FHA Backed Loans and No Money Down Government Financed Mortgages with Seller Funded Down Payment Assistance: $8,000 Tax Credit Costing $45,000 for Each Additional Home Sale.

In the department of crazy and loony housing ideas, the government has taken the place of some of the defunct toxic mortgage vendors. Some of the popularity of the $8,000 tax credit has gotten many people off the fence to purchase a home. Instead of the Alt-A or option ARM junk, the government is front loading incentives to suck people into the home buying vortex. Let me be clear, this is a tax credit. Got that? Meaning, someone is paying for this $8,000. Of course, we should already learn our lesson that giving front end goodies like teaser rates on option ARMs isn’t a good thing, but what the heck does Wall Street and our government care about long-term sustainability?

The National Association of Realtors is doing 6 percent flips with the success of the tax credit:

“NAR estimates that about 1.8 to 2.0 million first-time buyers will take advantage of the $8,000 tax credit this year, with approximately 350,000 additional sales that would not have taken place without the credit.”

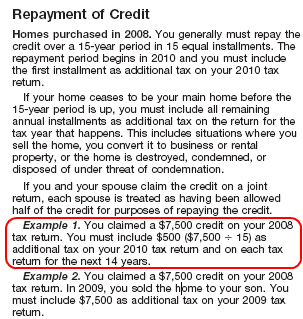

With 2 million people benefitting from the tax credit and only an increase of 350,000 additional home buyers, the taxpayer subsidy is gigantic (those NAR lobbying dollars paid off). Calculated Risk broke the numbers down and arrived at a cost of $45,000 to the taxpayer for each additional home sale. This of course comes on the front end since it seems like we are blowing our entire fiscal sanity on gimmicks like this and other fun house experiments like cash for clunkers. I say front end because if we look at the IRS Form 5405 we find this convenient little fact that the NAR doesn’t seem to dwell on:

Bwahahaha! Should have waited until 2009. So those people who bought in 2008 need to pay this back. But wait! For those who bought in 2009 it is free money express time:

$16 billion cost to taxpayers for 350,000 additional home sales. And given the reckless gimmicks and crony capitalism, we might have a $15,000 tax credit for 2010. If you doubt the futility of this money spending, let the customer speak:

“(NWI Times) We were planning to buy a home before the tax incentive was announced. The $8,000 was a bonus, but it wouldn’t have stopped us if it hadn’t been available,” Alyssa Newman said.

Like the Newmans, homeowners are finding another incentive to buy — falling prices.

“There’s a really good market for homes under $200,000 and especially for homes priced at $150,000 and under,” said Kristin McCoy, a Realtor with Wold Realty in Schererville. “If it’s in good condition (and) there are multiple offers — it’s gone. Many sellers don’t know what a fabulous market this is.”

But time is running out to qualify for the tax credit, says Jim Oster, broker-manager of the Lansing Coldwell Banker real estate office.

“Because you have to close on the house before November 30, about the latest you could buy a house is October 15,” Oster said. “There’s been buzz about renewing the tax credit, but I wouldn’t count on it.”

The damn insanity of it all is that home sales are going up because prices are falling! Yet here we are, giving incentives where they are simply not warranted. The market is correcting itself. Same thing with cash for clunkers. $3 billion to have a jump in auto sales for a month. How many of those people were going to buy regardless of the incentive? At times I feel that I’m taking crazy pills. The government is applying a taser to a fish out of water and is getting excited that it twitched.

But when you think things can’t get more mind twisting, the government and Wall Street step in to amaze us once again. Did you realize that many are buying homes with zero down through FHA loan programs? Forget about Alt-A and option ARMs for a second, many are buying homes with zero down financing sponsored by the government!

“(BusinessWeek) The days of home buying with little or no money down may be back-this time thanks to Uncle Sam.

Blamed for contributing to the housing bubble, zero-down-payment loans largely vanished when the market crashed and Congress blocked seller financing for government-backed loans. Now the federal government will be forking over cash at closing.

Buyers who haven’t owned a home for three years or longer are eligible for an $8,000 tax credit, thanks to a provision in this winter’s stimulus package. Now, under a little-noticed program announced May 29, the Federal Housing Administration will steer the funds to cover closing costs directly-in some cases even offsetting the 3.5% minimum down payment FHA loans require. That’s enough to cover most or all of the down payment and fees for homes up to the U.S. median price, now about $169,000.”

So right now we are juicing the housing market with financial steroids. How so?

