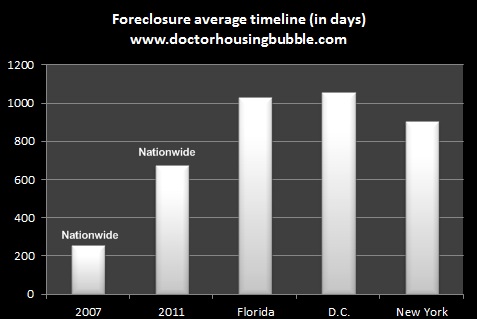

The future of the young American homebuyer. Average foreclosure timeline jumps from 253 days in 2007 to 674 days in 2011. Homeownership rates for younger Americans point to significant issues in household income, demographic changes, and attitude shifts in the desire to buy a home.

Young Americans have a challenging road ahead especially when it comes to buying in large metro areas. Since the Great Depression jarred the psyche of our economic fundamentals, each subsequent decade brought on a belief, a vision that the next decade would have it better. For most this meant a better road to economic prosperity and stability. There is a nostalgic reason that the “American Dream†many times includes a picket-white fence. After the end of World War II this is largely what occurred in the U.S. housing growth and the suburban dream expanded in what seemed to be an unlimited growth pattern to satisfy the collective unconscious desires. Yet this structural change came hand in hand with the baby boomer generation and households increasing their true earning potential. Yet younger Americans are facing a dramatically different landscape. They are confronted with tighter job prospects, a shaky stock market, and the growing expenses of college that saddle many with loans that at times appear to reach the levels of a mortgage. Make no mistake that this issue ripples across all age groups. The system for many years was built on trade-up buying. Yet many boomers are downsizing as they enter retirement and many young Americans are unable to pay top dollar for those homes. So what can we say about the future of the young American homebuyer?

Homeownership rates largely skewed by baby boomers and older Americans

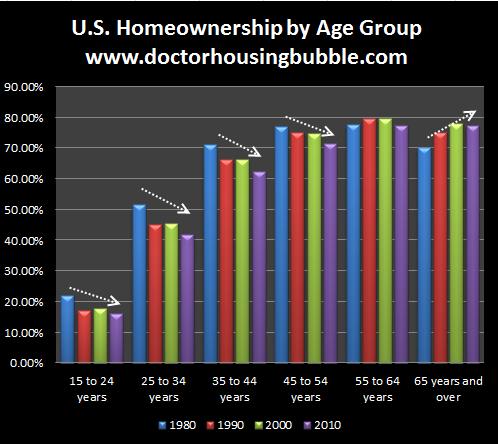

It would be helpful to first get a glimpse of homeownership across various age groups:

Source:Â Census

The overall homeownership rate is largely skewed by older Americans, those 55 and older. For every other category, the homeownership rate since 1980 has fallen and in some cases dramatically. Take for example the 15 to 24 and 25 to 34 age ranges:

1980 homeownership rate

15 to 24:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 22.1%

25 to 34:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 51.6%

65 years and older:Â Â Â Â Â Â Â Â Â 70.1%

2010 homeownership rate

15 to 24:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 16.1%

25 to 34:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 42%

65 years and older:Â Â Â Â Â Â Â Â Â 77.5%

I find trends like this fascinating because it gives us some deeper insight into the demographic challenges facing the future housing market. The big increase in homeownership at the upper-end is largely due to baby boomers moving through like a pig in a python. Yet the sizeable drop for younger Americans is also significant. Demographics can only speak to the major increases at the upper-end of the age scale since the above data is merely looking at homeownership rates broken down into cohorts. There are a few reasons that are likely to account for these shifts:

-1. Younger Americans are simply less affluent. This is backed by net worth data and also salary information.

-2. The decline in good paying manufacturing work. Some have to put off buying a home in place of going to college. It was easier to buy a home with a $25+ an hour job building automobiles with a secure pension and no need for a college degree. The American auto makers now have a new-tier for incoming workers for example were workers make $12 an hour and have stripped down benefits. This is just one of the many cases of where a younger buyer 40 or 50 years ago was able to buy a home and that option is much more challenging today.

-3. Movement to large metro areas. Many of the higher paying jobs now exist in highly populated areas. With the job market being volatile, you may have many younger couples opting to lease places as they move to other locations for career opportunities (i.e., Form Los Angeles to New York, etc).

-4. Delaying marriage and starting a family. This trend has been going on for a few decades now but the push to buy a home usually is done for emotional reasons. With younger Americans delaying marriage and starting a family, the emotional need to buy is pushed further out.

