Fannie Mae and Freddie Mac Gear up to Bailout California: New Housing and Economic and Stabilization Act Mini for California Lenders. $450 Billion in Alt-A and Sub-prime Loans Still Active in State.

Finding a dumpster for toxic assets just got easier when the tempest of financial distraction are keeping people focused on the shiny economic items of fear. Remember that much of the uproar regarding the $700 billion TARP bailout plan was how the government was going to price toxic assets? Which subsequently led to the demise of the first iteration of the bill in the House of Representatives. The bill then was saddled with an additional $110 billion of pork and beans and suddenly the bill made sense. Clearly the market didn’t think so and has seen the worst week ever. The market voted that idea down.

Paulson while scratching his head and looking at his “bailout for dummies book” must have found a cliff note telling him that Fannie Mae and Freddie Mac are already setup to purchase mortgages and in fact, for 2008 are pretty much the only game in town. Genius idea! So in the midst of the G-7 planning to authorize their own bailout with a Euro-zone flavor the idea of decoupling now seems like a wild-eyed joke. What is worse than an incompetent central banker? A group of central bankers. There are now reports that Federal regulators are going to require Fannie Mae and Freddie Mac to each purchase $20 billion ($40 billion combined) each month in sub-prime and Alt-A non-performing loans. That is right, the outrage that made the Economic and Housing Stabilization Act of 2008 go down in flames is now becoming a government mandate with Fannie Mae and Freddie Mac:

“SAN FRANCISCO (MarketWatch) – Federal regulators have ordered Fannie Mae and Freddie Mac to start buying $40 billion of troubled mortgage bonds each month as the U.S. government tries to revive the economy, according to a published report.

The purchases would be separate from the U.S. Treasury’s $700 billion bailout plan, which was signed into law earlier this month, Bloomberg noted.

Fannie and Freddie were taken over by the U.S. government in early September, in the first of several bailouts the government has launched recently to try to halt the spread of the mortgage-fueled credit crisis.

Regulators initially restricted Fannie and Freddie’s growth when they seized control. To “promote stability” and lower mortgage costs to borrowers, Treasury Secretary Henry Paulson said the two companies would be allowed to “modestly increase” their mortgage portfolios to as much as $1.7 trillion through the end of next year and said they would no longer be run “to maximize shareholder returns.”

Wow, since when was $1.7 trillion a modest amount? Amazingly this is additional money that will be flushed down the toilet on top of the $700 billion bailout plan. You can do the quick math here. If this starts this month, we have 15 months until 2010:

15 months x $40 bn = $600 billion more in toxic funds

Absurd. This does absolutely nothing except guarantee that the taxpayer is going to be on the massive hook with the worst assets known to humankind.  All this will do is take sub-prime and Alt-A paper off the books of irresponsible lenders and put them on your bill. Once again, the lenders are free to do what they wish and receive no justice for what they have perpetrated. Those that say now is not the time to point fingers are completely off base. Why? Because unless we can pinpoint who the criminal is first, we have the inability to assign the punishment for the crime.  I love how this plan states that Fannie Mae and Freddie Mac will no longer be run to “maximize shareholder returns” as if current shareholders need to be reminded of that most obvious fact or told that the sky is blue:

The scary proposition here is that people would be better off if we simply sent each household a fraction of the $40 bn each month directly. This idea will not promote stability because what then of the borrower? You really have to logically think this out. Let us assume a $50,000 household lied and got into a zero down $500,000 mortgage with a pay option ARM (a common occurrence here in California):

Borrower income:Â Â Â $50,000/yr

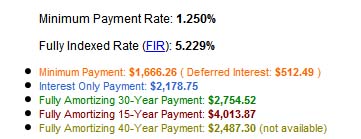

I ran the numbers on an “excellent” pay option ARM scenario:

So the current payment of the borrower is roughly $1,660 a month. Not bad, but once the loan hits a recast, the borrower is screwed. Let us assume that $1,660 was the maximum they could afford since taxes and insurance will run an additional $600 to $650 a month. Therefore, at the teaser rate their monthly payment is approximately:

Monthly teaser rate / house payment:Â Â Â Â Â Â Â Â Â Â Â $2,260

As you can see from the chart above, a fully amortizing 30-year fixed rate mortgage would run about $2,754 plus the $600 a month in additional fees bringing the real payment to:

$2,754 + $600 = $3,354 a month

The real payment is $1,094 more a month. So assume the government is going to try to please everyone (that is, the corrupt lender and the borrower that got in over their head). The lender is happy taking the $500,000 payment from the taxpayer. Thank you! Next, the borrower can only make the max $2,260 payment. What will the balance need to be knocked down to in order to make this work?

