Nothing down and low down payment mortgages inflate housing prices and increase the rate of foreclosure – Financial reform starts with increasing the down payment amount. How FHA insured loans infiltrated and filled the gap of exotic mortgage financing.

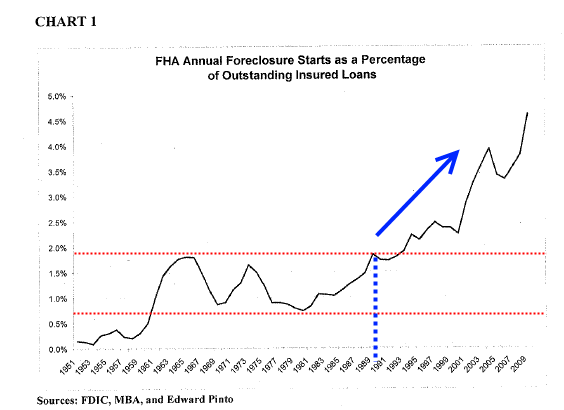

If we want to start with some serious housing reform we need to increase the down payment amount. I’m not a big fan of Fannie Mae, Freddie Mac, or the FHA but there was a long period of time, decades in fact where the system seemed to be working. At the very least there was no national housing bubble. The government backed loans with strict underwriting and this included sizeable down payments of close to 20 percent. In the late 1990s and starting in the early 2000s Wall Street investment banks thought it would be a smart idea to go with “easier†standards (aka a pulse) and fueled the housing mania. Fannie Mae and Freddie Mac was put into conservatorship after the collapse and yet little has changed in terms of housing finance. New discussions on reforming the mortgage market do very little in addressing how we went decades with a rather stable housing market with government subsidies in the mortgage market to this once in a lifetime bubble. The FHA has now stepped into the place of exotic mortgage financing to bring buyers into homes with pathetically low down payments. Low down payments are one of the main reasons why home prices became inflated and also lead to future foreclosures as we will explain shortly.

FHA backs 1 out of 3 California loans

Source:Â 2009 FHA mortgage data

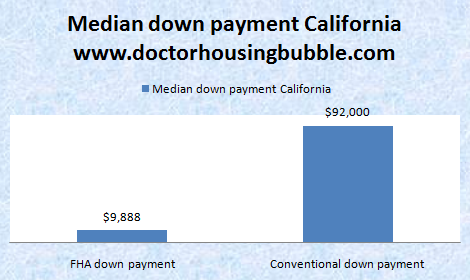

FHA insured loans are facing rising default rates because of their inability to restructure their down payment requirements. The FHA’s mission was to help and keep affordable housing loans open to those who wouldn’t typically qualify for conventional mortgage financing. As you can see above from the aggregate data FHA down payment amounts are nearly 10 times lower than those through conventional loans. This wasn’t a problem when FHA was a tiny part of the market. Today FHA insured loans make 1 out of 3 California mortgages and California largely is an overpriced market. This has now been going on for two solid years. In other words FHA is going completely against its mission by keeping home prices inflated and allowing a large number of buyers to use their mortgages. If we stick with their mission, does it then mean that 1 out of 3 buyers in California cannot afford their current home purchase and require the ultimate government backed subsidy loan?

There was a time for many decades when the typical down payment requirement was 20 percent. Incredibly over this time Fannie Mae and Freddie Mac did an okay job. Sure, I’m not a fan of the government subsidizing home purchases because in the end this inflates prices but we didn’t have anything close to a national housing bubble. All of this hit when Wall Street figured out they could lower the bar even further to make criminal bonuses and when things were certain to go bust, then the taxpayer would be there to clean it up. How did they know this? They bought politicians who wrote laws in favor of these leeches. All of it played out as planned and it is no surprise that banking bonuses are off the charts again while the economy is mired in distress. The fact that FHA insured loans now make up such a large part of the California housing market shows that people are still too broke to pay the actual market rate of even a basic conventional loan.