It is too early to tell if these trends will carry through this decade into 2020 but there is little reason to believe it will change. The baby boomer retirement tsunami is going to happen no matter what. This by default will flood the market with housing inventory. The timing is bad since we have a giant pool of shadow inventory that still needs to clear out.

A glimpse of the U.S. housing market

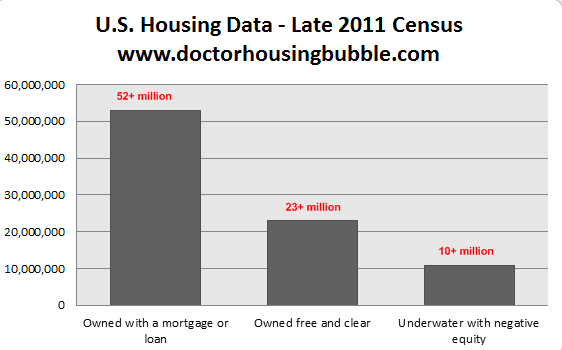

Let us now take a snapshot at the current U.S. housing market:

Source:Â Census

Over 52 million Americans “own†their home but carry a mortgage on the property. Another 23 million own their property free and clear. The majority are older Americans. Also, you have a large number of Americans in a negative equity position. Of the 52 million that own their home over 10 million are in a negative equity position. This trend has inserted a crushing blow to the overall home equity Americans have:

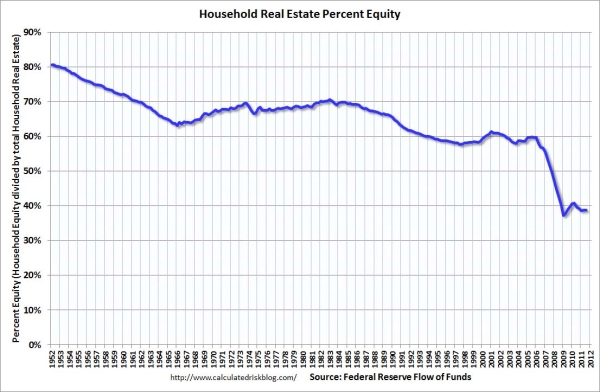

Source:Â Calculated Risk

The above chart was always a case study of why we were in a bubble even during the major price appreciation in real estate. Even during the housing bubble household home equity steadily declined as people leveraged to the max and also tapped money out of their housing ATM. Today this number is dramatically lower than the above chart shows because this also includes those who own their homes free and clear. If we simply looked at those with mortgages, we will find that many Americans have very little equity in their homes (forget about the fact that over 10 million would have to pay money to sell their homes).

This is why since the bubble burst in housing a large aspect for home buying has been with investors. The move up segment of buyers has been stunted because of the above reasons we mentioned for younger Americans. The shadow inventory remains elevated as foreclosure timelines are absolutely incredible:

The average foreclosure timeline for a home in Florida is over 1,000+ days! Nationwide we went from an average time of 253 days in 2007 to the current 674 days in 2011. Contrary to what is pushed in the media the housing market is in an utter mess. Banks have absolutely no idea how to deal with this mess so the path they have taken is that of least resistance and largest bailouts.

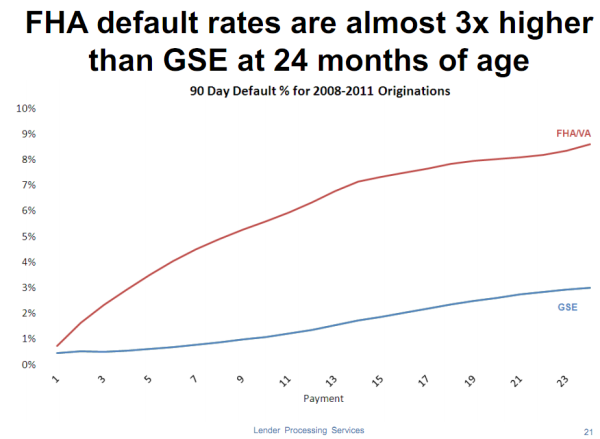

Another push for young buyers has been with low down payment FHA mortgages. As expected and as we have stated before, having a little down payment makes home buying like a call option. If a home goes up in value, then you win. If it goes down, as it has for many years now, then you simply walk away from the small premium. So let us now take a look at default rates for FHA loans:

Source:Â LPS

Not surprising but younger Americans who want to buy a home and do not have the savings to do so will usually opt for these loans that require only 3.5 percent down. Any little economic hiccup can throw things into a spiral and the last decade has turned the U.S. economy upside down like no other time except the Great Depression.