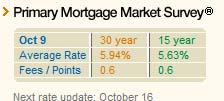

Well according to Freddie Mac the current 30 year fixed rate is 5.94%:

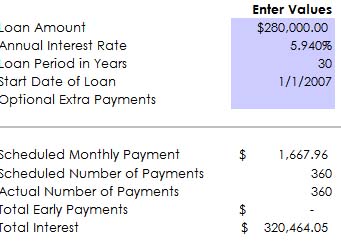

This is where the taxpayer gets royally screwed. Â The loan amount will need to reduced to $280,000 in order to meet that $1,660 a month payment!

Where is that $220,000 going to come from? Keep in mind that California has roughly $300 billion of the $500 billion in pay option ARMs outstanding so this state stands to benefit in an extraordinary way compared to other states. For example, say a state like Texas where a home would cost $100,000, a pay option ARM rework may only cost the taxpayer $5,000 to $10,000. Here, we are talking about a rework fee that is going to cost more than the national median house price of the majority of states! How does this help out anyone else aside from the lenders and those that made royally idiotic loan in bubble states? Wall Street and lenders are pushing their agenda on the back of many unfortunate states that are hurting with their local economies and are trying to lump everything under one umbrella; in reality it is a ploy to distract the American public to the most culpable states. FYI, Countrywide is out here in Calabasas California and New Century Financial out of Irvine California. Some of the borrowers that lied on their loans will walk away anyways because many were looking for a quick profit as well. Take a look at some of the Real Homes of Genius and you will see why.

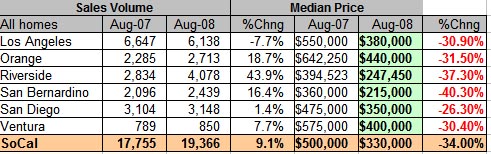

You may think that the $500,000 median price is way out in left field but remember only in August of 2007 did Los Angeles County, a county with 10,000,000 people had a median price of $550,000. Now, the picture is very different:

Yes, the above is the proof of a mania like no other. The nation might have gotten drunk on credit. But California overdosed on bad debt. This number may in fact underestimate the cost of what is out there. Keep in mind that many of the Alt-A and pay Option ARM loans are even worse than sub-prime loans because they were given to folks with better credit and therefore this allowed people with an income of $100,000 to buy a $700,000 home. They are worse in the sense that they will cost much more to remedy especially if this plan above goes through. This idea is as brilliant as giving loans to people with insufficient income to purchase McMansions with granite countertops. If you find yourself in a hole, put the shovel down and stop digging. The government with all these half-hatched plans is not only digging faster, but calling the CAT machinery to help.

In addition, how are they going to value the assets? If they are planning on using the now conservative crony capitalistic model which now looks like gold (I can’t believe this plan is actually looking better and better as each day goes by), this wouldn’t be so bad. They would have to do the following:

(a)Â Give lender only 90% of the current appraised value of the home, nothing more.

(b)Â Lender would have to pay one time fee of 5%

(c) Borrowers would have to enter into an equity sharing plan tiered on a 5 year model. First year sale at a profit, 100% goes to government. Second year sale with a profit, 90% of profit goes to government. And so forth.Â

You want to know a scary fact? There are still a crap load of sub-prime loans out there. According to data from the New York Federal Reserve for August of 2008:

Sub-prime loans outstanding:Â Â Â Â Â Â Â Â Â Â Â 2,919,604

Average sub-prime loan balance:Â Â Â Â Â Â Â $183,917

Total U.S. sub-prime loan balance outstanding (August 2008):Â Â $536,964,808,868

So we have over $500 bn of these loans still floating out there. How much of this toxic junk is in California?

