Gen Renter: The continuing expansion of renters in the United States. A permanent generational shift.

Never mistake luck with timing. That is one lesson gamblers and so-called investors forget time and time again. Even in baseball batting .300 is considered fantastic. The rhetoric being uttered by some people is similar to what was being said only a few years ago. Of course, the voices of the 5,000,000+ that went through foreclosure is largely drowned out similar to those that went all in with tech stocks right before the bust (where are the Pets.com investing geniuses?). Not to quote an Alanis Morissette song but isn’t it ironic? Suddenly folks that bought in 2011 or 2012 act as if they deserve a Ph.D. in economics. Don’t mistake luck with investing acumen. These people are caught up in the low rate, low inventory, and investor driven uptrend. California is an excellent example of this. Home prices are rising at astounding speeds pricing many out of the market. It is no surprise that the number of renters in the state is surging as well (this is also a nationwide trend). Investors dominate the market. A cap rate of 4 percent may be reasonable when the Fed is artificially creating a negative interest rate environment. This generational divide is going to continue and as usual, the US is going to undergo some dramatic changes including a growing renting class.

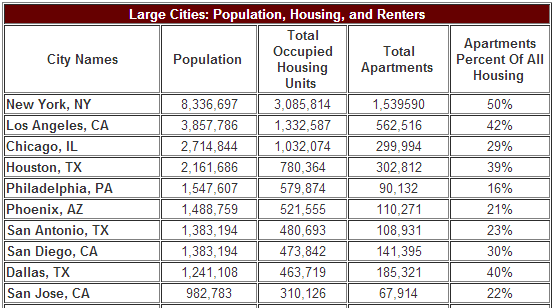

Timeline of generations

First, it might be useful to breakdown the generational timelines:

Source:Â The Echo Boom

The baby boomer generation had many fortunate factors that allowed them to use the “monkey throwing darts at a dart board†approach to investing:

-1. A devastated economy after World War II where the US was left in a prime competitive advantage

-2. Cheap plentiful housing

-3. A ridiculously strong dollar

-4. Strong government fundamentals (revenues versus spending)

-5. Favorable mortgage rates

-6. The start of a raging bull market

So of course this was a time when a blue collar worker, even one per household, was enough to purchase a home and have what you would call a middle class life. Job security, a near extinct term today, was common place. Owning a home with a blue collar job is no longer possible in expensive states. Even in more modestly priced metro areas, you will need to be a professional with competitive skills. America has a great product and prime housing locations are now open to the emerging wealthy around the world. Cash is always king. Just go to an open house in a prime location and see this in action. Yet because of markets now depending on outside factors, it can also be a double-edged sword (i.e., targeted location of Japanese money during their mega-run).

The timeline above is causing some interesting generational divides. If I had a nickel for every baby boomer that said “I worked flipping burgers when I was a teenager and had time to surf and bought my first house with a good down payment. Pay your dues!â€Â Of course they went to state college when it was practically free and ironically, would not have the skills and competitive edge to buy the home they currently live in if they needed to purchase today.

So this mindset is handed over to their kids, Gen-X that largely wants the same lifestyle but can’t do it in the same format. So they go into massive debt (i.e., student debt, massive mortgages, leased cars, etc). Not really wealthy but chasing a time that largely has passed. The world is fiercely competitive now. Gen-Y is probably the big change factor here and many enjoy mobility, have big college debt, and probably want smaller homes. Even if they want the baby boomer dream of the Endless Summer the global economy is not what it was after World War II. Guess what? We did a good job marketing that Endless Summer and now people around the world want it too (and the means to achieve it). Anyone that travels around the world understands that the emerging middle and upper classes want the same stuff as you do (i.e., nice homes, cars, good schools for kids, etc).

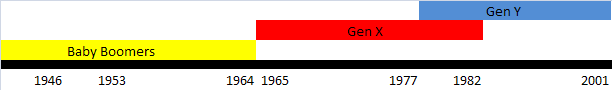

Homeownership by age

There is little doubt that younger generations simply are going to be less affluent. Because of this and the massive number of investors buying properties, many are either choosing to rent or are being bid out:

This is a big decline since the housing market went bust. Even with low mortgage rates, it is still a competitive market in many metro areas. Large pools of money are chasing better yields where they can find it. Why are investors crowding out regular buyers? Arbitrage. Plain and simple. Of course some are mistaking luck with picking the right time. Where are those 5,000,000+ foreclosed homeowners that picked the right time as well? Did any of these buyers go in with the intention of being foreclosed? Of course not! Yet licking wounds doesn’t make for the bravado of timing a purchase like getting in when Apple was cheap (what about those that got in when Enron or WorldCom was cheap?).

The declining trend nationwide

As we mentioned, this trend is nationwide although more pronounced in targeted metro areas:

People are social animals. They want to be around others that think, speak, and sound like each other. This is why in terms of mobility, people are largely inertial beings. This doesn’t make necessarily for a good life because variety and challenge is the spice of better things but it would be ignorant to not state the obvious. While the market busted, even those that lost their homes via foreclosure simply opted to rent instead of packing the SUV and heading east. Some did, but most didn’t.

So why is it unlikely that younger generations will pursue baby boomer pathways? For one, they don’t have the fortune of being at the right place at the right time. You actually need to be a pretty good dart thrower even to outpace inflation. Plus, this fortune came at the hands of a massive World War. History isn’t written by the peasants, serfs, poor, and those without a voice (or those that make massively bad bets in booms and busts).

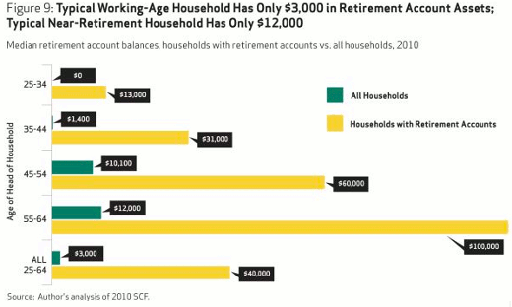

The retirement figures show us a telling story:

The median retirement account for those 25 to 34 is $0! In other words, most in this age range have no money saved in retirement accounts and these are the people that will have a chopped down version of Social Security. Even those 35 to 44 have a median retirement account of $1,400. It isn’t too hot for those at the top range either but you can catch the drift here.

In California as I had mentioned, you have a flood of golden handcuff real estate owners. Rich in real estate but lacking in many other income areas. This is the person in the million dollar Pasadena home carefully watching their grocery bill and complaining about their phone bill from Verizon while they “need†the new iteration of the iPhone 5. What is also funny is those counting their “equity†and acting as if they actually have it. Okay, you have $200,000 more. You have to sell to access it! And rarely is it the case that this group would sell a Pasadena home to move to Pacoima or Palmdale to leverage that wealth. They want Beverly Hills or Manhattan next. Property ladder mentality for life. Pyramids get smaller at the top (even the pharaohs knew this and they didn’t have access to the inter-webs). Gen-X seems to want this life as well but is going into ridiculous debt to keep the charade going. Gen-Y has different aspirations and even if they did want this, the market has priced them completely out.

