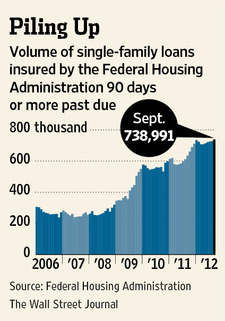

FHA inches closer and closer to bailout – 1 out of 10 of the $1 trillion in FHA loan guarantees is in default.

The bailout of the FHA is making its way here during the holiday season. As we’ve reported many times the FHA insured loan program was essentially a back door program of getting people into homes with ridiculously low down payments. FHA defaults were soaring to record levels as herd mentality buyers were entering markets to compete with flippers, foreign money, and Wall Street investors. Even with low interest rates FHA mortgage insurance premiums increased dramatically but the problems were already too deep. Essentially new buyers were footing the premium for all the nonsense loans made from 2008 onwards. So it should come as no surprise that the bailout is getting closer even though housing prices have gone up.

FHA bailout approaching

When the no-down crap casino loans stopped being made in 2007 the FHA ramped up its loans to all the broke Americans (aka little to no savings) still wanting to pursue the American dream of home ownership:

“(WSJ) The Federal Housing Administration is expected to report this week it could exhaust its reserves because of rising mortgage delinquencies, according to people familiar with the agency’s finances, a development that could result in the agency needing to draw on taxpayer funding for the first time in its 78-year history.â€

FHA insured loans were never meant to be such a large part of the market. Even in better times, FHA insured loans were 5 to 10 percent of all mortgage originations. Also, the mission of the FHA was never to finance $500,000+ homes in California. At its core it was a program to help lower income families into modest home ownership. Not a backdoor subsidy of keeping the bubble inflated. Since 2008 they were making up 25 to 30 percent of all loan originations:

“Though the agency guarantees fewer mortgages than either Fannie or Freddie, it now has more seriously delinquent loans than either of the mortgage-finance giants. Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from a year ago. That represents about 9.6% of its $1.08 trillion in mortgages guaranteed.â€

What a shocker. Massive government subsidies to people that can barely scrimp up a 3.5 percent down payment. Here in California that 25 to 30 percent figure also played out since 2008. In other words, in an inflated market people were leveraging up with FHA insured loans just to compete with flippers, Wall Street investors, and big foreign money. Yet the problem is that these people really did not have the ability to handle their loans and that is why the FHA is nearing a bailout. Align this with the Fed and QE3 and you can see that we are still missing the point. People are using massive amounts of debt to make up for lack of savings or actual production. We ran the numbers on a rent versus buy analysis and you can see how strained many in California are when you examine their budgets.

Now people argue that the loans that are going bad now were made in more frothy times. Yet that is the issue even with all the other toxic loans. We have paid for this and will pay for it. Look at the Fed’s balance sheet and you can see where most of the junk loans landed. Banks are still holding on to large mortgages that are in default but are simply not moving on them. The government and banks largely operate in a private-public partnership and ironically the working and middle class have shouldered the biggest part of this burden.

This is what happens when you condition a market to easy money. So now, the market is conditioned on the following:

-Low down payment – step in the FHA

-Low interest rates – step in Fed with QE3

-Investor buying – about 25 to 30 percent of all purchases for the last few years

-Foreign buyers entering frothy markets with hot money

The “organic buyer†is largely a small portion of this other subsidized and hot money inflows. Even with all the bailouts and home prices moving up the FHA is reaching closer and closer to a bailout as we approach a fiscal problem (that is we will need to raise revenues or cut – a combination of the both is more likely). Again, household income growth is weak and all this additional leverage is hiding the fact that things in the economy are still fragile yet the banking system is built on massive debt and we can’t let things go off the rails before Black Friday right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “FHA inches closer and closer to bailout – 1 out of 10 of the $1 trillion in FHA loan guarantees is in default.”

Sometimes we get what we deserve, sometimes it’s much worse than that…..

740K deliquient sure is a lot of deadbeat borrowers, but in percentage terms 10% overall doesn’t warrant panic, does it? Even the Snap-On guy assumes at leat 10% of his customers will burn him.

I think it’s like this. If you lose 10% of your profits you still have 90% so life is good. But an agency like the FHA is a non profit and losing 10% of operations or gross income won’t cover paying the bills. Compare it to a property rental. If you 10% short you can lose control of the property. And in this case the money has to come out of an already deficient budget – the funds of the US Govt.

LOL. If 10% of all Wal*Mart shoppers stopped shopping at Wal*Mart, Wal*Mart would be in a world of serious hurt. Profit margins at most big box retailers are in the low single digit range. A 10% loss is untenable.

