FHA insured loans filling mortgage void left from toxic mortgage lenders. Serious delinquent loans at 9 percent while FHA insured loans pass Fannie Mae and Freddie Mac in Q1. FHA a loan for non-savers.

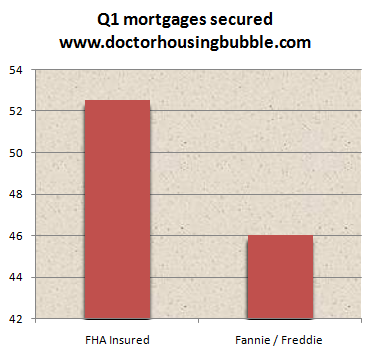

The housing market is sick. At least that is what is being said by David Stevens who is the FHA agency head. FHA insured loans have been an enormous problem and it is simply another wreck coming down the highway. The reason FHA loans are problematic is that they rely on an absurdly low down payment. Most can get by with 3.5% down payment and contrary to housing cheerleaders, most people purchase with as little as possible if they go with FHA insured loans. After all, if you had 20 percent down why would you want to take on a loan that had added monthly costs including PMI? But this is where the housing market is today. In fact, probably for the first time in history FHA insured loans were a bigger part of the market than dubious Fannie Mae and Freddie Mac:

*Billions of dollars

For the first quarter of 2010, FHA insured loans backed $52.5 billion in home mortgages while Fannie Mae and Freddie Mac combined backed $46 billion. This made up 95% of the entire mortgage market. So much for banks lending out their “own†money (which is our bailout money) and having faith in the American consumer:

“(Business Insider) This is a market purely on life support, sustained by the federal government,†he said at the Mortgage Bankers Association conference. “Having FHA do this much volume is a sign of a very sick system.â€

The FHA, which backs loans with down payments as low as 3.5 percent, insured $52.5 billion of home-purchase mortgages in the first quarter, compared with $46 billion of purchases of the debt by Fannie Mae and Freddie Mac, according to data compiled by Washington-based Potomac Partners.â€

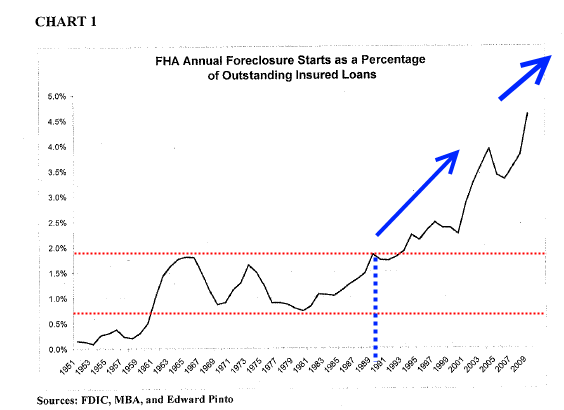

So it shouldn’t be a surprise to anyone that default rates are soaring for FHA insured loans:

Most recent data shows the “serious default†rate up to 9 percent. This is extraordinarily high. This is a market that averaged between 0.5 percent and 2 percent for nearly 50 years and we are still near peak levels of distress. Yet what do we do with this information? Instead of addressing the obvious problems, we step on the gas and decide to rely on these government backed agencies to do the dirty work of the banking industry. It is the perfect silo structure.

How do the FHA and Fannie Mae and Freddie Mac play into the banking industry silo? In a way it is the perfect crime. Banks are essentially borrowing for free from the Federal Reserve and as the recent volatility on the stock market shows, gambling and making big bets. If you look at the Q1 reports and the massive profits for banks, most of this came from their investment bank units (i.e., their high roller tables). These banks have been losing money on their lending to the public divisions on mortgage loans and credit card loans for example. So right now, banks are essentially pushing off mortgage debt that is basically guaranteed by the government (95% of the market). They are unwilling to lend their own money when they can gamble with taxpayer money on the stock market and make more this way. So the only home loans they will make are those they can push off to the government.

This again puts us in a precarious position of having another bailout in the short-term. Yet the remedies are so obvious. If the government is the mortgage market, they should be able to put in rules since they are the only lender out there. What have we learned from the years of this housing mess?

