Feudal America creating an army of renters: A larger percentage of household income is going to rents and the CPI is once again missing the housing boom.

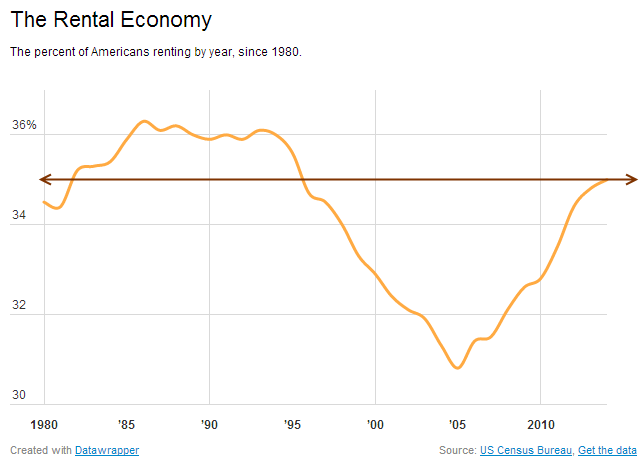

The housing market without a doubt is slowing down and it should be clear that the “hot†summer selling season is simply not going to materialize. Even in house horny Southern California, sales are down 12 percent year-over-year and the median price actually fell in July from June. Typically, the sunny California sun fries the portion of the brain looking at math during the summer but something else is going on. People also conveniently forget that 7,000,000 foreclosures have occurred since the housing bust hit with 1,000,000 happening here in the “never a bad time to buy†California market. We recently discussed the incredibly hot rental market in the state. It seems that rents are having a good run over the last year as more Americans welcome their new feudal landlords from Wall Street. In fact, we now have the highest percentage of households renting in 20 years. If we look at the data, what we find is that housing is simply consuming a larger portion of income for households. It is amazing how many people in California have absolutely no comprehensive plan for retirement. They are willing to leverage every penny into housing but ignore other important areas like building a balanced portfolio. Taco Tuesday baby boomers sit in million dollar crap shacks welcoming their student debt laden children back home while they feast on Purina Dog Chow. It is pretty clear what is going on right now: more of your income is being consumed by housing.

The conveyor belt to rental nation is moving efficiently

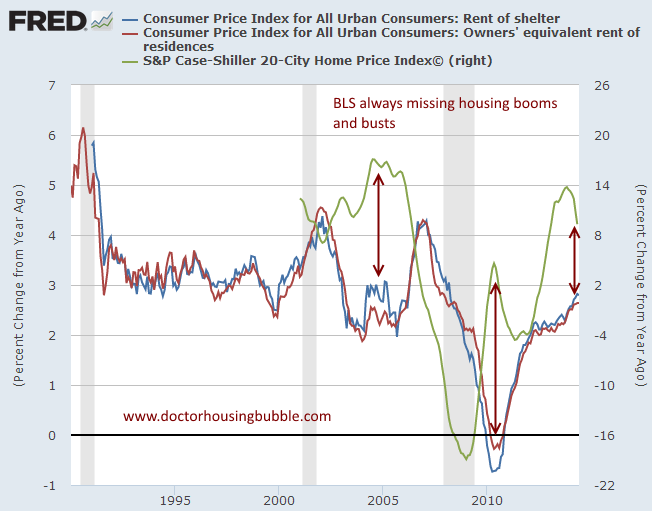

One of the points made during the early days of the first housing bubble was that the Bureau of Labor and Statistics did a poor job measuring housing inflation. The CPI uses the owners’ equivalent of rent (OER) as a substitute to actual housing payments or underlying home value (i.e., PITI). This does an okay job in stable housing markets but fails in meth addicted housing cycles like the one we now live in. The OER assumes you will rent your house out which of course, is not the case unless you are Wall Street. Many of the $700,000 crap shacks in SoCal would rent from $2,500 to $3,000 and probably went up about 5 percent over the last year. Yet some of these homes went up in price by 20 to 30 percent. If your goal is to measure price increases, shouldn’t you actually measure the price of the actual thing versus some derivative of it?

Since this is the measurement tool, you can see the big divergence in prices and rents here:

The CPI once again has missed the housing jump of 2013. For example, in 2005 when the Case Shiller was showing 16 percent annual price increases, the CPI was showing rents and the OER going up by 2.5 to 3 percent. Seems like a big difference but of course, this gives the Fed more fodder to say inflation is muted even though housing is the biggest line item for most American families.

You’ll notice that the Case Shiller Index which is one of our better gauges of price went up nationwide by 14 percent last year. The CPI went up by 2.6 percent for the OER. Big difference.

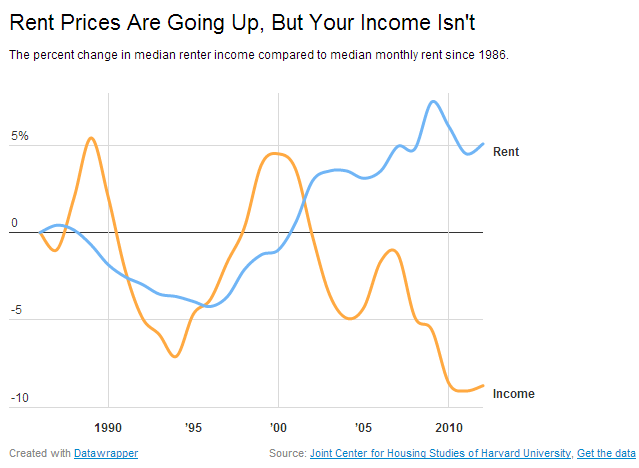

So how are people paying for all of this? Well people are simply paying more of their income to rent:

Source:Â Mother Jones

With rents, you have to pay with actual household income. This is why in California, you have 2.3 million adults living at home because they simply cannot afford a rental. Pent up demand? I doubt it. This is why sales are dropping and prices have gone stagnant. It isn’t for want of buying. No. In fact people are lusting for housing just like they were in 2005. If given the chance, people would “ice challenge†their way into a ludicrous mortgage with the aspiration of property laddering their way up into the feudal class. You might be a renting pleb today, but tomorrow you will be the next oligarch of housing. By the way, cash sales hit a four year low in SoCal since investors either want massive annual gains or good cap rates.