Correspondingly, profit margins at mortgage holders are also in the low single digit range. A 10% delinquency for FHA means FHA goes belly-up.

That is no-way to run a bussiness Son!! Very risky to opperate on such tight margins!! 10% should be noise. I wouldn’t take that bet: I guess that is why I am not in biz for myself, risk-averse/working for the maan. That might be the bigger gamble when TSHTF?

Shut down the program.

Shutting down the FHA program is not an option because post-October 2008, the entire purpose of the FHA is to inflate the pool of prospective buyers and create artificial bidding wars. The difference in purchase price between foreclosures and non-foreclosures is materially insignificant in 2012 (and 2011) due to the flood of FHA qualified buyers preventing price discovery from happening.

The FHA post-October 2008 is not about getting entry level buyers into their first home. The FHA post-October 2008 is about setting a price floor in mid-tier markets by flooding the market with FHA qualified buyers. Eliminating the FHA means an instant price plunge in the desirable mid-tier areas. The Federal Reserve and the banking cartel will fight this tooth and nail as this will decimate their balance sheets.

The FHA will be bailed out because the FHA post-October 2008 has been a safety valve for the mid-tier housing markets. Otherwise, we’d be seeing median SFR prices plunging to the $350k range for Burbank, Torrance, Pasadena, Cheviot Hills, Culver City, Sherman Oaks, Glendale, Encino, Irvine, Costa Mesa, etc, versus the current SFR $700k+.

I have to question this philosophy. What you are saying is that price fixing is a good thing.

You’re saying that without the mighty FHA, prices would fall to lower (fair market) values. And that would be an inherently bad thing… For who? Not for the people that want to buy homes, I can assure you of that.

How can you possibly think that you, the FHA, or any other bureaucratic government agency can better dictate the “fair” price of the housing market?

http://www.thecashflowisking.com

I was going to mention that politicos like Frank and Schumer played a big part in this Casino – Royale scenario, but sooner or later the trolls will show up and blame it all on Booosh.

You just did. Mention it that is. And troll. Rather clever but so what.

“So what” is that the Manchurian Incumbent managed, with 100 percent backing from his allies in the MSM, to win the election by blaming our present miserable economy, the result of 4 years of illogical, unworkable union favoring schemes, on former President Bush, who left Office Four Years Ago!

Blaming someone has little effect if it can’t be verified. These days people can, and did their homework and determined the Bush administration was the guilty party. Even the most ignorant of citizens can figure out when the housing market bubble and burst occured. Then there are some completely willfully blind idiots. Fortunately there weren’t enough of them… this time. But this country grows ’em like weeds down South and in the Midwest. Whites on welfare voting against social programs. You’ve got to love it!

Please provide proof of your conclusions, Cat – and also please show your work.

Cat – “Even the most ignorant of citizens can figure out when the housing market bubble and burst occured.”

The housing bubble started in 1997. Who was the president then?

The chickens will eventually come home to roost and patience is almost always rewarded.

I suspect most SoCal FHA buyers are taking a strictly monthly payment perspective to the home buying process. It should be no surprise in a region where the dominant culture is to try to convince others that you’re something more than you really are. It’s the leasing lifestyle.

What these folks don’t seem to take into account is that even though the monthly payment is reduced due to the current low rates on higher prices, the liability is increased. Smaller monthy payments don’t lower taxes, insurance and other costs based on the property price.

Increasing mobility requirements and stricter bankruptcy rules make the risks of buying much higher today than they were before. The higher the price of the home, the more of an equity position you need to make up for the transaction costs when it comes time to sell. With the trend of decreasing employment stability, it’s just that much more likely one may wish to sell sooner than later. This is especially prevalent in SoCal where the best job opportunity would mean an unreasonable commute without moving. Should life happen to a point where you have to file for bankruptcy and given Chapter 7 means testing, it’s also more likely that one is forced into paying on a foreclosed home.

Some of these buyers might point to a rent to buy ratio argument in order to justify a purchase from a financial perspective. While I find these claims to be highly location dependent and usually not taking into account total costs, they can only take into account where rents are today. Rents can fall, but the purchase price of the home is static and interest rates are the closest to zero that they’ve ever been.

The main difference between today’s SoCal housing mania and that of a few years ago is that the banks have better secured their positions. The borrowers have not.

I meant “could mean an unreasonable commute”, not “would”.

Hey Joe. Nice post. Made me think about that bankruptcy. While the avg joe got hammered with the new bankruptcy law (passed with a puuush by booosh if I recall correctly) the big banks got a pass bankruptcy card out of the suspension of mark to market and govt bailout money.

It’s tough to loose in ‘business’ when you can print money, buy both sides of the isle, and own the media.