California sub-prime loans outstanding:Â Â Â Â Â Â Â Â 445,678

Average sub-prime loan balance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $327,081

Total California subprime loan balance:Â Â Â $145,772,805,918

So even though 15% of the actual loans are here in California they make up nominally 27% of the actual value. Â Now with that said, let us shift and look at the Alt-A numbers which don’t present a better picture and also include the more disastrous option ARM mortgages:

Alt-A loans outstanding:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,259,502

Average Alt -A loan balance:Â Â Â Â Â Â Â Â Â Â Â Â $321,572

Total U.S. Alt-A amount:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $726,592,577,144

Right off the bat, we see that there is a much larger nominal amount of Alt-A loans floating out in the U.S. In addition, even though there are fewer Alt-A loans in relation to sub-prime they carry a much larger balance, nearly twice as much. Let us look at California specifically now:

California Alt-A loans outstanding:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 699,337

California Average Alt-A loan balance:Â Â Â Â Â Â Â Â $441,665

Total California Alt-A amount:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $308,872,676,105

This is where things get murky.  Even though California makes up 30% of U.S. Alt-A loans, nominally it makes up 42% of the full amount! This is where the $300 billion in pay Option ARM number comes from. In fact, they might as well call this the Fannie Mae and Freddie Mac bail out California sub-prime and Alt-A lenders plan because that is truly what it is.

Given how things are playing out and so many moving and fluid parts people are simply not paying attention right now. If this plan goes through, it will have the potential to mirror the cost of the $700 billion bailout plan. In effect, we now have 2 $700 billion bailout plans running concurrently. This is going to be a very expensive proposition for American taxpayers unless something radical is done to stop the economic digging.

Raw numbers of homeownership:

75.5 million households own their home

12 million are now underwater (16%)

64 million have equity

(a) 24 million of these own their home free and clear

(b) 40 million still have equity

In Los Angeles, 40% of those that purchased a home in the last 5 years is now underwater. Who are we really helping here?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

23 Responses to “Fannie Mae and Freddie Mac Gear up to Bailout California: New Housing and Economic and Stabilization Act Mini for California Lenders. $450 Billion in Alt-A and Sub-prime Loans Still Active in State.”

I must be reading your mind, Dr. I posted this story and video, yesterday, thinking about what you’ve been saying about Alt-A.

Alt-A House Debtor

.

Dr HB,

What does this mean for people like me who stayed on the sidelines? Any hope for us? What’s the impact to SoCal home prices in ’09? Will house prices stabilize or be impacted the same way as the declining Dow after the stunning (yawn) bailout?

I sold my house in ’05 and stayed away from a personal toxic mortgage.

I have 25% down payment and 780 FICO for home that I hope to buy in SoCal this coming spring. Does any of that even matter anymore?

How are they going to repay the reworked mortgages when the job market is tanking? When considering the changing job market is a home ownership becoming a detriment? Should many people even own a house if they are going to have to move to follow the jobs to other locations?

I hate our government. I really do. They are insane. They want me to pay for idiots, illegals, and the rich. I can’t make sense of it. I’ve saved for years and still can’t get in. It’s not fair.

They should not be doing any bailouts at all.

I’m so angry at this point I just don’t care anymore. I wrote those monkies for months saying no bailout and it did no good whatsoever.

Now, watch as the dollar falls and hyperinflation hits…

Let’s compare Mr. and Mrs. Prudent with Mr. and Mrs. Imprudent. The Prudents scrimped and saved a $50K down payment. They said, “A $250 K house is all we can afford” so they committed to a multi-hour commute , put down their $50K and bought one. The Imprudents also wanted a house, but felt they “deserved” better and bought one for $300K, no money down. Now the Imprudent’s loan is up for readjustment. All they could ever afford was payments on a $200K loan. So now, the Imprudents will have their mortgage balance lowered to what they can afford. They get to stay in the $300K house they bought nothing down. Meanwhile, the Prudents are still paying on their $200K 30 year mortgage which they can afford, so they get no help.

