The foreign buyer argument –Cerritos California has 82 percent of households listed as homeowners. Median income of $82,000 does not support city median price of $540,000. If it did, you would not see homes falling by $231,000 in a few short years.

California home prices in many cities are now poised for a second correction. The cities that will experience this change in the next few years are in mid-tier and upper-tier locations. With no summer bounce and sales falling, the economic pendulum is swinging to lower prices since incomes are not moving up. Make no mistake, you are seeing a correction already occurring but there are more crosscurrents entering these locations moving forward. Areas like Bel-Air and Beverly Hills are seeing price drops that were unthinkable only a few years ago. Not only in these prime markets, but you are also seeing price hits in areas like Cerritos where over 82 percent of households “own†their home. When I say own I mean this lightly because 75 percent of these homeowners actually have a mortgage on their home. I want to focus on Cerritos today because this city is a good example of the demographic argument. Cerritos demographically is over 62 percent Asian. The argument goes that money from Asia is flying into these markets keeping prices inflated. Although these areas have seen prices drop at a slower level, there is little evidence to support that prices are being pushed up because of this trend. Today we salute Cerritos with our Real Homes of Genius Award.

When the trend overwhelms a niche market

19127 WIERSMA AVE, Cerritos, CA 90703

Listed   02/17/11

Beds     4

Full Baths            1

Partial Baths      1

Property Type  SFR

Sq. Ft.  1,614

$/Sq. Ft.              $276

Lot Size 5,397 Sq. Ft.

Year Built            1969

Home prices from 2007 to 2010 crashed because of the toxic mortgage fiasco. From 2010 onward, I would argue that more of the price drops are coming because household economics simply cannot support current inflated spending budget. California has a stunningly high unemployment rate of 12 percent and an underemployment rate of 23 percent. Contrary to anecdotal examples, there is nothing special holding up a city like Cerritos. Just because the heavy part of the correction took longer to arrive here doesn’t mean it won’t occur. Take the home above, this home is listed as an REO with 4 bedrooms and 2 baths. At 1,614 this is a nice starter home for a professional couple. You even get a kitchen with upgrades:

The home looks to be in good condition and is a good sized property. If the argument about foreign money were true, you would expect this property to be snatched up at peak prices. Did you see the listing date above? This home has been on the market since February. The shadow inventory is large in Cerritos which signifies households are unable to pay for their monthly bills. As previously mentioned, Cerritos has a household home ownership rate of 82 percent so using Census data does provide an accurate perspective here whereas the county of Los Angeles has a household ownership rate under 50 percent.

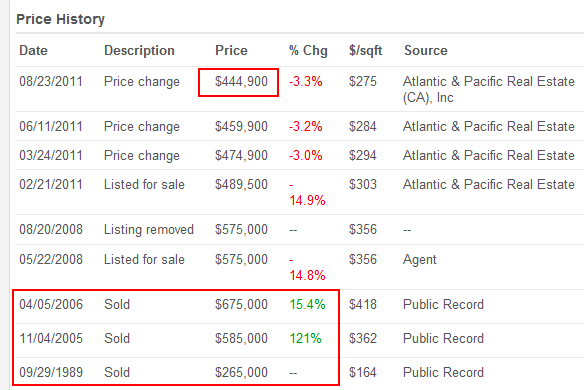

The median household income for Cerritos is $86,497. Let us take a look at the pricing history on this property:

Let us chronologically walk through what occurred here. First, this home sold for $265,000 in 1989, this was a previous housing bubble peak in Southern California. It then sold for $585,000 in November of 2005 and only 6 months later sold for $675,000 at the height of the mania. The home was listed for sale at $575,000 back in 2008 but no takers. This February the home was listed at $489,500 and no one bit. Little by little this home in Cerritos has trickled down to $444,900. Is this a good price? Can the median household income of $86,497 support this price? I will reiterate once again, over 82 percent of households in Cerritos “own†their home so the median income reflects a large portion of these households. The notion that you have $250,000 households snatching up these places is nonsense outside of a handful of cases. We are looking at the bigger picture here and the shadow inventory is a real problem. This home isn’t unique at this price point:

In fact, this seems to be the range in this neighborhood. Where are the hordes of foreign buyers with large bags of money? Have people forgotten this is a global recession? Have people forgotten the reality that California is in a tough economic ditch? Just because you have a small number of people with money buying some specific California homes in niche markets does not mean it can carry the entire market. Those arguing about the unique aspects of markets forget that short-term movements largely iron out in macro perspectives. So Cerritos didn’t go down as quickly as other California markets. So what? The city is still over inflated and just because more people kept prices high for a few years doesn’t mean things will not correct as the above trend now reflects. The above home is a nice starter home and it has dropped in price by $231,000+ from the peak. How long do you think it would take the median household in Cerritos to save $231,000?

