Global housing bubbles in perspective – Canadian housing bubble never corrected. China leading the pack in global real estate mania.

This may come as a surprise to many but the United States did not lead the charge in regards to creating the biggest housing bubble. I was trying to find a time in history where the world experienced correlated housing bubbles and could not find a time similar to the one we are living in when it comes to real estate. The reason for this is central banking policy around the world is very similar. Think of the Federal Reserve, European Central Bank, and Bank of Japan. There is interesting data highlighting the magnitude of global housing bubbles that actually makes US home prices look modest. One of the biggest challenges I see right now is when people use large area data (i.e., US, county, etc) and then transfer this to a small area that is clearly facing a mania. There are many areas that are seeing home prices now selling for 8 to 10 times the typical household income of those in the area (the US is now at a solid 3 to 3.5). So let us examine those global housing bubbles first.

Global real estate mania

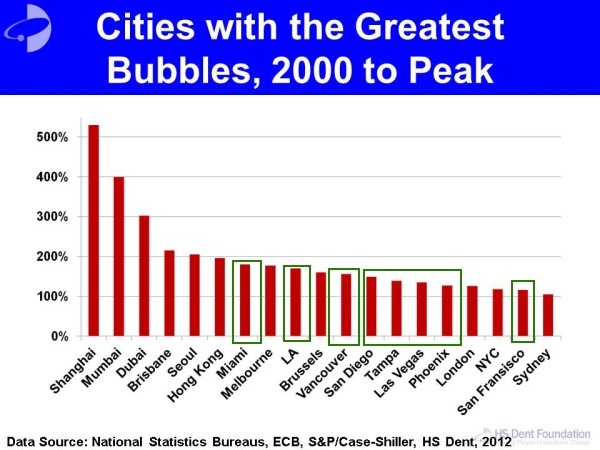

Without a doubt, China is experiencing the biggest housing bubble of all. There is little question about this. You are also seeing spillover money from China creating ancillary bubbles in places in Canada. One thing I will say about the following chart is that you have areas with growing middle classes as well. So the rise in home prices is coming with a solid rise in income. This is something that is not occurring in Europe and the United States for example. First, let us examine the leaders in the global housing bubble race:

From 2000 to Peak

-1. Shanghai – 500+ percent

-2. Mumbai – 400 percent

-3. Dubai – 300 percent

-4. Brisbane 200+ percent

-5. Seoul – 200+ percent

-6. Hong Kong – 200 percent

You can read the many stories regarding Chinese real estate:

“(BBC) If you want to find a place where China’s huge housing bubble has already burst, then Ordos is the place to come.

The story started about 20 years ago, with the beginning of a great Mongolian coal rush.

Private mining companies poured into the green Inner Mongolian steppe lands, pock-marking the landscape with enormous opencast holes in the ground, or tunnelling underground.

…Ten years later Ordos new town is an empty new city.â€

You will have to get to the seventh spot on the list above to find US areas. US areas like Miami, LA, and Las Vegas saw jumps of roughly 150 percent. The US as a nation would not even register on this chart. We talked about Hong Kong and how they are taxing foreign investment to curb speculation. To put this global mania in perspective, let us now see where we stand today in the US:

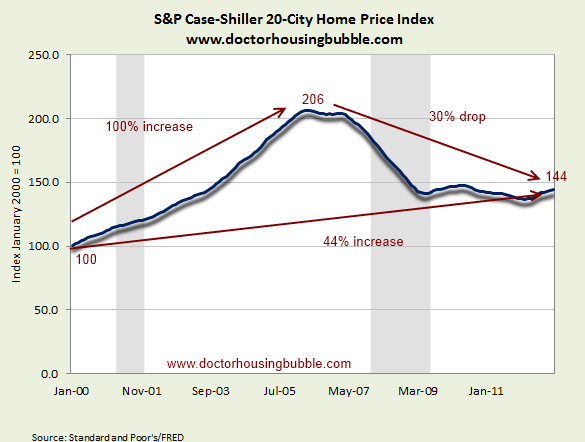

Home prices in the US as measured by the Case Shiller increased by over 100 percent from 2000 to the peak. Since that point, home prices have now fallen by 30 percent from the peak. If we look at the index we see that overall home prices in the US are up by 44 percent from where they were in 2000. Over this timeframe, the overall inflation rate has increased by 33 percent so in this respect, home prices on a national level look fine especially when you factor in the massive additional leverage you can get from the low rates being pumped into the market. If you are a typical US family in many of our 50 states, buying a home is a good move and probably even more affordable than renting. But be careful adapting this trend to niche markets that are flowing with flippers and outside investors for example.

