Financing the Flipping Dream: Alt-A Mortgages and California Mortgage Equity Giants: Number one Alt-A Owner Occupied State is California. Say What? Alt-A and Pay Option ARMs Fueled out of State Buying.

Back when the housing bubble was still a theoretical argument, I was making the case that many California aspiring real estate moguls were buying properties out of state with the intention of flipping. I would look at some of their worksheets and they paid no attention to the cost of financing or expenses since they figured that they could sell their home in one or two years. This was so common that it became a joke and I started calling these investors California Equity Giants. Many of the Alt-A and pay Option ARM products were marketed to would be investors as excellent loans for flipping. After all, why would you need a boring 30 year fixed mortgage when you would flip the property in a few years and eat up equity like a starving vulture? Plus, the toxic mortgages gave a higher payment to the broker but why bring that up right?

Currently there are $469 billion of Alt-A products floating around in our nation’s fragile housing market. Much of it is disguised under the good credit rating since the average FICO score of an Alt-A loan is 705 which is an utter joke. But one data point that has been completely missed in the Alt-A and pay Option ARM debate is how many loans are attached to non-owner occupied properties. That is, where are some of those California Equity Giants investing their money?

Do you want to take a guess which state has the lowest non-owner occupancy rate with Alt-A loans? California. Only 19.6 percent of Alt-A loans in California are non-owner occupied. Which in our case, is horrible given that 80.4 percent have Alt-A loans on homes that are in a position of massive negative equity in one of the hardest hit states. But you’ll love this. Some of the states with the highest non-owner occupied Alt-A loans are Florida, Nevada, and Arizona.

Alt-A Percent non-owner occupied:

Florida:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 39.4%

Arizona:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 37.5%

Nevada:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 37.1%

California:Â Â Â Â Â Â Â Â Â Â 19.6%

Now this data is astounding. For many of these states (all have seen the median price of homes drop by 40 to 50 percent) nearly half of the Alt-A products served as flipping vehicles for out of state and in state investors. Now we can never get an accurate figure of how many of the Alt-A non-owner occupied borrowers are actually flippers but it is 95% likely that they did not buy these homes to rent or as a vacation pad in Tucson. Why? Because you would be negative cash flowing to the point of draining your bank account. These loans were done to aspiring real estate investors that got sucked into the bubble glory days. And that is the more troubling aspect of this all.

The Alt-A and pay Option ARM products were all spawn of the housing bubble. They served one purpose and that was to survive in a bubble. I remember early on in the life of these loans brokers would say that these products were designed for doctors, lawyers, or business people who really didn’t want to tie up their income and wanted “cash flow” freed up in the near term. Oh sure, and most people that play junior varsity basketball will make it to the NBA. You tell me of the 2.1 million Alt-A loans out there how many are to borrowers who fit the best case scenario? Brokers pushed whatever product gave them the most money. It was that simple. People were too busy counting their bubble wealth to step back for a second and actually think of how idiotic the entire scheme had gotten. Housing became a quasi-Ponzi scheme. The only way for the system to keep going was for more and more suckers to be found. The suckers ran out and so did the funding and it all came crashing down.

I blame products like this but also a national obsession with owning real estate. No one has a right to own a McMansion no more than I have the right to own a Mercedes. These are luxury goods. This country has adequate rental housing but we have subsidized the system to actually penalize those who don’t own homes. You don’t get a tax break for renting. You can’t right off your rent for tax purposes. You would think that we would have learned something after this mega housing bust but here we are handing out $8,000 tax breaks for people to buy homes! People buying homes they could not afford is the exact reason that we are in this stinking mess. And if you need a tax break to lure you into buying a home then you are not ready to buy.

If you want further proof how horrific these products are, take a look at how many of the Alt-A and pay Option ARM products originated with a second lien. That is, low down or nothing down fantasy buyers. In California, there are currently floating around 186,917 Alt-A mortgages with a second lien on them. You can rest assured that 90 to 99 percent of these loans will implode in the upcoming months. This is where your piggy back loans and 80-10-10 crap came about. I remember when zero down was a crazy way to suck in unknowing investors to thousand dollar seminars but it actually became a mainstream way to buy a home.

