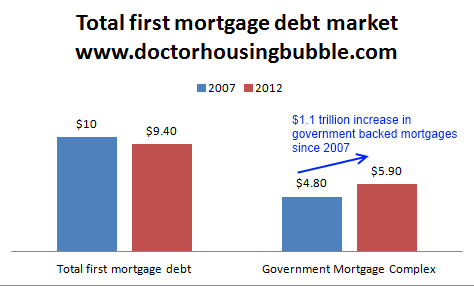

The incoming bailouts for the government mortgage complex and student debt markets – 15 percent of FHA insured loans are 30+ days delinquent. Total first mortgage market fell by $600 billion since 2007 yet government backed mortgages rose by $1.1 trillion.

The housing market is such an odd functioning system. It really isn’t a market in the true sense of the word but more of a carefully controlled market. I get a kick out of some coming out with grandiose statements claiming that nationwide the housing market is closer to reaching the bottom. This kind of statement is as audacious as looking out your window and saying the sky is blue. The median home price in the US is $156,000 and the median household income is roughly $50,000. Not exactly a stretch to state a bottom in price is likely at a nationwide level. Interestingly enough, now with all the chatter of a nationwide bottom the ratio is near a perfect 3:1 with median household income and price. Reversions to the mean eventually take place especially when incomes are not rising. Yet most of the market since 2007 has been artificially kept afloat with massive government intervention and I would say that we have a housing market that is essentially a ward of the state but also have a burgeoning student loan bubble. If the housing market or student debt markets were so healthy, why is the private sector MIA in lending action?

Government mortgage complex – New low-down bailout culprit

Make no mistake that since the market melted down in 2007, the private mortgage market has been nonexistent. While total first mortgage debt has declined by roughly $600 billion, the share of government loans has shot up by $1.1 trillion during this time:

*Trillions of USD$

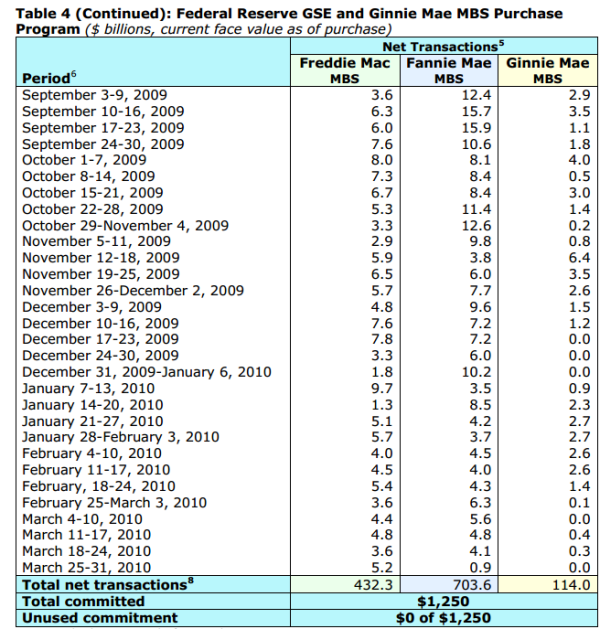

The government backed mortgage market is the housing market. I was digging through reports regarding the GSEs and their activities and you will find the data fascinating:

You can see most of the MBS activity for the GSE market came in 2009 and early 2010. What you are looking at above is the Federal Reserve actions in basically becoming the MBS market. In this timeframe, Fannie Mae, Freddie Mac, and Ginnie Mae ate up $1.25 trillion in MBS activity. This is why when you look at the first chart with government backed loans going up by $1.1 trillion from 2007 even though total mortgage losses have been significant with over 5,000,000 completed foreclosures.

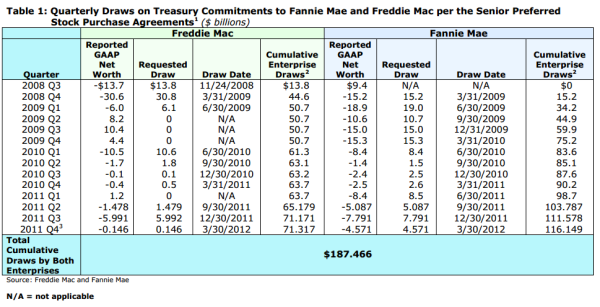

Has this cost us any money? Absolutely:

The latest data shows that the cost for taking over Freddie Mac and Fannie Mae has cost us $187 billion. Sure is a long way from the profit good old Hank Paulson told us we would be turning. The current mortgage system and banking system is essentially a churn machine to throw off profits to the financial industry all the while saddling Americans with more and more debt. Just look at the above data and show me where the private sector is? But the major banks enjoy all the perks of being government backed yet pass on all the major risks to the public. Some people pretend as if we just didn’t have the biggest financial crisis since the Great Depression. $187 billion is no chump change and this is merely looking at the running total for the GSEs. There are other trillion dollar games at play as well with guarantees, shifting toxic waste to the Fed, and now with insuring low down payment FHA products. The FHA insured loan market is now an even bigger risk.