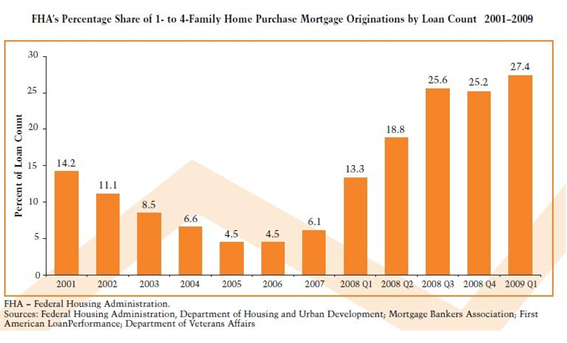

FHA share of the market

Source:Â Real Estate Channel

FHA loans were never intended to be a big part of the market. Here is part of the FHA background from the HUD website:

“(HUD) Unlike conventional loans that adhere to strict underwriting guidelines, FHA-insured loans require very little cash investment to close a loan. There is more flexibility in calculating household income and payment ratios. The cost of the mortgage insurance is passed along to the homeowner and typically is included in the monthly payment. In most cases, the insurance cost to the homeowner will drop off after five years or when the remaining balance on the loan is 78 percent of the value of the property -whichever is longer.â€

The cost of the insurance is passed onto buyers thus making home payments more expensive and the down payment flexibility is the crux of the issue. As many of you know 3.5 percent down is all that is required. That is why it should be no shock that FHA insured loans are now a big part of defaults:

Instead of talking about all these hypothetical and convoluted methods of solving the mortgage market how about we all start on the same page and increase the down payment requirement for all government backed loans? We all know this is one of the primary reasons for strategic defaults and it also allows too many people to buy homes when they are not ready. It used to be a ritual that families had to save two to three years (or even more) by tightening up their budgets in order to have enough money saved to buy a home. Now that has been taken out of the equation.

The main reason this nonsense is going on is that many Americans are broke. A decade of stagnant wages and the median household income of $50,000 just does not cut it for even $200,000 priced homes. In California, we are already seeing cracks in the system in prime areas where home prices are still too inflated for local family incomes. The irony is that these programs all keep home prices too expensive for the overall community. They go against their own stated mission.

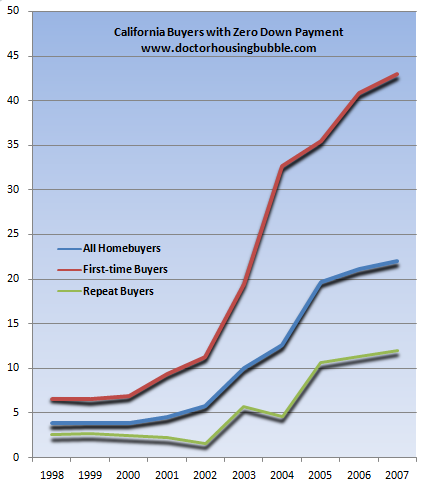

Wiping out a decade of mania gains

At one point in 2007 over 40 percent of first time home buyers used nothing down loans to purchase homes in California! Think about that. Many of these loans were toxic Alt-A and option ARM with recast dates that started hitting last year and will continue into 2012. Many have imploded but many have not. We already know with the solid number of homes in the shadow inventory that many people are living beyond their means with mortgages they cannot afford (or will not pay). Allowing for the continuation of low down payment programs like FHA insured loans is horrible policy. Immediately the down payment requirement should be put up to 10 percent. Here are a few obvious reasons why:

-Buyers come in with a larger equity buffer. As we know empirically, negative equity is the biggest reason for predicting foreclosure.

-Force people to budget over two to three years to test their ability to pay for a mortgage. A home is not like buying a stock, it is a longer term purchase thus requiring people to pay for the privilege of buying a home is important. It is a privilege since the government backs virtually the entire mortgage market.

-Low down payments keep home prices inflated. More and more people qualify or think they qualify and jump in without being ready to buy. This keeps home prices cheap initially but the longer term costs are shouldered by taxpayers (i.e., larger defaults with FHA insured loans).

-Stronger sense of ownership. If you had to put 10 or 20 percent down it is likely you will care about your purchase, more than if you basically bought an option on the home. FHA insured loans amount to call options on a home purchase. If prices go up, good, then you can sell later. If they go down, you only lose a tiny amount and the temptation to walk is increased much more thus adding fuel to future disruptions in communities.

This doesn’t take away from the fact that there are many wealthy buyers in California:

“(DQ News) In 2010, 29.4 percent of the $1 million-plus buyers paid cash, up from 28.9 percent in 2009 and the highest for any year since 1994, when 32.3 percent of $1 million-plus sales were cash. In the over-$5 million category, 62.2 percent of the purchases were cash. Among those who did finance their purchase last year, the median down payment was 40.1 percent of the purchase price. The lending institutions most willing to provide mortgage financing for $1 million-plus homes were Wells Fargo, Bank of America and Union Bank.â€

Nearly 30 percent of all buyers of $1 million-plus homes paid all cash. Those who financed the home went in with a median of 40 percent. This market is now operating with jumbo loans and you need to either have money or show sizeable income. Then again this is a tiny sliver of the market. Unlike the majority of the market where the median down payment is 3.5 percent (how convenient that it is the FHA standard) there is likely to be more problems yet again because of low down payment FHA insured loans.

