With fewer people being able to afford homes, Freddie Mac seeks widespread expansion of 3% down mortgages.

Low down payment mortgages are creeping their way back into the market like a cat sneaking up on an unsuspecting mouse. The only difference here is that the mouse is a million dollar crap shack with a 30-year mortgage attached to it. People forget that Freddie Mac and Fannie Mae, the massive Government Sponsored Entities were nationalized U.S.S.R. style during the Great Recession. Now that times are good all caution is being thrown into the wind and we are setting up the stage for Irrational Exuberance Part II. The U.S. economy is built for boom and bust cycles. Massive credit expansion is occurring and while people are working, their dollars are not stretching as far as they would expect. In San Francisco, you are now considered “low income†if you make less than $117,000 a year. That makes sense when a standard home sells for $1.5 million. So now we have Freddie Mac attempting to push 3% down mortgages on a much larger scale since many people are priced out. What can possibly go wrong?

Who needs a down payment?

There are costs associated with buying and selling a home beyond the mortgage or the down payment. You have closing costs and in many cases, there are commissions to pay out once escrow closes. These may range from 3 to 5 percent. So when you purchase a home with a 3 percent down payment, you are essentially putting yourself in a zero or negative equity position from day one if you needed to sell. Any little dip in the market can put you in a tough spot. Say prices drop by 10 percent and we have a modest recession. Then say you want to sell. Now you find yourself underwater and will need to pay to sell which was the case when we had our foreclosure crisis.

Housing values soared in practically all major US areas. Yet household incomes are simply not keeping pace and that is why affordability is so low. That is why California is becoming a renters paradise. So of course it is no surprise that Freddie Mac wants to make it easier to purchase homes with less money upfront:

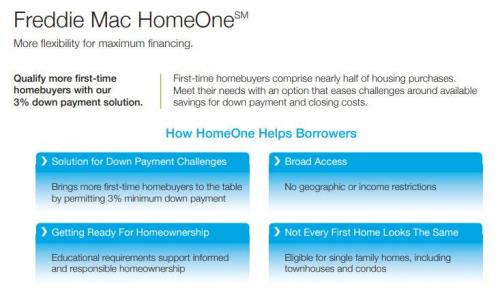

Now the FHA already backs up low down payment mortgages but these are constrained to lower to middle income areas. Freddie Mac is looking to go even bigger:

The big difference here is that there will be no geographic and income limits. This is really interesting and shows how quickly we forget about financial prudence. The sentiment is clear that people want to jump on the bandwagon and purchase homes even if it means they will go into massive mortgage debt. They rationalize that home prices have soared and don’t want to miss out. At the same time, the stock market has also soared. Why not go back in time and buy Amazon or Apple stock?

The middle class in California has been slowly cut down and you view this through more and more households becoming renters. Housing prices continue to be high because of low inventory, NIMBYism, foreign money, investors, and a variety of other factors. But all of these hinge on a stock market and economy that has been in a bull run for nearly 10 years.

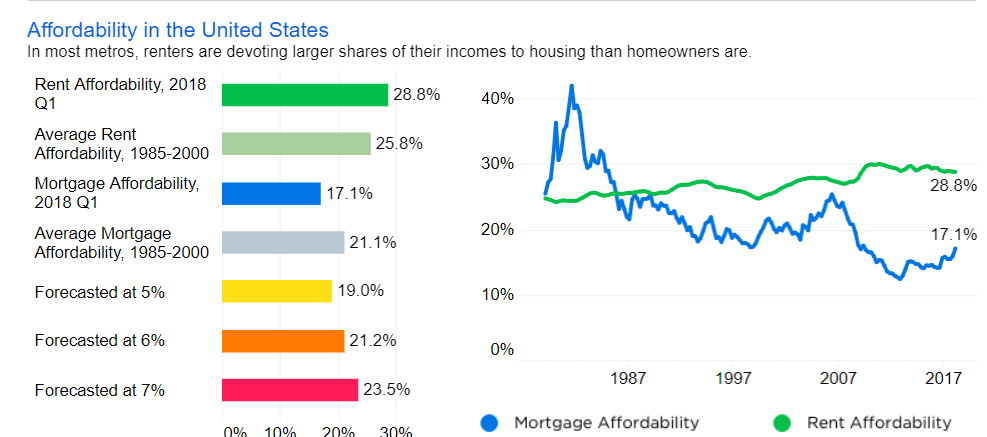

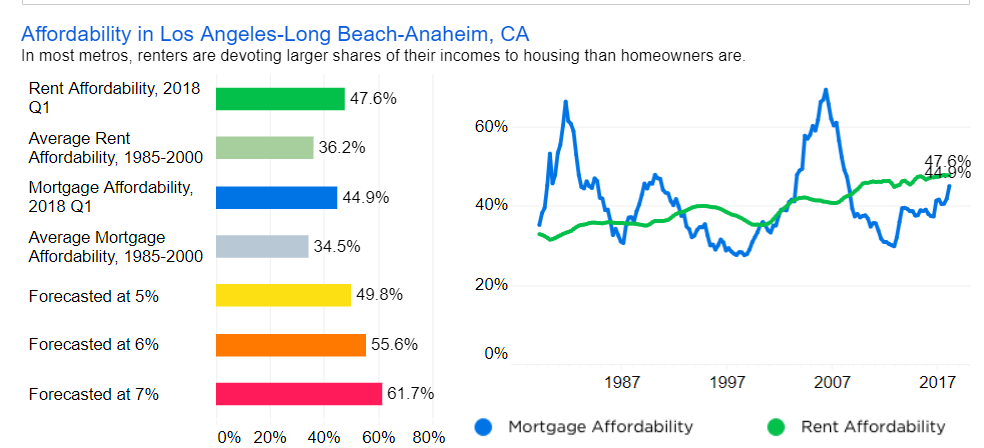

Look at US affordability:

The last time we saw numbers like this was in 2009. But look at the L.A. metro area:

Buying a home is very difficult and so is renting. So it is difficult for many households to save a healthy down payment to purchase a home. In comes Freddie Mac with a potential solution. And since everyone wants a piece of the pie, here we go.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

558 Responses to “With fewer people being able to afford homes, Freddie Mac seeks widespread expansion of 3% down mortgages.”

Rent costs always appear to be the hidden driver to force people to make irrational exuberance decisions when buying crap shacks. Renters are doomed to become foreclosure candidates when the SHTF.

You nailed it!!!

Low down mortgages are a good thing … as long as the borrower has better than average credit. Otherwise, generations of regular folks would never have a shot at the American dream.

I thought mortgages provide for exorbitant prices, without them houses would have to be cheaper? Or allowed to be smaller?

I heard a while back that in South America, it’s custom to pay the entire price in cash for a home when buying, rather than getting a mortgage to finance your purchase, and that this is why houses in South America are priced so low relative to, say, the United States.

A cash- only regime, or at least one that required a substantial down-payment, would certainly keep prices low, and did so until until the post WW2 era was well-advanced. I grew up in the 50s and 60s, when low-down payment mortgages were available only for those who got FHA & VA loans, and those were mostly available only for new houses in the brand-new lower middle and middle class “bedroom” auto suburbs that were springing up around all our older cities in those years, and which were probably THE major factor in the decimation of our older cities. Most people still went “conventional” with a 20% or more down payment, which you had to if you bought an older house, or in an older city or suburban neighborhood. House prices stayed low relative to incomes in the 50s and 60s, and houses, new or older, tended to be much smaller, mostly 1200′ to 1500′ sq ft. Only affluent buyers bought houses with 2000 sq ft or more, or even multiple bathrooms.

Sadly, our population and the corporations selling them goods from houses to cars, boats, and other “aspirational” consumer goods, discovered the dubious joys of revolving credit during those years, but at least you were prevented from tapping your home equity to buy consumer goods that outlived their use long before they were paid for. The result was the massive credit expansion of the past 50 years, and especially the last 30, that has swelled real estate and other asset prices to levels unrelated to dwindling real productivity of the underlying economy and created the biggest overhang of consumer, corporate, and government debt as a percentage of GDP in history.

LOL. Yes by all means let’s emulate the great economic successes of Argentina and Brazil. Jezuz people, do you ever listen to yourselves speak? You know where houses are super duper cheap? Somalia. I guess that place my be a paradise, right?