-$8,000 tax credit

-FHA sponsored loans (only need 3.5% down payment)

-lower housing prices

The major push here is the lower prices but given the first two, prices are being artificially pushed higher. Good times in the Taj MaUSTreasury. The mission of FHA backed loans was to give lower and middle income Americans the opportunity to buy when conventional financing would be harder to get. Stop me if this sounds familiar (ahem, subprime and other toxic mortgage waste). But that is the pretext. Sort of like option ARMs and how they were for rich doctors and glamorous actors who simply did not have the time to document their 7-figure incomes. In reality, people used the loans to speculate and got in over their heads. Now, the only barrier for people buying is having 2 years of W2’s and 2 years of tax returns with decent credit (which is a broad group) and you can go zero down. But didn’t you say we need 3.5 percent as a down payment? Didn’t you hear? You can do a special combo and combine the already low FHA down payment and juice it with the tax credit:

“(HUD) The American Recovery and Reinvestment Act of 2009 offers homebuyers a tax credit of up to $8,000 for purchasing their first home. Families can only access this credit after filing their tax returns with the IRS. Today’s announcement details FHA’s rules allowing state Housing Finance Agencies and certain non-profits to ‘monetize” up to the full amount of the tax credit (depending on the amount of the mortgage) so that borrowers can immediately apply the funds toward their down payments. Home buyers using FHA-approved lenders can apply the tax credit to their down payment in excess of 3.5 percent of appraised value or their closing costs, which can help achieve a lower interest rate. To read the FHA’s new mortgagee letter, visit HUD’s website.”

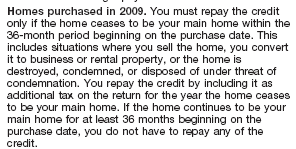

Non-FHA buyers can use seller funded down payment assistance and you can own a home with zero down. And if you want to see how much you can qualify for in Los Angeles County, let us take a look:

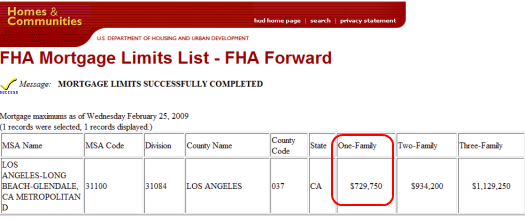

I sure shed a tear for the low income people buying those $729,750 homes. It really is a sad state of affairs. You thought Alt-A and option ARMs were bad but you have seen nothing yet. We already know that a lower down payment increases the risk of default but here we go encouraging it. And the shadow inventory just keeps growing:

Source:Â Hope Now, Calculated Risk

While the 60 days late is shooting off the chart (tracking upward since May of 2008) foreclosures are only slightly increasing (both starts and completions). Part of this has to do with loan modifications which have been a tremendous disaster since most re-default a few short months later. So all we are doing is kicking the can down the road and giving servicers $1,000 for each crappy worthless loan mod.

Let us go back to FHA loans shall we? You would think that these are going to the bread and butter states where no bubbles hit right? Nope. In fact, Southern California is eating this crap up:

“(DQNews) Last month’s median was the highest since it was $278,000 last December, but it stood 46.9 percent below the peak $505,000 median reached in the spring and summer of 2007.

In the region’s more affordable areas, many first-time buyers continued to choose government-insured FHA financing. Such loans were used to finance 37.2 percent of home purchases last month, up from 36.9 percent in June and 19.7 percent a year ago.”

What a stunner. You mean giving subsidized easy money to people in gold rush mentality California is going to work? And if you are thinking that it is hard to get beyond the underwriting think again. I’ve talked to a few brokers and they have told me they can qualify people with debt to income ratios of 31 percent all the way up to 50 percent. The first ratio examined is the front ratio. In this ratio they take your total monthly costs (principal, interest, taxes, insurances, HOA fees if applicable) and compare it to your gross monthly income. So if your housing payment is $1,000 and your income is $3,000, your front ratio is 33 percent.

The other more critical ratio is the back-end ratio which looks at your monthly credit expenses. This includes your housing payment but also car payment, credit card payment (minimum), and student loans. So assuming the above still applies, we then have $1,000 for your home, $200 for your car, $50 for your credit card, and $100 for your student loans. The back-end ratio is 45 percent. Depending on your reserves, work history, and other factors you will still probably qualify. Keep in mind this doesn’t factor in other costs! You can have a $300 cell phone bill and that isn’t in here. It is whatever pops up in your credit history.

