Fannie Mae and Freddie Mac: Government Sponsored Entities Finding Their way Back Home with a Bailout.

Fannie Mae and Freddie Mac have been bouncing off the ropes for the past few days. Last week former St. Louis Federal Reserve President William Poole announced that the two behemoths of the mortgage market may actually be insolvent. This of course has thrown a major wrench into the $300 billion housing bailout proposal that is now in the government backburner since Fannie Mae and Freddie Mac were going to be instrumental in helping the ailing housing market recover. Yet as it turns out, things are not so good at Fannie Mae and Freddie Mac.

Mr. Poole issued the following statement last week:

“(Reuters) Congress ought to recognize that these firms are insolvent, that it is allowing these firms to continue to exist as bastions of privilege, financed by the taxpayer,” Poole was quoted as saying in an interview held on Wednesday.

Chances are increasing that the government may need to bail out the two mortgage companies, Poole was quoted as saying.

Shares of the two companies have taken a beating recently on worries about whether they can withstand more losses and support housing as well as concerns that they may need to raise massive amounts of new capital.”

On Thursday July 10, Paulson came out saying the following:

“(Politico) For market discipline to be effective, market participants must not expect that lending from the Fed, or any other government support, is readily available,” Paulson said. “For market discipline to effectively constrain risk, financial institutions must be allowed to fail.”

Apparently, one weekend in Washington D.C. is enough to do a complete about face because on Tuesday July 16, 2008 this is what Paulson had to say:

“I’m not here recommending putting taxpayer money into these institutions at this time. I am recommending we increase the backup facility temporarily to minimize the chance that the taxpayer will be involved,” he said. “If you have a squirt gun in your pocket, you may have to take it out,” he said. “But if you’ve got a bazooka in your pocket, you may not have to take it out.”

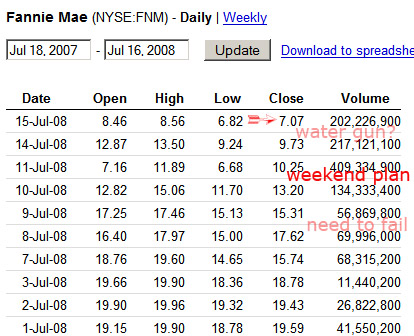

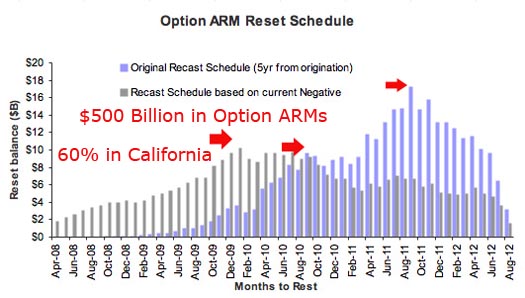

Bwahaha! Minimize the chance that the taxpayer will be involved? Don’t you love it when people use these qualifiers? You hear this all the time when people say, “don’t take this the wrong way (which of course you are), that dress/shirt/tie/hat makes you look like a moron.” Even though he isn’t recommending using taxpayer money right now, he wants to leave the door a tiny bit open just in case things go totally out of whack like having a rare event of a bank run occurring. Oh whoops, we already have that going on. In essence, they don’t know what the hell they are doing. In fact, it is the overall reality of the market that is carrying a bazooka and Paulson is coming to this fight with a squirt gun. Take a look at what has happened to Fannie Mae this month:

We can also see the same performance with Freddie Mac:

The problem with this type of behavior, where one week you make a statement about letting institutions fail and then bailing them out sends a schizophrenic message to the market. Maybe he was talking about IndyMac Bank failing after the market had closed on Friday?

It has been a circus on Capitol Hill this week. The heart of the current proposal is that Paulson is requesting that Congress allow the Treasury to increase their credit line to the GSEs as well as providing the option of buying equity in the firms should that be necessary. Given the massive sell-off what do you think? While this eleventh hour proposal is being hashed out and awaiting Congressional approval, the Fed led by Ben Bernanke has given Fannie Mae and Freddie Mac access to the discount window. Of course accessing the discount window would completely erode any semblance of confidence in these two institutions so maybe they can just go to the Fed’s anonymous swap meet?

