The rising inequality in the global feudal housing market: Big money devouring real estate assets at the expense of traditional buyers.

The traditional home buyer is tapped out. You have a massive number of young adults living at home with very little financial means for purchasing a home. It is understandable that after a recession, people need to catch their footing before moving out and making the biggest purchase of their lives. However, something bigger is going on here. Global pools of capital are chasing assets all around the world. Investors are devouring real estate in all areas of the world from San Francisco to Vancouver. The rising unaffordability in real estate is really a larger reflection of a rise in global wealth inequality. Contrary to what some people may think, having a massive middle class similar to what exists in the US is a historical anomaly. The default position for our modern day history is one in which wealth inequality is extreme and profound. The recent argument was that as economies grew, this wealth would eventually lift the standard of living for all. There is new economic research showing that this isn’t always the case especially went a rentier class emerges. In fact, this wealth gap is being fully visualized through real estate. Some analysts have been scratching their heads wondering how housing prices could go up while homeownership is actually falling. How do you have soaring home prices with household incomes dropping? The fact that investors are dominating in the housing market shows how large and powerful these big pools of money have become.

From owners to renters

The latest GDP report shows that the US economy grew by a weak 0.1 percent in Q1 of 2014. If you are in the business of deploying large pools of money, you will not be satisfied with that rate of return. The financial sector rarely had an interest in being actual property owners until the housing market imploded. As we noted cash sales from investors reached a record high in Q1 of 2014. Even for a well off couple coming up with $300,000 in cash to buy a home is going to be a far stretch let alone dishing out $750,000 or $1 million for a shack in higher paid metro areas.

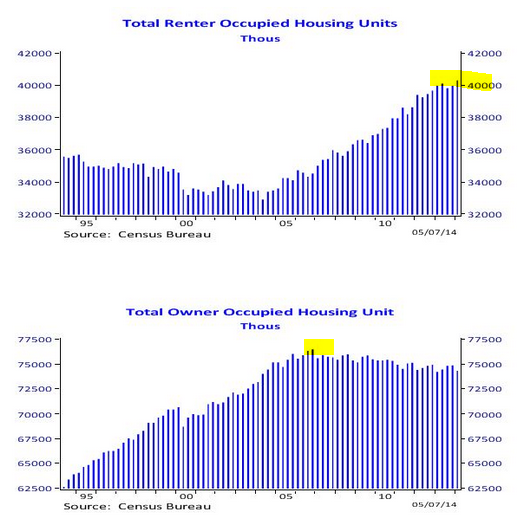

A trend that is showing this major structural change is by looking at the number of renters and actual owners in the US:

Since 2005, we have increased the number of rental households by roughly 7 million (a 21 percent increase). Interestingly enough, we have a foreclosure graveyard of 7 million over this same period. Owner occupied housing has actually fallen over this period. We are looking at close to one decade of data and we have fewer individual homeowners today than we did in 2004. But isn’t the economy in a full recovery? Didn’t the recession end in the summer of 2009?

Can’t afford to live on your own

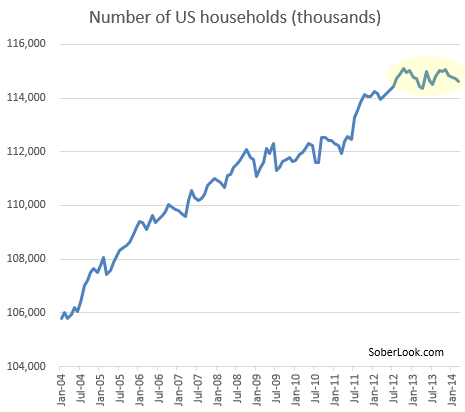

There is little growth in household formation:

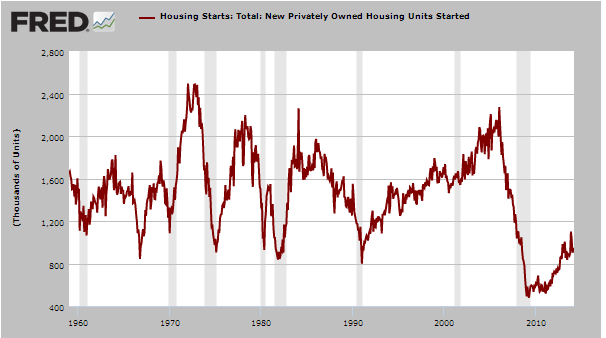

In previous recoveries, you would also see home building picking steam up but why build newer more expensive homes when the public at large is simply running faster and harder to stay in the same spot. Take a look at housing starts:

In better days, we would see more than 2 million housing starts per year. In this recovery, we’ve been doing our best to flirt with 1 million. As a country our population is growing but the young future home buyers, those Millennials are seeing weaker wages and many are living at home. There is also evidence that crushing levels of student debt are keeping some would-be buyers on the sidelines. Many baby boomers in more expensive areas are living in homes scraping by to pay the bills yet are watching areas globally gentrify around them. They have a million dollar ticket in their home but are unlikely to cash it in (possibly with kids moving back home or having no desire to leave the current market). That blue collar worker that bought in prime Pasadena in the 1970s and 1980s has no visible counterpart in this market. In fact, you can have a dual income family of professionals having a tough time out competing large pools of money from Wall Street to foreign buyers. Good or bad, this is simply the reflection of the growing global wealth disparity. Of course in tax happy places like California, when you have a larger and larger pool of renters seeing their standard of living decline, it is unlikely that low tax rates on a smaller pool of wealthy households will stay in place. The new buyers of today have the funds to pay higher taxes unlike the old families that bought and would be eating Purina dog chow if taxes went up one percent on their golden sarcophagus.

