Foreclosure millionaire style – 5 Beverly Hills foreclosures listed on MLS but 149 homes in foreclosure process – 107 of those foreclosures have loan balances above $1 million. One in seven homeowners with loans over $1 million are seriously delinquent.

“The rich are different than you and me,†said F. Scott Fitzgerald. To that Hemingway was quoted as saying, “yes, they have more money.â€Â If we were to ask that question again today we would find out that they foreclose in higher rates than the average home owner. One in seven homeowners with loans over $1 million are now seriously delinquent versus one out of twelve for the overall population. The rich are foreclosing in spectacular fashion. Most of those living in Southern California are fooled by the leased European luxury cars or the expensive homes that carry a substantial mortgage behind the scenes. These statistics only verify what most of us already know. Appearances are big in many markets especially in the land of Hollywood. Make no mistake that there are many rich people in California. Yet there are more phony imposters that merely bought all the trappings of wealth by leveraging their balance sheet to the hilt. Today we are going to dig deep into the Beverly Hills foreclosure market.

Foreclosure millionaire style

When it comes to foreclosing people living in once high priced homes are likely to be the most strategic in defaulting. Banks are slower to move on higher priced foreclosures because the market is thinner at the top. Plus, they just like pretending their balance sheet is worth what they are telling the public. Now that the toxic debt party is over good luck selling some of these homes. Take a look at this home selling in the 90210:

9832 YOAKUM DR, Beverly Hills, CA 90210

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Square feet:Â Â Â Â Â Â 1,056

This place is in the Beverly Crest neighborhood. If you look at the sale history you realize someone over paid:

Sold (06/21/1996):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $330,000

Sold (10/04/2006):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $779,000

The current list price? How about $504,950. And this place has been on the market since August so don’t think people are snatching things up just because they are priced at rock bottom levels.  As the housing market continues to decline, there are certain things we can do to increase the value of our homes.

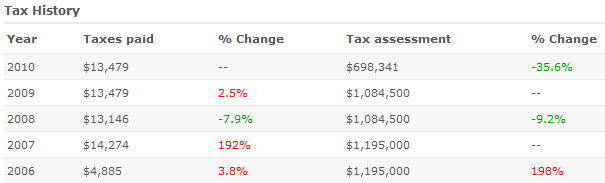

So you might be asking how is this a million dollar home? It isn’t but the tax assessment once believed it was:

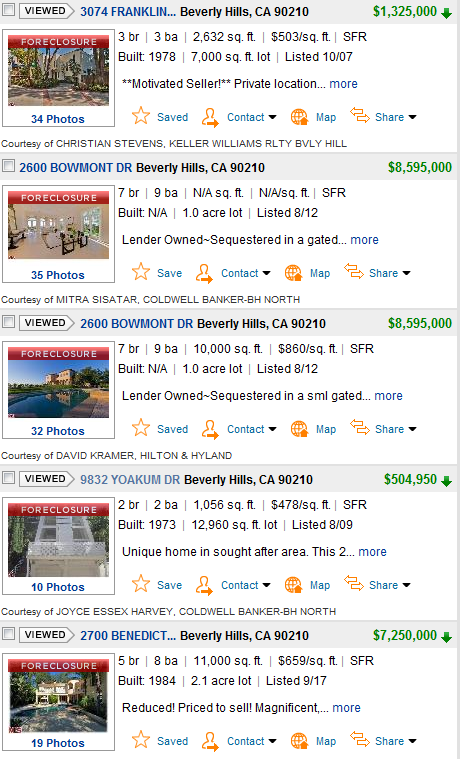

At one point this place was being assessed at $1,195,000! No wonder why local and state governments loved the housing bubble. Their tax base shot up. When I look on the MLS I see only 5 listed home foreclosures in Beverly Hills:

That $500,000 foreclosure sticks out like a sore thumb. But we have foreclosures from the low end all the way up to $8,595,000. Now you might think that 5 foreclosures for Beverly Hill is just a tiny amount. Well let us look into the shadow inventory:

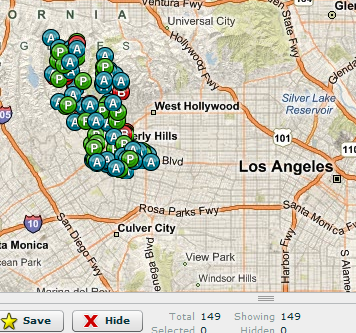

149 homes have a notice of default filed, are scheduled for auction, or are bank owned. Sure is a bigger number than 5 right? And if you think people are simply waiting to sell in the future many have already made the decision to strategically default:

“(CBS) For Darren Thomas that ocean view was quickly losing its value. He says, “I bought it for [$1.385 million]. It is worth less than [$800,000], maybe less.”