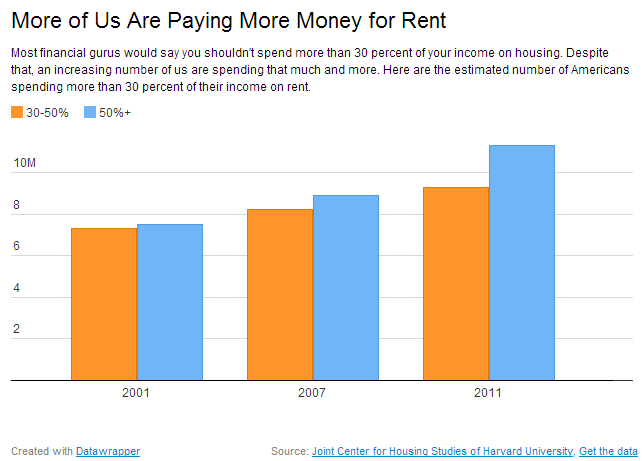

We now find that since the recession ended a massive number of households are paying more than 50 percent of their income in rent:

In places like San Francisco, I’m sure this is a good portion of households. This has big implications for our spending addicted economy given that a larger portion of households now rent:

Going back to the point of balancing out your plans for retirement, so many people assume their residence is somehow going to throw off income for them in old age. Many baby boomers are seeing this is not the case. You have taxes, insurance, maintenance, and other costs that actually suck money out of your income even when the principal and interest are taken care of. The funny thing about this is the big push for Prop 13 highlighted this at the core. That grandma that was being “kicked out†on the street because of higher taxes was an example of someone without a balanced portfolio. She had burned her mortgage but like death, taxes will never go away. Current baby boomers drinking Martinis in their hardwood floor and gold plated sarcophagus in SoCal many times are scraping by even though they have solid equity in their home. I love seeing a home in this category being put to market because you can see how outdated the place has become. Living in million dollar homes yet unable to make a few modifications.

Also, I tend to believe the renter numbers are understated. How many “kids†living at home are even paying rents to their parents? All we know is that 2.3 million adults in California live with their parents. This is one state of many. So for older folks, what will their income stream be in retirement? Social Security? Stocks? The figures don’t look good here. In many cases you have people with one or two years of living expenses and all of their net worth tied up in their home that will cost money to maintain. Now you can see why Prop 13 struck a chord back in the 1970s showing that history repeats and people in California have been lusting for homes for many decades, a tradition of sorts. Reverse mortgages are an option but your kids might hate you for it. Screw them right? They can pile into a rental and play furniture Tetris of getting in four people into a 2 bedroom 1,000 square foot place in any hipster area of Los Angeles.

It should be clear that what is simply happening is more disposable income is being taken into housing either by rents or mortgage payments. In California, close to half the state rents (and a growing number are living at home – rent or no rent). In L.A. County, the majority rent. Keep in mind all of this is happening as the stock market caps a near 200 percent run from 2009 and housing is coming off a banner 2013 year. Yet for Americans households, income growth is not keeping up. A big deal for the growing number of renters. For now, get used to the trend of feudal landlords.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

125 Responses to “Feudal America creating an army of renters: A larger percentage of household income is going to rents and the CPI is once again missing the housing boom.”

Interesting train of thought.

Our 24 year old daughter has no inclinations of moving out.

Can’t afford it and she has no student debt . Bit between car costs, insurance, phone she is strapped for the time being.

That being said, we are renters and enjoy having mobility and flexibility each time the lease renews. We all long for some permanence, but we aren’t convinced a mortgage is the way.

Out here in South Florida property taxes (2.5%) , flood insurance end up hitting the marginal owners once home values creep too high.

See what happens this year with new valuations.

Because I have no wife no kids I call myself semi-retired. My brother calls me semi-retarded

Ben hang in there, no wife, no kids, means more money for you to spend on yourself, enjoy!

I have one of those brothers. He wonders why I have money and he doesn’t.

Housing IS Tanking Hard in 2014!!

Way to go Jim! That’s the fucking spirit. There has never been a FED engineered “soft landing” in the history of ever. The price drops ALWAYS follow the tank in transactions. Take the payments on a house circa 2012 (before things went bat shit) and figure out how to get to the same payment with a 6% mortgage. That’s your likely ceiling for prices in 2016. The floor could be lower.

I like the sound of that. Did the math with traditional 30 yr at 20%. A home selling for $300,000 in 2012 to get the same payment at 6% would be $250,000.

RE: Jim

Now subtract from that $250,000 the lack of investor demand vis-a-vis increased inventory. You could probably shave another 10K or so off the top depending on the area. As I’ve said before, math is undefeated in the history of economics. We can argue ancillary factors but numbers are numbers. It would take circumstances of extraordinary improbability to keep this market permanently levitated. The likes of which have never been seen in financial history. On the other hand any small crack in the central bank planning all but guarantees a downturn. You and I are taking the safer bet.

You guys don’t think JPM et. alia is going to come back for seconds, during a tank?

So if we’re destined to be a nation of serfs and rentiers then shouldn’t we strive to be the latter? While housing prices do seem to be stagnating (at best) if the public mindset is shifting to accommodate spending greater portions of income on rent as Doc suggests then perhaps stretching to buy rental property really is the right play over the next few years.

All right time for everyone to gang up on me and call me a shill and/or a fool (though in fairness I’m not about to run out tomorrow and start buying apartment buildings). That said it’s useful to question our bubble orthodoxy and consider whether buying some form of real estate, even in today’s environment, might be the smart play after all.

Renting out properties can be very lucrative. Of course it takes the right mindset which I do not have. My Uncle, now in his 70’s is a multi-millionaire. He’s never had to wake up early to drive to the same job day after day slaving away while making someone else rich. He owns several large apartment buildings scattered throughout LA. He had time on his side and bought most of his properties over 40 years ago when LA was a much different place.

Cutting against the herd can be profitable, but you’d really want to run the numbers and weigh the risk.

If you have $2M to spare, then sure, putting $500k into a rental property might be good diversification of your portfolio.

If you have no assets and are getting in the game wholly via debt leveraging, it’s a pretty big gamble – and with the carrying costs and financing expense, in some areas of the country you’d be hard pressed to break even.

For example, in Portland, a SFH that sells for about 275k will see rental comps roughly around $1750. But even if you put $50k down, the monthly PITI will run you $1600. So your cash flow is +$150 less taxes, but that assumes full vacancy, and no maintenance expense.

It’s a gamble you might win in the long run if rents and/or values climb, but you could easily lose if values drop or the property needs significant maintenance.

And note that, for median family income for Portland, that rent is 41% of PRE-tax earnings.

Remember to calculate what your time is worth and add that to the cash flow equation because owning a rental property is not like owning a Ronco Showtime rotisserie grill – you can’t simply set it and forget it.

We’re all Oahu, now.

Everything is repeating the Honolulu experience — going back half a century.