First step in fixing the housing market is increasing the down payment amount on all government backed loans to 10 percent (at least). This is unlikely because it will reveal how truly broke most Americans are and how few can actually save what used to be a normal amount for a down payment.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

55 Responses to “Nothing down and low down payment mortgages inflate housing prices and increase the rate of foreclosure – Financial reform starts with increasing the down payment amount. How FHA insured loans infiltrated and filled the gap of exotic mortgage financing.”

The reason people can’t save 20% for a down payment is that even dumps rent for too much…renting is so ugly that taking the risk on an inflated mortgage is attractive. I have nightmare stories about renting from slumlords. If you rent ‘nice’ housing you are paying as much as a mortgage. It’s a no brainer to buy.

If you rent a house … more than likely the landlord also has a mortgage on the house … and thus … you’re paying the rent and providing a profit for ‘two landlords.’ And even if you do pay your ‘rent payment’ … which is also the mortgage payment for the landlord … the landlord might not pay the bank with the money you gave the landlord … and so the bank might just evict you anyway.

What a messed up system.

“Back then” WW2 generation landlords owned their rental properties outright.

It was a matter of personal pride for them to be able to afford to keep rents in line with local wages – doing so meant that they handled their own personal and business finances capably.

Further, that age group saw nothing wrong with keeping rents affordable so that their tenants could save their money and become property owners themselves one day.

Not so with the Boomer generation who saw things differently and in most cases, took out mortgages in order to buy “income property” and who raised rents depending on “what the market will bear” so that they’d make “a killing” in real estate.

In order to save for a down in Cali, a formula I found that works for us is to rent at less than 1 percent of our gross income. So income at $215k/yr = $1700/mo rent or less.

~Misstrial

I was chatting with the guy who was flipping the house across the street the other day. He shared with me that every offer he received included a provision for $10,000 back at closing. This not only tells me that nothing down is still out there, but that real housing prices are lower than the official selling price.

the 10k reimburses buyer for closing costs

or provides money to fix something/decorate,

or both

or “other,” sometimes it’s cultural dealmaking.

The low down payment plans were designed to fulfill 1960’s social & political idealogies.

Voters put the politicians into office that promised and promoted these monetary and social constructs.

With the 3 percent, 1 percent, and zero-down mortgage loans, buyers at the salary level of a drywall contractor or elementary school teacher would be able to buy into a housing development whose price structure would, in times past, be priced for the income levels of physicians, engineers, dentists, and other highly trained and educated professionals.

Voters got what they voted for….and all of the unintended consequences along with the policies/ideologies.

~Misstrial

The truly wealthy do not carry a mortgage. They simply write a check for the entire amount at signing, the keys to the property are given to them, and the deed is recorded.

There are co-ops in Manhattan where a potential buyer CANNOT have a mortgage on the property but must pay all-cash *and* have a liquid net-worth of at least $100M.

~Misstrial

Perhaps, but at least some of the Truly Wealthy still prefer to hedge; witness Dr. Roubini’s recent purchase in Manhattan, in which he opted for a 5/1 ARM.

FHA (3.5% down) is making all of us to be renters for life (40, 45, or even 50 year mortgage may be coming soon.) Don’t they read your articles! May be someone should email your articles to them.

On the other hand, if real estate prices in California come down, then what will happen to the State income (property tax)? And how does the State balance its budget (on top of the 25 billion dollars)?

California Has too many problems and it will takes years and years and …

I particularly love the articles out there on how raising minimum down payment requirements an additional 5% would “destroy” the housing market. Really? So, the market is almost wholly made up of people who can’t possibly scrape together even 8.5%? What makes anyone assume they could instead afford a mortgage payment at all even after a ridiculously low 3.5% down (plus HOI, plus property tax, plus PMI)? The Derp, it burns. I’ve caught wreck in the past for speaking out and saying that any down, government insured or not, needs to be 10-20%. If you can’t raise that, honestly, you simply can’t afford to own and take care of a house, period.

The simple fact is that not all people can afford to buy a house.

The government refuses to accept that.

If you can’t come up with a $20,000. down, on a $200,000. house, what does that tell you about the borrower?