The future of the American housing market does depend largely on how well financially younger American families will do. Just because a retiring American selling his or her home would like a peak price for their property they are likely to find a market that is hungry for cheaper properties. The game has changed and those thinking that a miracle in housing is around the corner fail to understand the built in demographics of the system. It is also beneficial on a long-term basis to have affordable housing so a larger portion of discretionary income goes to creating jobs and moving the economy instead of having large portions of our society trading homes with one another and pretending that is economic growth.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “The future of the young American homebuyer. Average foreclosure timeline jumps from 253 days in 2007 to 674 days in 2011. Homeownership rates for younger Americans point to significant issues in household income, demographic changes, and attitude shifts in the desire to buy a home.”

Dr HBB you keep me sane. You always give great reasons why housing will keep declining, but THIS is the one I love to hear because I don’t see how the powers that be get around this one. It seems to be the most inevitable freight train lying ahead, even it takes a few years to pick up steam. As a young person who is not too eager to buy at the moment, I will welcome “the great downsizing” with glee. My generation and especially the schlubs below me are a bunch of lazy, entitled, video game playing idiots. Most will never have good-paying jobs, be it for their lack of drive, skill, or simply the scarcity of high-paying jobs thanks to globalism and corporate baby boomer greed. Those that do have an education will be shackled by their baby boomer banker loans. I can’t see many of my generation and below being able to take homes off the hands of boomers for more than “dirt-cheap” prices once the shedding event begins. Without some flood of hard-working foreign entrepreneur types, the boomers will HAVE TO unload on the very same losers they pretty much raised and often employ/exploit, at least if they want to sell in say, 2018 onwards. Bitter against a particular generation? no, not me 🙂 Let’s just say we can all see now they weren’t the “greatest”.

George wrote, “Bitter against a particular generation? no, not me” but earlier you wrote, “My generation and especially the schlubs below me are a bunch of lazy, entitled, video game playing idiots.”

Your a hyprocrite AND A liar. You should run for public office, as only those who are (in their own minds) so enlightened and hard working, know how to lead the sheeple.

Whoa sorry if I hit a nerve but I don’t see how the two items are contradictory or even mutually exclusive. The Boomers ARE the greediest most corrupt and irresponsible generation the earth has ever seen. Every group of humans has a level of corruption of course, but look at the WORST crisis the WW2 generation was able to muster: the S+L scandal. The boomers were able to out-do the oldsters by a factor of 70! without the boomer bubble this blog would not even need to exist. Yeah that’s an over simplification but I think it holds up well. Jamie Dimon Ben Bernanke and Co. seem like boomers to me. And that to me doesn’t mean that the younger generations of today can’t be as crappy I described. And yes I do consider myself well above average for my peers as I can see what has really gone on in the last century and although we may all still be victims of what transpired, they won’t know what hit them and at least I will.

Eventually a larger number of the currently stupid young people will drop their video game controllers and see how royally the previous generations gave it them: sucking future wealth and prosperity into their present, racking up unimaginable public debt, and topping it off by shackling the following generations with crushing student loan and mortgage debt. The hardest thing that post-2020 presidents will have to do is try to put out the fires of the generation war that is certainly coming.

George, I’m of the boomer generation, and I applaud your critical thinking. It’s a

simple fact that if there are fewer eligible buyers, then sellers will have to lower their

prices if they want to sell.

Please don’t lump all of the boomers into the spend everything, save nothing

category. I’m a blue-collar, college educated,( just a 2yr tech degree from a local

community college ), and I’ve lived below my means my entire life. My parents went through the Depression, and it was pounded into all of their kids that to get ahead you have to be willing to delay gratification. My parents had a strong work ethic, and

I like to think it was passed on to all of us.

I hate the way the Government has squandered our national treasure with unfunded wars and banker bailouts and crony capitalism, but my vote never seemed to make a difference.Both political parties are corrupt.

Your generations time for being in power is coming up, so we should all expect to

see great changes in the system ? If not, (and I have my doubts ), then you might

want to soften your blanket indictment of an entire generation.

You sound very immature with your sweeping generalizations. Also, the “Greatest Generation” refers to those who fought in WWII, my parent’s generation. Grow up.

Yes, I know that was the pun. I was comparing the boomer generation to the WW2 Generation, the last decent one there was. but reading it over I should have stated it differently. I DO indict the whole generation because they took their eyes off the ball collectively and allowed corruption to entrench itself while they worried about their corvettes and mcmansions. it will probably take 50 years to clean up the mess if ever. It might take several President (Rand) Pauls and like minded individuals to do it.