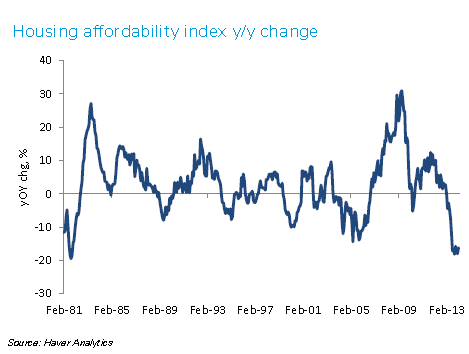

Housing affordability declines

The reason the market is dominated by investors is that regular buyers are cash strapped:

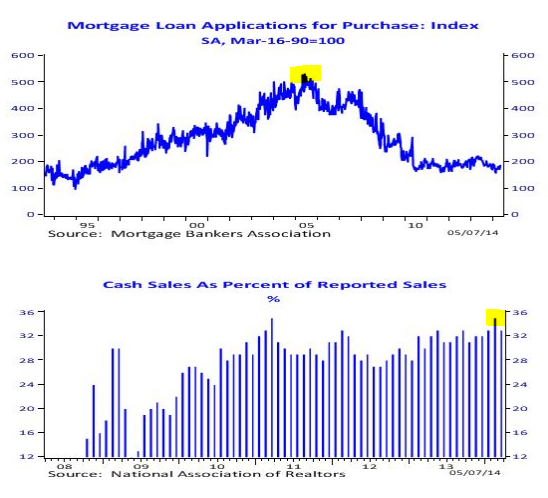

Rates going up modestly suddenly put a fork in regular home buyers last year, hence the record number of investors in Q1 of 2014. In fact, we are still bouncing at a trough of mortgage applications while cash buyers continue to dominate:

You’ll notice that mortgage apps are near an all-time generational low. You’ll see that back in 2008, cash sales as a percentage of all sales were closer to 12 percent (a healthier figure). Also, it is important to note that cash buyers made up over 42 percent of all sales (the data above looks at MLS sales and Realtytrac also pulls up auction sales that go off the books to larger buyers).

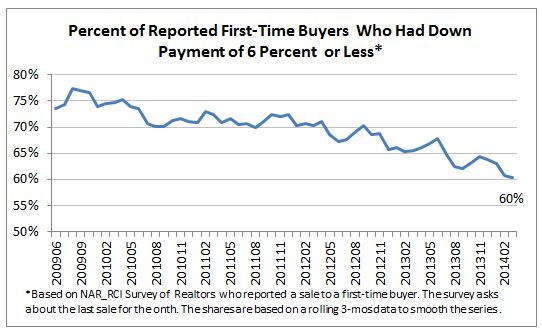

When we look at data like this, regular buyers are becoming a minority. Many of the “pent up demand†argument assumes first, that younger buyers have the means to buy. Second, it also assumes homes are affordable based on their income (which they are not). The global flood of capital is also based on access to leverage and easy money. Most regular Americans do not have access to this and their only means of buying is via a mortgage (with a paltry down payment). In fact, most first-time buyers put down less than 6 percent:

The only reason this chart has gone down is that first-time buyers have been pushed out of the market. I would imagine the first-time buyers competing today are getting assistance from parents or have the funds to actually buy a pad with a big down payment (not your typical cash strapped American).

What is troubling of course is that many of these investors are deploying capital thanks to record levels in stocks. Real estate prices are made at the margins. With this extremely low volume what happens when an inevitable correction hits? We already have data showing investors are slowly pulling back in certain markets. The stock market has had a fantastic run since early 2009.

In the end, it looks like things are reverting back to a modern day feudal real estate system. A growing rentier class and a boom in renters.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

103 Responses to “The rising inequality in the global feudal housing market: Big money devouring real estate assets at the expense of traditional buyers.”

Housing to Tank Hard in 2014!!!!

You may be right, but this IS true;

“Jim Taylor to blow hard in 2014”

Real Estate will only tank for the poor, the rich are doing fine and “Coming to America” for $500-700,000. Give us your poor, you huddled….SCRATCH, give us your wealthy, pay the American bribe to get a Passport.

America is run by criminals.

You’ve been chugging too much of your swill, swiller, if you think the rich will continue to be doing “just fine” when the masses come for their heads and everything they own.

“Vancouver real estate moguls unfazed by axed immigration program for millionaires.”

Canada this years started pulling back on their cash-for-visas program. And of course, most of these visas were going to wealthy Chinese. For those that are apologetic to this flood, don’t think these investors actually contribute to anything else than actual real estate:

“They report employment and investment income below Canadian averages and those of most other economic immigrants,†the budget document says.

“Over a 20-year career, an immigrant investor pays about $200,000 less in income taxes than a federal skilled worker and almost $100,000 less in taxes than one live-in caregiver.â€

So much for helping the local economy. Canada already took an active role cutting this program off:

“The wait list for the Immigrant Investor Program (IIP) has ballooned in recent years to 65,000 applicants, all of whom will soon have their application fees refunded.

Based on data obtained by the South China Morning Post and shared with Metro, about 40,000 of those would have been destined for Greater Vancouver over the next six years.”

Those thinking that an unlimited amount of money is going to pour into Culver City, Torrance, or any other wannabe rich market is going to get a surprise.

@ Jay I dont think there is anyone saying there is an unlimited supply of money headed into Culver City (“CxC” as the gangs call it) or Torrance or anywhere more than a few miles east of the the sand.

However, I think it is safe to say the home prices are not likely to crash. Could they drop 5%, 10%, 15% sure, but could they crash (defined as a 20% or more price drop) doubtful.

For those who purchased a home in 2011, 2012, prices have already risen more than 20%, so a crash means back to 2011 or 2012 prices….?

2 years ago, I took the Docs advice and purchased a home. But the key factor was my wife and I are both self employed, and did not need to factor in relocation as a significant concern. And purchased in a neighborhood we can live in the rest of our lives, completely foregoing the ‘move-up’ mentality during the prior bubble.

It may not be a good time to buy now, but those who bought in 2011, 2012 who have little risk of needing to relocate, and in a neighborhood they can live in for the rest of their lives are likely happy with their decision (and of course and affordable mortgage payment).

I hope the other renters who want to own a home can ‘figure it out’ as someone else posted this week. Most of these renters seem to want to live in SoCal, otherwise there is affordable anywhere in flyover country.

A selection of comments left on a good Canada house-price blog entry from April 2014 – I was trying to work out if there was anything in the ‘sellers fear buying’ theory.

Perhaps to many older owners of high-value homes considering downsizing, they may look at a listing of downsize property, (the asking price) and recoil physiologically. That reaction coming before acceptance they could perhaps get x2-x4 that price for their own homes; finding it difficult to accept it’s the reality (or temporary hyper-bubble unreal way) of things?

_______________

http://www.greaterfool.ca/2014/04/01/canuckistan/

~ Exactly. People don’t want to hear the truth. They just tune out. Doesn’t change the facts, however.

~ I am getting so sick of this crap. The debt pigs seem to be getting further ahead while the prudent savers are falling further behind. What a bizzaro world we live in!