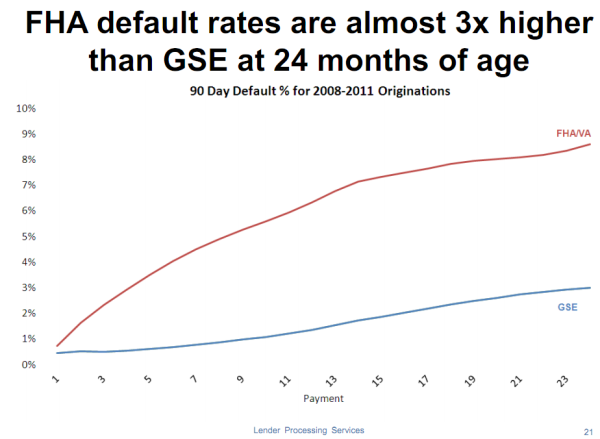

Default rates are soaring for FHA loans:

The FHA is completely backed by the government (aka the public) and this is a train wreck in the making. The average down payment for FHA insured loans is 4 percent (just a tiny bit above the 3.5 percent down payment amount). The absurdity here is that someone going in with a 4 percent down payment is paying the same as someone with say a 15 percent down payment and going with FHA. In other words, there is no incentive for less risky LTV ratios from the buyer’s perspective and this is exactly what they are doing. We are encouraging risky borrowing behavior and look at the above chart. This is a bailout in the making. Which other government representative that is a former banker is going to tell us not to worry, FHA will turn a profit soon?

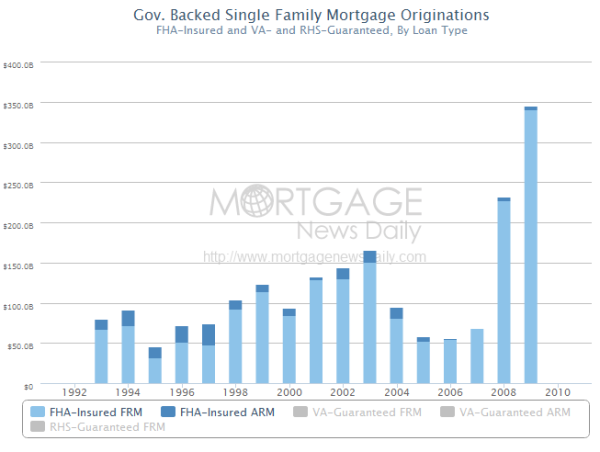

FHA insured loans have become a major part of the housing market:

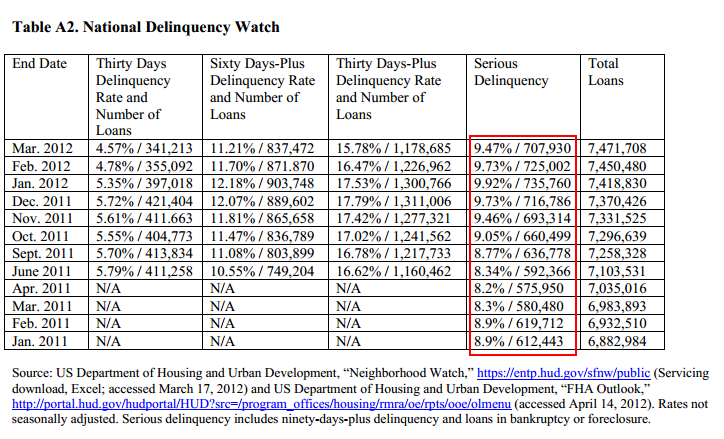

In 2006 FHA insured loans made up about $50 billion in loan origination volume. In 2009 it was closer to $350 billion and even more in 2010, 2011, and also in 2012. For example, in bubble land Southern California one out of three loans is FHA backed and this pattern has been going on for a few years now. Yet starting this month mortgage insurance and premiums are going up to cover this monstrosity and rising defaults:

Source:Â AEI, Ed Pinto

It is incredible that FHA is insuring a loan pool of 7,400,000+ mortgages with a serious delinquency rate of 9.47 percent! 15 percent of these loans are at least 30+ days delinquent. Instead of admitting the obvious that we are seeing similar Alt-A and subprime patterns here, the FHA is simply going to make it more expensive to borrow on a monthly basis instead of increasing that down payment requirement! All the talk of a healthy market is nonsense with 10,000,000 Americans still underwater on their mortgage. Even if this is a nominal bottom nationwide, what are the repercussions of backing another $1 trillion in questionable loans and having the Federal Reserve artificially keep mortgage rates at these levels? The risk is other bubbles. Those that claim things are fine would not in a million years lend out $700,000 to a person making $150,000 for a home in California yet they are perfectly fine with the FHA insuring these loans. Moral hazard galore.