-No or low down payments are a bad idea

-Cheap interest rates don’t solve all problems

-De-centralized lending is an absolute mess

So these three issues can be addressed by the following:

*Increase down payment requirements to at least 10 percent

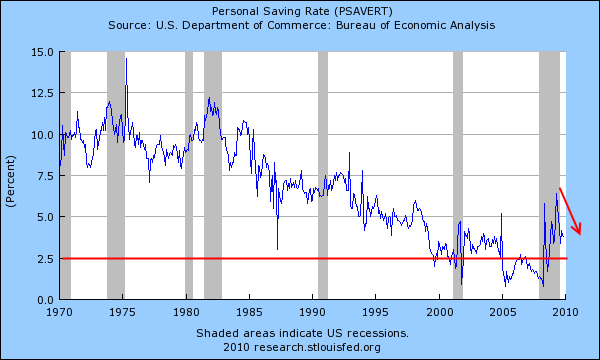

*Hike up interest rates to encourage savings which is healthy for a country with such a low savings rate

*Create a hybrid lending system where local banks have a piece of the mortgage action in their market. Why is this good? If a certain area implodes, those local banks fail and keep the problems clustered where they should be. Right now you have California and Florida loans for example dragging down many economies nationwide since all these loans flow to the same pool of risk. Local banks that made these loans have no skin in the game after the loan is made. A split incentive system makes complete sense.

Yet the Federal Reserve is comfortable keeping the current system going because they protect their banking masters. The FHA was never intended to pump out this much volume. But why is it doing so much work today? Because of the low down payment! People are still unable to save enough for even a measly 10 percent down:

The savings rate is actually trending lower again. So the recent boost in Q1 activity was largely based on spending more money than people actually had. So the FHA volume is merely the symptom of the larger problem of massive consumption based on easy debt. To fill the gaping void left from option ARMs, Alt-As, no-doc, interest only, and other junk loans people moved to the path of least resistance. As it turns out, it was the FHA. With a 3.5% down payment and with the combined tax credit that just expired, we got close to going zero down again. Sure, we had to verify income but is that our sense of due diligence now? We have become so accustomed to nonsense bankers that basically checking income is somehow the golden seal of approval for solid lending.

Gear up for another bailout folks. The FHA is coming to a wallet near you.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

42 Responses to “FHA insured loans filling mortgage void left from toxic mortgage lenders. Serious delinquent loans at 9 percent while FHA insured loans pass Fannie Mae and Freddie Mac in Q1. FHA a loan for non-savers.”

A loan for non-savers. To be fair saving money is extremely difficult given the current economic conditions with everyone: businesses and local governments looking to add new fees and costs to those lucky enough to still have income.

But the wise thing to do is not spend money or take on debt when one cannot afford to….which is pretty much everyone and why the market should continue to sour.

Here’s a lovely article tho:

Revealed: The home loan that could save you a fortune

http://www.adelaidenow.com.au/money/revealed-the-home-loan-that-could-save-you-a-fortune/story-e6fredkc-1225870019522

HOMEBUYERS are to be offered never-ending mortgages in a bid to overcome Australia’s affordability crisis.

ING Direct, Australia’s fifth largest lender, is preparing to sell loans that have no fixed term and no requirement to repay any capital along the way.

At current rates, the interest-only loans would cut repayments on a $300,000 mortgage by $5000 a year.

Repayments would be kept to a minimum, allowing borrowers to benefit from capital growth in their property.

“People are needlessly being denied the chance to buy a property while prices spiral rapidly out of their reach” ING Direct CEO Don Koch said.

“There is an urgent need to provide more affordable options and borrowers should be able to choose whether they want to repay the capital, or not.”

(more at link)

—————————————————————————–

Ha ha ha…..Enjoy!

It is definitely not easy to save in CA. It’s such an extremely expensive place to live, with high taxes and fees, high basic costs for just about everything etc.. Still these loans for non-savers are harmful and just leave 3rd parties (taxpayers) with the bill.

Never ending mortgages. Haha, why not just rent? Oh, I forgot, it’s because RENT is a 4 letter word ….

Reasonable people would conclude that you would have to be brain dead to buy most homes right now.

1. Jobs of nearly everyone is in jeoporady. How many people have truely safe jobs?

2.Taxes are about to increase dramatically at national, state and local levels.

Bush tax cuts expire at the end of the year, and the marriage penalty will be reinstated.

States are adding surcharges to most income taxes.

Local govts. are adding parcel taxes to anything that moves, in order to maintain spending.

This is not a blip in the economy. Most likely will take better part of a decade to play out.

Doc

>>

Love you to death BUT you are reasoning from synchronicity on the subject of FHA 3 1/2% downpayments and ar enot considering all other circumstances (under/unemployment) and the historically low default rate on 3 1/2% down FHA loans. You argument flies int he face of history and the totality of the circumstances.

>>

(1) FHA have been 3 1/2% down for DECADES. And (until the past year or so), their default rate was the SAME or LESS than 20% down conventionals. Hogwash and bullhockey that more down means less defaults. It is historically UNTRUE when the subject is FHA loans.

>

(2) FHA borrowers have typically been the bottom 65 – 70% of US households.