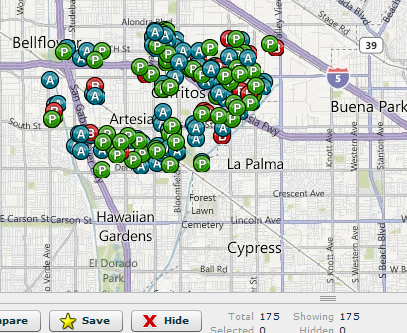

Cerritos has 9 properties listed on the MLS as distressed. However the actual shadow inventory data is enormous:

Those “P†dots you see are people that have missed at least three mortgage payments. Those “A†dots are scheduled auctions and are further along in the foreclosure process. The few “B†dots are the REOs. And how many other places have missed payments yet are not in the foreclosure process because of the shady banking system? Sure, people can believe what they want  but the economy and incomes in no way support current prices even after a $231,000 (34 percent drop) in a couple of years. The median price for Cerritos is $530,000, much lower than the peak but incredibly inflated.

Today we salute you Cerritos with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “The foreign buyer argument –Cerritos California has 82 percent of households listed as homeowners. Median income of $82,000 does not support city median price of $540,000. If it did, you would not see homes falling by $231,000 in a few short years.”

Cerritos: The next Santa Ana/Anaheim, get in before you’re priced in forever!

Correction: Should have read Cerritos: The next Santa Ana/Anaheim; Get OUT before you’re priced in forever!

Apparently Newsboy did not get the news, to wit: SUZANNE RESEARCHED THIS!

YES, *that* Suzanne! So you see, the NAR has TAKEN ALL THE RISK out of Cerritos! YEPPER! 😀 So you see, BUYERS are good to go!… as always… 🙄

Buyers from outside the US can also see that the US housing market is in a downward trend with no real relief in sight for some time.

Foreigners always oversight currency risk. Their investment in a U.S. r/e might go up 5%, but the US dollar might, at the same time, drop (depreciate) 10% against their own currency. And the changes are the r/e in the US and the US dollar will drop at the same time. DOUBLE WHAMMY!

YEP!… Bless their hearts. You saw the Japanese do it in the late 80s bubble.

This past winter we saw the Canadians–with their (temporarily) “strong” C-dollars–scooping up “deals” in So-Fla… we shall see… that USD-CAD FX chart AVERAGING well this year, but volatile… EUR-USD chart similar… I guess no one’s damaging their currency like the USA is… stay tuned.

(i.e. the “double-whammy” could be a nicely hedged “wash” as foreign currencies remain “strong” RELATIVE to USD…)

I think I have somewhat solved this problem with house prices. As a first time buyer, I am thinking more in terms of buying a 4 unit building with stand alone house for myself and having income from 3 units in back. I give up a back yard and garage but with a few thousand coming in each month, doesnt matter what happens to SFR house prices, right?

Have you ever been a landlord? Some seem to say it’s not as easy as it seems.

Daniel,

The problem with that line of thought is that small multi unit properties are just as overpriced, if not more so, than SFDs, at least in CA. A good (and tested) rule of thumb is that your expenses over time will equal 50% of your gross rental income. That doesn’t leave you much of a margin when you are looking at paying 250k-200k per unit. The number just don’t pencil out.

If this is really your plan, then I wouldn’t buy what you propose. You end up with a sort of deficient single family that people don’t really like, and apartments that aren’t that satisfactory either. I think it’s better to buy a duplex or something similar where you would like to rent if you were going to rent. Then, after you’ve lived there for a while, you can move up and out while keeping the duplex and renting it out to finish off that mortgage.

But in any case, yes I’ve heard horror stories about being a landlord. If you buy an ugly set-up, it will attract ugly people methinks.

This is somewhat anecdotal, but recent experience tells me that high rates of unemployment make for a lousy landlord experience. Obviously, the collection of the rent is biggest financial issue. Lesser issues involve the shutoff of utilities, due to lack of payment.

Then you have the social issues, like what horrible monsters emerge when unemployed people sit around all day drinking alcohol and smoking dope, or whatever it is they do to amuse themselves. You would think that someone that is unemployed would have all the time in the world to mow the lawn, but that assumes they go outside, other than to walk to the liquor store.