Student Loans

So it is obvious looking at the data that pure targeted government bailouts and gimmicks in accounting rules are keeping the market afloat. So what do we get for all this? A $187 billion price tag for taking over the GSEs, $1.25 trillion more in MBS debt shifted into the Fed balance sheet, and another bailout in the making with the FHA. Plus, we have had 5,000,000+ completed foreclosures since 2007 and the median price today is $156,000 with a median household income of $50,000:

“(NAR) The national median existing-home price for all housing types was $156,600 in February, up 0.3 percent from February 2011. Distressed homes – foreclosures and short sales sold at deep discounts – accounted for 34 percent of February sales (20 percent were foreclosures and 14 percent were short sales), down from 35 percent in January and 39 percent in February 2011.â€

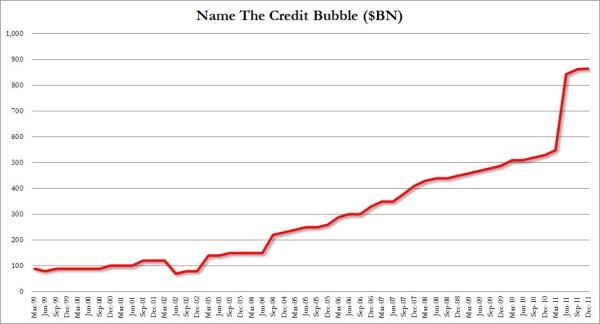

Yet another massive debt bubble has formed in the student loan markets. I find it interesting that a debt market reaching $1 trillion in debt outstanding had little coverage from the Fed only until recently. In fact, data on this market from the Fed was only recently released in the last year or so. It used to be scattered and hard to put together. Now that we can put it together, you know exactly why this was kept under wraps:

Source:Â Zero Hedge

I’ve talked about the long-term issues we will face with millions of Americans being saddled with unsupportable student debt when it comes to buying their first home. This is a serious issue. Just think of someone coming out with $50,000 in student debt trying to buy that $150,000 home. They already have debt one-third the size of the home they are looking to buy. Think that’ll make it tougher on their monthly disposable income?

The student debt markets are another fully backed government enterprise. The banking sector essentially is the middleman for government mortgages and government student loan debt. The major profits go directly to the banks, even if they fail since they get giant salaries/bonuses regardless if the loans they make implode at some point. By the way, student debt defaults are soaring. Does this sound familiar? Saying the housing market is reaching a bottom nationwide is no bold statement especially with the 3:1 income to price ratio. By the way, a bottom does not mean prices are now going to reverse. The real issue is how massive government intervention is and how close the big banking sector is aligned with our political system. Have things really improved? It is interesting to read the comments since many readers are educated enough to realize how massively rigged the game is (and by default, unsustainable) yet in the next breath people are looking to purchase a rundown shack for $400,000 or $500,000 in Southern California. We are starting to see the cheerleading coming out again but just like the last bubble, the silences on reliable household income data speaks volumes. All the above data simply shows an enormous debt game being held up by the government backed markets and default rates are uncomfortably high.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “The incoming bailouts for the government mortgage complex and student debt markets – 15 percent of FHA insured loans are 30+ days delinquent. Total first mortgage market fell by $600 billion since 2007 yet government backed mortgages rose by $1.1 trillion.”

Buy a house, it loses value, default, bank writes off debt! Attend college, can’t pay back student loan…appears govt floating trial balloons about writing off student loan debt! Buy it all with credit cards, can’t pay debt back…CC company simply charges it off! It’s a new era folks…call it “Everybody Wins, Nobody loses…ever! An Eternity of Fresh Starts! Reminds me of this Twilight Zone episode…I’m getting a Bernanke vibe from Pip…

http://www.youtube.com/watch?v=Wnevk-6h6aI&feature=related

I think you nailed our future. It is the only way to keep things going.

I thinking the chumps out there are people like me thinking “eventually the piper will have to be paid”.

The problem is, the piper accepts newly created cash or preferably digitally created cash.

Interest rates will begin to rise. Mortgage rates will go up again, and probably sooner than you think. Higher interest rates will spur the collapse of the housing market (and all the bubble schemes the FED and Congress has helped to create) and get banks to move off their inventory.

An 8-10% mortage (on the low end) will do wonders to shift housing prices downward.

Its coming. Just not soon enough.

But when will rates rise? Japan’s have been low for 20 years, and now China is just beginning to feel pain. Booms and busts tend to last 10 to 15 years, we are 5 into this one.

