Exploring the rich foreclosure pipeline of Beverly Hills – 2 Foreclosures versus 86 in the distressed pipeline. New data features allow public to search for distressed properties.

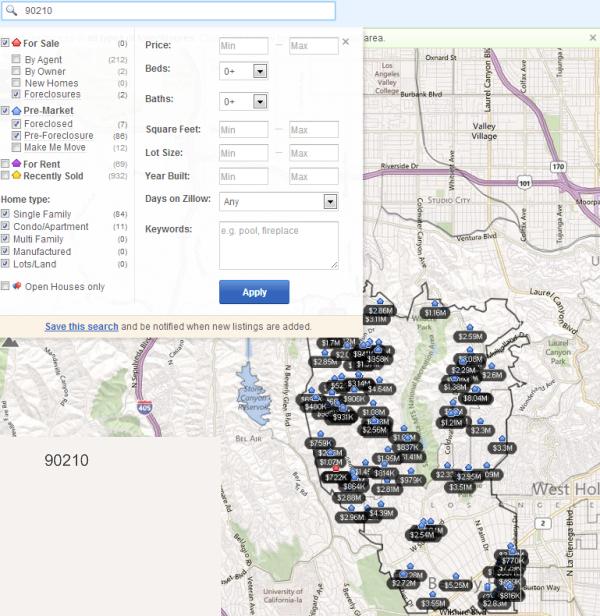

I have been crunching the numbers on the housing market and the more fascinating trend isn’t what is happening with home prices but the actual consumer behavior driving the change. When we started getting more access to information in the early 2000s I thought this would serve as a buffer in terms of capping future bubbles. Instead, it actually ramped up the mania. Information goes viral. So seeing prices go up actually caused people to buy basing their actions on recent trends and the information was available 24/7. Before easily accessible information you simply relied on local sales comps and the advice of your real estate agent. The newspaper analysis served as your bigger city snapshot. Today, most people can dig through the information and find tons of data. And this makes this boom-bust-boom cycle so fascinating. Some of you have noticed that Zillow now offers a snapshot of foreclosure data. For example, let us look at the always exclusive Beverly Hills.

Zillow and the pending Beverly Hills foreclosures

I think this snapshot tells a fairly important story:

In the 90210 zip code, you have 2 foreclosures listed on the MLS for sale. However, you have 86 properties in the pre-foreclosure process. 7 are foreclosed but don’t appear on the MLS. This is the distressed pipeline here. Some tend to think that banks need to sell but the rules of the game have been completely upended and changed. The Federal Reserve has essentially become the lending market by compressing rates lower via MBS purchases. The financial industry largely controls this economy and what has been created is a system that works perfectly in tune for their goals:

-The bubble inventory is inflated (kept in a backlog)

-Allow time for rates to move lower

-Let inventory decline naturally

-Fed ramps up the process

-Prices begin to go up

-Unload into favorable winds

Keep in mind that since the bubble burst, millions of people have lost their homes. This is a fact. Yet it is interesting to see even in the midst of the California echo boom that places like Beverly Hills have a ton of distressed inventory.

Let us look at one of the foreclosed homes listed:

13870 Mulholland Dr. Beverly Hills, CA 90210

Beds:Â Â Â Â 6

Baths:Â Â 9

Sqft:Â Â Â Â Â 10,847

Lot:Â Â Â Â Â Â Â 43,534 sq ft / 1.00 acres

Type:Â Â Â Â Single Family

Year built:Â Â Â Â Â Â Â Â Â Â Â 2008

From the ad:

“Stuning incomplete construction.This elegent home 4 Br+Maid’s+guest &9 Baths.Backyard has amazing views.This is short sale ,all the terms and condition subject to the lender approval.â€

Looking at the tax assessment, the place was completely redone (built) in 2008. The property was foreclosed at $4.6 million back to the lender and is currently on the market for $3.8 million. I’m curious to see what comes of this place. Even a low interest rate does very little at this price level in Beverly Hills.

If we filter properties in distress at $1 million and below we find 24 properties. I find this new Zillow feature fascinating and will essentially open up the distressed inventory for people to examine. But what will come of this? Access to information is simply a tool and people are going to use that tool to fuel their ultimate goals. And consumer behavior is driven by herd thinking. Right now, people think they are going to miss out on housing boom 2.0. So hard to tell how long this will last. It can’t last because household incomes are stagnant. Until that changes, we are simply experiencing another volatility cycle through real estate. I was talking with someone about real estate prices in China. It was interesting to hear that people are buying simply as a store of value (perception being that tangible hard assets are much more durable, even if the place is vacant or has the potential to fall by 50 percent – at least it won’t go to zero). You have to wonder if Wall Street investors are looking at the rental market through this perspective because land lording and Wall Street do not go hand and hand.

I’m sure many of you are going to see what is going on in your neighborhood now that this data is accessible. Don’t feel bad, even Beverly Hills has a good amount of people in the foreclosure pipeline.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

33 Responses to “Exploring the rich foreclosure pipeline of Beverly Hills – 2 Foreclosures versus 86 in the distressed pipeline. New data features allow public to search for distressed properties.”

