if you’re self-employed how do you get a bonus? Who is paying you a bonus, and why?

Hi Ripcord in regards to bonus, my partners and I share profit at the end of the year. It is actually capital gains, from the original investment in the company, not ‘bonus’ in the strict sense of the word. Thanks for asking.

This is sickening….that the governments and the banks are creating a housing bubble all over again, even though it will never be nearly as large or outrageous as the previous bubble. Think of it as a mini bubble. It’s insanity. This will eventually all come crashing down, and housing will lose another 50% or more. Just wait and see. The artificial demand and price manipulation creating by the policy of the banks/federal government/Federal Reserve will eventually create a major CRASH in the housing market. JUST WAIT AND SEE. In the meantime, I’m on the sidelines. No sense in being in a game where EVERYONE will lose out.

Exactly. The previous batch of posers, people with high (often stated) incomes and no net worth were flushed from the system only to be replaced by a new gaggle of “investors” and people caught in the latest RE hype.

Patience will be rewarded when the real washout in RE prices occurs ~2014.

I am with you! Right on the spot!

SOTCrapp

(I love the truthiness!)

I’ve pondered and analyzed this micro bubble as we hop from multi-offer situation to another,and watch howmuchamonth idiots pay way over list, and the house is a fixer. In my area (Ventura County) I see very little worthwhile inventory, and the regular sale market is at a premium. This inventory restraint is working well. I am so sick of this cr*pp as well. Add injury to this train wreck is that fact we’re cash, and actually understand equalibrium, CPI and salary ratios to housing.

I don’t see another crash myself. (But a gal can dream, can’t she!) I see the next two months telling us if the bidding war nightmare will simmer down, or we should all just move to fly-over land.

Hello ‘sick of this crap’ It is hard for me to see how there will be another crash coming. if the banks are trickling out properties onto the market as they please – seems to me they can do this for years on end to bouy home prices without causing a crash or will this crash come from somewhere else.

ps: it is shocking to me how little inventory there is in many regions of LA and that many of the houses are in really crappy places (on major roads like Bundy or Washington Blvd, or Sherman Way or within earshot of freeway, etc).

I agree with you that another crash is unlikely. The banks are not foreclosing on houses, and even they do, they are not forced to sell. They can hold on to whenever long they please. That part of the balance sheets of the banks are purged. I do not see housing going up much either in next 3 years. We probably will be like Japan for long time, but the price on everything is not going lower. Remember Tokyo is still the most pricey city after 20 years.

I think this post most clearly spells out what many of us think.

http://mhanson.com/archives/991

Should you buy now?

The FED has stated they will keep interest rates low until 2014.

Huge blocks of REO properties will hit in the first/second quarters on 2013. See CAR article: http://www.car.org/newsstand/newsreleases/2012releases/bulksalesbill.

In January the financial cliff will hit – who will be president? What will he do?

Nov – Dec is the best time to buy a house, typically saving 5 to 7 percent.

I would suggest waiting until Nov – Dec 2013 to buy a house.

You lost me at REAgent…

REAgent

You came here and quoted CAR? Do you drink the NAR & CAR kool-aid, or just expect to serve it? I was a member of both for years, and even I knew it was called a press-release, written infomercial, or this is how you reply BS. I’ve taken all those sales classes and practiced the role playing. (I know all the dirty little secrets.)

I am in agreement about waiting this out until the 4th quarter, but please, I don’t have money to tent my head from propaganda termites, so can you leave the propaganda off this intelligent based blog. Oy Vey.

REAgent

Sorry. I flew off my broomstick on that one.

Nothing will stop the REO Bulk Sales. They have the deep pockets already buying them up. I belong to an organization that is following this situation. Isn’t it interesting, that CAR was enjoying the bubble as it was rising, but doesn’t like the results post bubble. CAR helped cause this post bubble market. Time to pay the pipper. Unfortunately, CAR is getting us punished as well, the little guy just trying to buy.

