Time to make it easier for people to get loans with lower credit and lower down payments: FHFA looking seriously at making it easier for cash strapped Americans to take on mortgages.

If you had to write two chapters on the housing market between say 2000 and 2007 and one between 2007 and 2014 both would look incredibly different. One was guided by massive exuberance and a populist movement of giving money to anyone with a pulse. The latest chapter is one guided by big investors and low inventory. This long horizon now brings us to the present. Housing values are up solidly over the last year but not because the general public is diving in head first. This latest push came from a multi-year trend of “cash buying†and investor dominance. That trend has slowed. In order to get more interest again, the Federal Housing Finance Agency (FHFA) is looking at making it easier for the public to get loans. Ignore the fact that this agency has been rebranded since it failed fantastically in the last bubble and is now once again in charge of overseeing Fannie Mae, Freddie Mac, and 12 Federal Home Loan Banks.  Since many in the public can’t muster 5 percent for a down payment or have blemishes on their credit, the FHFA is looking at making things a tad bit easier for people to qualify. Instead of asking why so many have a hard time saving for a down payment or why people have lower credit scores, the banking/government hybrid is looking at making it easier for people to take on big debt with high leverage.

Cash sales and FHA loans

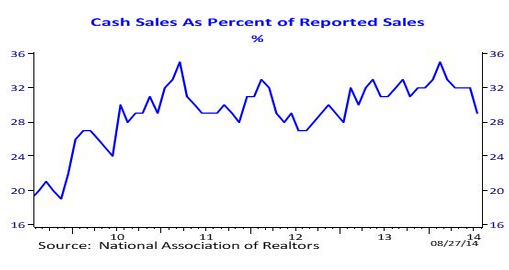

The nation is largely seeing a resurgence of renter demand. People would like to buy but budgets simply do not allow people to purchase homes at current prices. For example, take a look at the volume of cash sales:

Even for the typical home in the US of say $209,000 most will absolutely need a mortgage. That is just the name of the game. So of course, those circumventing the mortgage system are those with access to larger pools of cash (i.e., investors). Those investors are losing interest in many markets given how quickly prices went up. Value is harder to find. So it makes sense that now the FHFA is going to try to make cash strapped households leverage up at a point where prices are at multi-year highs.

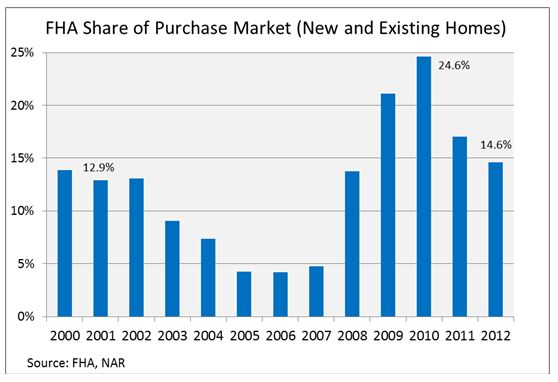

FHA loans which are wildly expensive when PMI and other fees are considered, have taken up a large share of the lower-tier market:

Even though FHA insured loans only require 3.5 percent down, many now carry long-term PMI and there is little reason to go this route unless you are exhausting all other borrowing options. The chart above shows that volume has waned here as well since the longer term PMI option was recently implemented.

Will easing standards work?

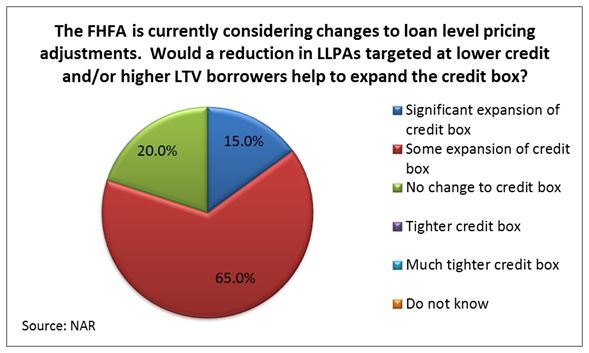

It isn’t all too clear that lowering standards will cause a massive resurgence or short-term burst similar to the home buying tax credit we saw a few years ago. Those in the industry do see this as expanding the borrower pool:

15 percent think this expansion will bring in more borrowers. 65 percent see some expansion while 20 percent see relatively no change. I believe that the lower you set the bar, the more people you will bring in. This should be obvious. But why is the bar being lowered? If we bring back no-income and no-doc loans you will have many people chomping at the bit to buy. Debt does not scare Americans.

So how does the FHFA plan on expanding mortgage availability?

“(WaPo) DOWNPAYMENTS. Saving enough money for a downpayment is often cited as the toughest hurdle for first-time buyers in particular. Watt said that Fannie and Freddie are working to develop “sensible and responsible†guidelines that will allow them to buy mortgages with down payments as low as 3 percent, instead of the 5 percent minimum that both institutions currently require.

This change would apply to a “targeted segment of creditworthy borrowers†and take into account “compensating factors,†Watt said. (Housing experts speculate that maybe the lower downpayments would only be offered to first-time buyers.) More details to come in the weeks ahead, Watt added.â€

“CREDIT SCORES. Most housing advocates agree that a bigger bang for the buck would come from having lenders lower the unusually high credit scores that they’re now demanding from borrowers.

After the housing market tanked, Fannie and Freddie forced the industry to buy back billions of dollars in loans. In a bid to protect themselves from further financial penalties, lenders reacted by imposing credit scores that exceed what Fannie and Freddie require. Housing experts say the push to hold lenders accountable for loose lending practices of the past steered the industry toward the highest-quality borrowers, undermining the mission of Fannie and Freddie to serve the broader population, including low- to moderate- income borrowers.â€

It is funny that the FHFA, now seven years after the bust is interested in helping “low- to moderate- income borrowers.†No matter how you slice this, they are trying to squeeze more debt onto already cash strapped households. Dropping the down payment to 3 percent is comical and frankly puts buyers into a negative equity position from day one (given that selling commission will eat up 5 to 6 percent). This push of course is coming because regular buyers are having a tougher time buying homes in the current market and many have already forgotten the graveyard of 7,000,000 foreclosures we went through.