I have no doubt in my mind the pain the USA will strengthen greatly…it’s just a question of when, and what do we do in the mean time? I personally don’t want to keep my head in the sand waiting for who knows what.

What will most likely happen is additional can kicking and money printing until the whole thing collapses and a one world, new monetary system is established. Even Jim Jubak on MSN Money is saying it as of today, though I’ve said it for a decade now to my people. This will not happen quickly, though it will probably happen in less than 10 years. There are simply too many Gov. promises outstanding that it can not keep.

Age, family status, education…all play a part in the individual choices we have to make. Many young people will be out of the market for 20 years as they slave off their student loans. The boomers are aging and will create excess supply as not as many children are being born today to work off (tax pay) the promises they made to themselves.

The bright side? Historically speaking we will be due for a now-unforseen technological boom sometime in the next 10 to 15 years. Don’t think that we as humans are suddenly “done”. The railroad, electricity, freeways, radio, TV, interent…all created great wealth. Or at least the illusion of it and the ability to keep man busy for well over 10 years each, and that’s the most important thing to remember. Heck, the cure for cancer has been valued at $50 trillion alone. I’m sure it can be said with fair certainty that SOMETHING will happen before us young bucks die off. It will be then that the greatest risk takers of now will be the most rewarded.

Your bright side doesn’t rhyme all that well with history. We can go as far back as the fall of the Roman Empire, (though you needn’t go that far back), where many of the technological advancements of the day — nay, wonders of their time — were essentially lost; the craftsmen and brain trusts eroded by the vagaries of an empire in decline. Many of these technologies were not again resumed and developed upon until some 1000 years later. In other words, things don’t always advance in a linear model.

Reality check — government borrowing has been occurring at negative real interest rates over the last few years. As long as inflation stays above T-bill returns, the government actually makes money on the money it borrows. I’m sure the government will find a way to squander the capital (though it can print more) but it shouldn’t be surprising why borrowing is on the rise. It isn’t clear to me that deficit hawks have a point today.

Ultimately, the bond vigilantes may get their way and rates will rise and new borrowing will have to slow. We still get to enjoy the negative real return on the note for the 10 years it lasts, though. With any luck the economy will have continued to improve by then.

The reality is that interest rates wont go up for many years. DHB is right – we need to clear out the inventory ASAP and increase down payments to 20%.

That would require mark-to-market and cause a 30% drop in RE prices overnight. That would destroy bank balance sheets. The fascist government banking system will never let that happen.

Deficits don’t matter…so I guess this increasingly popular meme serves as something of a vindication of Reagonomics and Dick Cheney, who also championed the idea.

DHB…I am looking at a 5/3, 2,650 SFH in Huntington Beach about 2 miles from PCH. Built in 1977, average to above average condition. It is a short sale and I am looking at 550k to get it…dummy landlord bought it for 885k in 2006. It is my parents rental for 22 years. I have all cash to buy it. My parents have stable income (as stable as things go these days), save them the moving hassle etc. The rest of my money is under management at the casino we call Wall Street. So what is it people like us can do? If I do the above I ran a model and at 3k rent less prop insurance, taxes, regular maintenance I am looking at a 6% net ROI. Do I think the house should go for 550k…no…but what are the alternatives? Look for a hard to find and overpriced rental in OC and pray the housing “market” stops being propped up or I wish would go to all cash like buenos aires? Or let a large chunk of my cash continue to earn me an aggregate .75% return while it keeps getting devalued with stuff like QE3 looming? Or invest in inflated, manipulated and hence risky wall street…I already have enough exposure there. I just don’t understand what good honest employed and frugal people are supposed to do. Until the manipulation stops, which it looks like it never will, until there is global thermonuclear meltdown that even the fed can’t support, it looks like I buy this and have a 6% ROI while mom and dad still have jobs and the other 2/3 of my money is at wall street…I don’t want my cash to be devalued further and I have more faith and trust in my parents motivation and ability to pay me rent than any other alternative. I just wish there was less manipulation, higher down payment requirements and housing was truly an open market like you stated.

Seems like not a bad diversification for you, presuming your parents would be paying at or below market rent to you at the 3K per month level You have an implied protection against massive inflation should that ever occur, too, without the volatility of the stock market, by investing in a nishish house in a nicer area of So Cal. at a not ridiculous price with stable tennants who are in your corner. I am presuming that the inflation will occur while the Fed continues to force interest rates to stay low, because if interest rates rise dramatically then your house value will get it hard.

I have a couple of observations:

1. “Until the manipulation stops, which it looks like it never willâ€â€¦ Never is a very long time. I remember when people told me that house prices will never go down. I am not convinced we really know what never will happen…

2. A smart “investor†includes asset depreciation in their return model. You need to account for capital loss the same way you would account for capital gain. This is similar to getting a 5% dividend on a stock that is now worth 25% less than the initial investment. Is that really a positive return? I am not clear why folks do not like to include asset depreciation expense as part of their return model when it comes to housing…

Re: Depreciation.