Thomas bought his townhome in 2006 but after seeing its value drop steadily he stopped paying.

“I haven’t made a payment in two years,” he says. “It was business decision. It was an easy decision. I have a property worth six or 700,000 less than when I bought it. I was making payments of 10,000 a month.”

Thomas has gone into strategic default. He could make payments but is refusing to put more money into a home that is worth less than his mortgage. Among luxury homeowners he is not alone.â€

Doesn’t that make you feel better? So when you hear all these stories about people being booted out of homes with $50,000 mortgages just remember the above where banks are allowing people with money to simply live rent free on the taxpayer dime. Remember, the bailouts are the reason this is allowed to happen. If you think there is remorse just look at this:

“People like myself, business people, are going it is silly to throw good money after bad,” says Thomas “The loss is not mine. The loss is the banks.”

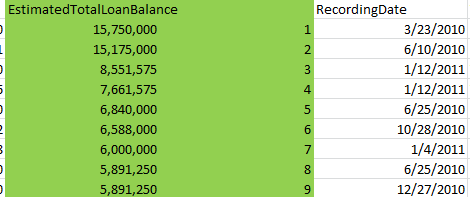

Actually the loss is the taxpayers. So the prudent middle has subsidized the speculation of banks and these Keeping up with the Joneses crowd. Let us look closer at the foreclosure data in Beverly Hills. How bad is it? Out of the 149 foreclosure filings in Beverly Hills 107 have an estimated loan balance of over $1 million! In fact, there is one foreclosure with loans of over $15 million.  Here is a tiny sampling:

Many of these are recent as well. Â The rich are different unless they are rich with debt.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “Foreclosure millionaire style – 5 Beverly Hills foreclosures listed on MLS but 149 homes in foreclosure process – 107 of those foreclosures have loan balances above $1 million. One in seven homeowners with loans over $1 million are seriously delinquent.”

Doc, it is 4 homes in 90210 listed as REO for sale, you counted 2600 Bowmont twice. That home was a 2nd TD stepping in to try and sell, payoff the 1st and walk away with something-they won’t, it has been listed forever and no bites.

Ditto 2700 Benedict.

Yoakum is in The Beverly Hills Post Office not City of Beverly Hills so is technically Los Angeles, the kids go to LA schools not beverly High and when you call 911 you don’t get BHPD you wait on hold like the rest of us for LAPD. The zip code is the same hence the nickname “Post Office”.

I am a REO agent in 90210, http://www.reoteamla.com and can vouch for what you are saying, there are literally hundreds of F/C sales postponed in 90210 every month, rolling over each month to the next and no payment made. Further, unless you are at least 12 months delinquent the banks have likely not even started the process by fillling a NOD. The Shadow lurks in 90210 larger than almost anywhere else. Why? Because the numbers are so great: for every million dollar loan you forclose on you must write it down to what was paid for the property on the courthouse steps so a million dollar loan without $5,000 a month in payments is a $60,000 loss. A writedown of (approx. average equity loss in this area) %30 to $700,000 is a 300k hit overnight so do the math, want to lose 60k this year or 300k today?

The really ugly story and totally unreported by major media is that the folks not paying a mortgage are also not paying their property taxes either and this is getting on for 3 years here. So we layoff Fireman and teachers, close parks and libraries, have 55 kids in a class and drive over potholes that should each be named like a mountain range so “these folks can stay in their homes” Huh?

I wish some bright spark in Sacramento would tell the Gov “Er, Jerry, did you know we have to wait 5 years to sell a home for back taxes, what if we like shortened it to, say 3 years”? Got to be a lot of revenue there and no one loses a job, just a house they didn’t have the common decency to honor the mortgage paperwork they signed.

The truth hurts. Thank you for your honest appraisal of the situation. It’s nice to know there’s at least one agent who speaks the truth.

I just ran the year-end numbers for price/ square foot on the Westside from 2007 – 2010. Average drop is about 20%. A couple neighborhoods are at 35-40% off peak prices. This only gets worse I’m afraid, as shadow inventory comes out of the shadows.

http://www.westsideremeltdown.blogspot.com

Love your post. I saw “Inside Job”, the movie on a plane yesterday and had to think of all the things the doc has been saying. This is an outrage. MI holds a tax sale after only 2 years and there many homes with $ 2,650 tax can be bought for $ 5 k and they rent out for $ 650. One day, I hope the Doc will compare the situation of MI to CA. Chris

With the tightening jumbo loan standards these higher end properties are toast. Unless you have close to $500k in the bank and serious, well-documented income (fulltime, not self-employed) don’t even think about getting a jumbo for one of these $1 million+ places. I bet seeing a $500k house on the market on a decent-sized lot in 90210 would have a lot of LA equity pretenders shaking in their boots.