Paulson hasn’t been explicit about the amount this will end up costing taxpayers. That is left vague and frankly is the most troubling issue at hand. This is incredibly disturbing simply because of these following statistics:

Fannie Mae

Assets: $843 Billion

Liabilities: $804 Billion

Current Market Cap: $6.91 Billion

Freddie Mac

Assets: $802 Billion

Liabilities: $786 Billion

Current Market Cap: $3.47 Billion

Combined the two GSE’s own nearly half of the $12 trillion in mortgage debt outstanding in the United States. If you don’t think panic is starting to set in just look at the actions taken by SEC chairman Cox who is going after naked short selling. No, this isn’t a new age stock trading technique but apparently is another red herring to go chasing after:

“(BusinessWeek) While Paulson’s testimony was primarily devoted to explaining his proposals, Cox used the hearings to announce an emergency move aimed at further stabilizing the mortgage giants. The SEC chairman announced that the agency will limit the ability of traders to sell short the shares of the two GSEs, as well as brokerage firms including Lehman Brothers (LEH), Goldman Sachs (GS), Merrill Lynch (MER) and Morgan Stanley (MS). Critics have argued that excessive short-selling, in some cases fueled by rumors that traders know to be false, has driven the slide in shares of financial firms, including the defunct Bear Stearns.”

Going after this is like going after speculators in the oil markets. Yes, they do have an impact on the ultimate price but their overall ability to impact the price treads on the margins. This is simply to distract us from the stunning $5.3 trillion in mortgage debt Fannie Mae and Freddie Mac have and also the stunningly low market cap in relation to their overall debt. This action takes away from the overarching core issue that we are simply in way-too-much-freaking-debt! It also doesn’t help when your share price is doing this:

If these events were separated out, the IndyMac Bank failure and the potential bailout of Fannie Mae and Freddie Mac, both stories would be fodder for an entire month. Yet they are happening simultaneously so there is simply so much information coming at us that is changing as quickly as the policy moves by our Treasury Secretary and Fed Chairman. Fridays are going to be particularly fascinating after hours for the next few months since the FDIC likes to swoop in after the markets close on Friday to announce bank failures which we will have more of.

While the majority of politicians were throwing softballs at Ben Bernanke on Capitol Hill already expecting to pass anything without even bothering to read it, U.S. Senator Jim Bunning flat out called the Wizard of Oz out of his clothing:

“(CNN) The Fed wants more power, but the Fed has proven that it can’t be trusted with the power it has,” Bunning said. “… Maybe we should give them less to do, so they can get it right.”

The proposal is currently before Congress, and Bunning said he was ready to fight it.

“This one senator you’re talking to right now will do everything in his power to stop any additional powers that will go to the Federal Reserve,” Bunning said. “And I have a lot of means at my disposal.”

Bunning, a Hall of Fame pitcher, used a baseball analogy to take another swipe at the central bank.

“Giving the Fed more power is like giving the neighborhood kid who broke your window playing baseball in the street a bigger bat and thinking that will fix the problem,” Bunning said.

Bunning also was scornful of the Fed’s action to back a Bear Stearns rescue package.

As the nation’s then-fifth-largest investment bank teetered on the brink of bankruptcy, the Fed agreed to provide backing for up to $30 billion for a deal for JPMorgan to take over the troubled company.

Bunning also was critical of recent action by the Fed and the Treasury Department to come to the rescue of mortgage giants Fannie Mae and Freddie Mac. At the Senate hearing, Bunning said it was proof that “socialism is alive and well in America.”

The companies hold or guarantee more than $5 trillion in mortgages, almost half of the nation’s total.”