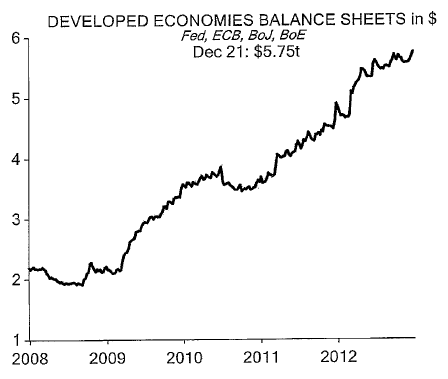

Now why did we experience this global housing mania? Part of it has to do with easy banking policies mimicking one another. If you think that all of this came at no cost just look at the balance sheet of big central banks:

Central banks have boosted their balance sheets from $2 trillion in 2008 to being on path to reaching $6 trillion this year. The Fed alone is inching closer to $3 trillion especially if they continue with QE3 and their mortgage backed security purchasing plan. It is very clear that the Fed became the bad bank to induce this housing boom and went as far as to take off MBS from the hands of these banks. Yet overall, the US on aggregate looks to be getting in line with prices.

The nationwide median home price is now at $180,600. The US median household income is $50,000. With 30 year fixed rate mortgages at 3 percent, this is completely affordable:

Down payment (10%):Â Â $18,060

PITI @ 3.5%:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â between $950 and $1000 depending on taxes and insurance

This is why nationwide it is hard to see prices dropping much lower. Yet in certain markets, high demand from investors, flippers, and foreign money is likely to cause a dip once it is extracted.

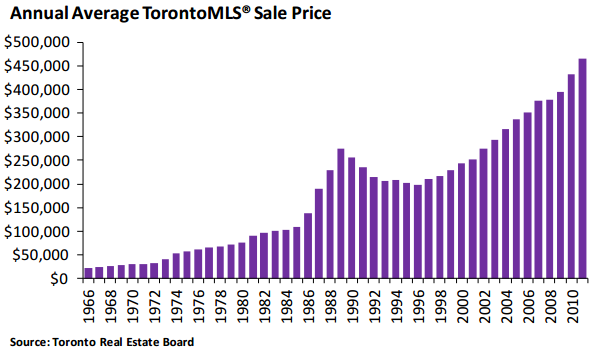

The global housing mania is fascinating because many countries are still in the process of their bubbles. Take a look at our friends up north in Canada:

In 2000, the average sales price of a Toronto home was roughly $240,000. Today it is up to $465,000. Canadian cities like Vancouver and Toronto have seen absolutely no correction and are benefitting from hot money from abroad. US home prices as you can see from the Case Shiller data above, are now tracking closer to the overall inflation rate.

Those thinking that there are no more housing bubbles simply need to look at a few other countries but also at more specific cities were flippers are back in force. Those thinking that global independent investors are buying up these securities are poorly mistaken. It is obvious that central banks are eating this stuff up but the question is, how long can this go on for?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

37 Responses to “Global housing bubbles in perspective – Canadian housing bubble never corrected. China leading the pack in global real estate mania.”

Here is a blog saying the Canadian bubble is over.

http://www2.macleans.ca/2013/01/09/crash-and-burn/

Oh my, it’s funny in a bad way.

“Rabidoux says people who shelled out for sprawling “McMansions†in the suburbs could be in particular trouble”

Written as if it’s never been written before… ?

America still rules the world. What do I care about Canadians and their beady little eyes and flapping heads? The grass/dirt eating Chinese? haha! Don’t care.

Your comments are unfortunate. While it it not my intention to insult you personally, what you have said only furthers the ‘Ugly American’ stereotype. Canada is a great neighbour and most Canadians I have met are nice people. Furthermore, while many Chinese are not living a first world lifestyle, there are probably about 300 million that are. I consider myself blessed to live in the USA but the current state of the nation is that we are living on debt, our infrastructure is crumbling, our academic levels lag the rest of the world and our graduates are loaded with student loans and there are not high paying jobs waiting for them. As we continue to print money which is backed by nothing we will watch as the dollar ceases to be the world reserve currency. As that happens, the nation will lose its superpower status. If you want an image of the future for many parts of the country, take a look at post industrial Detroit. A few places, like Miami and several Texas cities, have some vibrancy to their economy but as a whole the nation is in serious trouble. I wish this was not the case and while I am all for patriotism, I cannot support what you have said here.

I am Canadian and I can confirm that we have beady eyes and flapping heads. The southpark characters are actually quite an accurate portrayal.

