Reinventing Feudalism in America: How can existing home sales go up when mortgage applications are falling?

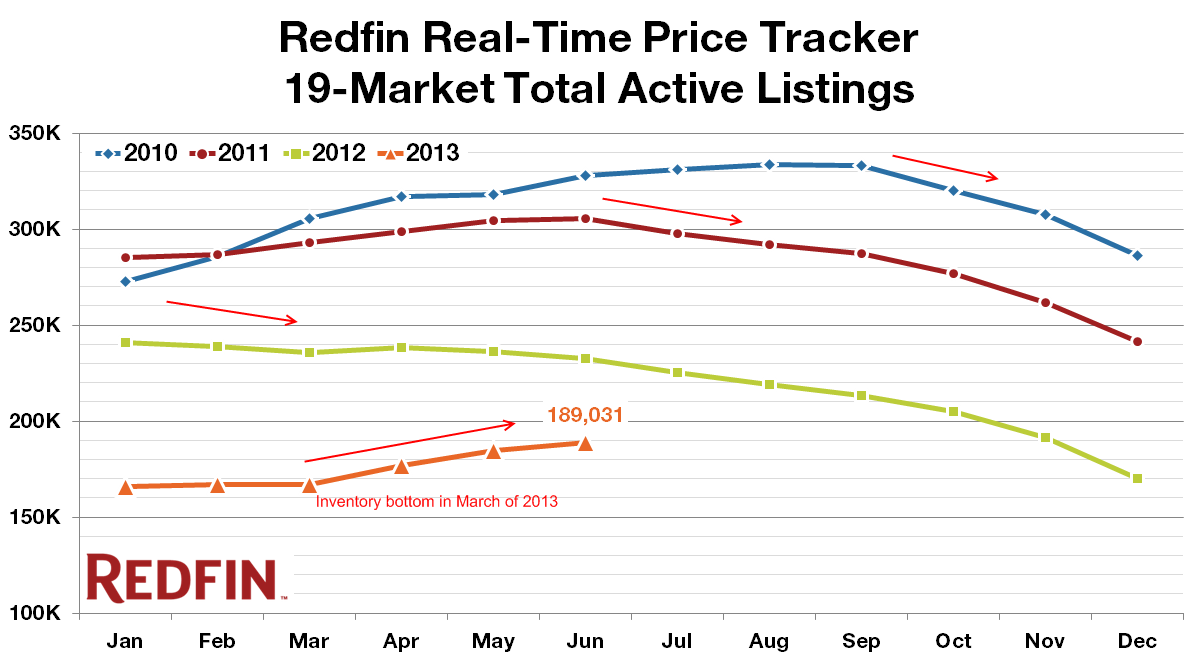

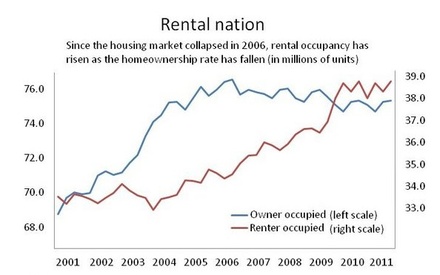

This week we were welcomed by the news that existing home sales reached a multi-year high. Good news right? Depends on where you stand since the stock market continued to react to the potential of the Fed moving slowly away from their unprecedented mortgage experiment. As you know, mortgage rates are now at a multi-year high as well. It is very clear that this has hampered the ability of your average family to purchase a property since the big money from hedge funds and investors is still fiercely competing for the current inventory in the market. Big trends do not change overnight. Yet it is clear that we reached an inventory bottom in March of 2013. It is also clear that cash buyers are a much bigger portion of our market today (in fact, they might be the biggest player of all). The real estate game has completely shifted from a stale boring play that tracked inflation to a boom and bust cycle that is fully dependent on the wills of the Fed. If that is the case, the Fed pulling back even a little is enormous. The nation is becoming one of more renters largely because low rates have done very little to help out regular families. The big winners of course are the large investors. So let us look at the paradox of the current market.

Existing home sales and mortgage applications

The news of rocketing home sales was plastered all over the headlines. However, mortgage applications are going in the exact opposite direction (of course little was reported on this):

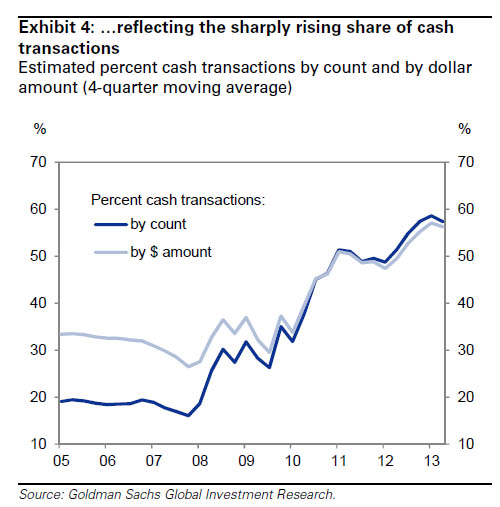

The median home price in the US is $214,000 and from multiple reports, most Americans don’t have much saved up (definitely not enough to buy a home without a mortgage or even a car for that matter). This trend simply highlights the massive power being wielded by the cash buying crowd. Someone is buying these homes and if mortgages are not being used, something else is being used. The cash buying crowd has always been around but as a small subset of the market. Today, it is one of the biggest players out there. The group is big enough to push prices up as it has over the last few years.