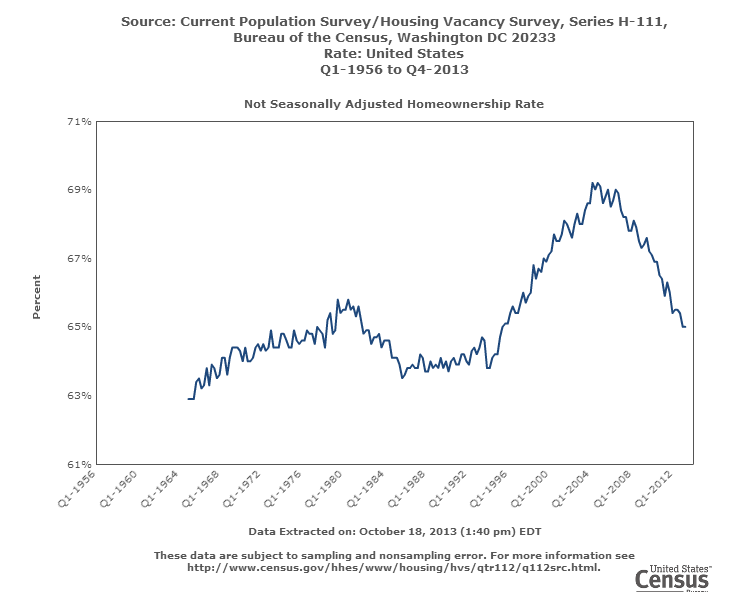

Rental housing

So it should be no surprise that most expensive markets are largely packed with renters (this is only a trend that will accelerate as income disparities dramatically go up):

Source:Â NMHC

It really isn’t shocking that 50 percent of New York is made up by apartments but look at Los Angeles (the city). 42 percent of housing is made up by apartments. This is very high and keep in mind this doesn’t factor in single family units that are used as rentals (the preference of the big money investors). Some may know this already but Los Angeles is a renting majority market.

In fact in Los Angeles County (beyond the city and covering roughly 10,000,000 people) 54 percent of households rent based on the 2012 ACS Census report. That is a solid majority. This is also another reason why items like Prop 13 are unlikely to stand the test of time. You already see roundabouts of getting money from Mello-Roos or HOAs. Irvine is a perfect example of this. Yet markets are fickle. This is clearly an unsustainable pace of price appreciation and already, sales are slowing down a bit in SoCal and inventory is up. Even last month the median price dipped a bit in SoCal and has remained at a tight range for a few months as well. Even with moves like this we will have a growing renting generation.

Housing starts still remain low overall:

Builders have a good sense as to this because of higher costs, land locked markets, and the big risk that when you build, you are basically making a bet for the future (that is, when you build and sell you will be compensated for your opportunity cost). The chart above shows that those that make a living on building and selling aren’t so positive on the future of housing. And permits are higher now for multi-unit family buildings riding the rental trend.

Nothing wrong with renting. Heck, 54 percent of Los Angeles County does this! You can also do this and live life (shocking, I know). Gen Rent is going to be around for a long-time and as usual, real estate is certain to bring us some interesting times ahead. From boom to bust to boom. And if you think sellers have some sort of allegiance to people based on age/race/nationality/etc just go to an open house in a prime location. The allegiance is to cash. The government shutdown was only resolved when the mega debt bill came due. We’ll be back at it in short order but Gen Rent is here to stay.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

87 Responses to “Gen Renter: The continuing expansion of renters in the United States. A permanent generational shift.”

I’m too lazy to buy a condo or two, and maybe a house, and use that as an income stream in retirement. I should, though, because that looks like a solid little investment for the rest of my life. Much better than even T-Bills.

Hi Doc. I am 53 y.o. so fall into the baby boomer category. Just want to share a story with you about my ‘roots’ here in LA. When WW2 ended my father got a job as a truck driver for Firestone when they had a huge factory in SouthCentral LA. He eventually (mid 1950’s) got into the Glassworkers Union and took advantage of his GI status and purchased a home in Westchester (built in post WW2) for $9K and a GI bill low mortgage. He owned a home, had a stay-at-home wife, 3 children, 2 old cars and private school for all 3 kids on a single blue collar job. Of course the unions were stronger back then. Most of my childhood friends had fathers who had blue collar jobs in the aerospace industry (Garret, Hughes, TRW, Airesearch, Mcdonnel Douglas, etc).

and most of my friends mothers were also stay-at-home mothers. Fascinating. I worry about my young nephews and what kind of a life they will be able to live in this ekonomy. I no longer call what the government does as ‘extend and pretend’ I think it is a whole new world that us baby boomers cant comprehend but it will go on.

@QE abyss – It’s good you brought this up because I think often people are missing some key ingredients that are different today from “back then”.

I’m 54 and my dad was an engineer for a big corporation. One salary household, 4 kids, stay at home mom, one car for about 18 years, 1 TV, 1 telephone, modest but big enough house with no fancy upgrades. Dad put all 4 of us through college on that salary and had a net worth of about 1.5 million when he died 20 years ago at age 69.

Now, I think it behooves people to re-read that paragraph above. What has changed more than wages are expectations and a willingness to hold lots of debt. Stunning as it sounds….my dad paid cash for every car he ever owned (obviously modest cars) and he never held a mortgage. It is quite easy to calculate what you’ll save over a lifetime on those items if you don’t pay interest on them. Hint: it’s BIG.

But, in this era of the last 20 years or so, LOTS of ego and pride is attached…not to your fundamental character…but to what crap your credit card will buy and you can flash around….looking for acceptance from others.

Ok, you get the idea. But, I’ll fortify that by offering that I spent my 20’s in the investment business and witnessed numerous people like my parents. Ex: the couple that owned 2 dry cleaners, stayed in the same house for 30 years, drove cars for 12 years before trading them in, didn’t blow dough on impulse junk, ETC. Guess what? They had a net worth of 2 million by age 60. There are lots of people like that.

People — it’s not rocket science! Live within or below your means, save money and invest in that which appreciates, not depreciates.

Feeling a little defensive after reading this post, Doc. @QE and Prediction RC – I’m 49, a life-long SoCalifornian. The scenario you both describe is very familiar. My closest high school friends have comprised my inner circle for more than 30 years, and I have seen their parents and mine grow old. In every case, these parents lived within their means, bought (one) modest but comfortable home decades ago, saved for college, and through their retirement years have remained in the same homes they lived in when we kids were in school — my own parents included. We’re talking teachers, small business owners, and blue collar workers, some two-income families after the kids were older and others one-income throughout our childhoods. They didn’t have all the fancy gadgets none of us seem to be able to live without these days, and I think this is one big reason so many people who came along after them have slimmer bank accounts and huge credit card debt. How many years did your parents own their one TV set, versus how often we feel compelled to buy a new computer or what-have-you? The latest and greatest version of something comes out, and people camp out at Best Buy for days to get one. Do none of those people already own said item — but it’s an earlier version? So yes, housing was more affordable relative to income, but older generations were much happier with LESS all around, and they kept it much longer. As for my generation, we did get lucky to a point. Many of us graduated college and found good-paying jobs pretty easily, and after five or ten years in the workforce could afford to buy a home, well before Bubble 1.0. Now, some fifteen to twenty years later, many of us have paid off those mortgages, or are very close. But let me tell you, Doc, it wasn’t just luck. It was hard work, good planning, conservative spending, and yes indeed, living within our means. Apparently, we learned something valuable from our parents that we are now trying to pass on to our own children, though I do fear as you do, QE, that they will have even less opportunity to build what we have than the current crop of 20-30 somethings do. So I feel for the Gen X and Y crowd. But only to a point. I marveled at the young man who posted on here recently that he makes over 100k a year and has 100k in savings — at age 30, but he’s still complaining. Wow. It took my husband over 20 years in his career to make that much! (And yes, ours is a one-income family since the births of our kids.) So yeah, I’m smug, and I have a right to be. These two tail-end Baby Boomers have earned that right, Doc.

Yes, a $400 subsidized iphone on a two year contract and 2 extra $900 TVs in a household instead of one TV and a land line phone really explains why the younger generations are screwed. Its purely a character thing and keeping up with the joneses. It has absolutely nothing to do with the fact of increased competed in for the same number of jobs and lower salaries due to globalization and all the free trade treaties we signed. It has nothing to do with the fact that my dad and his generation got free grants for college that costs barely nothing vs our generations that graduate college with more debt than boomers had on their mortgages with a lower statistical chance that the degree will pay for itself. Nothing to do with hiring medical costs. Nothing to do with a lack of pensions for us, which means we live more n fear of everyday of not having money for retirement. It just have been such a great feeling to literally count down the days until you hit 20-25 years at the same company where you worked 9-5am, 5 days a week, until retirement. We get to pray we can keep navigating a harder and harder global jb market with zero employer loyalty and no pensions. The reality is that the boomers lived successful, happy, financially comfortable lives merely by being born an American and not fckig things up-get Cs in High school, don’t even get a degree and you can still survive. Now you really have to be a ninja with luck to have that same life…and PS, the reason you boomers have that life you think you all earned due to hard work (which has proven to be lower hours than today’s avg worker) and the ‘right’ values is because younger generations are paying for in your misallocation/stealing of resources that belonged to others. So before calling younger generations greedy or materialistic, take a look in the mirror and recognize your generation borrowed/stole (which some would call greedy) from future generations to finance your lives…and still do.