You are correct in that law being pushed by Bush – it was one of a number of policies I had severe disagreements with on his watch. The big banking interests were all in regarding that law, and anything they’re all in about I’m immediately against. Someone responsible in our congress should bring about the idea of a full reinstatement of Glass – Steagall, but I’m not holding my breath – time to break them all up and start an honest accounting and initiate the free market in the financial sector.

“While the avg joe got hammered with the new bankruptcy law (passed with a puuush by booosh if I recall correctly) the big banks got a pass bankruptcy card out of the suspension of mark to market and govt bailout money.”

Yeah, except for lehman, bear stearns and washington mutual, and most of the companies that were creating mortages during the bubble. They all got wiped out.

I know this is late to reply to your comments but I’ve been away for the holidays. You know all that cash piling up from the bailouts. Taxee your point is sound but your spelling or grammar not. Loose is what happens to nuts. Lose is what happens to…. well…. us when they can buy both sides of the isles. This internet spelling amazes me in such a sports nuts culture. Remember, the Chargers lose the bankers loosen your grip on your money.

Rumble do not forget that banks still running on empty include, BofA, Wells, City and Chase.

http://libertyblitzkrieg.com/2012/11/15/the-fha-is-blowing-up-bad-news-for-the-housing-market/

The FHA is Blowing Up: Bad News for the Housing Market

November 15, 2012 by Mike Krieger

“A very important article came out from the Wall Street Journal yesterday titled “FHA Nears Need for Taxpayer Funds,†and it outlines the serious financial problems facing the Federal Housing Administration. For those that are unaware or need a refresher, the FHA has been the key element to the phony “housing recovery†the government has been trying to create. In the wake of the collapse of 2008, Fannie Mae and Freddie Mac blew up and what was left to pick up the pieces was the FHA. No private player would issue loans with down payments of 3%, but this was no problem for the FHA!

Interestingly enough, a lot of the subprime borrowers that blew up the housing market the last time became the primary customers of the FHA. Let’s see, 3% down and subprime borrowers…what could possibly go wrong?! …

This is a big deal. The FHA is already in trouble despite a miraculous “housing recovery†and we haven’t even hit a severe cyclical economic slowdown yet, which is almost certain to occur in 2013. What shambles do you think the housing market will be in once that happens and the last backstop to housing is broke? You can kiss this “housing recovery†goodbye. I think home prices nationally could fall 25%+ from here.”

We are entering the 7th year of falling home prices… Are further drops possible.. sure. But betting against housing now may not be a safe bet. Housing has taken a beating like no other asset class in the past 7 years. With our current debt levels and low interest rates… massive inflation is inevitable. While housing won’t keep up.. it won’t lose as much ground to inflation as the US dollar.

Also rents are moving full-steam ahead.. So a 30 year 3% fixed mortgage vs. a very similar monthly rent payment makes buying a pretty rosy scenario.

We could rent our place out and easily cover our entire PITI…

If something happens that forces rents downward.. Then all bets are off for housing. But I haven’t seen any sign of falling rents in the LA area. Rents are actually at all time highs in history.

There should be a law to protect honest buyers who are actually trying to buy a home to live in against all these big-money, all-cash investors and flippers. Perhaps a law should be passed that these sold homes cannot be resold again within 3 years of its sold date… and if it does, there should be a heavy fine or the house has to be resold for the same price that it was bought at.

I have given up trying to buy a house. Why? Well, majority of the time, I lose out to an offer that is paid in all-cash and for less then what I offered. And within 6 months that same house is back on the market for $100,000 more. WTF? This is happening too often for me… and what’s even worst now is that my agent is telling me that I lost my bid to a cash offer athough there were 50+ offers as well. This is insane.

Well, my tax guy did once tell me… when the herd is running one way… the smartest way to do is… run the opposite direction!!!

KEnX,

It’s super irritating for sure, what has become of the plight of reasonable shelter-based buyers. As has been mentioned to death, the banks and by extension the government, have went to extraordinary lengths to create the conditions we currently face. Combine that with hoards of owners in negative equity positions unable to sell and investors seeking returns.

The market is telling you something when those offers don’t get accepted. It’s still not a good time to buy.

If you haven’t figured it out yet I’ll clue you in: The new corrupt FIRE sector doesn’t want you to some day own your own home. The fix is in. They exist to serve themselves at the expense of everyone else.

I don’t think it’s as calculated as that, for the most part. I think simply, certain people are making lots of money, and with it gaining more power. They see it’s working for them. They are in control of policy-making and their power to do so grows, so they continue making policies that work for them.