Before you even wonder how safe these loans are 41.6 percent of California Alt-A mortgage holders already have one late in the last 12 months! Keep in mind that most of this junk hasn’t even hit recast points and nearly half are already late with one payment:

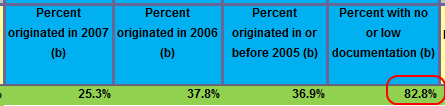

Some other useful information regarding the California Alt-A products are that 9.3 percent are already in foreclosure and 5.2 percent are REO. And you’ll love how thoroughly these loans were vetted:

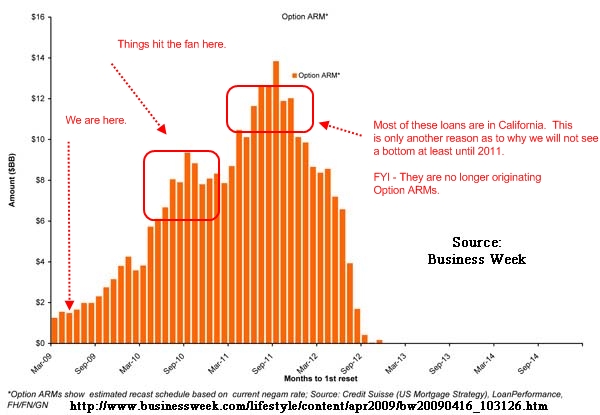

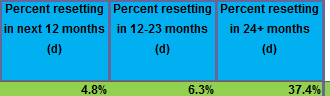

82.8 percent of the California Alt-A or pay Option ARM products were either low or no doc loans! Bwahahaha! This is pure insanity. These loans are going to go bad and go bad in an epic way. And many of the loans with a recast period haven’t even hit their major stride:

What is troubling is that out of the 2.1 million Alt-A loans 27.9 percent are on non-owner occupied property. That is, many of these are failed flips. So let us take a hypothetical case where someone in California had owned their home with a nice safe 30 year mortgage. They stayed up too late at night and saw one of those brokers with the Hawaiian shirt and bad tan talking about flipping real estate around the country. So they decide to take out two Alt-A loans and buy a property in Nevada and Arizona. Technically on paper this person in California is in a safe secure product but they have now leveraged themselves to the hills and have put their entire balance sheet at risk. For practical reasons we don’t have the exact data but from the high non-owner occupancy rate of other states, I assure this happened and happened in a big way.

Hopefully this gives you a new perspective on the Alt-A and pay Option ARM world. Things are evolving in this arena and it will be interesting to see what kind of dent is made when the PPIP taxpayer handout goes into effect this July. Ironically the PPIP has an initial cap of $500 billion, just enough for all the Alt-A loans on irresponsible bank balance sheets. Aren’t you excited that your money is going to go to bailout these kinds of loans? And since banks are so eager to give TARP money back, it would only be responsible to get rid of the PPIP and let them bid on assets with their newfound wealth.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

16 Responses to “Financing the Flipping Dream: Alt-A Mortgages and California Mortgage Equity Giants: Number one Alt-A Owner Occupied State is California. Say What? Alt-A and Pay Option ARMs Fueled out of State Buying.”

Here in Midwest City, OK, a suburb of Oklahoma City, there is a house across the street from my wife’s parents. This house is owned by some dude in CA, and has been sitting vacant for three years or more. Guy bought it after the original owner died. Problem is he is trying to sell a 70 – 80,000 home, in a neighborhood of like, for $120,000. BWAHAHAHAHA!

I just laugh everytime I see it sittin there empty, knowing it is eating him up. He is paying some local company to take care of the lawn and such. It aint never gonna sell for the price he is asking in Oklahoma.

So where do the CRA loans fit in? “Those people” did not buy homes to flip?

End of snark.

Please emphasize the rent vs ownership more. My mother rents forever in NYC, granted she had slid into a rent controlled apartment, but that just means that her rent is what it should be for a 1 bdrm. the rest of the story is that she has more financial reserves than I have, proud owner of a condo, I can’t really afford to unload.

Aren’t the TARP, PPIP and the printing press not as bad as i fear? As long as the total $$ amount they “generate” does not exceed last year’s “paper-losses” which were really only bubble gains to begin with.