Lately I’m seeing more and more “For Sale” signs stuck on car windows around town. Rent and mortgages have gone up so much people can’t pay for the other things in life they could before.

The more $$ people spend on rent/mortgage, the less is spent in the general economy. Bad news….

What a great government we have here in the US of A. Thanks for nothing!

Screw RE, should go to SoCal and scoop up all those late model BMW’s people are selling for dirt cheap and sell them elsewhere!

It depends on your circumstances(no duh). If you take out a mortgage and can afford(job security for 30yrs?) your property will be up more likely than not because of inflation. The correct question is that best option? Personally, i believe PMs are a way better option since they are very under valued, but most people don’t understand the concept of money. Too many have been brain washed to think that paper money (fiat) is the real deal? What is the difference between monopoly money and Federal Reserve Notes? Full faith and credit of a bankrupt nation?

I doubt many landlords are “feudal landlords”. Using the 50% rule , where a landlord only nets 50% of his/her gross rent, (after subtracting repair costs, management fees, taxes, insurance and vacancy factors), the landlord really isn’t making a ‘King’s ransom’. In fact, if there is a mortgage against the house, then there isn’t much positive cash flow at all. This would especially be true in Southern Cal, or in the Bay area, where house prices are high and CAP rates are low.

Even owners of apartment buildings are willing to overpay for the Westside. Ever seen the Cap rates on apartment buildings for sale in Santa Monica or Venice? its usually 2%-4% whereas midcities Cap rates are in the 5%-6% then of course in the hood the Cap rates are 6%-10%.

This may also be a result of the more intensive management required in the bad neighborhoods…

One more question:

If buyers and sellers are so pessimistic, if everyone feels like in a depression, if number of sales is lower than before, if everyone believes this is the worst time to buy, isn’t that an indication of a good time to buy? (from the consumer psychology point of view)

Isn’t everyone saying that we should buy when everyone is selling (nobody wants to buy) and sell when everyone wants to buy? There must be lots of serious problems to create a general state of pessimism with the buyers, otherwise they would be optimistic.

It looks that in theory everyone knows when to buy and when to sell but it is so hard for most people to act against the flow. 95% of the buyers want to buy when 95% of the buyers want to buy and that creates bidding wars. They are very few (5%) who can practice what they know in theory. Emotions like greed and fear are very powerful. It makes buyers and sellers overall to act exactly the opposite of what they say in theory that they should do – buy when “all the stars align” and all the buyers agree is a good time to buy and sell when all sellers try to sell at the same time.

This is how human nature works.

Exactly, I have thought the same way about that statistic. But if you go on sheer sales and price. Then in 2010-2012 when everyone was panic selling was the time to buy. Now with everyone panic buying and not a lot of choice on the market is the time to be patient. If you have a home its a great time to sell. I think half of the roller coaster is hanging over the ledge. Once the last car rolls over it, down we go HARD

“panic buying” – exactly.

A lot of people buying now, because they are afraid of being priced out forever.

RE: Bub Diddley

Your definition of “a lot” and mine differ SIGNIFICANTLY. There aren’t a lot of people buying shit. This market is at a stand still. Given economic uncertainty and lack of household formation I don’t think there will be “a lot” of buyers once the price drops start either. Remember there were tasty .gov incentives in 2009-10 that are unlikely to return.

“Then in 2010-2012 when everyone was panic selling was the time to buy.”

In retrospect, you are correct. Looking back you always have 20/20 vision but nobody knows the future. However, if I remember correctly, everyone on this blog at that time was saying that the sky is falling and only the stupid people who don’t understand economics 101 would buy. To be honest I was feeling the same way because I was reading the same news like everyone else.

In the middle of 2011 I bought a property in foreclosure. I was feeling sick to the stomach to buy it and read all the depressing news at the same time. However my logical part of the brain was telling me to act when I don’t have competition (against the flow). My offer was the only one although the agent for the bank was saying that he has higher offers. I told him to sell it to the highest offer because if I would be the seller I would do the same thing. I was firm on my offer and didn’t budge. 2 months later he called me that the bank accepted my offer (the only one). Last year I sold the place for twice as much after collecting rent on it and doing few cosmetic improvements like change carpet and do some painting inside.

To be honest, today I would feel even sicker to buy. The point is that no matter when you buy someone will say that you are stupid: when prices are low, everyone is saying that they will go lower (prices are low because everyone is feeling depressed/pessimistic); when they are high they say that they will go lower. I bought and sold countless number of properties. I lost on one, broke even on another and made money on all the rest.

It is a tough business!

“Now with everyone panic buying”

Where do you see panic buying in the last year outside SF? The doc and all the rest of the media is talking about flat or lower sales than last year. Did you find ANY “panic buying” article outside SF in the last year?

If you read all the RE articles, especially on this blog or zero hedge, they are all depressing. Even those on MSM were depressing in the last year.

Probably one of the worst times to buy, at least in my market(Coachella Valley) in recent memory. Low inventory(lousy selection/unrealistic sellers), high prices(probably 10-20% too high based on recent sales velocity), and ridiculously low interest rates(guess what happens to home prices when rates go up?-which they will from here).

And I’m a Realtor.

Will rates go up?

Japan has had low rates for 25 years.

“Will rates go up?

Japan has had low rates for 25 years.”

Japan has been in a deflationary tailspin for the past 20 some odd years which means anticipated inflation is most likely negative.

@bb

I would not compare Japan the the United States.

The debt (bonds) issued by Japan is held by the people of Japan. The debt (bonds) issued by the United States is held by China, Japan, Saudia Arabia and the Federal Reserve.

The people of the United States are leveraged up to the eyeballs in debt. The people of Japan is a country of net savers.

Comparing Japan to the United States is like comparing sushi to potatoes.

“Please don’t tell me you (of all people!) also think real estate prices can’t fall unless bond prices do.”

Carrying this forward because I am too lazy to keep going back.

I think you are missing my point. Debt is the real issue in a debt created asset bubble. The debt would have to continue to grow exponentially to continue the inflation of the bubble. This is the nature of Minsky’s unstable market theory. To look at bond rates in a vacuum is not what I am suggesting. I am suggesting to look at sub prime debt and watch for any increase in defaults. These defaults will unravel the credit system just like it did in 2007/2008. I think we need to remember that there is no price discovery in a frozen market. Is it possible for housing to “tank” in a vacuum? Yes! Is it likely? Probably not. I don’t know of too many financial crisis (aka crashes) that did not start with a credit crisis.

