Financial sleight of hand. The incurable onset of mortgage delinquency. Cure rate for mortgages at all time low. Government share of all income grows to record levels.

The current economy is based on smoke and mirrors pulled from the Wall Street bag of tricks. This has been the worst May on record dating back to 1962. Many Americans are finally waking up realizing that they have been scammed for the past decade and what seemed to be a recovery was merely a stock market going up for the benefit of a very few. The market is largely operating with the same structure that led us into the crisis so it should be no surprise that we have days where the market can seemingly fall 1,000 points with really no explanation. And if we look at the consumer mortgage market, we will find $10.2 trillion in mortgage debt outstanding. Over 14 percent of mortgages in the U.S. are either in foreclosure or 30+ days late. The show ends once the bag of tricks is removed.

So what caused all this volatility in May? Part of it has to do with global debt problems. These no doubt shook the markets. But if we look at housing, two crutches for housing were removed. The Federal Reserve finished buying up $1.25 trillion in mortgage backed securities and the government tax credit ended. In fact, you can see problems already hitting the market almost in real-time. Sales have fallen since much of the demand was pulled forward. You can expect this trend to reflect in home sales data for the upcoming months since many reports look at various points of the home buying experience and this can take 30 to 45 days to report.

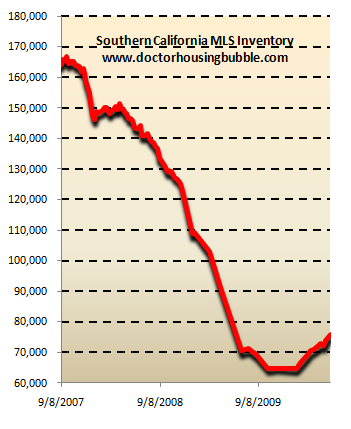

Inventory is growing:

Over two weeks Southern California added over 2,000 homes to the MLS. This has been the biggest move over two weeks since inventory started spiking up from the trough of 2009. Why do you think that is? Could it be that many bought simply because of the tax credit? Or could it be because programs like HAMP have now failed and some of these properties are now making it to market? Whatever the case may be, inventory is going up.

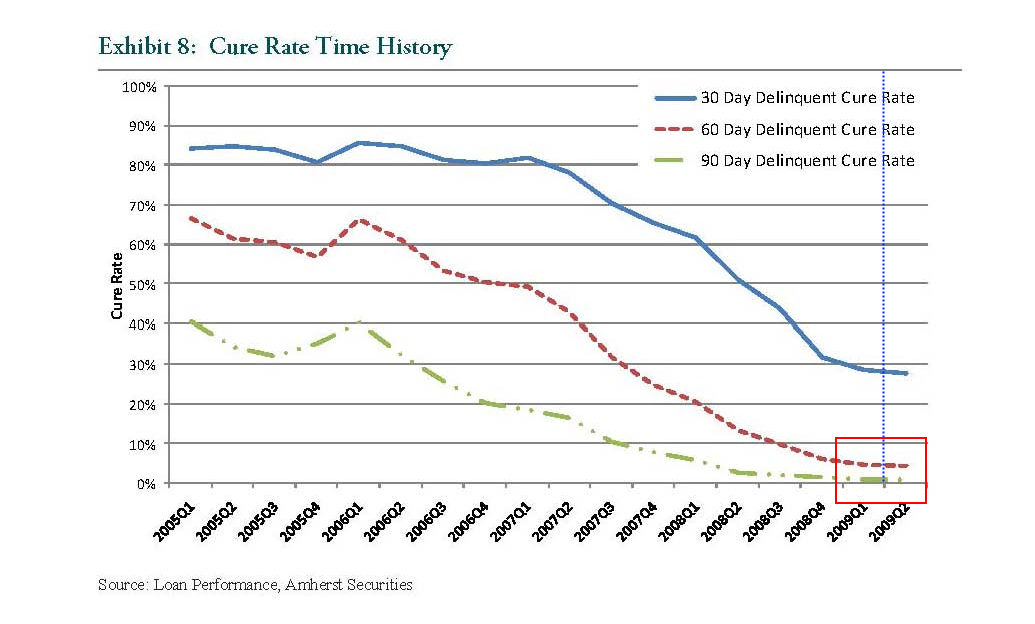

Yet a more ominous problem is the inability to cure mortgages:

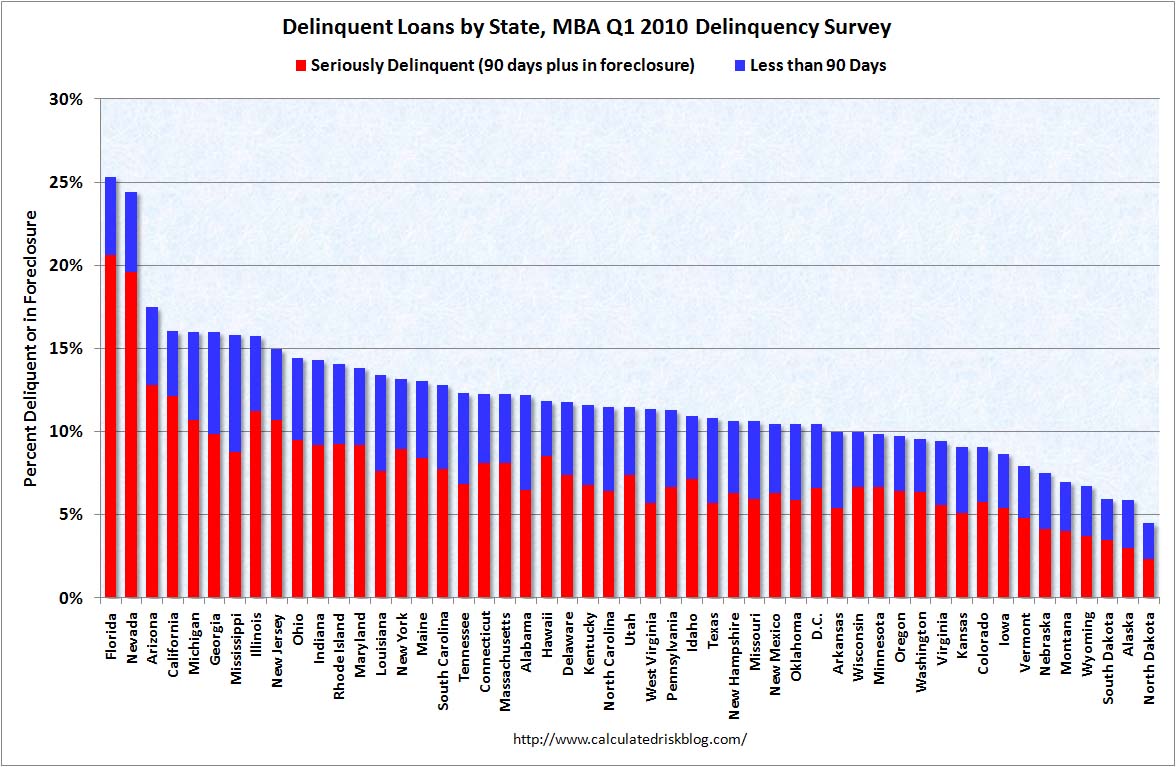

Source:Â Calculated Risk

As you would expect the foursome of Nevada, Arizona, Florida, and California have the most troubled mortgages. What a program like HAMP did was give the false impression that somehow homeowners would be saved by generous help from banks. The only thing the program created was a tiny window of false hope on a shoestring budget while the real funds were diverted to Wall Street. Now why have these programs failed? Because many homeowners really have no ability to pay their mortgage. And then you have a growing number that can pay their mortgage but decide to stop paying. What does this translate to? An incredibly low cure rate:

Carefully examine the above chart. Once mortgages go 60 days late, they are virtually a lost cause. The ability to cure mortgages is at all time record lows.  You might want to use caution when you compare mortgage rates.  A program like HAMP was fighting the above powerful trend. Keep the above in mind when you read the following data on distressed mortgages:

“(MBAA) The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 4.63 percent, an increase of five basis points from the fourth quarter of 2009 and 78 basis points from one year ago. This represents another record high.

The combined percentage of loans in foreclosure or at least one payment past due was 14.01 percent on a non-seasonally adjusted basis, a decline from 15.02 percent last quarter.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 9.54 percent, a decrease of 13 basis points from last quarter, but an increase of 230 basis points from the first quarter of last year.â€

So the bulk of the 14 percent of distressed loans are 90 days or more past due or in foreclosure. The cure rate for this territory is horrible. We can run the quick numbers if we like:

U.S. total mortgages:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 51 million

Loans in foreclosure:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,361,300 (approximately)

90 days late or more (but not in foreclosure):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,504,000 (approximately)

We have a potential pipeline of 2.5 million more foreclosures (almost assured in the 90 day group). Then you have another 2.5 million with at least one missed payment that have a low cure rate as well. This doesn’t seem like good news to me given the horrible cure rate on these loans. Part of the problem is with the overall economy. Even though strategic defaults are growing, 4 out of 5 foreclosures occur because people cannot pay for their mortgage. Then you have loans in California of the Alt-A and option ARM variety and you can easily understand why the housing market is in for another round of adjustments.