~ Active listings are below historic levels precisely because prospective sellers fear buying. Would you buy your own house today at market price? — Garth

~ Almost got my coworker mad enough to fight me today. It was totally innocent on my part. I know he was in banking before so I asked him why he has four mortgages? That led to bickering and then outright fuming and if I hadn’t stopped I bet we would have scuffled. I asked him if it makes sense that real estate will always appreciate in value. He said yes. Then I asked him if that means that the dump I just sold would one day be worth a million dollars. He said no. So then I said “I thought you said it would always increase in value†and then he was like “people can afford a million dollar mortgage because the wives also work now.â€

~ I used to get in those kind of fights with co-workers about religion. The real estate bubble is no different. you can’t convince them otherwise no matter what you say, their convictions are irreversible until the bubble actually bursts.

~ There is no shortage of listing in Ottawa. In fact there are twice as many listings now as three years ago. Hundreds of homes listed for 600K and more in the suburbs are not selling. Many have been on the market now for three to four years with no one knocking on the door……. Condos are just as bad. Hundreds for sale, but no takers….. will the market improve? for the seller, no. Prices will crash, eventually, when owners realize there is no way but down….

Jay – “Vancouver real estate moguls unfazed by axed immigration program for millionaires.â€

What/Who/Where is this quoted from? Some article or study? I agree with your premise that the whole “rich Chinese will save house prices” meme doesn’t make sense. I suspect that Chinese “investors” are actually mostly speculators and so far have not been able to find any empirical evidence to support or dispute this. We here anecdotes galore (the usual having to do with citizenship) while there’s a big black hole instead of data to know for sure what the motivations are.

Brain – “I used to get in those kind of fights with co-workers about religion. The real estate bubble is no different. you can’t convince them otherwise no matter what you say, their convictions are irreversible until the bubble actually bursts.”

So true, as evidenced by the comment from QE abyss, above. It’s always so apparent when they bring their personal set of circumstances and decisions into the debate.

“With this extremely low volume what happens when an inevitable correction hits?”

Golly Doctor Housing Bubble, I believe that the all powerful wizard of Fedoz would make sure that we never have a correction. I think we all need to think positive and everything will be awesome!!!

What?, you never replied to me last thread in regards to whart home ownership means to me. Kill the “sarc” and gimme your real take 🙂

As far as this thread I’m a bit disheartened at the Doctor’s “feudal present/future” meme. you cannot have a true feudal system in America’s Political/Economic system. Contrary to so many twit’s hopes the FED is not all powerful. They have been losing their arm wrestling match with the invisible hand since 2000, more probably 1980. Reganomics tried to create wealth out of thin air and all it did was triple the debt and lead to the S&L crash. The only thing that ended that recession was the Tech Bubble, then it popped. Housing Bubble 1.0 pulled nominal GDP back up, and then it popped. Housing Bubble 2.0, the Student Loan Bubble etc, make up the Great Credit Bubble that is about to pop. Each inflationary cycle produces less and less of a benefit and is concentrated amongst a smaller few. Eventually the rentier class realizes there is no one to rent to. There is no Neo-Feudalisim to come from this, only the inevitable reset we’ve been putting of since 1987 (thank you Greenspan, you fuck).

The world is burdened with M A S S I V E overcapacity. A deflationary correction that increases the 99%’s spending power is the ONLY SOLUTION to this economic fact. The FED knows this and Aunt Janet traded the honor of being the first female chairwoman for the disgrace of helming that criminal organization while the paper wealth of so many is destroyed.

THEIR IS ABSOLUTELY NO RISE IN REAL WAGES COMING FOR THE WORKING CLASSES. IN THE ABSENCE OF THIS A CRASH IS A MATHEMATICAL CERTAINTY.

You’re aspiring feudal overlords will learn this soon enough while the real criminals of the banking class will move on to exploiting Africa or whatever other place remains for credit creation to maintain their power.

What is it going to look like when the credit bubble pops? Serious question…you seem to know what you’re talking about…what is it going to look like?

I really can’t disagree with anything you said but I learned a long time ago that I can’t change the world so I just adjust the best I can. I would caution on defining happiness as “ownership” of some random asset. I remember some time ago that there was a study of dying people’s top five life regrets. You know none were to do with a house or a promotion or a task at work. So, I always ask myself if this is something that I will regret on my deathbed. So, if you don’t get to buy a house this year is that something that will haunt you on your deathbed?

RE:What?

I don’t need one this year, but it is a life goal. To be accomplished when I am able and it makes sense to do so. I’m not talking about a “random asset” , but a home. Where you invite family to enjoy a rec room you designed yourself. Or to landscape a back yard with plants and vegetation. To know on your deathbed that you left a tangible piece of your life’s industry to your heirs. That’s what making a house a home means to me.

“To know on your deathbed that you left a tangible piece of your life’s industry to your heirs.”

Heirs prefer cash! 🙂

What, Nihilist is right. A house is not a “random asset.” The right house is peace of mind. Tranquility. An oasis away from the maddening crowd.

I hate condo living. I hear my neighbors on the other side of the walls. I must hustle and jockey to use the communal washer/dryer. I can smell my neighbors’ cooking.

This building has a ton of HOA rules, which people are always breaking, and complaining about other people breaking. This building has no central air conditioning most of the year (it’s either heat or cool air, and they don’t switch to cool until June, usually), yet I am forbidden to buy my own wall unit, because the HOA fears that they’re unsightly, and thus will lower property values.

Condos and rentals come with rules. Owning a house, much less so.

Even so, my crappy condo, with thin walls, has a ridiculously high Zillow estimate because it’s on Ocean Blvd. in Santa Monica. I can see the Pacific from my balcony.

I love Santa Monica, and I’d hate to move away. But I probably will, because I can’t afford a house in Santa Monica.

What good end would come of increasing the spending power of the 99%? What would we do with it? Buy more crap that we don’t need? Take trips to places where the indigenous people would only dream of what we currently have? Consume more?

No, we should not be allowed to do that, we haven’t earned the right to consume the world. I find the repatriation of USD into residential real estate to be comical. Who could have ever thought that the money would come back? I mean we bought all this cheap junk for years, but they should not be allowed to spend the money on American assets. Now that is comedy.

Massive over capacity, to be utilized by increased spending power. No, what is happening is fine. Consumption by the masses should be suppressed if they are not creating sustainable productivity. Maybe, just maybe something will be left on the table for future generations if we don’t allow for the 12 year old watching keeping up with the Kardashians to convince daddy to buy her that fifth iPhone.

“What good end would come of increasing the spending power of the 99%?”

Let them eat cake!

RE:SAKMAN

“Massive over capacity, to be utilized by increased spending power. No, what is happening is fine. Consumption by the masses should be suppressed if they are not creating sustainable productivity.”