I have met dozens of people who now regret living it up, with a leased car, eating out 5 days a week, 200 cable channels(really, who wastes that much time watching TV?) and fabulous vacations using credit cards.

No one EVER regretted living below their income.

I regret living below my income. I saved my pennies and now I have cash. But for the past 10 good years of my life, I lived in a rental, I drove a plain car, and I lead a boring life. And I have some savings, but friends lived it up. They bought homes that went way up in value and others still have solid equity even after the drop. The home returned more than my savings. They I know of others who had nothing, made almost nothing, and lived it up on the tax payer dime. Now they will just walk away.

So who really won? You only get to live once and it’s about how you live. When you die no one will say, yeah he avoided the housing bubble and he was a great saver. But they will say “oh I remember that guy, he used to live in Beverly Hills and drove the Ferrari”, he lost it all, but wow he had a great run.

I am finding that being prudent isn’t all it’s cracked up to be.

Go for it Charlie Sheen. No one is stopping you. Different strokes for different folks. I’m sure your kids will appreciate that you blew their entire inheritance and will have great memories of you as a dad. If you are single then stop being a wuss and buy a home and get yourself a luxury car. It seems like you have a fragile ego that needs it and to be honest, it was people like you that drove up the housing bubble in the first place.

No one that has any character is going to say “wow, what a great life that idiot had spending money he didn’t have” unless it is a crew of people that value this vapid existence and measure happiness by cars, homes, and debt.

I regret too. Plain and simple.

Jeff- the issue isn’t one of ego. The issue he’s getting at is that he did everything right to stand on his own two feet and those that did everything wrong have lived it up hugely for years and now via government support are now enjoying life in great payment free house courtesy of his and other people’s tax dollars. Those people should have been destroyed but instead they are being famously propped up and pocketing their mtg payment each month (makes savings easy). There is something decidedly unfair in that.

Nice deal for them but this is equivalent to spoiling an already spoiled child. It is moral hazard at every level and encourages bad behavior. Hell, half this country, most residents of California, nearly all bank CEOs and risk managers, and every single politician need a serious ass kicking. Ass kickings build character and bring people back to reality that ugly stompings can and do happen. Our country would be better and stronger for it rather than coddling these saps.

Same story here. REally, I don’t know anyone who regrets living it up. So OK, I don’t have debt. Don’t have much else though either.

Aww, you sad sacks are such a bummer.

Maybe Christian Stevens above can tell us where we can “foreclose” on some rich person and take over their home, eat their food, and drink their booze, until the cops kick us out. Then, the house will be forced onto the market. Let the prices collapse.

Cuz facts is facts – they don’t “own” the house. They “owe” someone, probably us.

The shoe hasn’t fully dropped yet my friend. What you are seeing now are people dancing on the deck of the Titanic while the ship slowly creeps underwater and they have no clue that the ship is sinking. There is no such thing as a free lunch and everyone is going to have to pay the piper.

Well, Sean, it depends how you measure the value of your life. If your life is boring because you don’t drive a Ferrari or live in a million dollar home, then I think your value system is a little skewed. I know that propaganda about having to own everything has been pounded into your head non-stop since the day you were born, but you know, money doesn’t really measure your worth. Things like honesty, compassion, and generosity go a long way. There are such things as beautiful human relationships founded on things that go beyond the dollar bill. It’s about time our society woke up to that fact. Aren’t we crashing already because of our self-absorption, envy and greed?

Maybe he doesn’t have kids, Jeff.

Actually, I don’t have kids. One reason is that I didn’t want to raise them in an apartment in LA. As I grew up in a home and thought it would have been a more stable environment. But again, the prices were to high, and I waited…and waited…and waited. Months turned into years, and years turned into a decade.

The big home and Ferrari was not what I was looking for to be happy. I was using that as an example of how others wasted the “home equity” and how they lived it up. They can now sell the Ferrari and other items purchased with home equity and default on the bank. On the other hand, I have a 7 year old Honda.

The point is there is no accountability; so it turns out it’s how you game the system. Honesty, compassion, and generosity may go a long way – But they sure didn’t get you into a home before or now!

And in the end – who are the banks rewarding? The people who couldn’t afford the home in the first place. They are getting price reductions to stay in “their home”.

Am I bitter? Sure. I did what was prudent and in the end I got the raw end of the deal. Where is the justice in that?

Sean,

I, like you, was extremely prudent and essentially we lived below our means (or at least at our means and NOT above it). If you’re saying that you’re in a worse position than some others who you know who participated in this then you’re probably telling us that you didn’t invest your money in other ways. For example, rather than stick my money into a home and lose my equity, I invested in MANY other things that have done very, very well with a focus on cash flow (ATM machines, hard money loans, cash flowing properties in more stable markets, cash flowing domain names, natural gas royalties, and I can go on and on…). I took the “slow and steady” approach that isn’t much fun but that provides a very predictable and stable cash flow stream and I can now see that I’m the winner. Did I make a ton of money on the upswing? Definitely not. Did I lose a lot of money on the downturn? Definitely not. Was I able to sleep through every single night very comfortably while still making a good 10-20% per year on my relatively low risk cash flow investments? Absolutely.