Georgie boy……

It has nothing to do with the boomers, it has to do with the greed of those in power.

I am at the tail end of the boomers, some statisticians call me an Xer but I am old enough to know it is not about any particular generation, it is about those who hold the power and money making sure they continue to hold the power and grow their money and the remaining 99% of the population be damned, be it Xer, Boomer or Buster.

If you think it is a war of generations you are just another fool. It is the age old battle between haves and have nots.

Make up your own nick, you lazy, unimaginative, thieving slime wad.

Rand Paul? Now I know you are not only immature but nuts as well.

Well who other than Ron Paul would take a serious stab at the wall street crooks and GS? Obama? haaahahaa any other garden variety Republicrat? hahahaha Yes he’s a nut but he’s the only guy we have that sees the problem. Since his chance has come and gone, I do believe Rand will need to become a viable future candidate if we ever intend to fix the corruption. BTW name calling is about as immature as it gets, so I would suggest not throwing any more stones in your RGlassHG.

Oh and for those of you worried about another loony, inflammatory commenter with not much to offer the reader showing up, I have no intention of commenting on future articles. I tend to ruin comment sections anyway lol. I’ve been reading everyone’s comments for 4 years now and this article struck a chord where I felt the need to vent against an entire generation…and in a way warn them of what is to come after the occupy wallstreet youths realize that their first teqnique was futile.

Use your own nick, not someone elses. You are PATHETIC!!!!!!!!!!

Great post as usual, Dr. Still seeing 30%+ REO/Short sale inventory on the market in Orange County. It is going to take another 2-3 years for banks to unwind all of the houses at this rate. When you add on the baby boomers looking to exit the housing marking over the next 5-10 years, the housing picture doesn’t look bright in the short-term.

What also troubles me is that homeowners are still delusional about prices. I am seeing lots of sellers asking 2-3X mid/late 1990’s pricing and I think, “how much have incomes risen during the last 15 years”? Certainly not more than 25%, let alone 200%. For now I am waiting on the sidelines and will look for rental opportunities.

This is only true for the coastal areas. In some parts of California you can buy a house for the price of a tricked-out Escalade. You might not want to live there, but there are many houses that are cheaper now than they were 20 years ago. It’s only a matter of time before the desirable areas follow the huge price drops.

You read my mind Grantlabt. I can’t believe the asking prices of many of the homes in the areas that I’m looking to buy. I also have noticed a trend of scratching out the address numbers on the curb as if the owners don’t want us to look up the history on zillow or redfin. I have found that many of these egregiously priced homes were purchased between 2003 and 2009. My favorites are the ones whose asking prices are actually higher than what was paid for them during the bubble days.

What really frustrates me is when I actually do find a nice place that is reasonably priced only to have it sold before I can even get a look at it. So why does it frustrate me? Because six weeks later its back on the market for 150k higher than it was bought for. I can’t wait for these flippers lose a fortune. There are many examples of these ‘Real Home Flippers of Genius’ in this area. I really hope they get burned badly.

It’s tough to make a good projection just using simple logic and back of the envelope math, but the Millenials are somewhere around 80 million strong. This makes them a larger cohort than the Baby Boomers currently are. By 2020 they will be the most influential demographic in the US, and the Boomers should thank heaven that their late-children are much more politically liberal and technologically savvy than they are. It’s really the only chance they have at retirement-above-poverty.

The competing trends, as many have pointed out, is that they are starting out with lower real incomes and higher indebtedness than the Baby Boomers and Gen Xers did. Based on my back-of-envelope projection, the income issue will wash out by 2022. The indebtedness issue is going to be problematic. There are solutions to it, but those solutions will require political cooperation. Boomer political attitudes will have to change to make that possible, and fortunately that tends to happen to people around age 70.

I would love to see your “back-of-envelope†math that projects the “income issues†to wash in 2022. What are your assumptions? I think we all agree that real income is not growing. Are you assuming that inflation brings the prior two generations fixed income down to the level of Millennials?

I’d love to see that calculation too. Another point is that Millennials are not as tech savvy as people think. I have had to reinstall windows(!!!) for both my 20 year old sister and 16 year old brother both of whom have great educations and good grades. (I’m 31) They can’t even grasp the concept of data backup after having lost valuable data over and over again. Sure they know how to play modern warfare 3 and they love to post on facebook via iphone…. but the real engineering brains are in India and elsewhere. We will simply be a technology CONSUMPTION country if we are not already.