Why don’t you interview some landlords and ask them what they think of this rental market.

Depends where you are. We always have great tenants and no vacancies for our four apts. We screen carefully and even have the rents a bit below market value. Be good to your tenants and they will usually be good to you.

I am a landlady, too. Good times and bad. In bad, you will have to adjust rents and maybe security deposits. You just have to be able to be flexible like any business. And yes, being flexible with the credit scores, too, if needed and other data. When I first started out 40 people would call for one unit. Now it’s a fraction but if you rent is at a good price you will rent it out.

So I would do research. Assuming the amount you put down, your mortgage, the monthy payment, taxes, insurance, maintainance (this can be figured in with an investor realtor) you can see how financially feasible it will be. Be sure to investigate rents to see what you can actually get.

I bought when real estate was kryptonite and everyone was scared of it. That was a great decision (and risk). Now I am not so sure of the CA economy…I think buying in Austin or some other more business friendly areas of the US would be best.

Your thoughts on Cerritos is wrong. Most asian buyers in cerritos aren’t straight from asia with cash…never was. The koreans fcb’s go to pv or fullerton, chinese fcb’s go to irvine. So asian fcb’s never played a role in holding up the prices in cerritos.

Grew up in shadow park for many years, and rarely met a kid at school fresh off the boat w/ tons of money. And those that were asian fcb, they mostly bought into shadow park…only a handful to report in 18 yrs of living there.

Koreans that live in cerritos (specifically first generation Korean Americans that make up 50% of the city), are almost all small business owners. They bs their income. All of my friend’s parents were pretty wealthy in that community (real income exceeding $250k in the 80’s/early 90’s), but probably only reported 1/4.

Cerritos population is probably 50% korean. Of the 50% that’s korean, 75% are small business owners dealing w/ cash (eg liquor store, dry cleaner, coin laundry, check cashing, painter, construction) and of those 75%, 100% bs their income. Can almost guarantee the real income of the city should be six figures and that’s what supports the price.

But like everywhere, prices there will fall, but not because of your theory that median income can’t support prices.

Interesting point but again, why speculate on data that is so easy to pull instead of speculating?

http://factfinder.census.gov/servlet/ADPTable?_bm=y&-geo_id=16000US0612552&-qr_name=ACS_2009_5YR_G00_DP5YR5&-context=adp&-ds_name=&-tree_id=5309&-_lang=en&-redoLog=false&-format=

It turns out 13% of those in Cerritos are of Korean descent.

whodat.

Doctor Housing Bubble said, ” The argument goes that money from Asia is flying into these markets keeping prices inflated.”

Reread the article closely. Maybe you’ll understand that your in agreement with the good Dr.

Another point. How do you know that the Cerritos Korean Community are all 100% TAX CHEATS ?

I have never heard anyone talk about how they are cheating the IRS. Ever.

I’m gonna call bullshit on the stats stated in your post. I don’t believe you.

WHODAT:

Faulty assumptions:

1) majority of small business owners are tax cheats. (No IRS audits in Cerritos!)

2) simply owning any kind of small business guarantees you a six figure income.

Can you point to *any* kind of verifiable data to support such an absurd argument?

This is off on a tanget, but cash businesses usually have some element of tax cheating going on. From personal experience, I can attest that this is a worldwide phenomenon.

Has anyone noticed that after the recession started, more and more small businesses are going “cash only”? I suspect that to survive this recession, a lot of small b owners are starting to find new ways to improve their bottom line.

Classic example of an opinion piece with no facts to back up his pet biases! And here is another economic genius comment: “but not because of your theory that median income can’t support prices.” Income supports prices, genius, that’s the principal reason you qualify for a loan! Man, the education system in Cerritos must really have been a jewel when ‘whodat’ went there?

You are a serious fanboy. Hmmm…my education? Went to Whitney…look it up. Then went to Cal. Look at the API scores of elementary schools in Cerritos. Your credentials please? You obviously don’t know how to read. What I wrote was that median incomes in Cerritos can in fact support prices because it’s really higher than the 80 something k reported. That’s my argument. However I do believe prices will fall, but not for that reason alone. Get it?

Quit being such a fanboy. Yes, I made huge overstatements and over the top generalizations. However, I still stand by them. There are assumptions you can make of people…especially when it’s your own. Do koreans like kimchee? If a korean owns a liquor store, does he also own a gun? Have you ever seen a 1st gen korean throw a block party for all the neighbors? Like all things there’s a handful of koreans who don’t fall into the category, but those are outliers and not the norm.