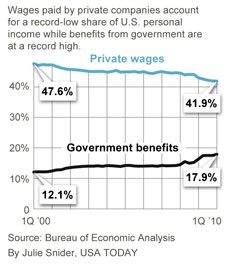

A few of you sent over a startling chart from USA Today showing the growing amount of government payments as a share of national income:

Source:Â USA Today

Key shifts in income this year:

“Private wages. A record-low 41.9% of the nation’s personal income came from private wages and salaries in the first quarter, down from 44.6% when the recession began in December 2007.

Government benefits. Individuals got 17.9% of their income from government programs in the first quarter, up from 14.2% when the recession started. Programs for the elderly, the poor and the unemployed all grew in cost and importance. An additional 9.8% of personal income was paid as wages to government employees.â€

The economy is not recovering is how I read the above. Unemployment benefits and food stamp payouts are at record levels. This is not a sign of a healthy economy. I know some want to spin this as good data but it really is a mirage. I always see these studies that show how wonderful it is that all this spending helps the economy. I realize that it is useful to have a safety net but please don’t spin this as a solid economic boost. If that were the case, why don’t we just guarantee everyone a $100,000 annual income for life?

The housing market is already pulling back only one month after a few government programs ended. We have millions receiving unemployment benefits and roughly 40 million receiving food assistance. Until we see this trend reverse and employment growing in a healthy way without government assistance, we can rest assured that any talk of a housing recovery is merely an elaborate trick.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

16 Responses to “Financial sleight of hand. The incurable onset of mortgage delinquency. Cure rate for mortgages at all time low. Government share of all income grows to record levels.”

Another great article…But, I think that after prescribing large doses of anti-depression meds that were heavily prescribed during the fall of the great housing bubble, the gov. has done a great job in giving the consumer a huge sparkle of hope for the “housing Market” to turnaround and gain huge equity some how…Maybe the Gov. should include a high dose of Prozac, Zoloft, etc. along with the EDD payments that many “needy” consumers need right now. That would really keep us “CONSUMERS” optimistic about it all…Or wait…is it already happening?

OBEY….SHEEPLE….RED PILL or GREEN PILL?

Heavy sigh.

So what we have, basically, is the government becoming feudal landlord AND food/health care/wage provider for more and more people. With no end or remedy in sight. Just more and more people reduced to peasants living at the whim and will of a Largesse Class. (Paid for by the few remaining wageworkers.)

~

As a small pusball of plutocrats sits back and figures out how to get rich from the crash.

~

What I can’t figure out is what will be gained by allowing people who can’t afford their mortgage payments to stay in their houses. If they can’t afford a mortgage, and didn’t think ahead, how are they going to afford everything else?

~

Oh wait, I already answered that. The government will be their daddy.

~

I would much rather this money go to small business creation–like the self-employment/microbusiness models proven so effective.

~

rose

California has just started to give a $10,000 tax credit for home buyers. This is more than the federal tax credit that just expired. California, despite its tremendous budget deficit, is still trying to kick the can down the street. Let’s see what happens when this new housing subsidy expires at the end of the year. Maybe they will come up with a new one.

Richard Russell said last week that we wont recoginize the country by the end of this year. I can see why. Although the recent relative strength of the US$ and the sliding stock and housing market will probably give the politicians another chance to create yet another stimulus package for $300B or more to juice the various markets. So we’ll have another little rollercoaster ride at the end of the year. Whoopeeee.

add 10% foreclosures to 3-4% normal rate is like adding 10% to 4% unem,ployment rate. Everything becomes a major economic bottleneck of a problem. ANd Zero would do what? monetiza debt of RMBSs he bought up? and add 12.5 Trillion through RRR sleight of hand to boot?

Banks will not lend on mortgages and hold long-term paper on short term liquidity infusion.

I am a simple displace disenfranchised carpenter at wits end. These guys are the real deal. If I see it, they see it.

Like Howie’s guests would say as they hopefor a real fat free lunch, “NO DEAL”

Thanks for keeping the focus where it needs to be Doc. Employment is where it’s at and always will be. Keep up the good work.

The 28 percent of personal income that is sourced from the government is startling but not surprising. I wonder how much more is generated from companies that are doing business with the government. It would also be interesting to see comparable numbers for other countries. Does China generate more income from private companies than the U.S.?

When I saw the reference to Richard Russell, I thought “Hey, wasn’t that the late segregationist Senator from Georgia?” He definitely wouldn’t recognize the country now. Well, a quick search revealed several famous Richard Russells, so I’m guessing it’s R.R. the goldbug.

I am still maybe 15 years from retirement, and I never did take out a HELOC, so my house is almost paid for. The 401k is there and some inherited property. I have a job with a pretty bright future prospect for staying employed. I’d like a comfortable if not extravagant retirement some day.