FTB, it’s true that medical costs were much cheaper 50-60 years ago — but that’s because many of today’s medical procedures DID NOT EXIST.

I had cataract surgery this year, at age 51. My meager insurance wouldn’t cover it, and I’m too young for Medicare, so I paid for it all. Expensive. Yes, 50-60 years ago it would have been cheaper, but that’s because interocular lenses hadn’t been invented. They’d simply have given me cheaper, coke bottle eyeglasses.

Nor did MRIs exist, nor all manner of health care procedures.

50-60 years ago, doctors made house calls with their black bag, sent a modest bill, and that qualified as health care for most people. Since then, there’s been an exponential increase in medical technology, and all Americans expect it as their right.

Like real estate, your personal location matters a lot. As noted, if you grew up in California as a baby boomer you had to be stupid to not succeed ( Vietnam draftees excepted) as junior college was tuition free and even UC was cheap. California only passed New York as the most populous state in 1968 so you could still buy new homes in the inner suburbs in the Bay Area on a modest salary. My first credit card was a gas card so it was hard to go into debt when you were young. I think I was almost 30 when Wells Fargo finally said I could have a credit card. OTOH, now retired in Sarasota, Florida I meet a lot of people from the rust belt who had a lot rougher time of it through no fault of their own. People who only gained equity in a home if they paid their mortgage down and even then never recouped what they put into the house because their states were losing population. Who lost jobs or businesses when a steel mill or auto plant shut down in their community. They had to hustle to retire. I got to coast and cash out a Marin County home I could never have afforded on the salary I made back then.

FTB is right. Saying that cable TV and iPhones are why nobody can save these days is a simplistic explanation to a complex problem. Not only has the economy fundamentally changed since then (offshoring didn’t exist in the 1950s, and automation was in its infancy), our entire society has. Of course people didn’t have computers in 1954; they didn’t exist back then. These days, if you have kids and do not own a computer, your child is at a severe disadvantage to children who use computers at home. The cold reality is, in order to compete in the MODERN job market (not the one that existed in 1954), kids today need to be immersed in technology. Now, you don’t need to have a $3,700.00, top-of-the line Power Mac, but you need to have a home computer.

WRT cars, unfortunately today’s cars are not made to last as long as the ones built in the 1950s. Additionally, in the 1950s, it was possible to do most auto repair work yourself, using nothing more than a basic set of tools. These days, cars are computerized; you have to have tens of thousands of dollars worth of machinery just to diagnose what’s wrong with a car, let alone work on it. Not everyone gets rid of a 15-year-old car flippantly. They do it because because it breaks down every couple of weeks, and every time it does, you are not walking out of the repair shop for less than $800.00. Heck, you might as well just get a brand-new car if you could buy a Mercedes for what you’re pouring into your old beater.

Granted, I’m not saying that overspending does not exist; the housing bubble proved that it does. But overspending is not the sole reason, or even the primary reason, why Millennials and even X’ers cannot live the way people did in 1954.

Well, I’m 61, so I’ll chime in.

Life was a LOT cheaper back then. Returning vets went to school on the GI bill, and bought homes in the low 3 interest rate range. Public schools were good and well funded, and college was almost free for the kids. Credit cards didn’t really exist for the masses until the early eighties, and most other petty debt that is all around us today was pretty much non existent. It was good to be on top of the world after the rest of it was in shambles from the war.

As a Boomer, I remember most families had a single income earner and were frugal people. One car, one TV and the kids had to earn the money to buy their own car at 16. There was almost no credit card usage, no HELOCs, etc… and mortgages were 20% down and had strict qualifying standards.

What changed over the years? The availability if easy credit and huge sums of money. From student loans to mortgages, the debt society expanded at a rate no one would have believed. And when a market has demand coupled with easy and large credit available…..it heads way up. And here we are today.

FTB…… stop buying all that junk out of China and places I never heard of and the jobs will stay in the USA.

But, you kids buys so much of that junk, all we are doing is filling our landfills with broken junk that lasted two weeks…..and they buy cheap from us as scrap.

Being tight works. Small cars run for 20 years with a little work and a cheap paint job…. Build a basic house once. You don’t need stone anything. But until you live cheap, you won’t get it. So keep chasing those Chine jobs and products…. and get a second job, I’m about to retire. You need a second job to pay the SSI I paid into, and is now spent……

not to mention the lower taxes that were paid by that generation! Huge difference! If Americans today could actually keep the money they earn we could probably afford our lives.

The Federal Reserve has been buying 85 billion dollars a month in U.S. Treasury bonds (government debt) with their “Quantitative Easing” program in which the government basically prints up money electronically and then purchases the U.S. Treasury bonds. Quantitative easing is helping to destroy the USA dollar.

Ron Paul recently said: “The longer [Quantitative Easing] lasts, the worse the correction will be when eventually people give up on our dollar and give up on our debt.â€

Mlimberg. I think you are confusing cause and effect. Do u really believe that younger generations have consciously said, “lets get inferior crappy products made of plastic and particle board from china instead of metal and wood products from the USA?” …..or is it that after the world wars the price of metals became very expensive so things stopped being made of them? Could it be that real wood/lumber is a commodity priced on a global market so it has also become mor expensive? Is it that younger people are spending more money on housing, college, food, energy, medical, etc that maybe that can’t afford better quality products? Is that American products that use American labor are often more expensive because not only are we paying for your salary today to build a product, but we get to pay for healthcare, pension, medical for life, the costs of OSHA, the cost of employees suing for sexual harrassment, paid sick days, etc, the reality is the combination of raw material pricing, expensive US labor in a now global world, free trade treaties signed by the US govt (who were boomers; not from gen x or y), companies selling inferior products (once again more boomers make products and are CEOs of companies creating the sht products built with planned obscelence) and families having less disposable income have forced our generations to own crappy, plastic products that break every two years. Sorry we all can’t afford to buy a bed frame made of real wood for $1200 or an outdoor table n chairs of wood for $3500. One thing I can tell you though, its not bc we want sht, but when all you can afford is sht, sht it is.

“The three decades . . . from the mid forties to the mid seventies, were the golden age of manual labor.”

* * * Why were times so good for blue collar workers? To some extent they were helped by the state of the world economy. * * *

They were also helped by a scarcity of labor created by the severe immigration restrictions imposed by the Immigration Act of 1924.” Paul Krugman, Conscience of a Liberal, Chapter 3 (pages 48-49)

“Bliss it was in that dawn to be alive, but to be young was very heaven! And so it was for the young adults of the fifties, those fortunate ones born in the low birth rate era of the 1930s.” Wordsworth, the Prelude; Richard Easterlin, Birth and Fortune, Chapter 2

“A small generation, presumably, would do well if it arrived on the labor market when demand was high. The catch here is unrestricted immigration.

Boomers QEA, Prediction, et al., do you know if you’re refuting Doc’s thesis or symbolizing it?

In 1968 a school teacher making $8-10K a year could buy a home for $20K and a new car for $2k. That’s one wage earning able to save $5K as a down payment on home and $2k to pay cash for a car.

Today that is impossible. Millennials must stay home to save on rent and to afford their college loans

I think there’s a fine line here some people are missing. YES, it took a lot of hard work to be successful, but it DID help that timing and luck were on the Boomers’ side. I can admire successful Boomers for their hard work while still acknowledging they had a bit of an advantage. It doesn’t diminish their accomplishments in any way.

My parents set a great example for me as well. My dad is a retired iron worker (union job with a pension) and worked for the same company his whole life. He also farms–has cows, chickens, bees, and a big vegetable garden. My mom was a secretary, but she stayed home with the kids until we were old enough to attend school.