Hey, did you ever take one of those $295 feng shui classes?

The smart one is the person collecting that much money from idiots.

You write:

“Nothing will stop the REO Bulk Sales. They have the deep pockets already buying them up. I belong to an organization that is following this situation.”

What organization might that be?

apolitical -REOMAC

What? “Official” recent CPI/inflation rate is cooked. See “shadowstats”. Do you really believe that the cost of living went down in 2009 (health insurance, gas, utilities, food etc)?

I think you are posing two different questions. First, I use the available information to determine the real versus nominal increase in price/cost. I do not have any other source of inflation rates other than the “cooked” rates. Please send me a link to historic rates that are not “cooked”.

Second, I have stated over and over why food and fuel have gone up and will continue to go up. The important point is that real wages (based on cooked rates) are flat while food and fuel rise leaving less devalued currency available for granite counter tops and marble columns…

Health care is a whole other story. The cost is going up because the real customer is not the patient. If you ain’t paying, you ain’t the customer. And no, your $10 copay still doesn’t make you the customer.

“Health care is a whole other story. The cost is going up because the real customer is not the patient. If you ain’t paying, you ain’t the customer. ”

That is something which has been visible here in Nordic: Hospitals are hiking their rates mercilessy as they know that law forces the state to pay whatever they ask. Not as bad as in US, but significant anyway.

Even when the other department of the state owns the hospitals and could replace the management at will. State internal battle and the tax payer pays the bill, as always.

The money got don’t go to patients or workers (nurses/doctors), but to management luxury and lavish lifestyle.

Finally; someone notices that lower interest rates mislead buyers into committing to much higher principle payments. Interest can be avoided by prepayment. Principle cannot. Therefore; which is the better buy:

$100,000.00 house at 10% = $10,000.00 interest per year early on.

$200,000.00 house at 05% = $10,000.00 interest per year early on.

It is clear that at the higher interest rate any fixed additional payment on the first loan will much more rapidly pay down the principle. Therefore, regardless the long term inflation rate the higher interest rate provides the better deal.

Yes, it sounds counter intuitive. However, I can also show that deflation is good for the lower and middle class while inflation is good for the government and upper class while crushing the middle and lower class.

Have a good day.

Bottom line – are home prices higher now, than in 1982? Yes. So in 2042 they will probably say the same thing about 2012.

See Japan…

Lets say I buy a $900k 1500 sq foot home in Hermosa Beach that is the same size as a middle class home in Texas that goes for $100k?

Does your 1-2% maintenance theory still work? If the $900k home has a spanish style clay roof i would argue that the $900k home would have less maintenance cost than the $100k home in texas.

A two-by-fur in Texas costs the same as a two-by-four in Hermosa, that’s fer sure!

The West side of Fullerton Ca. is a gang infested scum pit, with huge families in small houses and a police department that hardly ever patrolled the area, and the streets never got swept because the inept city refused to post no parking on sweeping days, so the dirt and trash just piled up, I was lucky and got the hell out in 2005 and never looked back, I feel very sorry for the few good neighbors who didn’t get out before the crash and are trapped under water, I doubt that area will ever get to the 2004 levels again.

Home prices are totally munipulated by interest rates. Realtors are in full denial of this as they want the maximum price out of the sale. We need realistic interest rates not the low bubble we are in now then home prices will stabilize at a much lower affordable rate.

Well, what I found interesting is Texas isn’t as cheap as people think. The US Census states that home ownership is 64 percent in Texas and the US average was 66. Colorado, New Mexico, and Arizona all have higher home ownership than Texas.. And Harris is only 57 percent home-ownership and Travis at 52 percent. Orange County is 60 percent. Housing is more expensive in the OC but it beats Harris home of Houston and Travis home of Austin. California is only 57 percent. Texas is a bargin if you can live in a nice suburban county like Collins where its homeownership is 70 percent.

Leave a Reply