The chart above simply adds more evidence to this scenario. Your regular buyer is being pushed out of the game while investors continue to battle over what inventory is available. Yet we are now seeing that an inventory bottom was reached in March of 2013:

The trend has been unmistakable. Since late 2010 available inventory has gone only in one way, down. That however has changed since March of this year. Inventory is now creeping up and in some markets, the turnaround is dramatic. Where is this coming from? You probably have two groups:

-1. Investor trying to time a top (including banks)

-2. Underwater homeowners no longer underwater exiting the game

Coupled with these two groups you also have your regular sellers and the trend has reversed. The normal crowd is also being pushed out because rates have gone up quickly this year.

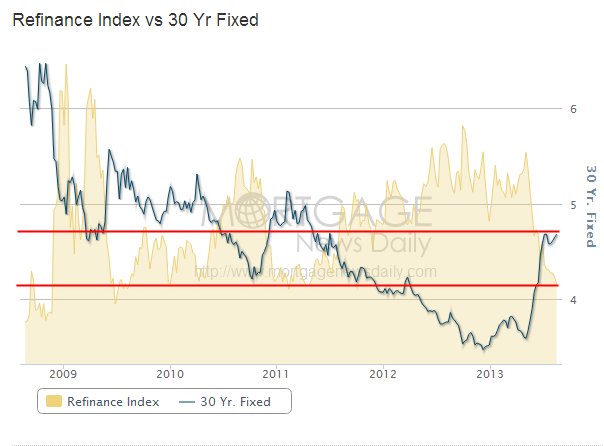

Refinancing boost collapsing

The economy has received an ancillary boom courtesy of refinancing activity. Keep in mind banks have made droves of money from refinancing fees. Yet with higher rates, the gig is likely up:

It is clear that the jump in mortgage rates has stifled this activity. Yet this only helps current homeowners (and by the larger trend, home ownership has been falling). Many investors were buying homes to rent out (this is how you have 5,000,000 people losing their “home ownership†via foreclosure only to exchange them back to financial institutions that have turned around and converted them to rentals). Without a doubt, many people should have not purchased homes in the last decade. That is an understatement. Yet now, instead of fueling the flames for the regular buyer the Fed has given large investors a big incentive to buy. No reform, just ramping the game up with a different tone. This is how you can have falling mortgage applications and a significant rise in home sales.

The cash crowd

The myth that somehow the cash crowd was small can be put to rest now:

It is obvious that the cash buying crowd is large and driving many markets. The big banks are carefully looking at the Fed’s next move because they realize that without low rates, financially strapped US households will not be able to purchase their property for a nice profit. The bailout was subtle if you can call the Fed’s balance sheet at $3.4 trillion subtle but the big win has gone to banks. Low rates alone are not enough to save an economy. The home ownership rate has collapsed and all this focus on housing has diverted our attention from other growth sectors to housing. Rents and home prices are rising yet incomes are not. Is this a positive development?

The trend is very clear now:

This trend has only continued in the last year. We are becoming a nation of renters yet home prices continue to go up as banks trade with one another leveraging low rates. Rising inventory and rising rates will definitely make an impact. Do you think this kind of cash buying trend is sustainable?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

71 Responses to “Reinventing Feudalism in America: How can existing home sales go up when mortgage applications are falling?”

Mortgage rates hit two-year high:

http://money.cnn.com/2013/08/22/real_estate/mortgage-rate/index.html

WE need to innovate our well being .America the great needs to transform itself

to be global competitive.We are the leaders of the world. R&D comes from the good

U.S.A..In addition most of the IMF is provided by U.S.A. .UN funding is mostly provided

by U.S.A. What do we received for our efforts. Nothing but grieve. U.S.A. should

choose our supporters most carefully.

I know that the general assumption is that most of these homes are being bought up by institutional investors, which seems to be the case, but, I wonder how many are being snapped up by Boomers downsizing. By that, I mean the few who actually have so much equity in the home that they can sell and pay cash for another home. Or, maybe, Boomers going into the Mom and Pop landlording thing as a retirement cash flow investment.

I’ve been thinking about those same two scenarios for a while myself. No doubt that a fair amount of that is going on, but I hope that both you and I are mostly incorrect, because in my case then I would be totally screwed by the Boomer Generation. As a borderline Y-Millennial I’m COUNTING on a crash from the current stratospheric prices (yes) to some semblance of the historical norm. Ideally I’m looking to purchase 3-5 years from now. I’d much rather pay more interest on a cheaper house than vice-versa. If the current charade is extended in perpetuity, then I guess renting it is for life. I simply refuse to feed the Gov’t/Wall Street beast that created this housing SCAM.