I understand what you’re saying- and agree. Debt created asset bubble…defaults unravel the credit system…the first signs are often seen in high yield junk…all true. But doesn’t address a very simple point.

A fallacy often repeated is real estate prices can’t fall without mortgage rates rising. Not true. Happened in the last correction, might be happening again now.

On an side note: Was at a restaurant tonight and the bartender was telling me how interest rates were going to rise. I cringed, reminded me of hairdressers telling house flipping stories in 06/07.

I know a stay at home mom who, 2 years ago, become a “real estate INVESTOR”. aka. a Flipper.

Before she morphed into a “real estate INVESTOR” she sold multi level marketing purses.

I checked her FB the other day – she’s back to MLM selling to the neighbors/friends/relatives. No mention of the “real estate INVESTING” any more.

Interest rates as a market signal are somewhat deceiving. What would be the interest rate of home mortgages if there was no such thing as GSE’s to buy/insure mortgages or QEFOREVER to buy up all MBS. Looking at a rate at a point in time in isolation and comparing it with other times can be deceiving. The Fed and Gov have been able to “clean up†the mess in the past by refinancing debt to a lower rate (kicking the can). Interest rates have not been a signal for some time they are now a lever. I believe it was the guy from Seattle that stated that this will be the first time in history that we will go into a recession with interest rates at negative/zero. That is why we should keep our eye on defaults not interest rates. We will eventually have to write off the debt… I am not sure how housing collapses before this.

“This is why in California, you have 2.3 million adults living at home because they simply cannot afford a rental. Pent up demand? I doubt it.”

Admittedly a perma-bear retard, it’s no surprise why am I’m not getting why 2.3 million people out of either the rental or housing pool doesn’t represent “penting up” of the demand side of supply/demand.

If these 2.3mm were fleeing CA to mobile home parks in Arizona, my macaque-sized cranium might comprehend the removal of people negatively effecting demand.

“Admittedly a perma-bear retard, it’s no surprise why am I’m not getting why 2.3 million people out of either the rental or housing pool doesn’t represent “penting up†of the demand side of supply/demand”

The problem with the supply and demand myth is that it assumes that all resources were evenly distributed prior to the game starting somewhat like the game of monopoly. The fact that people are “starving in Africa” does not mean that there is a pent up demand for tables at French Laundry. Demand assumes that the hungry have something to trade for the food they so desire. Without “buying power” there is no demand in the supply and demand myth. There is hunger/homelessness/sickness but without buying power, there is no demand. This is why the supply and demand myth has gone the way of bell bottoms…

Wow! I see the What? of intelligent discourse and empirical evidence has returned. Missed you bro 🙂

So, the quantity demand for SFR’s stalling (lower # transactions) has nothing to do with higher prices?

And if SFR prices were to @ Tank Hard then the quantity demanded for SFR’s wouldn’t go up?

“So, the quantity demand for SFR’s stalling (lower # transactions) has nothing to do with higher prices?”

There have been many times in history (not so long a go) where “demand” rose with both price and volume. So, maybe yes, maybe no. Quantity and price from the straight downward sloping demand curve and straight upward sloping supply curve is not a representation of any real market.

“And if SFR prices were to @ Tank Hard then the quantity demanded for SFR’s wouldn’t go up?”

Maybe yes, maybe no. There are many times in a “tanking” market that both volume and price go down together. Sometimes transactions “freeze” because there are no buyers at any price. So, the supply and demand myth is simply a myth.

Think of it as 2.3 million people who will be inheriting their parents’ homes. Pent up demand vanishes!

Yes, we are clearly in what one would call feudal housing environment where the global 1% is reigning over the 99%. How does this portend or even correlate with a fall in home prices?

What rentier nation is clearly causing (per DHB) is more allocation of income of 99% to rents or mortgages. How does that portent to a fall in home prices when “people need a place to live” and “SoCal is a global destination in the midst of a global urban macro- migration trend” and homebuilders are sidelined/hamstrung?

I would argue that it impedes economic growth. Housing price is just a side effect…

Jim Taylor: Housing isn’t “tanking hard”. Housing is flat YoY if you exclude distressed sales going to cash buyer investors. That’s right, the only thing that brought the numbers down are the massive YoY reduction in distressed sales. The market is normalizing.

When the market was on fire, people thought it would never stop going up. When the market was falling people thought it would never stop falling. People missed the bottom of the market and no amount of wishful thinking isn’t going to make a reduction in distressed properties sales and the same amount of normal sales YoY a bad thing.

Inventory is up. Sales are down. Its the capitulation point where sellers aren’t ready to give in to selling at lower prices. Once they don’t have a choice as they sit on market without interest it will start the move down and will accelerate quickly.

I have hear Phoenix prices are already down 10%.

Inventory isn’t up that much. You make it sound like we have 2 years supply again. As I said in the original post, sales are down because distressed properties are down not because of normal sales. You can harp all day about sales being “down” but the only sales that are down are foreclosures and short sales. Inventory is up because prices are up and less people are underwater. If prices begin to fall, you’ll see inventory fall again. We aren’t going to see 50% price declines again without another foreclosure crises and that simply isn’t going to happen because those loans don’t exist any longer. I’m sorry but if you missed the bottom of the market, you aren’t going to see a double bottom. Prices may decline some from here but we don’t have any sources for inventory to balloon like before. Distressed sales are down. New loans are some of the best in history (in terms of repayment). Home builders are building very few houses. Millions of households never formed. Those people that didn’t default/walk away (most of them) aren’t likely to do so if prices start to fall again, they’ll simply yank their houses from the market.

Explain to me, why do you think that inventory i

The tanking begins when sales numbers drop. The ONLY number that justifies a market is sales volume. People stop buying? That means everything else is out of whack. There could be low inventory, low prices and still be a tanking market if people aren’t buying.

Bubble Pop: my point is that sales are not down. Sales are flat. Distressed sales sold to investors flipping properties for a quick buck are down. This is like saying that the auto market is dooing poorly because repossession sales are down even though new sales are flat YoY. This actually means the economy is getting better and it means that there are less repossessions.

To reiterate, sales are not down. Short sales and foreclosures are down. In fact, those are the very things that were pushing down prices. With the low price properties drying up, is it any surprise average prices aren’t falling?

“To reiterate, sales are not down. Short sales and foreclosures are down. In fact, those are the very things that were pushing down prices. With the low price properties drying up, is it any surprise average prices aren’t falling?â€

Nhil, this is why I gave up on trying to have intelligent discussions on this site. The sea of retards that insist on their own facts becomes so tiring. I am tired of finding charts that clearly demonstrate to the latest bozo that they are a clown and then a new clown shows up with the same babble. It is so much easier to clown the clowns then prove over and over and over and over that they are f’ing retarded… I am so done…

What? – this guy is a shill. “Normal buyers” have been dropping off all year – not just investors.