I have heard that this seems to be a common practice amonst crooked realtors and friends. I agree with you. My husband and I are in the same boat

KEnX – “Perhaps a law should be passed that these sold homes cannot be resold again within 3 years of its sold date… and if it does, there should be a heavy fine or the house has to be resold for the same price that it was bought at.”

I understand your frustration and am in the same boat you’re in (given up on buying in Cali for the most part), but who is going to police people’s intentions? I owned a home for less than 3 years once. I had to sell it quickly due to job loss and for less than I paid. Should I have been fined for “flipping”? What needs to happen in my opinion is the end of government interference in the housing market and the end of preferencial accounting rules for the banks. Make the banks mark their assets to market and realize the losses. With the current exception to proper accounting rules their financial statements are garbage.

I wonder how many of these people with already questionable credit bought these homes with the intent of making a few payments, then just stopping knowing that they could live rent free for 2+ years. It wouldn’t surprise me at all if that was the plan for some of these buyers from the beginning.

So flippers aren’t a sign of a healthy, booming housing market?

Who knew?

Bingo.

And remember the prices in 2009 and 2010 were lower than now and 10% of them are delinquent. The loans being made now are even at a higher price. Just we just wait for this bubble to pop….

It would be hard to believe that renting the California Lifestyle would be available with an FHA loan. My guess these are lower income individuals, younger couples, first time home buyers, single parents and low end flippers. People have to quit blaming politicians, banks for their uninformed decisions. Put on your big boy pants and do the math.

I’m not sure about lower income folks. At least in SoCal, the prices are still unreasonable and out of reach for those without income to qualify, even for FHA. My bet is on younger couples and first time buyers with middle class income and marginal savings.

When one examines the stock of junk that’s available in SoCal for these prices, the FHA buyers leverage to the max level because anything less would make an apartment look more reasonable and their emotional driven anxiety over “ownership” takes over.

This creates a self fulfilling thought process which eschews overall financial prudence and focuses solely on monthly payment.

It’s all about finding the rubes and using them to generate commissions and insurance payments followed by insurance payouts backed by government printing then confiscating the properties and transferring them to the ‘right’ investors. A scam a banker could love.

I think that some are gaming the system, but I don’t think it is all that many. Why? It has to be your primary residence or else you are on the hook for the foreclosure taxes liability (and I think they can do a judicial foreclosure making you owe the money). I just don’t see that many households (primary residences) would take this risk of putting 3% down (say, $15,000 on a $500K home) and hoping they get to live there more than a year to make it worthwhile. Just think of the angst you’d go through.

I meant to add also that I think those who are buying the homes pretty much are banking on the continued policies that favor the banks and keep the risk of losses low. I presume they have a bit of an inside track to know where to buy and what to buy. So I think it’s mostly investors buying them.

According to the Dr, it’s been roughly 1/3 Jumbo, 1/3 FHA, 1/3 Cash

I woke up this morning to a quite house, broken bottles, dirty floors, half empty cocktail glasses, several random people sleeping in my living room, and even someone sleeping in the garage. A chair in the orange tree and the smoldering fire in the backyard, the refrigerator empty and a sink full of dirty, filthy dishes.. Now it is raining, not fully remembering the activities of the night before, I sat to read this article from my cell phone, I encountered the frustration of the capital one add popping up constantly. My sticky finger and cell phone combination could not alleviate the add. Along with a semi pounding headache and the daunting task of cleaning up after so many party goers, I went and got my laptop. Having been following this blog for sometime, this article seemed to affirm what we could all expect is going to happen. Still a prediction, but pretty obvious the FHA is going to have to be bailed out. Oh, my, as my head pounds, the thought of another government bailout, all from my hard earned dollars adds even more to the frustration I feel this morning. As so many were so pissed about the initial bailouts in the past, as I was, and the failing economic policies of the government, yet we still keep electing the same clowns. Not to mention how our personal liberties are being stripped from us, with so many people wandering around complaining the we should be more like Canada and readily accept having their liberties stripped because the government knows best. Now Texas wants to secede and the FHA is collapsing.

Well, it is just too much to think about. There could possibly be a huge backlash by the actual taxpayers toward the government due to more bailouts, we could only hope. But in the meantime, as we sit on this ship that has impacted the ice berg full on, we look on, like the band on the deck playing a last concerto. The question would be then, when do people wake up and start to bail? In the mean time, it is time for a drink to cure this headache. Or maybe I will just go back to bed.

There can no be bailout unless the Congressional Republican (tea party) agrees to it.

It will be interesting.

Jack I really like your comments.

As I see it , and as I asses the people around me, the majority of the people that are living in America want little more than a check from the government and are willing to sell pretty much anything to get one.

Oops I meant assess. Anyway Jack, that seems like you had one hell of a party last night.