The push coming from renter nation

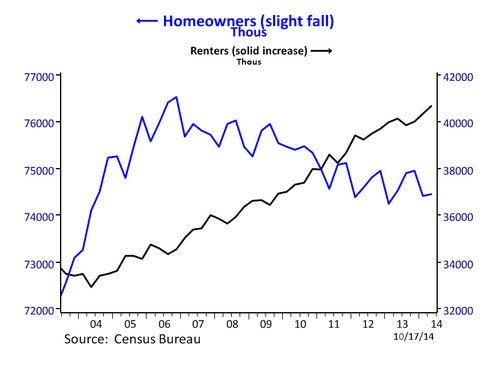

The second chapter has also been one of adding more renter households:

It is no surprise that while this talk of the FHFA lowering standards is happening, the homeownership rate hit a near two decade low:

“(LA Times) The share of Americans who own their homes slipped again in the second quarter to its lowest level in nearly two decades.

Just 64.8% of U.S. homes are owner-occupied, the Commerce Department said Tuesday, down from 65% in the first quarter and the lowest count since the third quarter of 1995. The figures are adjusted to account for seasonal variations.

In Los Angeles and Orange counties, 49.1% of homes are owner-occupied. That’s the lowest rate of any big metropolitan area in the country.â€

You also have Los Angeles and Orange counties reporting the lowest homeownership rate of all big metro areas in the country. This is now a renting majority region.

Implications?

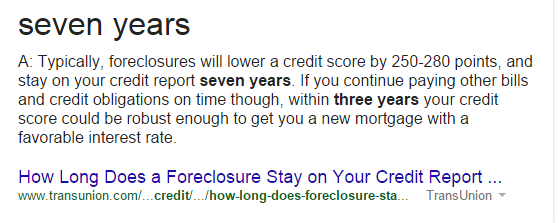

Should this occur, it is very likely to aid in sales nationwide. By how much? That is hard to say since dropping the down payment from 5 to 3 percent will simply cut into the more expensive FHA market that already allows you to go in with 3.5 percent down. I do agree that the credit change will be more substantive. I find it interesting that this aligns perfectly with the length of time a foreclosure stays on your credit report:

The bubble imploded in 2007 so this is a nice time to wash away those old foreclosures and hit the reset button on your FICO score. Whenever you lower credit standards you will increase the pool of potential buyers. That is what will happen here. But you are setting up a large portion of the population on a razor thin margin and you have to wonder what will happen when the next inevitable recession hits. Boom and bust. The makeup of the current housing market has turned everyone into a speculator. Nice to see the FHFA is now “concerned†with housing affordability and access to debt.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

114 Responses to “Time to make it easier for people to get loans with lower credit and lower down payments: FHFA looking seriously at making it easier for cash strapped Americans to take on mortgages.”

Housing To Tank Hard in 2014!

“US home resales are at the highest level in a year, a sign the housing market recovery is gradually getting back on track” Hurry, buy now, before home prices go higher in 2014. The market is booming. Buy, buy, by!

Ira…Nobody is more of a bull on housing then me. I feel a man and woman’s castle should be their dream.

That said, I also look around before I cross a street even though no car in sight and look at the price tag twice to make sure that is the price.

Most human beings are cautious by nature, and because God gave us a marvelous computer in our head unlike the computer we sit in front of it reminds us when things don’t seem to add up and to remember past experiences.

People of all walks of life were affected by the sub-prime fraud, It could have been your parents, your, siblings, close friends or yourself but the effects were far reaching.

Humans don’t forget major occurrences in their life, for getting to pay a bill it happens getting a notice to vacate or loss of equity is another matter. Buyers are still scared of what happen and more then ever have to be convinced it won’t happen again, a home is just to big a risk to lose it twice, thus the recovery is painfully slow no matter what you read?

They’re trying their hardest to gin up the market, but here’s a CNBC article called “Slump in mortgage rates fails to rally home buyers.” Refi’s are up but originations are down —

http://www.cnbc.com/id/102108564

The reality is, outside of the high end, the market is tapped out.

That’s exactly why they want to lower the bar down to as close to 2005 as they can. It was the only way they created volume and wild price inflation then, and it’s the only way they can do it now.

What. No it can’t be. The GSE’s are coming to save the day? Probably after elections or who knows. all IMO

It’s possible that this Administration has propped up the market with the good intention of helping banks and underwater borrowers. Knowing that this artificially inflated market is about to tank, they want have as many lendable borrowers as possible, hoping

for a “soft landing.”

They can’t have a soft landing without NINJA loans because working people’s wages are lower and inflation in the necessities is raging. The only other option would be HUGE subsidies for first time buyers like in 2010. Getting subsidies passed or the revisions to Dodd Frank to allow NINJA loans are nigh impossible, especially with the GOP likely controlling both houses in 2015. Hell it’s in their political interests to have the crash happening during 2016 as they run against Obama/Hillary just the way Obama ran against Bush/McCain. No crystal ball needed when predicting the actions of self serving politicians.

Here we go again.

It’s like deja vu all over again

it all has to come down eventually.. it’s gonna be so sweet when i buy at the bottom. properties in new york, london and paris are going to go for pennies on the dollar. and i can wait!

.. or maybe, just maybe, when all the property in prime areas are owned outright by the superwealthy, there becomes no incentive to sell at a ‘reasonable’ price. without distress, nothing is crashing, period. and the proof is right here: owner occupied units are way down and trending lower. this does not bode well for what remains of the american ‘middle class’

I hear so many people say this, but I’m curious to why these same people didn’t buy the last time it was at bottom in 2008. IMO, that really was the most bottom we will ever see it, so even if a new bottom out happens again it will not be along the same discounts. Furthermore, out of first hand experience, I really did buy at bottom but it wasn’t easy. If you can’t afford to buy now, you’ definitely won’t be able to compete with those people who bottom feed. I was frustrated for over a year trying to outbid people with full cash offers up to 30% over asking when it was the bottom because houses were so cheap. So unless you have vast resources and connections, there’s absolutely no way you will buy at bottom even if your timing is correct. Going back to what I said earlier, if you aren’t able to buy now it’s not likely you have the swagger to pull off a buy at the bottom.