Landlord,

The difference between Brazil now, and the U.S. in the 50s, is that here in the U.S., housing and other necessities remained cheap, while productivity and wages soared. The 50s and 60s were a true economic golden age in this country, and it was underwritten by SAVINGS, not easy credit. The same little cottages that are now 70 years old and cost $500K in the Inland Empire, were spanking new and cost $8,000 to $12,000.. and were inhabited by working-class and lower-middle class people. There was also almost no homelessness then- the only homeless people were “hobos” or “bums”. But people then also had more modest expectations across the board- one bathroom and one family car was considered sufficient for most people, and people saved a higher percentage of their incomes, greatly to the benefit of their baby boomer offspring.

Now we are truly becoming like Brazil. I never in my life saw so many homeless people, especially so many homeless families, or so many working people who work two or even three jobs but can still barely afford a 2 bed apt in any neighborhood, let alone a little “starter” house.

Sadly, the prosperity of the post-war era bore the seeds of our economic destruction. That is when we began to become complacent and careless. That is when we started to live on revolving credit, and when American manufactures, fat and complacent from their blazing success in the previous 30 years, started resting on their laurels, turning out ever shoddier products while comfortable in the belief that their defense contracts would keep them fat forever with no further need for improvement or innovation. American cars were becoming jokes by the early 70s, known for their short lifespan and shoddy manufacture.

Since that time, and since our departure from the gold standard, we’ve suffered rampant inflation, our money losing about 90% of its buying power since 1970, when you could still buy a comfortable, well-built house for $25K- $30K in most locales, and not too much more than that in CA. We were a creditor nation before then, and were a debtor nation by 1976, with a trade imbalance that has yawned wider every year. Before 1970, almost everyone was housed, if not very well, and we had a broad middle class that lived in modest comfort with one breadwinner’s wages, but by the 80s, housing and living costs were soaring, as was household debt, with more people living in deeply substandard conditions despite government housing assistance of various types, while still more others were grossly overpaying relative to their incomes to buy large, expensive homes that went way beyond necessity. Yep, we are becoming Brazil.

Mr, Landlord,

To a certain extent you are the one not listening. Debt has made every single thing more expensive since nobody shops price but monthly payment. Just look at the cost of college tuition which reveals in stark detail the reality of how once you can borrow to buy, the price skyrockets. Another thing that forces prices to rise is insurance. That’s why heath care costs for things you need as gone nuts while things like eye surgery and other cosmetic surgeries (those things NOT covered by insurance) have been dropping like a stone.

this insanity may last longer than I will be around BUT at some point what people actually earn will matter again…..I suspect that the grand kids of the boomers will bear the brunt of that reality. Since all the kids of boomers are getting their free house and they are going to squander that head start they have been given……I see it all around me ……….and there’s a lot more $35K a year earners then the $200K a year “professionals” you keep talking about

Since low down mortgages allow more people to buy homes, and remove more homes from the market, the effect is to increase the price of unsold homes. If I was a buyer who could actually afford 20 percent down, I would be against this handout to the real estate industry. But then again, people who can’t save, and want to buy a home they can’t afford, should be able to do so with the full backing of the American taxpayer, right?

@ JEM

Its a regulatory issue. Both at the banks and in the RE industry. Bubbles like this only occur when the regulators are incompetent or, more frequently, in on the scam.

What we have today is a sickening combo of both. Many of the regulators can’t wait to get their sinecures in industry once they leave office. They also, to extent, truly believe that the govt. shouldn’t get involved in the industry since somehow govt. is always bad at everything.

Its absolutely stunning to see the mistakes of the previous bubble get repeated in such a short time frame, everyone in charge lived through what happened back in 2004-2008 after all, but here we are I guess.

We are inching towards what might become a correction. I favor a crash to shake out the excesses, but that won’t be allowed to happen. Housing market has become a surrogate bond market. Investors want to be rewarded so a greater discount rate is applied to justify present values. If your ran a regression line that excluded the last few years rent increases, affordability would be even lower. The real problem is that all assets are now positively correlated so there is nowhere to hide. Home, share and bond values will all fall as interest rates increase. Fiscal stimulus this late in the cycle may push rates up too quickly. Recession is over-due and then the deflationary cycle will accelerate. Wash, rinse, repeat.

I just bought a home below market value south of the blvd that needed some work. We had 20% down but put down 10% and used the other lump of cash for renovations. We’ll see if it was right move.

@RE cheerleaders: we got another one who bought during the peak. Get your gear on and start formation. Let’s all cheer and congratulate this fellow to buying the American Dream!!! Great job buddy! Congrats! Don’t listen to the PermaBears! Go out and buy!!

Unless you have a crystal ball and also know everything about thiis persons situation you can’t really judge if this was a good move or not. Yes prices will go down eventually, but it could be years from now and maybe only drop 20% over a few more years after a 20% rise. By the time it hits bottom it could be 2025 and prices will be the same as they are today. Not everyone has the luxury to live with their parents until they’re 35 and speculate in declining crypto currency with their excess income.

Yes, i agree. Prices will collapse. 55-75% by 2020ish.

I wish my in laws or parents would live closer to work. I would move back in in a heartbeat. Renting a cheap apartment close to work and close to the beach is a great option too. Let’s me save a ton of money each paycheck.

@ Les.

South of which blvd? I assume that is the term used for South of Ventura Blvd? if so, does that mean Encino or Sherman Oaks?

Good move, considering you have to live somewhere, and rents on a 2 bedroom house are @ 2,500 and up. I bought S. of the Blvd in 2004 and LOVE it. Hills, trees, views, wild animals, etc. I’m in Woodland Hills, work in Sherman Oaks, so the drive is a breeze. Beach is 15 minutes away, and I swim in the ocean as often as possible. The west side folks rag on the Valley, but they have no idea how nice and quite it is here. Not to mention the tax deductions we have by owning. So no matter what happens to housing, you made a great decision. Congratulations !!!!!!!!!!!

My homes are all beach close … but I always liked Woodland Hills and some of the other cities south of the blvd. Frankly, I am surprised they are not much more expensive. That is the nicest spot in the valley. Very nice.

How much more of a tax deduction are you really getting now that the trump tax cut is in effect? The answer is not much.

I grew up in this area 91364 way back 30 years ago. Nice area and quiet. Like you said close to Zuma Beach too. Downside is Woodland Hills tends to be the hottest part of the valley in the summer. Great point for Santa Barbara getaway trips too.

Housing to tank hard!

There you go!!! You got it Jim!

2 peas in a pod. Lol.

Jim’s prediction of ‘housing to tank hard’ will be correct one of these decades.

Jed, absolutely. I couldn’t agree more with Jim. Housing to tank hard soon!

QE Abyss, exactly! No crash no purchase. All you need is patience!

Thanks Jim!

I am glad you are back! After 5 years of the same post, I think you are correct now.

Your prescience is guiding us all now.

Except, it used to be “Housing to tank hard soon!”

Did you forget the soon?

We all want to know.

Jim, today is July 1, 2018. The year is already half way over and there is NO TANKING IN SIGHT. Given the strength of the economy, stock market, housing market…your next good buying opportunity won’t come until some time in the 2020s. I hope everybody on the fence who didn’t buy is saving vast amounts of money for the next down turn.

Buying opportunity in 2020 is also my prediction. We are finally on the same page blankfein

When a market crashes, it is first unseen. Existing home sales fell 2.5% in April to a seasonally adjusted annual rate of 5.46 million and were 1.4% below the year ago level, the National Association of Realtors (NAR) Chief Economist Lawrence Yun.said. From January through April, home sales are down 1% from the same period a year ago.

Greenspan said in mid-2005 that “at a minimum, there’s a little ‘froth’ (in the U.S. housing market) … it’s hard not to see that there are a lot of local bubbles”. David Lereah, former chief economist of NAR, distributed “Anti-Bubble Reports” in August 2005 to “respond to the irresponsible bubble accusations made by your local media and local academics”.

It didn’t fall all at once, but national home sales and prices both fell dramatically by March 2007 — the steepest plunge since the 1989 Savings and Loan crisis. According to NAR data, sales were down 13% to 482,000 from the peak of 554,000 in March 2006, and the national median price fell nearly 6% to $217,000 from a peak of $230,200 in July 2006. Nonetheless, it wasn’t until June 16, 2010, that Fannie Mae and Freddie Mac would be delisted

In 2013, Jim promised a HARD TANK in mid March 2014.

Then he promised a HARD TANK before the end of 2014.

If we have a HARD TANK now, we’ll at most be reverting to 2014. Maybe 2015. Which would be no tank at all, from a 2014 perspective.