Mortgage applications have been dropping for months, as well as sales volumes. Don’t waste your time.

http://www.haver.com/comment/140813k_big.png

@Dom volume has dropped for years. We are nowhere near the volume of 2005/2006.

Sales in LA down 12.5% from last year. Even mainstream/hype media can’t deny it anymore.

http://la.curbed.com/archives/2014/08/socal_housing_sales_plummet_cause_no_one_can_afford_to_buy.php

Dom: I agree that housing sales are down overall. I’ve said as much if people would care to read my comments with a critical eye. Distressed property sales are down. Normal sales (ie: Not distress property sales) are flat. I’ve said this repeatedly. This obviously means there are less mortgages being taken out as there are less distressed properties for sale. REGULAR sales are flat. The same number of people bought houses via regular sales this year than last.

In other words, if there were 100 houses sold that were not foreclosures/short sales last year, there are 100 this year as well. If there were 50 short sales and foreclosures last year, there are only 20 this year. Obviously there are less mortgages being originated as there are less distressed properties for sale.

Case in point:

http://www.dqnews.com/Articles/2014/News/California/Bay-Area/RRBay140814.aspx

Adjustable-rate mortgages (ARMs), an important indicator of mortgage availability, accounted for 25.6 percent of the Bay Area’s home purchase loans in July… and up from 19.3 percent in July last year.

Jumbo loans, mortgages above the old conforming limit of $417,000, accounted for 56.6 percent of last month’s purchase lending…and up from 49.9 percent a year ago.

Government-insured FHA home purchase loans, a popular choice among first-time buyers, accounted for 10.9 percent of all Bay Area purchase mortgages in July,…up from 9.8 percent a year earlier.

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 2.7 percent of resales…and down from 4.6 percent a year ago.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 4.2 percent of Bay Area resales last month. That was down from …8.5 percent a year earlier.

ARM Loans Up.

Jumbo Loans Up.

FHA Loans Up.

Foreclosures Down.

Short Sales Down.

So yes, everything I said is on point. Normal sales are NOT down. You’re seeing declines in cash buyers coming on to buy distressed properties to flip for a quick buck. What amazes me is that the “smart” people here either don’t read my entire post, read it but don’t understand it, or are brainwashed into thinking all news is bad news. A year from now, those charts are going to be down again YoY because there will be even fewer short sales and foreclosures but it will be down less because there is less room for it to fall.

Don’t kid yourselves. Things have turned around and normal home sales are not falling.

The Observer:

http://www.latimes.com/business/la-fi-home-sales-20140814-story.html

Buyers scooped up 20,369 new and resale houses and condos in the six-county region last month, down 12.4% from a year earlier, research firm CoreLogic DataQuick said Wednesday.

Once distressed sales — foreclosures and short sales — are removed from the data, conventional sales fell only 2.8% in July.

So housing sales are down 12.4% YoY but 9.6% of that is from distressed sales because the foreclosure inventories are being worked through. Again, this is a GOOD THING for the market. I wouldn’t call a decline of 2.8% all that worrying (in fact it’s barely newsworthy but they have to throw out these sensationalist articles to draw views). You guys are basically saying that less foreclosures is a bad thing – in other words it almost sounds like you WANT people to lose their houses? To me it’s a good thing that more people can afford their mortgages and less are losing their houses than this time last year.

We just inked a one year lease on a 2 bed 2 bath townhouse in Carmel for the bargain price of $2,200 per month and feel lucky to get that price. Near parity but I don’t have the risk and the $450. HOA stroke each month. Our still single son will live with us and chip in a bit for utilities.

The master plan is to purchase a patio home in Arizona in the $160k range and put a renter in it until we have wrung every penny possible from our current jobs here in California.

I have had similar thoughts and I think that is smart. Just make sure you can get a really good property manager being out of state. That is the one thing that worries me, but if you can find someone you trust to do it then I think its a smart move.

BTW $2,200 for Carmel is a fantastic price! Nice job.

“” until we have wrung every penny possible from our current jobs here in California.””

Sounds like you two darlings have gubmint jobs, the question being state or federal (or one each?). You whiz kids do know that even when you move to AZ, you have to pay Cali income tax on your CALPERS pensions (ha ha take that scum)!

Hi,

Just wanted to know what you’re seeing in the Carmel market? I would like to retire there and have been looking, mainly on-line. Somehow, I don’t think it will go down much, if at all. I visit e every couple of months and will be there next weekend. I have a realtor who sends me listing

Maybe rents are up because more homes at being rented then just apartments. Many homes were sold to investors so that is somewhat of a new rental market. Traditionally most rentals were rental complexes not single family homes.

Is there a number for rental prices per square foot? I bet that’s down.

Interesting observation, but I don’t think it actually is making much difference in the data.

I only skimmed it, but look at the Center’s reports. Here’s one: http://www.jchs.harvard.edu/sites/jchs.harvard.edu/files/jchs_americas_rental_housing_2013_1_0.pdf (particular p.4 and 15-18)

Here’s a snippet: “While the share of single-family homes that are rentals also ticked up from 14 percent to 16 percent over this period, this increase only brought the share back in line with its long-run average.”

It seems unlikely that a 2% shift in market composition is really weighing that heavily in average rent increases. Anecdotally I’ll say that for Portland we’ve hard our rent raised by at least 5% a year in units we’ve been occupying, and in 2 years since 2009 we’ve seen increases of 9% or more.

So you posit an interesting theory, but I don’t think it’s a major factor in the data.

Anyone know how many square feet of residential living area there is per capita in the major metros in California? I heard it’s around 900 square feet for the US as a whole, more than twice the amount that China has as a whole. Some people I know, including myself, have over 2000 square feet of living space per person, so an overall average of 900 seems about right.

Dr. HB, at some point if you have time I would be interested in a Real Homes of Genius post about the Highland Park neighborhood. Some hipster magazine called this the hottest neighborhood in the country. For $500,000 you get a 1,000 square foot fixer “Conventional sale!” Just 2 years ago these houses were $250,000.

It’s a wonderful area. Occasionally a couple of people are shot on the street. The schools are awful. If you want to get to another neighborhood you can sit on the 110 or 210 freeways. The air is rotten. Dreamworks and Pixar have been laying off well paid animators and sending their jobs elsewhere. And when you want to get out for some fun you can go up to York Ave for a $10 beer. Fabulous!!!