Boomers perplexing me a little too. I know many broke. However, there are almost 80 million of them and only about half are broke i think. Even if only 25% have money thats still 20 million peeps, many with pensions and homes clear of mortgages. Also, 1% of the population controls 40% of the wealth and many of the 1% are boomer aged or a little younger. I think many of these boomers will downsize as usual. However, some may stay as following generations had kids later in life so many boomers may keep bigger houses longer to have the family over. Or maybe they know their kids n grandkids are screwed so they hold onto the house for them. Also, many boomes got spooked out of the stock market after the crash, then went into cash and bonds and cds and are making no return on investment. Since most wont buy physical metals, that leaves real estate as a likely investment. Add in all their money managers at the banks telling/selling them on the rent to own model or the need to be in physical assets because of money printing. Hard to quantify but old people with money buying real estate certainly doesnt sound too surprising.

I talked to one of the major builders (Plantation Builders) in Brunswick Forest subdivision (just south of Wilmington, NC), and he told me that most of his buyers are cash buyers moving down from the Northeast and from Ohio. Last year my wife’s parents sold their house in Sun City, Az for cash. They paid cash for it when they bought it. So not all cash buyers are investors, and not all investors are cash buyers. Blackstone recently borrowed $2 billion to buy rental properties.

I am at the end of the baby boomer generation, so most of what happens “in the news” with baby boomers doesn’t happen for us. We tail enders, sort of laugh at what we call the spoiled offspring of older baby boomers who seem to get it all, super rich childhoods no recession ( until 5 years ago) then “older” baby boomers who bail them out and or keep them on a permanent allowance.

I am so rooting for you younger buyers to get your wish with lower prices! My sons are low to mid twenties and they all rent for super cheap out of necessity and we taught them to be frugal, and mostly, don’t listen to any news hype or disaster talk, and don’t listen to a banker or real estate industry person ( most of whom have loads of debt I think)

The large percentage of Baby Boomers that are, on paper, broke, are so , because they fell for the real estate game hook line and sinker when they were young, like we did. Then their taste for the finery and location location location ( and accompanying award winning government school!) ensured their broke lifestyle.

Isn’t it amazing how a school building, granite counter top, wood floors, stacked surfboards in the garage of a mcmansion, and neighbors with bmw’s and mercedes will twist a right thinking person into a covetous person in a heartbeat. I still will think, wow how do they get all that, even though I have lived long enough to know how.

I am so proud of you young buyers that don’t want to “keep up with neighbor”

We became debt free, buy living in a modest neighborhood and paying down all debt and trying to live completely debt free. It is still the only way to true solvency.

My older baby boomers relatives will only consider prime areas and would never move to our neighborhood, even though they have debt and they are in their late 50’s and early 60’s now.

My only obstacle has always been my pride, in the end.

Buy used where you can, Save your money and rent cheap. Let the latest real estate scammers lose their shorts.

Black Swan, Brunswick Forest and your wife’s parents’ Sun City transactions represent what percent of transactions in the US real estate? Your sample size is so small that it has no significance. As far as Blackstone collecting 2 billion from wealthy speculators to invest, is it really borrowing since it’s non-recourse? As usual, it looks like your wife corrected your spelling and grammar mistakes, but you better find someone to do your mathematical calculations and reasoning.

It always makes sense to pay a higher interest rate for a cheaper house then refi at a latter date. Rates will most likely never be this low. We too are waiting for the house of cards to fall. I refuse to pay the inflated prices of this market. It will happen in the next 3-5 years when all the investment firms try to dump their houses for a higher return. Sit back and watch this whole scam unravel!

My parents just did this. Sold their overvalued (IMO) house in North Tustin for $1.3 million, and moved up here wherre I live in WA. Bought a nicer, newer, larger home up here for $400k.

In our local market (North Lake Tahoe), about half the weekly RE listings sport “New Pricing” and “Reduced” banners. Prices are probably up 20% to 30% from last fall and up 40%-50% from lows. Sales still taking place with units sold about 50% better than 2011-2012 but new inventory appearing. Part of this is driven by resort nature of Lake Tahoe area. Those who want to sell before snow starts have to reduce prices and apparaently a lot of sellers are liking the recent increases.

If companies in specific locations cannot provide enough income for an average person to live on their own and the homes that are available are priced too high then this really becomes the new feudal society or pure capitalism. Never enough for the person to live on which means permanent rental environment for those who lack in specific skills and need federal/hud assistance. The stores (not fortune 500 companies) that surround these pricy homes have to be employing workers who probably either have a teen of a wealthy family that need temporary work or these people are probably living near by with maybe a few others in an apartment trying to make their ends meet or maybe they are commuting much further away from IE or somewhere else. Maybe they are seniors who need extra money to work as well, but live in the area. Is this the type of environment Pasadena or other good cities want to see?

My wife and I have been looking for over 14 months in Corona and have lost several homes to cash/investor buyers, we refuse to pay over true value. When is all of this going to stop? Do I just jump in the pool or how long do I wait to see if the market drops off but by then rates will be much higher…

Six months ago, I stated that while prices would move inversely to interest rates, we were probably at the “montly payment bottom”. Meaning as rates rise, values fall, but PITI will remain equal.