I’m 38 and married. I work hard too. I put myself through college, and I’ve worked ever since I could legally do so. (And before that, I did babysitting and leaf raking and worked on the farm to help out.) I have never NOT worked. I’m married, and my husband has done the same: graduated college and was always employed.

But yes, I have a computer and internet and cell phone (and I need all of those for my job.) And I had to pay for college by waitressing and taking office jobs. I’m not scared of hard work.

But we rent and we can’t afford to start a family. We have savings, but times are undeniably tougher than they were for Boomers.

I’m not complaining. We’ll be fine, and we’ll work hard, and social security may or may not be there for us, so we’ll save for our own retirement as much as we can.

There is no such thing as job security anymore. And definitely no way to live on just one of our incomes. (We make about the same, and sometimes just barely make six figures together, but we live in Queens, NY, which is more expensive than most of the country.) I have worked 5 different professional jobs since college — when I hit a ceiling at one job, I got another to move up.

But rent is $2k / month and houses (even out in Long Island, NY) are at minimum $300k for a super fixer upper to $600k for something nicer but still modest. I’m not seeing a way to afford that.

When my parents bought their first home, it was 2x my dad’s salary. We’re looking at 3x our combined salary. Do you see why this is harder?

This generation is not lazier than the previous generation. The opportunities are fewer and pay less and housing costs are higher.

Again, I’m not complaining. It is what it is, and we’re doing okay. We’re debt free, have college degrees and full time jobs, and a little savings and decent emergency fund. We could certainly be doing worse.

Can someone please explain to me how both housing prices and the price of rent are both going up while wages remain stagnant? It would seem something has to give considering a finite amount of people need a roof over their head.

The insight I’ve gained as a now 40-something renter is that rents are calibrated to a price point just below what would make you jump to a mortgage. So if you want to rent in a solid middle class area near decent jobs you will pay close to what a local monthly mortgage would run. So rents track up with the monthly mortgage rates for comparable local housing.

@Christ D., also reputable experienced property managers and owners typically restrict rentals to tenants whose gross (before tax) income is 3X the monthly rent. Responsible mortgage lenders also restrict mortgages to buyers so that the total of mortgage, mortgage insurance and property taxes is around 32% of the buyers gross monthly income, plus or minus a few percentage points.

Either way, rental or mortgage, you are looking at a maximum monthly outlay of 31% to 34% of gross monthly income. In the fly-over regions of the U.S., this number is normally a lot lower.

One reason – Population density – as population reaches a tipping point, price of land skyrockets. Get housing price and population data for the last 100 years from the Bureau of the census and run correlations on changes, with delta in population lagging price by 20 years and look at the remarkable R squares.

A compounding reason – foreign competition – there are a lot of wealthy people in the world buying houses in California.

Understanding that, or trying to ( I’, 60 and don’t get it) I read Dr. Housing Bubble and pick up a bit here and there, but I’m with you…. We are all writing about human nature, that will never be stable, and free will, because you can do that…… It’s always changing, but never will stop, yet your question asks that it does, but won’t.

You can still apply 1950’s ideas and live. Cheap and save. It works……

Home prices went up not because the average citizen was buying homes due to low interest available to them and decent wage growth, rather prices rose due to the fed’s artificially low rates that allowed investors to buy up tens of thousands of homes.

As they leave the market and the economy and job market remains in poor shape expect home prices to stagnate or drop

The problem is cheap credit.

http://www.youtube.com/watch?v=sruhSoS7J6M

We are in a very messed up economy. All of our cash saving will be worthless pretty soon. The printing machine full effect. The government rather devalue Hard working American’s cash savings than let the real estate market be a free market.

If you had the money in 2011 and 2012 and DID NOT BUY… I truly feel for you. I did not have the money… so I don’t feel as frustrated as some of you.

In February and April I bid 20K and 25K over asking and lost to other people on two different properties. houses sold for 70K and 93K over the asking price… the realwhore told that fellow biding high was going to get a 3 or 5% government program loan to buy… I was furious I almost beat up my idiot realwhore…

“If you bid up close to what the other person is bid is YOU will probably get it because you have 20% and the deal will close sooner.”

I hate realwhores. I could beat up one and not feel the lease remorse… they got inside information with the brokers to squeeze the most money out of hard working n saving people.

Realtors weren’t just selling property before the crash; they were selling ARM’s loans. They were the ARM’s loans champions. I remember, even as far as back in 1999, I was looking at a 1 bed vacation condo in Hilton Head, SC for 60 or 80K, and after I decided against it, the realtor’s ‘Hail Mary’ was a lesson on the joys of an ARM’s loan.

When I moved out here, in 2005, the realtor already had a series of places to show me, right off the plane, all of which were only in my -ARM’s loan- price range.

I hope the good Doctor will allow me to indulge myself with another brief boomer history. I am an original one, 66 years old. I have four university degrees, three graduate, including a PhD. I paid less than $10,000 tuition at both public and private universities for three of the degrees. I had a scholarship for the PhD. My undergraduate tuition at UT Austin in 1965, my freshman year, was around $100 a semester. That covers education cost.

With regard to real estate, I bought my first home four years ago. I rented up until then mainly because I have lived all over the world in three continents and eight countries. I speak three languages which have been worth their weight in gold. My one and only home cost $60,000 and would easily be worth over a million in a “nice” California neighborhood. It is mid-century, with over 2,500 sq. ft. My real estate taxes are around $50 a year. I am retired now and the city I live in, Merida, Mexico, is much more modern than my Texas hometown. It has all the amenities of any mid-sized US city, with all the big box stores but also the charm of a village because each colonia (neighborhood) has its own market. Just about anything one would need is within walking distance as well. The medical care is better than most US facilities. People come for medical tourism. National health coverage is by age and I pay about $350 a year. Needless to say, there are a lot of boomers heading to similar places. But, it will always be a small minority. As the Doctor says, people generally stay in one place, sometimes for the wrong reasons.

I have a close relative with a similar career but he stayed put at UC-Berkeley for 30 years and ended up with a house in Forest Hills, SF that he paid $65,000 for in the 1960’s that when he died in it was worth $1.5 million. Luck of the draw. Happy I took the road.

How is the crime in Merida, Mexico?

One friend, with relatives in Mexico, told me that all of Mexico has become dangerous and crime-ridden. Kidnapping of Americans, for ransom money, is commonplace.

This friend is a filmmaker. He tells me that if you want to shoot a film in Mexico, you have to pay protection money to the local crime syndicate or your production will be in trouble. They’ll steal your production equipment, and if you’re lucky, that’s all they’ll do.

Do you feel safe in Merida?

Fulano sounds pretty content in Merida, and posts various reasons why he/she enjoys living there…presents to me as a well traveled, intelligent person, capable of making choices that work best for his/her situation.

Why bring up crime rates, if a person feels safe, or your friend, “the filmmaker”? Yikes.

Yes, I feel safe in Merida. Other parts of Mexico, especially the border area and obvious problem states that are well known, are not safe. However, if you are retired and not working it is quite a different environment. Do some research and you will see that most of the crime is directed at drug dealings and their assorted peripheries. Merida has a population of about a million with 12 murders a year. Oakland, for example, which is not the murder capital of the US, had over 35 times the murder rate of Merida.

“Visitors can relax in Yucatán, the safest state, which has about the same murder rate as Finland.” http://www.economist.com/blogs/graphicdetail/2012/11/comparing-mexican-states-equivalent-countries

After 47 months of saving, my long term account totals should hit 6 digits next month, at the age of 33. During that period I made between 45k and 69k/year in gross income. I could not have done that if I had stayed in California.

Money is the wrong metric to look at this through though. The main differance between then and now is how much more effort we have to expend per unit of energy, as a society. It is no coincidence that the fields with the most human interaction and least automation are the ones outpacing inflation by several multiples.

I lived in California for 18 months, made “OK” money, but not for the 4 hours in traffic, small apartment, twice the price of the new house I got just a state over, same income, less traffic…. I don’t get it. Weather in California isn’t that great…. strange to watch 20 people living in some houses, tarps for bedrooms and garages that never have cars in them?