My folks used to check cash. Every small business owner came to them…anything that involves cash and/or trying to minimize income by evidencing increased expenses and reducing deposits w/in their own accounts. Also, all my friends whose parent’s drove 7 series beamers, S class benz’s all got grants for college…go figure. Guess they just knew how to stretch a low income.

I’m surprised the good Dr. didn’t mention the fact that this house is right next to the 605 freeway. I don’t know the Cerritos market but I would not pay 440k for the privilege to hear and breathe Socal traffic all the time.

Oh… I thought you had to PAY EXTRA for that slice of “local color”… LOL!

People are paying that price because the Whitney high school (and Cerrito’s public schools). Those are Asian that will sacrifice anything for their kids.

I’m from Asia also, the other day I came across a discussion forum based in my country that people were talking about a educational book set (books, CDs, DVDs etc.) which is priced from $1,100 ~ $6,000. Yes, you got that right USD 6k for a whole set and $1,100 for an entry level set. And the average salary there is less than $20k per person. My family tax bracket is 33% and even we don’t think we can afford that.

As for the cheating IRS Whatdot mentioned above is actually true, or at least to my knowledge. Why do I know? Because I used to work at different restaurants in Asian areas while at college and I was a waitress + cashier. I have college friend who is a CPA he told me the same. I have friends who worked at Asian company and they said the same. THEY ALL CHEAT!! I wish IRS would catch them. Only you white folks thought nobody (or only a tiny group of people) would jeopardize their family and business to cheat but to MOST Asians especially those who are not grow up in US, they have been dishonest to the entire system for all their life.

OT. Wife and I been house hunting in the SF East Bay. As I price homes its clear that FHA buyers have significantly skewed comps towards higher price points while much of the RE noise has been directed towards foreclosures many of those get cosmetic remodel and become prime FHA targets, nothing like a shinny stove!!! The issue is that conventional buyers with larger downs are actually at greater risk of losing a significant portion of there equity when FHA pulls the plug.

What plug? 3.5% down plug? Not sure that would ever happen.

That makes sense to me. The Berkeley area soared with everything else during the bubble, but now has been pretty resistant to the downdraft. It’s hard to find “real” information about what’s going on. Wish we had a Bay Area Dr. Housing Bubble!

It’s easy to start a blog

wordpress.com

tumblr.com

Patrick.net focuses on the bay area…

Patrick.net is good, but it doesn’t have the depth or insight of Dr. Housing Bubble.

True dat…

How much does it cost to RENT a home in CERRITOS.. that’s what you have to compare… RENTS are not dropping… Wake me up when rents stop rising and fall significantly…

At current interest rates of just under 4%… If you do the math… Owning this home and renting this home are about equal… after tax deductions.

“Owning this home and renting this home are about equal… after tax deductions.”

Don’t forget that this house is on the way down ultimately to sub $300k, so you have to factor in a loss of $130k / 36 months = $3,611 per month for about 36 months. Now how do those rent/own numbers look?

Shhh…you don’t want to scare away potential knife-catchers now, do you? 😉

*Suzanne* AND her mentor, David Lereah, BOTH say… wait for it… it’s a GREAT time to BUY!

Actually, checking my log files… they ALWAYS say that, hmmm… WHY is that? 🙄

Rents going up? Where? I’m in the San Gabriel area (good school district), and just lowered my rent by 10%. Good renters are hard to find. You’re looking at asking prices and assume rents are going up. Good look raising rents in this environment.

Anyone been to a foreclosure auction to see how what’s going on? Investors, families, other there to buy? Are people paying full price or do places sell at large discounts? Most places torn apart? Can anyone point to an auction sold house on zillow or similar to see how it played out?

Can the median household income of $86,497 support this price?

Assuming the buyer has saved up $90,000 in downpayment (i.e. 20%), the $86K in household income appears to support a house price between $405K (conservatively) and $475K (aggressively) based on a 30 year mortgage at 4.5%, as per the mortgage calculator at http://cgi.money.cnn.com/tools/houseafford/houseafford.html.

So, I conclude that the asking price of $445K is well within range of any buyer at this income level.

On a related topic, the monthly payment for buying this home would be around $2,200 (including $4500/year in property tax, and $480 in home owner’s insurance). This compares favorably with $2,250 and $2,490 in rent being paid at two 4BR homes on Benfield Avenue (on the other side of 605).