Another factor is the reduced inheritance pool that will be handed down from Boomers to their kids. My parents (depression kids) paid off their homes free and clear, of course, and then watched it’s value inflate dramatically as all the Boomer kids hit the market. Since that was a major component of their net worth, that money was handed down to the Boomer kids to spend or invest or even buy more real estate. You won’t see that happening again over the next twenty to thirty years.

No way the true ownership rate among 25 to 34 year olds is 42%. If you take out those who bought during the bubble (and who are probably squatters now) it has got to be somewhere between 20-25%. I’m a 33 year old lawyer and among 20 of my closest friends and colleagues in that age range there are maybe 3 or 4 of us who own homes. Me and my wife have no kids and bring home much more than the median income. Plus the only reason we bought was because of the call option that the doc discusses(Bought in the IE and work in LA). There is no way this gets better for anyone my age. I still find in mind boggling that we could not reasonably affordable to live within 30 miles of LA.

Will, of the 24-34 year olds I know from work do own homes. How you ask? Mommy and daddy came up with the down payment for them to buy otherwise they couldn’t buy. And their combined income including the significant other is no where near yours. And yes, they are probably under water now at least some of them.

Will, you are comparing living in the LA suburbs to everywhere else in the country. That graph is of the US. I have many friends in the 24-34 range that own homes and even bought in the last 8 years. This in South Jersey, Philly suburbs, for around 200-300K. Thats not an unreasonable price and especially for a suburb about 20 miles from the 5th largest US city.

The reality is that Cali and Southern Cali is in denial and in a ridiculous over inflated bubble that will take some time to come down, if ever. I just moved out here in March of 2011 and I can’t fathom how so many people can own such expensive properties from SD to SF all the way up the coast and not just waterfront, but miles inland. It makes absolutely no sense that this many people make this much money.

The stats say that 75% of Boomers have not got anywhere near enough money for retirement. And I doubt they can earn very much income in their post 60 year old status. So, if they own a home, free and clear, they will probably figure on staying in it until they die. For the one’s that don’t own a home….well, let’s just say we’re going to a have a huge number of people retiring underneath a bridge somewhere.

CAE said, “….well, let’s just say we’re going to a have a huge number of people retiring underneath a bridge somewhere.”

I got into a friendly argument with someone on a stock board shortly after the dot-com bubble burst. I suggested that, sooner or later, a significant number of illegal residents from Latin America would eventually go back, rather than retire under bridges here. I was told that would NEVER happen.

Well, we’re only four years into this 20 year Bush-Obama depression, and already we are down to no net illegal immigration. As it grinds on, and illegals struggle with high unemployment and no retirement safety net, we’re going to see a huge out migration, I’m betting. So for all intents and purposes, we’ll have a shrinking population, just like Japan has now. How’s that deal working out?

For illegals here, most work for cash, and pay little or no tax, income or FICA, and those with kids under 18 often qualify for medicaid. so, for now, the cash flow isn’t too bad. But the flip side of that is there will be no medicaid once the kids are over 18, and no retirement benefits, since nothing was paid into the system, or paid in under a phony ss number. Those people will be leaving in droves, I’m guessing.

This will have a self reinforcing, downward push on the economy for decades. As population drops, or at best is flat, the economy won’t grow, and the average age will increase, and productivity will plummet. I’m really puzzled by the political paralysis gripping the nation. You would think this far into this ‘below the bridge dwelling’ disaster in the making that there would some sort of national consensus to restructure the whole shebang.

Interesting take. I think you may have something there.

there have been discussions among politicians about including illegals in social security. it may be pandering to hispanics for votes, but there is probably a better than even chance it will happen. politicians have no problem spending our tax money to get themselves re-elected. if/when it happens, i don’t doubt the illegals will go back home. they r here for economic reasons. when our government starts sending them social security checks they won’t have a reason to stay.

This is a very real and terrifying reality. I think the same thing where will all these people end up? Even those that own their homes outright will need to pay insurance/taxes and repair/maintain forever. There is no “free” and clear!

Your final paragraph statement is dead on, but so few people seem to realize this. Cheaper housing is actually a GOOD thing. I still completely faili to understand why rents are so incredibly high though. Currently it is signifigantly cheaper to own than rent in the IE almost anywhere. In many cases you could be paying half the price on a monthly basis to own rather than rent. I guess so few people can qualify that it has come to this.

When I was in my 20s it was always cheaper to buy. Being able to save money, having good credit to buy and the reward was owning a house with a lower cost than renting.

With the cost of maintenance, it has to be cheaper other wise owning is essentially economic punishment, unless of course, you get house prices to rise faster than incomes somehow!