What is it I’m missing?

20 years ago, it was pretty nice to live there, even with the long drive… today…. To each their own…. it’s home to you guys, I respect that. Just not for me.

This blog follows my theory on the real war in this country…the generational war. When you look at the 1920s it was all about women and voting. The 1960s revolved around African Americans and expanding their rights. Even Gays and Lesbains have seen expanding right after a fierce battle with extreme conservatives. The underlying battle is baby boomers v gen x and y. Where you have this older and entitled generation of sloths that are more than wiling to saddle their children with debt for a bowl of soup (cite Isaac and Jacob, Genesis). It’s under the surface yet very real because as a gen y’er I ask:

1- why should I pay for SS and Medicare when I won’t see the results?

2- why would I go to college and pay 10xs expected payout? Oh my parents who paid a fraction of the cost “encouraged me”

3- why should I join a system that pays for this?!

Cranky CPA, the older generations have been subsidizing you for the first 20 or so years of your life. Or did you pay tuition to attend grammar school, and then high school? Did you pay for all the utilities and police protection you received as a child? For use of the playground? Even your college loans were subsidized by older generations’ taxes, in the sense that they were government guaranteed.

Time to give back.

That’s a bit of a strawman as no one is suggesting that younger generations should contribute nothing at all. Distractions about consumer items aside, the argument is that attaining the same level of home ownership requires more money in *real* terms than before. That is proven and Boomers as an age cohort are benefitting to the detriment of younger generations.

You are so right! And now the younger generation will pay higher healthcare premiums to pay for Obamacare. And prop 13……

OTOH, didn’t Obama mandate, by law, that “children” can remain as dependents on their parent’s health insurance until age 26 or 27?

So those higher healthcare premiums that younger people will be paying won’t even kick in until the later half of their 20s.

I only have catastrophic/hospitalization health insurance. It doesn’t even cover emergency room visits. All my life, I’ve paid for all my dental and eye exams and needs, and the occasional doctor visit (ear infection, ingrown toenail, fractured toe, etc.). I had a physical checkup this year, at age 51 — my first physical checkup since I was 16, 35 years ago. Just saving money.

All my life, I’ve been paying into Medicare, and getting nothing from it (or from my insurance). I just hope you young ‘uns will keep Medicare solvent until I kick off.

——-didn’t Obama mandate, by law, that “children†can remain as dependents on their parent’s health insurance until age 26 or 27?

So those higher healthcare premiums that younger people will be paying won’t even kick in until the later half of their 20s.———-

The key word is CAN. Birthparents are not mandated to allow their offspring to stay on their insurance policy; they can tell the insurer to take the offspring off the policy at 12:00 a.m. on the offspring’s 18th birthday, and there is nothing the offspring can do about it. I strongly suspect this is what most people do. The notion of family in this country is not the same as it was in the 1950s; you yourself put “children” in quotes. Once offspring turns 18, they are no longer considered their birthparents’ child. They are just offspring, and that’s it.

It used to not be this way. Even today, obituaries still use the deprecated term “children” when making reference to the offspring of a 90-year-old decedent, even though the “children” are in their 60’s and 70’s. People used to look at this differently; the word “child” had two definitions, one meaning any minor, and one meaning one’s own offspring regardless of age. I think we’ve lost something by re-defining the word.

Baby boomers spoiled their kids. Now it is pay back time. They will have to pay our bills from all the deficit spending under our Dear Leader.

I’m a baby boomer who flunked out of many colleges, and could always get into another one. I was fired from many jobs, but could always land another one. I failed, economically, many times, but could always get another chance to succeed. I grew up in an America where there was upward mobility and anything was possible. In today’s America, the mobility is downward.

My kids, even though they are living in this time of downward mobility, are lucky, because I caught the waves during the housing bubble, and got out of the water before the last wave broke. They are growing up in a life of privilege that I, as a baby boomer, from an upper middle class family, could only have dreamed of as a kid. Still, I am doing the best I can to teach them that while they are very fortunate, “the nail that stands up, gets hammered”. As most Americans continue to grow poorer, it is best to keep one’s good luck to oneself. Those who are financially successful will be well-advised to keep their real names, along with their tales of good fortune, out of the social media.

Jamie Johnson made a documentary called “The One Percent”. He is from Johnson & Johnson fame. The film is basically him interviewing other .1% , or at least attempting to interview them.

One theme that you pick-up on in the film right away is that the vast majority of these people DO NOT want it known how much they actually have nor who they really are.

Gen Y is the face of the next housing crash, something I’ve been arguing with housing recovery cheerleaders for a long time.The real estate never goes down crowd argues “we have done polls and found that Gen Y has the same aspirations towards home ownership as previous generation.”

The obvious retort from smaulgld.com is always ” you might as well have asked them if they wished to be billionaires, movie stars, professional athletes etc”

Their desires do not square with their miserable economic circumstances. Millions of millennials are living in their parents’ basements either unemployed or underemployed with massive amounts of student loan debt. Hardly the profile of a qualified new new home buyer.

There is no rush by Gen Y towards household formation and Gen Y household formation will probably end up as renter households.

Hey Doc,

Thought I’d point out that Time Magazine shifted the years a bit on the whole Boomer age group and rightly so in my opinion. The Boomer cut-off is now 1961. Safe to say I have absolutely nothing in coming with my older, Boomer siblings. I do mean nothing, from when I got married and had children (later in life) to politics and musical tastes. Time Magazine dubbed us “The Lost Generation” back in the ’80s and now they decided to put us under the Gen X umbrella.

I didn’t buy a house in the last two booms, why? Because the thought of that enormous debt (this would have been a Silicon Valley purchase in the mid-90s) and not living within my means was absurd. Fast forward to 2002, SoCal and I still didn’t jump during the whole run-up. Funny that I didn’t even realize people were using liar loans either, I thought it was me who didn’t have my financial act together.

But when the proverbial sh*t hit the fan in 2008-09 and my savings, job and everything else went up in flames, I would have been holding a mortgage I could not have paid. So, we rent.

Have no idea what retirement is going to hold.

Kind of off topic, but maybe the Dr can address this in a future post. I was looking on Zillow yesterday at areas in the San Fernando Valley, east through Glendale and over to Fontana and was really surprised by the number of blue properties (pending or foreclosed homes) compared to red properties (for sale). Many of the blue properties were foreclosed on in 2010 and still have not been put on the market by the foreclosing lender???

With so many distressed properties in those areas, how can people feel confident buying there that prices have support? Did I not read that the banks that got a pass on the “Mark to Market” rules for the last 5 years will have to start abiding by those accounting rules again in 2014? If Mark to Market rules come back, then the banks will finally need to market those properties, rather than dribble them out one by one as is now the case.

If that is the case, inventories will go way up in some areas and that could depress prices again.

What do you think Dr?

@Jim wrote: “…Many of the blue properties were foreclosed on in 2010 and still have not been put on the market by the foreclosing lender???…”

Federal law U.S.C. Title 12 §29. Power to hold real property, allows banks to keep foreclosures off the market for at least 5 years, and up to 10 years if selling them sooner would do them harm.

So these 2010 foreclosures may not get put on to the market until 2020. As long as the Federal Reserve keeps the Federal funds rate at close to zero percent there is no reason for the the banks to unload foreclosures. With official inflation at 2% to 3% (and real inflation at +5%), the Fed’s overnight rates at close to zero percent means that banks have no incentive to sell foreclosures.

@Jim wrote: “… If Mark to Market rules come back…”

Mark-to-market was instituted for mortgage related issues in 2007 and then suspended in 2009. Mark-to-market will not come back for mortgage related issues. Doing so would render many financial institutions insolvent overnight.