>

And before the financial snobs start with the “those people shouldn’t own homes”, that means households with an income at or below $75000. And if they don’t buy a home, when those those households retire and can’t afford market-rate rents then the self-righteous will whine that when those those households, “should have planned ahead” and purchased a house so it would be paid off when they retire and they wouldn’t have to pay rent or a mortgage. Yieee……!!!!

>>

(3) The groups hardest hit by unemployment are the BOTTOM 60% of all households. Study by the ** At Northeastern University – http://www.clms.neu.edu/publication/documents/Labor_Underutilization_Problems_of_U.pdf.

>

Here is the breakdown of underemployment/unemployment % rate by household income by decennials – 10th percentile, 20th percentile etc of all household iincomes.

>>

Bottom 10% ($12,499 and less) – 20.6%

>

20% ($12,500 to 20,000) – 17.2%

>

30% ( $20,000 to 29,999) – 12.7%

>

40% ($30,000 to 39,999) – 8.3%

>

50% ($40,000 to 49,999 – yep pretty much the median household with its $54K+/- income) – 6.1%

>

60% ($50,000 to 59,999) – 5.4%

>

70% ($60,000 to 75,000) – 4.4%

>

80% ($75,000 to $99,999) – 3.6%

>

90% ($100,000 to 149,999) – 2.5%

Top (incomes over $149,999 up to Bill Gates) – 1.6%

>

(Won’t add up to 100% because 5.3% of households in study did not report household income)

>>

(4) FHA borrowers ARE NOT defaulting becuase they had only 3 1/2% down. Hell’s bells they were underwater the minute they purchased a house because if they went to sell before 3 -5 years went by, the realtor would charge more than they had as a downpayment. That is true now and it was true 25 – 35 YEARS ago – and they weren’t defaulting at the current rate 20 years ago. Ergo, the downpayment amount of 3 1/2% is not a causal link in the defaults. You have to look at all other possible factors,

>

(5) FHA borrowers ARE defaulting because, as a class, they are in the household income brackets hardest hit by underemployment and unemployment. ANd if they don’t have the income to make the payment because of job loss or hour cuts, then it wouldn’t mean diddly if they had 50% down or in equity. They couldn’t tap the house equity because no bank with more brains than a rock would lend to them without income…….well, except for the insane bubble lending which is now history.)

Unemployment in CA is still at record levels with no real end in sight. Real stability and recovery in the real estate prices will not happen until unemployment gets down to 7% and below. 10 years out? Maybe.

Good valid points but they miss one critical and very important issue. The FHA never in it’s long history has had this amount of the mortgage market. It was never meant to be a big part of the market. Well it is now.

>

In the 1990s for example, FHA had roughly 15% of the entire mortgage market through insured mortgage origination. This dropped to a low of 4% in 2006 when all the toxic waste was being pushed into the system.

>

In Q1 of 2010 FHA insured get this, over 50% of all mortgage origination volume! Half the market in terms of loan volume was backed by the FHA. This is uncharted territory so looking at history won’t provide a good perspective.

>

With FHA raising its limits, you now have people in SoCal for example buying inflated homes with government backed loans. I’m sorry but there is no need for a $729,000 loan limit for “working class people.” The median home price nationwide is $177,000 – we should cap the FHA limit to the nationwide median home price.

>

Whatever the case may be about what is causing all these defaults, something is amiss and we are heading into another bailout. I used to remember when a bailout was shocking news. Now, it is a shock when something isn’t bailed out.

>

Also, I disagree with the idea that a low down payment isn’t such a bad idea. It is. A low down payment is bad for a variety of reasons. First, it provides no buffer. People start out in a negative equity spot day one. If you factor in 5 to 6 percent in associated costs selling a home, there goes that 3.5% down payment and more (aka negative equity). And study after study has shown negative equity as the number one reason for defaults. Plus, you have no buffer for market declines. Pre-bubble, housing prices were relatively stable aside from minor regional bubbles. So that is a reason for FHA stability until this point. But clearly housing prices are anything but stable. So keeping the same model in place and even increasing volume is flat out insanity. The defaults are telling us something is wrong.

>

Bailouts here we come.

Ann, what is the fundamental difference between an FHA borrower and a borrower whose loan is insured by someone else? Honestly, I wouldn’t know where to look to validate the facts you presented in your post but I fail to understand how the insurer of the loan has any bearing on whether or not the loan will be repaid successfully. If your point regarding the historical success of 3% down FHA loans as compared to 20% conventional loans is correct, perhaps this would explain why lenders over the past few years thought that issuing no money down loans was a sound idea. Your implication in point #1, “Hogwash and bullhockey that more down means less defaults”, is that the amount of skin in the game a borrow has no bearing on how likely they are to perform on the loan. This is nonsense. Based on the magnitude of the equity loss over the past few years, the lower the down payment, the higher the chance of default. If two borrowers both pay $300k for a house and the value drops to $250k, the borrower with a mortgage balance of $291k is more likely to leave than the borrower with a balance of $240k. Disputing this is futile. The FHA loans being issued now will only have a chance to succeed at a reasonable rate if the housing market stablizes or improves, which seems extremely unlikely based on low interest rates, impending tax increases and continued high rates of employment. Comparing the historical performance of these loans to the current market is comparing apples to oranges. By the way, someone who puts 100% down is about 0% likely to default. More down = more reliable.