I pause because here in California, the unemployment rate is now up to 11.9 percent and the state just had to grapple with plugging $60 billion in budget deficits this year. Instead of hunkering down and worrying about stabilizing employment, we are pushing people into buying homes. I look at things like this and just see an anxious poker player going all in on a bluff. He is hoping that on the river, he will get employment but early indications do not look positive. What does he care? He is gambling with house money.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

28 Responses to “FHA Backed Loans and No Money Down Government Financed Mortgages with Seller Funded Down Payment Assistance: $8,000 Tax Credit Costing $45,000 for Each Additional Home Sale.”

There are tens of thousands government employees in California earning over $100,000.

Several thousand of these earn between $200,000 and $800,000.per year.

Because they are senior employees, they will not be effected by any layoffs.

If you have a guranteed job at that income level, and a guaranteed 6 figure retirement, with fully paid medical,probably is a good time to buy a home.

You certainly do not have to save for the future.

Well, I find these programs to be of dubious effectiveness. But the most defensible general purpose would be the Keynesian one – that these extraordinary government interventions and bank tactics aren’t attempting to prevent a necessary and inevitable correction to housing prices, but merely trying to delay them until the overall economy is healthy and confident enough to handle them without the collateral damage that a panic-derived death-spiral overshoot would create in these shaky times.

The problem is still twofold. 1. You still can avoid neither the eventual price-correction nor inevitable financial losses, and 2. The stimulatory effect of the tactics becomes the “new normal”, and you can’t take them away without depressing future prices and sales.

As for 1 – I agree that timing is important – but as Dr HB has been documenting – confidence (almost crazy, bubble-like, amounts of it) really returns when many people start believing “The bottom is here!”. Dragging a correction out over half a decade or more – like Japan – prevents the return of mass optimism.

And as for 2 – think about interest rates. Rates are at historical lows due to the exceptional efforts of the Fed to buy both MBS and Treasuries – activities that cannot continue indefinitely. If rates climb from 5% to 6%, then the PITI monthly payments for the same house price would increase (by about 10%). If average incomes do not rise at least as much – then prices must come down even further when higher rates arrive. I am more concerned about effects like these than even the “distressed inventory management” strategies of the banks.

Good post! Another thing that hasn’t been given enough mention is the credit card companies (CHASE to name one) is literally doubling it’s interest rates on good customers with good credit. My interest rate jumped from 7.25% to 14.95%. Apparently my account was part of a larger group that were lucky enough to be selected to have their rates doubled. When I called and asked why, I wasn’t given any reason. I am someone with great credit and no debt. The only thing that I can think of is that I generally don’t carry a balance.

Anyway, I’m paying off that card. However… this is L.A. most people can’t pay off their cards!!!

I have no problem with the government stepping in and spending during a recession/depression. But it would make more sense to hire all these people who can’t get a job and have them do real worthwhile work with tangible benefits. If instead of giving money away they hired people to do the massive renewable energy projects we need to replace the energy we get from finite and depleting oil reserves, we might have a chance at a decent future. But I’d rather the government do nothing than continue with these wishful thinking, blow the bubble back up giveaways.

Just wanted to give everyone some first hand info about the credit crunch. I recently called AMEX to ask for a credit line increase for my small business and they turned me down; this is not a big deal but when you look at the larger picture it paints a very negative picture. Let me give you some background on the situation… I have multiple lines of business credit and have no business debt; I am moving my office to get lower rent and wanted to use my AMEX cash rewards to get money back on the payment to the moving company rather than get points from my other credit line. I don’t run up huge balances and always pay in full each month, so the credit limit from AMEX is fairly low. Anyway, they declined my request. So I asked them to roll the second line of credit that I have with AMEX into the first and that would be fine. They declined that as well and told me because of the current economic situation they have frozen most business credit and are unable to do anything for me. I was irritated by this but it was not a big deal (I will just use my BofA credit line). But think about this situation for a moment, if banks such as AMEX are not willing to lend and have locked the credit lines, they are indicating a bearish stance on the the economy. Furthermore, think about all the businesses that need the credit to pay employees and keep their day to day operation running; thankfully I am not in this situation but many other small business owners are and will have start to cutting down the business just to survive. This recession isn’t over by a long shot. More than anything all the problems we are seeing are a reflection of the demographic changes in the US population. We have less people and the Baby Boomers are retiring. Very similar to Japan a few decades ago. We might not recover for years and may just have to get used to lower standards of living and less economic activity.