Definitely agree with the entitlement comment above, but feel it us more geared towards Gen Y. The majority of people in my generation have parents that were children during WW2. Those values of hard work, scrimping and being a contributing member of society were passed down to us. I too have 3 degrees (teacher) and have student loan debt, but that is all. We rent. I had the pipe dream in 2006 to buy a home because I was tired of commuting and wanted to be closer to my job. Big mistake. Although we could afford our mortgage, the value dropped 60%. We walked. Not proud of that but financially didn’t make sense. We tried to negotiate, turned down blah blah blah. You know the story. The point is that it was stressful. I constantly thought about the value, knew we were trapped. I couldn’t live that way anymore. Renting is a choice, technically we could buy again (Bay Area) but why? If we did this now we would be in the same position as we were 7 years ago. The house of cards will fall again, and yes it’s not about timing or luck but we will be smarter next time. The good thing is that we are basically forced to save our money, maxing out retirement accounts or be taxed at a ridiculous rate. So things happen for a reason.

Cranky,

I hear you. It is different now and binging up such “pat on the back” stories as most of the “heroes” above wrote about themselves does nothing for anybody now. As the article states it was easier decades ago. You could work and save your axx off today like the “heroes” of yesterday and have little or nothing at the end of a few years. 4 degrees? That is no accomplishment that is a luxury and bragging about it is pathetic, shows you learned little. I know I worked hard but got really lucky and had the “timing” of years ago to make things much easier for me.

Desmo,

Sounds like you have a bad case of envy and jealousy. The only reason I mentioned that I have four degrees was to place their tuition cost in perspective to what today’s university education cost. I earned those degrees to work as a university professor, a requirement for the job, not a “luxury”. Just for the PhD alone the amount of earnings foregone was over $250,000 and that is to enter a field that pays much lower than the private sector. If you look at doctoral programs today in my field, computer science, you will find that the students are almost entirely foreign born. It makes little sense today to make the sacrifice, both economically and career, to earn a PhD for Americans. And, by the way, we Boomer university professors are starting to retire in mass and good luck finding qualified replacements.

Fulano, u have my respect for moving to Mexico to try and do whats best for your family. However, one thing I don’t think we’re worried about here in the states is a lack of people with a bunch if useless degrees (many of which should be self taught on an ipad and not paid for) that can’t succeed in business (or maybe don’t want to) who want to teach at universities, and hopefully get tenure, even in computer science.

FTB

I would suggest you the read the article below, co-authored by a UC-SD President. It might open your eyes to what the US higher education system has done and will hopefully continue to advance not just “business” but science and technology. Anyone can find examples of waste in education and what you call “useless” degrees. The US has been the global center of higher education for a very long time. This does not mean that new technologies will not change education. On the contrary, many institutions are in the forefront of innovation. I am not sure who would teach in your “university” if there is no peer review of work and talent through graduate education. I guess we could just have people who are successful in business teach all the courses. There are a small number of cases where “dropouts” have been become extremely wealthy. But, even Bill Gates contributes millions to the current education system.

http://www.rca.ucsd.edu/speeches/TIS_ResearchUniversitiesCoreoftheUSscienceandtechnologysystem1.pdf

The US is facing global competition and is mostly losing to it. As more of the wealthy realize they are next on the list for bail-ins, tax hikes and capital controls, they will want to hide their money in assets that are hard to expropriate. Owning rental housing is a pretty safe place compared to a lot of other investments. As the wealthy get wealthier and the poor get poorer in the US, look for more and more homes to owned by fewer and fewer people.

>Owning rental housing is a pretty safe place compared to a lot of other investments.

You never own a property, the local taxing authority does. Further, when the SHTF and many want to dump properties, they will find out just how illiquid they are. It is simple, a new mini-boom has happened in real property in former bust locations, and it surely will go bust all over.

I find it hard to believe that municipal, state, and federal governments would not increase their levy on RE holdings and transactions–especially if the majority of the country are renters.

Even if the wealthy were able to “hide” their wealth in RE, at some point the assets would be need to be sold for currency so that the wealthy can trade for goods and services. Last time I checked, the wealthy do spend money. What’s the alternative, trading land deeds for food and yachts? Governments control the trade infrastructure. Even if the wealthy simply passed land along to future generations, at some point someone is going to want to sell and the government will be right there with its hand out. The same goes for raking in rent profits. They will find a way to take more of it.

It seems really naive to think that governments will just sit by and leave stones unturned.

Death taxes, gold holdings outlawed, and secret bank account investigations are just a few things that come to mind. The best you can do is to arbitrage the time before the tax authorities change the rules of the game.

the rules of taxation is not in the working man’s favor.one’s labor should should not be taxed.to beat the tax system one must incorporate no natter how small of a business you have.then and only then you will be able to enjoy the fruits of your labor when the corporation takes care of your needs.

“People are social animals. They want to be around others that think, speak, and sound like each other.” With more education, we will make a new man and woman that will like diversity. “Diversity is our strength” they will be taught. The future is like Sweden, where there will be little difference between economic wealth, only if there is proper education, otherwise we will devolve into tribal strife like there is in the third world. America only did well after WWII because they ruled the world. The future is east, China. Chinese, (with some Koreans) will buy up the good locations in California. America’s empire is setting. It will never be as wealthy as after WWII. Time to share, according to President Obama.

More bogey-man socialist BULL****.

If you spend even a few minutes researching the matter, you will see that there is definitive proof that the wealth distribution in this country is getting less and LESS equal:

“Wealth inequality in the United States

is at historic highs, with some estimates suggesting that the top

1% of Americans hold nearly 50% of the wealth, topping even

the levels seen just before the Great Depression in the 1920s”

“Wealth inequality increased during the first two years of the recovery. The upper 7% of households saw their aggregate share of the nation’s overall household wealth pie rise to 63% in 2011, up from 56% in 2009. On an individual household basis, the mean wealth of households in this more affluent group was almost 24 times that of those in the less affluent group in 2011. At the start of the recovery in 2009, that ratio had been less than 18-to-1.”

And so on, and on and on.

So I would not worry about sharing. The wealthy in this country are in no danger of sharing anything with anyone.

I am a genXer.

I came to this country when I was 17 with $42. My wife came to US when she was 14, her family had virtually zero money.

I am 37 now, she’s 36.. we own a house in 90049, investment properties, and have about $1mil in retirement accounts.

This did not require any spectacular luck or skill, just a whole lot of hard work. Anyone who keeps bitching how tough their life is, maybe should just work a little harder.

Hard work alone won’t get you ahead. Burger flippers work hard. Sharecroppers work very hard, harder than anyone on Wall Street.

It’s been said, “Don’t work hard. Work smart.”

I’m curious to know how you managed to accumulate so much wealth within 20 years of entering the U.S. What college degrees did you and the wife get? Any financial support/investment/business contacts from relatives? Financial help from either the U.S. or foreign governments? What fields did you earn your money in?

Or like my friend in LA and his brother, just be born as a son of a landlord. My buddy works so hard in the company Maserati that his dad bought him bc he is short and nerdy and dad wanted him to get laid, as he drives around listening to music and stopping off at various apt complexes picking up rent checks or speaking to the supers about needed repairs. Yes, he is definitely smart n savvy that one.

I flipped burgers before.. my wife worked in a laundromat before. You don’t have to be super smart to know that those are not careers. Work hard means a lot more then just find a random job.. it means charting a career path and staying on it.

We have no wealthy relatives.. and very few relatives in US in general, so we just supported ourselves and each other.

We both went to state schools, I did engineering, she did biochem.

I ended up with an MBA from a top 10 school, she is a surgeon.

Along the way, we invested smart, did not spend on stupid sh!t. Real estate has been good to me.

Overall the formula is very simple.

1) Chose a career path

2) Work hard to advance along that path

3) Save your money and invest

FTB, being a landlord isn’t all that easy. My father, now deceased, was a New York City landlord. A refugee from Europe, who ended up buying a rent-stabilized building in a bankruptcy sale.

Being a New York City landlord (with all the laws in tenants’ favor) is an awful thing, a situation that I would only wish on my enemies. That’s why I’m not a landlord, but merely the son of one.

I laugh at all these people who fantasize how wonderful it is to be a landlord. With the increase in rentals, tenants rights laws will spread.

