Foreclosures and Negative Equity – Why Financial Bailout Programs Fail in California. Income, Budget Problems, and Underwater Mortgages.

Foreclosures are still a big chunk of the housing market in California. Of homes sold in December in California 41 percent were foreclosure re-sales. What that means is the home has been foreclosed in the last year. Now you would expect in a state like California with historic budget issues that people would be more cautious about forecasting booming home prices. After all, on Friday we learned that the California unemployment rate is up to 12.4 percent bringing the overall underemployment plus unemployment rate up to 22 percent. This in itself should put a damper on housing prices. The major focus has been on how deep prices have fallen so therefore, home prices must bounce back. Yet little focus is given to the actual economy which is the primary driver of home prices. Negative equity is a reflection of bubble prices and a poor economy.

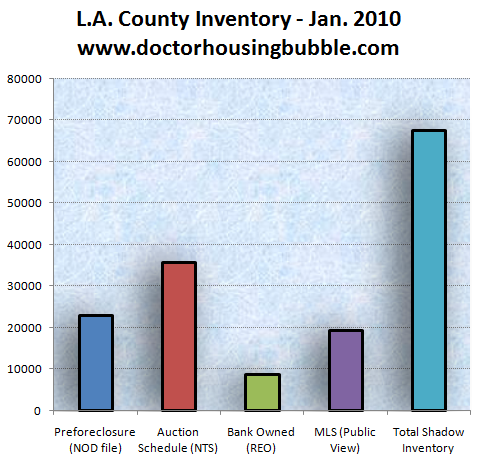

Before we examine the nature of negative equity, let us first look at a few of the biggest MSAs in California and their negative equity market share:

The above data comes from reports from First American CoreLogic. It is rather obvious that nearly every major MSA in California is underwater. North, South, East, or West it really doesn’t matter. Negative equity is a big part of the market. Someone can look at the above chart and say well at least Orange County or Los Angeles isn’t that bad.  Actually there is a large amount of shadow inventory in both of those areas as we pulled up in previous reports. Negative equity is massive in these areas yet the above chart doesn’t highlight this fact because it is focusing on what happened and not on what is going to happen. What I mean by this is areas like the Central Valley and the Inland Empire have giant negative equity numbers but these areas have also seen the bulk of home sales in the last year. So current prices actually reflect a more realistic valuation. Therefore, when we analyze the data we get a more accurate look of what is going on.

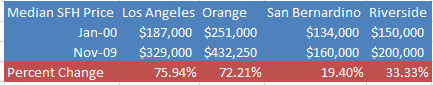

Take the Inland Empire above with over 50 percent of homes with a mortgage being in negative equity. Will prices fall further? Hard to say but these counties have already corrected the entire housing bubble:

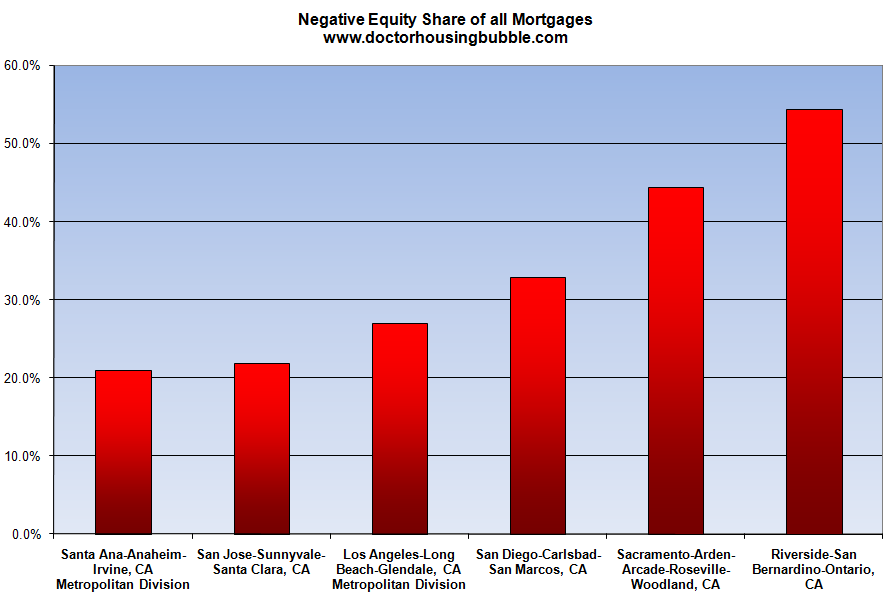

So even though negative equity is enormous, sales volume is indicating that the market is now getting closer to finding a stable point. However, areas like L.A. and Orange County are largely still in bubbles as the above chart indicates. Just because sale volume has been weak in these areas the overall market hasn’t shifted much. Plus, if we look at shadow inventory in say Los Angeles County banks are employing stalling methods to keep inventory off the market. Take a look at the L.A. data:

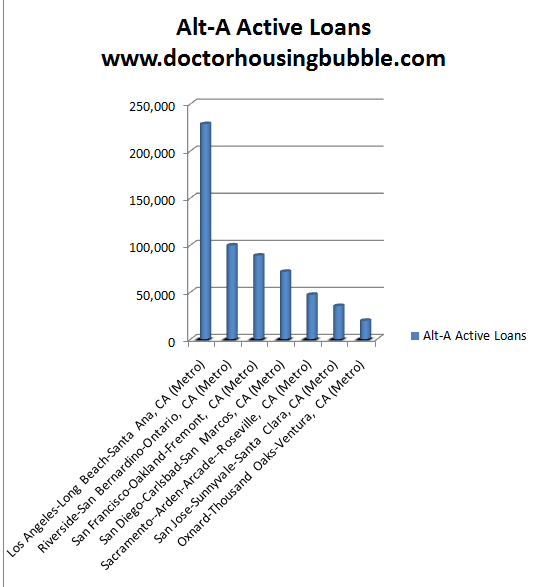

So when we look at the above MSA negative equity data, it is a reflection of a market that has had lower sales volume. These markets have a higher proportion of Alt-A and option ARM loans:

And this is really the next phase of the bubble. Toxic Alt-A and option ARMs are now defaulting at a record pace yet the inventory isn’t hitting the market. And just because it hasn’t in the past doesn’t mean it won’t. In fact, some banks are now releasing inventory now that HAMP is reaching the January 31 deadline date:

“(Review Journal) Bank of America expects to release about 6,000 foreclosed properties into the Nevada housing market in 2010, or about 500 a month, an executive with the bank said Wednesday.

It’s part of the so-called “phantom inventory” of foreclosed homes being held by banks as they work out loan modifications and negotiate short sales, two of the more desirable alternatives to foreclosure.

Throughout the country, estimates of homes being taken back by Bank of America range from 11,000 to 14,000 a month in the early part of this year to 29,000 to 35,000 by November and December, said John Ciresi, vice president and portfolio manager for Bank of America in Towson, Md.

The system became “clogged” by a voluntary moratorium on foreclosures while banks met the requirements of President Obama’s Making Home Affordable mortgage plan program and by state legislation requiring mediation before banks can start the foreclosure process, Ciresi said at a panel discussion sponsored by the Nevada chapter of the National Association of Hispanic Real Estate Professionals.â€

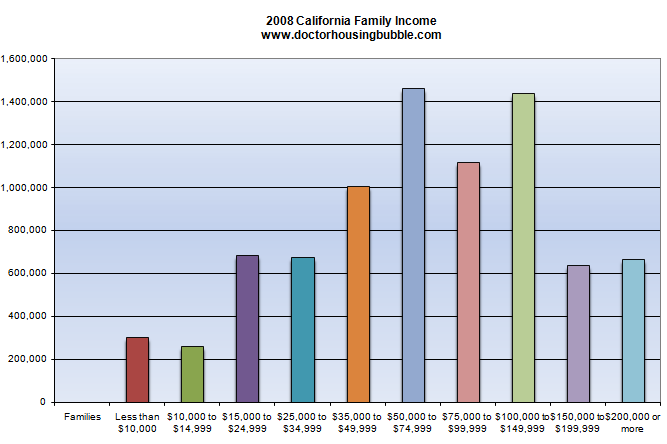

Hard to deny shadow inventory when one of the top banks in the country is actually admitting to this. But this is the next phase. California will start seeing more price pressure in certain areas as more distress properties compete in the market. Clearly foreclosure sales have driven down the price on lower priced areas but they will also do the same in the mid to upper tier markets. If it isn’t because of sheer price it will be because of the poor employment situation. 12.4 percent unemployment? We are in record territory. And for those that think every family in California makes $250,000 that is not true:

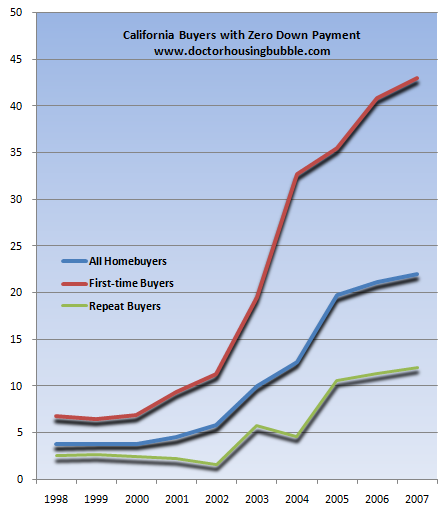

Negative equity is here because people over paid on homes. And those prices are still too high. Some have argued that inflation will bring prices back. Really? For over a year we’ve been experiencing deflation so I’m not sure where the price pressure for homes is going to come from. One simple rule to remember is people in the area have to be able to afford the homes. In California, it was nothing down through Alt-A and option ARM products. Nothing down and not verifying income brought this massive bubble:

At one point in the bubble over 40 percent of new homebuyers went with nothing down. Now, FHA insured loans allow people to buy homes with 3.5 percent down which isn’t that much better. Since we know negative equity is a big reason for foreclosures, after all if you had equity you would just sell, then why are we allowing people to buy homes that are on the edge of negative equity already? A 5 percent price correction will put tens of thousands more into a negative equity spot. Yet the policy with the housing market has been driven by the banking and housing industry since all they care about is churning volume. They don’t care if you end up broke and unable to make your mortgage one year down the road. They already got paid. The system still has the inherent flaws that led us up to this mess.

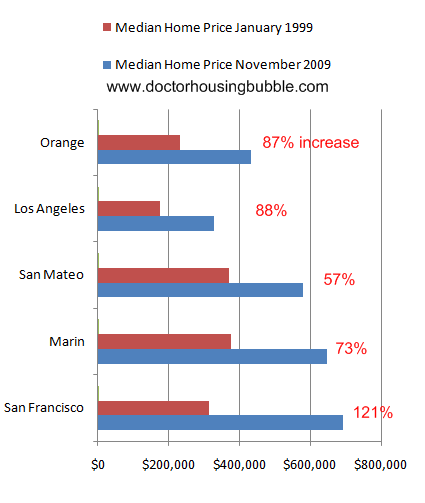

And those counties with the supposed low negative equity still are enjoying bubble level prices. Look at the five most expensive counties by price increases:

Now why are we to expect that these counties don’t correct? Income levels are off. Their economies are worse off in comparison to how they were in 2000. Yet people somehow want to believe that a correction won’t happen in their area. It will. This bubble was a decade in the making so two years isn’t going to right the ship. Those in the housing industry would like to believe that just because interest rates are low and you can buy a home with the price of a flat-screen TV that somehow this will save the market. Yet the economy is still in a mess.

I get e-mails with complex plans of how to save the housing market. It is rather simple. First, a minimum 10 percent down payment for any government backed loan (no tax credit or seller kickbacks). If you can’t save 10 percent then you should rent. Nothing wrong with that. Next, the Federal Reserve needs to stop buying mortgage backed securities just to keep interest rates low. You do realize that by this occurring, home prices stay artificially high? Remember Alan Greespan and his low rates and support for adjustable rate mortgages? Without this support prices will find a more normal equilibrium. Finally, no foreclosure moratoriums or back up programs for the banks. Notice how lower priced areas like the Inland Empire now have tons of sales activity? Because prices have corrected! That is really it. Will it be painful? Of course. But isn’t the pain already here anyways? The only folks not feeling the pain are the banking industry and Wall Street. If changes don’t occur, we risk putting our entire economy at further risk merely for the housing market. Banks and those in the housing industry would love nothing more but you can see what happens when we follow their policy guidance. It is time to listen to folks like Paul Volcker and Elizabeth Warren.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

16 Responses to “Foreclosures and Negative Equity – Why Financial Bailout Programs Fail in California. Income, Budget Problems, and Underwater Mortgages.”

Thanks for another great article; I agree generally with what you said, except the following: :the Federal Reserve needs to stop buying mortgage backed securities just to keep interest rates low.”