Nothing to see here folks. The FHA will get their bailout and your kids and grandkids will pay for it. If you read the MSM headlines, we are in a recovery…although fragile. What politician would want to derail that now. Just have Ben wire over the money and all is good.

We live in a bizarre financial world today. To thrive or even survive you need to change your financial perspectives.

@lord Blankfein

“Nothing to see here folks. The FHA will get their bailout and your kids and grandkids will pay for it.”

Our children will not be paying back the federal debt!

From Warren Mosslers “7 deadly innocent frauds”:

So I then asked him the following questions to hopefully

illustrate the hidden flaw in his logic: “When our children

build 15 million cars per year 20 years from now, will they

have to send them back in time to 2008 to pay off their debt?

Are we still sending real goods and services back in time to

1945 to pay off the lingering debt from World War II?â€

Of course, we all know we don’t send real goods and

services back in time to pay off federal government deficits,

and that our children won’t have to do that either.

Nor is there any reason government spending from

previous years should prevent our children from going to work

and producing all the goods and services they are capable of

producing. And in our children’s future, just like today, whoever

is alive will be able to go to work and produce and consume their

real output of goods and services, no matter how many U.S.

Treasury securities are outstanding. There is no such thing as

giving up current-year output to the past, and sending it back in

time to previous generations. Our children won’t and can’t pay us

back for anything we leave them, even if they wanted to.

Nor is the financing of deficit spending anything of any

consequence.

Someone has to pay it back and TPTB are conveniently kicking the can down the road…so yes, your kids and grandkids will be on the hook for it. Since I don’t have any kids, status quo it is.

Mossler is kinda right, but not really. Cars won’t be sent to the past, but they should be sent to the (foreign) creditors to whom the debt is owed. Or some of the cars won’t be produced because the economy is corrupted by excessive debt. Either way, the middle class will have a lower standard of living thanks to the debt.

@howdy there

“Mossler is kinda right, but not really. Cars won’t be sent to the past, but they should be sent to the (foreign) creditors to whom the debt is owed. Or some of the cars won’t be produced because the economy is corrupted by excessive debt. Either way, the middle class will have a lower standard of living thanks to the debt.”

They have dollars that are not convertible into anything. The cannot demand a set amount of gold or silver for them. All the government promises is to accept them as payment for taxes due. They can get whatever if offered for sale by someone an whatever price that person wants for the item.

hey rumble,

They can’t convert the dollars into gold like in the past, but they can compete with american buyers for american goods (such as houses). And of course, increased competition for goods means higher prices. Higher average prices without increasing incomes means a lower standard of living. If you’d like further detail, I’d refer you to an excellent reference called our currrent situation.

@howdy there

“They can’t convert the dollars into gold like in the past, but they can compete with american buyers for american goods (such as houses). And of course, increased competition for goods means higher prices.â€

They can but they are not. If they were competing with American buyers for goods we wouldn’t have a trade deficit with them would we? The trade deficit tells you that they are saving the dollars and not spending them.

Our current situation is that foreign money is competing for house sales and that is causing a shortage of homes for sale and is driving up home prices? When I look around I see a housing industry that is pretty much still decimated.

“Higher average prices without increasing incomes means a lower standard of living. If you’d like further detail, I’d refer you to an excellent reference called our currrent situation.â€

Real labor wages have been stagnant since the 70’s and prices are higher now. Is our standard of living lower now than it was in 1975?

Buying a house has become like buying a used car for most people. Little down, smaller monthly payments, interest only, whatever it takes to get you to take the keys. Throw in investors and flippers and you have a repeat to the last housing bubble. It ends the same way but only worse as now the gov’t instead of the banks is on the hooks. Bernanke is the biggest crook to come along since……. Greenspan. Desperate measures for desperate times. If you buy now during the current obviously manipulated market, it is your own fault, once the crack in the financial dam begins to break..AGAIN.

All the signs are there if you open your eyes.

http://www.westsideremeltdown.blogspot.com

late summer, you may be right.. But you look pretty foolish this year. Cherry picking falling home prices and short sales. The majority benefit from flat or rising home prices.. The majority win come election time. The electorate will protect the majority voters.

This is America…we have no intention of paying down the debt–it’s just numbers. The rest of the world is doing it too. It’s like the Matrix–hard to tell the real from the virtual. There is an end to this and there will be a lot more losers than winners. They used to at least act like they had a formula for housing. It’s taken on a life of it’s own and to tame the beast will cause financial devastation…no easy solution.

“This is America…we have no intention of paying down the debt–it’s just numbers.”