Imagine being a landlord, and signing a lease for X amount of dollars, then waking up one day to find the rents rolled back by law, and you’re no longer able to raise the rents beyond a certain point, and you must renew the tenants’ leases for as long as they choose to live there. It happened in Santa Monica in the late 1970s.

I live in a condo. When I move, I’m selling. No way will I rent it. No way will I fall into the landlord trap. Much better to be the son of a (former) landlord, than an actual landlord.

@ son of a landlord:

I agree, being a landlord is no cake. Especially in an uberliberal states, where tenants have all the rights. The real estate that I own is in a “red” state, where it takes about 2-3 weeks to evict a deadbeat tenant. My real estate holdings are all single family homes, and it’s easier to deal with middle-class tenants. I would imagine it’s a total nightmare to deal with low-end apartments.

Son of a landlord-as a NY native I know rent controlled and rent stabilized apts very well. However, I think you are missing a key point in regards to your father’s story. When he purchased the building, the reason why it was the (lower) price he paid was because of the rent stabilized and rent controlled apts in it. Without those apts, the building would have sold for much more as its all about future rent rolls. So, your father gets stability of tenants as these folks usually never leave such a rent controlled scenario, but his upside is capped in terms of getting market rates. Also, these rates go up every year, albeit it changes by how much each year as its a (fake) battle between tenants and landlords and then a board chooses how much one-year and two-year leases go up for every single such apt in NYC. Looking at historic rates, should give a landlord a pretty good idea up front, what he will be able to charge his tenants, years down the road. I’m assuming you would not think its fair (it would be a windfall to the buyer/your father in this case) for a seller to sell a building for less money (say $1mil) because of rent controlled apts and then after you dad buys it, to simply be able to get rid of the rent controlled apts so then the building is instantly worth $3mil. There was full disclosure before the purchase as this stuff is regulated by the city, so it kinda seems your dad got the apt building he bargained for, no? This is not an endorsement of rent control or rent stabilization, btw; just stating that, IMO, your dad got exactly what he was supposed to get, a bunch of apts with rent control.

Please, please look around you !! If you live in Los Angeles go to Santa Monica or the Grove stand anywhere and just listen to how many people are speaking different languages. Go to the banks and see how many different languages are being spoken.

I feel bad that my niece and nephews have to learn a new language here in the Unite States in order to make it.

Just look around you and see how many Asia people are now living in Los Angeles.

Where I live I only see Asia people buying real estate.

When all you have to do is buy a $500,000 home to become a US citizen. That is a lot of money but people from other countries are doing it.

This country has changed and US parents better get there kids up to date or they will be left behind.

Yes, the future is from Asia. That is because your wise leaders sent your jobs to my country so we produce things that you give us money for and we use that money to buy the homes cheap from people who lost their jobs because they were sent to my country. Blame your wise leaders for sending the jobs to my country. Of course we thank your wise leaders for all that they have given us, we also contribute money to their election campaigns because we see how the system works in USA democracy, it is the oldest profession in another form.

Ah, Mr Lee, the truth comes out – you still do not see the US as your country. Instead, you see the one you were born in, which isn’t the US, as your country – per your own words. Nice. Thanks for the appreciation for everything that your time in the US has provided to you.

Not the first time i read someone saying about 500k citizenship. Such thing doesn’t exist. There is a limited 10k visas a year for the Entrepreneurs (buy a RE is not enough). This is from the USCIS website:

“You must invest $1,000,000, or at least $500,000 in a targeted employment area (high unemployment or rural area). In return, USCIS may grant conditional permanent residence to the individual.”

So you must Invest in a commercial enterprise in the United States and create or preserve ten permanent full time jobs in US in order to qualify for a Green Card (not citizenship).

This is way far from saying that 500k house gives you a citizenship.

I better say this.

This is not a black, white, brown, yellow or green issue.

This is what it is. There is an old saying. “Nothing last forever”.

So as someone once said in a movie “we can either get living or get dying”.

If would be great to go back to the old times but we can’t.

As someone said in an old blog. We got use to living off of other people paying cheap money. Now the table has been reversed.

Let’s stop complaining and figure out how to get this country back on track.

It’s a bit rich to read comments by Boomers that attempt to blame decadent consumerism on the very demographics by which their financialization, marketing, and corporate profit schemes helped to create. It’s like the drug dealer pointing the finger at the user or creating a monster and blaming that monster for its existence.

Yes, we have problems. The decisions of the past helped to get us here. History didn’t begin when Gen X and Y were born.

+1 joe. Its almost as if the boomers here forgot they have controlled and still control the govt and corporations and they set the rules and ‘taught’/raised the lower generations. Who do the boomers think made the rules n literally took a great country and turned it into a debtor nation to finance their lifestyles that they couldn’t otherwise afford? Gen x and gen y are trying to play the game made by boomers and for boomers. I’d like a boomer logical response if someone has one. Btw, I’m not asking for govt handouts as I believe in small govt, but its very frustrating when boomers can’t even admit the system we now live in is the one they created under their watch.

FTB: “Who do the boomers think made the rules n literally took a great country and turned it into a debtor nation to finance their lifestyles that they couldn’t otherwise afford?”

Much of that “lifestyle” Boomers couldn’t afford was spent on their kids. The best neighborhoods, the best schools, the best toys, gadgets, clothes, piano lessons, soccer practice, etc.

Joe, you hit the nail on the head. It’s almost comical reading some of these boomer sob stories of how hard they worked and the big sacrifices they made. They got the luck of the draw of being born at the right time and had opportunities that no future generations will.

Regarding rampant consumerism, I think the boomers took this to new levels. At least here in Socal, boomers with above average IQs generally have lots of disposable income. Foreign luxury cars, constant home improvements, traveling, helping out less fortunate kids is all part of the equation. The younger generation didn’t have a vote or a voice in what transpired. Boomer politicians, policy makers and corporate leads sold the next generation down the river…this can’t be refuted!

In re-reading many of the Boomer posts, I have to admit that most to admit to the good fortune of experiencing less expensive cost of living, more stable incomes, less expensive education, etc.

The decadent consumerism meme many B’s have for Y’s and X’s, though, is a farce. First, the options were fewer in their day. Second, as a child of Boomers, I saw that they gobbled up every available “high tech” item that was available, whether it was a PC, microwave oven or a popcorn machine.

Also, items such as cell phones, smart phones, laptops, etc., are one of the driving forces behind the incredible gains in productivity (i.e., increased in rates of GDP) seen over the past 30 years. Sure, people who really can’t afford big-screen TV’s buy too many, but I see as many 60 somethings cramming their plasma’s into their beat-up vans outside Best Buy as underemployed 30-somethings.

Though many Boomers here (educated, investment-oriented, etc.) have been “frugal” and “worked hard for what they have;” they are, in fact, the minority of Boomers, most of whom haven’t saved nearly enough for retirement, despite their leg-up on opportunity. As is pointed out in the article though, there is no generation doing well in the retirement-savings department.

One major reason that Boomers are behind despite their advantage is because they were caught in the profound and nearly imperceptible shift around 30 years ago from company sponsored pension plans to individual retirement savings plans. One source of retirement started to dry up while another was being subtly rolled out advertised as a supplement, when in fact became the primary retirement savings vehicle.

Fulano provides a good lesson. Opportunities are still out there. They just might require living in a bubble-community in a 3rd world country.

@ Joe, FTB, Blankfein, Dfresh …..the real problems you should be focusing on:

1- the pitiful victim mentalities you possess. Get back to us in 10 and 20 years and let us know how that has worked out for you!

2 – your anger should be directed at your parents. Because it is they who threw too many pillows out for you AND let you believe that life didn’t have to be hard. It’s NEVER been easy but you all are too soft, clueless and myopic to understand that.

The boomer stories above aren’t coming from a place of bragging nor have the financially careful ones had meager lives —- *you aren’t comprehending what you are reading* — they were told to illuminate the f**king formula! It’s not complicated. Read what Mik wrote and read it again til it sinks in. (Mik, you have my respect).