Thank you for calling it the way it really is DHB. When the real estate bubble was building up, I was wondering how my kids will ever afford to buy a home in the neighborhood they are growing up in (OC beach city). Heck, I couldn’t afford to buy the exact same home I was living in at the market price then. Good thing we bought it a couple decades ago.

But now that the bubble’s popped and the RE prices are becoming more realistic, I have a new concern. I’ve been saving for my kids college since they were born. When their college savings accounts were opened up over a decade ago, I was reasonably comfortable that 4 yrs of education at a UC school will be covered with the savings & investing. Well, my investments haven’t exactly matched the pace of the UC tuition going up. At this rate, I’d be lucky to cover maybe 2 years of tuition.

We have 6 figure salary, putting money in 401k, saving for kids college, saved rainy day money, have a rental, don’t plan on retiring until at least 65 but I just don’t see the light at the end of the tunnel and feel so trapped… Chances are my kids will have to get student loans even for a 4 year degree unless they get scholarships. If they want to get an advanced degree in addition, their student loan will be their mortgage. Hopefully they will pick a field that will be financially rewarding as well as personally satisfying.

So what’s the answer to financial security? I won’t even ask for financial freedom. About 5-6 years ago, a person in investment business told me I should consider moving to another country because American economy will crumble down. I was laughing inside. Now I wish I was paying more attention to what he was saying… I guess the good news is that it will be easier for my kids to buy a house. Not sure if I should laugh or cry…

If your kids are planning on a liberal arts education, they’d be better off if you bought them franchise businesses and stay out of the white-collar ghetto route. Looking down on the merchant-class has done America no favors. All the well-heeled neighbors in my posh area are immigrant merchants. Sadly and ironically, they are all sending their children to college to be respectable white collar citizens.

How can you know they will even be interested in home ownership? I wouldn’t worry about something so far off in the future…

If you’re too dim-witted to come up with your own nick, I would be happy to sell you one for a very affordable fee…….LOSER!!!!!!!

Wow.. Thank you for this valuable information Dr. HB. You spell out the facts so well. It seems like 2005 was the real turning point in a secular bull market for housing. So many reasons for this, as has been discussed before. If people just take the time to educate themselves on what is really happening, they can avoid making emotionally bad decisions that can shackle them to a house that drains the money and life out of them.

On The Westside, everything turned a couple years later in mid 2007. Since then, we have been on a downward trajectory of about 6%\year on average. That tells me, given the average declines, we have 3 – 5 years minimum, until we approach a bottom. If someone buys a house today, they will be out 10% (6% sales commission, 3% closing costs and 1% in taxes) once their deed is recorded. This doesn’t even include insurance, maintenance and opportunity cost. Not to mention any future declines. Kind of like driving a new car off the lot and losing value, except at least you have a new car and not a 60 – 70 year old house.

I’m afraid the best years in housing are over for a long, long time.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

All good points. In a nutshell, buying a house always made sense as long as there was constant appreciation. Take the appreciation away and the equation definitely changes, add in price declines and it can get pretty scary quickly. Most Americans are awful at math, most haven’t caught on that even a 10% decline in home values could be financially devastating if you need to sell in the short term for any reason. You will need to come up with close to 20% of the value just to sell the house and break even. I really doubt this has crossed the minds of most of the 3.5% downpayment crowd. As always, buyer beware! 🙂

Let’s see… Rent a house for $2000 a month for 30 years… Spend $720K without a SINGLE rent increase. And after 30 years… continue renting.

Buy a house now for $2300 a month PITI… Spend $828K after 30 years… live in your home for retirement.

Let me remind everyone that the stock market has returned ZERO profit over more than a decade. So pretending that extra money saved renting will grow is a crap shoot. Chances are a bunch of companies you are invested in will go belly up.

If housing falls and bankrupts a generation.. who will buy the goods that will prop up the stock market?

@CaliOwner – Your numbers make sense with the assumption that you actually buy and hold your house for the next 30 years. I don’t know how reasonable it is to assume that you will be in the same house for 30 years. The days of pensions and gold watches after 40 years with the firm are basically over. Throw a couple household moves in there, RE fees, title, taxes, and I think the math is different.

I think we’re in the middle of an lifestyle transition in the US, where we transition from a suburbia-based 30 year to a transient urban 3-5 year lifestyle – one where if you lose a job you can find another in town without relocating. If you live out in South OC and your Irvine job dries up, it’s a loooong commute to LA.

