9.3 million Americans went through a foreclosure or short sale between 2006 and 2014: Home shopping in Compton California.

One new argument I’m seeing is that over the last decade, 10 million Americans lost their homes through the foreclosure process and given the timing, their credit records are now absolved and they are itching to get out and buy. Unfortunately, most will rely on fixed rate products and the ability to leverage up is preventing them from buying and pushing them into rental Armageddon. Of course those that sell homes see this as a potential bonanza of potential clients. But what are you going to sell? Although inventory is picking up, competition is still fierce and many of these households lost their homes because they were levered up to high. They are in the market for affordable homes which currently, there are very few. The logic goes that since lenders are checking incomes and these loans are fixed, everything is perfectly fine. Yet we are in a big bull run for the stock market and trends do change. In California, housing is incredibly unaffordable to most families. Is there something to be said about those 10 million foreclosed families?

Will the foreclosed buy?

We need to be clear that most of those 10 million foreclosures occurred on properties with boring vanilla 30-year fixed rate mortgages. The toxic junk imploded in dramatic fashion but most of it happened on conventional products. When the income stops, it doesn’t matter what kind of loan you have if you can’t make the payment.

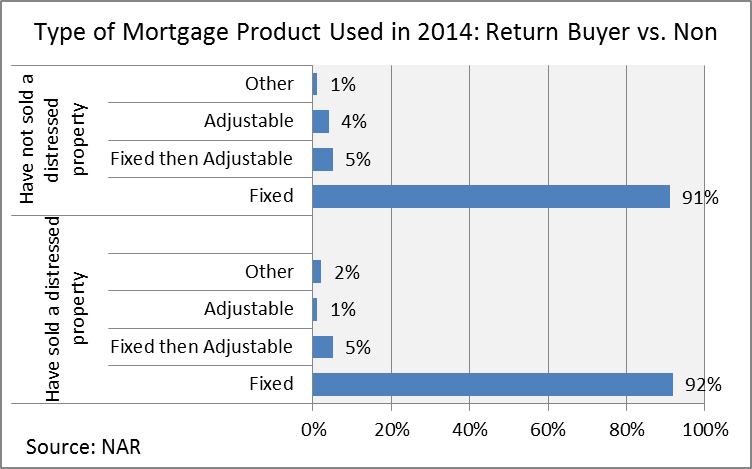

There was a recent report highlighting that most of those who went through a foreclosure would purchase a home with a conventional product only:

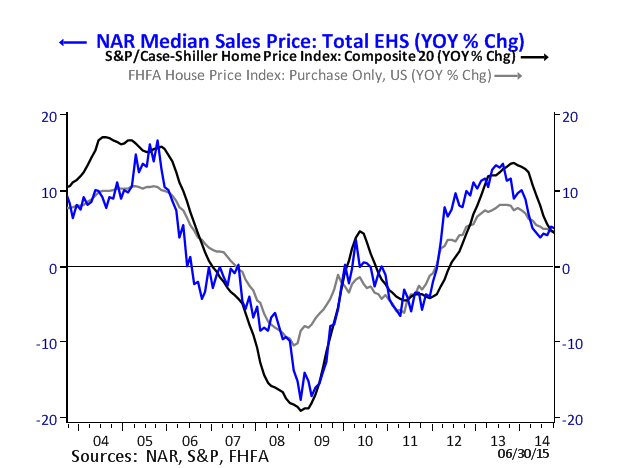

Of course this assumes they can out compete investors. Now that property values have been inflated again, it is perfect timing to let the masses back in the game. We are already seeing that the massive run up in home values is losing steam:

The homeownership rate is down to multi-decade lows not because of lack of home buying desire, but because incomes can’t keep up with home prices. Low rates are the only way you can fudge the math and make the monthly nut manageable. For most, the next best (and only) option is renting.