What is particularly shocking is the actual size of the annual budget deficit. The headline number for the last four of five fiscal years has been in the neighborhood of $1.3 trillion per year. But that is the cash deficit.

If you use GAAP accounting, which businesses must use, the fed ANNUAL deficit is over $5 trillion. The difference is the under funding of federal and military pensions, social security and medicare trust funds, not paying interest on the under funded portion, etc.

Therefore, with the annual deficit well over 30% of GDP, a hyper inflationary tsunami will be washing up on American shores in due course, perhaps within a year. I’m not sure about houses, but just about anything tangible will sky rocket in terms of the rapidly depreciating dollar. Over the last couple of years, as the European Union has slid toward anarchy, the dollar has gained very little ground versus the Euro. Does that not say it all?

Will I be able to sell my TANGIBLE car for Million dollars and pay-off my mortgage with the proceeds??

Jason, I think you’re bang on for both the size of the deficit being insane, but also understated.

However, I wouldn’t try to time the disaster or assume hyperinflation will be the outcome. People’s inability to recognize the looming disaster, or desire to overlook it, combined with political will to hide it could stretch the wait for much longer than seems possible.

Also, I’m estimating 30% chance of deflationary spiral, 70% chance of hyperinflation.

@dark ages

Why would we pay off the debt? You are are confusing personal debt with federal debt. They are not same.

http://www.rooseveltinstitute.org/new-roosevelt/federal-budget-not-household-budget-here-s-why

http://resourceclips.com/2011/02/15/government-debt-is-not-like-household-debt/

@dark ages

More on federal debt from warren mossler:

“Any $U.S. government deficit exactly EQUALS

the total net increase in the holdings ($U.S. financial assets) of

the rest of us – businesses and households, residents and non

residents – what is called the “non government†sector.

In other words, government deficits equal increased “monetary

savings†for the rest of us, to the penny.

Simply put, government deficits ADD to our savings (to the

penny). This is an accounting fact, not theory or philosophy.

There is no dispute. It is basic national income accounting. For

example, if the government deficit last year was $1 trillion, it

means that the net increase in savings of financial assets for

everyone else combined was exactly, to the penny, $1 trillion. (For

those who took some economics courses, you might remember

that net savings of financial assets is held as some combination

of actual cash, Treasury securities and member bank deposits at

the Federal Reserve.) This is Economics 101 and first year money

banking. It is beyond dispute. It’s an accounting identity. Yet it’s

misrepresented continuously, and at the highest levels of political

authority. They are just plain wrong.”

Hi Rumble–Unfortunately, you and your source are incorrect. The issuance of USA Treasury Bonds by our govt., many of which are purchased by our quasi private Federal Res. Bank, is check kiting game, nothing more or less. Here’s how it works:

The Federal Reserve Bank creates money (dollars) out of thin air. It then uses this ‘out of thin air’ money to buy freshly issued Treasury Bonds. So fed’s balance sheet shows an asset, the Treasury Bonds, and a liability, the ‘out of thin air’ dollars it just created.

The USA Dept. of Treasury shows a liability, the bonds it sold to the fed, and an asset, the dollars they just got from the fed. So now, the USA Federal Govt. has money, (dollars) that they can spend on real world goods and services. But no work was done to create those dollars. Remember, they were conjured up out of thin air buy the fed.

So, we getting a constant increase in the money supply, which is inflation. This is why we have these asset bubbles forming all the time, such as the housing bubble that is the main topic on this blog. The main problem with these asset bubbles is that they lead to misallocation of capital. So you end up with gluts, in this case a glut of houses. A decade ago it was a glut of worthless dot-com stocks.

You should quit reading Mosler. He’s being deceptive, probably to make govt debt seem more acceptable.

It’s true that government deficit spending does create a debt on the govt books and an asset for the beneficiary of government spending, but it’s only a ‘net’ increase if you don’t include the govt debt in the calculation. The undefined term ‘everyone’ is key. By counting every debt and asset except govt debt, then he can claim that the only ‘net’ increase is due to govt debt.

If you redefine ‘everyone’ to include govt and thus include their debts in the calculation, then net savings is 0.

@Jason Emery

“Hi Rumble–Unfortunately, you and your source are incorrect. The issuance of USA Treasury Bonds by our govt., many of which are purchased by our quasi private Federal Res. Bank, is check kiting game, nothing more or less. Here’s how it works:â€

I’ll make sure to tell him how incorrect he is, but I do have some questions/observations:

“The Federal Reserve Bank creates money (dollars) out of thin air. It then uses this ‘out of thin air’ money to buy freshly issued Treasury Bonds. So fed’s balance sheet shows an asset, the Treasury Bonds, and a liability, the ‘out of thin air’ dollars it just created.â€

Yes, when the government spends money, it is creating it out of thin air. And when the federal government taxes it destroys money, or “uncreates†it. The federal government cannot run out of dollars. It neither has nor doesn’t have any dollars much like the scorekeeper in a poker game does not have any points.