+++++++ ding ding ding!

this is reality, folks. the investor class has the means to outbid you at the bottom

if you aren’t treating your house as an investment, then you’ll get crushed by those that do

it’s the same with stocks: if you’re going to capitulate at the bottom then shame on you, you’re making an emotional decision. i’m not saying prices won’t crash — never have, never will. but i am saying good inventory and good housing is becoming more and more scarce — good luck getting anything more than a total beater when prices ‘crash’ 10-15% (which by the way can be had right now anyways if you simply ignore the list and make an offer)

california is boom and bust

the stock market is boom and bust

the money still flows to the top

same game, different mechanism

Yo.. You are posting nothing new about life in general, who should care you were frustrated that a person with cash out bids you everytime?

As a former auto dealer if a sales consultant new that two buyers who walked in, one had full cash offer the other suspect credit but a super nice person, who do you think the sales consultant is going to ask first if they can get them anything to drink?

@robert. Sorry I wasn’t clear. I bought my house in cash so I was already ahead of the game compared to most bidders. HOWEVER, I wasn’t at the time used to bidding 30% over asking and that’s when I kept losing out to bids and by the time I started catching on that I had to bid that much over, it was much later and prices had already started to heat up a little bit. On top of that, even when I was putting 30% over asking, I was STILL losing out to bidders who had connections. I’d put a bid on a house for $320k and the house would simply be sold within 24 hours and I’d check zillow months later to find out it sold for ~$200k. So not only do you have to have all cash, you have to be well informed with realtors who know the game. Keep in mind, bidding 30% over is sort of normal now but it certainly was not when the market crashed it was a new thing.

@robert, also in regards to your statement about being a car dealer, I had the impression that car salesman don’t like the cash purchase because they make more commission by financing it. Sounds like your story has plot holes.

And the beat goes on.

YO….Glad you paid car, now a lesson in the auto business.

Sales consultants like RE agents love clean cash deals, notice I said suspect credit, sales consultants don’ t get people bought fiance does, all the sales team wants is to close deals get paid, try to sell another car in the same day.

Sorry Yo, meant to say glad you paid cash for your house very good work.

As I said several months ago the powers to be would make adjustments to keep housing afloat. With the fed now promising lenders they assume no risk in writing these loans it all but assures that RE agents will paint a rosy picture to buyers.

Matter of fact, on the local news first thing out of a young couples mouth, ” we can now look at luxury homes “.

They saved 40k which means at 3% they can offer on over 1m dollar homes with little risk. If they get in trouble they walk, not enough down payment gets you thinking again in the wrong train of thought I might add.

We will see if the flood gates open, I know one thing, the fundamentals of buying and selling are again push aside, RE industry in one powerful lobby, they wanted this they got it?

Going out on a limb here… If the prez gives mass amnesty, bam, there’s the demand that’s been missing on the low-end for the longest. Mr. New Permanent Resident, would you like to complete your American dream combo with a side of mortgage debt? We have been keeping a nice formerly foreclosed rental under the heat lamp for your consideration to purchase and occupy.

“If the prez gives mass amnesty”

I think you are confused about how our government works.

The last time I checked, Reagan had given full mass amnesty. Reagan was a Republican. Therefore to assume that a liberal President wouldn’t be able to pull off the same feat, would be grossly misguided.

He’s already stated he’ll do it by “executive order”. That’s how our government works now.

Why don’t you enlighten us with a response of substance? If I’ve got something wrong, let me know how it’s wrong. Labeling people as “confused” and offering no argument as to why is really pathetic.

YoSig – “The last time I checked, Reagan had given full mass amnesty”

See now, I’m not convinced you actually did check. Reagan signed an Act of Congress into law; you know, a bill gets passed by both houses and then it sings a song on the capitol steps (see Schoolhouse Rock). This is actually how our government works. Now maybe the very idea of this law makes you hopping mad, but it was all by the book; not a presidential decree.

Obama has said he will “fix as much of our immigration system as I can on my own†but what he can accomplish by executive order is in much doubt and will clearly be much more limited. Does he even mean it this time, or is he just playing both sides of the election fence? Who can say? He could declare that the undocumented must all tie their shoes and be nice to the elderly and it will still get challenged and sit in court for years and years. Also, whatever action he takes (if any) can be undone by any subsequent President.

Congress could do an end run around him by passing something more limited and incremental and taking the wind out of the issue. They would only have to work together and hammer out a compromise. Anybody forsee that happening? The Left would rather flog the issue so as to turn out Latin voters and the Right wants their base to get all frothy about the Great Mexican Peril.

tl;dr: Don’t wring your hands too much about blanket amnesty by executive order. It’s not going to happen.

Hope you found this enlightening.

I’ve been keeping the pages from the open houses I attend as I always like to go back and see what the property sold for.

After attending an open house for a 900 square foot house in a shady area of Echo Park, my wife and I had a conversation with a hipster couple out front. She asked what they thought, they responded they loved it, but they believed it would go for $750k which was 100k over the listed price of $650k. I sort of laughed and reminded them that the neighborhood wasn’t too good and not only did it not have a garage, but it didn’t even have a driveway, so they’d be street parking at their 750k house.

Well that listing went to the top of my pile and it went pending soon after the open house. I have been waiting to see what the final sale price was….?

Looked today… de-listed 10/10/2014.

Anyone know if that could mean anything other than it didn’t sell or the buyer didn’t perform?

Quite a few from my stack are de-listed now, including a lot of out of state properties I’ve been watching. Those usually go de-listed in exactly 2 months.

I have a hard time believing any numbers regarding inventory.

List, wait, de-list, wait, then re-list. The ole “Days-On-Market reset game.”