Hey Man, don’t harsh my government cheese!

I’m eager to take advantage of the FHA program and the tax credit but here in Silicon Valley, almost all the listings are short sales and REOs and the banks don’t want to deal with the FHA. The inspectors are unpredictable and just gum up closing with individualistic constraints.

Even though I’ve made 9 offers over lists with a pre-approved FHA lender behind me, all the banks have turned down my bids even if over a competing all-cash offer.

In other words, the FHA program isn’t making a difference here in my San Jose market.

It really is amazing how much they are throwing at this. You’d think with how cheap they have made it to buy a home now we’d see rents coming down a lot more than they have. I’m hoping by the time I finally get booted from my home that rents drop. 5% interest with an $8000 tax credit. At that point even if you bring nothing to the table you are looking at what $1000 piti maybe on a 150k 3-4 bedroom home? A 1 bedroom apartment in the Temecula area is $850 a month. That house is no less than $1500-1600 a month rent.

We really don’t even have a government. We have lobbyists. The system is all fu**ed up and just plain wrong. In the end the taxpayer has to pay for all of this thievery that lines the pockets of the Wall St/banking scum.

This nonsense cannot go on forever. The dollar will crash.

“While the 60 days late is shooting off the chart (tracking upward since May of 2008) foreclosures are only slightly increasing (both starts and completions). Part of this has to do with loan modifications which have been a tremendous disaster since most re-default a few short months later. So all we are doing is kicking the can down the road and giving servicers $1,000 for each crappy worthless loan mod.”

Dr.,

Your last sentence in this quote actually understates the insanity. JP Morgan is my servicer for my 1st mortgage. I qualify for the “responsible borrower” portion of the Home Affordable program (meaning my servicer will “allow” me to refinance at a current rate – to the extent my loan-to-value is not more than 125%). I read in Bloomberg that JP Morgan is getting paid by the Treasury $2 billion in fees to help run both of the modification programs under the Home Affordable deal. That’s more than $1,000 for each loan mod. Also, JP Morgan won’t do my loan mod for free (even though they are already getting paid the $2 billion). They want 2 points. For me, that’s $6,600 if I were foolish enough to do it. My original rate on my 1st mortgage is 6%. Current rates are about 5.25%. The payback period is like 20 years. No thanks.

I could really use a loan mod on my 2nd mortgage, which has a rate of 7.375%. Guess what – it’s not eligible because it is not underwritten by Fannie Mae or Freddie Mac.

Net effect, as you point out so well, is that my taxes are being purloined to pay the likes of JP Morgan and a whole bunch of irresponsible home borrowers AND a whole new slew of irresponsible “new 1st-time” home borrowers (who are now using the FHA deal and the $8,000 tax credit). The government is relying on my good faith to continue to pay my mortgage “as-is” in order to subsidize all of these other parties.

My 2nd mortgage holder is sending me letters every month begging me to refinance them out of the loan and they are offering me a $4,000 rebate if I can find someone foolish enough to do the refinance. They are scared to death that I will walk away from my house and send them the keys. They should be scared. They should be very scared. Why? Because my house value is now down to about $325,000. My 1st mortgage is $330,000 and my 2nd mortgage is $62,500. The only restraining factor that keeps me from walking away is my credit rating and my down payment of $21, 250, plus the “principal payments” that I have made to date (since February 2007). (side note: my front-end financing ratio was never more than 30%.)

Think about those stats, and then think about the fact that the accounting industry has blessed the practice of my lenders not writing down the value of my loans on their books yet. This is a shell game, and the question I keep asking myself is why I should keep playing it as the “responsible person” that I have always been.

You nailed it; I’ve discussed government turning into a subprime lender many times on the blog.

Already we can see FHA / Ginnie Mae will be the next Freddie and Fannie. It is so pathetic we simply are repeating the same things we just did as a nation. But now institutionalized by the government.

http://www.fundmymutualfund.com/2009/08/wsj-next-fannie-mae.html

This should be of no surprise. There is obviously a race to bankrupt the nation. The whole mess is a giant ponzi-scheme and the only way to keep an exponential curve from retracing in the opposite direction is to keep feeding it–but that is unsustainable. This mis-allocation of resources goes on, because we are past the point of no return. The world won’t end but the severe disruption of our phantom-service economy will result in a collapse that may usher in the next Dark Age. Elliot wave calls this the decompression of a Grand Super Cycle event, an order above the Great Depression. Maybe we can call this the Grand Depression? The recession is over alright. What lies ahead is the question.