I can see that interest rates are low, and first time buyers are waiting in the wings (like me) and wages are flat and banks are trickling out the homes for sale (less inventory) but what has not been clear to me is what will cause home prices to fall again by what some claim is 20%. If prices fluctuate +/- 10% over the next couple years, I dont see the point in waiting if I plan to live in the house the rest of my life. Of course, if I knew prices would drop 20% with 2 yrs then I could save a lot of money by waiting. Alas, maybe I am a whiner waiting for the bottom 2.0 of the market which no one can predict?

Daniel, the risks are that we slip back into a recession (more job losses, slower income growth/possibly decline) or even more dire is that once interest rates go back to a more normal range of 6-8%, or possibly even higher, that is going to kill the RE market. Figure out how much house you can afford now on 3% mortgage rates and then re-do it for 7%. You’ll see a huge difference and that’s where the price decline can come from.

Now if you’re waiting to buy you have a quandry because you’d like to lock in these low rates as well. I’d say if you can find a home you THINK you can stay in for at least 10+ years then you should just buy now at the low rates. You take the risk of price depreciation but in 10 years who knows where prices will be. The more money you can put down now is good too so you have some equity even if prices decline 20-30%. Or put down as little as possible, borrow as much as you can at these rates and play chicken with the housing market and the fact you might lose all of your equity some day if you are forced to sell early.

Not a decision I’d want to make but good luck!

Please consider property tax into your equation as it is based-upon purcahse price. Potential rent shoud cover all monthly overhead, so buying would be a no-brainer if the two are close, better-yet if local rents are above your outlay.

1. I learned something very interesting about using Zillow. Thanks,

2. Not sure how to apply to my ZIP Code.

I see 117 “for sale” and 43 in “pre/foreclosure”.

But, all the foreclosures are low-priced crap.

And, Zillow does not show the 40+ units that are under construction right now. You can only find these by walking down the street or digging into property records.

Nope…not showing the all. I can see at least one that I’m sure of in my old neighborhood.

http://www.zillow.com/homedetails/400-S-Rossmore-Ave-Los-Angeles-CA-90020/20775175_zpid/

It went into default back in late 2005/early 2006

http://www.zillow.com/homedetails/400-S-Rossmore-Ave-Los-Angeles-CA-90020/20775175_zpid/

What a great feature you have uncovered. Thank you.

One realtor in my area told prospective buyers last year that prices “cannot drop any lower.” However, I now see prices dropping even below my predictions to below $45 per square foot and they still sit on the market for months. Incomes are stagnant and or falling and many renters I talk to have no interest in buying anymore since they realize how transient their lives are and they may move again in 3-4 years. Very very few people these days will “stay in a house for the rest of their lives.” It’s a new world out there and young people (potential buyers) are realizing that.

This.

The new reality is that being tied down to any one particular area is more limiting than it used to be.

Mobility is becoming more of a factor than it ever used to be and the last thing a lot of people in overpriced areas like SoCal want is to be leveraged to the hilt in a home that they can’t offload without getting royally screwed.

I don’t believe that Zillow or RealtyTrak are anywhere near completely accurate when it comes to foreclosure/default statistics.

My next door neighbor has not made a mortgage payment since March, 2009 and the property doesn’t even show up as a “pre-foreclosure” on Zillow or RealtyTrak.

It would only show if the lender has filed a public notice. For example, a Notice of Default. If the owner is in default and yet nothing has been recorded at the Recorder’s office, then Zillow would not show it.

I too know of people in default for years and yet they have not received a Notice of Default and therefore it does not show on any public sites like Zillow.

The shadow shadow inventory!

Aside from not giving notices of default, banks have 5 years to sell REOs (and can request a 5 year extension from the Fed). This adds up to really, really being able to trickle out inventory (the “shadow, shadow inventory” as Joe says).

Google, “How Financial Institutions Can Effectively Manage and Dispose of REO Assets”. The pdf article with this title, that will come up in the search, really indicates just how the banks are handling these toxic assets.

I doubt there will ever be a deluge of foreclosures on the market. The banks are allowed to trickle them out for a very long time. And that’s what we’ve been seeing. Trouble is that every time there looks to be a run up in real estate prices, the banks will get on the ball to put more of them out there and that may put too much inventory on the market. Although this does not look to be happening…..yet.

I know of two in my immediate neighborhood that are default but not showing-up on zillow. One has been delinquent for almost 3 years and one is delinquent for at least one year.

Bam Man and Sadie, I’m curious about your neighbors if they are at fault or if they were victimized.

Paul – one I don’t know, the other had a job loss

Zero foreclosures in my zip code, according to Zillow.

Wow, thanks for pointing out this new feature – works great in San Clemente! It actually shows you the full addresses of anyone delinquent, so now your neighbors will know as soon as you are behind on your payments, ha ha

This zillow foreclosure feature is great. You can definitely see which properties are in default with an address that is provided, how much they are behind, when NOD, Auction and foreclosure occured. Can even see how much they are behind and who the lender is all for FREE. On RealtyTrac, you could only see a a rough area of the homes affected.