If you get a chance, you can look up the entire prepared comments by Senator Bunning for an excellent tongue-lashing of Boom Boom Bernanke and Golden Sachs boy Paulson. The only caveat that I would add is that “corporate” socialism is alive and well in the United States today. IndyMac can fail because after all, $18 billion of $19 billion in deposits are only to folks with $100,000 or less. Bear Stearns can’t fail because hedge funds with trillions of dollars would come under collateral risk and you wouldn’t want the bourgeoisie to lose money would you? The proletariat can run around and find that their U.S. Dollar is buying less, their bank failed, employment is less secure, and their investments are going down the drain. This is after all a mental recession since no official government data states we are in a recession!

The motivation to bailout Bear Stearns only a few short months ago was to avoid a financial meltdown. If bank failures and Fannie Mae and Freddie Mac being down approximately 90% isn’t a financial meltdown, I’m not sure what is. If you think this circus of smoke and mirrors isn’t enough the Fed enacted this tough mortgage regulation which doesn’t even start until the fall of 2009 and only applies to the dwindling issuance of sub-prime loans:

-Verify Income (Do we really need this in writing? Apparently so)

-No penalty for early payments (aka prepayment penalties)

-Scrutinize ability of borrower to actually afford the mortgage (no more $720,000 homes for folks making $14,000 a year)

-Ban misleading advertising (you mean no more $500 a month payment for a $500,000 mortgage?)

-Push for escrow accounts (your payment looks nice when you don’t include monthly taxes and insurance)

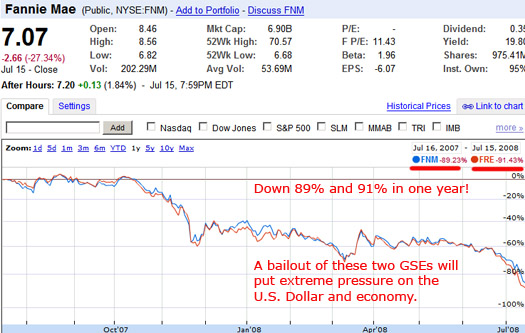

My main argument here is why in the world are we waiting until fall of 2009 and why not enact this common sense legislation to all mortgage products today? In fact, if we are to nationalize Fannie Mae and Freddie Mac and use them as the savior of the housing market you would expect that the above should hold true as well. This legislation is more hype than anything. The sub-prime debacle is running its course already. We have new challenges. IndyMac Bank proved that Alt-A loans are problematic and we have $500 billion in Pay Option ARMs that’ll start recasting this fall and winter in large numbers.

This legislation is simply more smoke and mirrors. What about going after yield spreads for brokers where incentives were given to pushing consumers into riskier products? Why not make these rules standard for the GSEs since they now encompass 70% of all recent mortgages? These are easy to implement guidelines that make total sense. But when we have to have our Fed Chairmen put in writing that you need to verify someone’s income before giving them a loan, we have a bona fide problem on our hands and no squirt gun is going to fix that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “Fannie Mae and Freddie Mac: Government Sponsored Entities Finding Their way Back Home with a Bailout.”

The government has intervened in several instances this year. It seems our government is willing to go to great lengths to assure global investors that the US is still a financial stalwart.

However, everything that we love about the US is that it is the paragon of free market capitalism. Rather, it *was* the paragon of free market capitalism. This recent intervention is troubling because it is irrevocable and cascading.

It seems odd to me that Bernake and Paulson’s generation would commit to such a moral trespass. I had thought that my generation was the slacker crowd–perhaps it is. But this series of judgments has me feeling that our current financial leadership is of questionable moral turpitude. I don’t profess to know this opinion is justified, but I can’t shake it.

Wow….what a gigantic mess. And to think, we have not even begun to see the next wave of ARM resets.

We are in for a lot of Wall Street manufactured economic PAIN for the next few years. They bled the markets dry and now we all pay the price.

Add to this, the credit crunch, oil prices, food prices, and just about everything else prices- this ain’t gonna be easy…

What does a privately owned business under the control of the federal govt equal? Fascism. I have been against a bailout since the beginning.

What’s next? A baby boomer losses 200K plus in the stock market and will look

to Washington for a reimbursement?

I’m maybe alone on this, there should be NO bailout of any kind. They all should be allowed to fail, if they do fail then that’s life. I know it sounds harsh, but that is the easyest way for a reality check.