What I want to know now is will we have a massive deflationary depression, or a wild bout of inflationary spending with the dollar going to the bottom. For the latter, buying real estate in the next round of foreclosure madness would be a good strategy (holding Mr R.R.’s favorite investment might not be too bad either). For the former, holding dollars and dollar denominated US Government securities would be the right thing to do now. If it is something in between? Will we wiggle through a loophole with the economy picking up steam to bail out the Government? What about foreign economies? Europe is a grease fire, but what about Asia and Latin America? This whole economy thing is one tough nut to crack.

Or how about a nice mix – stagflation, perhaps? As far as holding gold if you’re betting on (hyper) inflation…that’s fine and dandy, until the powers that be decide to (once again) outlaw it in the hands of private citizens and mandate its seizure. At least for those who aren’t insiders/friends of the regime/Goldman Sachs etc.

I am just a dummy! I cannot believe the people I run into that have their heads in the sand, or don’t care or are just plain stupid. Don’t they SEE what is coming? Don’t they study anything? Are they happy knowing they have lost big $$$$ in Oct. of 2007 and the Market and Wall Street and The Fed Res. are going to get them again? It’s all a Madoff Scheme……The idea of Globalization is not new and only a few key phrases researched and studied will allow sheeple to at least know how their demise will come about. Research some of these;……… The CFR…….The IMF……..The Bohemian Grove……..The World Bank……The Skull and Bones……The Bank of England…….The Trilateral Commission…….The Rothchild Bank……The Bilderbergs……..Fractional Reserve Banking……..Fiat Money …….The truth about the Fed Reserve, which is nothing other than a banking CARTEL set up in 1913 to fleece the sheep can be read about in an excellent book, “The Creature From Jekyll Island”, by G. Edward Griffin. How can jobs be created? Like our money? Out of thin air? Folks, your are getting a lot of BS from fhe department of lies in D.C. We are being lied to, cheated, and deceived by the bankster/gansters of wall street and other central banks of the world controlled by the same few.

Move up buyers are a dying breed which will and is having an significant impact on the RE market dynamics. A survey by the national Foundation for credit below and link:

“Of more than 2,000 respondents to a survey conducted by the National Foundation for Credit Counseling (NFCC), nearly half — 49% — believe they will never afford a 20% down payment to purchase a home.

The NFCC said the discouraging news implies that buying a home will always be out of reach for these people. In the past, finding the money for a down payment was only a problem for first-time homebuyers, the NFCC said. After making the first purchase, borrowers could use the proceeds of selling it as a down payment on the next one. That was in an appreciating market, however.

“Due to today’s turbulent housing market, the problem has now spread to those who currently own a home. Many mortgages are underwater. Thus, even if the homeowner is able to sell their current house, there may be no profit available to satisfy the down-payment on the next home,†according to the NFCC survey report.”

http://www.housingwire.com/2010/06/01/survey-finds-nearly-half-of-americans-cant-afford-large-down-payments-on-mortgages?utm_source=rss&utm_medium=rss&utm_campaign=survey-finds-nearly-half-of-americans-cant-afford-large-down-payments-on-mortgages

ron: That’s a *GOOD* thing. If people cannot save 20% to buy a house, they simply do not deserve to own. Let them rent. Let the rest of us who HAVE been diligent in saving and managing our money buy.

@Seth

~

Buying in this state, at the end of the day, is a long-term bet on this state even for people who have 20% down. Anyone want to take that bet?

~

Aside from that, there’s the idea that prices might still fall leaving you owing more than the house is worth. The first rule of investing is “Don’t lose money.” The second rule is, “Don’t forget rule #1.” $30-50k worth of depreciation is at least a couple of years worth of rent, leaving out the costs of home ownership, escrow costs, realtor fees, hassles, and loss of mobility.

Seth:

The prior market (last 40 years) has centered around the move up buyer and their ability to make larger down payments which over time has created the current price banding in the RE market. Without significant sales velocity from the move up buyers the RE market will depend upon cash and GSE buyers for sales velocity which will probably kill off large segments of what is now the upper price bands say 450K to 950K as an example. These upper price bands will collapse over time and compress the price range into very narrow points. When I first started buying property back in the early 70’s their was a big difference between home for 30K vs 32500K that sounds silly today but I would not be surprised to see that type of price compression return.

Thanks for your comments, Foolio. Stagflation is probably a more likely scenario than Weimar style hyperinflation. I don’t think that confiscation of gold is likely in this global economy. Roosevelt confiscated gold when dollars were gold-backed, so he could re-value the dollar. The dollar long since has shed all ties to gold, so seizing gold would do no good over seizing any other property. I think that resistance to gold seizure would be nearly total among today’s gold owners. They’d only get the current inventory of gold dealers which is small. Owning gold through foreign ETFs would explode under those circumstances. Gold and other precious commodities are probably the only real defense against stagflation, as stocks and real estate depend on support from economic activity as our host keeps trying to convince everyone. A real estate market rising without support from the underlying economy = housing bubble!

Leave a Reply