So a second correction, if it comes about, should be mild.

And, if the Federal Reserve buys longer-maturity bonds to force a further drop in 30-yr mortgage rate, to say 3.5%, then the same $86K in income will support house prices in the range of $447K to $527K (as per the mortgage calculator). It’s a big if, but then we may have seen a bottom, at today’s prices.

Please let me know if any of the numbers I used above are incorrect.

Even assuming your numbers were right, your position is based on them spending nearly 50% of their take home income on housing. This is not a sane amount, not consistent with historical norms even in California, and I don’t think most private lenders would lend you that much.

You are assuming a $90K down payment?

Guess what happens when you assume?

if youe assumptions are correct, many smart people will be there buying.

$480 annual for homeowner insurance on a $ 450k property ?? Works with a $25k deductible, I guess. Doubt the lender would go for it though.

I think that mortgage calculator is extremely aggressive, even on the conservative number they give. I punched in my own numbers, and it gave me numbers for a house that was 5x my income and a monthly payment that I can’t even imagine paying monthly. It would leave no flexibility in our budget, and pretty much assure that we couldn’t save/invest any additional money. We would be sinking everything into our house.

So many people are SO SCARED of losing their jobs, and so many people who “stretched” to get into a certain house in a certain neighborhood or school district are so sorry that they did so. When you combine the fearfulness of the still employed and the remorse of those who paid too much, you put a huge damper on the house market.

When prices are going up five to ten percent per year, you need to buy SOMETHING as quickly as possible to get on the housing ladder. But now, prices go down significantly each year and the selection of houses available for sale steadily increases. There is no rush to buy, and those who wait can save up a bigger down payment and either pay less for the type of house that they always planned to buy OR spend the same amount that they always planned to spend but buy a nicer house or buy in a nicer neighborhood or a better school district.

I wouldn’t be surprised if completely new housing strategies don’t emerge among Generation Y and those who come after them. For instance, if you only have one or two children, why not rent until your kids are grown, and then build a small dream house, or buy a condo in a swanky part of town? Or, if you are planning to have a bunch of kids, why not buy a townhouse when you first get married, live there until the oldest child is 10, then rent a huge house in a great school district till the youngest graduates from high school, and then buy something small but nice? Some of the kids who grew up in heavily-mortgaged McMansions, with quarreling, anxious, overwhelmed parents are going to make very different choices when they get married.

I remember seeing a little piece of kitchen kitsch in the kitchen of a middle-aged working-class couple back in the early 80s. It said, “Better a small house than a big mortgage.” Kind of funny, because McMansion fever was just warming up at that point.

The whole McMansion craze was partly based on wanting to be in a safe neighborhood with good schools, but was also dependent on house prices rising every year. Without constantly rising property values, people would have looked a lot more closely at the real estate taxes, maintenance, and utility bills associated with a big lot with a huge house. The skyrocketing real estate prices provided a bailout or subsidy for the unaffordable pricing.

Things should get interesting this winter.

“When you combine the fearfulness of the still employed and the remorse of those who paid too much, you put a huge damper on the house market.”

…

“I wouldn’t be surprised if completely new housing strategies don’t emerge among Generation Y and those who come after them… Some of the kids who grew up in heavily-mortgaged McMansions, with quarreling, anxious, overwhelmed parents are going to make very different choices when they get married.”

Cogent insights, eloquently stated. Are you, perchance, the spouse of Dr.HB? 😉

I hope this post ends up somewhere near Enzo Mimo’s reply to my post — there was no “reply” button under Enzo’s post.

Enzo: I am not related in any way to Dr. Housing Bubble, but thank you for your compliment!

I do think that attitudes toward housing will undergo a profound shift over the next ten years or so. Only the swankiest condos will continue to be considered desirable, as SFRs will fall in price nearly everywhere, making the purchase of a condo as a starter home an unnecessary step. As fewer and fewer people have stable, long-term employment, fewer people will be willing to take out a thirty-year mortgage, or to pay three times their household income for a house.

The real losers in this situation are the people who have already bought a starter home, and are now trapped in it, and the renters with young children who would LIKE to be homeowners, but KNOW that they will be catching a falling knife if they buy within the next couple of years.

Living with kids in an apartment is no fun — I’ve done it. I lived in a huge complex in Irvine with a tiny playground. The management company sent out a notice that they would call the police/child protective services if any child was seen playing on the playground without a parent being present. You also have to keep your children quiet all the time in an apartment. If you rent a house instead, you never feel settled, as you are always less than a year from having your lease run out, and the children are never going to want to lose their friends and their school.