So, in summary, you did the right thing by sidestepping the storm but if you just let your money sit or if you participated in the stock market without looking at alternative investments then perhaps you will feel a little slighted. All of that being said, I guarantee you that your restful nights of sleep over the past many years were worth their weight in gold, as I doubt the others slept as well as you did!

Good luck to everyone and watch out for the second shoe that is now starting to drop. Now that the government can’t afford (or at least won’t be able to due to the shifts in Washington) to hand out tax incentives for buyers, we’re going to see the market’s true colors, as the artificially incentivized demand is finally gone. And, combined with record foreclosures predicted in 2011, record shadow inventory, Alt-A and Option ARM, etc, Wave 2 should be interesting and honestly pretty brutal. I’m looking forward to finally buying a property in 2014-2015 once things have settled down and bottomed out. And, in the meantime, I’m continue to be a very happy renter and enjoy our daily sun 🙂

Investor J

I’m right with you on this. I’ve lived in a 1200 sqft shitbox for 20 years, and started looking to move my family into something bigger 8 years ago. Sure, I’m glad that I didn’t buy at the bubble peak, but every day I pay for my prudence by living it a cramped place while friends live much more comfortably (albeit in negative equity LALA-land).

Ultimately money is only worth what we spend it on. If I die a rich old man, did I really have a better life than those who spent it all on what they and their families enjoyed?

JEFF,

You are not getting it.

Life is about making the best choices. Capitalism has always rewarded those who make the best choices.

In the last 10 years, the game changed. The FED has made it clear that those who are prudent will get screwed and those who take risks will have the FED on their side. The FED has literally warped Capitalism.

The question must be asked, is this a permanent change? Going forward is being Prudent going to be the stupid thing to do as it was in the last 10 years? Is being irresponsible going to give a person the best life going forward as in the last 10 years?

Many probably believe that punishing the prudent is temporary however given the level of debt in this country I believe that the last 10 years will be the norm from this point forward until our system collapses on itself.

That said it has become increasingly hard to take advantage of the system if you are an average guy. On the other hand if you are a bank or a multimillionaire, I am sure it is still like Christmas out there.

Sean,

You have savings that will help to keep you afloat in difficult times. They have nothing, they will sink. You are in a better shape. I would rather be in your position than theirs.

This statement explains why it was bad enough what happened, but that there was no punishment that has created the moral hazzard that is destroying the engine that drives the entire country. Jared Diamond refers to this as ‘Rational Behavior’, where people gratify themselves at the cost of everyone else. The Manhattan crowd have no regard for the rest of us–they consider us expendable. If you think we are being thrashed now, think again. They will completely destroy us–and they will drink our blood again in the next panic. My greatest fear is that Blankfien will get another word from God to do more of His work…scary. Dark Ages…exaggeration? I hope so.

I have to agree: I look at all the SENSABLE years I scraped and saved, I made good money, bought a decent place and a used Porsche and was scammed by DLG so am now wondering how long I can survive by eating oatmeal and beans. Perhaps I would have been much happier if I’d spent every dime doing what I wanted: roadracing around the country, I’d just be as poor as I’m now. Moral: don’t spend your life storing your nuts for your old age!~~~

Your cash is trash, or soon will be. Living below your means is good if you actually save money and build wealth. If you had taken that money you saved and bought gold, silver, oil, multi-family housing or a number of other hedged investments, you would be living the life of Reilly now. But merely putting it into the bank or into bonds is a fool’s game. If you bought gold at 280 an ounce in 1999 or silver at around 4 bucks, think what you would have now.

I regret it now! I should’ve taken the banks and my fellow taxpayer for as much as I could’ve, probably 10 or 20 million or more! And be living large in some multimillion dollar 90210 estate for free 2 years, maybe 3 or more!

Hindsight’s 20/20. If I would have known I could live in a beach front million dollar property for 5 years @ 1%, nothing down, get unemployment for over 2 yrs, short sale and only have my credit get hit for 3 yrs, yea, i would have totally taken that route. And I hear hell throws a hell of a party. Let me in.

Well the party is over. But since you didn’t play we have a consolation prize for you!

You will get higher taxes to help pay for the party. Also, we will make it harder for you to find a job. And just to make sure it doesn’t happen again, we will reduce the home price for those who bought and give them a second chance to finance. You keep renting without any tax deductions because we need all of the money we can get from you. Thanks again for not playing – enjoy your prize.