It’s this type of statist bullshit that really pisses me off… It’s not your fucking job (or gubment’s) to suppress anybody’s spending power. Yet this is exactly what bullshit Free Trade, fiat inflationary thievery, immigration insanity and a wholly corporate owned federal government have done to the working class. In the absence of those 4 factors you wouldn’t even need a minimum wage. We’d have the same purchasing power we had in the 60’s before we went broke fighting Vietnam.

People like you make me sick. So quick to judge what other’s should or should not have and all to willing to let .gov do the dirty work for you. If society moved to anarchy tomorrow I don’t think you’d be so quick to tell others their labor should not earn them quality food and shelter. If you did there would be no .gov enforcers to save you from the hungry masses.

Wow, NihilistZerO! What a great post! When was the last time America actually saw balanced growth: imports/exports/stuff people actually would buy? Was it 1968 just before the recession? I don’t count the Reagan hocus-pocus years as one of those times either. That was just a desperate attempt to get out of the 1970’s by making people “feel good.”

“Heirs prefer cash!”

And that’s the problem What?, common people have lost their sense of legacy and place in time. Unfortunately the oligarchy’s heirs have not, thus our current predicament. I expect better of my lineage.

“A house is not a “random asset.†The right house is peace of mind. Tranquility. An oasis away from the maddening crowd.”

Which is why nobody is buying. What better way to get away from all that madness than by putting yourself at minimum 500k in hole? Needing to plunk down even more to make your shack livable condition. Having no control over who buys the shack 10 feet to the right or left of yours. Taking fewer vacations to really get away from the madness. Sounds like a dream.

I know there are good homes out there, but lets be honest, 99 percent of them aren’t even close to realistically priced for a stable economy and are massive financial traps. Its not even just about your own finances. I nearly bought in what is hyped as an “upcoming neighborhood”, but decided against it looking at the economy. Yeah, sure I may be fine, but what about the neighbors?

9 out of 10 open houses I’ve attended for the past 5 years are unoccupied homes and that speaks volumes to me.

You are pal what your screen name says… ZerO???

“The fact that investors are dominating in the housing market shows how large and powerful these big pools of money have become.”

That’s what I’ve been saying all along. More people have more money than anything that is “reported” by graphs and inaccurate statistics.

Yesterday At Mother’s Day function, someone mentioned that someone else had just bought a house, and I said, ‘wow’, they bought at the peak of the bubble.’ And my niece, a 40 year old real estate saleswoman said to me, ‘So, you bought into the hype? I laughed and said, ‘yeah, I sure have,’ and wisely, we both left it there.

Most likely like many events in the world the powers to be decided long ago that America must come in line with the EU and realize not everybody will get their dream of owning which is the EU way of homeownership, upper middle to rich will own, everybody else is to rent?

Look at wages ,cost of living etc. this line of thinking and pressure is exactly what America did, homes will be for the upper end of society which is happening right now in this country.

What’s missing from your analysis I think, Doc, is the question of what the “big money” in your equation will DO with all of this property? Can’t really sell it (unless it’s to other big money). Can’t live in too many houses at once. They can try to rent it but the return on rentals in SoCal is, generally speaking, pretty terrible.

So even agreeing with your hypothesis above (big money pushing normal middle class buyers out of the market)- I have to wonder what you think the “big money” is going to do with all of this property that they are gobbling up? (side note- how many of the Chinese investors that are buying in Irvine ACTUALLY live in those houses??) Are we going to have a nation of absentee landlords? Empty dwellings that no one can afford?

As you point out so often- these are not “stupid” rich people- so what’s their end game?

Perhaps big Wall Street money has an accord with the banks – maxing out real estate, and complacency of individuals in the market; both buyers paying crazy sums, and complacent older owners sitting on homes worth fortunes. Wall Street is only buying up a trace fraction of the total market, after all, at the market. And isn’t it their investors on the hook for it anyway?

There’s a certain thing called “SMOOTHING” in sectors of UK financial (equity/pension) type services, giving a current value on a portfolio – where future equity/value position may move further and further out of line with the “unsmoothed” value, necessitating a sharp correction at some point in the future.

It may somehow suit the purposes of big participants (Wall Street + Banks.. but certainly not individuals getting carried away into the buying frenzy) to long smooth out their own position now, when exposing themselves to buying at high prices, even when they suspect (or plan for) a whole-of-market crash down the line. Depending upon their exposure, but even then, they’re getting a rental return (mostly), and will be able to sell out part of their position into a crash, whilst Wall Street attracting money from real-estate total believers, and creaming off investor fees/bonuses on current ‘returns’.

Then all the upside of a whole-market crash, with banks lending to younger people coming through to buy crashed value real-estate. Houses owned outright or by the highly-equity rich is “dead-money” for the banks. My bet is that they’ll want to get volume number of new mortgages on houses into the future, even if it requires crash value houses. 30 year mortgages 5%+ is huge money for the banks, in volume.

However I might have veered a bit too far into fairytale market theory, and it might NOT all be a massive pump-and-dump operation, with complacent older owners not even willing to sell at massive fortunes, and hyper-crazy “”Want a home” “It’s gone up so much, it must go up more in the future” “Look at the population growth – not building enough houses” real estate mad individuals buyers in this current time gobbling up massive mortgages… with Wall Street and the banks standing ready to see how they withstand a true hard free-market in the future.

The average college graduate now leaves college with $29,000 in debt. In a recent survey 85% of graduates said they did not have a job lined up after school. How long do you think it’s going to take them to pay off their student loans and then save for a down payment? With household formation plummeting, the entry-level real estate market is frozen, with no trickle up to higher-priced home-sellers.

Meanwhile the size of the labor force is shrinking and wages are stagnant.

In desperation, the banks are lowering mortgage rates and loosening credit standards again, trying to keep the party going.

Does this sound like a good time to buy a piece of real estate? Hell no. After 2016, the new president — whoever it is — will let everything crash again, and then take credit for re-building it.

I’m staying on the sidelines, happy to rend and put my money to work elsewhere.

“After 2016, the new president — whoever it is — will let everything crash again, and then take credit for re-building it.”

Had to call you on this BP. The “President” isn’t gonna let shit happen. Whatever Oligarch puppet is installed will have ZERO control over the coming crash. Besides we haven’t had a real president since Kennedy.

I’ll offer you one caveat. One term of Rand Paul with some carefully crafted executive orders MIGHT change things…

NZO, at the end of the Clinton administration we had a giant bubble that burst just as Bush took office (NASDAQ, internet new money, etc., all tanked). At the end of Bush we had a giant bubble that burst just as Obama took office (real estate, sub-prime finance, eventually all of Wall Street).