Are you talking real money or taxed income?

For taxes, the profit on the sale of a rental property is based upon your cost basis, depreciation reduces your cost basis, while passive losses are limited to $25K per year, so you have to weigh whether you want to claim a tax loss now and pay the tax on the profit later. Also, you can only depreciate the improvements, not the land. And only 2.5% per year.

In terms of real money, depreciation of capital investments assumes a salvage/scrap price significantly lower than the purchase price–while until the last 6 years the salvage price of the real property was significantly higher than the purchase price. So how do you depreciate an appreciating asset? Most significantly, please tell me the salvage/scrap/iow–end-of-depreciation-term price of a piece of real property. Show all your work. I want to see this.

JC, you sound like a tax accountant and you, like all accountants, seem to miss the point…

Patrick, 3K rent sounds a bit much for a house you can buy for 550K. Wouldn’t you want to give your parents a little break too…just sayin.

What do your numbers look like if you only get 2.5K rent?

You might want to think about the fact that when prices are falling cash increases in value. Over the next few years, those that are able to MAINTAIN their wealth will be the winners. Do not be programmed to look for return in a deflationary hell.

You have over half a million dollars in cash. You can go ahead and take it a little easy now.

Enjoy your life. Landlording is not much of an ambition, and neither is trying to be the richest guy in the bone yard.

Our competition for a final home with no mortgage have been FHA buyers being coached by their know nothing nefarious UHS (used home salesperson). It is just amazing that another mini bubble has started in Ventura County. Although you need a decent FICO and I assume good income/debt ratios (changes so much), the 2 year and you’re back in the game fiasco is getting deadbeats out again. They can overbid, and stay free. Cash & Close or 20% DP folks are taking it in the shorts/dress. We’re in the over 50+ crowd. We “ain’t” got another lost decade to wait this out.The iventory is so manipulated, it makes me want to SCREAM.

To think the next bail out of gamers will be FHA players is sickening.

I am going to start averaging into the stock market over the next 4 years with the cash I was going to use for a house.

Screw this crap. I ain’t even looking anymore.

I should add…..since I know about all the anti stock market posts that will probably follow….

I am not stupid, I know the stock market is as propped up as housing, but I can get yield, and if I do it slowly, I can get an average decent “average price”.

My main worry is holding cash while I wait this all out, which may take up to 10 years. Just visit shadow government statistics http://www.shadowstats.com/ . Real inflation, not the phony CPI they put out now, but the very CPI the government used under Carter and Reagan shows prices rising at between 6 to 8%.

The latest computer you buy, made in China, has a powerful offsetting factor against the real increases we all see in rents, medical care food, due to a trick methodology called hedonics.

Before you go down that road, hop over to stockcharts.com and compare 10 year appreciation in real estate vs. sp500 vs. gold vs. dollar. Then say to yourself “buy low, sell high”

Stocks are near all time highs. Gold is at all time highs. Bond prices ate near all time highs. You’ll be talking a devalued asset (cash) and exchanging it for an overbought one. Yeah, there are problems with real estate, but they will work themselves out on the medium to long term. As we genXers learned, the millenials and genY can’t put off adulthood forever. I don’t care what the market looks like. The second kid will dislodge you from apartment living.

In any case, I definitely wouldn’t want to hold cash. Over 10 years, it is going to lose at least 25% of its value to inflation, and there is a lot of national debt to be inflated away. You can get a good 5% dividend on many big pharma stocks right now. (Check 2013 tax law about dividend tax rates.)

Well, Ian, then the obvious solution is:

Don’t breed.

I’m with you mad as heck, seeing the same thing. Why should the government compete with private enterprise as they are now doing. We worked and saved all our lives to get ahead, now we must compete with the same government that took our money under law. And the student loans are just a joke, many just take the money and don’t go to school and the government knows it, but it’s just another way to throw money out into the system.

The assertion was that banks were unwilling to lend at any price. (Far more profitable to borrow money from the fed for free and use it to buy T-bills.) The government would then be stepping in to fill a need that the private sector is unwilling to do. It is not unlike basic science research funding, or medical insurance for the elderly.

Perhaps they are willing to lend now. Dunno.

Can’t figure out how to reply to Ian, so here’s my comment: Gold is NOT at an all-time high! Neither is silver. People keep saying that, but they never look at the charts. Look at Jesse’s Cafe Americain (April 20): http://jessescrossroadscafe.blogspot.com/

Our mortgage broker encouraged us to use the FHA low down loan. We can come up with 100K for a 500K house easily, but he said “save your cash.” Why the hell would I want to pay interest on that extra 100K on top of the loan. With all the defaults, PMI on FHA is going up to, so there is throwing another $250 a month out the window. What a joke.