Say both houses went down by 35% in value. The Prudent’s 250K house is now worth $162K, their loan balance is $200K, but they can afford the payments. They get no help. The Imprudent’s $300K house is now worth $195K, and because they can’t afford the 300K mortgage, it gets knocked down to what they can afford. Say the same $200k the Prudents can afford.

Who came out ahead, the Prudents in their now $162K house which they put $5K of life savings into and which they owe $200K on but get no help because they can afford their payment, or the Prudents who now live in a $195K house paying the same payment as the Prudents even though they didn’t put a dime into it? At every level in this bail-out the prudent people are being asked to bail out the foolish. Thirty percent of the population are renters and 30% own their homes free and clear. Most of the mortgage holders can afford their payments. But they are all being asked to bail out the imprudent. Disgusting.

I aren’t so good at cipherin’ but gosh dern, them sure is some big numbers! I recon’ my offspring will have to ‘splain em to me someday on account of the fact that they’ll be payin’ fer it.

So I guess I’ll never be able to afford to buy a house again, since I’ll be busy helping millions of other Americans pay for theirs.

I love the way they tried to sell the bailout package to the taxpayers:

“TaxPayer, give us more of your hard earned cash, so we can in-turn continue to offer you debt — oops, we meant credit.”

Since we didn’t bite, they just decided to force it.

That’s Democracy for ya!!

DHB,

Sorry, it is late so my thought process is not on par. I really dig reading your posts, but I believe that this one has a minor discrepancy. In comrade mccain’s proposal, liar loans will not qualify for the housing welfare to reduce (via taxpayer scratch) note balances. Therefore, both the lender and borrower are S.O.L. and not qualifed for welfare. Either way the whole deal regarding bailouts suck. I’m tired, this was not intended to be a bashing. Again, I dig the site. Be cool.

I was on the NY Federal Reserve website earlier today working on the same California subprime and Alt-A statistics. I suspected the general outcome. I was also looking for a precise definition of “subprime”.

The Doctor has done all the numbers for me! Yippie! Thanks!

The other bad news of the day is the LIBOR one month rate rocketing almost 2% in the last month 2.76% to 4.64% and climbing daily. All the Fed’s policies are not going to help borrowers indexed to the LIBOR rate. Ah Oh.

More Bears please!

Doctor,

So what’s to stop the govt. from trying to reignite the housing bubble?

I keep hearing from our “leaders” that it is crucial to stop home prices from falling any further. I believe that among the many results of the bailouts that the govt. hopes will occur is to prevent a recession (which is needed, by the way) and to prevent foreclosures. In order to do so, then home prices need to held where they are, and in the case of So. Cal, artificially propped up. I believe that we are still way overpriced here in So. Cal.

Generally, I believe that the two biggest factors that led to the housing bubble were (1) Greenspan dropping interest rate to 1%, and (2) the total lack of lending standards that allowed anyone to buy a house.

The FED has already dropped the interest rate to 1.5%, and no doubt we will eventually see 1% again, maybe even lower. As far as bringing back the days of no lending standards, why can’t the government just encourage banks to start making loans to anyone again by promising to buy those loans, no matter how crappy they may be, from the banks?

Everyone knows we’re in a recession that will most likely get much worse – what better way to get the economy growing again then to get the housing market up and running again? Sure, we’ll just have this same problem in a few years from now, but who cares, that’s a long time from now. What matters to the govt. is that we avoid a recession NOW, they’ll worry about the consequences later.

So what do you think?!

And the shell game continues, only to make matters worse. I can see the price declines in California will ultimately be horriffic. But it appears they will come in agonizing bits year after year due to govt intervention. All those areas artifically propped up will get slaughtered. Yes I am talking about prime California property. You can bet they are the ones who most took advantage of this unregulated credit bubble and are the most leveraged. Not subprime.