It tells you that rent is too high and wages are to low to allow anyone to save a decent amount of money.

Take a look at average wages and rents if you want to know more about the average first-time buyer. Rent is way too high to give a first-timer any opportunity to save for a down payment.

The way it works now, if you rent, you have basically two options: either live miserably in a s-hole and save, so that you may one day, very far down the line, own your own home, or live in a decent place and never think about buying. Of course, one of the problems with living in a pit is that you often end up spending what would otherwise have been saved doing things (like drinking yourself into oblivion) to distract you from your miserable living situation.

So yeah, I guess you can have the “You cannot save $20,000, what is wrong with you…” mentality if you want. On the other hand, the average individual has to make some serious concessions if they want to save. There simply isn’t any room to budge.

Oh please, Petrin, spare us the terrible tragedy that is most peoples’ lives. There can only be so many winners in the game of life. The vast majority are losers, and rightfully so. We can’t all be alphas, heroes, in the top .1%, top 1%, top 5%, top 10%, top one fifth or whatever cutoff line for the good life you perceive there to be.

If everyone is rich, if everyone is affluent, if everyone is beautiful and successful and wealthy and living the good life, then NO ONE IS. We have a homeownership rate that, at close to 70% still, is FAR too high and vastly inflated through government handouts and the subprime, no down/low down, no doc/low doc, NINJA loans. Not everyone deserves to own a home, not even close! Owning real estate is not a civil right or a right at all – it’s a privilege.

Ah, and as for “average wages” or even minimum wage. If you’re making “average” or median wages/salary, then you are AVERAGE, at best. Still far better than the minimum wage slaves/peons, but if a person is dissatisfied with their salary or wages, then it’s up to them and no one else to better themselves and their lot or position in life.

Those with the character and drive to improve their life, those with the dedication to educating themselves will almost always succeed and thrive. They will be able to name their salary and worth their pay (or create their own businesses and opportunities). People for the most part get paid what they are worth. Another sad tragedy of life.

As for making concessions in order to save – please! The bulk of the ‘concessions’ are luxuries – cell phones, internet, cable, premium car leases/transportation, dining out, partying…you should be willing to sacrifice, eat nothing but beans ‘n rice, mac n cheese etc. for decades, like previous generations did, in order to save for a home. We as a society have been so damn spoiled the past few decades, we have no idea what truly struggling is. But with the constant slip in the quality of life we are experiencing, we better get our shit together soon.

Agree!

In fact, many working poor that are either homeless, sleep on someone’s couch, or who rent a motel room on a weekly basis do so because they are unable to save for a security deposit.

Read Nickle & Dimed by Barbara Ehrenreich. Expose on how difficult it is for the working poor to get by and on each step of the way there are those who lie in wait to take advantage.

Renters are a step up the ladder, however irresponsible and greedy landlords of the Boomer age group are there to make sure they capitalize off someone else’s vulnerability.

To get past this, you have to live waaay below your means, even if that means renting a small mobile home in a distressed park – you have to be willing and really do this in order to save for a down.

This is what we did: bit the bullet and rented a small rental out in the high desert for $975/mo. 3 years. And do not tell your landlord what your goals are – they tend to think that what’s your is theirs. Save quietly. Shhhhh……

~Misstrial

in the past people bought a house beyond their means because 1) easy lending standards and 2) the expectation that they would pay off loans/trade up, etc.

#1 seems gone.

#2 seems ? gone?

what’s left? demand based on what people can actually afford.

my partner is eager to buy a house, by the way. we’ve been waiting for years having sold our last house in 2004.

ps

we are in Marin County… where it does seem like more REOs are coming on the market.

Does anyone know if it makes sense to use a specialist vs. a regular realtor to buy a bank owned property?

thanks

It makes sense to use NO Realtor, most especially with an REO, since the legal entanglements are way over the head of even “experienced” used-house agents.

You need an experienced real estate ATTORNEY, and you need to approach the banks directly. The lawyer’s fee will typically net out to LESS than the commission demanded by clueless agent-TORs, and you’ll have a sealed deal that actually qualifies for title insurance, i.e. won’t blow up on you later.

Paying someone with no skin in the game 6% (or even 3.5%) to simply unlock the door and point out the crown molding is beyond silly, even more so in this still-declining market. Cut the leeches out of the deal, any way you can. There’s enough false fluff in the deal already.

“Nearly 30 percent of all buyers of $1 million-plus homes paid all cash. Those who financed the home went in with a median of 40 percent.”