Son of landlord,

That doesn’t make sense. 2009-2012 was the buying opportunity. (Bust) followed by a boom. Now we are in the peak phase. Boom and bust cycles more in ten year phases. The market will crash soon and we will have a buying opportunity around 2020-2022.

Just have some patience!

Did you give up on the ‘soon’ part, Jim?

In your dreams Jim! I lost a lot of equity believing in your wildest dreams!

“Fewer people can afford to buy? freddie-mac-3-percent-mortgage-income-limits?â€

Impossible!! Our real estate cheerleaders have told us that pretty much everyone makes 200k!!! Houses are cheap! Buy now! But for some reason our real estate cheerleaders don’t buy….they want YOU to buy!

Weird isn’t it? If they all make above 200k why not add to your RE portfolio? After all, buying means the grass gets suddenly greener. All problems vaporize and happiness will overflow you. Just buy (now) and get richer!

Buying is the path to great riches…..but when it comes to prop 13 these 200k boomers who sit on all this wealth quickly flip the switch…..all of a sudden they hide behind poor grandma! We can’t afford to pay our fair share in property taxes! It will force us to move.

By the way….if everyone makes over 200k how come the median household income suggests otherwise? You see, realtards, lenders and RE cheerleaders hate date and statistics (unless it’s manipulated BS like inventory is low or any statistic coming from the NAR).

That’s the reason re cheerleaders don’t talk about rental parity and median household income. They rather make up fake stories and tell you it’s just YOU that can’t afford a house. Everybody else owns at least one. Lol. This blog has been so entertaining. Thank you realtards!

Millie,

I can’t speak for others but I have never said “pretty much everyone” makes $200K. What I have said is plenty of people do make $200K. And you should try to meet those people and learn from them instead of wallowing in your misery.

What’s happening in CA is the Brazilification of society. You have a small % of extremely wealthy white people that run things. Then you have a small chunk of mainly white upper middle class people that are the administrators for the rich. Those earning $200-500K as lawyers, doctors, IT execs, etc. And then the vast majority is non-white and dirt poor.

We’re not quite at favella style poverty in LA but we’re a lot closer to it today than we were 5 years ago. And it’s coming sooner or later. When you elect communists and import millions of illiterate peasants from Centra America, this result is inevitable.

Red state (when it was nice) – > Blue state (things fall apart) -> Brown state (collapse into failed state)

The poor saps in Clownifornia are in that last phase change. Smart folks without oodles of $ are gtfo’ing.

@Mr, Landlord

“I can’t speak for others but I have never said “pretty much everyone†makes $200K.”

You didn’t use those words but you tried to make the case that yes $200K/yr salaries were common and easy to get therefore housing prices are sane and sensible which is indeed BS.

And its BS because only around 7-8% of the population in CA makes $200K/yr or more. You can’t have a housing market that is sane and sensible when only 7-8% of people can afford it.

“What’s happening in CA is the Brazilification of society….. And then the vast majority is non-white and dirt poor.”

No duh. People have been saying that for years. Its as obvious as the housing bubble. And its more of a thing for the entire US rather than just CA right now…but what is your point?

Like if you know the US/CA are getting “Brazilificized” than how in the heck could you EVER possibly believe that housing prices over the last few years have been even close to sane?????

“When you elect communists and import millions of illiterate peasants from Centra America, this result is inevitable.”

Hhahahahahahahaha CA’s economy has been doing better than nearly all the states in the US right now and the current Dem leadership in CA are anything but Communist!! Most of them are essentially Clintonite Third Wayers still!! They’re pro-big business as all get out.

There are too many illegals in CA but that is more of an issue with the farmers and restaurants hiring practices at this point. If those illegals would stop getting hired they’d stop coming here you realize that right? Yeah the farmers/restaurants would have to raise their prices if they raised wages but other countries don’t have a issue with that and there is no reason to believe it can’t be done here either.

Oh FFS not the “if we stop hiring illegals lettuce may increase by 2% and that would mean the end of the world” argument. Somehow farmers hired American workers up until the 70s and 80s and people somehow managed to afford to eat. It’s a ludicrous argument. Same for restaurants. I know this may seem like crazy talk but there are places in this formerly great land of ours, where – GHASP – American citizens still work in restaurants. They bus tables, cook, clean, take out the trash, etc. They even work at McDonald’s. They work as landscapers too!!

It’s amazing how many Americans do the jobs Americans supposedly won’t do anymore.

And if you don’t think CA is becoming Brazil you’re either blind or not paying attention. It is exactly becoming Brazil….good weather, nice beaches, small minority of ultra wealthy white people with a somewhat larger but still relatively small administrator class, with a vast majority of poor brown peasants. And just like real estate is astronomically high in the nice areas of LA or SD, they are also astronomically high in the nice parts of Rio and Sao Paolo. Try finding an apartment under $500K in Rio that is in a livable area. Hint: you can’t. And if you want a house, better have 7 zeros in your bank account to even think of buying.

tts is a totally delusional slave living on the Democrat’s bankrupt Commiefornia plantation.

@Mr, Landlord

“Oh FFS not the “if we stop hiring illegals lettuce may increase by 2% and that would mean the end of the world†argument.”

That isn’t my argument. That is the argument the farmers and business in general uses when someone tries to shut down their access to illegals by actually enforcing the rules on the books and punishing the businesses doing the hiring too.

I’m perfectly fine with paying a little more for my veggies and I think most would people would be too once they saw how minimal the effect of higher wages on pricing of end products would have on farm labor and workforce labor in general.

Right now farmers would rather let crops rot in the fields and try to use expensive automation, which just a few years ago many would’ve claimed was too expensive to buy too, rather than raise wages.

https://www.independent.com/news/2017/jun/22/labor-shortage-leaves-13-million-crops-rot-fields/

https://mic.com/articles/8272/alabama-illegal-immigrant-crackdown-destroys-farm-business#.LEEFTrVVj

“And if you don’t think CA is becoming Brazil”

Where did I say that in my reply to you? You didn’t even read it if you think I did. Or you’re imagining something that isn’t there.

Personally I don’t care too much about the color of the people’s skin there though, brown white yellow or red is fine by me, that was a odd tack for you to take on this subject.

@ samantha

Heh you don’t know a thing about me.

I don’t even live in CA and haven’t for years. I also happen to live in one of the most Republican states in the US too though my own politics are quite different.

Next time at least try to read up on a given posters previous posts and put some effort into your trolling otherwise you just come off as lazy and knee jerk in your posting.

“And its BS because only around 7-8% of the population in CA makes $200K/yr or more. You can’t have a housing market that is sane and sensible when only 7-8% of people can afford it.”

Only a relatively small portion of California has truly crazy prices. You don’t need to make $200k to buy in most of the state. $500-700k virtually anywhere except the major metros, tech centers, and within a few miles of the coast will get you a decent place for a family:

https://www.zillow.com/homedetails/1276-Avenida-Amistad-San-Marcos-CA-92069/51077569_zpid/

That’s San Marcos, CA, with good (if not great) schools, a college town with tons of great suburban neighborhoods, and a 10-15 minute drive to the minor tech hub that is Carlsbad and the beach. With 20% down, that’s a $3,200ish PITI, which a $100k household income would (barely) qualify for. Overpriced, yes, but nothing like LA or the bay area and attainable by a young white collar couple who spent their 20’s being smart with money (and were maybe gifted the down payment, so blame the parents too). It also isn’t undesirable the way people imagine living “inland” to be. If you’re okay with an hour commute, or work from home, your choices are amazing at that price point.

People seem to be nearsighted about prices, or intolerant of anything except their idea of the ideal human culture (metro sardines). If their area has crazy prices, then “prices are crazy”, period. No thought of moving to places that are frequently far nicer and cost far less money. I’m thinking that what they really want is their stock option payday without having to live 4 geeks to an apartment. I guess it doesn’t work that way.

John, that house is 635k plus closing costs in an area where the median household income is 80k ish. But hey, you got schools there and the sun is still shining!

What a steal, the house is only 8X the median household income!!

Since everybody makes over 200k (except the 18year old fry cooks) this house should go quickly: Call today or it will be gone by tomorrow.

Wait, I am wondering why its sitting on the market since 82 days. You must have been the only gold digger discovering this treasure.

“John, that house is 635k plus closing costs in an area where the median household income is 80k ish. But hey, you got schools there and the sun is still shining!”

You can twist my words all you like, Millie. Everyone else got the point.

John,

“You can twist my words all you like, Millie. Everyone else got the point.â€

Exactly! Your attempt to make this house look reasonably priced can easily be ridiculed by breaking down your points and showing some data (median household income).