To your point #5, “FHA borrowers ARE defaulting because, as a class, they are in the household income brackets hardest hit by underemployment and unemployment. And if they don’t have the income to make the payment because of job loss or hour cuts, then it wouldn’t mean diddly if they had 50% down or in equity”. Actually, it would make a huge difference because with 50% down or in equity, they could sell the house and use the money until they got back on their feet. I agree that they would not necessarily be able to keep paying on the house, but they would not have to default. They would have the option to sell. This is another big difference between a large or small down payment.

People should not buy things they cannot afford. Not shirts, not cars, not TVs, not iPods, not purses, not expensive dinners, and, oh yes, I forgot, they should not buy houses they cannot afford.

If FHA loans are such a great idea, somebody besides the taxpayer should insure them.

Ann,

You seem to be making an emotional plea for the welfare of over half of the population to maintain their right to own a home. With over half of my family in this majority group, I can appreciate the sentiment. However, pushing people to buy homes that they can ill afford is not in their best interest. In fact, as I have witnessed personally, you set them up for financial ruin.

Through a combination of a downsized job in a downsized profession, medical problems, and a bad initial predatory loan, a close relative of mine recently foreclosed on his home. In addition to the economic woes listed above, he also bought in way over his head at the top of the market with very little money down. It was a train wreck which I had no control over.

We will all pay for the bank hit (the NW house is on the market for a third less than the loan was for) through the bailouts. My relative paid through: losing all vehicles, all savings, self respect & family security, having to relocate away from loved ones, and a botched credit rating. Sad story.

Had this relative been restrained from getting into a crummy “no money down” loan to live his American dream, he would have been much better off. I wish I could have stopped him. I wish I could stop many in the parade of suckers now. Exceedingly low or no money down loans are a really bad idea right now. They prop up the market but with bad bets.

I imagine that there are still people in the bottom majority of the population who do not own a home right now but who could save a prudent 10% of 177K. Five hundred dollars a month gets you there in three years. By that time, perhaps housing will have stabilized some so that they have a handle on what kind of an investment they are getting themselves into. If someone can’t save 500 a month, how likely are they going to be to be able to weather any storms to stay in their home? What would be wrong about waiting in the current situation?

My best advice for anyone (including all of my beloved relatives) is:

If you can’t afford to buy right now, don’t.

The only problem with that idea is that it is cheaper to buy than to rent in a lot of cases, and many people for sure can’t afford to pay $1500 or $2000 a month to rent a place to live. As of now, even an old converted motel room rents for $500 a month or more, while a decent apartment or house will start off in the neighborhood of $1000. Granted, there are a few cheaper places, but they aren’t much good if you can’t afford the up front costs of moving in, which are running in excess of $1500 on a more modestly priced home just to have electricity and basic services.

I agree with everyone else’s counter points to Ann’s argument. Ann – you definitely have some valid points, but 1 thing left out is the loan to income ratio (DHB eludes to it with the 729k “limit). I don’t have specific numbers to back this up, but Im willing to bet in the past, the 3.5% down loan was only approved if the borrower made enough money to handle the payment based on the standard 30% of your income rule. You are right, a smaller down payment doesn’t mean anything if you buy a very cheap house that is well within your means. Unfortunately not many of those houses even exist due to the bubble. Instead it seems the 3.5% is just being used as a way to make the down payment of overvalued houses “affordable” (in an effort to keep prices from falling), while the monthly payment remains unaffordable over the long-term.

I’m sorry, but if you can’t afford to save money without a mortgage payment, then what makes you think you can afford the mortgage? It’s almost definitely going to cost your more than renting. People always say “renting is throwing money away” – but what do you think property tax and interest is? Aside from the tax refund (which is only around 30% of what you paid out), you don’t get the rest of that money back. Plus, for the 1st 8 years of “owning” your home, you are pretty much paying all interest…and guess how long the average person stays in a house? 8 years! No down payment means next to no equity after 8 years…which means you pretty much just rented it anyway…except you got a deed and the ego boost that comes with being a “homeowner.” The banks aren’t stupid. Also…those fees you pay when you buy and sell…thats money thrown away as well. That’s a lot of money thrown away, and you still have your mortgage payment! One more thing – pull up a mortgage calculator (http://www.mortgagecalculator.org/) and compare the total payments on a 300k house with 3.5% down vs a 300k house with 20% down. You pay 70k less over the life of the mortgage when you put 20% down (including the down payments and assuming a very low 5% interest rate)…and that doesn’t even factor in the PMI. Plus your monthly payment is 300 bucks a month more with 3.5% down. If you can’t keep up, you know what you are gonna do…refinance, or take out a home equity loan, which means maybe your 30 yr mortgage is now a 35 year mortgage. Eeek. With a low down payment, you are still renting…just your landlord is the bank, and they dont’ come by to fix the toilet when it breaks. (heck, i’ll even argue you are still renting even with 20% down)