Watch for it in 2016. Whichever party is in office pushes every button to grease the wheel, but you can’t run forever. In this case we’ll have low interest rates through most of 2015, but as soon as rates rise, including mortgages at 5.5%-PLUS, we’ll head back into recession for a year or two. House prices will tank.

The current economy is on life-support. None of the fundamentals are solid. Watch for a re-set at the end of Obama’s term.

Word of the week – Demopublican. Please use in a sentence…

“None of the fundamentals are solid.”

How do we know? They keep changing the math so there is no way to have comparative analysis… Employment, GDP, DOW, etc. is impossible to measure over time because the measuring stick keeps changing…

One of the things people constantly overlook is population growth. In places like SoCal it is constant and relentless. Couple that with policies that limit supply and prices can only go one way.

There are quite a few very nice areas in this country where you can buy a perfectly good home for under 50k. I always find it odd that the herd never deviates from the madness of the crowd. I can’t imagine why anyone who would like to own a home one day thinks living in California is a good idea. It just goes to show that poverty is a choice.

At least its a dry heat, right?

Poverty can be a choice. As a SoCal native, I was shocked to learn of how cheap homes were elsewhere. For a long time the in laws tried taking us into moving by them (eek!). They kept showing me home prices as a carrot. This all fine and dandy till you figure out there’s nothing in my job field that pays well enough to do it. I would simply be moving across and losing out on the weather.

In my case maybe not all, there’s a reason those prices are much cheaper. Having said that, I can’t explain SoCal. There can’t be that many doctors, CEOs, drug lords, and lotto winners around.

I meant noting in my job field out of state.

I meant nothing in my job field out of state that pays well enough….

“There are quite a few very nice areas in this country where you can buy a perfectly good home for under 50k.”

If they were such “very nice areas”, more people i.e. “the herd” as you call it, would want to live there, and the prices would not be under $50K for very long. But the grass is always greener…and those “very nice places” undoubtedly have severe issues causing their pricing to be so low. It’s all a matter of supply and demand.

“I always find it odd that the herd never deviates from the madness of the crowd.”

There is general safety and security (and very often profitability) in numbers and in the herd mentality and the madness of the crowd. Not that it can’t lead to widespread suffering and pain for most if not all of the entire herd/crowd, but unlike the go it alone rugged individual buying that $50K house out in the wilderness, there will be a greater fool to come along ~99.99% of the time when it comes time to sell. Out there in the no man’s land of $50K houses, there is again a very good reason or host of reasons that they sell at $50K or less…

“If they were such “very nice areasâ€, more people i.e. “the herd†as you call it, would want to live there, and the prices would not be under $50K for very long.”

In other words, a location can’t be considered nice if it’s not crowded and expensive. Urban elitism. For all of the things great about SoCal, this ugly and oft-unmentionable mentality is in high supply here. Can’t see beyond their own shortcomings any more than the folks they label as being in “fly-over country.”

Population growth doesn’t push up real estate prices, IPFreely, even in SoCal. All that pushes up prices, is having active buyers and seller, transact at higher prices. Values/prices are set at the margin. As Doc in this entry says.. ***Many of the “pent up demand†argument assumes first, that younger buyers have the means to buy.*** and it would not surprise me if we’re nearly running out of upsizers willing and able to meet current asking prices. Prices can also cascade quickly in a market panic, when sellers and buyers agree much lower prices than surrounding homes had sold for in recent past, and bring out more owners to market.

_________

Elliottwave: Asset prices rise not because of “buying†per se, because indeed for every buyer, there is a seller. They rise because those transacting agree that their prices should be higher. All that everyone else — including those who own some of that asset and those who do not — need do is nothing. Conversely, for prices of assets to fall, it takes only one seller and one buyer who agree that the former value of an asset was too high. If no other bids are competing with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to disagree with their price. Financial values can disappear through a decrease in prices for any type of investment asset, including bonds, stocks and land.

http://www.elliottwave.com/freeupdates/archives/2008/05/02/Bear-Stearns-Explained-How-Financial-Values-Can-Disappear.aspx

Figure it out. Population keeps rising in SoCal. That means more demand. Then, not many new homes being built. That means less supply. Econ 101: More demand and less supply means rising prices. And, that is exactly what you have. Don’t waste your time trying to explain away this fundamental.

You should be spending your time figuring out how to make the right investment in real estate. Even when prices are rising and should continue to rise for some time, it is easy to lose money by purchasing the wrong house.

Another way to lose lots of money is by waiting until prices drop. Eventually that will happen, but not until prices skyrocket higher. You may never see prices this low again, even in the next drop.

Brain, jt is right, the supply is being actively restricted here in SoCal to match up with the historically small amount of demand. There’s so many people still not paying their mortgages here so the normal foreclosure process which would liquidate said supply is being held back. The shadow inventory issue has not been resolved. I guess everybody either forgot about how the rules were changed by the Fed and state governments or they think this is the new normal.

jt – If only SUPPLY + DEMAND = PRICE was always correct. It isn’t. When prices plummeted in SoCAl in the 1990’s, there were probably plenty of people who wanted to buy homes then too.

There could be plenty of demand, low supply of homes and prices could still drop. Why? People can’t afford to buy and sales will slow down. When sales slow down, prices will drop in order to get people to buy again.

I can ask whatever price I want for my stucco box in Compton. There may be a few that want that stucco box. No one’s going to buy that stucco box until the price is in line with the market.

Where, WHERE are there “very nice places in this country where one can buy a home for under $50K”. Please name some by all means.

JT wrote: “Figure it out. Population keeps rising in SoCal. That means more demand. Then, not many new homes being built. That means less supply. Econ 101: More demand and less supply means rising prices. And, that is exactly what you have. Don’t waste your time trying to explain away this fundamental.”

…and the rest.

We’ll see who ends up on the permanently wrong and wounded side of this equation. It’s me for now, but together with my 2 brothers and sister we’ve saved up an arsenal of non-leveraged money, with the expectation of a massive house price crash. Population growth = demand = rising prices = Econ 101. Guess what, there was demand in 2008 as well. It’s all about what people can and will pay for houses. “Buying is dead money” as us renters say.

People want to believe things are as simple as supply and demand. Simple concepts for simple minds.

For instance, there are many inputs into demand. Credit is one of those inputs and it shouldn’t take a lot of imagination to know how that can affect demand. Population is only one input of many. We can have an excess of people in a given cohort but it doesn’t necessarily mean that each of those people are productive or bring an equal amount of value to the table.