My point is that this house is massively overpriced. I’d buy it in the 300’s.

Only an idiot would think that buying at 8x the median household income is justified because of good schools.

And yes, we know your answer. Everybody makes 200k except 18year old fry cooks. And if a millennial thinks this house is overpriced he probably got a useless 250k degree or eats too much avocado toast.

https://newswars.com/san-francisco-logs-over-16000-feces-complaints-in-one-week

Is that a lot?

He said logs

“Your attempt to make this house look reasonably priced…”

On the contrary, I admitted it was overpriced, but I understand that reading comprehension isn’t your strong suit.

I also never mentioned median income: “…which a $100k household income would (barely) qualify for. Overpriced, yes, but nothing like LA or the bay area and attainable by a young white collar couple who spent their 20’s being smart with money…”

Keep trying, Millie.

What’s that like? Always being the dumbest, most obnoxious person in the room?

What you always do John….when cornered you start with insults.

Cornered? You blatantly twist the words of anyone you don’t agree with, because it’s the only way you can “win”. That’s insulting.

Do you even know what the term “Freddie Mac income limits” means? I’ve explained it more than once.

I’m beginning to think you understand less than a quarter of what you read, and to make up for it, you cherry pick sentences from people who don’t agree with you, put them wildly out of context, insert massive amounts of sarcasm, and voilà , there’s your “argument”. You make yourself look foolish every day, Millie. Every day.

Good point M…Its funny how people mistake luck for knowledge and fail to realize THEY are the ones forcing unsustainable market conditions through THEIR greed.. They’re the smart ones until it implodes, then its everyone else fault..

Ya, ya i know I nailed it again.

Conversation between RE cheerleader and a millennial regarding affordability:

Millie: I keep reading about affordability issues in California, historic low sales and historic low homeownership rates. Must be because of the huge disconnect between low income and overpriced crapshacks.

RE cheerleader: low income? Everybody makes over 200k here! Don’t count the illegals they are not part of the statistic. Fool!

Millie: but nobody I know makes over 200k.

RE cheerleader: son, you need to meet new people! You have loser friends!

Millie: so what kind of friends do you have and how do you even know how much they make?

RE cheerleader: son, you gotta learn a lot. Yesterday, I had dinner with ex-president bush, a surgeon named helga, an Astronaut (Sergei) and a 5 star general (Smith).

The conversations are normal: hey George, how are you, I make over 200k, haven’t seen you in a while! George: I make over 200k. I am good, just playing a lot of golf and bought my 30. House. Me: oh cool! So same old same old. How are you helga, do you know what you gonna order? Helga: I am going to get the steak. I make over 200k and I will get a beer! Me: sweet! Sounds like a plan. What is Sergei ordering? Sergei: i am ordering pasta! I love their pasta. I make over 200k. Me: great! Good choice! ….And so it goes…

Millie: but that doesn’t reflect like the normal circle of friends does it? If we all had these friends why is the median household income only 68k, or 75k?

Angry RE cheerleader: dude, just because you are a loser does not mean everyone is a loser!

Millie: okay, okay. I got it. You are doing well.

RE cheerleader: damn right! I bought real estate a long time ago. I made a killing!

Millie: that’s great. Don’t you think prop13 seems outdated? Boomers who bought a long time for a very cheap price have locked in property taxes based on that cheap house price from 20 years ago? Millie’s who buy today based on the highly inflated price have to pay 1.2% property taxes of that inflated price. Why should we finance these government subsidies that only benefit older people? It screws us and it seems you could easily afford to pay your fair share?

Very angry RE cheerleader: Poor grandma!! POOR GRANDMA!!!! POOOOR GRAAAANDMAAA

Millie: I don’t understand. All of you make over 200k, you sit on highly inflated houses but you can’t pay your fair share in property taxes because of poor grandma?

RE cheerleader: yes, yes, yes!!! You fool!!

Nice Mille. RE cheerleader = Mr. Landlord.

Anyone making less than 200K is a Loser in his Trump-loving eyes.

Millennial has no freaking clue what property taxes pay for.

Try paying property taxes for 30 years that build a community. That were at market rate and went up 2% per year to build the community.

“RE cheerleader: son, you gotta learn a lot. Yesterday, I had dinner with ex-president bush, a surgeon named helga, an Astronaut (Sergei) and a 5 star general (Smith).

The conversations are normal: hey George, how are you, I make over 200k, haven’t seen you in a while! George: I make over 200k. I am good, just playing a lot of golf and bought my 30. House. Me: oh cool! So same old same old. How are you helga, do you know what you gonna order? Helga: I am going to get the steak. I make over 200k and I will get a beer! Me: sweet! Sounds like a plan. What is Sergei ordering? Sergei: i am ordering pasta! I love their pasta. I make over 200k. Me: great! Good choice! …And so it goes…”

Things change in your 40’s, for some people. A more relaxed attitude about income when you’re comfortable with your life. It remains a taboo subject at the office, but I know what nearly all of my friends make simply because the wives all talk about it. The only exception being the wealthiest ones, but their net worth is obvious and I can make an informed guess – e.g., the head of cardiology at a chain of so-cal hospitals – $600k? 700? Enough that accuracy doesn’t matter. Not counting her engineer husband’s salary. They throw great parties.

“Millie: but that doesn’t reflect like the normal circle of friends does it? If we all had these friends why is the median household income only 68k, or 75k?”

The median includes 18-year-old fry cooks. We don’t hang out with 18-year-old fry cooks.

“The median includes 18-year-old fry cooks. We don’t hang out with 18-year-old fry cooksâ€

That’s so perfect! I’ll build that in next time! Thank you!

@John D

“Things change in your 40’s”

Millenials are rapidly approaching their 40’s and are all still much much poorer in general than their parents were at the same age.

I don’t think you and others really understand just how bad the situation is at all.

John D,

Even if the wives don’t blab about the income – and not all do – it’s not that hard to figure out. If you know someone’s profession, employer (or if they own a business), age and location you can make a pretty good educated guess about their income.

And also people over time self segregate. If you make $200K, chances are everyone you know socially also makes around $200K. People who make $200K don’t hang out with people who make $40K. Yes I know there are exceptions, but generally speaking your friends are a version of you.

@Millenial

you forgot the racism.

otherwise spot on.

tts,

I know they’re poorer. But it’s also their choice to take out outrageous and necessary student loans for useless degrees, move to a coastal town, and then complain about the price of real estate there. Meanwhile, in my neck of the woods (one of the nicest cities in the state, as far as I’m concerned) a nice condo goes for $330k-ish. Two people making a combined income of $70-75k would qualify for a 3% down loan on that including PMI. That’s $17-18/hour full time. A waitress makes that. So do construction workers and mechanics. No, a lone fast food employee would not qualify. Should they? The payment would not be as affordable as it was several years ago, but I just don’t see it as a huge problem. If a millennial in a coastal metro can’t afford it there, they need to either stop complaining and wait for a downturn, or move. The day they can’t afford a home in Ohio or Florida is the day they have a legitimate gripe.

I’ve got guys in my department who are single, in their 30’s, own property, and drive $70k cars. It’s all about how you choose to educate yourself and where you choose to live. People need to stop telling high school kids that they need a $250k education to be successful, and start telling them that living in a “hip” city is more likely to lead to disaster than anything else.

PREACH IT BROTHER JOHN D!!!!

It’s mind boggling how kids spend $50K+ a year to go to a no-name, never heard of it college for a teaching degree, or nursing or “general studies”. The same degree that can be had for $10K at a State U. That generic degree has the same value in the job marketplace. Unless you get into a top 20 college or major in something really specific that only a few schools offer, find the cheapest college option you can and go there.

As for the hip city, I’d advise the yuuutes to spend a few years in NY or LA or SF out of college. At 23 and single it’s a good place to be. I spent the first 10 years of post college world in coastal cities. But at some point in my early 30s I realized walking distance to 21 Ethiopian-Asian fusion restaurants kinda loses its appeal after a while.

The smart play is live on the coast when young, save money, get established in a career, then move somewhere cheaper. Either work for an employer that allows remote work or work for yourself. For in demand professions, employers will accomodate those situation. Give me a high speed connection, a cell phone and a reasonably sized airport and I could live anywhere in the world.

And the other thing I will never understand is why a teacher or nurse or what have you would ever want to live in a high cost city. Those jobs can be had anywhere as well. Yeah pay is somewhat higher in LA vs Topeka, but relatively to cost of living Topeka teachers are much better off. As are nurses, cops, firefighters, etc. You read all these sad stories in the MSM about the poor teacher in LA that can’t afford to buy a home. Easy solution…MOVE OUT OF LA!! Problem solved.