“The USA Dept. of Treasury shows a liability, the bonds it sold to the fed, and an asset, the dollars they just got from the fed. So now, the USA Federal Govt. has money, (dollars) that they can spend on real world goods and services. But no work was done to create those dollars. Remember, they were conjured up out of thin air buy the fed.â€

Yes all money is created out of thin air by either federal government deficit spending our when banks make loans. How else would money be created? How does work being done create dollars? In the private sector if I work for my company for two weeks I get a pay check. But my company has not created the money to pay me, it can only pay me with money it has earned from other peoples spending. My income is from someone else’s spending and my spending will become someone else’s income. A private citizen or company cannot create money, that would be counterfeiting.

â€So, we getting a constant increase in the money supply, which is inflation. This is why we have these asset bubbles forming all the time, such as the housing bubble that is the main topic on this blog. The main problem with these asset bubbles is that they lead to misallocation of capital. So you end up with gluts, in this case a glut of houses. A decade ago it was a glut of worthless dot-com stocks.â€

Doesn’t a growing economy need a growing supply of money? Our population increases by 2 million people a year, don’t they need to purchase stuff in the economy? Isn’t there more stuff that can be purchased today than there was 5 or 10 years ago? Our trade deficit is 4% of GDP, if the government does not run a deficit that matches then the private sector will not be able to purchase all of its output. If the private sector desires to save money where will it come from if the government does not deficit spend?

How can government spending create inflation if we have millions of unemployed people and a huge economic output gap? If we had near zero unemployment and our factories were running at capacity and then additional government spending could create inflation. But we are no were near that point.

So the housing bubble was caused the government increasing the money supply too much? Wow, never heard that theory before. All this time I thought it was caused by banks or sorta banks like countrywide that gave out home loans to anyone that could fog a mirror. Or a real bank like Washington Mutual:

WaMu made billions of dollars’ worth of loans with only “limited documentation” of the borrowers’ income, net worth or credit history. Such loans — often called “liar loans” or “NINJA loans,” for “no income, no job or assets” — make up three-quarters of its $58.9 billion option-ARM portfolio.

Zero down loans are back in full force adding to the problem of :”hot money” flowing in from overseas. The solution is a tax on all second, third etc houses as well as a tax on this laundered money moving in from places in Asia.

Realtors are fond of saying, “all RE is local.” That’s true now. Property values are still sliding fast in many sections of the country due to wage stagnation and joblessness. Too bad the FHA losses are passed onto innocent middle class people.

I hate to rain on the parade of optimism about real estate, but if you are watching closely, The new Democrat super majority in Sacramento is “reviewing” repealing prop 13 as it applies to commercial properties.

Commercial properties are residential properties over 4 units as well as store and industrial properties.

make no mistake prop 13 will be repealed by the Democrats and then incrementally raised and expanded. Properties affected will devalue proportionally to match increases in property taxes.

As the assessed property values decrease due to the added tax burden associated to the repeal of PROP 13, and the tax collections in the future will fail to meet expectations, the repeal of prop 13 will no doubt be expanded to residential properties. This will of course all be sold to “help the Schools”.

Renters of course will not escape, as owners of residential properties will raise rents to compensate for the added tax burdens.

Look out below!

Good points Greg. Reminds me of the late 1980s when Congress revised tax laws concerning real estate. My RE sunk over 35% within one year as taxes were imposed on RE investors. The deficit forced Uncle Sam to search for funding and right now RE is a fat cow waiting to be milked.

About time they stopped CORPORATE WELFARE! Prop 13 was sold as to not put old ladies out on the streets, but in reality, the corporations use this loophole to transfer company holdings and AVOID the tax. We SUPPLEMENT major money makers like Disney…who don’t need a dime of taxpayer money.

One day people will pull their heads out of their collective a$$es and realize that without PEOPLE, there is nothing…no corporations, no jobs, no good, no nothing. The middle class is just about eliminated because unions are almost gone….yet unions are still demonized. You all get EXACTLY what you deserve and that is too kiss the a$$ of the elite rich plutocracy. You and your children will get less and less and live under the new american austerity…..and the only thing you will give a shit about is a 300 lb woman on Dancing with the Stars. Yea…like someone said the other day..”Wal-Mart rescued America”. LOL, I quit voting….YOU are too blame for our corrupt system. Yes, you and your parents and all of you who vote for them. Reap what you have sown.