As for supply, shadow inventory still exists in SoCal. Nobody knows how long that situation will continue or what the next possible phase change will consist of. What we do know is that it’s without precedent which makes it difficult to make reliable claims about where supply will be in the future.

Here’s a house listed at $49,000, in Salton City, CA: http://www.realtor.com/realestateandhomes-detail/950-Lido-Ave_Salton-City_CA_92274_M20895-27523?row=8

There are cheaper ones. This house was listed at $11,000, but it’s Pending: http://www.realtor.com/realestateandhomes-detail/1619-Desert-Air-Ct_Salton-City_CA_92275_M17385-17988?row=1

Original person said “VERY NICE places where homes can be bought for under $50K.” Are you telling me the Salton Sea area is a nice place? Might as well just buy a few blocks of rundown Detroit suburbs…

“The rising unaffordability in real estate is really a larger reflection of a rise in global wealth inequality.”

Myth! The rise in global wealth inequality is irrelevant to home prices. It’s all about local median incomes! That’s why prices in Culver City are mythical! Look at the rolls! The median income for Culver City is barely over the median for LA proper! Growing wealth of the 1% has nothing to do $800k crapshacks in CC! Exclamation point!

Wrong! It is all the rich Red Chinese monies out there that buy those how-zezezez. The “Illegal” Mexicans have something to do with it as well but I can’t remember what… Oh yea, don’t forget the “they” that are in complete control and will be able to control it fo-eh-vah!!!

We are, at this time, selling our home in Silicon Valley. It is actually on a very large lot with about 2700 sq ft of living area. Its in great condition and has many amenities. During our first open house, which lasted for about 3 hours, there were approximately 50-60 potential buyers looking at the home. We estimate about 150+ people came through the home. It was pretty crazy. From what I can tell, anecdotally, the article here is absolutely on the money; if you can handle a pun. Pay attention. We’ve been here about 25 years and are sizing down. We are surprised at the overwhelming amount of interest generated. I have followed the Dr. Housing blog for the interesting commentary and once again, this article is right on. Of course, we hope the market holds together until we relocate out of the area. I spoke with one potential buyer and she told me she has recently bid on 6 homes and lost them all. The last one she tried to buy she bid 50 thou over asking and still lost the nearby property. We’ll be reviewing offers on our home shortly. It will be interesting……

It’s a great time to sell. Congratulations will be in order soon!

The market is hotter than ever in the Bay Area.

@Deano, the Bay Area is the ultimate Ponzi scheme. Think about it. Companies with negative earnings, infinite P/E ratios and nose bleesd stock valuations churning out paper millionaires who fleece naive investors into thinking their vaporware has value. Then these Silicon Valley companies crash under their own profitless weight. And the employees then move on to the next Bay Area company/stock market scam.

They better hope no one wises up to their Silicon Valley Ponzi schemes (aka next hot high tech company)…

Be sure to thank Ben Shalom for your windfall. If not for a world awash in liquidity to throw at tech IPOs you would not be making out as well as you are. Not being bitter or judging and by all means congratulations on timing the market. But a wise person never confuses good fortune with keen insight or skill. Not to say that you are doing so 🙂 And again congratulations! Hope your next home is a comfortable one.

It’s not just Ben Shalom. Alan Greenspan begat the current mess in cahoots with Ben by refusing to turn off ZIRP. Before ZIRP, investors could get 5% to 7% interest on savings accounts, certificates of deposit and money market accounts. In the Greenspan/Bernanke/Yellen world of ZIRP, they get nothing so they chase after real estate and stocks instead.

No need to be bitter. Let’s see who is bitter when curt’s house triples in value over the next three year! We all know that how-zing can only go up! 🙂

Could we refer to him as “the Bernanke”? It would be clearer and avoid any anti-semetic undertones. Unless that is what you were going for, then by all means continue. I had to look up the name because I had no idea who you were referring to.

I thought Shalom meant goodbye. It is actually his name. We are in strange times if using a persons name is considered racists. I guess we can’t use the “W” for George W Bush anymore as a way to identify the clown… Sad… I say W at least a couple of times a day myself and it will be very hard to break that bad habit.

Do you disagree that it would be clearer to refer to him by his surname?

What is the point of indicating a person by using a middle name that very few people know? Is it to provide us with more information regarding a man who just left his Chairmanship?

When I saw it I immediately thought, “Oh, he is a Jew”. Why convey his Jewishness? What is the point of that? Here let me connect the dots.

Nihilism–>Neitzsche–>Nazi Philosophy–> Hate Jews

Evil Banking Empire that NihilistZero Hates –> Hate Jew Bankers

You are suggesting that it was just another useless comment by NihilistZerO. If so, I can agree with that.

Don’t be overly complacent by amount of viewers all being “potential buyers,” and even if they were, when sentiment changes… they can disappear. Good luck though, as I would have thought you’re on the smarter timing of things, downsizing now. Bring out the smart downsizers to market. In theory high prices should bring out more supply, but way too many owners are complacent, expecting even more house price inflation wealth. No forgiveness into the crash.

Beach areas of SoCal are hot. Case in point. Fixer at 315 Aliso, Newport Beach. Last I heard, 10 offers with more expected at the cutoff.

JT, you made this comment above: “Population keeps rising in SoCal. That means more demand.”

This is a totally wrong statement. If the supply is one house, if you have a billion penniless people who desire that house greatly, the price is zero, not a million. A high number of penniless people do not constitute demand. It is better to have 2 millionaire competing on a house than 30 million people with no money.

I hope that the explanation is clear enough for you to realize that a large number of people would not constitute DEMAND. Otherwise, India with over 1 billion people would be very rich indeed. Also, Switzerland, with a fraction of India population would be very poor because of low demand.

That’s hilarious flyover, and it’s also the exact point I was trying to make.

Curt, refuse ALL first round offers and tell them all to come back with the best and final offer…the dotcom funny money crowd are such suckers you will probably get multiple offers at twice your asking price. A fool and his money…

Claro que si!

OK, here it is Tuesday PM and the potential buyers keep coming through. Its pretty crazy. I know this interest can’t last forever and I hope to sell at more than asking. As I write this I am talking to people going through the home and there are more to come tonight. My realtor says there is one offer pending. There was an article in MarketWatch regarding real estate in San Jose. Its pretty amazing:

http://blogs.marketwatch.com/capitolreport/2014/05/12/the-typical-home-sold-in-san-jose-would-buy-12-5-in-youngstown-ohio/

I am primarily a stock market investor and as such I realize this current mania can’t last. I will not hold out for the potential top. This home will be sold to a buyer with reasonable offer and that can perform. We actually own another home in the Napa Valley and will be moving there. That home is half the size of this one and in a beautiful setting. I really don’t care if this one goes up further as we are still invested there. So let’s see what happens…

“I really don’t care if this one goes up further”

OK, now you’re just rubbing it in!