I regret it some too. I Was too Risk-averse to jump on the rollercoaster, I wanted to go surfing instead. At least i got to drive my buddies Turbo Porsche, and other high-end cars, and act like a big shot while he was riding high on the bubble. He was delusional, it felt real for him at the time, while I was uncomfortable, cuzz it all seemed to be built on bull-crap, which we all know it was. He doesnt regret it, but wishes he woulda saved a bunch of the earnings which was in the millions. Now he has no pot to piss-in.

I regret it. I now find myself rooting for Sheen and Lohan. People who expect consequences for those that misbehave likely will have a long wait. I now enjoy reading about people squatting in lavish homes. I don’t get angry anymore, it’s like rooting for Redford/Newman in “The Sting”. Some Real OC Housewife doesn’t seem bothered about NOD, foreclosure notice, etc; just shop, make dinner plans, mani/pedis, laugh. Banks and govt don’t seem very worried about it, why should I? Next time, I’ll know to order lobster.

So sad what is about to happen in California and the vast majority of people won’t see it coming. Thank God for Dr. Housing Bubble. The people I’ve tried to warn either get defensive or offensive. Oh well, can’t say they weren’t warned.

No need for concern, Concerned. Taxes/fees will be simply be increased, majority of people will pay up because they love California and won’t leave. Austerity…maybe for some, I’d bet few/no govt layoffs (Unions bosses don’t like that) or bennie reductions for illegals (politician cannot alienate Hispanic voting bloc, see Meg Whitman for example). Businesses will continue to flee California, politicians just laugh and say good riddance, plenty of clean, green jobs will be created to fill the void. See, no need for concern!

If most of the people are not seeing it, it is not coming… Few economists got Nobel Prices on variations of this topic. No matter how delusional are the people about the reality, if they are majority their perception will materialize and the economic fundament will have only secondary minor effect? That is the way it works in optimistic madness no catastrophe is possible. Is this good explanation why San Francisco was expensive way out of its economic fundament even before the bubble, became even more expensive in 2006, is still expensive and most likely will be expensive even with the worst drop imagined ahead of 20% ?

@Max, sadly I know an equal amount of people who have no qualms living it up. They lived it up, rolled over their debt to home equity and are not paying the loans and still having a ball .

Life ain’t fair !

The home in your picture is under contract. Seems someone snatched it up.

It is an easy decision if you live in California. The loans are non-recourse. It is much harder to default when the banks can sue for for the difference you owe. Otherwise I would have defaulted 6 months ago.

Can someone explain what the doc means by the banks don’t want to foreclosure because they don’t want their balance sheet to take a hit? I understand that may affect some banks, but aren’t most of the loans packaged up, securitized and sold to Fannie and Freddie? So, it’ll be these GSE’s balance sheet that will take the majority of the hit by the foreclosures right?

I’m not sure if the GSE’s were buying the $1,000,000 and up jumbo toxic loans. I’ve seen $3,000,000+ option ARMs blow up on the IHB. Where these loans are actually hiding is the $64,000 question.

these jumbo defaulted loans are hiding marked up to bubble levels or maybe even higher by now on the banks assets side of their balance sheets as they weren’t guaranteed by FHA. Unless of course you are a good friend of the Fed in which case they bought them from you at artificial high prices and you got off the hook with more liquidity.

I would like to hear those backroom talks when the FDIC decides to take over a bank, for the benefit of another one of course. It wouldn’t surprise me one bit if a smaller bank taken over by the FDIC actually has a better balance sheet (the real one, not the one that BAC et al. show to investors…) than the large one that will benefit from the takeover.

Jason

Almost every mortgage above $2M is on a bank balance sheet somewhere – it was difficult to securitize loans above that amount.

Also, once the securitization machine died in the summer of 2007, many banks kept originating jumbo mortgages and they all ended up on the balance sheet.

As far as taking the hit, the poster above has it partially right – you don’t take the writedown until you foreclose. But you don’t even take the hit for the lost interest, you still count that as income.

Its pure can kicking.

Not only do the banks not take a hit on all those high end mortgages still on their books (which are now not paying a single penny)…they also charge huge fees, penalties, etc. against the loans and claim those as PROFIT. Even though they will never see a penny of that paid, either! Mark to myth!!!

People that made bad decisions in the first place like buying a house and car they can’t afford will more then likely do it again. They might be getting out scott free this time but I’m sure they’ll manage to put themsleves into a position in the future were it’s not going to work out so well for them. If everyone lived within in their means, including the government and the banks, we wouldn’t be here in the first place. I personally don’t want to stoop down to that level. Does anyone know how to access those shadow inventory maps that DHB puts on his blog? I’d like to know what’s going on in my neighborhood.