Instead, continue to rent and try to save what you can, because if you can’t save while renting, then you aren’t going to be able to afford a house.

Most studies do seem to indicate that mortgage defaults are heavily influenced by being in negative equity. And, as Mr Mortgage has pointed out, given the transactional costs to sell a house…most people are at least 6% or more underwater the moment escrow closes on their house.

Seems to me that when we go the polls it is a choice between dumb and dumber. D.C. lawmakers write the rules and they are as dumb as a box of rocks.

If it wasn’t for an FHA loan then I would not have bought my first home back in January. I didn’t need an FHA loan but it allowed me to hedge my bets in case it doesn’t work out. I bought in the Inland Empire and actually could have paid cash for the house but I figured that by only putting 3.5% down I would be in a better position to strategically default if the neighborhood got crazy in a couple years. I wasn’t really worried about the price dropping because I doubt it can go much lower than I paid but there are several foreclosure in the community so I can’t be sure who will move nearby in the coming years. The neighborhood is great now but if it goes to the crapper within the next couple of years then I will not hesitate to default. Even after the small down payment my mortgage is still $1200 a month cheaper than when I lived in Burbank. I would imagine there are thousands of people like me who bought recently but in some of the mid-tier areas(300k-700k) and those with FHA loans will begin to strategically default in a year or two when the prices come tumbling down.

I completely agree with Chris. If you can’t put down a big chuck of money, you should not buy. I hope the price will come down far enough so that we can buy with cash. I just read something on the Yahoo Frontpage today about the more promising cities of the next decade in US. Within the top 10, none were in CA. It really sucks here now. The schools are in the bottom on the national list and still on the down hill. The government is broke, meaning even higher taxes are coming to us. Relocation has definitely crossed our minds. But I still have work to do here. So stay put for now.

3.5% can be a reasonable down if the borrower is pretty stable, but has a modest income. They’d have to come “from the neighborhood” to some degree – someone who sticks around. 3.5% converts someone from a renter to an owner – but at a cost affordable to people of limited means.

Chris is right the 3.5% down is just another toxic loan but this time made directly by the govt. It’s like this: 2/1 in LA costs $700,000. No one is moving up into a 2/1 so to make it affordable, the down is only 3.5%. Better than a 0 down ARM or something like that but still only like 30K down. The monthly payment on that must be crazy.

There are still a lot of people with a lot of money who buy property and don’t even think about the price when buying. At what point do they get hammered and stop buying everything in sight? What happens to the rest of the economy when people can only afford basic needs – food, shelter, transport and clothes? If everyone in an area bought $1 million dollar houses and is able to pay (but not have extra for anything else), does the value ever really decrease or do they just hold out until someone will pay that price?

William, your strategy is a good reason to discontinue the FHA program.

In the early decades of the program, people in this country had a different ethic. Your home purchase was SACRED. People would do whatever they had to do to make their house payments- do without a car, wear old and hand-me-down clothes, live on soup and cereal for years, if that’s what it took. Before the 80s, you never tapped into your home equity for consumer goodies….. and you never bought a house with the idea that you might “strategically default”.

We won’t heal our economy until we get over this mentality. When people are entering a house purchase with the idea that they will bug out and simply not pay, whether they can afford to or not, we have a big problem,which will only be cured when the credit dries up totally.

As it is, it would be great to be in a position to pay cash, and that’s what I’m aiming for. It is late in my life, but the prices are so low on foreclosed Chicago condos being sold for cash only, that it’s worth the wait, even at my age. They are often one-third the price of comparable units with financing available, and though they tend to need more work to move in, the work can usually be done for a few thousand, much less than the price difference.

We can now see how, during the depression of the 30s, banks were requiring 50% down payments. We will be back to that standard very soon.

William,

~

That’s actually a really good idea. I guess the trend is your friend. If the government wants to incentivize that sort of activity, there’s no point in fighting it. I just wonder what having an abysmal credit rating after defaulting will do for your prospects for renting.

~

IDK, it might be more trouble than it’s worth or it might be a way of halving your rent. California is so horribly screwed anyways what does it really matter?

~

Can someone fix the site code so that paragraph breaks start showing up??!!!??