Highland Park sounds like Vallejo in Northern California. Prices have nearly doubled since 2013 but you still have to dodge bullets, ruin your suspension driving over potholes and live in a neighborhood where you are surrounded by section 8 rentals

It seems to me that Highland Park is becoming the spill-over neighborhood where all the young film, tv, music, IT people are looking to buy who work in downtown LA and Hollywood.

I gotta give some of these youngens credit that they have so much hope in gentrification that they will pay those prices in Highland Park or worse yet Boyle Heights.

http://latimesblogs.latimes.com/lanow/2012/03/highland-park-gentrifying-.html

http://la.curbed.com/archives/2014/04/boyle_heights_getting_first_starbucks_in_gentrification_hot_zone.php

All it takes is a Starbucks… right 🙂

Highland Park/Eagle Rock – My best Friend’s home is on the market, starting today. $579k. He bought it in January 2012 for $330k, from a flipper…let’s see what happens.

https://www.redfin.com/CA/Los-Angeles/1727-N-Avenue-45-90041/home/7079706

A 75% profit in 2 years? With that logic, this home should be priced at $1,013,000 in 2016. When that owner gets bored and lists the home in 2018, it should fetch $1,773,000. And so on.

Yep, housing will only go up up up up up.

Nice house but his asking price is further evidence that people are pulling prices out of their asses and hoping someone will sniff and like. There are a house on Beverly Glenn just south of Mulholland Drive that went on the market 3 months ago for 699K. It’s been reduced to 549K for 2 weeks now and still no offers. I have the down payment and credit to buy but why would I when no one knows what real values are? Oh sure, if I was a millionaire maybe a 20% hit (200-300K) wouldn’t hurt but to a guy like me looking at 500-600K places — a 20% drop would sting.

I look at new listings almost every day in the LA metro area. I look at everything out of curiosity, not going into the detail page, but just for size, sale price and last sold price. Anyone notice the past few months that a lot of people who bought at the low in ’09-’10 (not flippers) are now trying to sell for 100k+ more? Maybe they are just fishing for a sucker. But what if someone bites? Will that profit get them into a bigger but equally over-priced home and a higher mortgage? Or are they gambling that the market will tank again, then they can buy on the cheap? Rents are up too, so if the market doesn’t tank and just flattens, they might be paying more rent than the mortgage they previously had…

@ Forever_Sidelined wrote: “…a lot of people who bought at the low in ’09-’10 (not flippers) are now trying to sell for 100k+ more?”

That is called “exit strategy”.

Median household income in the Los Angeles-Glendale-Long Beach region is about $52K per year. A family can cash out and move to a middle level market like Houston, Dallas, Atlanta, or Omaha where median household incomes are closer to $60K per year and houses can be had for under $200K.

The house was house of the day at LA times. http://www.latimes.com/business/realestate/hot-property/la-fi-hotprop-tiny-home-eagle-rock-20140814-story.html

So if I read this right if Rent is not being factored into the CPI then the FED and bankers may have their excuse to keep interests rates low FOREVER!!! What a great plan until it unravels. In guess with that in mind the banks can keep slowwly unwinding foreclosures at higher prices while keeping the rents going up y-o-y until maybe peasants bring out their pitchforks.

all in my opinion

when everybody is buying,be fearful….when everybody is fearful,i will be buying…..so far people been buying,i feel sorry for them

UCLA study shows LA has most unaffordable rental market in the nation: http://phys.org/news/2014-08-ucla-la-unaffordable-rental-nation.html

Yet the vacancy rates for rentals in LA are among the lowest in the country.

@bb – that may be true, but average of over 50% of household income going to housing expenses puts a strain on the local economy in many ways. That’s not good when 70% of the economy is from consumer spending in one of the largest local economies in the world.

Not according to the comedians from Trulia…

Old news. LA employers have always paid shit. My old landlady’s primary income was her rental property – she didn’t have or couldn’t get a job – so rents were pretty high. There are a lot of other people in LA who own rentals as primary income.

It’s not just home ownership. It’s a generational movement —

Millennials Are Renting Instead Of Buying And The Retail Industry Is Freaking Out

Read more: http://www.businessinsider.com/millennials-renting-instead-of-buying-2014-8#ixzz3ANtMdSqs

These cultural shifts are something to watch, they can have a significant impact on so many different areas.

Imagine if social trends change so much its looked down upon to have a mortgage, or spend money on things you can borrow or rent when needed.

It really is happening — this movement to downsizing, renting, sharing, and borrowing. Hard to say if it’s a result of young people graduating with huge debt load to lower paying jobs than they’d expected or if it’s rebellion against what their parents stood for. Don’t know about you but I wanted to be the opposite of my parents.

I suspect it’s a lot of things.

The lack of jobs and the relative cost of housing to incomes is likely a bigger factor than trying to be different than one’s parents. If 2,000 ft^2 SFH close-in were $500/mo, there’d be no shortage of millenials trying to rent them.

Student loans may be a factor, but particularly with federal loans I think that effect is overstated. Even on a 10-year payment plan the average student would pay about $250/mo – that’s a pittance compared to avg rents or mortgage costs. Some people pay near that much for cell service/internet/cable, or on car payments. Certainly it might be the straw that breaks the camel’s back, but it’s generally not the main load.

Read into the student loan numbers what you like. With the median income being $48K/year for a single CA resident, I think carrying $30K in debt is a burden (be it student loans or something else) that will keep first time buyers in the 30s from entering the market – and the worse part is there doesn’t seem to be any end in sight to the triple digit education cost inflation. http://www.asa.org/policy/resources/stats/

Most of the reason for the shift are valid. However, I have been thinking of another reason.

Most of the immigrants who came in the last 3 decades are from countries where it is is common to have multigenerational households (i.e. Mexico, China, India, etc.)

If you think that most of these immigrants went to CA (percentage wise), that can explain the trend.

I think it is a combination of more than one factor, but immigration and culture of those countries plays an important role.

LOL–> “Taco Tuesday baby boomers sit in million dollar crap shacks welcoming their student debt laden children back home while they feast on Purina Dog Chow.”

Fail to see how boomers is eating dog chow if A) They bought before the price run up 20+ years ago B) Mortage is already paid off or much less than rent C) If they still have 401k (which is doing well BTW) plus pension. I’m just curious.

It’s gluten-free dog chow.

Someone had mentioned the Amgen layoffs in Thousand Oaks/Conejo valley impacting the prices of homes. Interesting, one of my family member’s clients was a top top founder at Bain. He has been flying into town frequently for the last 6 months and is continuing to do so. Anyone have any personal insights into the impact in that market? Not a whole lot of young people can afford to live there, but the boomers are not quite the retirement dembographic yet. May be looking to buy within a year for family reasons… any help would be most appreciated.