The Westside of Los Angeles is on the chopping block.

http://www.westsideremeltdown.blogspot.com

One point that I just do not get about the various “homeowner” bailouts is why they are geared to the current occupants instead of just floated out on the market. Why should the nation be willing to forgive, say, $70,000 of principle to the current occupant when maybe someone else with better credit could take over the house with only a $25,000 helping hand? The current occupants have no ownership in these properties, so why should there desires have any bearing at all at how the nation goes about backstopping the housing market? I don’t think we should do it at all, but if we want to put families in otherwise empty houses we may as well compete these families to see who will do it for the lowest cost to the taxpayer.

Hi! Dr.,

Job well done. Our Paulson is insane to be a crazy cheerleader for cooking up a financial hurricane very recklessly. But what can we do?

There is one small part of “rescue” plan in the July version that you may omit in your statement when you mentioned the first 3:

a) Give lender only 90% of the current appraised value of the home, nothing more.

(b) Lender would have to pay one time fee of 5%

(c) Borrowers would have to enter into an equity sharing plan tiered on a 5 year model. First year sale at a profit, 100% goes to government. Second year sale with a profit, 90% of profit goes to government. And so forth.

(d) Borrowers would have to pay FHA sur-charge or premium of 1.5% interest on the new revised loan. It would add to the prevailing interest.

If the condition (d) is not revised and my understanding is correct, the interest rate would go up to be 7.44%, not 5.94% you mentioned in this article. If I am wrong, let me know and updated.

Thanks,

Well I guess were going to end up paying for the house we couldn’t afford anyway. I hear Obama is calling for a 90 day freeze on foreclosures. Why doesn’t he also throw in a 3 month moratorium to paying rent in there also?

What about investors, non owner occupied units. Do we get part of the government windfall too ? If we are going to bailout B of A I want my part.

Please,

It was all a bad dream. If these lenders actually had to use their own money then they would not have made the Ninja loans. They would have said, no. Sort of the way I say no to my son who wants everything.

Now we have a mess and we did not need to. Indy Mac was a joke lender. Wamu another no doc liar mortgage joke. Oh my god, Fremont, the biggest joke of the liar loan companies.

I say we are on the brink of financial ruin and I hope to god that I am wrong.

The bankers’ real interest is…interest. Mortgages represent long-term interest-based profit streams. All we hear about is principal amounts in the news stories, press conferences, policy suggestions. But there is a shadow world of interest profits behind all that, and it’s not being covered.

~

THIS is why they want the value of housing to stay up. Bigger loans mean more front-end-loaded interest, and banks want money NOW. They don’t want cramdowns because that hurts them NOW in the heavily front-end-loaded-interest-curve department. They don’t want defaults because they will have to sell later in a crammed market at a much lower price, and those new mortgages will be much lower, with less front-end-loaded interest.

~

On a $100,000 loan at the current 6.3%/fixed 30, the cumulative/total interest is $122,800. That’s bad enough. But the real story is the rate at which you, the borrower, pay that interest to the lender.

~

For about 17 years with that loan, each month you pay more to the bank in interest than to the principal. The highest I:P ratio is in the first payment, and that shifts microscopically each month. On the front end, about 5/6 of each month’s payment is interest. At the end of 10 years, you’ve paid the note down only by about $18,000, and you’ve paid the lender $63,874. You’re halfway through paying the whole interest bundle before you’re even 1/5 through paying your principal down. Around year 20, by the time you are paying about 50-50 each month, the bank has already made as much in interest as they lent you.

~

Think about this in light of the current mortgage crisis. The bigger the loan, the more heavily the interest is balanced on the front end. THIS is why they pushed the jumbo ceiling up for Freddie/Fannie. THIS is why they want housing prices to stay up. They want more people in packages NOW to get the interest river flowing again. And this is why they want people in houses NOW before things go down more. They encourage blame–all those greedy people, stupid about mortgages–but the fact is, bankers COUNT on their customers to be arithmetically ignorant.