But say you want to buy in Los Angeles, in the heart of county and need “cheaper†priced homes. Let us look at some “deals†in Compton:

949 W Brazil St, Compton, CA 90220

4 beds 1 bath 1,122 sqft

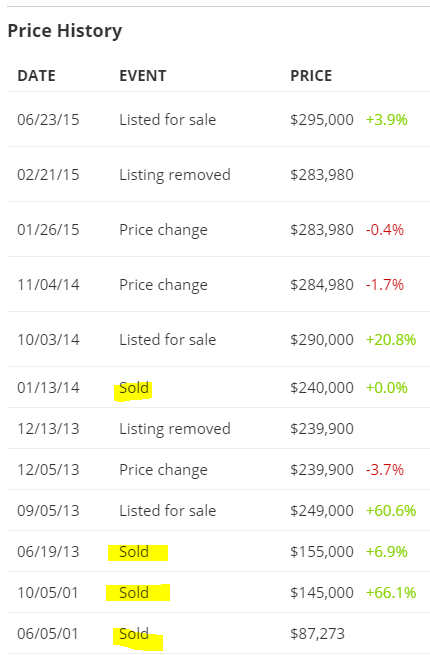

I’m surprised you could squeeze four bedrooms into 1,122 square feet. This place is currently on the market and ready for you. In California, it is rare that someone would stay in a property for a long-time. This home alone has seen a lot of sales action since 2001:

It sold in 2001 for $87,000. Then, a few months later sold for $145,000. Then, 12 years later in 2013 it sold for $155,000. Early in 2014 it sold for $240,000. The current list price is $295,000. Good deal?

But maybe you need a bigger home in Compton:

1201 S Acacia Ave, Compton, CA 90220

5 beds 3 baths 1,842 sqft

Let us take a look at the ad:

“***JUST LISTED HUD HOME IN COMPTON*** This 5 bedroom, 3 bathroom HUD Home features include: chain linked fienced front yard with 3 steps leading up to the wrap around front porch (perfect for relaxing on those summer evenings). Tiled entry with bedroom 1 to the left of the entry that leads to the living room with private door out to the side porch. Spacious kitchen with granite like counter tops, double stainless steel sink, disposal, water softener, vent hood and inside laundry room with access to a 3/4 bath and closet, plus back door which opens out to hardscaped backyard and a 2 car detached garage with addition of 3/4 bath. To the right of the entry is bedroom 2 with private full bathroom with combination bath tub/shower. Stairs at entry lead up to 2nd floor landing which affords access to bedroom 3 and full bathroom 3 with tiled floors and bath tub and bedroom 4 converted to kitchen with double stainless steel sink, disposal and vent hood. Bedroom #5 off of landing. DON’T MISS OUT ON THIS OPPORTUNITY!!!â€

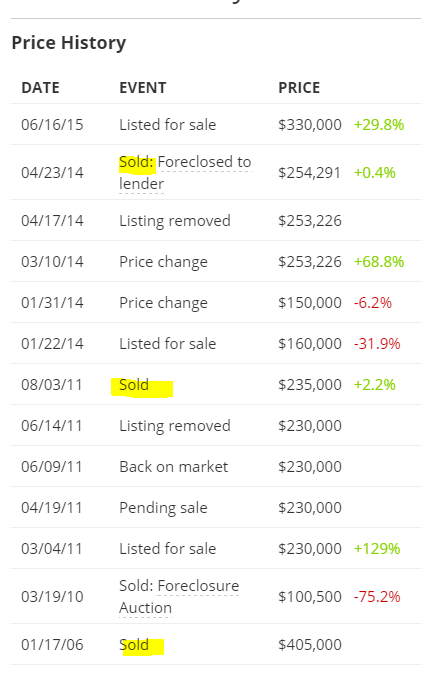

I’m not sure how a chain link fence is “perfect for relaxing†but maybe this is a new selling technique that I am unaware of. This is a home that gives us a glimpse into bubble mania:

Someone paid $405,000 back in 2006. This buyer was foreclosed on in 2010 and the home left auction at $100,500. It then sold in 2011 for $235,000. It was foreclosed again in 2014. It is now listed at $330,000. So according to the theory going around, we have two foreclosed families here that are itching to buy new homes. But where? They clearly couldn’t afford these lower priced homes in SoCal. So suddenly they are good to go this time around? In reality the data is showing that these families are more than likely part of the new 10 million renter households in the US.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “9.3 million Americans went through a foreclosure or short sale between 2006 and 2014: Home shopping in Compton California.”