Great points Millenial!!!

Hey mr landlord have you tried to enroll in any classes at one of theses “affordable†schools lately? The minute open enrollment starts the classes are full like a Black Friday sale! Every other school is $200,000+.

I know and interact with A LOT of people in the real world and never meet theses large populations of $200,000+ earners. The only people under 40 I know “getting†houses are literally having it all sorted out by mommy and daddy or granny and Grampy. Then they just rent out rooms just like they already did as renters and still have the same shit income jobs as before. I know multiple millennial “winners†who do exactly this. Basically same scenario as when they rented but now landlord doesn’t get to decide to just fuck them over whenever and impose their personal bullshit on them.

Oh yeah and most people I know can’t even get a home in antelope valley much less LA. So the whole “all the under 40’s are trying to live in expensive cities†is a bullshit false story. Try again.

Millennial gets it.

I know plenty of dual income with close to $200,000 annual income since I’m in the medical profession. Most already over leverage to buy 500k-$1 million dollar home with little down payment and high monthly mortgage rate. I can’t imagine paying 30 years mortgage $3000 to $4000/month for 30 years.

My wife and I make combined salary of $300k+ with $300k for down payment living rent free. We refuse to buy in this market. I’ll wait until there is a market correction to buy.

I know plenty of dual income with close to $200,000 annual income since I’m in the medical profession. Most already over leverage to buy 500k-$1 million dollar home with little down payment and high monthly mortgage rate. I can’t imagine paying 30 years mortgage $3000 to $4000/month for 30 years.

My wife and I make combined salary of $300k+ with $300k for down payment living rent free. We refuse to buy in this market. I’ll wait until there is a market correction to buy.

It just feels like a Ponzi scheme. Everyone is using their inflated housing to buy more inflated housing. Our neighbor is crap – cars everywhere, people liking three families to a houses, schools that are threes. Yet the condos are 800-1.2 million and houses are 1.6 million or so.

We can’t afford a house with a 325k income and 400k in savings. Who is buying the houses is beyond me. I never see anyone move into the recently sold houses.

We are easily the top 1% of income in our neighborhood. Most people are undocumented (earning 50k) or H1bs (earning 80-100k). I have yet to meet a single person who could buy the houses on income alone in this neighborhood. How can this be sustainable?

The 20% down payment in the old days was proof of the ability to save and mange money. Now it is not required. People with no savings and no ability to live within their means are given mortgages. If they break a shoelace, they default. If the market, which is now at the peak, drops back one iota, they are underwater, owing more than their house is worth.

This is wrong on so many levels.

Amen Roddy. I never bought a piece of property without having to endure a wide scale anal alien probe and 20% down even with a gold standard FICO, savings and 10 years at the same job.

Plus having to write a letter declaring fealty to my debt vehicle.

I did, however, buy what I could afford over the long term and as something to live in, not as an investment play and never used the equity for anything but improvements in the structural aspects of the house like windows and electrical.

Grateful to be off the credit, mortgage and automobile debt wheel.

Being prudent with money takes a little skill, a lot of delayed gratification and some luck.

“The 20% down payment in the old days was proof of the ability to save and mange money. Now it is not required.”

I wouldn’t exactly say “not required”. At the $453k loan limit, 3% down with closing costs could be $20-30k+. Their credit and length of employment is proof of the ability to manage money, and their income allows them to qualify.

The changes now allow people with higher incomes in more areas to use this program. It doesn’t allow poorer people to buy. They still have to qualify. The only problem here is having a larger number of buyers speculating because they don’t have as much skin in the game. However, losing $30k is still a tough pill to swallow. We’ll see how it plays out.

You’re not wrong but you have to remember the old saying, “If I owe you a thousand dollars and can’t pay, I have a problem. If I owe you ten thousand dollars and can’t pay YOU have a problem.”

I read that $117,000/yr story on cbsnews. The article also goes on to illustrate that teachers, police, firefighters, emergency responders, etc. will no longer be able to afford to buy in the Bay Area and are beginning to fill those positions closer to their homes outside the immediate Bay Area vicinity. But I’m sure cbs news is fake news right? 🙂

But I’m sure cbs news is fake news right?

Well, yes. CBS is full of fake news.

People insult Fox News. Yes, it’s trash. But no more so than CBS, the New York Times, or any other mainstream news source.

Nice attempt at false equivalency. But if you actually read the New York Times, or any newspaper for that matter, you’d pretty quickly see the difference between them and Fox News. But you’re probably not interested in learning anything outside your narrative.

Chris, you are a brainwashed goofball. The NYT is partisan trash owned by a Mexican billionaire who hates Trump and staffed with liberals who are masters at propaganda. At least Fox owns their conservative bias; The NYT is WILDLY biased towards the left and LIES about it. Anyone who reads it is a complete dope.

Fox News: Gives both sides of the story with a slight right tilt

CNN, NYT, WAPO, CBS, etc…gives only one side of the story with a communist tilt.

CBS isn’t lying but they are forgetting that the average firefighter and cop in SF makes 1.5% of his yearly salary in OT. If they are getting 100K they are getting an additional 1.5 in OT.

I know many cops/paramedics/firefighters in Chicago also earn at least 100% of their base yearly salary in OT as well.

3 to 5 percent commission….for the BUYER? I’ve bought close to 20 houses in my life and I have never paid a commission as buyer. Typically closing costs on the buy side is 1-2%, which includes pre-paid items which aren’t really costs since it’s still your money just in an escrow account.

I think he is referring to cost to sell; so, once the buyer is in with minimum down they are upside down on day 1 due to the selling costs. Of course that assumes you sell immediately or value drops as opposed to considering some appreciation and principal pay down.

This is so funny. Every day here and elsewhere we are told how incredibly rich Californians are. And as I have been saying forever, it’s all BS. $100K in coastal CA is barely middle class. Turns out I was wrong. It’s not even middle class, it’s working poor. Someone making $100K in SF has a lower standard of living that someone making$ 40K in Indianapolis or Cleveland.

And not only is your standard of living barely above a burger flipper, you also are taxed as if you are “rich” (according to Democrats anyway). So you are effectively paying $100K taxes for a minimum wage job.

But hey man, 5th largest economy in the world and stuff!!!! LOL

Mr. Landlord,

Yes, and a big problem nowadays is that our federal and state systems assume that the cost of living is roughly constant around the country. In CA 100k income means you can barely get by. But you are taxed as if you are wealthy, because in most parts of the country that would be true.

$100K isn’t wealthy anywhere in the US. But yeah, the tax system is kind of messed up when $1 earned in SF is treated the same as a $1 earned in Cleveland. Ideally there should be some cost of living adjustment for tax rates. But if that were to happen, there’d be so much fraud, you’d have everyone “living” in Cleveland somehow.

Next time you see an RV on the highway, look at its license plate. There is a good chance it will be from S. Dakota. Why? Because SD has nod/wink attitude that allows people to claim residence there in order to register RVs at a fraction of the cost of their home states and pay a lower sales tax. So magically 1/2 the retired people in America with RVs “live” in South Dakota. I have an uncle who did this. He’s got one of those $250K RVs and he saved $10K in sales tax and saves about $1K a year by having it registered in South Dakota. Of course he’s actually only ever spent about 2 hours in the state, but details, details, he “lives” in SD technically.

I can only imagine how many millions of people would suddenly “live” in South Dakota or Wyoming or middle of nowhere New Mexico if the feds started taking a cost of living approach to income taxes.

The tax system isn’t assuming anything about the cost of living, not at least anymore since the personal exemption was eliminated.

If the standard of living relative to the cost becomes a poor value–as is currently the case in coastal California–people vote with their feet and leave.

The tax system shouldn’t need to account for this as the market will take care of it.

*As a side note, some claim it’s only the poor leaving California, but that is a lie.

That is the reason I always repeated on this blog that what you make is irrelevant. Those in Zimbabwe are all billionaires (I always use this example to create a clear picture for those who do not get it). What counts is purchasing power after ALL the taxes. By that metric, most in coastal CA a dirt poor. Yes, there are few pockets of super rich people, but those are in the top 0.01%.

High income means very high taxes at state and federal level (tax donkeys). With the crumbs left, people fight incredible high cost of living. That is a sure recipe for poverty and a miserable standard of living.

5th largest economy with the highest supplemental poverty rate in the nation.