I rent in the Conejo Valley and the inventory for an entry level home in the 400K-500K range is zero to none. Unless you are making 150K or more buying a decent house here is nearly impossible. 800K is what you need to get you into a decent starter home. Simi Valley and Moorpark have more options or the west end of the Valley. My price range is 450K and a condo is all I can get in the area.

Dan – I’m blessed to be over that marker mid 200K avg. Still can’t justify buying though. How many first time buyers in their mid 30’s can earn that much to replace all the boomers’ homes. Amgenites, for one. Unless your commuting to the city every day, dual income, and in the top 5.0% of earners. Still, how could the top earners replace all those homes? Still wondering about the impact of the well paid Amgen folks have on Conejo Valley prices….

Gotta say, Dan … I, too, live in (No.) California, but I’ve NEVER heard anyone call 800K a STARTER home!!

“I rent in the Conejo Valley and the inventory for an entry level home in the 400K-500K range is zero to none.”

That isn’t strictly true (but close enough). I live in an entry level home in the western Conejo Valley that would sell for $500K – actually a bit less now that the market is weakening. It’s 40 years old and at 1200 sqft is small for all anything but a couple or a very young family, but the neighborhood and schools are pretty good. There are several similarly priced neighborhoods in the older parts of Thousand Oaks and Newbury Park.

I’m not saying these are great deals. I think my house too should be at least $100K lower in anything resembling a real market, but this is the sort of home that is legitimately still in reach for the typical professional couple out here (making $75-$100K each).

Having lived in this neighborhood for over 20 years I can tell you what the life cycle is. Young couple moves in and typically reproduces within 1-3 years. 5-10 years (and another kid or two) and the house starts to seem desperately cramped and they bail for greener (and bigger) pastures – to be replaced by a new young couple. I’ve seen 2-3 replacement cycles during the time I’ve lived there. Only childfree couples like my wife and I tend to spend decades there (and even we are feeling cramped and want to bail at some point).

Anyway, I’m hardly a booster for the Conejo Valley (most boring place on Earth that my wife refers to as Stepford Oaks), but it has resisted some of the more extreme pricing of prime L.A. and remains at least semi-affordable for professionals willing to start small and bite the bullet.

Apolitical Scientist, I’m having a hard time imagining that a couple who makes $150K-$200K per year feels good about a 1200 sq ft. home in the Conejo Valley. That’s why none of this adds up, to me.

GH, I’m a single guy who lives in a 690 sq ft condo. 1200 sq ft would feel spacious to me.

Son of a Landlord, sure, but we’re talking about couples, and that often means kids, too. We just moved out of a 1300 sq ft place, because adding a child made it feel tiny. It would be one thing if we were talking about in the city, where it is walkable, but a 1300 sq ft starter home in the Conejo Valley for $500K? No thanks. Maybe for $250K.

I just got back from a week in Portland, and it made me feel sick. I can’t really imagine a better city, and it makes LA feel pretty nasty. $500K in Portland would get us 2500 sq ft in the city in a beautiful old home. We don’t love warm weather, either, so I think we’re going to focus on moving to Portland in the next couple of years. Apparently, lots of Angelinos share similar sentiments and are moving up there in drives.

Trick with Portland is jobs tend to pay less. Have a lawyer friend who moved up from the Bay for the same reasons you cite (cheap housing! milder weather!) and he took a 50% to do it, and found out that utilities were twice as much.

Somewhat ironically, on average you’ll pay at least twice as much per month for water in Portland vs. LA. You’ll save a bit on A/C, but you’re only really going to feel wealthier if you’re bringing significant equity in your pocket and/or keeping your L.A. salary when you move up.

Just in passing – I think tacos are delicious and Tuesday seems to be a good a day as any to eat them.

People overspend on food as well as houses. No shame in eating cheap.

Chances are those taco shells are made of GMO corn that will spike your blood sugar and cause the cells in your gut to explode. People overspend on pharmaceuticals for type 2 diabetes.

Chances are you are lots of fun at parties.

By 2025, the projected costs of treating diabetes in the US are in the $300 Billion/yr range with an extra $200 Billion on top of that for missed work, etc.

In 1990 the cost was something like $4 Billion.

Maybe we are in the minority, but we, and most BB’S we know planned well, and will have no problem retiring in CA. As well, many of our kids have already staked their housing claim here or elsewhere.

That said, it is sad to see how housing has become such a difficult issue for many in this state and elsewhere, but if people come to CA for jobs, they have to live somewhere, and I can definitely understand how weighing the decision of whether to rent or buy can be a real challenge.

Not to worry, the home price problem has negative implications for all residents of the state. Most people are unaware of the interconnection between events. So yeah, you say no problem, but it becomes your problem too in ways you probably don’t realize. Of course some will make out better or worse than others, but no one gets off completely free from the effects.

China is slowing down, Japan turned negative, along with the EU. The foreign investors will not be coming to keep the prices up. Better sell now and get out.

Burnout in life, some have it in jobs, marriage, same old ,same old. I believe a lot of the buyers are just sick and tired of granite counters, stainless steel, neutral colors.

Most every home either upgrades to these or when buying new it is the must have upgrade. Of course the sellers or buyers of new homes think this entitles them to ask whatever they want because they have what they never had before.

Trouble is, this upgrading has been so overhyped for years now buyers are about sick of the same pitch, it is overpriced because it has granite counters etc.

So add in, not very good properties on the market, high prices, RE agent who has no idea, it adds up to, not interested in buying at this time, buyers need to step back and think about all this nonsense.

For all the house poor people who think that Purina Dog Chow or Fancy Feast are the only options, i have good news for them…Cesar Canine Cuisine Gourmet Filets featuring Filet Mignon flavor in sauce, or Cesar Canine Cuisine Savory Delights with Rotisserie Chicken Flavor with Bacon and Cheese in meaty juices.

Just so sad and unnecessary. Have you seen Steve Keen’s PILL suggestion – that mortgages should be capped at some fixed multiple of imputed rents. That way the person with the biggest down payment wins the house, rather than the person most willing to go into debt. I wonder if it would work – would love to see it tried somewhere.

How about capping ownership of houses to 1 per person?

How bout we try freedom? Eliminate the GSE’s and see where the chips fall…

Amen.

We’ve tried everything else for the past 80 years and all we’ve gotten is rampant inflation, which is the thing that is REALLY destroying our seniors and poorer people, and asset inflation, which benefits no one, ultimately, but the people at the top of the financial cartel.