I have been saying this all along! People in 1MM plus homes have another source of income and they don’t base the purchase as much on “monthly” payments. So it’s not based on income. Glad to see you are catching up.

This is why the high end market in Bev Hills and San Marino are NOT going to fall steeply any time soon. Sure the scraps in the 90210 PO box might fall on some idiot who bought a shack. But I don’t see the high end falling like everyone expects.

I want the high end market to fall as much as everyone else who is waiting to buy. As I would be the first to buy in Bev Hills or San Marino if I could get a nice home for 750K. But I don’t see it happening.

Best case scenario is that prices in the high-end of the areas mentioned will go sideways for the next 7-10 years.

I don’t think one million really qualifies as high end in LA. That’s what a lot of places are listed at (and some sell) in my middle class neighborhood near the intersection of san vicente and fairfax. I would wager that most of these folks have a mortgage. Upper upper end? Sure a lot of all cash deals. A buddy but a more expensive place not far away with an interest only last year- still silly mortgages at least at that point. We are definitely not close to being out of the woods- patience, patience, patience…

oops I meant “bought”

Unfortunately I agree with Sean. We are in a tremendously bifurcated market in employment and housing. The great recession has fallen disproportionately on the poor and poorly educated while the rich are now humming along as if nothing happened. The national unemployment rate may be 9%, but the rate for those without HS degrees it’s 14% and for those with a BS or more it’s 4%. The rates are somewhat higher in CA, but the stark fact remains: For the rich and well educated there is no recession. Money is not tight and there is little downward pressure on home prices in the segments that appeal to these buyers.

I wish this weren’t so. I’ve been waiting to buy a move up home for 8 years now, but I have to admit that my finances are as strong as they’ve ever been and the same is true of all my professional friends. Anyone in this segment who wants to buy another house can – and that isn’t a recipe for major price declines.

The only mechanisms for continued depreciation are:

A) Competition with distressed inventory, but with the banks capable of extending and pretending ad infinitum this effect seems to be much weaker than we’d hoped.

and,

B) Reduction in first-time move-up buyers who would often come from the income/education segments who actually are impacted by the recession.

This latter phenomenon has reduced demand at the lower end and had some impact on prices, but much less as we get to the sort of mid-upper end homes that most here are interested in.

In short, the economic phenomena the good doctor describes are real and have had some effect, but these phenomena have not impacted the higher end of the market as much as we’d hoped. National monetary policies forcing the effective devaluation of the dollar will do the rest. I do not expect any further dramatic reductions in nominal housing prices.

Those mid-upper tier homes are where all the optionARMs are hiding.

They were purchased in 2005-2007. Just add 5 years until reCAST. Not reSET…reCAST. Probably better to add 6 to that number being that people aren’t getting NOD’s in a timely manner.

Plenty of poseurs out there. Plenty.

@Apolitical “B) Reduction in first-time move-up buyers who would often come from the income/education segments who actually are impacted by the recession.

This latter phenomenon has reduced demand at the lower end and had some impact on prices, but much less as we get to the sort of mid-upper end homes that most here are interested in.”

Indeed, but therein lies the (overlooked) rub, to wit: the potential “move-up” crowd, regardless of edu levels, cannot “move-up” if they have to take a significant loss on their CURRENT homestead, which, as noted, is down in the hard-hit mkt. segment. It is good you highlighted this particular factor in the “market freeze”, seldom mentioned outside this blog–i.e. the well-employed, high FICO peeps who, despite those advantages, still can’t be “conventional” home-buyer mover-uppers.

Renting it out is not viable for most, due to the usual trifecta: 1) aversion to landlording; 2) Debt overhang still on their FICO; 3) Current market rents will not cover PITI, feeding back and amplifying both #1) & #2)

“rich are now humming along as if nothing happened”

People who are more highly educated may have a job, but is that job a high-quality, good paying job like their parents had? Professions like engineering, law, and such are being decimated by off-shoring and outsourcing just like the blue collar jobs were a decade earlier.

I don’t see this trend of “richer people being unaffected by the recession” that you’re seeing. I see decimation of the middle class, the poor becoming poorer, and a few rich people being unaffected. An entire generation of future homeowners has been eradicated by student debt and offshoring. Wealthier Baby Boomers don’t see it because they have moved into management and are doing the off-shoring.

“The rich and well educated ” I separate the two qualities.

Paying too much in the first place. Stubbornly believing your worth remains long after the market has collapsed because you can afford the payment. You like paying the taxes.

That is not well educated.