Good work DHB! The Economist has also been tracking global home prices since 2002. Here is the link to their interactive home price index: http://www.economist.com/blogs/freeexchange/2011/03/global_house_prices

I just checked a bunch of Santa Monica properties on Zillow and they look to be about double – 100% up – from their 2000 prices. I’m comparing to sales in 2012. Prices have been going up there and not down over the past year so I expect them to be over 100% higher in 2013. I don’t know what it will take to get them in line with the rest of the country or even other parts of Los Angeles. I’m not referring to actual prices, but percentages. Will they ever get to a price point that’s just 44% above their 2000 sale price?

West LA will never correct to the rest of the country. It’s an expensive highly desirable area to live. I feel the prices today are probably as low as I’m going to see them the rest of my life while interest rates are also low.

Do yourself a favor. I used to live in LA. Go to the library and ask if you can get copies of the LA Times from the fall of 1987 to the summer of 1989. You will find many articles explaining why the change in housing prices reflected a fundamental change in the role of LA in world trade, etc etc. Of course, these were rationales for a bubble. It crashed from 1990-1996. I know; I was a victim, and rode the thing the whole way down, believing it was going to turn around imminently. Of course, it turned around, but not because of LA, but because of Greenspan’s idiotic money printing.

With all the leverage and policy, I don’t see prices reverting to pre-bubble levels. This is because the previous prices are no longer relevant; the rates and conditions have changed. So when I see a % drop from a bubble top, it’s only going to be down to what current rates vs. incomes are supporting. However, with all the external money supply, we’re competing against others holding dollars and wanting to convert them into assets.

Finally, the Feds want to make sure you really qualify for a mortgage:

http://mobile.businessweek.com/articles/2013-01-10/the-new-future-of-mortgages-an-explainer

Sadly, it won’t kick in till Jan 2014

Hi Janum, this news from the Fed, tells me that perhaps there will be a further run up in house prices in 2014 as more formerly unqualified first time buyers get some ease into qualifying for a mortgage.

Wondering, since this is a global economy, that they are somehow leveraging other countries to keep the housing market from crashing. I mean Canada is in a bubble and will crash soon. Perhaps they can do this in a revolving manner for many years to come. After all it is the global financial elite running the show.

I think we will see a reversion to mean, only very slowly. I think of the residential real estate market like a giant gaping hole in the floor, with the present housing policy serving as a massive wool rug flopped over top — so thick that standing in the middle of the rug, your rate of descent is barely perceptible.

That and with enough people standing on the parts on solid floor around the edges are holding the tension…. what happens if they starting lifting off?

Neighborhood Update

I mentioned the other day, a home around the corner was listed (a refurbished cheaply REO, believe it or not) $129K over what we paid in late Sept. 2012. The price just got a $60K haircut.

Evidently, the listing agent “bought the listing”. Very common in the industry.

Maybe another price reduction will do the trick. Buyers listen to their agents to avoid thinking for themselves. Sad but true. Our Buyer’s Broker hated that about us, but man did he do good for us after the transaction closed. Way beyond the call of duty! Saved us serious money and even hauled away our pile of debris and trash FREE!

Another post about Cash and Close Toe Tag home?

Hey nick of time – nobody cares about your story now… This is a housing bubble blog, FYI….

Glad u are happy u overpayed your hard earned cash for a POSvalley fixer lol

Look, I know this blog and comment section is basically a support group for those of us who have waited endlessly for prices to drop and really want to feel justified in our decision. But I hope this doesn’t mean we have to slam everyone who chose otherwise and accuse them of being fools (or even worse *realtors*). If we go that route then this just becomes a self-reinforcing echo chamber devoid of real information. I for one care about making accurate predictions about the future of home prices – even if that knowledge proves that we’ve all been fools for staying on the sidelines this long.

AP,

I’m with you. The smug comments from any perspective aren’t helpful to those of us who are truly interested in a critical analysis of the information which is being presented here.

I do wonder why some posters feel it’s necessary to post about how they are so happy and satisfied with a recent purchase. I can’t help but think that if they are so content with their new home, why are they spending time on here telling us about it and taking time away from enjoying the property? If they are so sure of their position, then why bother even reading this blog? If our haunches turn out to be wrong, then they are all the better for it and wouldn’t it have been a waste of time coming on here to try to convince us otherwise?

It sort of reminds me of Facebook posts where someone is trying to convince their “friends” of how interesting their life is by checking in everywhere they go and posting pics of their purchases/meals/drinks/etc…

I think you’re confusing reasoned analysis versus outright cheerleading – there are a number of long – time posters who’ve recently bought in CA, after waiting vainly for years for the next correction. They had valid and perfectly understandable personal reasons for doing so – and laid out solid economic fundamentals as underlying factors as well. It’s only when others come on and basically tell us how anyone in the market who doesn’t jump in NOW are bloody damn fools. When that becomes their basic premise, they will eventually be mocked for their views.