53% of individual employees in the U.S. make less than $30,000 a year. No income to buy

“…No income to buy…”

Or to rent either, short of a room in a garage or a tent in a backyard.

My wife and I visited some retired friends in their apartment in Reseda. In the apartment next door lived 3 Spanish-speaking families in a 3 bedroom apartment. Each of the three families had multiple ninos and ninas. Average family size was five – Two parents and three children. There we had a three bedroom apartment with 15 occupants.

Nice cozy neighborhood.

Following their dream to make it big in Aztlan.

Good info, but likely you’ll soon receive a rebuttal that “its different here, SoCal full of 100K+ wage earners, world class city, Compton gentrifying, weather, beach, Disneyland, etc. In other parts of the US 330K gets you this:

http://www.trulia.com/property/3026231696-6519-W-Straight-Arrow-Ln-Phoenix-AZ-85083#photo-24

http://www.trulia.com/property/3111983676-9818-Shirland-Ln-Frisco-TX-75035#photo-2

http://www.trulia.com/property/3200823816-9815-Ensley-Ln-Leawood-KS-66206#photo-1

http://www.trulia.com/property/3173908872-2454-Webber-St-Sarasota-FL-34239#photo-1

http://www.trulia.com/property/3204962499-16

644-Jones-St-Omaha-NE-68118#photo-11

But one cannot deny the ambiance of the 330K Compton property, as aptly stated above “chain linked fienced front yard with 3 steps leading up to the wrap around front porch (perfect for relaxing on those summer evenings).”

Great rebuttal. I couldn’t agree more about other choices in other places in the $330,000 price range. The LA Market has gone nuts again and people forget how big the world is. There is life beyond LA. Why not look elsewhere where you don’t have to mortgage yourself up to your eyeballs for a marginal or just plain dangerous area. What about other cities, other states, or even other countries?

There are choices….

http://www.westsideremeltdown.blogspot.com

Ben, surely you realize that income stats for “employees in the U.S.” are irrelevant to Los Angeles real estate. It’s local buyers’ wealth that matters.

And those “local” buyers include a good chunk of the world’s 1% (many of whom own a second or third home here, despite also having homes in New York or London or Moscow or Shanghai.)

I’d like to see house prices in Santa Monica or Pacific Palisades or Brentwood TANK HARD. I don’t expect that to happen. Too many of the world’s wealthy seek houses in those areas. Doesn’t matter what American workers in flyover country earn.

no income to buy in places like compton. we both know the 1% do not go real estate shopping in compton

100K local wage earners — check

gentrification of L.A. — check

L.A. as a world class city — check

I’m surprised that Warren Buffet, Bill Gates, or Carlos Slim haven’t bought up L.A. all by themselves.

@ben, you are correct. The top 1% wouldn’t be caught dead buying in 75% of SoCal. Most of SoCal is an urban armpit.

@son of a landlord, properties in the 310 area code are being driving by the stock market. Whichever direction the stock markets go, so too does properties in the 310 area code.

Prince of Heck, here’s a few more:

“wealth” instead of “wages” – incomes don’t matter – check

non sequiturs of “prime” with a false dilemma around “tank hard” to divert attention away from the topic – ghetto flips – check

elitest overtures – “flyover country” presented with coastal snobbery – check

What I find most disturbing about the “everyone wants to live here” meme is how it glosses over the problem that with increased globally provided benefits comes increased global downside exposure.

Even Snapchat’s own CEO says they’re in a bubble. This tech bubble will pop, and Silicon Valley/Silicon Beach will go with it.

30% of Americans have no emergency money at all, and only 20% have six months of living expenses saved.

Who is buying these dumpy houses? Who that can afford a 300k loan wants to live in a feces pit? I get living in the hood if the price is right, but c’mon.

Institutional investors have permanently wiped out lots of inventory, exacerbating the decreasing home ownership numbers.

@FresnoResident

Institutional investors won’t own those properties outright until they’ve paid off their lienholders. And there is hardly anything permanent when it comes to investment groups.

Institutional investors won’t own those properties outright until they’ve paid off their lienholders. And there is hardly anything permanent when it comes to investment groups.