This was before the latest little “boom” this spring. I think prices are overshot by 10% regardless of rates, and that’s “Bubble 2.0”

I also believe as long term rates rise over the long term, prices have to and will fall. What one can buy at 3.5% is much different from what one can buy at 6% or more.

But isn’t that really what everyone is talking about? Buy at 3.5% and get a crackerbox in the ghetto, or wait for rates to rise and get a decent place in a nice area. If rates rise, this would indicate a good economy, and salaries would stay the same or rise too. Downpayments are easier to save for, you get a better place, and you might even be able to have your downpayment cover >20% of house price. Less to finance, more wiggle room with monthly budgets. More wiggle room = more consumption = better economy. Hmm…sounds too easy.

Perhaps the idea is now to hold properties while the cost of rent goes up to make the high prices of homes look as if they are at rental parity? That is only way they could keep this party going. So anyone who is renting may as well buy if that maybe the full intention of what hedges and other investors are thinking. This would in itself mark the bubble top if that is what may be happening or a new paradigm in cost of living.

Curiously LA-er, if rates rise to 6% and prices go down, unless you are paying cash, how do you get a ‘better’ house? Unless you use the differences in prop taxes and down payment towards your monthly payment, wouldnt the higher interest per month just get you pretty much the same house as before? The money savings would be if you can refinance later at a lower rate (which may come true or may not). Also, unfortunately higher rates doesnt mean all is well in the world. Sure, the fed and govt may say they are tapering (which will raise rates) bc unemployment is getting better (if you count part time jobs being created bc of obamacare (and capitalism in general to be fair)), etc. but for the million reasons already discussed on this board, sht still sucks for most folks. IF QE dow ta

You should do the opposite of what you suggested. You have to remember that your down payment is your equity in the house, so you own 20% equity in the face value of the house you buy. If prices drop because of rising interest rates, your equity drops but the amount you owe on your mortgage doesn’t change. So you will still pay the bank the 80% you financed plus interest, even if the house doesn’t accrue in value at the same rate. In the case where housing prices fall, your equity will decline but the cost of your mortgage will continue to rise at whatever the interest rate is, eating away at more and more of your equity. Essentially your down payment is taking a subordinate position on any future cashflows from the sale of the house. The bank gets all its money plus interest before you see anything. So if you believe rising rates will lead to falling prices you are better off just sitting tight and waiting for prices to come down. Keep in mind there is a very real chance you buy a house today, rates rise and prices drop 5-10% and you lose 25-50% of your investment immediately.

@FTB, you are right about the monthly payments. But what LAer is really implying is getting into the home.

Case in point: the average cash down payment for a mortgage in 2012 was around 22%. Exception would be if you go with FHA or VA.

So, mid-tier markets at $600K conventional loan would need a $120K cash down payment to get in @ 3.2% interest rates. Since most American households do not have $120K cash laying around, the option is to go “ghetto”. A $60K cash down payment on a $300K is closer to what middle class America has tucked away.

When interest rates go back to their historical average of 8% to 9%, then these $600K mid-tier homes become $300K mid-tier homes. The monthly nut does not change, but the ability to get in does as the buyer will no longer need a $120K cash down payment but rather a more reasonable $60K down payment.

I see your point about buy-in costs, Ernst. Certainly less money required if one is always looking at things from the same down payment percentage regardless of the price of home purchased.

IMO, and its just an opinion, I’m not sure how quickly we’re reverting to 8-9% rates. We keep piling tons of debt at the federal, state and local levels. Individuals have piled up a ton of credit again as well. 8-9% rates could be the final death blow so I would think the govt may try and avoid going that high. In terms of 30 year rates, the last time we went above 8% was in 2000 for about 8 months of the year. Then there was a month back in 1997. Before that, things were very different and rates were higher (up to almost 18% in 1982). So in the past 16 years we had 9 months total above 8%. In terms of above 9% rates, we had one month in 1995 or about one time in the past 19 years. History does repeat itself sometimes and maybe its volker time again, but I wouldn’t call it a foregone conclusion. Gas as a % of income, college as a % of income, etc keep going up so perhaps housing as a % of income is going up too. Water is the next. Life is getting more expensive as we move toward one global interconnected pile of dung where banksters control almost every market whether through the ebb and flow of debt issuance or via asset purchases/market manipulation. I could be way off here, but my guess is that QE tapering doesn’t last very long. Then we get to see if the fed can regain control over the bond market or not. All just my guesses. Ask my Gemini a$$ in a few hours and maybe my thoughts change.

@FTB,

Reversion to the mean for 30 year mortgage rates (8% to 9%) is probably a lot closer than most people realize. It’s not going to happen in 2013 or 2014 or even 2015.

Interest rates were driven down by Baby Boomers needing to park their retirement funds somewhere. The traditional investment strategy is to invest in stocks when one is younger (higher risk, higher returns) and then move over to bonds as one gets older (cash preservation).