Prop 30 passing just when about half way towards balancing the budget. And they have a $100 million dollar train to build.

Yes, as income falls, govt will be going after other sources for revenue. Transactions, real estate, wealth holdings…you name it. Can get blood from a turnip. Listen for it. You can almost hear it coming.

Agreed. Both the Federal Gov’t and the state of California will be pursuing revenue by any means possible. I would even add to your list of “transactions, real estate, wealth holdings” with things like speeding tickets, seat belt tickets, large sugary drink fees, permit fees, doctor’s visit surcharge….who really knows. You can definitely hear it coming. Pay off your debts and hide what assets you can, as soon as you can.

spot on post, the court ruling on heathcare being a fee not a tax is the death-nail. impose a new fee, collect the new fee, if you want to fight the fee we the people have to file a class action lawsuit. ice-berg right ahead…..

Joe, I am curious why you advise we should pay off debts as soon as one can. Is it because you think the economy is going to get worse and people won’t have enough money to make the payments or is it because you think interest rates are going to rise drastically.

If hyper inflation happens won’t that make debt much less of a problem?

Please explain your thoughts on paying down debt ASAP.

Greg- I’m in the camp that interest rates will not rise dramatically anytime soon. Second, servicing debt obligations can prove difficult if things get worse, especially if your creditors are part of the banking/government/union cartel.

If things get a lot worse, I certainly don’t want to owe any institution money. If things don’t get worse, I gave up a little leverage, so what.

Joe, thanks for clarifying that.

I agree with you. I’ve been trying to downsize my expenses for a while now. I bought a house cash early this year, just so I didn’t have to keep paying the $1900.00 in rent that I was paying.

It’s now almost November and the part of the entertainment industry I work in is really slow. Which is strange because we are always busy around the Christmas season.

I’m glad that I’m not paying rent anymore, and it does help me survive when work is slow, but it’s nerve wracking when I see the State government on the move to repeal Prop 13. It’s going to make it a lot harder when the government starts to shake me down for more money.

I don’t know if we are being impacted because of the Obama health care laws, but I’ve never seen the industry this slow around Christmas, ever.

I’m sorry I’m so pessimistic about the economy, but I really do believe things are about to get much worse.

I think a lot about what to do with savings. They aren’t earning anything. If I wait, will inflation reduce the purchasing power to nothing or will deflation help cash value ? Do I build and keep an emergency 6 month reserve ? Do I pay down $50,000 in student loans that are at 6.5% for some god-awful reason when other money is 3% (the Department of Education will not let you “refinance” to get a lower rate) ? Do I buy a house when all the price pressure seems downward long term ?

I consider a house an “asset” only when it saves me money vs. renting, in terms of saved cash flows. It happens that dumping money into it further reduces the monthly cost, but that is only worth it when the equity isn’t going to get eaten up by further declines. And so we are back to the “monthly payment” mentality.

It can also be treated like an option – price drops too far, bail. Except that if the monthly payment is lower than local rent the incentive is lost to bail especially if you are on the hook for the write down (post-2012 relief gone?). But then again you get a tax bill for only a % of the write-down and you can negotiate with the IRS. An FHA loan is like a smaller option premium then isn’t it ? When people lose this bet, the government (and thus people in general) is footing the bill.

Does having a house allow one to respond to inflation OR deflation ? I’m trying to figure that one out. Assume you are sitting on cash reserves and then suddenly it becomes clear which way it’s going. Either you dump $ into the house, or you sit on your cash reserves. I think in either case basic goods have to increase relative to housing as a % of the budget – representing the fact that the real value of housing is lower than the nominal value we keep putting on it. Having the house gives you the option to convert cash into something else, but many people would argue you can just buy gold or something to get the same effect.

It’s a pretty confusing world now. All of these shell games are nothing more than wealth re-allocation (including printing money or the equivalents), and I think I am going to lose whether I play or not. Why not just write down the houses and keep the original owners ? Oh that’s right, commissions. The more people fail, the more the houses churn, the more $ is extracted. Socialize the losses. Can we hurry up and produce something of real economic value already ? That’s the only way for a country to work itself out of debt. Very frustrating watching this happen.

I agree it is confusing. There are no rules to follow anymore. The only thing I can think to do is do a little of each. Pay a little extra towards the highest interest loans, but not too much. Minimize expenses. Put a little into low interest, no risk CDs, a little into gold/silver, and a little into a blue chip company stock that pays dividends. And hope and pray real hard for 13+% CD rates, like we had after the S&L crisis.

I’d sure be happy with 3% on a CD right now and if it occurs, you can bet I will be investing in them. If rates keep increasing, I will pay the 90 day interest penalty and move to a higher paying CD.

Leave a Reply