Anns, you definitely have a point that this crises is a two-tier type. Unemployment situation in the low and high end is incomparable and all this reflects the increasing price differential between low and high end of the RE market. The default rates on FHA loans reflects the overall mortgage market condition. There is no other way unless having strict correlation between them if one (FHA loans) are more than 50% of the whole. I definitely agree with idea of low down payment – high risk of default. Promoting low down payment has only one reasoning to increase prices so everybody in the RE food chain cuts bigger slice , banks bigger principal, RE brokers bigger commissions, mortgage broker bigger commissions, gov bigger taxes… all this on the back of the pity first time home buyer. The claimed goal of affordability is achieved in opposite in 180 degree… 719K limit is a hint, it does not fit well with “affordability†and it is a sign that FHA has different agenda than officially claimed. The whole FHA is bad for the waste majority of the people in this country. In order to make my point clear how important is down payment let me tell you how it looks my situation. I promised my wife we are buying something in the fall/winter. I have plenty of savings, more than $100K in euro overseas , in 4% interest CDs. (Before laugh on my euro , you should know some of it is converted form dollars when they had parity in 2003 ) . No matter what I buy I do it with 3.5%, it also does not matter that my family income last year was 135K. I think there is a downside of buying at this marked and I will leave all (or almost) that downside to the bank/FHA/gov/taxpayer. If banks/gov are playing hard with me I play hard with them too. This is my plan because if this crises was played out without gov intervention, bailouts and crony maneuvering in DC prices would have got down 50% across the board, already in 2009 and it would be bonanza for prudent and responsible renters like me to solve their housing situation. (Instead I am left renting since 2003 and every possible obstacle is thrown against my home ownership). Changing the rules of the game in the beginning of the second half creates moral hazard, monsters of it, gov pick winners and losers and nobody know right from wrong… If the downturn was left on itself to unfold I would buy cash ( I have also rental properties overseas to sell if I need to, where prices make sense) , please pay attention here, again because I believe there is no down side on such purchase and I will be willing to bet a lot. Once we are done with “buying†I will pull all my money from this country and those banks, and just then I will buy some sunflower seeds to enjoy the new game in town, how it plays and how it ends… You can go from here about moral hazard, if they made me irresponsible and emotional with my money bets…

Hmm. Debtor’s prison. That might cause housing prices to crash, wouldn’t it? When in sunny California the only punishment for walking from a loan (assuming all purchase money) is a hit to the credit score, why worry about the market going down when you can just walk? Especially if you have the income and the cash reserves to do just fine without needing any kind of loan (credit card, car, etc). I mean really, what’s a few years of a bad credit score compared to being handcuffed to a mortgage that’s backing a really sour investment? We’re seeing the tipping point for a lot of Californians (I would guess at least 20-25% negative equity).

As a side point, think about this… do you think the kids growing up these days have as good of a work ethic as the prior 1/2/3 generations? We better hope so, because they are the ones that are primarily going to be paying for all these bailouts. Otherwise, if we default on foreign debt, expect our creditors to be fairly upset…

As was mentioned before, as soon as the credit dries up (can’t last forever), watch the squeeze (increased down payment requirements, higher interest, etc). This will especially be exacerbated in California where lenders will need additional protection through these tools given the non-recourse rules regarding purchase-money loans.

The next 10-20 years could be scary.

Cheers.

FHA financing WAS a very good idea when used properly. I use to sell houses at my father’s firm in Louisiana back in the 90s and saw many lower middle to lower class families able to purchase their first homes using FHA financing. That is who this program is designed to help and why the default rates were always historically low. The income limits and credit qualifications were pretty strict. FHA financing was never designed to get upper middle class people into $700,000 houses. The problem is not the program because I have seen the good it has done but the application of the program by our government trying to prop up this housing market.

da-di-da,

your writing style is hysterical. are you doing it on purpose or is it a happy accident in your second language?

“waste majority of people”

brilliant.

i always look forward to your posts.

Yes, the US government is doing what it can to help the big banks make a profit.

Why? Those profits will build reserves at the banks so favored giving them more breathing room in the continued series of financial crises ahead.

I admire and appreciate Dr. HB’s focus on housing but housing is but one part of a bigger picture.

My understanding is that regular financing rates are now dependent on the borrowers FICO, while FHA are not. That would be one reason to go with the extra FHA PMI payments instead of just higher interest rates with the 20 percent down. Months ago FHA was talking about taking FICOs into account, but I have not heard what FHA did about it.

William shows us that it’s not the FHA borrower who’s screwed, it’s the taxpayer who takes on the risk since with no money down in a non recourse state like California borrowers can walk away while the FHA (i.e. the taxpayer) will be stuck with the loss… This is why 3.5% down is a bad idea, not for the borrower – but for the rest of us!