~

Now consider the median CA housing price, $370K. Multiply that 6.3%/30/100K loan by 3.7:

~

3.7 x $618.97 = $2,290/mo, you’re thinking, and “How much would I have to make” and so on. But what your lender is thinking is 3.7 x $122,800 = $454,000 in interest over the term of the 30. ***The lender gets $370,000 of that by the time the mortgage holder’s payments just start to break even with interest,*** in year 19! The lender gets their half of their total interest long before you reach half of your principal paydown.

~

This is why they encourage people to refinance–to get the interest to reset to the fat part of the curve, the beginning. This is why they encourage people to “trade up” with housing, or to flip. This is the hidden Mobility Tax on people who move every few years, as Americans did thru the ’90s and till recently.

~

These numbers don’t include other costs, like tax and insurance. Nor does it cover the fact that a lot of people finance their closing costs. But if you plan carefully, and save, and have discipline, you can effectively reduce your mortgage rate to about 2 percent by aggressive prepayment in the first 1/3 of the loan.

~

However you cannot do that while the median price of housing ($370K) is more than 5.4 times the CA FTB’s estimated state median income ($68K).

~

Another banking industry strategy is longer loans. If you take the 100K loan to 40 years, as some are suggesting, a 6.3% loan would make the lender a whopping $174,208 in total interest. At the end of the loan, the borrower pays close to twice the principal amount.

~

If you borrowed the CA median for 40/6.3%? The total interest would be $644,571. Front end loaded. The first 30 months of this loan would pay under $200 to principal, and nearly $2,000 to the bank. It’d take you nearly 30 years before you were paying more principal than interest each month, and by then, the bank would have gotten $567,528 from you. The more money you borrow, the more heavily loaded on the front end the interest is, and the quicker the banks make their lump. This is why they don’t want affordable housing, or big down payments, or reasonable terms.

~

See why they wanted and still want refinancing? See why they want to keep people in their price-propped-up houses, and get things going up again so people will trade up again? The clock resets…and you’re worth jack squat, and resetting the clock on your wage-slave chains. THEY MAKE THEIR MONEY ON THE FRONT END.

~

The banking industry wants to protect mortgages because front-end-loaded interest is one of the easiest, most diabolical schemes ever cooked up by bankers. The asylum-feeling focus on keeping people in inflated houses and mortgages owes to bankers wanting that transfer of cash from individual homeowners to themselves right now.

~

rose

PS–Please note that the 40-year mortgage scheme turns a California median house into a million-dollar house.

~

$370,000 (median price/principal) + $644,571 (total interest at 6.3%) =

$1,014,71

~

In this way, the median buyer literally makes another millionaire in the FIRE industry.

Well, in general i’m all for helping the poor; where it will do some lasting good.

~

But all this does, is get a bunch of bankers that need to be fired, out of hot water.

~

Americans will be paying this and the more recent wars off for decades.

Rose, you rock!

Guys, good news!

Check this out

http://www.realtor.com/search/searchresults.aspx?zp=90505&typ=1

In Torrance, 90505 only 2 weeks ago the cheapest house was $550K now you have this first 2 from the link more than $100K down. Thank you my lord! It seems that the sellers are running out of Cool Aid around here too finally. I checked out the first. It is REO, but in very good shape. I bet at the end of the winter the market as whole will be $100K across the board.

Like Wisincompetent, I’m interested in knowing whether gov’t intervention in the markets could potentially artificially freeze home prices, especially the lower-prices homes on the market. My wife and I have been looking at homes, but they don’t seem to be making significant price drops once they get below $275K – $300K. We’ve been holding out for a $220K – $250K home in the valley (North Hills, Northridge, Tarzana, Encino, West Hills, etc), but the only things we’re seeing in that price range are (a) uninhabitable condition, (b) terrible neighborhood, or (c) both a and b. Are we ever going to be able to afford a decent home?

~

What do you think, dr. HB?

I wrote about this in August – The GSE bailout is a regional bank bailout, but they don’t want to call it that – too much like the S&L Bailout – more lies from the Government,

http://yourmortgageoryourlife.wordpress.com/2008/08/23/gse-failures-are-actually-a-massive-regional-bank-bailout-in-disguise-how-the-fed-is-planning-to-get-the-lipstick-on-this-pig/

Leave a Reply