If it stopped buying, … and it may do so this year, … and if the Fed did not give stated support to the two mortgage GSEs, Freddie Mac and Fannie Mae, the US Dollar would plummet like a rock; that day is coming soon enough, there is no need to move it along.

I’ve been reading this blog for well over 3 years now.

It’s amazing to me at least how long this thing just keeps going and going and going.

The more the onion gets peeled, the more you want to cry.

Many times, even though I have seen the statistics, I just feel compelled to re-read it once and twice to believe it.

Things like – NO DOWN PAYMENT. As a 50 year old, I almost feel like Rip Van Winkle waking up and asking “when the hell did they start doing that?”

Amazing that you could buy something like a home without a single dollar down. I can’t even buy a dog at the local pound without 100 bucks.

More amazing that people didn’t take a minute to do the simple math of financing things like commisions and fees that would triple in amounts over the course of a 30 year mortgage.

I always got a laugh when people would want to add on upgrades like granite and stupid stuff, and not consider the long term cost of these upgrades.

When all they had to do is save a little money for a year or so, and viola’ $1500 equals $1500, not $4500.

My son is 27 yrs old. He is beginning to think about making such purchases.

When I tell him about credit union cars loans of 24 months max, secured with your savings account deposit, and 20% down payments, he looks at me with an amazed look. Like I’m from another century. Well, I am.

But not the 19th century.

But that’s financial engineering right?

But like Paul Volker said, the only decent financial engineered product he has ever seen is the ATM.

I sure hope the Doctors right about OC prices coming down. I thought for sure I would have bought by the end of 09 but prices just aren’t where I think they should be. I’ll try to be patient and continue to wait for south OC prices to come down.

This bubble took 10 years to create. So only two years into a correction is way too early. Especailly considering the massive govt intervention to keep the wolf at the door. The CA real estate market correction from 1990 to 1996 took place with very little, if any, intervention. So this one could easily go over 6 years. or longer if unemployment persists over 7% for a few more years.

Looks like some real estate deals are big enough to fail:

Side story from the NY Times:

http://www.nytimes.com/2010/01/25/nyregion/25stuy.html?hp

Huge Housing Complex in N.Y. Returned to Creditors

Nicole Bengiveno/The New York Times

By CHARLES V. BAGLI

Published: January 25, 2010

The owners of Stuyvesant Town and Peter Cooper Village, the iconic middle-class housing complexes overlooking the East River in Manhattan, have decided to turn over the properties to creditors, officials said Monday morning.

Skip to next paragraph

Related

Times Topics: Tishman Speyer Properties

The decision by Tishman Speyer Properties and BlackRock Realty comes four years after the $5.4 billion purchase of the complexes’ 110 buildings and 11,227 apartments in what was the most expensive real estate deal of its kind in American history.

The surrender of the properties, first reported by the Wall Street Journal, ends a tortured real estate saga that saw the partnership make expensive improvements to the complex and then try to rent the apartments at higher market rates in a real estate boom. But a real estate downturn and the city’s strong rent protections hindered those efforts, leaving the buyers scrambling to make payments on loans due for the properties, which have been a comfortable harbor for the city’s middle class since they opened in the late 1940s.

“We have spent the last few weeks negotiating in good faith to restructure the debt and ownership of Stuyvesant Town/Peter Cooper Village,†said the statement by the partnership. “Over the last few days, however, it has become clear to us through this process that the only viable alternative to bankruptcy would be to transfer control and operation of the property, in an orderly manner, to the lenders and their representatives.â€

Metropolitan Life built the complexes for World War II veterans in the 1940s, when the city was in desperate need of new housing. It received tax breaks and other incentives in return for maintaining low rents. The buildings became home for generations of workers searching for an affordable spot in Manhattan.

But with the real estate market soaring in 2005, MetLife decided to sell. Tishman Speyer and BlackRock won an auction the following year.

This month, the partnership headed by Tishman Speyer defaulted on $3 billion in debt on the properties, and in the last few days secondary lenders have been calling to replace the partnership.

Under one scenario, Tishman would have been offered a long-term contract to operate the complex, but it rejected that plan. Lenders will now be looking for new managers for Stuyvesant Town, and its smaller adjacent property, Peter Cooper Village, where the rents are typically higher and the apartments more spacious.