It’s sort of like crowing over the 5th largest turd in a toilet. It’s just a number.

California is not the fifth largest economy. It only looks like that because CA is part of a much larger economy. Should CA be independent it’s economy would decline greatly as it would have to pay for a lot of needs it now receives being part of a larger government.

It’s like bragging you make a million dollars a year as CEO of a company, when in reality it’s your father’s company, and similar jobs would go for a lot less.

Moving to SOCAL next year, hurry up and tank realestate, otherwise im a renter till it does.

It is probably best to rent in an area first that you intend to buy.

That way, there are no surprises.

The last RE bubble peaked in 2007. It took until 2011 to hit the bottom and 2013 to start rising again.

Even if it crashes next year, 2019, you probably shouldn’t buy until 2023.

My crystal ball is broken but based on the last crash, 2023-2024 will be a good time to buy.

Disclaimer:

Jim Taylor has much more experience than I do at this prediction stuff.

Here is from 3 years ago, 2015.

http://www.doctorhousingbubble.com/california-housing-history-real-estate-market-trends-30-years-of-data/

I think the doctor is getting a little ahead of himself with the doom and gloom thing. While more people putting 3% down is not a good thing, it doesn’t mean those buyers can’t afford the loan. And implying that people will be putting 3% down on $1m+ homes is misleading – for most of the country, the Freddie Mac loan limit is $453k. Those people also still have to meet strict income requirements. In other words, at the time of purchase, they can afford it. What they do with it once they discover they’re underwater is another story. Those who considered the purchase an investment may walk, but I don’t believe that those who consider it a home are much more likely to walk than someone who put down 20%.

We are still a far cry from the loose lending standards of the last bubble.

In my area, $467k (highest you could go with the loan limit) gets you a very nice 4/3 home in a great neighborhood, with a PITI of around $2,700, for a house that would rent for $2,400-2,500. That’s not ideal, but not exactly what I would call dangerous.

EXACTLY John D.

He’s got it.

Stop with the scare tactics of lending to everyone and ohhhh only 3% down on a million dollar home. THIS IS A LIE!

That is NOT the case. Absolutely correct as I posted below; the MAX loan amount is 453,100 on these 3% down mortgages which translates to 467k price point. Anything above requires 5% down. Don’t forget these have higher rates and higher PMI factors which means a higher overall payment BUT the buyers still have to qualify with the debt to income ratio.

This isn’t PRAVDA or CNN; let’s stop with the mis-information please.

And of that $2700, around $2K is interest/property tax which means it’s tax deductible. For someone in the 22% tax bracket, that $2700 PITI is really $2300 after the deduction. . And the other $700 is principal payback, ie equity. Which makes the effective payment is in the $1600 neighborhood.

$1600 to own vs $2400 to rent.

“$1600 to own vs $2400 to rent”

I’ve owned a house that is basically just renting from the bank and the fucking payment is only half the fucking battle………talk about cherry picking numbers……I’ll take that $2,400.

LOL, what battle? It’s simple math. $2400 is more than $1600. I guess you mean maintenance and repairs? Not sure where you lived, but nobody is spending $800/mo on maint/repairs for a $2400/mo rental.

I suppose if the house is 200 years old or something, maybe $800/mo can happen. For a typical division tract house built in the last 20 years, it’s more like $80/mo.

My credit union does a 100% loan up to 1 mil.

Name please?

Dan,

Navy Federal. 100% no MI (non VA). There is a 1.75% funding fee but you can roll it into the loan (101.75%LTV).

So Cal Guy,

Thx; I did check it out and you are right they do offer that program on a case by case basis. No set guidelines, but, essentially looking for the strongest borrowers; high ficos, stable employment, low DTI’s.

1mil @6% (which is what it comes to with a good credit score and buying out origination fees) PITI = $7,100

So, you need to make around 250k/yr to get in the game on this loan. Guess it’s been around for awhile, just the 1st time I have heard about it so they must have a pretty high decline rate. In any case, good heads up as I always like to keep myself informed on all available credit options in this market.

Dan,

It’s definitely not for weak borrowers. I have my loan through Navy Fed (not the 100%) and the underwriting was really smooth. They actually allow up 40% DTI on the 0 down program plus give you a rebate if you use their real estate purchasing program. Rates have gone up but they were around 5% just a few years ago. The advantage is you can deduct the interest versus PMI. Not a bad deal in my opinion if you can afford the higher payment.

Best post on topic, hands down! Everyone, back to topic!

That being said, I’ve always maintained that the real estate crash was three teired.: A working class debacle, a middle class bad slump and a wealthy adjustment. This news won’t lead to a new crash in Beverly Hills, just Riverside.

No wonder people will risk it all to buy a house with a low down payment.

After all, you too can rent a 2 bedroom apt for only $2500

https://la.curbed.com/2018/6/27/17509640/los-angeles-apartments-for-rent-silver-lake-north-hollywood

I have no problem with low- or even no-downpayment mortgages, as long as that mortgage isn’t backed explicitly or implicitly by the taxpayer. That’s where the problem comes in, having the taxpayer subsidize risky mortgages and hold the bag whenever there’s a downturn. That’s just bad policy.

Sounds like a Dumbacrat policy

Almost all home mortgages have been at least implicitly backed by the taxpayer since the 1930s, when the GSEs (government-sponsored enterprises) like FNMA, and later, FMCC (established by the government to keep FNMA from becoming a monopoly) were founded by our government, to buy mortgages from lending banks and S&Ls, to free up their capital for more mortgage lending. Without Fannie Mae and Freddie Mac, as they’re called, 30 year mortgages would almost not exist and mortgages either would require 50% or higher down payments, as the did before 1938, and longer term mortgages for 25 years or more would scarcely exist. The government guarantee was always implicit, else this type of lending would have been judged to be far too risky for most investors.

Actually, the entire financial system is backed by the feds. Trust me. If any financial problem ever appears that is large enough to damage the financial system, the feds will show up and carry the water needed to fix it. That is life in America and you have to accept that because the alternative is a disaster.

The fact that there are 30 year fixed rate loans that exist is scary. The rest of the world does not lock in that long.

What will the banks do when all of the sane people who refinanced down to loans between 3% and 4% and Savings accounts are paying a 6% savings account rate.

Our Millennial will have missed out but all of us GenX, Late Boomers, and sane Millennials who bought a house will be safe and secure until we retire and pay off the loan while collecting 6% in savings and only paying 3% on our mortgages.

Don’t laugh, that is what my parents did in the 70’s and 80’s with their 6% loan while banking with CDs reaching 15%. Now we are at 3% for loans??? Crazy.

I am waiting for my bank to offer me a deal I can’t refuse to give up my 3.5% 30 year mortgage

your parents home cost 10,000 dollars…..strike….

Seen it all before, Bob,

“The fact that there are 30 year fixed rate loans that exist is scary. The rest of the world does not lock in that long.”

Total BS. Look at Europe, 30y mortgages are common.

“What will the banks do when all of the sane people who refinanced down to loans between 3% and 4% and Savings accounts are paying a 6% savings account rate.”

Sell the loan. collect the fees. Behind Fannie/Freddie stands the taxpayer.

“Our Millennial will have missed out”

Missed out on what exactly? On buying at the peak? You probably not know that it is better to buy a lower priced house at a higher interest rate instead of buying an overpriced house at a lower interest rates.

Since this probably confused you already, just remember, its all about the price of the house not the interest rates. Interest rates change and you can refinance later. You cannot change the price you paid for the house.

“but all of us GenX, Late Boomers, and sane Millennials who bought a house will be safe and secure until we retire and pay off the loan”

Yep, just like last time when we had 7Mio foreclosures.

“while collecting 6% in savings and only paying 3% on our mortgages.

Don’t laugh, that is what my parents did in the 70’s and 80’s with their 6% loan while banking with CDs reaching 15%. Now we are at 3% for loans??? Crazy.”

I am looking forward to higher interest rates. I am sitting on cash and wouldn’t mind parking some at a higher paying CD.

Millennial, everything I say is true.

Canada, Europe, and Australia have longer term loans but they are more like longer term ARMs since the interest rates adjust after 5-10 years. Unlike the US where interest rates on fixed loans are locked in for 30 years. It is almost impossible to get a fixed rate 30 year loan for a low rate anywhere other than the US (unless you pay an extremely high rate). Look it up.

I don’t know how the bank is going to sell my 3.5% 30 year fixed mortgage when savings rates hit 6%. Maybe they will sell it back to me for the true amount of the worthless loan. I’ll have to be prepared and figure out what my 3.5% loan is worth when I am making 6% with an insured bank account.