Is this all that it is that’s really going on with the whole listed /de-listed / listed / de-listed thing?

Because with sites such as “The Zillow,” the listing history is generally provided, and therefore, quite transparent.

So I have also been wondering about what is going on with such “busy” listing histories; I would love to hear if there are any other ideas about what this could be about.

Also, the Freddie and Fannie “First Look Initiatives,” to me, look sort of “gamed.”

Sure, they allow first time owners (who pledge to occupy the properties after closing) the first 14-21 days to make an offer on the properties–no investors are allowed to bid.

But, oddly, the Fannie and Freddie (Home Steps and Home Path) properties do not seem to be well-priced. So, if the folks who are first-time homeowners are confined to buying these properties, due to down payment constraints–they seem to be being hit with over-market prices in addition to the PMI. (It seems like they are being taken advantage of again–both in sales price and PMI.)

I’ve also seen several instances in which the list price on the house is lowered soon after the First Look Initiative is over. So if the first-time home buyer makes an offer then–when the price is more reasonable, they’re–by that time–competing with “all cash” and “investor” types.

It just doesn’t seem to pass the “smell test” to me.

I know that that FHFA has an OIG (Office of Inspector General), and I’ve thought about calling and giving specific examples–but I don’t know if their OIG is the type that is paid to “look the other way” or truly cares about/investigates such complaints.

(Oh! And I have also noticed cases in which the actual addresses on the Fannie and Freddie houses are completely wrong–almost as if to be “hidden.”)

But now I’m sounding conspiratorial! Sorry. (I’m not, by nature.)

Anyway–if anyone out there has the real scoop–I’m all ears!

DOM has not reset with a delist/relist for several years…but that was a very common sleazy tactic several years back….stale listings are nearly always stale for good reason.

Doesn’t work bubble. DOM in most databases shows combined DOM which includes previously cancelled listings, their list prices and price change history.

You’re absolutely right that it’s the classic technique of delist/wait/relist/wait/delist…

In some databases there might be a combined days on market, but most of the consumer facing sites that I’ve seen don’t use that metric. The Zillows and Redfins of the web do get gamed by this technique and it’s a way to keep a listing more front and center. Greed and marketing.

Zillow shows a history of all the listings.

Could be a title issue, structural issue flipper found out about that he has to repair because he knows it will come up in inspections, or maybe they just fired their broker and are waiting to relist with someone else.

@ Earl-

Correct, homepath/homesteps almost always price them WAY too high. This is because there is no appraisal requirement for homepath financing and it is still considered conventional. They hold their own note.

Consequently, in most cases they don’t sell quickly. Back in the day they used goldenfeather to list them and they would go on what was known as a “daily” meaning they would look at all bids if they didn’t sell during the sealed bidding process. A buyer’s best option here is to look for the ones that have been on market for a while and then just low ball the piss out of them, and ask for them to pay your CC’s too. I’ve made a couple deals like this where I was shocked they took the offer but they did and the buyer actually ended up getting a great deal.

900 sq ft. Echo Park. No parking. $650K. Insanity.

I’m pretty sure you could rent 900 sq ft. in LA for considerably less than that mortgage.

This will likely have a minimal impact as it doesn’t sidestep LTI and DTI ratios and nor does is sidestep Qualified Mortgage rules. It affects the additional credit requirement layering by banks. It also stands to take loans away from FHA and give to Fannie and Freddie. However, as I posted earlier this is where you can submit public comments to the FHFA if you appose this, either by webform or email address:

https://www.fhfa.gov/SupervisionRegulation/Rules/Pages/2015-2017-Enterprise-Housing-Goals.aspx#SubmitForm

And can be directly emailed at:

RegComments@fhfa.gov

Subject line: Comments/R​IN 2590-AA65

Be careful though, a nice way to drop home prices is by lending to marginally qualified borrowers with no real equity given the low down payment. A recession will create foreclosures and little reason not to just walk away from a home where you only lose 3% down.

That was the traditional mechanism, but in the last cycle we saw banks willing to sit on bankruptcies and short-sales to avoid recognizing a loss on their books.

In many cases they seemed to allow the property to remain in limbo for years until the sales environment was more favorable. I priced a number of short sale homes in 2010 and in most cases the price seemed to be structured to avoid the lender taking any loss on principal.

I’m a bit skeptical this time around would be all the different, and if equity is only 3%, the price can’t drop much before the banks would have to be willing to eat a loss to move it off their books.

Change GAAP to require mark-to-market, and it’s at least possible the lenders would behave differently.

Thank you Blert! There are still literally millions of homes in a state of limbo. Zombie banks and zombie homes. I think they will continue to do whatever they can to keep the music playing but we know the game of musical chairs and there is always those left without a chair when the music stops. Until eventually when there is only one left. The wealth is being ever concentrated.

Banks need to have skin in the game again and that means eating their losses like the underwater borrowers. No more tax bailouts.

When Wel Matt was put into his current role, the smell of greed, corruption and back door plays were going to be the norm….Mel Watt is dirty, these institutions are supposed to be wound down…There is no recovery, if so, these taxpayer butt massagers and FASB 157-8 would be re-instated.

Credit criminals love government programs ran by career banker shill men….

Housing bubble v2 with massive foreclosure coming soon to a neighbor near you. Save up!

Stock up on precious metals and other currencies.

You’re late John… Housing Bubble 2.0 has been here for a years or more.

Now Housing Bust 2.0, that is coming sooner than many think 😉

Lord B.,

I have “my ducks in a row†and I am still waiting for that crash so I can add to my portfolio of rental homes. By the way, I am also looking for that 3 BR, 2 BA, double garage within 2 miles from ocean for under 400k …:-)))) So, you will have serious competition when the crash comes. I just hope there will be ONLY the 2 of us because I don’t want others to step on my toes…:-))))

I hope that Skeptic and Brain of E. will be looking for under 300k when the crash comes otherwise I don’t think we’ll find enough inventory to keep all four of us happy.