The first of the Baby Boomers is 67 years old. As Boomers age, the 30 year Bull Market in bonds will come to an end and interest rates on the 30 year mortgage will revert to the mean as the Boomers start drawing down their investment portfolios. Generation X is broke as is Generation Y but Baby Boomers are not, so interest rates will go up as Baby Boomers retire and pull money out of their retirement accounts.

I don’t expect to see 8% to 9% 30 year mortgage rates before 2018, unless we get a lot more Detroits, Stocktons and Riverside municipal bankruptcies.

Right now, the bond markets are flush with Baby Boomer retirement funds. This will be slowly coming to an end.

you sound like my daughter and son in law, they pulled out of the game as well, wisely. If more people had the moral fortitude you display, we wouldn’t be playing this silly boom bust garbage

Boom bust cycles…

https://www.youtube.com/watch?v=EeIM-4hJO44

Hey, I hear you! 😉

My wife and I are standing by the edge of that same pool too!! And, like you, I too, refuse to pay above, as you refer to true value!!!

Been tracking both Corona and Eastvale, and to some extent, Lake Elsinore.

I received another (of five recent) alert from Redfin, of a price reduction in this area; moreover, as I mentioned in another recent thread, I have noted the inventory in Eastvale, has expanded very much this past few weeks.

With a daughter in her senior year of HS, we are going to wait until at least spring (April) before we decide how to move forward.

I really think this thing is going to break (one way or another) by then; my view continues to be this is against the wind of fundamentals, and unsustainable. And yes, interest rates will most likely be higher, but maybe the properties will be priced right.

Stop worrying about the rate. Take the higher rate and the lower initial house price. Your benefit more with higher rates. You pay less property taxes, you are in less borrowed debt, and you can pay more towards the principal so it’s inconsequential what the rate is because it will drive you to pay off the mortgage quicker. Don’t heloc your equity over stupid bs like a car or. Vacation. save and buy those cash. Pay a extra $100 a month towards the principal. And you will be amazed how much you are curtain out of the total. I will always take a high interest rate and lower house price over high house price with low interest

“The real estate game has completely shifted from a stale boring play that tracked inflation to a boom and bust cycle that is fully dependent on the wills of the Fed.”

That is absolutely true — the real estate market is currently at the mercy of the Fed.

There is no doubt that prices will cool now that interest rates are rising, the hedge funds no longer see more appreciation in the future, and as has been the case for the last 6 years, average incomes continue to flat-line after falling sharply.

Doctor Housing Bubble,

You really need to define “all cash buyer”. From what I can see, is that it means non finance contingent offers. This simply means that there is no mortgage required for the purchase correct? This does not mean that the purchase was made by folks showing up to open houses with suitcases of cash. I think I have stated that the banks are financing the “hedge fundsâ€, banks are financing the flippers and some are using 401K’s as collateral as well as other assets to get personal loans to purchase properties.

The reason that this is important is because the real limit is credit not cash. I am sure you have seen our national savings rate. Not much real money. The funny thing I keep hearing is how retiring boomers are buying up properties as cash-flow investments. However, I continue to read how the boomer generation is cash poor and house rich. I am not sure this is really the case. I think the most likely case is that funds are buying up the properties with TBTF bank financing and plan is to sell these to 401k’s and pension fund managers around the world. Sound familiar? These guys are really one trick ponies and this is just the latest version of the same old tired act…

I keep hearing that we don’t have all of the sub-prime, ninja, etc. loans so we can’t have a crash. The issue with this belief is that it makes a number of questionable assumptions. First is that “all cash†means that there is no financing. Second is that investors hold on to losing investments. Third is that there will be others waiting to buy when funds backed by SFR’s are dumped by pension and 401K fund holders/managers therefore, there will be no need to liquidate. Fourth is that rents can only go up which assumes that we will never have another recession. I could go on but I think you get my drift.

I think we can be pretty assured that we will have another recession, another asset crash (stocks, bonds, real estate, precious metals, etc.) and another financial crisis in the near future. I think it is absolutely silly to predict when and how big. This is more like predicting earthquakes than predicting hurricanes. We know that as time goes on more and more pressure is exerted on a fault line and that there is more and more stored energy that will eventually be released. We just never know when and how bad.

What?-

“The funny thing I keep hearing is how retiring boomers are buying up properties as cash-flow investments”

I don’t think anybody will argue with me when I say wealthy disparity in the US is increasing. It’s not very effective to simply look at the national savings rate or median income rate. About 10m American households have a net worth of $1m (not counting primary residence). Simply stated, even though there many American struggling to save a dime, there are also many other Americans flush with cash with nowhere to invest.

“I keep hearing that we don’t have all of the sub-prime, ninja, etc. loans so we can’t have a crash”

Housing prices are sticky; very sticky. The one thing that “unsticks” housing prices are forced sales, especially foreclosures. In the last housing crash, the areas that were hardest hit were the areas that had the most foreclosures, where people could walk away form their homes without much recourse. Many people had very little equity in the first place and were so poor that even if their loans were recourse loans, the banks had little incentive to pursue a judgement.