Go to realtytrac, enter your zip code, and map it. While you won’t get specific addresses or any good, specific details, it will give you a list of all its listed pre-foreclosures, NTS, and REOs with the address numbers removed. You can also match up the entries with property records based on the square footage on record and street block (i.e. it will list “S. Elm Street” and have a dot between the 500 and 600 block, so you know it’s somewhere on that block on that street and can use the square footage to match it to public records). Once you have the address, you should be able to again use public records to find any loan information.

Thanks Foolio! I really appreciate it.

how does a bogus (and amusing) listing like this get listed by zillow?

http://www.zillow.com/homedetails/301-N-Almont-Dr-Beverly-Hills-CA-90211/2130209240_zpid/

Read the description and the source under “price history”

That’s really bizarre!

under the system we have used since the beginning the bank with a million dollar loan counted that on it’s balance sheet as an asset. You lend money and the return is your profit.

When this form of accounting called “mark to market” was suspended during the crisis a loan that was now non performing or for which the payments were not being made and should have been a liability was allowed to remain on the bank’s books as an asset. In the old days the banks would have to move the loan from asset to liability and also mark the value down to a good faith estimate of current value, once that was determined, the banks then had to “reserve” the loss by setting aside an equal amount of cash to cover the loss.

So, a $1,000,000 loan on a home worth $700,000 meant the bank had to set aside another $700,000 to cover the liability; a total now of the original loan ($1,000,000) and the new value ($700,000) of $1,700,000 that isn’t making the bank a dime. NOW, no reserve, no mark to market and the bank can hoard it’s cash in case the rule is changed.

The rule will likely not be changed even though the Accounting Standards Commission would like to see it changed because if it were there may only be 4 solvent banks left!

So really why would any bank foreclose when they can sit on these bad loans pretty much forever without having to account for them correctly and announce billion dollar profits when everyone knows they have a book of business that it woefully underperforming. Smart money thinks if they wait long enough the market will improve and the hit they take lessened but as we go forward my personal opinion is this is intermission not the bottom. The RE m,arket will not improve until we flush the toilet and get this garbage off to a new owner.

What Washington does not get (amongst much else!) is that a loan mod only benefits the occupant. A short sale or foreclosure benefits about 17 different workers and CREATES jobs, what we need most here in CA. In a sale, Realtors, loan officers, escrow, title, termite contractors, rertrofitters all work. The new owner goes to Home Depot and buys roofing, paint, carpet, he hires electrticians and plumbers cabinet makers and all the various trades that are currently out of work or underemployed.

What does the beneficicary of a loan mod do? Well in about %67 of the cases he defaults again.

“What Washington does not get (amongst much else!) is that a loan mod only benefits the occupant. A short sale or foreclosure benefits about 17 different workers and CREATES jobs, what we need most here in CA. In a sale, Realtors, loan officers, escrow, title, termite contractors, rertrofitters all work. The new owner goes to Home Depot and buys roofing, paint, carpet, he hires electrticians and plumbers cabinet makers and all the various trades that are currently out of work or underemployed.

What does the beneficicary of a loan mod do? Well in about %67 of the cases he defaults again.”

Absolutely brilliant. The good Dr. should take your statement and run with it. Too bad the scum in Washington and Sacramento would never listen…kicking deadbeats out on their asses, BOO HOO!!!

Too all those who wanted to live it up…

NO WAY!!! Sure, we look like the schlubs, but you still have to live with yourself. Besides, this rampant I don’t give a dam about anyone, but myself is the reason this country is in the mess it is!

Lastly, we all now who the posers are. Sure, you may get a great ride for 5 years, but when you lose it everyone will know and then what? I guess if you are single it isn’t as bad, but what about all the families that had to deal with an out of control spending parent or parents? What about the kids. Great ride, but now we move in with the aunt and uncle.

Sorry, I made some mistake in my life, like credit card debt and student loans when I was in college. I don’t want to go back, even if it means living in a teepee in the middle of South Dakota.

Freedom from the system as much as humely possible is better than seeling your soul to the devil for a moment of luxury.

I suspect that “freedom from the system” might be the only path people can take to change how the system works.

Stop feeding the beast, in time it will fade and die.

So true. The only freedom left is financial freedom.The big trawling nets caught most of the credit hungry fishes-but a few of us managed to escape.

Message submitted to Gov. Brown earlier today:

Dear Governor Brown,

A growing number of Californian are choosing to stop payment of their mortgages and live payment-free in the knowledge that financially fragile banks will not move to foreclose or evict them for a prolonged period, over two years in many reported cases, fearing the impact to their balance sheets.

Unfortunately, these same persons often fall arrears in their property tax payments, harming all residents of California and exacerbating our state budget crisis.

I urge you to take leadership in directing our government to move immediately to reduce the delinquency period after which government can seize and force the sale of properties to satisfy tax obligations. Seizure and sale upon a one-year delinquency period would allow new owners to be installed and payment of property taxes promptly resumed.