Housing to tank HARD in 2017! 🙂

I don’t think Jim Taylor is going to get his 2014 tank wish with sub 4% rates we have now.

I think ur prediction is more accurate than old jims prediprediction

” I am also looking for that 3 BR, 2 BA, double garage within 2 miles from ocean for under 400k ”

There are plenty of these homes available in Oxnard. Of course these will be older homes, and Oxnard has many problems with gangs, and the streets are in poor condition, but commenter Carlos thinks that this will be the next Newport Beach.

I’ll leave that house in Oxnard to Skeptic.

I am very picky on location. I know some of my fellow bloggers shop based on price.

Two concerns:

a) Tsunami

b) Global warming = rising water levels

I wonder how Balboa Island will fair though I suspect the super rich will lobby for a dam to be built at tax payer expense.

Seriously, I am aware this sounds paranoid, but any relatively cheap places (not Santa Monica) where altitude picks up quickly off the beach?

Good lord b ya’ll, it’s time to put a stop to straw man arguments…

What’s not different here is that the entire region including so-called prime locations have exposure to future corrections of unknown degree and duration. The unknown includes the potential for significant events.

That said, the majority reasonable in the skeptical camp have never suggested fire sale pricing for beachfront property.

We can all agree that prices overall are higher in SoCal versus most of the geographical footprint of the country’s remaining land. That’s elementary and thus not in question. That’s not what it’s different here is about.

It’s different here is about the region’s predisposition to speculative mania and the associated cognitive dissonance that comes with it.

“That said, the majority reasonable in the skeptical camp have never suggested fire sale pricing for beachfront property.”

It is true. However, by their desire for prime locations (10%) they implied it.

Otherwise, I agree with your comments. It is a mania in over 90% of SoCal, the part where most of the bloggers don’t want to buy because it looks like a third world place. It looks like a third world country with London prices.

“However, by their desire for prime locations (10%) they implied it.”

At a certain point it just comes down to a semantical debate.

Haha flyover. I do read and re-read all the comments. That one nearly slipped past me.

By the sounds of it, you might be adding to your portfolio of investment properties before I enter the market. Take care not to over-extend your position.

_____

Claim = As soon as prices drop a little, the number of buyers on the sidelines willing to jump back in increases.

FALSE. There are very few buyers left, and those who do want to buy will be limited by increasing difficulty of borrowing.

The reason everything continues the same is because the real government (made up by the FED and CFR) is the same. Just because the public figure changed does not mean that the FED or the Council of Foreign Relations changed their policy.

A good example was with the attack on Syria last year – when all the electorate from the left and the right wrote to their representative that they are against, the president found himself isolated. Fast forward one year, after the approach was changed, they attacked Syria without anyone saying anything (without a small minority which understands how things work). I blame Obama because he was the president but I am 100% sure that if Bush, McCain, Clinton or Romney were presidents the same line would have continued.

Why? Because all were from the same CFR. I am convinced though that if someone like Ron Paul or Ben Carson would have been there, he would have opposed the attack. That is why everyone outside of the real government faces the full force of the MSM controlled by few people and all from their group get a pass regardless if the letter after their name is D or R.

“What does this mean???â€

Eden, in regard to your comment about all of sudden all numbers looking good:

It means that midterm elections are coming soon, the Minister of Propaganda provided the numbers the Democrats requested because they will be adjusted after the elections same as in the previous elections. Some things never change.

The sheeple have to feel good at least about the numbers if not in real life when they go to the booth. Since “mesiahâ€s appointed czars said so, it must be so. Did he ever lied to the sheeple???!!!!…..

Dropping lending standards is what got us into this horrible situation. These fools never learn. 1 years from now they will go back to liars loans and bank of America will announce again that they will start writing mortgages for illegal aliens again.

since 1913, the purpose of government is to take money from the middle class and give it to the poor and the 1%. game is almost over. no more middle class. welcome to the USSA. bow to your overlords

Yay! Now it’s even easier for everyone to get their piece of the American pie. White picket fence, two cars in the garage, and debt up to your eyeballs. Regardless of what happens, the show must go on. Churn & burn my friends.

Love this idea. Need to pump that bubble a bit more so I can make more money on my house when a house horny buyer ignores reality to overpay on it.

How unfortunate.

One would have hoped all those cash investors would have battled it out by dropping prices to find buyers but instead we are pushing people to over leverage and bail them out.

I still think a lot of people will balk at buying. As DHB has pointed out, 2br 1ba is not a very desirable home for a family. Proper homes are just too expensive in most places.

Reality is that stable employment is rare and people prefer mobility. So we shall see how many people bite.

Time will tell.

*sigh*

There is some hope though. There are 2 sides to the lending equation. Despite this move by FHFA (and it is difficult to assess it against wider economy), still got wider money tightening ahead, credit standards tightening for new borrowers and no sign of any lift in buyer eagerness. You can not force people to borrow (especially where they do not see good value, or have concern about economic conditions going forwards.)

Some of the talky talky about loosening credit criteria I think is jawboning, to soothe vested interests, without so far doing much to begin an easy credit party. A case of not believing 100% what the mouth says, but watching what the hands do.

A peek at how things are grinding out at wider national level:

http://www.cnbc.com/id/102108564

– Refinance applications jumped a whopping 23 percent week-to-week on a seasonally adjusted basis; volume was at the highest level since November. Mortgage applications to purchase a home saw no boost at all from lower rates, falling 5 percent from the previous week and 9 percent from a year ago.

– “More days on market, prices are coming down, the offers are even lower and there are just a lot of houses out there, so it’s a challenge for sellers. I think you have to lower the price in order to sell it.”

– “We have started to move mortgage finance back to a responsible state of normalcy—one that encourages responsible lending to creditworthy borrowers while maintaining safety and soundness of the enterprises,” Watt said in prepared remarks Monday. While there has been plenty of talk by lenders and federal regulators of loosening credit, the talk has yet to filter down to consumers.

__

What the hands are doing/planning for?