Even if actual number of cash-purchases is inflated because the are doing a cash-out refinance, having skin in the game will slow the number of owners that are underwater and willing to walk away. Even when you refi out, you’ll still need 20-25% down after all.

Right now rents are trending upwards, but let’s say they stay stable. Of course investors may not be happy if they don’t achieve their expected their ROI, but it seems more likely they would rather keep a small ROI rather than sell for a large loss. However if you believe rents are going to crater downwards, then yes, I think there would be a big sell-off from the investment crowd.

I don’t think anybody would say that rents will go up year after year, but historically what the most consecutive years of declining rents?

We will certainly have more recessions in our future but we will NEVER have another recession without monetary printing (or for those who don’t like to believe it is the printing of money, “Quantitative Easing”).

And that is the kicker in all of this.

What?

In California, DataQuick defines cash buyers as those who acquire title without recording a deed of trust. In other states there are different documents. I don’t know Goldman Sachs’ definition is, but since there is no central registry of real estate purchase contracts, I doubt that it has any thing to do with mortgage contingencies.

DING,DING,the chinese are here paying cash for homes,AND the RUSSIANS were on the internet BRAGGING they will have ‘AMERICA” under their full control by dec.15th and your fighting over home values,YOU BETTER ASK your self, whats life going to be like under a RUSSIAN dictatorship?and what if they just take you to a fema death camp and seize all your land and property?WAKEUP,your out of time,their getting ready to attack america and you don’t care,BUT YOU WILL SOON………………..

Make sure you stock up on Guns and Butter since you appear to be ahead of the curve. Also make room for refugees in your nuclear silo as well out on the prairie.

Wont the Wolverines from Red Dawn protect us?! Im thinking the 80s original cast would be best as it included patrick swayze and c thomas howell. You live in arizona, a land locked state that allows its citizens to wear 6 shooters in holsters into mcdonalds. I dont think you need to bone up on your russian or chinese just yet.

It’s been a long hot summer, huh, Arizona? You need to get out more. Maybe the shooting range at sunset?

America has Terry Crews, we are fine

http://www.youtube.com/watch?v=gQWq1Z-J-EE

I heard the Ding Ding in 2006 as a 32 year builder developer fully invested in RE.

“WAKEUP,your out of time,their getting ready to attack america and you don’t care,BUT YOU WILL SOON ” I second that.

What’s it going to like when the Russians invade?

1) the government will be the biggest player in the housing market, giving out loans and setting rates.

2) Young healthy people will be allowed to be raped by health insurance companies, under the guise of socialized medicine, which will steal a large portion of their investment money/down payment money, even at the ‘bronze’ level.

3) Oil, gas and coal companies will continue to get large subsidies from the government, suppressing a fair market reaction to expensive fossil energy.

4) You know the rest.

Where do I subscribe to your newsletter? I’d like to know more about the invasion plans. Will they be bringing any of those “russian mail order brides” with them? Maybe the troops and brides can all fit on one boat….

DHB, just how much of this investor ‘all cash’ buying is being driven by Section 8 housing vouchers? Obviously a government guaranteed rental payment is worth more than a rental payment from a private tenant. An investor not even care about capital appreciation if they have the cash to buy more homes in the same community and rent them out to new Section 8 homeowners. In fact, it will drive down property values and make the rental return even more lucrative.

“How can existing home sales go up when mortgage applications are falling?â€

Maybe because there is a 1-2 month lag between applications and actual closings. In other words, the home sales which closed this month, were from mortgage applications submitted months ago. Give it another month or so, and the lack of apps will begin to negatively affect sales and prices…at least that’s how it should work in a free (non centrally planned, non manipulated) market.

We may not have to wait too long. Existing home sales just tanked and well below expectations. Uh oh spaghettio.

http://www.cnbc.com/id/100983583

Yep. http://mhanson.com/archives/1439

Do not worry Russians will not go to Arizona. LOL

Wells Fargo cuts 3,000 jobs as mortgage refinances drop;

http://www.latimes.com/business/la-fi-bank-layoffs-20130823,0,961124.story

Probably relocating this department to a cheaper state.

The majority of wells fargo mortgage biz is in Des Moines. Not expensive but not exactly cheap either, if the definition of cheap is like Mississippi

Of course the big win has gone to banks. The Fed is owned and run by banks, just like the politicians. It is the taxpayer that gets every last cent he has that is sucked out of him. It is the old egg trick. Prick a little hole in the egg, and suck out all the inside and you are left with an egg shell, that from the outside looks whole. The whole thing is a sham, led by the shammer in chief, Obama. Actually, Obama, to be a candidate for President, passed his fidelity test to the real rulers. He is their employee.

A couple of years ago, Dr. Housing could never have forecasted this development, because it is something new.

Inventory is low, but velocity is high, hence the high prices, just like in 2007.

Eggxactly. RE inventory movement is high relative to supply. The whole idea is that it will spark M2 velocity which is at historic lows that has the Fed shitting in their pants.

Here comes a rather large eventual increase in the rental pool eligible for section 8 housing among other governmental benefits.