The real “winners” are probably the kids who are in college now, as the bubble will be flat as a pancake by the time they are ready to purchase a house.

Yes, Laura, there is a deeply enchrenched psychology (both here in U.S. as well as regionally and globally) that RE prices always go up, which has influenced 10’s of millions of Americans to make certain RE purchase decisions (Suzanne-researched -this thinking, flipping, low down payments, McMansions, HELOC piggy banks, second homes, etc.) that have worked well up unitl recently.

A good friend of mind married someone who came from a very wealthy family. The advice of her self-made millionare father to his new son-in-law was “buy as big a mortgage as you can possibly afford.” This was based on the concept of using leverage in a constantly appreciating asset.

We’re in the midst of a change in mass psychology regarding RE. The massive amounts of FHA buying over the past 3 years will add another stiff cocktail to the inevitable, RE hang-over, as these 3.5 percenters see their meager equity vanish into thin air and enter into the buzz kill of being upside down in a depreciating asset.

Then, the rising interest rates…

I agree with Enzo. Very well said, and succinctly put. +1

$405k conservatively? Seriously? 4.7x household income? This is the kind of thinking that keeps the bubble going.

My pet theory is that people are not wedded to a neighborhood, and instead gravitate towards an affordable house in the best neighborhood they can afford, that is a practical commute from work. If we suppose that is true, then it seems to follow that the “best” neighborhoods will tend to stay up because even in a down economy there are always some windfall buyers and they will prop up prices in the best neighborhoods by moving in from elsewhere to take advantage of the low crime / schools / sea breezes / equestrian center that makes at town shine, soaking up the slack.

We certainly did see the high end rocket down when the dot com bubble collapsed. That downturn is different than this one. The dot com bubble was all about windfall from various IPO-without-business-plan. When that money dried up there was no longer a supply of buyers willing to pay for over priced luxury houses with found money.

This down turn is not about a collapse of windfall profits — companies are still very profitable. This one is about debt overdose and deleveraging. It primarily affects the low end of the market — those least likely to pay with cash. If you aren’t in debt and have a secure job, this recession is probably almost pleasant. Prices are lower. Traffic is reduced. Note that windfall buyers can have annual income that is quite modest. It just spikes briefly. They won’t look like they can afford the payments on the house. They can’t. They pay most or all of it with cash.

I bet it doesn’t really take that many people to support prices in the top tier neighborhoods.

Yes, but you ignore the fact that buyers used excessive leverage not only in the low-end but through the low-end all the way up to the $1-$1.5 million range. Those $1.5 million homes were previously around $750K, which used to be considered high-end for most parts of the country. Look at large homes in central LA prior to the bubble. Nice, large homes in Los Feliz were selling to wealthy people for $600K-$850K. Now, they’re in the 2-3 million range.

All of this is immaterial anyways. As long as the banks hold on to these houses, hoping for a “recovery” (read: unlimited governmental support), our entire political economy will be oriented to protect the banks. While the rest of the economy gets progressively worse, banks will muddle through. The whole system is at risk now, and housing prices will be the last of our concerns if this continues much longer. It’s shameful what’s going on.

Why should anybody from abroad be interested in buying this property. Apart from it being next to a freeway, there is absolutely no place where you could walk or cycle to that is not covered with buildings. It is almost 10 miles to the beach, and even further to reach some farmland to the east. Why should I want to live there?

Because it’s the USA. They don’t care whether it is in the middle of a hellhole. They don’t invest in Detroit because they don’t know the city, but everybody knows Southern Cal.

IT still has a great patina to people who live across the pacific.

if that’s true – they outta be checking out victorville – they could buy a half a dozen houses for the cost of this one

Ian, I think you’ve nailed it that windfall buyers are supporting prices in the nicest neighborhoods. That’s certainly what I see here in the SF east bay, where homes in the most desirable areas (e.g. piedmont, berkeley & oakland hills, etc) often sell within days of being placed on the market. In contrast, homes in blighted and less desirable areas sit for months, even after significant cuts to the asking price.

Who are these windfall buyers? Biotech and certain niches of the tech industry are doing very well in this economy. Profits from these industries spills over to a myriad of small consulting companies that do everything from building lab equipment to web analytics.

I do believe that a percentage of these windfall buyers are foreign (primarily Asian) buyers. Much of urban California is now a demographic and economic extension of the Pacific Rim economies. Despite the global recession, Hong Kong’s inflation rate for July 2011 was 7.9%. Similar facts abound.