Unless you have a lot of cash and can avoid a mortgage, taxes, housing prices and interest rates control the cost of housing PMI. In 2007, interest rates were over 7% and housing prices were almost to the same level as today.

Here is what wiped out renters who wanted to buy in the early 1980s. Interest rates went from 6% to 15%. Inflation led or followed so housing prices were flat with a slight increase. Housing prices followed inflation. Housing prices rose with inflation but incomes lagged. Housing never crashed. People who bought were lucky to pay 15% for a mortgage and were later lucky after 10 years to refi as rates dropped. It could happen again. Or maybe not. In summary, houses were rising with inflation 15%/year and interest rates were rising also. Not a good time to buy a house. Great if you already owned a house with a leveraged 6% mortgage. It could happen now if inflation increases.

Bob,

“Millennial, everything I say is true.

Canada, Europe, and Australia have longer term loans but they are more like longer term ARMs since the interest rates adjust after 5-10 years. Unlike the US where interest rates on fixed loans are locked in for 30 years. It is almost impossible to get a fixed rate 30 year loan for a low rate anywhere other than the US (unless you pay an extremely high rate). Look it up.”

Lets play a game. I provide two websites from Europe referencing 30+ years of locked in rates and you provide one website in return saying that it is not true what my websites are referencing?

Fair?

here we go. I picked Europe’s largest economy so this is in German:

This is a private lender.

https://www.nowofinanz.de/40-jahre-zinsbindung/

“Wir können Darlehen mit einer Zinsbindung bis zu 40 Jahren vermitteln.”

Darlehen=loan, Zinsbindung=fixed interest rates. They even exceed 30 years and add 10 on top!

Die Welt is one of the main newspapers i believe:

https://www.welt.de/finanzen/immobilien/article151968189/Zinsbindung-fuer-zehn-15-oder-gleich-40-Jahre.html

“Zinsbindungen von bis zu 40 Jahren sind möglich”

means: fixed rates up to 40 years are possible.

Bob,

once you come back with a website saying this is all baloney i will come back with two websites from another European country.

Hey Millennial,

Good Challenge. Especially when your post is in German.

means: fixed rates up to 40 years are possible.

Are possible? Are you kidding me? Everything is possible at a 15% mortgage rate.

Here are some of the rules of Fixed Rate for Europe but in English.

Borrowers will need to be prepared for some less-than-appealing loan terms as well. In many countries, repayment periods tend to be shorter, often ranging from three to 15 years. With interest-only mortgages, borrowers are often able to renew the loans—which often have repayment periods of five to seven years—at the end of the term, although most lenders in Europe require mortgages to be repaid by the time the borrower is 70.

https://www.marketwatch.com/story/buy-a-home-in-europe-get-a-lower-interest-rate-2013-03-22

My statement is correct. NOBODY in the world offers an affordable 30 year fixed mortgage other than the US.

You could also look at the Wikipedia site.

https://en.wikipedia.org/wiki/Mortgage_loan

I can keep going until you wave the white flag.

Bob,

“Until I wave the white flag obviously You don’t know me. Have a feeling this will go on for a while.

“Are possible? Are you kidding me? Everything is possible at a 15% mortgage rate.â€

I am not kidding. Yes, it’s in German….which is no problem I can translate it for you. But numbers don’t need to be translated. If you open that first website you see that they offer 2.25 % for 40 years.

I went straight to the source and provided the detail and you are still sticking to your story because you read a marketwatch article?! You want more proof? Here you go. This is Sparda bank, from what I researched and learned while I was in Germany this is similar to a credit union here. On the conservative side:

https://www.sparda-west.de/baufi_konditionen_145668.php

Even that “union bank†is offering 25 years fixed rates at 2.49%.

Yeah, I know. The US is soooooo amazing with 30 year 4.5% loans. Nobody in the world is offering it. Except europe is offering almost half the rate. So your point is….America is great, buy now?

Dear Millennial,

Please post your backup in English so we can all read the fine print.

You are correct, on the English sites, there are loans available at 15% rate for 25 years.

All of the others have 25 year loans with 4% rates BUT with a loan that adjusts after 5-10 years.

Please provide backup that we can all read.

Backup?

Dude, don’t let the facts go in the way of a good story! After all you have done all the research! You read Wikipedia! Just stick to your story. America is great. Buy now because we have 30year loans at 4 percent. Everybody else in the world has 15 year loans and 15% interest rates. That a great line. We need to buy now to secure this deal! It’s a gift!

Millennial, if you don’t have any English sites to prove your point, I’ll take that as a white flag.

My point was actually related to 30 year fixed loans in the US at ridiculously low (below 4%) rates.

My Silent Generation parents won the lottery with their 6% mortgage rate in the 60’s while they kept their cash in the 80’s Reagan era 18% CD’s . Same incentive not to sell or move as now. Prop 13 was just icing on the cake.

If you don’t buy now and inflation repeats like the 80’s, you will miss out.

Or as you predict, housing will crash 70% and you win as all of the recent buyers in this blog panic and foreclose. It is hard to see 50% of your net worth disappear in a year and then continue to fall for the next 3 years without panicking and dumping a bad investment. You and all of the other rental REITs out there are waiting.

If only my crystal ball hadn’t fallen off the shelf during the Northridge Quake.

Sorry Doc, but I need to clear up a lot from your article as someone who writes Fannie Mae and Freddie Mac mortgages on a daily basis.

There is NOTHING new about this Freddie 3% down program! NOTHING. Fannie has had this identical program for the past few years. It’s just that Freddie is catching up and Freddie’s version used to be 3% down was tied to income limits in certain geographic locations.

I.E. Corona = 90k max income limit

And it would vary by census tract.

All Freddie did was lower the income limit on this program to be inline with Fannie version (called Home Ready) and create this other “new” Freddie 3% down program without limits. This new program literally does NOTHING for homebuyers nor does it extend credit to really any new buyers. Actually; since the other program Freddie had (which was 3% down but tied to income limits) was cheaper (lower rates and lower PMI) the reverse argument can be made that the lowering of income limits on that program (called “Home Possible”) has actually REDUCED THE AVAILABILITY OF CREDIT to potential buyers.

Furthermore, let’s talk LOAN LIMITS!

All the 3% down conventional (Fannie and Freddie) programs, cannot exceed a LOAN AMOUNT LIMIT OF $453,100. So, that means that in order to ONLY put 3% down on a purchase; the MAXIMUM PRICE you can go to is $467,000! Anything above this price point will require 5% down on a conventional loan.

So, for those readers that think these buyers can go out and only put 3% down on an 800k house, that is simply NOT TRUE.

Don’t believe me? I can send you links to Fannie and Freddie guideline books and you can see for yourself. Or, call a (good) mortgage loan officer.

Also, remember you must qualify with certain debt to income ratios and the PMI on these loans become astronomical if you do not have good to excellent credit.

So, ask yourself, how much house can you buy at $467k? B/c if you want more house, then you need 5% down conventional or need to go FHA.

Now, on to FHA; you say” Now the FHA already backs up low down payment mortgages but these are constrained to lower to middle income areas.”

I am unsure what you mean by “constrained”? FHA does not have income limits whatsoever and plenty of people use FHA that have higher than “middle incomes”. There are times where FHA is cheaper and makes more sense than a conventional mortgage.

Doc what you may be referring to is the max loan limits calculated for FHA per county as calculated by FHFA’s income survey. I.E. Orange county loan limit = $679k vs Riverside county loan limit = $406k

The loan limits are derived from median income county surveys so I am guessing that is what you were referring to; but, to clarify; FHA does not have buyer INCOME LIMITS for qualifying purposes.

I love the reading different viewpoints and debating on RE; however, hate when I see mis-information or lack of education on lending, so, I hope that I can provide some clarity in that arena as that is my main business and what I do each and every day.

If you can get a 5% down with higher loan limits, you have to go for it.

Another excellent post from someone who knows something.

What is not being mentioned is with a 3% down payment your going to have to pay mortgage insurance which will increase your monthly payment anywhere from $167 on up depending on the price of the home.

If your credit score is below 700 there is no point in taking a conventional 3% down loan due to the PMI cost one would rather go with FHA.

FHA interest rates are lower and the FHA PMI rates will be lower than conventional with an under 700 credit score

It is just not realistic for a family putting 3% down to then have a $4k monthly mortgage, especially since you then have to pay PMI due to not having 20% down. We lost our home in 2008 and have never recovered. So sad what’s happened to the American dream.