This nouveau Rentier class will NEVER own these properties outright! They will be foreclosed long before then. Just like the wanna be RE moguls of Housing Bubble 1.0 they are over leveraged based on fantasy cap rates. Housing Bubble 2.0 could burst even more spectacularly than 1.0. The presence of investors vis-a-vis Joe 6pac home debtors has all the making of a run-for-the-exits-liquidation-flash-crash if revenue’s to the various REITs and specuvestors under perform. Then you’ve got the boomers who see the writing on the wall and realize they may not live to see the next market top. This is the madness the FED has enabled.

4 those that care, I made my first real post at Housing PANIC! 2.0

This thing is going to TANK so HARD it is not even funny. Vacant homes all over held off the market. Imagine when they are brought to market. TANKING BEGINS SOON!

And let me add I am not happy aobut this. I wish the wrecklessness never happened in the first place, but what is about to happen is just the free market running its course. The sad thing is as exciting as it is for many savers to get a chance to buy homes at a low price when this bubble pops will be ruined with the horrible standard of living for all. THis could get scary fast and I fear for what this country will look like for most American’s. I don’t know if I will ever buy a house even if prices drop 50%. It has been a fantastic investment for the last 50 years, but going forward I don’t see much appreciation when no one has jobs, and lending and banks are closed. How much can you sell a home for without a 30 yr mortgage?

Perfect wraparound porch for relaxing and playing that traditional game of “firecracker or gunshot?”

you need to read this http://ochousingnews.com/ no tanking going on at all, in fact it’s a great time to buy in LA and San Bernardino counties as long as interest rates stay low. Sorry Charlie it’s not going to “tank”. But maybe if you buy a tank??

Chinese stock market has seen a 25% shave in the last 30 days. Either more money is going to flow here or it’s all going to flow back out. I’m betting it’s going to flow out.

If the money flows out, then all that’s left are people who have to rely on their incomes to pay the mortgage. The numbers in that situation simply are not feasible.

The laws of gravity apply to economic markets. Those who don’t believe so are the ones who will get hurt the most.

I would be too embarrassed to keep coming here and declaring the sky is falling, if I was you. It’s a good thing you don’t invest or you’d be broke from being wrong. No offense. 🙂

Wish you were right. I waited for your promised Tank last year. Didn’t come.

@Jim Taylor, sorry Jim but Federal banking laws allows banks to keep foreclosures off of the market for a period of up to 10 years. Factor in that banks strategically did not foreclosure on some properties until 2, 3, 4 or 5 years of non-payments, and you are looking at a time table of 12 to 15 years.

The SHTF in 2008 so that means you are looking at years 2020 to 2023 before any normalization in the housing market. Banks could start dumping properties on the market earlier but with interest rates at zero percent they have no incentive to unload inventory.

JIM. it’s not going to tank for another 5-10 years, how long have you been saying “it’s going to tank” ? are you ever going to throw in the towel?

I don’t think it will tank, but it will go down some very soon. It doesn’t take much to turn the momentum towards buyers. A general economic downturn, a couple of homes in the neighborhood get priced too high, then sit on the market for over 90 days, now you’ve got the buyers smelling blood and the sellers in a bit of a panic. It quickly spreads to the whole market.

I think the clock is ticking again towards the second act of the housing crisis. In Southern California, it may be rent armageddon. Few can afford to buy, and there are few developable tracts of land unless you go 2 hours into the desert. Those ho do buy in marginal neighborhoods, will get hurt! Denver is a whole different story, Not only are existing homes being sold the same day they go on the market, there are new housing developments everywhere. You do get a nice house, a 1000 times better than those L.A. crap shacks, but prices start in the $400k and with a few add-ons, quickly rise to the $500’s to $700k. The problem is, unlike California’s tight market where cash is king, Denver appears to be lots of families taking on 30 year mortgages at a time when real estate prices are arguably high, and when a sure thing has gone the way of dinosaurs. Only a fool would believe there will be no more economic hiccups or that one spouse or the other won’t lose their job, and that everyone will magically save enough for a rainy day! Call me a pessimist, but all I see with all these new homes is more pain lurking around the bend.