I am an expat living in Southeast Asia. I retired from NASA in 2004, sold everything and got out of Dodge because I no longer could afford to keep up with the Joneses. In fact, now that I look back seven years, the Joneses can’t afford to keep up with the Joneses either.

I have been reading these comments for over three years now and I am still amused over a lot of the undercurrent messages of the replies – which things are going to get better. Face it – they are only going to get worse and all of the hope in the world isn’t going to change that.

I have lived in New York, the San Francisco Bay area, Santa Barbara, and Los Angeles. I also lived in Alabama, Maryland and Hawaii, so I’m not exactly a bumpkin in regards to experience.

In all the above, I’ve owned or bought seven houses and made a profit, some large and some small, on all of them. I did not buy or own a house during the recent bubble, thank God.

What I’m saying here is that I was once a dedicated believer like my parents that you could never go wrong on buying real estate and it was a good investment. I no longer believe this, not because I am smarter then anyone else, it just takes common sense, getting your head out of the sand, and looking around at what is happening in the US of A.

Things have changed and will no longer be the same. There will be no going back to the good ole days, because the good ole days are gone forever.

As far as buying a home now, in 2012, 2013 or even 2014 (I’m being generous) – forget it. The same comments you’re reading today; you will be reading in the future, just like the optimism I was reading over three years ago. Whatever you pay for a house today, you will be underwater by tomorrow and these are the cold hard facts.

On the other hand, here in Southeast Asia, purchasing real estate is a sound investment (right now) but this too could change because folks, this is a world wide recession. Buying anything in the U.S. is a dumb idea.

I would like to clarify that this is being written by a poor soul, who believed in the system, was a 100% sure that his retirement investments where going to take care of him along with social security, in a little ole house with a white picket fence around it. Wrong! That was a pipe dream, just as buying a house in today’s economy is.

So, let’s stop misleading people like the majority of us, things are S _ _ _ _ _ and are going to remain that way for several years to come, so we need to readjust. I again will clarify that I am living on a fixed income and my views do not reflect those that are in the minority, meaning the wealthy, although they are shrinking as quickly as the home prices.

Yep, the boomers lived thru the “Golden Age” in the USofA.

Anyone expecting, or projecting, along similar lines will be SADLY mistaken….

Got PMs?

I find this to be a very interesting post! I actually went back and read it a 2nd time carefully.

You wrote: “Things have changed and will no longer be the same. There will be no going back to the good ole days, because the good ole days are gone forever.”

What exactly do you think has happened to the USA? What do you think our future is?

Not exactly.

http://www.huffingtonpost.com/2011/09/09/paul-krugman-50-percent-chance-global-recession_n_955507.html

“My pet theory is that people are not wedded to a neighborhood, and instead gravitate towards an affordable house in the best neighborhood they can afford, that is a practical commute from work.”

Ian ollmann good theory!

….depends on how you define “best.” For many “recent” Americans, it involves being within one’s specific ethnic group. Look at Persians in Westwood or Ventura, Asians in Cerritos, Orthodox Jews in BH, etc. This cultural bias can prop up prices by boosting demand.

And, I beg to differ with a few on this board including the good Dr., we are not in a global recession. The economies of China and India are doing quite well (particularly at the top), and many of these newly minted millionaires are looking to leave their homeland for places where there are better schools and safer societies (i.e. personal and legal freedoms are more secure), and there’s no better place on that front than the Good ‘Ol USofA (as long as you live in Manhattan Beach, of course).

Interesting what your feelings about China and India and I would agree there is truth in what you say. But on the other hand a few years back I was reading Revolution of Hope By Vicente Fox. I found one very little interesting morsel in his book and it was what he said about China. He noticed China had huge cities with nice shiny buildings that had no people in it, basically ghost towns. He want on to say a few years earlier they had been farming towns. So I would not be so quick to jump on the China band wagon.

I think you are a bit deluded if you think that the US is the most attractive place for a newly minted multi millionaire from china , the reality is that the us is a very attractive place for a newly minted IT graduate with no money but ambition to work hard from Bangalore as it offers the chance to earn a high wage relative the the opportunities at home, for the multi millionaire the oppressive global US tax system makes it a no go area, Singapore would be a much more attractive option in terms of cultural fit as well as low taxation, it offers a route to citizenship for mainland chinese with $20 million in assets and they have a lot of takers, the areas in the US with large Asian populations such as Cerritos are full of Koreans who came over poor and worked hard , that is what the US attracts and will continue to do so …

Dr. HB, you might like this article…

Link: Another Disaster in the Making

…

While consumer credit overall has drifted lower since the financial crisis unfolded (as it should), the amount of school loans outstanding has rocketed higher.