Thank you for posting your message to Gov Brown. I will borrow it and post a similar one to Gov. Quinn of IL. Even though IL is a recourse state, we have a soaring default rate, and these places are not paying property taxes.

The Sad fact of reality is the Feds are allowing these banks, lenders to hold these properties on their books with absolutely no penalties or remorse. while the tax payer picks up the tab. With that strategy is it any wonder why more and more people are just walking away. The Morality issue is mute at this point.

I too did not fall for the BS and get stuck with a bad mortgage and bad credit. I could not see what people were thinking buying a house they could never afford. This wasn’t the first housing bubble. How could they not see this coming? I saved my money and bought my place last May at 1/2 the price it was sold for last. I’m paying less than rent to buy. I DON’T have any regrets!

I guess I got lucky. I sold in 2004 and then saw prices soar where I had lived. But, I built a new home in the country with great mountain views and paid cash. Now, the homes in my old area are below the 2004 price. My new place is still above what I paid for it because it was in a rural area. I also avoided the 2001 and 2008 stock market crashes. I feel like the next one will get me and everyone else.

i have a descend job but moved to ca six years ago. i kept waiting for

the housing price to drop. but it still is too high. my family have to

love in a 2 bed room apartment . last week, when i paid my rent of

1780, i just felt so bad. if i had a house at a reasonable price,

how much more assets i would have saved. i am seriosly thinking aboutmovingout of the

state.

I am in the same boat as most everyone else here. Since moving out of my parents’ home more than 15 years ago, I have rented. And for the past 2 years, have patiently waited for home prices in my area (westchester county, NY) to come down to reasonable prices. But thanks to quantitative easing, the taxes taken from my salary are subsidizing the banks and allowing them to sit on houses that should have foreclosed a year ago.

BUT, I have to ask, what are the potential repercussions if the banks were to immediately fire-sale their shadow inventories? Surely, housing prices nationwide will sharply drop again, maybe by a significant amount. AND, what would that mean for families that are currently paying off their first and second mortgages, when all of a sudden they, too, are underwater on their loans? Will foreclosures become a contagion, and what will happen to our fragile economic recovery? If a large percentage of people in our country are homeowners, doesn’t it make sense that our politicians are approving measures that will protect them?

For our country’s stability, doesn’t it make sense to let the foreclosure epidemic burn out slowly, rather than have an epidemic ravage through our country unchecked?

PS- Christian Stevens for President!

“Protecting homeowners” at the expense of the rest of the population just because they are a large percentage of the population does not make any more intrinsic sense than blowing up a massive debt and asset inflation bubble in order to “stimulate the economy” did.

Both are short-term expedients- you could call them “feel-goods”- that merely disguise the underlying disease- the lack of productivity- and make the condition they disguise worse instead of better because the disease continues untreated.

The disease we have been trying to cure with these destructive expedients is dwindling productivity and lack of investment in new industries that add value and that we will need to have a future as an industrial society. In the 90s and 00s, our leaders of both our major parties have sacrificed the future to paper over our malaise by policies that encourage asset inflation and debt creation, and massive mal-investment in one sector of the economy at the expense of potentially much more productive industries. What we got was a huge mountain of debt that people never could afford to repay, and an even larger mountain of claims on the same underlying assets by means of derivative instruments based on that debt. It was completely inevitable that as some point this hairball of leverage would start to unravel, and pumping more money into it to support it is only depriving potentially more productive endeavors of the capital they need.

By committing more of our present and future wealth, both personally and as a country, to “protecting” the mal-investment that gave us the debt bubble, we are putting more of our population at risk by sucking them into assuming major debt to acquire an inflated asset, and misallocating more precious capital that could be doing so much more good- creating real value and opportunities for investment and employment- in the industries we will need to carry on as an advanced society….. and made our economy even more unstable, and unsustainable, than it already was, and are at even greater risk of total collapse than we were two years ago.

At some point we will have to get our economy, and our population, back on an honest footing. Instead, we’ve only rendered our situation more precarious than ever by committing the resources of the entire population to protecting one asset- housing, and we’ve created a major moral hazard and many perverse incentives in order to do so, thus rendering our system more unstable than it already was. At this time, our banks have about 5X as much leverage as they did in Sept 2008, and we have now created a need for a bailout of the FHA in not very long by turning the agency into the nation’s major subprime lender in order to suck more buyers into buying homes at prices that they can’t really afford and that make no sense in view of market fundamentals. Vintage 2008 and 2008 FHA mortgages have combined delinquency and default rates exceeding 20%, which is truly frightening when you consider that the FHA writes more than half the mortgages now that so many lenders have collapsed and credit standards have been tightened at the banks. Meanwhile, the $6 Trillion or more of public money that has been spent or committed to the multiple bailouts and to providing more easy money to keep the bubble inflated, has been taken from other urgent public needs and is added to our national debt with no offsetting gains in productivity.