__

Citi, Goldman Sachs, others release stress tests

Published: Sept 15, 2014

[..]For instance, Bank of America’s latest adverse scenario features a U.S. economy with home prices declining 25%, compared with a 21% predicted drop a year ago. It also includes a 5.9% decline in Eurozone real GDP, compared with a 5% decline in the year-ago scenario.

-WSJ / MarketWatch http://www.marketwatch.com/story/citi-goldman-sachs-others-release-stress-tests-2014-09-15

“Some of the talky talky about loosening credit criteria I think is jawboning…”

We have an election coming up in a few weeks.

They can qualify whoever they want for a mortgage, bottom line is that “homeowner” has to be able to afford the monthly nut, repairs, taxes and maintenance. And they have to be dumb and desperate enough to buy at inflated prices. AGAIN.

The NAR and govt. will do anything to keep the RE mill going. Anything.

3% down mortgages 7 year auto loans 24% credit cards

America is #1! In debt slavery!

As AK suggests: go to the link and add your comment. There were only 34 comments when I posted mine yesterday morning. I doubt it will do any good but at least speak up. There were actual comments supporting this insanity. Again. Still.

There are 42 as of noonish on 10/22. Of those a few seem to be off-topic.

With interest rates under 4%, locking in a 30-yr at that rate with a portable mortgage is appealing. That would give me the freedom to move without having to give up that rate if rates rise in the future. Google search was fruitless, apparently no bank offers portables in the U.S. but seems to be available in .ca, .uk and .au.

Just look at gas prices to know the mindset of most Americians, all I see is lot of low milage brand new high HP SUV’s and cars.

Now the sales consultants push 400 HP and 0 to 60 times and buyers love it. Same with houses, at 3% down and lower standards the buyers will now get giddy along with the RE agents and look at 4000 ft homes and not the desirable move to a house they can afford for 30 years. That is the American buyer, bigger is better debt doesn’t to most buyers?

Rather than reflate by repeating

predatory lending and selling the

junk ultimately to Washington, with

the borrowers then chained for life,

potentially, why not have Washington

buy properties at whatever values suit

the banks and offer rent-to-owns to

any takers?

The math is very complicated ENEN, as is the warped politics and vested interests. They shouldn’t be involved at all in holding assets in my opinion.

Keep in mind, below, is from a source of 1992. Unlike past few decades of history, going forwards in the current time I believe holding money is a sound decision at such low rates 0.25%, against money/credit becoming scarce. Yet a bit push on to get buyers to lure pay high prices. I would rather see banks write lots of new mortgages, on low-mid-high prime houses that have had a crash, because banks make so much money over 30 years with mortgages. Not buy at peaky prices, and low rate mortgage that can only go up.

_____

[1992]According to well-informed sources in Washington, the FDIC still holds properties taken over from banks that failed in the 1930s. As this suggests, historically the FDIC has not been a good place to pick up bargains because the FDIC has had a policy of holding assets until their nominal prices recovered to match the FDIC’s original liability.

When you consider that, at 5 percent interest rate, the present worth of one dollar over forty-five years is about ten cents, you can see how unprofitable the FDIC’s policy of holding assets has been. It totally ignores the basic economic fact that a dollar many years from now is worth less than a dollar in hand. If the the FDIC accounted for the present value of money, as it may have to do as money becomes scarcer, it would most probably loosen its grip on repossessed properties and auction them in lots accessible to small buyers.[1992]

if they lend to people with good credit, then I see nothing wrong with it. People pay to live somewhere every day, just because they can not save up for a down payment does not mean they are not worthy of owning a home, we’re being able to purchase one and pay it off. I know myself, I had kids young, and I make decent money, but not big bucks by Los Angeles standards. but I am adamant about paying my bills, & I have excellent credit. if somebody let me live in a house right now, I will happily pay for it for the next 30 years until its paid off, that’s called good credit and good morals. There is no reason we should not get people into homes, and let them pay for them legitimatly if they are honest and creditworthy.

Realist….You are a good credit risk, as a former landlord it was difficult to rent to folks with marginal credit report yet many times I took a chance on them. The out come, these folks stayed in many cases years and never a problem with missed payments.

When I sold the building these people cried because they were fearful of once lease was up they would either be raised or thrown out. New owners did just that, they let them go to get more money out of people with higher credit scores what a mistake.

My old tenants never bothered me with the small stuff, new owners had better rent ratio but nothing but problems with tenants. In the end the building is about half empty, they deserve this, you can’t always judge people by numbers or ratings, you must take them on face value, I find most folks are good ,honest , willing to pay their bills on time.

Good credit doesn’t say anything about present capacity to service debt, it merely predicts likelihood of repayment. If in an efficient free marketplace people can’t save up enough to put skin in the game, prices come down to a supportive level. Instead of that happening in this cycle, we have well-entrenched interests doing everything they can to prevent that from occurring, mostly via supply restriction and accounting chicanery. Problem is, they want to have their cake and eat it too. Either someone takes the hit on the imbalance through deflationary measures or the problem flows to another area.

The debt slavery can and will continue.

http://www.marketwatch.com/story/housing-inflation-hottest-since-2008-as-rental-demand-soars-2014-10-22?dist=afterbell

Wow… wow

I have a bit 100K down-payment. oh boy… with this situation… when I buy it will be with 3% down… about 10-15K tops..

If it’s close to rental parity… oh well… will buy and if it tanks in 2016 or 2017 or 2019 or…

I’ll walk away.

i’ll play the game, i’ll cheat on my tax, i’ll do whatever… as long as I am not one of the few idiots playing by the rules… fuck it !

One of the ekonomists I follow predicts the housing price crash will happen when there is a job-loss recession. Other than that, we will muddle through the background noise of gentle ups and downs in house prices.

Defaults. They’re like dominoes. Defaults cause the job loss recession. We’re dancing in a default mine field.

Instead of making it easier for marginal buyers to go into a ton of debt, why not make it less attractive for specuvestors, flippers, hedge funds, etc to buy SFHs? What benefit to society do these “investors” bring?