I wonder: does it really make sense for young people to be taking on extraordinary debt loads to finance an effort that no longer offers good value for money at a time when the longer-term outlook remains decidedly shaky — at best?

Sounds like another disaster in the making to me.

Tyrone: Here’s a similar analysis, and is the only one that I’ve seen which caught the fact that the “auto loans” category is due to subprime car loans being back. This is why car sales went up recently:

http://www.financialarmageddon.com/2011/09/another-in-the-making.html

Contrary to all of the MSM hype that consumer credit is back, the bottom line is that it’s not. Subprime auto loans are a sign of desperation, that will blow up like subprime loans always do.

As far as student loans goes, ummm, this increased in July!?! Uh huh. Summer vacations must be over. More likely is the fact that people are turning to these just to get cash coming in to fund their lifestyle. And they don’t realize the seriousness of the repercussions here. Such folks are really screwed, for a long, long time.

The Definitive Article!

Bubble university. Student loan accounts now match up with the number of auto loan accounts in the U.S.

Future American home buyers will be hampered by massive student loan obligations and growth of for-profit education.

Knife Catcher Report: I’ve been checking lately and noticed that a lot of houses in my rather upscale, but modest, community are being listed at less than their selling price of a year or two back. Yup, “investors” jumped in and bought homes between 2009 and 2010 and are now selling them for less than they paid. Not only this, but many have been listed now for well over 60 days!

Fully expect this phenom to gain traction as the FBs realize they got suckered into swilling NAR koolaid and have been used to ARTIFICIALLY buffer the ongoing HOUSING CRA$H in Cali…

http://www.irvinehousingblog.com/images/uploads/00%20Favorites/IHB%20California%20Kool%20Aid.jpg

As long as the former Golden State continues to chase medium to high paying employers out of the state (i.e. until the electorate gets a clue, as in 2030?) housing will continue to DEFLATE to its proper pricing.

If you’re Debt Owner sitting on on the sidelines, there is NEVER going to be a better time to sell/default than right now – The amount of pain you wish to endure is entirely up to you!

Yup. Unemployment is growing, the shadowing inventory is growing and the population is aging. Real estate is in a perfect storm. I don’t see how home can go anywhere but down for quite a while yet.

Just got my AARP magazine for this month and what do you know….there’s a big article about the high numbers of retirees that have not paid a mortgage for well over 2 years, yet have not received any foreclosure statements from their lender. I guess it’s the new retirement plan. Just stop paying to live somewhere.

Agree! I bought a condo 1 year before the local peak in MDR. Sold short in June 2010. Person who caught the knife came in with family money from Santa Barbara. I, too, had been encouraged to “buy as much as I could borrow” . Naively, I did not appreciate the danger of the 5/1 Interest only pick a payment loan. We chewed up our 10% downpayment by going negative amortization for a few years. Then when it came time to sell… the commissions and fees are a killer!

Sorry, but what kind of retirement plan includes Still having your freaking mortgage! What were these people doing for the past 30 years?! Why not keep working till you’ve paid for your house then retire. Or sell it and downsize.

I guess they’ll be waiting on a government bailout… Only the government doesn’t care because these are not their rich donor class.

Dr. Housing Bubble,

Thank you for this article. It was fully analyzed and precise to the point. We just moved here from NJ, we resided here because the school system is graded very high. The housing market in CA is over appreciated, sometime I wonder myself how these people afford housing here. Average house is starting $550,00.00 and up, but average media hh income is $84,000.00, the math simply didn’t add up. There is something very wrong here.

Best leave California behind, hope you can get some money for your homes. I left in 2008 and it’s great. But is you like having snowflakes dictate to you from Sacramento stay right where you are, we don’t want you out here.

In general California real estate is the worst value for the dollar.

I have my shop built in my backyard, the permit was easy to get… Because I was not in California. In California it’s easier to get welfare or a government check then a building permit. Especially for a machine shop in your backyard. Now I am a good neighbor. There is sooooo much insulation in that building that I can have the stereo turned up to rock concert volume and you can’t hear it outside. So my lathe and mill wouldn’t be bothering anyone but me.

In California I doubt I could have built the building, let aloe equip it… Even better here your neighbors mind their own business.

Leave a Reply