“According to the U.S. Department of Homeland Security (DHS), an estimated 2,830,000 illegal immigrants resided in California in 2011, compared to 1.5 million in 1990 and 2.5 million in 2000. This number represents about 24 percent of the entire estimated illegal immigrant population in the United States (11.5 million in 2011).

This estimate puts the percentage of California’s population that are illegal immigrants to be about 7.5 percent, with a majority (about 60 percent) being from Mexico. Across the entire United States, an estimated 6.8 million illegal immigrants were from Mexico, up from 4.7 million in 2000. The Almanac estimates that Los Angeles County was home to 762,000 illegal immigrants in 2010.”

http://www.laalmanac.com/immigration/im04a.htm

A look at section 8 housing please see link below:

http://www.gosection8.com/section_8_affordable_housing/california_section_8_affordable_housing_rentals.aspx

Not surprised to see this. More free handouts from the US tax payer and the only reason why the Hedgies are buying up properties. Best places to see this will be the hardest hit areas of housing: Arizona, Nevada, Kalifornia, Florida. Any others?

New headlines to comes…These states have the largest section 8 housing on record.

Of course the cash crowd is huge. The banks want us in the stock market and the housing market.

They have herded us away from savings into the vehicles they want us to be in. They want the savers into real-estate with cash deals to paper over their crappy loans. They want housing to go up to so they can dump these properties back to us.

As soon as the cash investors starts to wain, lookout for “new ” home ownership loan programs for the non-cash buyer. They will be buying in at all time highs before the bottom falls out again.

This is a well orchestrated pump and dump. The bond market may put a hitch in their plans…we’ll have to wait and see.

Cash buying crowds= ASEANS, illicit drug money laundering, QE 3, 4(?) full circle(s)

Maybe 3% legit U.S. citizen purchases….just guessin’

I think the 1% who control everything needs to be better explained. The true 1% is measured in overall wealth, not in income. The only 1% who have the power to control our lives are the mega wealthy rich across both political parties who are the TRUE few who should be sharing their wealth. What justice is in accusing a person who may be in the 1% (rich in income) but has had to pay his way with loans etc. to reach a better standard of life.

New-home sales dropped dramatically in July – Bam!

http://www.mortgagenewsdaily.com/08232013_new_home_sales.asp

Anecdotal.

Covina 3/2 listed at $340k. The all cash offers came in at $300 to $310 total waste of time. 25% down and other financed offers drove price to low $350s. In escrow in the low $350s after 2 weeks on market.

This is what you historically used to see with cash offers (low ball) There were no serious cash offers. Home had been paint and carpet rehabbed – nothing extravagant. I heard about all these cash buyers outbidding first time homebuyers – not even close on this one.

If there’s no audit of the Fed, the potential exists that banks and hedge funds will be in the game to take profits by engineering market economics via banking manipulation

for a while.

Demographics are destiny. Baby Boomers are retiring 10,000 a day for nearly 18 years starting in 2010, the low part of the market. I live in Naples Fl and its the final party of the largest richest retirement in American history. There are new home being built everywhere in places never built before. Enjoy the largest retirement in history. After the Baby Boomers retire and die, America takes its place as a third world nation.

The “baby boom” retirement issue is not unique to America. Similar and worse demographics exist in Japan and throughout Europe. A large number of developed economies are in the same boat. China did the same, purposely, through its One Child Policy to encourage consumption and increase standards. Clock is ticking on that one too.

I don’t dispute the demographic thesis but it’s all over the place. No answers but it’s almost like our political machine: looks like the worst mess on the planet until you look at the overwhelming majority of others. On a relative basis we are okay. Still no excuse for the crap that goes on thought.

wait for the margin calls:

http://online.wsj.com/article/SB10001424127887323936404578581991623331764.html

Hey tapis, intriguing post. I’ve read commenters here claim that this time is different because buyers are coming from net liquid positions. If what the WSJ reports is true, it just goes to show how pervasive financialization schemes continue to be. I’m also catching wind of purchasers utilizing HELOC lines to buy investment properties. How is this stuff not like what happened last time?

Pulling out equity in one place to buy another place is an old RE investor scheme, that’s been around since at least the early 1990’s (that’s when i read about it in a creative financing book).

I should have been more clear, I’m catching wind of this activity picking up since rates cratered.

Here is the rental market for you in MN. One of the more vibrant states.

“Since the year 2000, rents have risen about 6 percent statewide after you take into account inflation, at the same time that renter incomes have fallen by about 17 percent,” said researcher Leigh Rosenberg.

http://minnesota.publicradio.org/display/web/2013/08/13/social-issue/report-affordable-minn-home-rentals-lacking

Wall Street is in the midst of its Pump & Dump of real estate. Same old story. Totally manipulated market with the FED on steroids. They must really be shittin bricks. Plus Ben is on the way out, what does he really care what happens next. Look at how the view of Greenspan changed in retrospect, once everybody got burned. The banks are the Fed and the Feed is the banks. If you think they really care about anyone else, pull your head out of the sand. Hedge Funds are just unregulated banks now, or is it unregulated banks are just Hedge Funds. Same animal.

Silver market just broke out this week. Looks like we could be in for some major rotation from real estate now into precious metals.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Wrong.