I’m not an economist, .But I am feeling more and more certain that in about three or four years, we are going to have an economic disaster in California, if not in the rest of the nation, which will dwarf this one. Real wages have certainly not gone up for years. Unemployment here is as high as it’s ever been post-Depression. Many of these jobs are not coming back. And many other jobs are being downsized, reduced in hours and salary. So where are all of these new homeowners going to find the money to pay their mortgages?

Our economy was badly suffering in 1991. Then we got the techno boom, and the stock bubble. Then when that collapsed, we got the real estate bubble and the housing-as-ATM “wealth effect.” All of that bought us 15 years, but it’s all gone. People are going to have to pay their mortgages every month with real earnings, while still taking care of basic necessities. I think many of these new buyers will default within a few years. Will the government then print another ten trillion dollars, and turn us into the Weimar Republic or Bolivia? It seems absolutely impossible that this will end well; it’s like covering a growing earthquake fault with a few wheelbarrows of sand.

People keep talking about buying houses (overpriced still) because it is a good hedge against inflation, however I don’t get how these prices stay the same given higher interest rates. For the life of me, I cannot see how it’s possible to keep prices where they currently are, let alone reinflate them.

It’s crazy…..

Is it 2012 yet?

It’s going to happen a lot sooner than that – in 3-4 years you will be talking about “back in the good old days” referring to 2008-09!

The great news about these no money down programs and the automated underwriting offered by the FHA is they tell you if you do not follow the guidelines you are discriminating and not following the FHA program guidelines. Then like my compnay who has offered these programs as a broker through FHA sponsered lenders and FHA sponsered underwriters, now that the programs do not perform, “Surprise”, and unemployment has grown, the loans originated by my company must be audited. No problem, they came in for a week and audited everything from operations to files and found nothing but admiration. Today at 10AM I am still required to meet with the FHA about having our rights removed because when following the guidelines and not descriminating our low income, rural community borrowers defaulted at a higher rate than the national average. FUNNY HOW THAT WORKS and now I must lay off my entire staff who acknowledged by FHA followed the rules!!

I have felt the impact of the California state budget problems through my kids’ elementary school and fear what is ahead if the budget gets worse. A few quick examples…for the past three years the kids have come home on the first day of school with a list of school supplies needed for the year. No problem. Except that the supplies are not for my kids, they are for the class as a whole to offset the costs to the school. The schools asks for a dozen glue sticks, stacks of paper, multiple sets of crayons, etc. This is a way for the parents who can afford school supplies to pay for the kids who have parents who cannot afford supplies for their own kids (or more likely, do not prioritize school supplies over their desire to eat out/smoke/drink/etc.) . I think this is ridiculous. I remember when I was in school, if you did not bring your own notebook paper, some would be provided for you but it was the crappy beige paper that would rip immediately when you tried to erase something. Why is that not the case now? Why am I paying for supplies for kids with degenerate parents? I already pay a shitload in taxes which more than take care of my share of the school budget. It pisses me off to know that the people who pay virtually no taxes are now taking another ride on my back through school supplies. And the kids are getting almost no homework this year. Why? Because the school is on a “paper budget”. Why doesn’t the school just give the kids textbooks and have them do math problems on a piece of notebook paper? Is it because parents cannot afford paper and pencils? Give me a break. But that is the reason I have been given by teachers at the school. They actually give the kids math homework with problems pre-printed on a sheet of paper to ensure that every kid has the tools to do work. Nice concept, but when the school cannot issue more than 5 minutes of homework because of budget shortfalls, all of the kids suffer. I fear for future when the products of the awful California school system are sent out into the world to actually earn a living. What is happening here?!?!

The Government has shown its hand and it shows it is NUTS.

The Government will do whatever it takes if the housing market remains weak.

Next possible plan, as crazy as it sounds, a mandate that forces all lenders to allow as much as 12 either consecutive or nonconsecutive late payments before a loan can be considered in default. . And if that doesn’t work, 24 months.

The question is, can a Government that controls the worlds reserve currency and can print that currency endlessly without repercussions (so far) control the entire u.s. economy?

I certainly wish I knew.

Robert have you ever think how expensive the wars are this days? We pay fair taxes, not very high, but instead of getting free schools (including the universities) and health care for everyone as in Europe we get wars. Think about it.