You are drawing the wrong conclusion. This is 2010 and 2009 which were super high outside of 1994 which was the tail end of the last recession when CA property busted and lending was tight. It’s not as if everyone has been paying cash for $1m homes in CA all along. Look at the volume of $1m homes – or even just jumbo and larger, sold in 2009 and 2010. Its pathetic because financing is hard to get and relatively expensive. It is this fact combined with low volume that produces the high relative percentage number.

Now if this was on super high volume, I’d say plenty of cash was out there which I think was your thesis, but that’s simply not the case. Sellers aren’t selling, banks are holding the big hits, and a large number of people either can’t afford or can’t get the financing under a tight underwriting paradigm. Hence the $1m+ market is small. Also most banks sell to cash buyers these days so that is also skewing it.

On your other point about the true high end areas – I agree. Prices may move down some, even significantly, but there is always demand for prime Malibu ocean front, Beverly Hills, etc .

I also wanted to add that the way these and many homes got to $1m was not organic salary but rather an amazing bull property market powered by boomer demographics and interest rates dropping from 18% to 5% from the early 80s to mid 2006. This allowed a massive equity build for people to roll from home to home as their homes and leveraged equity profits outpaced income. That tap has not only been turned off but seems to be about 2 decades from beginning again as interest rates aren’t going down, boomer demographics are on the wane, and that rolled housing equity took and continues to take a mega hit.

Despite the nationwide publicity (and pathetic BEGGING), it seems Ed McMahon’s gated Beverly Hills McManse followed a typical market trajectory, i.e. dropped from $7.8+M(?) to finally selling this past Oct. for $3.9M… put this one in your “monitoring” basket:

http://www.redfin.com/CA/Beverly-Hills/12000-Crest-Ct-90210/home/5258297

Remember all the really BAD moves made by Japanese “smart money” during the S&L bubble, two decades ago… i.e. Big Money making moves in a super rarified end of the market has nearly zero correlation to the fat middle market where most of us live and deal.

And the price of the houses priced over a million will not go down as much, since the wealthy is getting wealthier and the poor is getting poorer…

New yor Times reporting that prices have dropped much even in cities like seattle.

http://www.nytimes.com/2011/02/14/business/economy/14dip.html?_r=1&hp

The latest rumor is FHA will be requiring 10% down as they try to wind down their position in the mortgage market. There’s even talk about eliminating Fannie and Freddie now. That, combined with a rise in interest rates, should cause housing prices to fall. Prices on the Westside are still 20-25% overvalued, compared to declines in other areas. With rents being about half of a mortgage, the smart money will keep renting until buying makes sense.

http://www.westsidermeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Wells Fargo lowers credit score requirement for FHA mortgages:

Wells Fargo recently announced that effective Jan. 15, 2011, it will accept FHA-insured mortgages for borrowers with credit scores as low as 500. For borrowers with credit scores ranging from 500 to 579, a 10 percent down payment is required, and the down payment may not be a gift or be part of a down payment assistance program. Borrowers with credit scores of 580 to 599 are required to put down 5 percent, and the down payment may not be a gift or part of a down payment assistance program. Borrowers with a credit score of 600 or higher are required to have a 3.5 percent down payment, and a gift is acceptable. For all borrowers, seller concessions are limited to 3 percent.

WELL… it’s a start… a very small step in the right direction… though I’m sure I’d be bug-eyed if I knew what a FICO of 500 actually implied in terms of credit history. =:O

I still remember, in the mid-80s, as a freshly graduated engineer, seeing my older home-buying colleagues go down to the HR dept., to MEET FACE TO FACE with a LOAN OFFICER! While there, they would then sign HR waivers allowing disclosure of their entire salary and promotion history, and it had better match what they’d filled out at the bank!… and that was with 20% down!

Gotta go figure out how I can “game” these Fed/FHA/TBTF-Bankster trends to my advantage, hobbled as I am with responsibility and a FICO score of 810.

Another great article. Well researched and easy to read. Doc, what you say can hardly be disputed. Just look at the rising default rates of FHA loans! “Stuff happens” and homeowners need to pay for a new hot water heater or more expensive repairs. Just ask a landlord. Faulty wiring, roof issues, it’s much more than just the mortgage payments!!