The surrender of the property is a huge blow to Tishman Speyer, which controls Rockefeller Center and the Chrysler Building. When it spearheaded the Stuyvesant Town purchase, it projected itself as the best stewards of such an iconic property.

But instead Tishman Speyer and its partner BlackRock found themselves facing a mountain of debt. It had been negotiating since November to restructure $3 billion worth of loans and to hold on to the properties, which cover 80 acres east of First Avenue, from 14th Street to 23rd Street. But their reserves, once stuffed with $890 million for capital improvements, interest payments and renovations, were left virtually depleted.

The rents collected did not cover the mortgage payments, as the new owners failed in their efforts to increase net income by steadily renovating and deregulating vacant apartments while raising rents substantially.

For tenant advocates and urban planners, the sale underscored the loss of affordable housing in the city and the highly speculative financial structures that, they warned, would only end in disaster.

Who is helped and who is hurt by the government’s policy of artificially holding up house prices?

Who is helped?

Of course, the banks are helped, by delaying pesky write-offs and defaults.

Supposedly, underwater homeowners are helped, but are they really? After government support is relaxed is there any doubt prices will go down? Wouldn’t homeowners be better off getting out now, so they can start rebuilding their finances? It’s easy to feel sorry for people losing houses, but at least those who bought in the bubble with little down (and most likely to be underwater) don’t stand to lose much financially by leaving their homes now. Besides, a lot of defaulting homeowners are getting free rent for the two years or so it takes for a bank to evict them.

Long-time homeowners are helped to get a higher gain on sale. But this is nothing but a windfall from Uncle Sam. They would get a fair return simply by selling at a normal market price.

Who is hurt?

Buyers are hurt. Cash and high-equity buyers stand to lose much of their investment as prices adjust later. Low-equity buyers may wind up underwater.

Potential buyers without enough income to support a high monthly payment are frozen out of the market.

Banks and other mortgage investors would stand to lose if today’s buyers go underwater in the future.

On balance, I think the negative aspects of government price support outweigh the positive. Further, if the government wants private investors to supply mortgage money, that would be a lot more likely if private investors had confidence that another loss of house values wasn’t imminent.

“Who is helped and who is hurt by the government’s policy of artificially holding up house prices?

Who is helped?”

Couldn’t have said it any better myself J–

Banks, real-estate brokers, mortgage brokers etc. are helped. Home-buyers are not. Home buyers will pay more. Banks and the real estate industry will leech the difference off of society like the vampires that they are and pretend like they are doing you a favor. The government will continue “more of the same” no matter who is in office, because the biggest contributers to their campaigns are—you guessed it—banks and the Nat’l Assoc of Realtors.

We need to get rid of Ben Bernanke! It was his job to keep the economy from failing and he failed at his job. Bernie Sanders, Independent from Vermont, wrote this letter to everyone about four reasons not to reinstate Bernanke. I don’t understand why Obama wants him now.

http://sanders.senate.gov/newsroom/news/?id=3153fb79-cfb0-4527-a1e6-ef74abaffe74

Biggest contributors? Don’t forget your paramilitary police forces around the country. In California they rank at the top for spending. Why do you think we have so many people imprisoned for “crime” here in So Cal? The UNIONS run the government as well, using the same tactic as the banksters….they BUY new laws to further their own survival and expansion. More police…more prisons…more laws to make things illegal in order to expand their turf.

Police and firefighters are scamming the system too. 3% per year of retirement at age 50.

Vote ALL defacrats and banana republicans OUT of office. If we fired every politician, MAYBE they would get it…or maybe, but probably not.

A voice of reason out there:

WSJ

JANUARY 26, 2010, 11:22 AM ET

Dean Baker: We’re Still In a Housing Bubble

Home prices have posted six months of gains, according to the Case-Shiller home price index, released this morning. But some housing bears say that the fundamentals don’t support those price gains and that, even once the market finds a bottom, home prices aren’t likely to show significant appreciation for many years to come.

Housing economist Dean Baker, the co-director of the Center for Economic and Policy Research, laid out his case at a risk conference last week for why we still have a housing bubble. Adjusted for inflation, home prices are still 15-20% higher than they were in the mid-1990s. “There’s no plausible fundamental explanation for that,†he says.

Why? Simple, he says: Economic fundamentals are all going in the other direction. Rental apartment vacancies are reaching record highs. Many segments of the housing market are still oversupplied. And the core demographic in the country—the baby boomers—are reaching the age where they’re more likely to downsize, buying less house in the years to come.