Brilliant article again, if only we had a crystal ball to see 12 months from now.

One good point mentioned above is what happens when the investors change their tune about real estate and they will for sure at some point, the question is will it be the heard mentality of dump and run just like they do in the stock and bond markets, or will it be different this time……this could make 2007 and 2008 look pale in comparison if you really think about it….when the market changes there is always an oversupply of properties, last time it was REO and short sales due to bad loans and people over extending themselves, before that it was the savings and laons fiasco… next time it could be the “The great investor and institutional property collapse”…. in a changing market it could takes months to sell and do they have the patience for that? I think not!

Real estate is not liquid if they need their money in a hurry.

“if only we had a crystal ball to see 12 months from now”

But… oh never mind…

If the banks dont have to process foreclosures and homes are being bought with cash, any correction will be pretty small.

“If the banks dont have to process foreclosures and homes are being bought with cash, any correction will be pretty small.”

As long as there are still cash buyers with it’s time to sell.

You believe you have a say, when you really don’t. The Bilderberg group is meeting within the next few weeks; such powerhouse people meeting that refuse to release what their discussions are about. It’s laughable, some of your arguments.

It’s the Baby Boomers! No it’s Generation X! Now, it’s the beats that are being raised now! It’s the Democrats! It’s the Republicans! It’s the Chinese! It’s the illegals! It’s the blacks! It’s everyone else’s fault!!!

Lol, how naive of all of us. The Walking Dead, of sorts. Tunnel vision for the nearly blind.

The few elite in power dictate what happens to every single one of us. You’re a slave if you make minimum wage and ur a slave if you make millions, albeit a slave to different things.

We have all the power, but were to greedy and self-serving to realize it. Things are going to get much, much worse. And the culmination of all of this greed, is the Earth purging us- its parasite. We are as much to blame as all the bankers. The writing is on the wall. Times are bad, but they are about to get horrifying.

What will you do when you realize that all that paper you sacrifice your life for, is a simple illusion?

Actually,

I have the money.

I just lack the stupidity necessary to buy a 3/2 snout house 5 feet from my neighbors on all sides for $750k.

I’ll let you know when I gain the idiocracy necessary for that purchase.

“I have the money.

I just lack the stupidity…”

Hey there are plenty of commenters on this site that can help you on this!!! You know what they say about a fool and monies!

Donny,

I am in exactly the same boat but weary of the constant arguments with my xx. Someday someone will do a study of gender roles in the housing bubble and it will anger a somewhat large and extremely vocal group.

dave, not sure if you were reading this blog back when “blert” was posting, but he essentially espoused that women were mostly responsible for RE mania. I have to admit, I never thought about it before it was mentioned, but then I started thinking a lot about it, and even after a short period of observing, I think there could be something to it. I’m reminded of the realtor.com commercial someone posted recently. In that commercial, it’s all women, being annoyingly cat clawing over stupid superficial bullshit. Maybe you guys are right.

DonnieJ…that is a choice many Cal folks have been up against for years. I can remember my wife and I looking at property by JM PETERS back in 83′. 5ft lot line and 18ft back yard from the 500’s unheard in that year, but he sold them all in 9 months.

Today I ‘m thinking at least $1.2m on resale, the lots can’t grow the pool of buyers does, because of Cal sheer size of population and demand?

Doc, it’s pretty simple really. Many of the traditional buyers who have enough for a down payment and enough income to pay for (and qualify for) a big loan, and a stable job…do not want to overpay for a house, and they sense that this is another bubble forming before their eyes. And it is partly about incomes. Forking over 1/3 of your gross for a house is one thing, but incomes haven’t gone up (like other things have, e.g., health care premiums, gas, food, etc.) so buying a house in the ‘hood of choice would mean forking over 1/2 of one’s gross income (these are ballpark figures but are accurate for me). But more importantly, taking on a mountain of debt never looked so scary, as we peer over the edge of the horizon at the future of the economy. The house of cards seems to be about to cave in again. The Fed can only do so much. I am not looking forward much to what the economy in tatters will look like and I have no plans to “swoop in” and feast on the rentiers’ carcasses and buy a house. But when the prices have become this detatched from incomes, buying a house simply isn’t alluring anymore (and the risks of financial ruin via taking on a mountain of debt have never been worse). Seems to me that we will be heading south in a big way right around election time in 2016 if the muppet masters can continue making hay while the sun is shining (time to rehypothecate something new today). Until things really correct and reset, it really isn’t the time to be pining away, dreaming about all of the “benefits” of homeownership, unless you are ready to face the reality of possibly losing it all if this construct falls apart.

BAR –

You are spot on about uncertainty not only creating a big headwind for the housing market, but for the whole economy. Everyone knows deep down that the economic patches implemented at the end of the Bush administration and carried on with steroids during the current Obama administration has not provided a sound foundation for future economic growth. The odds of another even larger crash seem to be on par with the odds that the economy will somehow stumble its way forward.

Taking on the risk of home ownership at current prices and in today’s economy is a dicey proposition. Real estate prices in California’s coveted locations has always been expensive. Those who keep hoping that housing prices in these areas will come down to an affordable level are simply not being realistic. Better to accept the reality and adjust one’s life accordingly.

Well said. On a home purchase in SoCAL, I have enough money for the banks to extend credit, but personally it would require too much debt. I can’t sign on the line when my future job situation is in doubt. I am not particularly scarred about the future. I just wish owning a house would be part of the solution and not the problem for my personal finances. It is not as if I want to “fight the Fed”, but why do they want to pick a fight? Will they be happy when they weed out the very last saver through a program preventing deflation for the last 80 years.

The problem with the logic of “I won’t buy until”: My job situation is secure; Prices come down, etc. is that all of these conditions may rarely be satisfied simultaneously. In my job in the SoCal Aerospace industry I have NOT been under some threat of layoff for about 10 of the last 25 years (and most of those 10 years were during the most ferocious portions of one or another housing bubble). This is not too surprising since boom times for employment are when many others will likely be thinking of buying a home as well.

I’m not saying your prudence is incorrect, but simply that you may be setting near impossible conditions for home purchase. Never buying may still be the right choice, but recognize that it is the choice you may be making.