I’m with apolitical scientist & Joe.

I agree, thank you for saying it’s not useful to berate comments simply because we don’t understand or relate to them…

Or even if they are complete bunk and totally some nutball coming here to try and talk pro-bubble sales B.S.

If someone makes a comment that you think is total bunk or some kind of cheerleading from someone in the business, or even just a crank… Just as easy to just calmly state your opinion, disbelief, or disapproval without getting vitriolic.

Indeed, one’s point is likely not going to even get communicated if you sound kind of hysterical.

I see this lots on a variety of topics. You get a blog about an issue. Then you have professionals in a related professional field, you get amateurs in the field, you get customers/end users in the field, and then just outside parties who have some related interest in the matter.

It does NO good for anyone looking for information, or looking to spread the word about something, to create an echo chamber where only some opinions & perspectives get through, and the rest are discounted or silenced by crude arbitrary censor or angry & hostile censure.

I guess this is a hot button for me, because there’s a topic I only recently learned about – because it just happens to be something that doesn’t PERSONALLY effect me (though I care about it), and what with all the other important issues I’m interested in that DO personally effect me, I just didn’t know. Well, after learning about it I wound up at a blog where the people were totally in an echo chamber of knowledgeable professionals all very attached to the issue, where obviously they think that anyone that’s not exactly knowing & feeling the way they do, is just wrong.

Sadly these same people are mostly complaining that they’re not getting enough support from the public for their political issue.

I’m thinking geez, then don’t treat the “lay people” like dirt, and maybe we can learn & help.

But anyway, obviously housing is something that is pretty personal to EVERYONE from one angle or another. So you have to expect that people who read Dr. Housing Bubble a lot… well, a lot of us are coming from very different angles.

I started coming here when I had 4 family members & 1 friend living in southern California. I lost touch with the friend a couple of years ago, and the last of my family members moved out of Socal just a couple of weeks ago.

BUT, fact is, the reason I’m still reading here is because it’s a blog with information that is relevant to not just SoCal… And I find the comments from various perspectives to be very insightful windows into reality.

Though I’ll admit I don’t have any use for people who just spout off total nonsense. Like I’d hope the admin would delete comments from people who started claiming that prices were being driven up by extraterrestrial aliens making investments in Burbank. LOL

Or maybe not. That might be entertaining within itself I suppose.

But nastiness is not really entertaining, and not really productive either.

I’m just glad that nobody (at least not that I’ve noticed) has gotten up in my business for not living in California & commenting here. LOL

BTW: I’ve never seen any pro bubble sales B.S. nutball types myself, I’ve only heard other people mostly talk about them… or accuse someone of being someone who’s done that in the past. So is it something that used to happen quite frequently here??

I have seen charts many times on the web of different counties in Europe for housing prices. There were a lot of countries that were going up more than the United States the past 15 years. I think the only country that was way below the average for housing price increase was Germany.

This is probably first post to acknowledge US housing price is not crazy high in comparison to the rest of the world,and as an aggregate, US housing may not go lower. CA is a little different, and it has always been higher than the rest of the country. Those high prices in Shanghai and Toronto are somewhat funded by the same money from Fed reserve. Shanghai market is hard to understand, and essentially their purchase is a lease for 50 years or 70 years of the buiding, but the land is not included in the sale. Their country is totally less than 70 years old, and their one child policy will have some kind of effect. Their political system is also inherently unstable. That’s why a large amount of money outflow to Canada, US and Europe is seen. Those money outflow from China are going to real estate in large part, but only in selected markets. US housing is stabilized. the real bargain was two three years ago. There are still opportunities, but you have to keep you eyes open, and know your market and your neighborhood. If you see one, act quickly. The same is true for stock market. GE stock at $5 is long gone. People need to know crashing price only exists when it is a forced sale. There will be no crash when people drink their coffee and discuss the sale.

no one on earth can compare “the bubble” with what Alan Greenspan blew up come 2008. Housing was just the “tip of the iceberg.” you had THREE “securitization engines” that that guy blew up…mortgages, credit card and second lien…EACH worth around a trillion bucks! those markets have not suddenly “rematerialized” either, though the actual…ahem…”market”….for homes has apparently bottomed. The idea that there exists and endless store of liquidity to drive prices higher is every capitalists dream…but alas it is just that…a DREAM. Sure, you can make money flipping, you can make GOOD money contracting…but the only market that didn’t blow up was the treasury market…came close, nay…veerily “Uncle Gorilla Paper” soldiers on. while the dollar amount is not starting to come down from “extraordinary check bouncing heights” we’re still talking in the hundreds of billions. in the meantime “all assets are henceforth tied to equity prices courtesy of your Chairman and Happy Face…Ben Bernanke.” Enjoy it while it lasts folks!