Here in Utah there are nice homes above 13th east under 300k and in my neighborhood values are in line with incomes with homes selling at 3 times annual income. I do not see a crash here, but SoCal has been very volatile my whole life so crashes are inevitable

Denver housing is affected by the new cannabis industry. It could fall once more states make it legal.

Re: Denver housing market, things are already starting to cool off. The days of multiple offers are coming to a close, I think. There seems to be a lot of inventory in very expensive neighborhoods that seems to sit for weeks without selling. Prices here, IMHO, are absurd. From yesterday’s Denver Post: http://www.denverpost.com/business/ci_28441860/denver-home-prices-hit-new-high-june-but

Cannabis surely has had an effect. Dispensary owners can’t put their money in FDIC-insured banks, so many pot shop owners are buying homes priced 200-300k and turning them into 4/20 friendly “rentals” for Midwestern folk who want to vacation here for pot tourism. These places rent for $2-3k per week and you can smoke the place up and have a grand old time. Stuff like this is making it a nightmare for people like me and my husband, who tried to buy a home in a low to mid price range last year. Pot shop owners are all cash buyers — very hard to compete with that.

100% agree with you. I live in Denver and now they’re saying the only people who aren’t having a hard time buying homes are those looking in the $400k-$1m range. WTF? Really? What is the long-term strategy for savings, education, maintaining a home, and disposable income? What if a parent becomes ill and you have to sell and move suddenly? What if one spouse loses their job?

I for one, cannot wait for the crash. It cannot come soon enough.

Neighbors house in Atlanta sold in 2 days, above asking price. These are modest homes in the mid 200k range, but they don’t stay on market long.

Tanking is quite impossible with the current powers running the lending engine of the nation.

Lest we forget, first mortgages for SFH — vanilla homes — has been entirely socialized.

You can read that to mean politicized, too.

&&&&

Folks, the top players have taken the market ‘off the map.’ They have no more idea of what to do next than you do — than anybody does.

What you’re looking at is the flailing of the best and brightest.

Like a heroin addict, they need to quit — but they can’t bear cold turkey.

&&&&

Keep a weather eye on Red China — and the imploding bubble there.

America and Britain are no longer the primary liquidity engines of the planet, Beijing is.

Also, take a tip from the roll over in lumber pricing, copper pricing, even OPEC crude.

{ Have you noticed that OPEC has ENTIRELY lost control of the oil market?

Have you noticed that no-one, certainly no talking-head pundits, get any air time discussing this astounding turn? }

What’s happening is that the prior trends have reached the end of the road… and the canary that’s dying is in Shanghai.

One should expect to see a dramatic fall off in Red Chinese real estate buying power in the months ahead… looking out fifteen-months.

Chinese mercantilism is likely to prove out as a BIG issue in the election.

Other nations that will be following China to the end of the mercantilist road:

Germany

Japan

Korea

France

ALL of the economic interests that have had a piece of this trading engine will suffer — a LOT.

You ultimately don’t win by piling up fiat ‘chips’ in your corner.

Like on-line gambling joints, it’s only at the beginning, with the teasers, that it looks like you can actually come out ahead.

i still say everything to crash sept 2015 – debt, real estate, credit, WWIII, …. everything

“America and Britain are no longer the primary liquidity engines of the planet, Beijing is”

based on the fact that the Chinese printed more money since 2008 than the BOJ, the ECB and the FED combined i guess you are right but the Chinese total debt levels have exploded since 2008 as well, it’s debt is on par with that of the US.

have a currency peg to that of an appreciating currency helps and allows China to print like mad and buy up the world.

Spot on, sir. You see the whole picture.

The Chinese stock market is experiencing a 1929 moment. Soon the bubble will pop and then there will be war to take people’s minds off their problems. The internal loan situation in China is very dangerous. It is now too late to escape. We in San Marino got out in time.

Everybody’s wrong, including you. If you were correct in your assumptions you’d be a very rich man. Richer than anyone, since you have all the answers. But you’re not. Greece defaults and the markets are up today. Not so fast, the deal’s are not complete. They never will be. “The road goes on forever and the party never ends.”

“the Party never ends” , so the Chairman says. There are others who see dark clouds over Red China, a future split of the regions.