Many, perhaps, but not most. The housing blog nerd sect isn’t exactly representative. Even intelligent, capable, financially literate professionals don’t do deep dives on macroeconomic, global finance or socio-demographic cross-currents that effect real estate prices.

Remember, human beings are intuitive beings first and foremost. Our rational mind just serves to articulate our hopes, dreams, greed and fears.

What’s “too expensive” for most is what they cannot afford in terms of monthly nut. Always has, always will be.

NZ is your typical house buyer…believing that a house is not a home without ownership. If he had a baby on the way, I doubt his rational mind would last too long over other, stronger house horny powers.

Housing does not need to have such high profit margins and places for so many non value added middlemen. Brokers, makers of derivatives, realtors, millionaire CxOs in publicly traded construction. Corporations etc can be replaced by machines. The Amish and Mennonites build quality houses in a week or two without that crap.

It doesn’t HAVE to be only for the rich if we can redesign the means of production in a LEAN manner. It’s a question of political will. Do the people have any?

Mennonite build

**PIVOT ALERT**

Due to inventory increasing, slow sales in the face of nicer weather and investor demand pulling back, we are now going all in on foreigners buying everything not nailed down in cash.

We had extreme inequality in the early 1900s, but housing then was affordable. The main factor, in the US, California in particular, was population density. We don’t read about that very often.

Our population has increased since 1970 entirely as a result of immigration – immigrants and their descendants. The 1% lobbies (over one billion $) for more cheap labor, and the working class gets screwed.

Was it affordable?

I guess if you count living in a boarding house as the host or the tenant.

New York City tenements in the 1900s were reported to be small, squalid, and filthy. Filled mostly with immigrants, city tenements in the 1900s were not unlike the immigrant clown houses of today.

So in a sense, we are reverting to the way things have usually been.

Even if you have enough for a decent down payment, stable job, what you can buy with your income is a dated little stucco shack that needs a complete over haul. Some people are not buying because what they can buy does not suit them. Younger people cannot buy starter homes because they can’t afford it. Older wealthier couples don’t want to sacrifice everything for a crappy piece of shit house/neighborhood. People are fighting for scraps at the lower price ranges. Not a lot of good decent homes at the lower ranges. You have to resign your self for dated and ugly or more money to remodel.

And?

San Diego inventory up 82% YoY, while at the same time, Median $/sq ft is up only 1%. Get ready for the drop in prices…

Rest assured to all of you out there, that I know exactly when the bubble will pop.

It will happen the day before I list my house for sale this fall.

I carry a dark cloud over my head of bad luck so monstrously immense that it bends light around it. I have never experienced a financial windfall, not ever in my whole existence.

The proverbial Job looks upon me with pity. I once had a lotto ticket where every single number was one digit lower than the big jackpot. I was on vacation and “off the grid” when the big crash happened and missed out on selling my ETF shorts. I let my girlfriend go in front of me at Disneyland and she won a car, then dumped my arse.

The Gods will not in any way let me make a penny on selling my house. On that you can most assuredly have faith in if nothing else in this farce of a reality.

Don’t spend anymore time arguing about timing, go out and enjoy your life. Hug your kid. Call mom. Give your spouse a massage of the temples and ask how the day went.

Your day is going to better if you do and a lot better than for “Cory” over at the Automatic Earth. That poor sap just had his ‘messiah” shite all over him.

http://www.theautomaticearth.com/nicole-foss-at-atamai-ecovillage-new-zealand/

I recommend anyone here, who thinks they can reason out what tomorrow holds, read his comment post.

Interesting comments on that blog. Is that a ‘prepper’ blog?

As for your personal misfortunes, it reminds me of an old Seinfeld episode. Why don’t you try doing what George Costanza did? Everything you normally do, do the opposite. It worked great for George, got him laid and a job in the Yankees front office.

It is a prepper blog but the IQ level of discourse in the comments have been above par for the genre.

I tired that last month, I got a job as the assistant to the assistant to Donald Sterling at the LA Clippers.

That is how efficient my luck is, I didn’t even need a female to get farked.

I know that I am offending many who seem to take this all so serious but you brought it up not me. Donald Sterling… He is the poster boy for when you are in a whole the first thing to do is stop digging…

Sterling’s just trying to dig his way to Korea. He loves them so much he figures they must love him back and will take care of him.

I know a way you can help yourself along with society. Start your own blog and post every daily activity so we can short/hedge. We will all follow your blog and you will actually make money because your site will go viral and you will be making appearances on the View talking about your successful site PotusHedge. No one will read the gloom and doom sites anymore because everyone will be rich including you!

That’s all I need is for Kramer to put out a contract on my arse.

C’mon Pontus take it for the team?

All,

This just in from the most reliable financial news source CNBC “Goldman Sachs: This bull market has longer to run”

http://www.cnbc.com/id/101670665

“If you start to believe in the U.S. recovery there is certainly a school of thought that that’s the gorilla still in global growth.”

I thought I needed to believe in unicorns and rainbows and that the wizard of FedOz has everything under control and that our leaders have our best interest at heart and…

I’m game if that’s all it takes to have global economic prosperity! I”ll believe if you’ll believe!!!

Dig into the CNBC archives for 2007. It’s near verbatim. Then again what can we expect them to do, tell the truth? 🙂

BTW I love how “little r” can’t get a single response to his lame posts anymore. Does getting schadenfreude from the isolation of someone with such obvious human deficiencies (I mean really car salesman AND a realtwhore in the same lifetime???) make me a bad person?

Sounds like you miss my post ZerO. BTW, this car salesman and realtwhore plus to boot I was a 222 avg class A baseball player. Yes sir I’m a loser in life, right now looking out my second home in the mountains window typing away, and thinking how I obtained all this.

I should have listen to people like NihillistZerO, I would have been even richer???

No response to me needed, not here to further my ego, want people to know that there is always opportunity and to read my post because you should look to successful investor and businessmen like me for advice in life?

Realtwhore is so passe…we prefer the term Realturd as in, jeeze that guy is a real turd. Realtard is politically incorrect, but that shoe does fit oh so well as well.

BTW, Robbie Bobbie roberto, are you that blowhard idiot from the redfin Orange County forums, the realtard always talking about the OC market never having gone down in the 20 years you’ve been shilling there?

Anyone out there from MA? The prices are out of control and every house needs $150k of work to make it livable. There are a lot of “pending” transactions but not many actual sales. I keep hearing about all of this activity but the actual sales don’t match the hype. Any insight?

Leave a Reply