&&&

Let “investors” buy multi-family units and keep the townhomes and SFHs to owner-occupiers. If “investors” don’t want to invest in multi-family real estate, they should invest in other businesses that create jobs. Allowing investors to buy up residential real estate drives up prices and rents, which chokes off our economy. Laws need to change to eliminate the skimmers of real-estate.

Joe excellent post, investors like me years ago bought income property only. I owned small plaza and apt buidings. When I was very young I did buy several homes in $1.00 down payment days. When I bought those I fixed them and sold them. After that I did nothing but invest in income property, I did of course buy and sell personal residences to play the move up game to a better home and location.

True house investors who never move in are carpetbaggers who do ruin many comps in neighborhoods over the long run they leave a area in canage,

Why are people bailing out the flippers by buying overpriced homes just because a flipper added granite counter top and new paint? I don’t get why home price shot up so much when income remained unchanged. If people just say no to these non sense listings, we would not have this problem. Be patient, buying now will just be supporting the flippers. Nothing can go up forever especially at these prices.

I’d love to know the percentage of cash vs leveraged transactions on flipped house purchases. I’m willing to bet it’s somewhere close to 100% leveraged. That tells you everything you need to know about why people are willing to “buy” them.

Geez people, why are you all freaking out? These are not NINJA loans or 2/28’s. These are 30 year fixed loans for people with good jobs and credit, that can not save up $30k in a society that breeds them not to. DUH! Who didn’t see this coming???

Don’t fight the Fed.

interesting how the FHA market was so much lower during the boom years. I would think that since subprime borrowers were blamed for the housing crash but that would far exceed what is being marketed today. But ironically it’s the exact opposite. There are more FHA loans as market share shows when compared to back during the boom years. This is in direct contradiction to the storyline of how subprime borrowers caused the housing crash. However anybody with a brain cell can research this and find out that in fact the housing crash was caused by the brokerages and banks becoming one in the same the destruction of Glass Steagall and them gambling on the housing market and basically stealing the equity the day borrowers closed escrow whether they had a 30 year conventional fixed rate or a subprime loan it made no difference and this chart shows beautifully how that whole storyline is nothing but a lie.

take ownership of the fact that you bought rental properties at the top of the market. you’ll heal faster

I’ll second that!

Lynn, during the last few years of the mania there were two primary buying groups that bid up the market to its demise:

a) Subprime borrowers

b) Speculative borrowers

Leverage with caution. That is the message of this blog and others like it.

via Wikipedia QE:

“In late November 2008, the Federal Reserve started buying $600 billion in mortgage-backed securities.[42] By March 2009, it held $1.75 trillion of bank debt, mortgage-backed securities, and Treasury notes; this amount reached a peak of $2.1 trillion in June 2010.”

Whatever happens in the next 6 years, the banks will rein in the profits one way or another, perhaps this time it’ll come directly from the consumer through the much-feared bail-ins, while we few who can manage to dance around the raindrops can come out of this better off than we are now.

I live in redondo beach. Houses are selling for $50-100k over asking, and prices have gone up steadily since i started looking in june 2013. Horrible properties. So much for the “tank.” I actually believed it too. I see Belmont heights area selling below asking, but not in my neighborhood. North redondo golden hills area is NOT prime real estate. And 85% of the houses are just so ugly ugly ugly! I can’t find a $700k crap shack. More like $850 crap shack.

Golden Hills in Redondo not prime? 3/4 of a mile to the ocean, walking distance to the Hermosa pier, some of the best public schools in the state, HS at Mira Costa….not sure what would qualify as prime in your book, waterfront in Newport Beach?

The PTB have made an epic error.

Long before now the market should have been adjusted back to 15 and 20 amortizations.

This transition should’ve been made before the last leg up.

Shortening the amortization period forces more skin into the game — but over time.

&&&&

Even so, 0-care is CERTAIN to vaporize the First-Time-Homebuyer.

Most of this damage lies directly ahead. It’s truly new ground.

The bottom rungs of the property ladder have been blown away.

Bringing in poverty stricken Latinos and Haitians will only magnify the trouble, as they must inevitably consume social goods/ services even as they are unable to contribute.

Sao Paulo, here we come.

“Even so, 0-care is CERTAIN to vaporize the First-Time-Homebuyer.”

Could you please expand on this?

In a nut shell:

To be a home buyer — even a first time home buyer ones income HAS to be above the range of 0-care subsidies.

Yet all non-subsidized 0-care policies carry an implicit TAX used to cross subsidize those with lower incomes.

This tax bite is pretty much a PER CAPITA tax. It goes into full effect the moment you’re outside the subsidy zone.

By per capita we mean that the tax is the same per person — independent of income — as long as that income is above the subsidy zone.

This tax impact will hit one’s wages even if the employer pre-deducts its expense BEFORE your W-2 figure is calculated.

It’s economically false to assume that ANY employer is paying for any employees health tab. Such a mechanism is just another way of paying employees — who STILL have to earn the income required to pay it.

ALL modern payroll software tabulates ALL of the direct expenses triggered by employment. It’s this final, full, value that is used to judge whether you’re on the bubble — or have a safe job.

Most of the posters that I upset here have never hired anyone, have never run a payroll accounting package, and have never talked to a small business man.

Consequently they have government faith: that Congress can legislate wage gains straight out of thin air, and that mean, evil, capitalists and Conservatives are all that stands in the way of bliss.

Here and there, you’ll find exceptions to such a characterization — but most Progressives will fit this thumbnail description.

Certainly Barry fits such a mind set. Now that he’s getting tabulations from his own experts as to how the numbers fall… he’s freaking out and delaying 0-care in every manner possible… something like 60 executive ‘adjustments’ to date.

BTW, the 0-care website STILL doesn’t work. Only the front end part that the public sees is up and out there. The links to the immense databases that were to establish the cost structures are still too daunting to assemble. Entirely new optical fibre networks have had to be rolled out. Ancient data from all over America must be ported to new, consistent data structures. (You wouldn’t believe the differences across the whole system.)

All of these expenses have to be paid — one way or another. They won’t be paid by those getting free or super low cost medical insurance.