“Meanwhile, the $6 Trillion or more of public money that has been spent or committed to the multiple bailouts and to providing more easy money to keep the bubble inflated, has been taken from other urgent public needs and is added to our national debt with no offsetting gains in productivity.”

TELL IT SISTER! Bernanke is risking the planet in an attempt to secure his place in the history books.

That’s essentially been the plan/policy. The banks have been given 2 full years to build up their balance sheets. Credit conditions in this country have vastly improved over the complete lock of 2008. Market valuations are up. They were able to swap distressed assets with the Fed to bolster capital ratios and then borrow at zero and invest with near infinite leverage in Treasuries. Everyone thinks the banks are overcapitalized but they need that capital to offset the losses from working through the housing inventory (and forget commercial real estate – can’t be dealt with at this point).

It looks like the time is ripe for the banks to begin working through most of this. Rulings have been favorable and while proper docs need to be filed, securitization methods were largely upheld. We need a functioning housing market and that means inventory to clear. I’d expect properties to come out of the shadows soon. The “big if” is what it will do to pricing, what the government’s threshold of pain/policy response is, and what exogenous shocks may happen – just look at middle east, Europe, and China slowing.

Protecting homeowners at the expense of everyone (or everyone else)? Why not protect any majority? Protect white folks from minorities and their rampant crime, no? Protect straight people from the gay minority! Protect fat/overweight/obese people from the skinny and fit minority.

I paid off my modest house in 1999. Pay off all credit cards every

month. Save up to buy cars with cash. Save money in a savings account. I realized that investment counselors have one goal in mind: to separate me from the cash I scrimped to save. Every one of them has convinced me to buy a sure thing in the market, took the commissions and disappeared, leaving me locked into those money-losing “sure things.”

Well, I may not have the biggest house or the fastest cars, and I do have relatives left and right owe me money I loaned them to keep them afloat while keeping the foreclosing bankers at bay as they hang up on the credit card collection agencies who call daily trying to get them to pay the ten grand they owe…but overall, I’d rather be in my position than theirs.

It’s great owing nobody. No mortgage, no rent, no outstanding loans.

Amen to that!

In a very similar position to Koblog. I recently asked a banker if I should pull some equity out of a house that I own 100%. The money could then be invested. He said,”Unless you have a very specific reason to take a loan on the house, don’t.” Guess whigh banker will be getting my business.

Please do not forget that by and large, for every family losing a home through foreclosure we have several offers from equally deserving families that saved their money for a downpayment and want to move in, move up or move west and they are on the sidelines waiting for prices to come back down some more. There is a huge block of voters pretty pissed off right now that all this Fed subsidizing of deadbeats is keeping them in rented accommodation.

As for pricing I do not think we will see a huge drop overall, but that is like saying it is 50 degrees today in the USA, real estate is too regional for a blanket staement like thart. Here in CA I know we have about %15-%20 still to go in the middle class markets and about %30 in the high end. I am pretty sure the lower end has seen a near bottom, maybe %5 down from here.

The biggest problem will be if you do need to sell it may take a longer time to attract buyers so be smart and look into that 90’s sales ploy: Seller financing. Carry back a second at a good rate if you can and you will have to beat the buyers off with a stick.

Thanks to all for the kind words but MANY thanks for the email to Jerry Brown about property taxes-that is the biggest plus to come out of Doc’s great blog this week.

“Thanks to all for the kind words but MANY thanks for the email to Jerry Brown about property taxes-that is the biggest plus to come out of Doc’s great blog this week.”

X2

Wonderful post and dialog all around! You hit the nail on the head Christian! AND provided a constructive suggestion for California to manage a portion of our own unique situation in this whole debacle!

Its just insane, a freakin JOKE to keep all those “strategic defaulting” CRIMINALS out of prison. You fucker sign a contract, then you are BOUND to it. You took the risk.

Unscrupulous criminals like this one, are the primary REASON all the banks have become pretty much worthless.

Because the goddamn politicians and lawmakers ALLOW these criminals to go in strategic default, rather than persecute those guilty of contract breach, convict them and put them in prison for 15+ years without parole.

Or still better: putting all these criminal imposters in quarries, where they can work 20hours per day, in order to pay back their mortgage + interest + interest of the interest.

IT’S A FREAKIN JOKE, THAT THE TAXPAYER HAS TO PAY FOR CRIMINAL LIFESTYLE CHOICES OR FOR BAD ECONOMIC DECISION OR RISKY DEALS GONE WRONG, OF SUCH SCUM !!!!!!!!!!!!! WHAT A FREAKIN JOKE !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Leave a Reply