So what?

The historic conditions that lead FHA loans to have low default rates have changed. Now the American people are forced to backstop the entire mortgage market despite these high default rates. Obviously this isn’t correct or sustainable.

dog-walker, sorry for my English, but you still cannot have as much fun with it here on the DHB as my kids ( born in California) .By the way English is my third language and I feel lost in translation sometimes…and as you can see even Microsoft spellchecker does not help a lot. Ha-ha-ha! Besides the English I don’t understand many more things here, this unreasonable passion to buy things , cheap plastic things ( which you cannot really sell on garage sale later), this relentless pursuit of bigger and bigger, this sheepish trust in authority (be it the word of the local realturd or the gov), but this is different topic for different blog. On the topic of this blog what do you thing when I finish the sunflower seed who will win? Ha-ha-ha!

As William and Di-Da-Di show their intentions to use the FHA loans, we see the problem right there. I can’t say I blame them given the current circumstances, but mortgages were created as a tool to make a purchase, not a way to hedge your risk against the price of your home falling.

I live in Long Island, NY where things are similar to California (high prices and stupidly high property taxes). The painful thing here is that rent prices are also out of control because so many people refinanced and took money out. Now they are pushing their high mortgage down on the renter.

Should be 20% down, 10% interest rates, and we need to get rid of prop 13. There would be some pain for a short period of time, but in the end this would make housing much more affordable and drastically improve the states fiscal situation. California schools were ranked #1 when prop 13 went into effect and now they are ranked #48. All prop 13 really does is transfer money that should have went to schools(and the state) to Wall Street Banks. In the end people never actually paid less for their houses, just less in taxes and more to the mortgage. Personally I’d rather see my money go to kids getting a better education than Wall Street. It also has the added bonus of keeping housing prices in check. Think of all the people in $1,000,000 homes that could never afford it if they had to pay the true tax value. This would have kept the prices from going so high.

Very well written Ann. But don’t forget, all the peasants are the ones for causing this by attempting to live with security, it’s just the banks bubbled it out from under them with the blessings of the banana republicans and defacrats.

Blame the victim….

I think the attitude of the big boys is finally catching on to the little guys. GM had 80billion+ in debt and when they emerged from bankruptcy, they had less than 20 billion dollars in debt. Bank of America(yes a bank) walked away from almost 1.5 billion dollars in real estate that they acquired through a partner company.

If a bank can walk away from mortgages, why should the average homeowner be tossed in jail? All these days, the big guys played and made money and if they lost, the taxpayers or other banks or people in other countries had to pay. Not one person was arrested. The day they bring criminal charges against the CEO/board of directors and other top officials for walking away from debt, is the day I think we can judge some homeowner who decides to walk because he is upside down on his mortgage.

I am not a homeowner-luckily I did not buy . But I think it is seeping in from the top..

Mr. DG,

Corrolation is not causation. Prop 13 was not the cause of the relative and absolute decline in California’s public education performance although chronologically it was coincident.

The real causes are three: 1) a state Supreme court decision that all districts had to spend equal amounts per student 2) public employees were allowed collective bargaining (unionization) and 3) immigrants swelled enrollments.

Cause 1 meant a locality could not excel. Cause 2 meant that the employees diverted the available resources to their own pockets and removed incentives to individual excellence. Cause 3 meant that the student bodies were diluted with kids from families with little cultural value for education.

I actually think that Mello-Roos and CFDs (my understanding of a CFD is a loan to the city paid by the subdivision it is assigned to) are a bigger problem than prop 13. Don’t get me wrong, prop 13 is as unreasonable as the sliding tax scale but the supplemental taxes on newer subdivisions is nothing more than a city orchestrated ponzi.

<

The house we bought in 2006 had a CFD which required a 40 million dollar payoff over 40 years. There are about 280 homes in the subdivision which means an additional $3500 or so per house per year. When we bought the house we were told that this was to fund a new elementary school right next to the homes which was to be completed in two years. Several of the families bought homes there because of the pending school. About a year after we closed we found out that there would be no school built so I called the city official in charge of this CFD to ask him what the money was for since the school plans had been scraped. I was told that this fee was to pay for the grading and infrastructure associated with building the new homes in our subdivision (which is on pretty flat land). The area surrounding where these homes were build was already fully developed so there was not any (or minimal at best) new infrastructure to be built. I asked him, "If the reason for the CFD is to pay for new roads, sidewalks, streetlights, etc., then why don't the homes built 15 years ago when there were no major roads, sidewalks, etc. have any CFD attached to their tax bills?" Of course I got no actual answer other than city official BS. Come to find out that the money from that CFD is being used to build a new city hall, and build roads not even close the subdivision which is paying the money. Isn't this pretty much what a ponzi scheme is? Stealing from Peter to pay Paul? Once the pool of greater fools is dry, the debt jugglers will see the balls all come crashing down.