The 0-care tax impact has to be the highest ever — outside of wartime. The only sector of the economy big enough, and wide enough, to eat the expense is the housing market. We can’t stop eating or driving to work. The belt tightening must happen in real estate.

Appreciate the response.

Blert, as much as you state the obvious, some bloggers here not only are not able to connect the dots of cause and effect, they can’t see the connection even when you show it to them.

I said the same thing many times, that O-care will decimate the first time home buyer, I explained why, and then I still received all kinds of partisanship replies as if I was talking politics.

Those who read my comments know that I care less who is in power because I hate lots of things done by both Ds and Rs.

How exactly does ACA affect homebuying? The greatest impediments to homebuying among the under 40 crowd is stagnant income & ever increasing cost of housing. ACA helps reduce healthcare costs, so it’s one thing that’s actually helping younger folks keep more of their money.

It’s the under 40, healthy adults that are statistically over charged the MOST.

You need to reread the entire theory of how 0-care is supposed to work.

The elderly receive suppressed rates. The high-earning young adults get zapped.

It’s not unusual to see rate hikes of 300% for such souls… compared to the prior norms.

Getting the employer to cut the check does not mean that said monies are not charged to your cost of employment in the internal accounting. Should you fail to hit the mark, you’re on the bubble — and will be laid off as soon as it’s practical for your firm.

In the construction trades, that usually means the end of the contract.

BTW, new hire (apparent, W-2) rates for blue collar construction workers have ALREADY been rolled back $5 to $7 per hour — a flat roll-back — up and down the scale. For those at the bottom, the net result is freaky.

Smaller firms are just kicking the crews loose — and off the prior health plan.

The administration is trying to stop this trend, but it’s hopeless.

In Europe, employers shrink down to avoid such expenses. It happened in Hawaii, too.

No firm can compete with a $6 per hour head wind on blue collar labor… whereas it’s no biggie for attorneys and doctors.

LAer,

Excluding the very poor, it is the most regressive form of taxation. It is the nail on the coffin of middle class. It is not only high percentage of middle class income, it taxes even based on the number of children.

This is why it was embraced by all the rich (0.1%) democrats and republican alike (more democrats than republicans) – the republicans just the “progressives” neocons and RINOs.

The constitutionalist conservative base, ALL rejected it and declared “wacko right wing nuts” (by the progressives) just because they were smarter to understand the cause and effect and to connects the dots.

Blert, what do you make of Bruce Bartlett’s attempt to portray O-care as textbook Republican health policy? http://www.theamericanconservative.com/articles/obama-is-a-republican/

http://medicalhypotheses.blogspot.com/2009/11/clever-sillies-why-high-iq-lack-common.html

Hackman: ^^^^

Writing something absurd and controversial will get you noticed and published. This goes double for anything that falsely portrays Barry as being a conservative.

If he had written about what a total fiasco 0-care is — and must be — no-one would line up to publish his me-too opus.

He also pulls polling values right out of his ear. Who can believe that Barry pulled genuine conservative votes in 2012.

Certainly Colin Powell is no conservative — never was — never could be. He was launched into politics by Richard Nixon… probably as a token. Once Powell was inside the White House he ceased to be a military man — regardless of the uniform. Like North, it was all politics all of the time once he was a NSC staffer. [This slot is also described as a White House Fellowship. How token can you get?] He was groomed thereafter for higher command — on the fast track. He made his biggest leap under Liberal Republican George Bush 41. Then George Bush 43 makes him an even bigger wheel.

All of the other ‘conservative’ Republicans mentioned were, and are, (like himself) Liberal Republicans. However, if asked, he would claim to be a conservative.

In a similar vein, Al Franken does NOT consider himself to be on the far left. In his own written words — he is in the center. (!)

So, such self-delusions are as common as dust.

Of course, his pierce is not serious commentary. It was written “out of hunger.” (ie he needed the money and the exposure.)

BTW, the WSJ is NOT a conservative publication. It has to hire J school grads from the same Progressive institutions that staff up the NY Times and the Washington Post.

It’s only distinction is that it normally does not carry Barry’s water.

How far do we have to go back to find a true conservative president? Grover Cleveland?

Read between the lines of the new lending rules, ATR and QM requirements.

The bottom rungs of the property ladder will be supported by 40 year amortization loan options. Coming soon to a lender near you.

The geniuses on this board say, “no way!”

wrong direction my friend. we’re going to see 50 year mortgages first to increase ‘affordability’ and ‘multigenerational wealth building’

blert is lost in the fog of war. He’s delusional because Barry-O didn’t shake his hand during some stupid luau in Maui. Give it up, freak, you really think that TBTB scour the i-web for your missives to create policy? You some freak, blurt.

red flags were all over the place four year ago, when the underwriters were more concerned with a few hundred dollar cash deposit in checking account than the backend DTI ratio of 50%.

The housing bubble in SoCal can’t continue when good paying jobs are leaving the area. Simply put – we all can’t deliver pizzas to each other.

Exactly. Who are the large employers? What are the growth industries?

Creative destruction, outsourcing and technology have reduced employment in SoCal bit by bit over the years.

I ran U-Haul numbers, as someone had mentioned awhile back, as a gauge to what is happening to the population in Los Angeles. I tried several different cities. Denver, Portland, Nashville, Phoenix. All of them it was more than twice as much to take a truck to those cities than it was to bring a truck to LA from one of them. Productive people are leaving.

ak, regarding your concern about global warming: I, too, have that concern and wonder what elevation would be adequate. Your thoughts?

Denver?

Productive people don’t use UHaul. They use private moving services or Pods.

I’m calling total bullshit until you show us the proof. Don’t forget to clarify your interpretation of productive in this context.

Passing out credit is not going to work, as wages are not keeping up with inflation. Even if a person prudently buys less home than they are approved for, it will only be a matter of time before the associated costs of ownership are crushing the wallet.

Until property taxes are reined in and and purchase prices are steady, this is a lose-lose situation. 🙁

Leave a Reply