Huh, that’s a pretty ludicrous you gave. Most Californians do not buy a house and stay in it until being wheeled out on the gurney. I remember reading a stat saying the average time Californians stayed in their house before selling and buying another one was 7 years. This system always worked because there was non stop appreciation for decades…that is until now. I never said it was a bad idea to buy, I’m sure everybody on this blog eventually wants to own (myself included)…but I caution people to do so when the time is right and your financial situation allows it. My message is very simple, people using small downpayments who are buying now might be in for a world of hurt if for any reason they NEED to sell their house in the not so distant future.

@caliowner – what is the return on housing? if you crunch the numbers, i bet that 0% stock market return starts looking pretty sexy.

Don’t forget about Prop 13 folks. The same legislation that these geezers benefited from is now biting them in the ass. You really think 20/30 somethings can afford to pay 1.5% on a $600k home? Give me a break. That’s another $10k a year that they don’t have. And educated 20/30 somethings WILL factor this cost into the equation. $10k is nearly half of my annual rent in a home that is currently valued at $560k according to Zillow/Redfin. Ridiculous.

Many people also forget that the geezers all bought new or relatively new houses requiring little maintenance or renovations. Many of these places are now 40 or 50 years old and need LOTS of work and money to get them up to snuff. Let’s see…new electrical, new plumbling, new HVAC system, new windows, new doors, updated kitchen and bathrooms….this all costs lots of money. One more reason to be very selective if you decide to purchase a home!

And let’s not forget that some of these homes were sold to anyone who could fog a mirror during the bubble, who have now been squatting for two years and are in the process of further thrashing the place, or they are sitting empty REO growing mold. Pitiful!

I’ve simply not seen the referenced trend here in San Luis Obispo, CA. Homes are being snapped up very fast at any price and rental rates have gone up at least 30 percent in the last year alone. Plus, there are not many listings for homes and condos., and rentals are snapped up withing a day or two. Very different here.

San Luis Obispo Homes For Sale & Real Estate

323 results. 20 unmapped.

For Sale(290)

For Rent(13)

How is that Egyptian river Dan

I also live in SLO county. Homes in the city of San Luis have dropped, but very slowly and sales do seem quite brisk for “perceived” good pricing. We sold in So County in 2008 and the property we sold would probably fetch 25% less now. (represents about 38% off top prices). Seems like we should have another 15-20% to go down. May take into 2013 to get closer to a bottom. John Talbott’s book “Sell Now”, written in 2006 has been spot on. He thinks down 58% from peak in SLO. SLO is popular so may not quite make it that far, but it definitely could.

Hi, not sure (maybe I’m dense) why the citation of figures in relation to my post, but just our place alone is up over 25K in the last three months based on sales and like units. I think the demand from retirees is a big factor as I’ve been told on several occasions that the “move up” market is completely dead in this area. So it’s outside money mostly and given the wealth accumulated during the “baby boomer” era, I think it’s safe to say that there’s plenty of money out there to keep our local market high relative to other more income dependent areas.

Hi Doc,

I am a bit confused at to what you are stating when you talk about Baby Boomers, white picket fences and home buying right after the conclusion of WWII in 1945. Those aren’t Baby Boomers buying those homes…the first baby Boomer didn’t even turn 18 Y.O. until 1964.

And 1964 they weren’t buying homes: they were either in school or being drafted for Vietnam. So, let’s be generous, and state they started buying homes in significant amounts when they turned 21, in 1967 (which I doubt, more like early 70’s). There were no “$25/hr auto worker jobs” back then Doc, trust me on that. You state that “40-50 years ago” there were these jobs: no, there were not.

Maybe by the mid to late 90s, go check and see. In point of fact, the middle Baby Boomers, now 56, graduated from high school (1973 & 1974) into one of the worst job markets in US modern history (until the present), and struggled to find good paying manufacturing jobs, or any jobs for that matter. So many went on to college, and granted, they did not face the tuition nightmare today’s young folk face…but we didn’t have anything to do with that.

As far as retirement: we are the ones that built up the HUGE SURPLUS Social Security NOW ENJOYS, sound until at least 2042. So, to read these crybaby comments about how our children will need to support us is laughable: WE SUPPORTED the so-called “Greatest generation”: their grandparents. By paying quadrupled FICA rates thanks to Reagan.

I agree with your assessment that the baby Boomers will have a hard time selling their homes in the face of the current conditions…so place the blame properly: “Globalization”…so-called “Free Trade” that does not protect US domestic industries while the countries exporting top us block access to American goods.

EDUCATE your readers into understanding a basic concept: TARIFFS ARE A GOOD THING…which is why the Founding Fathers placed them into existence, but not “income taxes” on LABOR. You see, LOWER CORPORATE TAXES and LOWER TAXES ON ULTRA WEALTHY means LESS PUBLIC GOOD.