A lot of people with good financial planning lose their homes in a recession, especially when an unfavorable life event hits during a recession. You can not take it personally. Often, it is a case of bad luck. Don’t let it get you down. You have to move on. Remember, if you are alive, and you have good family and friends, you are winning at life. Material things are secondary. Good luck.

They wouldn’t have a $4k monthly mortgage with 3% down these days. Limits wouldn’t allow a loan that size. Maybe it’s possible with horrible credit and a high enough rate and PMI, Dan would know better than I.

Just curious – if you’re willing to tell, why did you lose your home? Variable rate reset? Job loss?

You didn’t lose your home. You signed a contract with a lender agreeing to pay back a loan. The penalty for not paying it back was forfeiting your home. Your home wasn’t lost or stolen or taken away. I hate it when people who willingly broke a contract they agreed to play the victim card.

Heather,

Your #’s are way off. As i’ve said, max price point with 3% down (conventional) is 467k and therefore with 3% down even with terrible credit (assuming you got approved) wouldn’t get to $4k.

To say the mortgage (without PMI) would be $4k shows you don’t know what you are talking about.

Anyhow; if the credit is not very good it’s flipped to FHA where 3.5% down is needed and the PMI is cheaper than conventional anyways.

Doctor, you should do a story about IRS 1031 Exchanges.

This allows the owner of a business property (e.g., a rental) to sell it, use the assets to buy a “like kind” business property (another rental), and defer all capital gains taxes on it.

I’ve come across two sellers who, I was told by the realtors, are doing 1031 Exchanges. One listing said that “buyer cooperation on a 1031 Exchange” was a requirement for any offer.

I suspect this program is ripe for abuse.

You own a house. You convert it into a rental, for the required period of time. Exchange it for another rental, for the required period of time. Then convert back into a home for yourself. Home for home, all capital gains tax deferred (i.e., not paid).

I’m wondering if you can get away with renting to a relative? Your kids? Your spouse? Or even to yourself? You place the house into trust, then you rent it from from trust, which is technically a different person.

I’ve done searches and discovered that maybe half the condos in my building are owned by family trusts.

As long as you live in a primary residence for 2 out of 5 years, you get a $250K (single) and $500K (married) capital gains tax exclusion. This has been the case since the 90s. For non-investors, capital gains taxes on real estate is almost non-existent.

I’m well aware of capital gains exclusions. But …

I saw a house in Santa Monica this year that’s listed at $1,150,000 over the previous purchase price in 2013.

A capital gains of $1,150,000.

That’s one of the sellers planning a 1031 exchange.

I remember another Santa Monica house last year that was sold at a capital gains of over $1,000,000.

And those aren’t the only examples. I’ve seen many Santa Monica and Brentwood homes that were purchased during the recession, whose current list prices are well above the capital gains exclusions.

Dan, you said:

“A week ago …, you said that there are for sale properties everywhere in Mission Viejo …. Now one week later you put your house on the market as a for sale by owner not even on the MLS and had an open house with interest and one day on the market already receive an offer! I don’t know Gary, it kind of sounds like there is buyer demand and it seems like if there were so many properties for sale on your street and in your neighborhood you wouldn’t get an offer on the same day your property went on the market.”

“What are your thoughts?”

“Care to share the approximate price range you have it listed at?”

“Furthermore you stated that all five of the couples were professionals which to me sounds like they can afford to purchase your property and make good money which doesn’t jive with a lot of the Perma Bears on this site that say they don’t know anybody that makes more than 50 to 100 thousand per year.”

“As I have said before you really have shown courage to put your money or property where your mouth is and I think you are getting a taste of a strong buyer demand what are your thoughts on all of this?”

Dan, I got two offers within 24 hours of my open house. One was low, the other was good. However, my potential buyer is having trouble closing his current home’s escrow so it doesn’t appear that the deal will go through. If the deal falls through, I may take my home off the market and wait until next spring to sell. I now believe that prices will be at least 5% higher next year.

In an case, I am still impressed the strength of the market and now believe that the real estate top is probably about a year away. The low inventory of homes for sale and the quickness with which homes appear to be selling suggest that the top is not real close.

Also, my nephew, who is the CEO of a small California home builder, currently sees no sign of a real estate top. He said that 80% of the new homes being sold in Orange Co. are being sold to Asian buyers. However, he worries about what those buyers might do if prices turn down. Are they speculators or long term investors? Will they run for the exit at the first sign of a downturn?

Gary

I think you just made Millennials head blow up.

Surprisingly high demand and low inventory

Professionals who are the buyers that make good money

And gasp, Asian buyers!

All three are myths according to mr. Millennial.

Not one “Taco Tuesday Baby Boomer” comment? I don’t think this was written by the Doctor.

Hi, Enjoy your Columns / Articles. Even if we do see home ownership increase , people are still

limited by the increasing , ” GIG Economy” where people are having to accept non – full time , single employer . I feel this will still limit people whom can buy a SFH since society is moving away from this

and at this time , no provisions for society to purchase a home .

It should be interesting to see how GSE ( Fredie, Fannie ,ect) adopt to qualifying buyers in the GIG economy >

Mitch,

Gig economy?

You permabear! America is great again and the housing market could not be hotter! I am a RE cheerleader and everyone in close proximity makes over 200k, easily!

People keep talking about teachers, firemen, policeofficers not be able to afford a house?!? First off all, who needs these low-income people anyways?? If you don’t make over 200k don’t even talk to me. I am so fed up with these freeloaders and the whining. All of my friends own many multi dollar homes and pay next to nothing in property taxes!

That’s what you get when you have your MBA!

People who don’t have a doctor title or MBA should be grateful they don’t have to live in containers like in the good old Soviet Union!

Stop whining, go back to school and get your MBA. Next thing you know you make 200k and buy your first two houses. Once you bought ten houses you might get a chance to join my club! And I swear if I hear rental parity or median household income one more time Iam going to explode!

LOL.

The only thing I can say in mild defense of the pro-housing crowd is that more people do have the option of working from home now, and rich people who can work from home will choose coastal CA.

Is this all you have left, Millie? Taking pieces of other posters’ comments out of context and surrounding them with your own lies and sarcasm, all with third grade grammar? It’s funny, but not in the way you’re hoping for.

John,

All I have left? I am just getting started!

Yep, it’s pretty funny…..just not to everybody…..unless you can laugh about yourself.

Oceanbreeze you have it backwards. “Rich†people who can work from home are increasingly moving out of high tax areas such as coastal California. It’s those who have to come into the office everyday that are being forced to stay.

https://www.zerohedge.com/news/2018-06-28/us-housing-unaffordability-remains-near-all-time-peak

RE will crash hard

One man’s foreclosure is another man’s opportunity for a flip.

There is this myth out there among the perma bears that anyone can walk into a lender’s office with $0 in their pockets and walk out with $1M loan. This is a fantasy. I was talking to my lender earlier this week about lining up a mortgage for another property I’m looking to buy. Keep in mind this is a bank I’ve been doing business with for years and have several mortgages with already that has never had even so much as a day late payment. And my FICO score is in the high 700s with income well above $200K (which according to Millie doesn’t exist, I know). And this is a small local bank, where I know the mortgage broker personally. It’s not like BoA or Wells Fargo where I’m one of 20 million customers and deal with some call center rep from India who doesn’t know me from Adam.

And still, for this new property I have to go through the same rigorous underwriting process as always…tax returns, bank statements, proof of assets, the works. And I need to put 25% down as I have had to do for all the investment properties I’ve purchased.

So one of those things is happening…1. I need to find a new bank since this bank is the only one that has lending standards anymore. Or, 2. the idea that lenders just hand out $1M loans to anyone with a pulse (as Millie and Co. seem to believe) is nonsense.

I’m leaning towards #2.

My bank started giving me my FICO score, and my Wife’s credit card company gives us her score. We haven’t been below 800 yet. And our total income is nowhere near $200K/yr. You must be in hock up to your eyeballs.

I say Apple and you say Orange! What does your reply to do with Landlords factual statement?

He is referring to purchasing another investment property and everything he stated is correct. 20% minimum down payment and income verification via tax returns, w2s, pay stubs, verification forms etc…

So bc your bank says you have a high credit score you get to skip the rest when purchasing a property? Haha. Too funny

Another lending assumption akin to the sub-prime is back crowd where you can now buy a million dollar house with no income verification, 0 down and a 500 credit score. Laughable.