I worked as a loan agent from 2003-2006 and you should’ve seen the crazy stuff that was going on with these Option ARM loans. People were making A-RAB money off of these things… 3-4% in the back end from bank rebates and then charging 1.5 points in the front to the borrower for the “privelege” of the legendary 1% interest loan. And these sheep were all too eager to snatch them up. Several of my coworkers would only push Option ARMS because they were such moneymakers.

I’d like to say that I never did any of these loans, but the $15,000 payday on just one of these was too good to pass up. This symbiotic system was set up where everyone: the bank, loan officer, borrower were all tied by greed. I’m sure I’m biased but I think that overeall, these three groups share an equal amount of the blame. I think it’s really hypocritical when the same borrowers that were drooling over how much they could flip a property are now screaming that they were victim to banks and lenders.

Thanks DHB for providing this service where people can actually learn about this process and be informed in making wise choices.

I don’t quite get it yet….once us taxpayers end up with all these “toxic assets”, will we, I mean “congress” or whoever, be the ones deciding if the house-debtors will be allowed to stay indefinitely? Will “we” be DIRECTLY changing loan terms, extending them, reducing principal as needed? I perfectly understand how removing the “toxic assets” will save the greedy banks (that we don’t need), but what happens with the actual loans thereafter? who will be managing them, going after the house WHEN the debtor defaults, etc? Will there be the Obama Ministry of Mortgages? After everyone holding a gub’mint home loan realizes they don’t “really” have to keep paying to stay there, and then don’t, what happens? Talk about a Moral Hazard. Or maybe I’m not seeing the scam the right way.

You are normally pretty good at sourcing data, but what is the source for the data in the blue boxes?

I have only recently stumbled upon your blog (last week). But, I must say that I am impressed with your facts and your reporting.

Trouble is, surfaddict, that, while the gains were “bubble” gains, the losses are very real, and are coming out of OUR pockets via taxes, inflation, and loss of purchasing power, jobs, and wages, as everyone staggers under the load of the bailouts and very real losses.

A relative handful of people made enough money together to retire a substantial portion of our public debt, which they damn well ought to have to do since it is their cause we have so much of it.

The rest of us are poorer and have much less opportunity to improve our situations because of this debacle.

Well no the printing press is bad. You are assuming the money will only go into asset prices (bring back up housing or the stock market). But really, it will go into the cost of living, and you’ll watch all your basic expenses steadily increase.

Yes the rental market is strong and yes you do not get a tax break for renting, but I’d like to add that the rental market, out of fear, has tightened up it’s credit requirements! Also, if you want to see something funny, go out and try to rent a ROOM from one of these people who lost everything and are unstable and are first time landlords in their own house. They have no conception of what it’s like to be “roommates” and they are all in for a surprise when they actually try to let a stranger live with them. The greed is pretty funny when you get down to that level.

Pedrito, perhaps one reason your Mom has more financial reserves than you do is because she has rented for a long time, while you threw your money away on a condo.

True story: An acquaintence who is also a real estate agent is talking about buying houses and condo foreclosures in Phoenix for $20,000 to $30,000 so she can become “solvent” once again. Where do these people come from???

Doc, as always an excellent read, although with a slight error. You say “No one has a right to own a McMansion no more than I have the right to own a Mercedes.”

Actually we do have “a right” to own any asset we want, but NOT “the obligation” to own them. I think you meant to say that people felt they were entitled to own assets they could not afford.

Real homes of genius begs for 619 6th. St. Coronado, 92118.

Have watched this sharecropper’s shack go on market, sell, and now go to foreclosure….

I think this one tops all….

You should remove Central Coast Bubble from your blogroll. This was shut down about 6 months ago. (Apparently, no bubble in San Luis Obispo.)

I just love you rational Doctor. Well thought out are your arguments.

I have one question for the Doctor, where do you get all of your data from? You are obviously running queries against some database is it a California government DB? Does such data exist for Nevada i.e. Las Vegas? Or could I ask you to write a blog on NV Las Vegas in particular? No one knows for sure but some Realtor I read speculating that the bank has something upwards of 30,000 bank owned properties on there sheets in Las Vegas! Talk about Las Wages! That the properties won’t sell in MLS and they are afraid of devaluing further the market by releasing them all on auction and are doing so slowly.

Any comments on NV real estate?

Leave a Reply