I often find 4 4-digit bills in abandoned rentals. some silly young person blowing thousands on the wrong cell phone plan. They lease sports cars as “babe pullers” and have no clue how to budget or even save towards a goal like a down payment for a house. There is a need to teach the kids how to make it on a low budget. (There were times when I lived on 4 2 a day for food while owning 30 units and some houses free and clear)

LOL… I too never cease to be amazed at what (often embarrassing) “possessions, papers and effects” tenants leave behind… there’s a lag, but eventually, and sadly, personal dignity seems to follow a plunging FICO score. =:O

What will be most interesting to see is if they really make people who strategically default wait for 7 years to finance another home. The people who do in general are in a much stronger financial position than others and I have a feeling the banks are going to want to make money on them. Right now every is saying you really have to wait the 7 years, but when I say I want to buy and have a 40%+ down payment I have to think in a few years someone is going to want to make that loan.

Well certainly, there’s ALWAYS credit available… at twice/thrice the going interest rate. The 7 years, IIRC, applied to GSE-backed loans… if you’re implying that prohibition may fall to political pressures (read Bankster Lobbyists), I would not disagree.

Certainly with a whopping 40% down–and a perception that your target market has “bottomed”–so-called hard money loans would be available, and yes, even some big banks would originate with that much equity to foreclose on, err, I mean put on their books.

Then again, in a “recourse” state (e.g. FL, AZ), part of the recourse might be you forking over a big chunk of what you walked away from N years earlier, before any new paper is floated.

Great look at strengthening the argument that housing prices are still way too high!! The market will not move sideways, or up, but down down down. What’s the true worth of a house? Patrick.net has a calculator based on rental prices, but these are rental prices being paid to support loans on overpriced houses to begin with. Traditionally real estate has about kept up with inflation. So using an inflation calculator (http://www.usinflationcalculator.com/) I did a simple calculation:

House purchased in a nice neighborhood in the OC in 1976 before the boomer run up $85k. True number here cuz I know the owner – a relative.

Zillow estimate – $765,000

Inflation calculator value – $325,000

Scraping FHA loans, forcing larger downs is another excellent way at bringing housing prices back to realistic levels.

God bless the FHA and the people who thought 3.5% was a good idea! Wife and I bought a house in the Inland Empire back in Jan 2010 and the only reason we did was because we recognized the FHA loan/call option similarities that the Doc talks about. 5 bedroom house built in 2006 and the down payment was lower than what me and my wife bring home in a month. Never in my life would I have imagined that would be a possibility. We could have paid all cash with a $15-20k loan from family but saw no reason to do so. As of now the neighborhood is very safe with very few foreclosures but if that changes then we will not hesitate to leave. We are in our early 30’s so in 10 years this will either be the best thing we ever did or an inconsequential mistake we can look back and laugh at.

Won’t forcing larger down payments simply artificially deflate prices instead of the opposite today? If we want to get back to fair market real estate valuation, the Gov’t needs to step out of the lending role and back into the regulation role. The last article I read stated that the average US home price is now equivalent to prices in 2002. To me, that seems about where the market would have been prior to the last bubble.

@Grant: “The last article I read stated that the average US home price is now equivalent to prices in 2002. To me, that seems about where the market would have been prior to the last bubble.”

Highly dependent on locale. In my hugely Bubble-ized® Zone (Miami-FtLaud), Duh Bub started in mid-2000, and was already WELL-inflated (though nowhere near peak) by mid-2002. 1999 is the benchmark year of sanity down here, though some segments will overshoot that nicely… heh-heh-heh…

What does the price of Oil have to do with future Calif RE? Well its takes auto’s to live in suburbia or most of LA for that matter and anyone in Northern Calif living North of the Golden Gate needs a car. The idea that Green Tech or electric cars will be any replacement for low cost oil lives in Disneyland. Calif housing was and is being built around the auto and any significant cost to fund that expense will significantly impact housing prices now and in the future. Maxwell is well know in the energy field and his predications on oil prices have been very close to reality. So his recent predication of $300 a barrel by 2020 should be taken seriously!

http://online.barrons.com/article/SB122065354946305325.html#articleTabs_panel_article%3D1

“Only price will slow the use of oil; the rising price tells us we don’t have enough. So, we are now beginning a bitter, bitter competition for fuels that will see the price rise to ridiculous levels.” – Charles Maxwell

Maxwell has worked since 1999 as senior energy analyst at Weeden & Co., an institutional brokerage firm in Greenwich, Conn., having started as an energy securities analyst in 1968. Oil prices came down last week, trading at around $108 a barrel, but he predicts an eventual sharp move upward — to around $300 a barrel — owing to a lack of available supply.”

Let’s take a ride in the wayback machine for and look at some listing prices for Hancock Park.