This is all a plan to introduce ameros to the citizens of the USA. Canada and Mexico are already on board.

Welcome to the United States of Delusion Comrades! The only way out of this Hall of Mirrors nightmare scenario may be to shatter the glass. This country does not respond to sane reasoning anymore (like Dr. HB blogs). It will take a crisis of such magnitude to bring us to cold, hard reality that none of us can fathom it. Think shock and awe. Of course, it doesn’t have to be this way but until we get the real “change we can believe in”, that’s where we’re going.

BTW, with all this talk of shadow inventory and bank shenanigans, how’s Freddie and Fannie doing with the $96B the taxpayers have forked over? I can only speculate that they are hiding their true losses just like everyone else except that they have the ultimate get-out-of-jail free card (taxpayers, I mean Chinese) ready to sop up the losses.

I agree. I have an 800 fico, purchased my home with a 30 year fixed. Very responsible. I am sOOOOO tired of seeing my neighbors who spent the past 6 years with cashout refis and buying 2 boats, motorhomes, seadoos, cars, etc. now living in their home without paying the mortgage for the past year. I thought i was doing right and when they were doing all these cash outs, I warned them that of the bubble. They worried for a couple of months and now laugh at me since they are living rent free, collecting unemployment which was extended and see me go to work. Congrats to me! I just officially crossed the 30 day late. I learned we just have to play this game because at the end of the day, they will bring back loans since there are so many foreclosures and provide credit to these people and we the responsible parties will look stupid once more. My friend decided to do the same thing. Nice having an extra $5K to spend every month. And I will ext. and do a short sale then rent for 2K/mo and wait for the financing for “us” bad credit people. Quite relieving I have to say!~

AhFiT

Good for you!

If only I was in the position to do something similar I would do it too. Unfortunately I cashed out of North Park in mid 2004 which now appears to be the dumbest thing I ever did, so far.

I guess putting 100% of my investiable money into precious metals and their stocks back in 2002 helps soften the blow.

We’re going inside the California Housing Bubble to see what really happened.

This tiny house in a gang infested area in the city of San Fernando was bought with this money from this bank.

Was the realtor stupid?…no…she made a commision.

Was the buyer stupid?…no…he received a loan based on a pin number without a real social security number because he is actually an illegal alien.

Was the seller stupid…no…she received 10 times what the home’s value is really worth and sold it to her cousin who was from El Salvador,

Was the appraiser stupid…no…she is the daughter of the owner.

Was the mortgage lender stupid…no he made a commision.

Was the bank stupid?…no…because greedy Wall Street Invesment firms bought up all the stinky liar loans and resold them as CDO’s

Was the Wall Street Investment firm stupid?…no…because they sold those loans as CDO’s.

Was the Federal Reserve stupid…no..they got the Government to bail out the big firms that were to big to fail with TARP money from tax payers.

Was the Government stupid…no…they had the U.S.Treasury print more money and the Feds laundered the money through Caman Island Banks to buy more U.S. Treasury bonds. So who is stupid?

Hey look…here comes a resposible white guy to deposit his paycheck in our branch in San Fernando…he must be stupid to continue doing business with us.

Why am I speaking with a French accent…because look at what America has done to it’s economy…you are all stuuupeeed!!!

When I sold my house in May I got several offers with FHA financing that would have had me financing the down payments in fact if not terminology so regardless what the official story is it’s still being done one way or another.

Our rental community in Colorado has been trying to buy in droves this year. It is ironic that the “credit” is to be paid back. Don’t think they know that yet!

Just an anecdotal note on purchase rates regardless of incentives vis-a-vis cash for clunkers. My family manages a car dealership which decided not to take part in cash for clunkers due to the paperwork and the loss of the trade-in sale. However, before the dealership decided not to participate, they had about 50 deals lined up under the program. As of last week, about 50% of those who were going to buy under cash for clunkers bought anyway–even though they could have easily gone down the street to the next dealer. My guess is at least half of the remaining half would have bought regardless. While you can’t generalize from the particular, its interesting that the gov’t is undergoing massive spending to juice the stats by what, 5, 10, maybe 25%?

The next leg down for housing won’t come until the 2nd shoe of the stock market drops…

This run from 6000 to 10,000 DOW in less than a year is ridiculous… and unprecidented.

We’ll have a huge stock sell off this year… What sane money manager will sit on 40% gains going into 2010? A huge sell off is coming… It might even be as dramatic as some of those 700 pt sell offs we had in march…

Leave a Reply