I’m so sick of this damn government intervention screwing up the market for the silent majority of hard working play by the rules middle class. If everyone would have to come up with 20% down, houses here in Burbank worth living in would not have to cost 1/2 a million dollars. I mean 1/2 a million dollars!!! Since when did this become the new norm, and average Joe’s like myself even believe that it’s OK to spend that much damn money on a house. Why just a decade ago 1/2 a million would have gotten me a palace. Now I get a middle class home in Burbank (if I don’t get outbid by a “sky’s the limit FHA knucklehead”) Hell if I wanted to throw caution (and sanity) to the wind, I’m approved for 700K. Hell maybe I should buy a 700K home, stop making payments, and live rent free while I wait for Bernanke and Co. to give me some way to be more of a deadbeat. In the meantime I could go to college on student loans, and get those “forgiven” later too. In 7 years I would have may credit back, and a doctorate degree plus lots of cash I saved living rent free.

“If everyone would have to come up with 20% down, houses here in Burbank worth living in would not have to cost 1/2 a million dollars.”

Creative financing (either done by the government, corporations or individuals) is the only thing keeping this shell game going…for now. If everybody had to come up with 20% down minimum, housing prices would crash overnight. We have become a nation of “gotta have it now” and that means no sacrificing, no saving and the powers that be will keep enabling this behavior until it absolutely can’t go on anymore. 3.5% down FHA loans, leasing luxury cars and buying all the latest useless electronic crap on credit is the new reality. The worst that can happen if you stop paying is they will take this shit away from you and you’ll have a lower fictious credit score. Pathetic!

I’ve been going through the crap for 7 years now Lord B. I thought a crash would happen, it did, I thought more would happen and it didn’t. The Gov power (illusion) is strong and can kicking is working. Eventually I have to ponder the time vs. opportunity “lost” not cost, lol. Meaning – I ain’t getting any younger and the kids aren’t getting any smaller. I can’t keep them cramped in a 2BR forever.

I couldn’t believe this the other day, I was talking with my conservative friend. He own a condo, slightly underwater. He has student loan debt from getting his Masters, and is pondering getting his PhD, for another $30k loan. He fully admits he will never be able to pay this debt off, so staying in school and deferring the payments is his best bet. He said he can continue to acquire property with his job income, rent it out and make more money, and stay in school thus deferring his loans. He’s sick of “playing by the rules” and getting shafted for it, and he wants his piece of the pie.

I guess it shows economics is one thing, but time is another. Time is never on our side.

Your conservative friend who wants his piece of the cheater pie is going to take it in the shorts doing what he did if he jumps into it this late in the game. This won’t last forever – its too prone to volatility by factors out of control of the Fed or other governments. Once something new happens, they will again change the rules and guess what, like many millionaires in ’29, he’ll be broke and on the street from playing the same game and getting caught at it. The trick is to stay ahead of the game, and get out before the last hand is laid on the table.

I can apply all these arguments to cheap credit while buying a new car. The borrowing rate is 2.75% or so, and the prices are sky high, consumers think nothing of plunking 25K down on a vehicle that depreciates in value, and the car dealers won’t budge on the price. You could get that same vehicle 10 years ago for 13K.

So myself, wanting to buy a new car, and having cash, sits on the sidelines and continues to repair the same car. Dealers and bankers shoot themselves in the foot with the ‘easy money’ even though its ‘easy’ its inflated – buyers lke myself don’t buy. They wait. WAIT.

As soon as the tide turns to -everyone- doing this, the rules will be changed again and we’ll be in GD #2 without anyone being able to stop it. The Fed may just find themselves the champion of a hyper-inflationary GD with no value to the currency.

The prudent thing to do is rent, and cover your assets that you have with something out of fiat money which can be deflated at will by the Fed.

CC– you nailed it. Anything to keep the money-go-round spinning. You are just a leavening agent and you must do you part to keep this lead balloon called the US consumer economy aloft. Your blueprint is just the spirit.

RE: FHA vs 20%: this is old but good.

http://patrick.net/forum/?p=16515

“Eventually I have to ponder the time vs. opportunity “lost†not cost, lol. Meaning – I ain’t getting any younger and the kids aren’t getting any smaller. I can’t keep them cramped in a 2BR forever. ”

Papa — I hear what you’re saying, and I sympathize with you. However, there is a fleet of actuarials and otherwise bean counters that have already anticipated your attitude and have drafted policy thusly. “At some point, the Gen X and NEXT will capitulate.” Thereby paying for the boomer’s retirements and keeping money flowing at a desirable rate of velocity. The staring contest you will inevitably lose is jiggered by the PTB so that you can only ever lose.