Remove the government from housing altogether, and the supports for these surreal prices will disappear. So will a lot of the fake “value” that people have in their houses, but in return, they might get expenses and taxes that stay mostly level throughout their lives, and won’t have to fear being taxed out of the houses they struggled to buy and pay for, and eventually, out of their very lives.

I was worried that, after 2009, Dr HB wouldn’t have anything to write about, because we would be returning to a normal, stable, housing market here in SoCal.

BWAHAHAHAHAHA! Boy, was I wrong! Thanks for another great blog post.

Amen

SAN DIEGAN –

As a 1st time homebuyer, your steadfastness scares me. Leads me to believe we may be indefinitely in gridlock.

Boomers will stay no matter what. Prop 13, weather, et cetera.

What’s interesting is that they will stay no matter what the outcome. In your case, very responsible. Your kids are settled here or comfortable elsewhere. You are happy with that.

To all our California boomer families out there, this is what the kids that followed your directions are thinking….

We need to be successful and put family first. My generation of 25 – 35 year olds usually stays close by. There are also many of us that do, in fact, earn $200K – $300K per year.

We are the ones that live/moved to the city. Some of us (me) have stay at home wives. We plan. We live in the top percentile of wage earners in your demographic and especially our own. But at 200-300K we are not rich. We are responsible. We pay AMT. Yet, we cannot afford the boomer’s bottom wage earners replacement homes, while still following your responsible teachings.

We hold out to be close to our parents, our close family, yet nobody holds out for us. This comes to you from the most conservative of us. We earn a great living. However, as children of a boomers, we spend much time thinking of ways we can live poor to be a good family citizen to live close to our parents. We succeeded financially, and have family values. Yet, our families inadvertandly value their homes more than being close to their family.

However, there are a lot of us out there. We are the ones in their 30s than can buy your 800K-900K house. However, we’re stuck in gridlock. We are the ones that became lawyers, doctors, bankers, et cetera and earn well for our age to buy your home. Only, you won’t sell it to us. Even though we are trying to by it to live close you’re friends, who happen to be our parents (not your kids).

I guess family values have turned upside down, and even the kids that did things the right way, have to move away from socal. If the investors are getting out, and we are the responsible first time buyers, who will the move-up buyers be?

Personally though now, I am confused by this. I’m still trying though, have the money to buy, but just don’t see the value.

Thanks all for listening what our generation thinks. Any thoughts?

–

JAE,

While I’m sympathetic to your situation I’m confused by your complaint. Is it over-inflated prices or “gridlock” (i.e. restricted inventory) you find upsetting? My impression is that while prices are too high, if you can afford $800-900K as you describe then you should be able to buy a pretty decent home anywhere in CA except for the SF Bay Peninsula and prime coastal SoCal.

I’m not saying this is a great idea in today’s market, but that inventory limitations due to “gridlock” don’t seem to be so much of an issue in your market segment. There is a good supply of homes for sale – the prices are just too damn high.

Anybody making 200-300k can spend way more than 800-900k at today’s rates. Sure homes are overpriced and we should all be afraid of overspending, yada yada yada.

At 250k/yr – if you lose 40% to taxes, SS, etc. you’re still receiving $12.5k a month. A 30yr fixed jumbo is available for 4.002% today. 1 million dollars at that rate is $4,775 for P and I, leaving another $7,725 for your Starbucks, property tax, etc.

I can’t stand to hear people making in the top 10% bitch that they can’t afford what they’d like. Get over yourself, make a budget and figure it out.

Well Said Jeff

While I agree with you that the value isn’t there in most cases, $900K is 3x $300K income which seems reasonable enough from just that perspective. It’s difficult to sympathize with your scenario when most 25-35 people I know would be looking at around 8-12x income individual or combined for the same $900K. It seems a bit weasel wordy to write that many and a lot of 25-35 people are earning $250-$300K. More like a minority, but hey, however you want to define many and a lot.

Refutes everything you said JAE

http://www.forbes.com/sites/marymeehan/2014/02/21/the-baby-boomer-housing-bust/

What’s your position on immigration? According to the San Diego Union Tribune there are 70,000 Iraqis in San Diego county now! Indians, Russians, and other Asians of all stripes are flooding in too. Apparently we are even flying ‘southerners’ in from Texas as well. Meanwhile your boomer parents and their parents have decided to make building anything really hard and really expensive. They chuckle about how they got theirs while cursing domestic flyover immigration yet rolling out the red carpet for any type of foreign immigrant legal or otherwise.

Realize the shortest straw has been pulled for you. Perhaps the only way to win their game is to not play it.

Got demand?

我ä¸ç›¸ä¿¡åœ¨ä¾›éœ€ç¥žè©±

WÇ’ bù xiÄngxìn zà i gÅngxÅ« shénhuÃ

Heard on 670 KFI-AM today that home sales in California fell from June to July. Median home sale prices also fell a bit:

June 2014 — $415,000

July 2014 — $413,000

I found this article which mentions the sales dip, but also observes that median home sales prices are up year to year: http://www.modbee.com/2014/08/14/3486997/california-home-sales-plunge-in.html?sp=/99/1526/

July 2013 — $385,000

July 2014 — $413,000

That’s great news. Hopefully they’ll keep falling further.

For those of us who might end up on a dog food diet. I recommend Orijen. Organic, all natural, free range, fresh ingredients, locally sourced in Alberta, 35% protein, http://www.orijen.ca/products/dog-food/.

LOL not sure if you are being serious or not. But I like it.

I’m joking today Jim Taylor. 10 years from now? Who knows. I read the Forbes article you posted. The one below it had an interesting and frightening line, “too frail to work, too poor to retire.”

The wife is a foodie and only eats organic. This really opens up my options. Thanks! I am still working on the whole sponge bath in the car thing as well as el numero dos if you get my drift. Well, I still have plenty of time to “plan” my retirement…

Jim – I am hopefully the boomer article comes to fruition. I used to believe all those same sentiments. However, what I’m seeing is boomers stay, or reverse mortgage, etc. Even at the expense of their kids leaving the state. I do hope this article is correct though.

Jeff – Keep in mind, people need to save for kids college, retirement, etc. We all just don’t buy what we can afford on a monthly payment. Also, I am commissioned and I am conservative so I count my commisions l kinda like non recurring income. Commisions, jobs, industries can be wiped out fast. Btw- are you a realtor or insurance guy?

I do admit in retrospect my post was Knox of a drunken blathering. However, if I am a minority and I still don’t want to spend on these homes. Who will?

Leave a Reply