I can completely understand why someone would be upset at my previous post because I took advantage of an FHA loan. But I do resent the fact that some people are implying that by doing so I am screwing the taxpayer….only because the taxpayer is me. Due to my income I was not able to qualify for the $8K tax credit and I pay way more than $8K in taxes every year. Yet someone making 50K with a couple of kids likely paid under 8k in taxes and they were able to claim the credit. So how am I not getting screwed on that one? Even that is not what upsets me most about this whole housing debacle in So Cal. I find it utterly ridiculous that I had to move so far to find a reasonable deal. Me and my wife are both in our early 30’s with no kids and bring home several times the median income, yet we can’t afford a house in the San Fernando Valley. Where are people getting this money from? Are they not aware of all the pain about to come? I have to believe that the future fallout is going to be worse than 2008. It just has to be. How long it can be delayed is the question that remains to be answered.

FHA or other government mortgage programs with low down payments are the new normal. Equity extraction has been the dominate theme in housing since the 90’s so the number of households that have significant equity to put down on their next purchase is relatively small and those that do have significant equity generally have low turnover rates therefore the government has stepped into the market using FHA/and other GSE’s to pick up the sales velocity using income driven/low down payments/high DTI ratio’s and low FICO scores otherwise the RE market sales volume would have collapsed into a cash only market.

What we are seeing today is the outline for the new normal RE market which will be driven by government sponsored underwriting standards that will probably offer mortgage contracts that look more like leasing (think auto’s today).

Equity build up in housing is now a relic of the past business RE model as we fully engage the only issue that seems to matter today which is how much can the household afford in monthly payments!

DG is right. Whitehall is wrong. Of course Prop. 13 is the problem. Californians have fantasies about getting something for nothing. Education costs money. Replacing property taxes with a lottery wasn’t the smartest move. More specifically:

1. Prop. 13 is a corporate measure, disguised as populism. Why is Disneyland taxed at its value in 1977? Most business property is similarly under taxed. 13 drove the bubble and made many people landlords who never should have entered the business.

2. Whitehall’s arguments about collective bargaining and illegal aliens would be great if California was the only state that had them. These issues have happened everywhere.

3. Have you been to the schools lately? Money hasn’t been spent. The old “temporary bungalows,” are still there in many places. They weren’t designed to be maintained and cleaned. They were only meant to last the duration of WWII. They are full of dust and mold and are impossible to work in.

Finally, 13 might have worked if it had been as advertised: A means of protecting people from bubble value property taxes. Instead of only covering principal residences, it covers the entire state. Who says CA isn’t business friendly?

I was wondering how the prices have gotten so out of wack with the national average. Besides easy loans and unnatural appreciation what is driving these high prices? I did some construction debri cleanup in Florida in 2004, and some of the homes were priced at it seems $160,000 or so. So what is it? Is the land cost very high? Or do the cities add crazy fees, in my area in Petaluma (northern California) if I remember correctly they charges around $40,000 in fees. Are the builders greedy. Are wages too much for the construction workers here? I mean in a free market in Florida they did it all for under $200,000 for a basic home. Is one of the problems basically that the local city halls got into the real estate game too? To fund their retirement at 50 and bloated pay?

P,

Can you provide data showing at least a correlation between per capita spending on education and the academic performance of students?

~

Put up or shut up.

“Me and my wife are both in our early 30’s with no kids and bring home several times the median income, yet we can’t afford a house in the San Fernando Valley.”

~

Blessing in disguise right there. Why would you want to buy in the state’s armpit?

~

” Where are people getting this money from? Are they not aware of all the pain about to come? ”

~

Well, look at the people in the San Fernando valley. Do they strike you as people who plan for the future with good impulse control?

[quote]I was wondering how the prices have gotten so out of wack with the national average.[/quote]

Prop 13 probably has something to do with it, in that is does keep old properties off the market and thus makes the real estate market less fluid than it would normally be (you don’t sell old or even inherited properties if you are getting a tax break you won’t get in any other circumstance). Still I think Prop 13 contributes, but I don’t think it entirely accounts for it. So then you are left with what to explain California’s whacky real estate prices? Sunshine? Nice try but some other states have fairly good weather as well. Overpopulation? The state is definitely overpopulated, but you would figure that would work itself out with people relocating to cheaper states. California psychology, as in that sunshine must be causing brain damage?

California is out of whack because of all the smoke and mirrors . You have people who have become rich because of real estate sales . You have trust fund babies and lots of inherited wealth and many more spending every dime and borrowing just as much to keep up. Fiscal responsibilty is to California what sane is to insane.

Leave a Reply