“Paying for the boomers’ retirements”? What planet do you live on? Every pension system in the nation–and world–is being systematically looted to keep the money flowing from the people whose labor put it there to the people who have mastered the computer-algorithm harvesting of exponential profit via fixed rates of interest.

Those last two sentences convinced me that you’ve got the “New American Dream” down pat.

“They pretent to lend us the money and we pretend that we’ll pay it back.”

And the press is a little behind as usual:

http://money.cnn.com/2012/04/19/real_estate/short-sale-rise/index.htm

Read the books Dr. HB recommended……”ONLY YESTERDAY” by Frederick Allen Lewis……this is a complete re-run of what happened leading up to and including the great depression……

We haven’t learned from our Past !!!

Who learn what? They just robbed us again. This will happen over and over again.

There is no ‘we’

We keep hearing media stories telling us that the foreclosure rates are decreasing, but this article tells us the much deeper story.

Lenders have now been selling more homes through the short sale process, avoiding foreclosure, but these still represent distress sales.

The media focusing on foreclosure rates going down, has us focused on the idea that the economy and the housing market are improving.

http://www.globest.com/news/12_333/orangecounty/residential/-320717.html?ET=globest:e30180:363795a:&st=email

I agree with the poster who said that capital preservation will be key. When the world is losing wealth at an astonishing degree, preserving what you’ve earned is also a great way to get ahead. It’s really hard to invest in stocks (propped up), metals (bubble), housing (deflating bubble), cash (inflation). There’s really nowhere to run – they’ve got us cornered.

Housing will probably bottom in the next 3 years, then everyone will start buying. Real appreciation most likely won’t happen for another few years after.

So . . metals, by which I presume you mean gold and silver, are in a bubble? Really?

Gold and silver are money. They always have been, at least for the last 6,000 years. If you believe that the U.S., EU or Japan will get it’s debt addiction under control, then by all means shun the purchase of gold and silver. If you see no reason to think that public and private debt is under control or going to be reduced in the U.S., EU or Japan then the currencies in those places must inevitably fall in value compared to gold and silver. It’s really that simple.

Gold and silver satisfy none of the conditions of actual bubbles. Participation in them by investors is incredibly infrequent and the fundamental case for their value, the debasement of fiat currencies only gets better and better.

I agree with you.

What bubble? Real estate is up 700% since 1980, even after the crash and Gold 100%. Stock market is up 1300% since 1980, Gold 100%. Gasoline, up 400% since 1980, Gold 100%.

What is a bubble? When everyone owns or wants to own and everyone is sure it will be higher tomorrow than today. That sounds like the opposite of Gold.

If you are familiar with Gold you will know that very few people actually own gold, after all, there is only enough gold to give every man women and child less than 2 ounces. You would also know that for every pro gold story there are 3 gold negative stories. And, many who think they own gold, actually own paper gold.

With the money supply increasing 10%or more a year, how could Gold not cost more tomorrow than it does today.

I will admit one thing has changed. In 2002 when I began buying Gold and Silver in earnest, Metals were a no brainer. What was the downside risk to 325 gold and 5.00silver? True, it is no longer an “no brainer” and if I didn’t already have what I have I might be afraid to buy but common sense dictates, if they print money, gold will always rise in response, in the long run. Why would anyone be afraid to buy gold today when they know for sure it is going up? A bubble is when everyone is sure it will rise.

My favorite argument that the bone heads throw out is “you see WE BUY GOLD signs everywhere” and that to them is a sign that gold is in a bubble.

In fact, “we buy gold” is the exact opposite of a gold bubble. If everyone was buying it, that is one thing, but if everyone is selling to the few who can afford to buy, well, that is something entirely different and that is what we are experiencing.

People who have not yet read Rogoff and Reinhart’s book, It’s Different This Time, really should get a copy and read it. It is a very detailed and thorough study of sovereign debt and default over the last 500 years. Talk about a consistent pattern throughout history!! We’re in it now and heading for very strong trend towards currency devaluation.

I totally agree with you. I just want to add that maybe “paper” gold ( a piece of paper acting as a substitute for the physical gold) IS at its bubble. I heard from http://www.chrismartenson.com that 90% of gold we see in this market are paper gold. So I’d suggest that people who is interested in buying metal should consider avoid buying paper metals.

James T,

I think you need to calm down. I wrote that metals are in a bubble but was merely pointing out that we have limited options. Even if you believe all the hoopla about gold/silver, most people have much more money in stocks than in metals. If you believe in it so much, you must be holding 70% physical metal right? I own silver and a little gold because I believe in diversifying and that it might be a good investment considering the Fed’s actions, but it’s not a 100% guarantee the way you’re making it sound.

I’m not here to argue semantics in what constitutes a bubble either. Gold has enjoyed a meteoric rise and there’s a good chance of a pullback.