Put some sand bags around the upper deck and the elevation gives you an easily defensible position …

Haha kingsnake, when I saw the photo of that second house that’s the first thing I thought as well. Congratulations for having the guts to say it! 🙂

Until the first molotov cocktail lands on the deck…

The problem with the Boomerang buyer theory is the same problem that the Housing is in Nirvana stage 2013 call has.

Chapter 7 and foreclosure previous homeowners don’t really have that much capacity to be able to buy in this current cycle and this is why they’re light in this cycle

The better model to go buy are Chapter 13 and short sale previous owners as there was at least some income capacity then

A few days ago gave an interview talking about the state of housing, U.S. economics and my take on Greece issue and why the world doesn’t really think it’s a big deal, China is much more important

http://loganmohtashami.com/2015/07/03/2015-housing-economic-update-interview-with-david-lykken/

Your hypothesis is that prices won’t go down unless there is a job-loss recession. Considering that investors represent a huge proportion of RE purchases during the current “recovery”, I would think the bursting of an asset bubble be the primary culprit this time. After all, the Fed and government’s trickle down policies have benefited large firms the most and encouraged them to over-leverage.

I’ve been watching the market in LA for a few years now trying to decide if/when to sell and then whether to rent or buy. I’m still not sure what to do, but I have noticed that the price points at the top and at the bottom see quick sales and everything else seems to languish. Over 1.75 and under 750 sell like hot cakes. The rich don’t care and will pay anything for what they want. The low priced homes sell fast because the mortgage is a lot cheaper than rent. People beg borrow and steal to get a down payment and then take in renters to pay the mortgage. Anytime there is a “deal” that is, a cosmetic fixer, investors swoop in and pay cash. So, there are no deals for regular folks I cannot believe the prices and this cycle will last and I agree that it is a false economy driven by the fed rate. Scary times for us, particularly when so many Angelenos rely on housing as an investment for retirement. Have to because it is so expensive one can barely save after paying dearly every month. Even living modestly

“Costs”

Surge in L.A. crime in first 6 months ends more than decade of declines

http://www.latimes.com/local/lanow/la-me-ln-garcetti-beck-crime-increase-20150708-story.html

Only in L.A. (or any other major US city) …

I guess it depends on which gang territory you’d like to be in as well. In the second house you’re in Acacia Blocc Compon Crip territory, in the first house you’re in 151 Original Bloc Piru. So, you can be a Crip or a Blood just by choosing your housing location.

https://www.google.com/maps/d/viewer?mid=zN85NJfsbSnM.k7DeR3PbATPw

http://www.laweekly.com/news/graffiti-is-blooming-in-los-angeles-could-that-mean-something-5666143

“At the end of May, total violent crime in the city was up 25.7 percent compared with the same time in 2013, according to Los Angeles Police Department statistics. It has been billed as the city’s first sustained crime increase in more than a decade.”

Nothing to see here but greener grass.

Housing unaffordable. Non existent job market for all but the most connected and educated. No hope on the horizon. Is anyone really surprised crime is up???

SoCal looks like it did in the early 90’s right before that deflationary bust…

Let’s talk shit in my unmoderated comments section at Housing PANIC! 2.0

Crime is not up because of any bad economy.

Crime is up because the courts have ordered prisoners released due to prison over-crowding: http://www.latimes.com/local/crime/la-me-ff-early-release-20140817-story.html#page=1

“Crime is not up because of any bad economy.

Crime is up because the courts have ordered prisoners released due to prison over-crowding: http://www.latimes.com/local/crime/la-me-ff-early-release-20140817-story.html#page=1”

The two issues are connected. The state doesn’t collect enough revenue to service its obligations, such as incarceration, so the “fix” was to reduce the burden on the incarceration infrastructure.

In other words, those costs are instead manifesting as an increase in crime.

@SoL

I think you’re being naive to say that with rents and food getting exponentially more unaffordable that some with criminal inclinations are acting on them when they otherwise wouldn’t be.

Out here in the AZ Desert, the Real Estate Hustle Boys and Girls are at it again, They

are proclaiming rents are rising fast. Better Buy Now! Low Rates! When in fact as a landlord, majority of rents are not rising, but steady. Only in new Apt complexes are the rents higher than average, but plenty of incentives and virtually lackluster demand,

and many more coming on line.