Far from some rosy estimates that housing is going through a temporary, once in a lifetime downturn, and that once the market bottoms, homes will again appreciate well beyond the rate of inflation, Mr. Baker argues that home prices are far more likely to increase annually at the rate of inflation, at best.

“If anything, I expect housing to be weaker than normal rather than stronger over the next decade,†he says. “People who say this is a temporary story, there’s no real reason to believe anything like that.â€

The recent burst of good housing news has been fueled by government stimulus, including the tax credit, low mortgage rates and easy financing from the Federal Housing Administration. Mr. Baker, who had been a skeptic of the tax credit, concedes that it has worked. So, too, he says, has the FHA effectively supplied credit to goose sales.

But that’s likely for the worse, he argues, taking the opposite view of policymakers at the FHA.

“As a matter of policy I can’t see that we want people to buy a house in 2009 that’s 10-20% higher than it would sell for in 2011,†he says. “In so far as the FHA was encouraging people to buy homes in bubble markets that were not deflated, that’s not good for the FHA and you didn’t help the homeowner. We didn’t do those people a favor.â€

The first criminal conviction related to the mortgage-backed securities. The judge severely chastises Wall Street corruption:

http://www.law.com/jsp/article.jsp?id=1202439500771&src=EMC-Email&et=editorial&bu=Law.com&pt=LAWCOM%20Newswire&cn=NW_20100126&kw=In%20Securities%20Dealer's%20Sentencing,%20Judge%20Blasts%20'Corrupt'%20Wall%20Street%20Culture

“As a matter of policy I can’t see that we want people to buy a house in 2009 that’s 10-20% higher than it would sell for in 2011,†he says. “In so far as the FHA was encouraging people to buy homes in bubble markets that were not deflated, that’s not good for the FHA and you didn’t help the homeowner. We didn’t do those people a favor.â€

My point exactly in my post from 1/24. FHA=”More of the same.” Low/No down loans which artificially increase demand while the banks restrict supply for as long as they can in a desperate effort to keep prices up. Bad news for the housing market in general when these loans go bad, and for bad news for the taxpayer who will be left to foot the bill when people walk away from their FHA loan in 2 years. The only ones who benefit from FHA are those in the Real Estate industry.

I agree that the shadow inventory will keep prices from rising any time soon. What I’m not sure of is the idea that the income statistics for the area are truly representative of the buying public. Specifically, foreign money that is trying to get out of the dollar and into the United States. I have heard that real estate in certain areas in Southern California is very desirable to foreign buyers. I believe that this is another factor in the lack of as steep a plunge of prices in the more desirable coastal Los Angeles and Orange counties compared to the drop in the “Inland Empire”. I wish that you would do some research in this area. Specifically the ethnic makeup and citizenship of current buyers. I only have anecdotal information, but it makes me suspicious. I have seen with my own eyes, statements of accounts set up in the name of poor relatives of rich foreigners that were large enough to buy several houses for cash!

I don’t agree with Bernie Sanders much and I am from Vermont but I think he is right here.

Housing economist Dean Baker, the co-director of the Center for Economic and Policy Research, laid out his case at a risk conference last week for why we still have a housing bubble. Adjusted for inflation, home prices are still 15-20% higher than they were in the mid-1990s. “There’s no plausible fundamental explanation for that,†he says.

People citing Dean Baker as proof that THEIR area is overvalued should be very cautious not to overgeneralize. Mr. Baker bought a house 3 months ago in Washington DC – an area that went up 165% from 2000-2005, and only went down 15% since. Turns out, SOME areas are going to do better than others — sometimes much much better.

Not saying your area is one such immune area, but be warned – Mr. Baker himself had to eat crow on his neighborhood – perhaps you will too.

A couple, one a firefighter the other a teacher graduate college and start working at age 25. Each starts out at $40,000 (just a number). They receive 3% annual pay raises and retire at age 55. At retirement their combined incomes are $194,180. The firefighter retires at 90% of income, the teacher at 70%. Their annual retirement income is $155,345 and is adjusted annually for inflation for life. Healtcare and other benefits are basically free for life.

And with tenure and unionization, they probably cannot be fired during their working career. All guaranteed on the backs of the taxpayer.

Leave a Reply