The bottom line is that when the government makes an effort to make something more affordable for you, it almost invariably makes that thing more expensive.

“The bottom line is that when the government makes an effort to make something more affordable for you, it almost invariably makes that thing more expensive.”

James T, this is such a basic, irrefutable, provable truth that it ought to be considered a basic economic principle. It has proved true in housing, transportation, collage, and food (“price support” subsidies for not growing anything).

A corollary principle is that subsidies encourage uneconomical, unsustainable behaviors and development, while punishing economical, sustainable behaviors and development.

When the govt makes something more “affordable” I think they really mean more “available”.

I’d prefer to see some numbers on your assertion; I can’t say one way or another.

However the bigger issue I see is how to quantify things such as “affordable” or “expensive.”

For most of the modern era in this nation, the value of an hour’s labor, compared to the cost of various things, has been a solid standard. In the 1970s it was discovered that financialization could skim more and more profit from an hour’s labor while still supplying the illusion of abundance through consumer debt. The value of an hour’s labor has plummeted ever since, despite massive gains in productivity by the ever-shrinking pool of workers. (That is to say, the gains are skimmed upward; the labor is forcibly flogged to the bottom.)

So, has housing truly been “affordable”? Or was it simply that new and ever more baroque debt instruments came in to make it look that way? My view: the latter.

They can’t keep printing money forever. The dollar is losing its’ status as the world’s reserve currency, and the petro-dollar trade is on the way out as well. Russia and China are trying to figure out how to stab us in the back. Our economy sits precariously between a rock and hard place.

I agree that everything they have done is an assault on the good and decent people, while the reckless and stupid get away with murder. My opinion of the government could not be any lower.

Easily accessible credit/currency will always be a strong catalyst for inflating prices. One thing to keep in mind is that when money for a mortgage is as cheap as it is now and it still cannot raise the price of real estate….this is probably a dead market for anyone looking for consistent appreciation.

Currency is an intermediary for an exchange of value. Not value in its own right. So when money is created for uncollateralized debt or rented out at extremely low rates from someone who creates it out of thin air….where is the value that was supposed to have created it????

This value does not exist and hence indicates the real value of the currency. The longer this trend continues, the less value this currency will have.

The devil is in the details. We are still in a housing depression, no matter what the govt tries. Just kicking the can further down the road until the road falls off a cliff. Prices still dropping every week on The Westside.

http://Www.westsideremeltdown.blogspot.com

You can’t just take out student loans and not go to school. The money goes directly into your student account and the first thing that’s paid is your tuition. If there’s money left after that, you can have it deposited into your bank account or get a check cut for you. Financial aid offices at the schools have to monitor drops. If you drop your classes right away, you have to pay the loan money back immediately. If you wait until later in the semester, you don’t have to pay it back, but it’s still due very soon after that if you don’t stay in school until graduation. The government can garnish your wages if you don’t make payments, but you can stall and defer for quite a while. They will eventually garnish your wages. I know people in ths situation now.

In most case, PhD students are fully funded. Their tuition is paid and they’re given a living stipend. They get a combination of felllowship money and payment for working as a TA or an RA. Students sometimes take out loans because the stipend isn’t huge, but it can be enough to live if you live very cheaply. Eventually, even PhD’s graduate and have to work and the people who take out students loans have to pay them back. As DHB has pointed out, the purchasing power of many graduates with big student loan payments are not in a position to purchase a home due to their heavy student debt load.

I know these things because I work at a university. Contrary to the opinion of some people, we are paid pretty low wages even though the tuition costs for the students where I work are ridiculously high since I’m at a private research university. I don’t know where all the money goes.

It would appear that some of that money that seems to be going down the proverbial rabbit hole at some universities may be going instead to a huge overhang of institutional bloat, mostly at the upper and middle management sinecures in the ivory towers. Some trend lines suggest this bloat has increased along similar upswings among the government workforce, with many positions garnering annual salaries of $100,000 going up exponentially as the economic conditions have worsened.

FYI – some sources for that opinion:

http://hereandnow.wbur.org/2011/11/02/university-cost-bloated

http://online.wsj.com/article/SB10001424052748703749504576172942399165436.html

I won’t even get into the recent shenanigans regarding the GSA – no doubt it surprised no one on this blog.

Kindly quantify your term “many.”

25% of all student loans are now in delinquent status. People need jobs in order to make loan payments.

Does anyone know where I can find statistics on vacancy rates and rents, specifically for S.D.?

You’re right that high student loan debt is not compatible with our current housing markets and systems. The reality is that our entire wage and finance structures are not compatible either, and haven’t been for at least 11 years. It is all in transition.

These will be problems for Generation Y to solve. Based on what I’ve seen they are an intelligent generations, ready to work, and prepared to solve them. I realize many people are not as optimistic as I am. But that’s their problem.

Leave a Reply