EVERY generation can complain about the one before it….so what’s the point? People somewhat older than me could say plenty about what it feels like to be DRAFTED to war, women & minorities could tell lots of real stories about harassment and discrimination that limited their lives for thousands of years….and the list goes on and on and on.

Good grief, grow up and stop crying! And tell your parents they get a D+.

@ Prediction Reality:

My lot in life is really good. I have a great career, make plenty of money and own a place 1 mile from the sand in the South Bay. That’s far from crying if you ask me. I’m just stating the facts of what the boomer generation has accomplished regarding the “I got mine, screw the next bunch” mentality. If you honestly don’t see this, there is no point in arguing. Regarding Mik, all the respect in the world to him. He worked his ass off and is now reaping the benefits. But let’s be realistic, have a surgeon/top 10 business school grad couple is FAR from the norm in this world!

My parents are pre-boomer generation from the old world. They have seen more hard times, heart break, carnage, death and destruction than anybody has right to. I wasn’t coddled one bit growing up, I can guarantee you that I’ve had more shit jobs than you ever had: mowing lawns, washing cars, fixing cars, working construction, fast food, supermarket peon, etc, etc, etc….

I’m just stating the obvious that people like you fail to comprehend. Times have changed drastically and it’s only getting worse for future generation. Open your eyes and accept reality!

PRC, I agree that some can act like victims (myself included) but there are some factors at work here:

1. The typical starter home, sub 500k, now ends up in the hands of the all cash hedge/reit fund as a rental. Some never even appear on the market.

2. Job security. It’s rough out there. My parents, non-college grads, both worked at the same companies for 30 years and amassed an impressive portfolio in that time. I expect to stay at a job for maybe five, with some periods of no income in between. This is the new normal.

Point is, am I really supposed to leverage myself to the hilt (6-700k) in this sort of climate? Boomers like to point out how GenRent squanders their money on gadgets, but that is nothing compared to a 3k/mo mortgage payment (which is now what we’re expected to pay because of the market forces at work). No thanks.

Prediction reality check-all I can say is you make stupid assumptions about people just because they are stating facts that you don’t want to hear/mess with your world view that the boomers had some mythical worth ethic and everyone else since then is now lazy and materialistic. I actually went to a cheap state school and paid for a legal degree at a top five law school in the country by myself that cost me $150k, i briefly worked as an attorney at a top 10 law firm (before realizing i hated it). I now own a company that i started by myself with no loans or help from anyone that now has over 10 employees. I pay employer and employee sides of social security (the full amount every year) for myself and the employee sides for all my employees. I pay federal tax and state tax in multiple states. I rented a one bedroom apt my whole life until finally buying in texas this year. i have been working and paying into social security since i was 13 years old (i had to get my moms permission to work at that age). My parents were divorced and we had no money so as a kid/teen/college kid I mopped floors, worked in a warehouse, delivered pizza, etc. I wouldn’t call myself coddled. Unlike the fortunate few, I don’t like my curennt job very much, so my goal is to stash cash for my family and retire at some point, Is that OK with you? How much do I have to contribute exactly to finance your lifestyle before I retire, if ever? I know its hard to hear the truth…your generation (and I’m not saying each individual person, but as a whole) is leaving us with a big fcking mess due to

PRC – Understanding the mistakes of the past is an important step in changing the future. I’ll take complaints over complacency any day.

Accusations of “whining” seem to be the last refuge of someone without a useful perspective to share.

By the way, for all you know, I might be a Boomer myself.

Not all the depression era kids grew up to be responsible savers. My parents lived the standard suburban dream on dad’s engineer’s income. But they never had quite all the stuff they wanted, and saved little and took out 2nd mortgages on the house. By the time they retired they had enough to live on – barely – and only thanks to the fact that pensions + social security were still livable a generation ago.

This was a good object lesson to me – perhaps too good. I’ve lived like a grad student my whole life, saved a bundle and live in the same small house I bought 22 years ago. This conservative mindset can go too far though. By always preparing for the worst I’ve been unduly risk averse, let myself believe the doom and gloom mantra and avoided some real estate investment opportunities that would have significantly benefited me.

I’m hardly a real estate cheerleader, but do believe that an excess of pessimism can be almost as harmful as the headless mania we constantly decry on this forum.

Before the GI Bill/WWII, home ownership was in the 30% to $40% range. By 1960, it was in the 60% to 70% range….what changed? Govt intervention. Ah, the good old days.

Great timing. Article in wsj this weekend about baby boomers vs gens x, y and z…..

http://online.wsj.com/news/articles/SB10001424052702303680404579141790296396688?mod=trending_now_5

When I bought my house in 1988, I ate hot dogs and beans for a year to save a down payment even though I made 60k and I could have bought more house than I did. But being my 1st place and conservative I was then able to save and invest for the next 7 years, and all done by not extending myself. Live below your means and anyone can do it. My grandparents came from Europe with very little, but worked hard and were smart and frugal, and they made it. Keep the car till it dies, dont buy everything you see, fix it, wear it out, whatever, anyone can make it in the US.

To have made 60,000 a year in 1968 was a rather extraordinarily high income. That was the same year I got my first paid job as a laborer on the township road crew working my way through my first year of college, for which job I was paid $2.00 an hour, which at the time was a decent wage, especially for a kid. There are elements of inter generational rivalries on this message board, but the big picture is that real inflation adjusted wages for the bottom 90% of the population peaked in the early to mid 1970’s, and have been declining since that time. It’s only the top 10% of the population composed chiefly of professional and executive level employees, successful business owners, etc. who have seen real gains in their standard of living for these last 40 years that came from their labor. Otherwise the way to get ahead was a successful investment of some sort. The disparities between rich and poor have grown rather ominously for a long time. And I think the reason we’ve seen so many investment booms turning into busts and then back to booms can be attributed to a growing amount of money accumulating in comparatively few hands, with those wealthy speculators all trying to outwit one another, and in the process bringing down financial calamities such as what we witnessed 5 years ago after Lehman Brothers’ sudden collapse.

Boomers that think we are going to pay for all the expensive entitlements you guys put in place are crazy if you think the young can afford it. We will default on the debt at some point and there will either be a huge haircut to benefits or the they will print resulting in very high inflation. Better prepare.

let me tell you what the world of gen x / y is like right now…

first off we never ever settle down because jobs don’t last forever and no one can afford that 70s show type life style. so the renting lifestyle kind of works anyway. no one works anywhere for 20 years anymore. i think amongst some of my friends athe mentality has changed. the smarter people know that the way our parents lived either barely exists anymore or soon won’t so we have to be prepared. fact of that matter is, if you go into debt to buy a house, you are chained to it. you are chained to the jobs in the area and the region. if you need to move across town to get a better / different job (or say another state) you are either stuck with a horrible commute and your life sucks, or you can’t move to that other state.

maybe people my generation have learned their lesson after the last collapse, maybe they are just broke. but we don’t trust the boomers or the bankers anymore or the realtors. at least the smart ones. why would we? that generation has managed to lead our entire country off the cliff and into what looks like the start of our downfall.

i’m 32. i’m about to sign a job offer which pays something like $130k a year to write code so the masses can continue to be entertained online (this would be my 5th real job in 10 years out of college, i’m a mercenary i guess)…. you would have to threaten me at gunpoint to buy a house right now and commit to it. i have $200k in cash , and a paid off BMW. i would rather throw my money into another expensive car than real estate because the loss of flexibility and ability to hop to the next job is too great. hell why not right, everyone i know who has a house seems near broke, dying from payments / home improvement / maintenance costs. might as well rent and buy a porsche right?

that is what its come down to. people like me who can “afford” houses don’t want to commit to anything because we need to stay one step ahead of i suppose the rest of american falling apart. the people who aren’t making more than say 50k + in los angeles, can’t afford to buy anything anyway and no one will lend to them. and theres this great middle ground of people i have noticed that are just smart enough to qualify for mortgages and just dumb enough to believe the realtor story and commit (i have a friend single guy, makes around $75k a year, bought a 400k house by himself because it was “going to go up” last year. works for northrop grumman which is closing socal offices left and right…)