I agree. The zillow info is much better. On a couple in my area, it’s telling how much they owe, i.e. a house last sold for $350K in 1999 and it will be auctioned for $1.2 million (indicating they must have taken some serious equity loans).

I find it interesting how Zillow shows prices skyrocketing in some areas while the estimates for rent are static.

How accurate do you think zillow’s forclosure inventory is. For example, the link below shows shows the loan was in default back in 2006, but the owner wasn’t served with a notice until 2012. Is that correct, or am I reading it wrong?

http://www.zillow.com/homedetails/5003-W-137th-Pl-Hawthorne-CA-90250/20401893_zpid/

Nevermind, 2006 was when the loan was issued. I get it now.

Given some comments above about those in default that have never had a Notice of Default recorded and therefore they do not show in the Shadow Inventory it would be interesting if the Credit Bureaus released the data. Maybe not on an individual due to privacy, but on a zip code basis. I wonder how that would increase the Shadow Inventory?

I think someone should ask the GSE’s to do the same. Overlay defaults not recorded by zip code so we can all have access to the data. Dr.HB, file that FOIA request would ya?

Well, even if Zillow is accurate with the data they get, they are still completely reliant on the Banking system for this data. How many people are years behind on their mortgage payment and have yet to get an NOD? If the lender does not file an NOD, the process is not officially started. Hence, no foreclosure.

I’ve heard that 90% of underwater mortgages are still making monthly payments. Sean O’Toole may have better data on this than anyone as he runs Foreclosure Radar and he’s a pretty sharp guy that tends to tell it like he sees it.

Let’s hope the Zillow foreclosure feature lasts. Privacy-related concerns are already surfacing like in today’s LA Times:

http://www.latimes.com/business/realestate/la-fi-zillow-foreclosures-20121026,0,7986391.story

Earlier this year, Redfin offered a feature showing comprehensive sales records of individual real estate agents. You could see who handled what in different neighborhoods and how well their properties sold — for example, above or below asking price. The resulting uproar saw this feature disappear after a week or so.

Not everybody wants transparency, but, thank you, Doctor, for continuing to provide transparency with your blog.

That would be a bummer if the feature disappeared due to privacy. But, really, it’s just pulling from public records, so hopefully it will remain.

Anyone else notice how flooded the market has become in the last week? Santa Monica has seen an explosion of listings. Problem is, the pool of buyers always shrinks this time of year. Seems like dreamers hoping to get out from underwater, before we start price declines again for the 4th year in a row.

http://Www.westsideremeltdown.blogspot.com

I wonder if it’s related, in part, to the realization that there’s a new tax on real estate sales in 2013 as part of Pelosi/Obama-care and people hope to sell in time to avoid it?

I’m in SoCal & 60 days ago I submitted an offer on a house, a short sale, to BofA. My realtor & the seller’s realtor have been pressuring the bank for an approval. Another buyer was previously approved but it fell out of escrow due to their finances. How long can the bank take? even after they approve, we still have to wait another 45 days for escrow. Am I taking some risk here? Can the bank decide to foreclose on it? No one seems to know anything.

For what it’s worth, I noticed something interesting in one scenario that I looked at with the Zillow foreclosure search feature.

I know a homeowner that’s been in default with BoA for well over a year now. The home has actually been scheduled for auction on a couple of occasions but the homeowner has just barely been able to delay the auctions by working out some sort of temporary arrangements with the bank at the last minute.

The homeowner says that at present they’ve worked an arrangement with the bank to bring it out of foreclosure but I know that they are still something like ~15 mo behind on payments. There’s also a second that I don’t think is being serviced either.

The Zillow search doesn’t show this home as a pre-foreclosure or foreclosure but if you look at the public records in the expanded detail, it clearly shows the NOD and auction notices plus it states that the property is in foreclosure.

The point I’m making with this is that it may be that Zillow will not show a property in the foreclosure filter if the bank and homeowner have arranged for something. I also wonder if these anecdotes from commenters where they report that a property will go up for auction or short sale only to “disappear” shortly thereafter is due to the property owner doing some last minute deal with the bank to “save” their home.

1. Zillow is total crap.

2. Beverly Hills has 3 zip codes: 90210, 90211,90212 so searching 90210 only doesn’t really tell the tale.

3. I have a foreclosure listed for $4,860,000 in 90210 currently and 2 more on the way so not sure where Doc’s numbers are coming from.

4. Most (over %70) of delinquent homeowners have not had a NOD filed yet so will not show as a foreclosure. Which is why Zillow is crap: it is only as good as the crap data fed into it and as long as the FED allows Mark to Unicorn accounting the real shadow inventory will remain in the shadow.

anyone use PMML?

it is aweful

what a bogus “standard”

by some cheesy company down south

zementis?

every heard of them

i heard they are going bankrupt

like most california companies

Leave a Reply