People who buy or rent these days are throwing their money away. Just rent a room/home from an individual. You can find tons of places on craigslist and similar websites. Home prices are insanely overinflated as are rent prices. Large greedy corporations are pushing up rent prices to unsustainable levels. I have lost count of the number of people I see doubling and tripling up in an apartment just to afford a place to live.

With only 6 in 10 Boomers having ANY retirement savings and most of those have not saved enough. Sure there are a small % that are OK but the vast majority are banking on selling their home to fund their retirement. As with most large market movements, the question is not if it will fall but when.

Corporate America has decided to pay senior management based on stock price, so they have gutted companies to push up the price. Meanwhile, Capital expenditures continue to be put off and companies are running at skeleton staffing levels. These short term games can only last so long. So what will happen when the stock market crashes, the housing market crashes, and no one can retire?

I think we all admit that Compton is far from becoming gentrified in the near future. However, places like South LA (near USC) and neighborhoods in East LA (near Cal State LA) may see SFH and land prices holding their own due to biotech corridors.

Cal State LA BioTech (East LA)

http://www.theeastsiderla.com/2014/11/eastside-chases-after-a-biotech-future/

USC Biotech (South LA)

http://www.president.usc.edu/message-to-ambassadors-2015-03/

If you are in driving distance of a “hood” you are not in a safe place. Home invasions happen all the time in SoCal, and it is painfully easy for criminals to go on Safari and run back home to the hood. You might be better offer living in this shack, no one would think to look there for a $100k earner and all his valuables.

I wonder how close this place is to that MS-13 banger that killed himself with lead poisoning trying to gold plate his testicles? The Darwin is strong with that one.

“Costs”

Surge in L.A. crime in first 6 months ends more than decade of declines

http://www.latimes.com/local/lanow/la-me-ln-garcetti-beck-crime-increase-20150708-story.html

Forgot to mention… “incomes don’t matter”

I was watching the local news yesterday and they reported crime rate in LA rising in 2015 to concerning levels. The chief of police said in the press conference “there are more people living in the streets now”, I’m assuming he’s referring to the cause of crime hike. He also mentioned he doesn’t know why. If he thought about it, he would know it has to do with high cost of living.

The bill on “everyone wants to live here” is coming due and this is part of how it gets paid.

No free rides.

Will Chinese buyers flee or flood US housing?

Turmoil in the Chinese stock market could have a quick and direct effect on U.S. housing. From newly built homes in Irvine, California, to Miami condos to Manhattan luxury towers, Chinese money has been flowing freely. The question now is, will trouble in the Chinese stock market translate into more or less cash coming into American neighborhoods?

“My conclusion on China is that those who are buying U.S. real estate are doing it with a very long-term view-to diversify their assets, provide a safe haven in case something happens at home,” said John Burns of California-based John Burns Real Estate Consulting. “I don’t think a 30 percent stock correction after a relatively recent 150 percent boom changes much of that. If you told me the economy was going negative, their shadow banking system was exploding, or the government clamped down on foreign investment, then I would be concerned.”

Chinese are now the biggest foreign buyers of U.S. housing. They poured $28.6 billion into properties in the past year, more than double the investment of number two, the Canadians, according to the National Association of Realtors. They are seeking top schools for their children, better health care, fresh air and a safe haven for their cash amid economic uncertainty at home.

That has meant great opportunity for U.S. builders and developers. Miami-based Lennar (NYSE: LEN) is partnering with China-based developer Landsea on a condominium tower in Weehawken, New Jersey.

Lennar is also part of a huge new development of single-family homes in Irvine called Great Park Neighborhoods. It’s still adding new homes and Chinese buyers have been flocking there in big numbers to take advantage of the good schools and a growing Chinese community.

“You always have to be watchful. It doesn’t necessarily mean concern,” said Lennar CEO Stuart Miller. “You have these cross currents. It’s impossible to know how they play out without sitting back and waiting to see. With economic turmoil comes a heightened desirability to place money where it is stable and secure. While the real estate here becomes more expensive, it also becomes more desirable.”

(more)

http://finance.yahoo.com/news/chinese-buyers-flee-flood-us-151248367.html

Leave a Reply