What was the tax rate on someone earning $100 million under Ike? 92%. That’s correct, 92%. However…that person could avoid paying that…by investing in America: If he took that earnings and reinvested it in R&D, or new machinery, or factories (all job-creating endeavors), he was not taxed on it…while expanding his wealth base.

Education, not mindless drivel blaming other generations, may go a long ways to solving America’s fiscal nightmare.

And this statement: “Most will never have good-paying jobs, be it for their lack of drive, skill, or simply the scarcity of high-paying jobs thanks to globalism and corporate baby boomer greed.” shows education of how we got here is desperately needed.

Baby Boomers aren’t corporations, most of us worked average paying jobs, our spouses did too, some of us even (horrors!) never played computer games instead we worked TWO FULLTIME JOBS. Many of us worked FULLTIME JOBS while attending high school.

Many of us owned small businesses, and not only paid our FICA…we paid the retirement FICA of 10 or more workers, enough so they qualified for S.S. when they reach that age…and they ain’t baby Boomers.

So please, someone change the crybabies diapers, I’m sick of hearing them howl…I’ve already changed all the diapers I ever plan to change.

And learn the correct definition of a TRUST FUND and quit yer bitchin’.

You had me sold until you said “tariffs are a good thing” Who decisdes how much? and who decides how to spend the tax revenue? Trade is between individual people, not countries. I’ll take the risk of a blowout on my rig with chinese tires. If I want better ones, maybe Ill buy Michelin(french) or american, goodyears (some of which are made in Chile). Stop hatin on the poor man, I want liberty, a free market, and choices. Your approach leads to only one choice and ultimately a monoply.

The “Great Society” of the 1960’s came at a great cost. Add in Vietnam and we were spending way more than we actually had. That’s why the French started taking all their payments in gold and then Nixon closed the gold window. The inflation of the 1970’s showed how well that works out. The 1960’s really were the good days. Stuff was cheap and the population was relatively small. That’s all changed now. As usual, being the first Boomers, like being first to any party, the oldest one’s really got the best of all the was offered up.

The very issues discussed with confirming and exacting numbers on this blog I happened upon, just posted. The Dr.’s inductive reasoned belief that this whole debt/jobs fiascoville is not good for the young…yeah, it’s worse than that. http://viableopposition.blogspot.com/ for Thursday, Jan. 5. Boy, that really cheers you up, doesn’t it?

@farang – Please. Baby Boomers have the dubious honor of leaving the country in worse shape than when you inherited it. And in unprecedented fashion no less The siphoning off of the country’s wealth from its citizens, the exportation of our manufacturing base, etc. were all orchestrated on your watch. Own it. Please don’t be so quick to take offense at these realities when they’re pointed out. The generational war is inevitable and pepper spray isn’t a legitimate defense. I’m GenX. Some of my best friends are Baby Boomers. Let’s make this right.

@ George – The Millennials are much more computer literate than you suggest. Also, there are plenty of excellent programmers here. Needing to outsource and provide work visas is fabricated best I can tell. We’re chock full of human resources. We just need the right leadership.

Let’s lay at least part of the blame with Goldman-Sachs and the rest of the Wall St. crooks, please.

@StaticKlingon – sure. The executives at GS in particular, WS in general, who have been running the show are/were from which generation?

Ignore this loser. He lacks the intelligence and integrity to use his own nick. Nothing but a common thief and a loser.

Apparently at least 50% of the unemployed with mortgages don’t have to pay their mortgage for year due to Freddie Mae, Fannie Mac, FHA programs. This is distinct from the issue of banks that don’t want to foreclose, this is an actual government program allowing unemployed people not to pay their mortgagtes for a year (of course unemployed renters get no such breaks):

http://www.latimes.com/business/la-fi-0107-freddie-loans-20120107,0,3769966.story

Now if you think the economy and housing prices will recover, you can just regard this as a little government help to tide people over in bad times, kinda like the Great Depression. But if you don’t believe the economy and housing prices will recover, it is an attempt to kick the can down the road, make the economy seem more prosperous than it is (until after the elections?), make the banks look ok for another year, and yet another form of the shadow inventory.

It seems that there is a lot of blame being projected concerning how we got here. Please take the time to listen to the following Bloomberg interview … it makes sense to me that demographics have played a much larger role in creating the housing bubble and by nature will dictate the future of the eral estate amrket for coming decades.

http://www.bloomberg.com/video/83555894/

Leave a Reply