I’m going to jump in here in the fray. Let me say that I am not a Realtor or in that business. Having said that I often hear the comment that people would rather buy when rates are higher and prices have fallen. “D” stated above:

“It always makes sense to pay a higher interest rate for a cheaper house then refi at a latter date. Rates will most likely never be this low. We too are waiting for the house of cards to fall. I refuse to pay the inflated prices of this market. It will happen in the next 3-5 years when all the investment firms try to dump their houses for a higher return. Sit back and watch this whole scam unravel!”

There is no guarantee to this strategy however. The hope is that prices will fall enough and rates will not rise too much. Then there is the hope that you can always refi later at a lower rate. One has no control over those rates and what if they don’t fall?

Let’s use the example of someone who puts 20% or so down and gets a conventional $417,000 loan. Earlier this year you could have got this loan for say 3.5% making payments of $1,872.50/mo. To get that same payment at today’s 4.75% rate you would have to see the loan amount drop to $359,000, a $58,000 price drop. So prices would have to fall more than 10% in this example. Is it possible? Maybe..but if you wait 3-5 years..let’s say 3 years for the sake of argument then that homeowner that bought earlier will now have paid down $25,000 on his loan and also have gotten some tax benefits along the way. So my question to ponder is that while some out there are renting thinking I’m saving money since it’s cheaper could you save an additional $83,000 ($58k +25K) in only three years to be on the same equal footing as the earlier home buyer? And how can you be assured that home prices will drop that much?

What-if applies to everything. No assurances. Price levels and borrowing rates move up and down.

I can’t figure out where the $25K in principle pay-down is coming from in any of those scenarios presented outside of a standard amortization schedule. Tax benefits are not a given in every situation, most take a standard deduction and lower rates make this an even higher possibility. Let’s also not forget insurance and maintenance. In the scenario presented, the $25K had a negative return after three years and should the borrower been forced to sell and lock in the loss, selling costs (even taking into account the paltry capital loss tax exemption) would likely make the loss even worse. The renter could have realized a positive return less taxes after three years on a variety of investment vehicles.

Joe, you are making rent vs. buy a pure mathematical equation. First off, most Americans don’t understand much math beyond elementary school levels. Second, there are plenty of intangible benefits you get from owning versus renting. There is something to be said for never having another rent increase, never having to move again, having your own garage, washer/dryer, privacy, ability to customize to your likes, etc, etc.

I’ve read through most of the comments and it all comes down to people speculating again. Higher rates will come, lower prices will come, fed will lose control, lower rents will be here, etc. These are all guesses. People bought in the last few years based on facts that their payment is set in stone for the next 15 or 30 years. There are many more people in this camp than the arm chair economists.

Agreed. Understanding the math behind financial decisions is important to having control over one’s financial destiny and a lot of folks instead seem to let emotion guide this process.

Rents don’t only move in one direction.

Property taxes and insurance aren’t static. Maintenance and repair outlays further offset a fixed P&I payment.

Never having to move again, really? Major life events are unavoidable. Job loss, relocation, death, illness, divorce, newborns, and so on… There’s a reason mortgage rates track the 10 year T! We’re living in highly mobile times more than ever before.

Plenty of rental houses with a garage, privacy, bring your own appliances, and privacy. A degree of customization can be had in many rentals and is often overhyped as an argument for purchasing. Sure, a renter isn’t going to do major renovations – and that’s a bad thing? Frankly, renovating is a pain in the ass and that’s why a lot of people want something ready out of the box, rental or deeded.

Of course it’s all guesses and speculation. No one has a crystal ball. That’s why we’re here having discussions around the possibilities and likely outcomes. I’m willing to bet that the people who bought in the last couple of years that are absolutely confident in the decision they made aren’t here debating, much less reading Doc’s posts. Much as I’m aware, the point of this blog is not to stroke the egos of home purchasers.

Joe you bring up some good points. Insurance and maintenance is not figured in. My maintenance for my home is very little and I have a great deal on insurance so they are not big expenses. Every situation is different I realize and some houses can turn out to be money pits.

The $25k was the money that was paid down on a typical amortization schedule. There is no guarantee on investor returns especially in this market so the renter may or may not be better off.

Yes, if the buyer is forced to sell after three years there would be costs there. The original situation was not if the buyer had to sell however within three years. One should buy only if they definitely can see them staying in that place for a much longer time.

Having said all that if I was a buyer right now I wouldn’t be happy. Not sure how high rates will go and not sure what the Fed will do to intervene. It’d be nice to have a crystal ball. I just know that I could not purchase my own house today, only about three years later and I wonder how many years I would have to wait to afford the same scenario I got on my home back in 2010? I guess I’ll let you know in a few years.

For Housing bubble 2.0 to occur, Blackrock and other investors have to be forced to sell in a declining market. If these investors experience a cash crunch, they will simply turn to the Fed, who will print up the money and loan it to them at a ultra low rate. The cost of a $1 billion loan at 0.5% interest is only $5M which can be easily covered in rents. So another housing bubble is impossible

Leave a Reply