Great work as allways DOC.

because hedge funds with trillions of dollars would come under collateral risk and you wouldn’t want the bourgeoisie to lose money would you?

bourgeoisie = middle class. Perhaps you meant filty rich?

Who the hell can we believe in Washington? Any credibility that Paulson or Bernanke had has been completely erased but then again we should realize by now that these guys are only puppets and the guys pulling the strings are the Corporations.

Going after the Yield Spread Premium was not a solution. Banks offer the same sort of compensation to their loan officers (LO’s), but they do not have to disclose it on the closing statement. If Banks had to supply the same data as Brokers do on LO compensation, a consumer could accurately shop loans. Don’t think that bank LO’s are a pristine as the wind driven snow. A great deal of problems came from the broker world. There is no doubt of this. Even more trouble came from in house LO’s, yet to come to light. The solution to predatory lending is simple: put LO’s on a salary or “flat fee” arrangement. Commission driven income incentivises fraud and abuse. Sure, it means a $150k or more haircut on a persons income, but good ethical LO’s will have business driven to them and any temporary loss of income will be replaced quickly on volume. The same thing for REALTARDS but without some level of enforcement from the Government it won’t happen. A $14,000 income buyer who purchased a $729,000 house didn’t get into that mess soley due to the lender. You had a REALTARD who also helped along the way. Reigning in LO’s can be done quickly, but the next step of regulating Agents is going to be along way off.

my .02 – and more.

I’m with Sean, let the whole thing crash now, stop propping it up and prolonging the inevitable. It’s going to be painful, but the sooner we go through the pain, the sooner we can start to heal and rebuild. No bailouts for anyone anymore. Corporations aren’t people, they don’t have “rights” — they have responsibilities, objectives, and privileges. Since they aren’t human, they aren’t entitled to bailouts. And when the gov’t starts bailing them out at the expense of the human taxpayer, it shows exactly where that government’s loyalties lie. Gov’t + business = fascism, there’s no way around that fact. Supporting gov’t bailouts is supporting fascism.

I sold “short” shares of Freddie Mac in January at $31.28 per share. I issued a buy to cover order on Friday for $5.75 per share. I made a nice profit. I am very pleased. I knew this was going to happen because the goverment was forcing Fannie and Freddie to take bad loans and raise the jumbo limits to $720,000. Yesterday the SEC made an “emergency ruling” to limit short sales on Fannie and Freddie stock. To bad for them, because I already got out on Friday. I’m just waiting for the other home related stocks to tank even further, so I can capitalized on my short sales on those as well.

It is now becoming clear at a country wide level that basically we were in a trance state for the last several years and couldn’t see the facts even if they were staring at us in the face.

We assumed that the Feds, the Gov. and private industry experts knew what

they were doing in terms of the housing bubble. As long as they said everything was fine, we were happy to stay asleep.

Now this same trance state exists at all levels of our society. For example after working at the front line of my particular industry for 20 years I can share that we are unconsciously making long term mistakes that will cost society dearly and at the same time are also constantly subjected to new laws and regulations which are extremely expensive, very cumbersome and to a large degree useless in taking care of our real needs. In other words my industry is very tunnel vision in its behavior and the people (gov. and consumers) regulating us have no clue what they are doing either.

The one good news is that by simply growing up and maturing as human beings

we can actually increase our economic productivity tremendously. Imagine actually putting our life force behind processes and projects that actually make a difference to our well being.

Thank you Lakotawolf, I’m glad that somebody else gets it. The time for Bullshit is over.

Didn’t we have a similar issue when the car manufacturers petitioned the government to bail them out for their losses because the market crashed for gas-guzzling SUV’s even though the trend had been coming for close to 10 years?

Democrats created the Fannie Mae and Freddie Mac problems years ago. They stopped ALL eforts at reform until it was too late. Now they are trying to blame Bush, McCain and Republicans, everyone but themselves. That’s the Gods truth and here is the proof:

http://strategicthought-charles77.blogspot.com/2008/09/democrats-created-fannie-mae-and.html

Leave a Reply