My beef with this and other price-only comparos is that it overlooks one key factor: earnings/income. A key reason why the US and the UK got their fingers caught in the mortgage crisis was that housing prices were growing much, much faster then incomes. An annualized increase in real estate prices of 10-15% is not a concern as long as average incomes also rise by the same or more (and, yes – 10-15% increases in earnings/year – I’d like that, too 🙂 ). This relationship is a bit more realistic again here in the US then it was, but still a lot worse then 15 or 20 years ago.

I’d love to see some tables or charts showing the ratio of average housing price/average yearly income year-to-year for the places listed above, as well the key cities in the US discussed here. A notable increase in the cost/annual income ratio should be a good predictor of trouble to come.

Average per-decade income growth in America is on a bad trajectory.

1951-1961 = +45%

1961-1971 = +59%

1971-1981 = +112%

1981-1991 = +58%

1991-2001 = +51%

2001-2011 = +31%

http://www.ssa.gov/oact/cola/AWI.html

It’s really quite simple. Housing has bottomed in most areas as long as interest rates have bottomed. If the market forces the 10yr up to a more historic mean of 6-8%, watch out below.

I wish interest rates would just increase already; maybe it would force banks to release properties in anticipation that prices will fall. As long as the expected direction of prices is up from all this manipulation, they can take their sweet time. Sooner the inventory clears out the better. Little price jumps like in 2012 are similar to dead cat bounces; but once it falls below that blip again, I see a lot of people trying to cash out when they realize prices are not stable.

Interest rates in 2000 were 8%. Now, they’re 3.5%, a drop of 56%. The theoretical baseline $100k home 2000 has a $733/month PI and theoretical $144, whereas the theoretical home with 44% price increase from 2000 to 2013 has a $646/month PI.

Homes were either over-priced in 2000 or we’re in a mammoth interest rate bubble in 2013.

Well, the down payment isn’t going lower than the FHA 3.5%, and lowering the interest rate seems unlikely to reduce the PI by much anymore, even if it drops to 2% or something. We can keep increasing the money supply but I wonder how much of the coming drop in housing will come from inflated prices in other basic items; so not just ability to qualify, but the ability to support monthly payments when gas/food/etc starts to rise more.

Just feels like a bad future all around because the fundamentals are screwy and we lost touch with what actual value feels like with all these games being played. The most sophisticated wealth redistribution game in history, being played globally with multiple market bubbles? Or just a natural result of how we mismanage fiat money?

I generally think that housing should be 3 years gross income, and CA is permanently overpriced, but this is mainly around the metro areas I found. I’d prefer the market imploded all at once but I doubt it will happen so neatly.

In 1984 when the rates were hitting 17.5% for an ARM, we took the plunge into our first home. Eventually, we refi’d into an 8% fixed. (The cap was 5 points either way.)

In 1998 paying 7% (30 yr fixed) we upgraded to our McMansion. We were stoked at 7%.

Rates should truly be higher than 7%. The economy was strong back in 1998, jobs plentiful and salaries were good. Fast forward to now, and this engineered market is FUBAR in my lifetime.

AHA! “bad economy=low rates, good economy=high rates.” of course it doesn’t hurt to have it all denominated in dollars. i would recommend 10 percent of your home’s value be placed in gold at all times….then kick back and “wait for that Government check to bounce…again.”

13 Horribly Depressing Real Estate Ads

Dead on Arrival

Some have called the housing market the “dead spot†in the U.S. economy — but a seller in Raleigh, North Carolina, seems to have taken the concept literally.

Among photos of a typical living room and one-and-a-half baths, is a photo of, yes, a stained outline of a dead body.

Yet it seems that the scare tactic actually worked—the home sold at the end of June–albeit at just over half of its original listing price.

9-Worst-Recession-Ghost-Towns-in-America

Really enjoyed this blog post, is there any way I can receive an update sent in an email when you write a new post?

Here is another article on how Mumbai’s real estate bubble is on the verge of bursting. Infact, cracks have already started to show. Residex, the housing price index maintained by the NHB, indicates a 11% decline in the prices of the high profile Western suburbs in the Jan -March 2013 period.

http://stockmusings.com/mumbai-realty-prices-drop-in-western-suburbs/

http://stockmusings.com/mumbais-residential-realty-bubble-may-burst-anytime-now/

Leave a Reply