November 1972

111 N. June St. $185,000

225 S Rossmore $150,000

82 Fremont $95,000

355 N Las Palmas $159,500

184 S Hudson $279,500

344 S Hudson $295,000

435 S Rimpau $220,000

335 S Hudson $215,000

424 N June $139,500

114 S Rossmore $134,500

116 N Rossmore $119,500

515 S Hudson $135,000

626 S Windsor $125,000

224 N Rossmore $99,750

367 S Rimpau $185,000

335 S Rimpau $295,000

325 S June $134,500

414 S Muirfield $150,000

Wow. Those were the days huh?

WOW amazing! I ran 336 S Hudson Ave through this inflation calculator to get an idea of today’s dollars, came back at $1,538,904. (http://www.usinflationcalculator.com/) They started selling this place in 2009 at $9,450,000 and just started up again at $6250,000.

$1,538,904 would be the day! Probably not going to happen…

Thank you! What a great post 🙂

~Misstrial

Valentine’s Day “gift” from mega-brokerage Raymond James, i.e. DOWNgrades across the homebuilder sector… seems the “outlook” for the usual “Spring pickup” is way too rosy for those who must actually risk money on the sector.

http://www.marketwatch.com/story/raymond-james-cuts-view-on-home-builders-2011-02-14

agree that minimum down should be 10%, I would go further to limit a buyer to one goverment backed loan in a lifetime, either one owner occupied home or one investment property, bring these loans back to a way for a person to enter the market, not use over and over

My nephew and his wife are “unable” to save a down payment for a house.

However, they CAN afford

Cable tv ($70/month)

Anniversary trip to L.A. -flying and renting a car

Eating out both breakfast and dinner on the weekends

The lastest cell phone with all the “goodies”

High speed internet at home

Flying to any friend’s wedding, wherever it is

Hitting the wine bar after work

Driving to work (“I would rather be dead than have to ride a bus”)

Monthly parking at work ($120)

Some of these expenses are understandable.

High speed internet, if done right, is the least expensive form of entertainment around. $30 for all the streaming movies and TV you want via Hulu, or spruce it up with Netflix for $40. Unless you can’t wait to watch the season premiere of V, season 2, it is an extremely affordable form of entertainment that makes cable TV useless.

Driving to work is sometimes cheaper than mass transit, riding a bike, or walking. I used to walk to work every morning (5+ miles, one way) for exercise and found the cost of gas was offset by my increase in appetite.

Unless you really think you can eat that four foot tall bag of chips and jar of salsa the size of a baby from Costco before they go bad, eating out is often cheaper if you are single. I don’t think I can eat a loaf of bread fast enough to warrant buying one. They always get moldy.

Drop the wine bar and pick up a case of 2 Buck Chuck.

All that other stuff, especially the travel, is disposable.

Is this really what it’s supposed to take? If you want the “honor” of affording a mortgage, you have to severely limit your quality of life? That sounds like a crappy way to live just to afford a roof over your head that you can actually have hope of paying off one day. You gotta enjoy your life no matter what point of it you’re in.. especially since it could end tomorrow for all you know. I’m offended for your nephew that you would consider him unworthy of a mortgage because they enjoy their life.

What I want to know is if we will hear from the people buying today when their “investment” goes to crap.

While we all have probably heard of co-workers, neighbors, friends, etc who took a bath on their 2004-2008 purchase, you hear VERY VERY little of people who are stuck with a property they could afford, but are severly underwater. Say someone with a $150K houshold income purchased at $530K in 2006, but now the property is worth $350K or so…and they are stuck.

The reason I bring this up is that I notice lots of investor activity in my part of downtown LA. And I don’t get it. Current rents absolutely do not justify purchase prices. Furthermore, you don’t even get the numbers to come up right on an all cash transaction once HOA’s are factored in. So I’ve heard that many people invest on the theory that they can get 5% return which is better than an investment anywhere. Except 5%of a 200,000 purchase is $10000. And after factoring in $200+ HOA, there is simply no way a 450 sq ft place is getting $1100/mo rent, not even around here.

So who are the ding dongs doing this investing, and will we hear them pipe up a few years down the road when their investment didn’t pan out?

Short ans: REITs & hedge funds doing the buying.

~Misstrial

Fixer-Upper With Hot and Cold Running Rumors

LOS ANGELES — An unfinished mansion on 22 acres in the Hollywood Hills, occasionally used by gangs, Satanists and drug users, is on the market.

Leave a Reply