Holiday Wealth Annihilation: 3 Trends Ending 2008; Housing Prices down for 28 Consecutive Months, Place 20 Percent of your Portfolio in the Mattress, and a Shopping Tax Holiday.

Flying over Arizona on the red-eye I couldn’t help noticing all the interspersed housing subdivisions lighting up the desert landscape like a sand painted Christmas tree. Earlier I had caught CNBC reporting that Phoenix had the worst year over year drop of all the Case-Shiller metro areas. How many of those units are sitting empty, underwater, or incomplete awaiting an audience that has neither the money nor will to purchase a home in this fragile economic climate? With epic Ponzi schemes this year is becoming Enronesque. Financially many will want to forget 2008 and chalk it up to experience.

Alas, I wish it were so simple. The market rallied on news that the government was going to buy mortgage backed securities which ironically is something it already said it was going to do. Great. However the caveat is the securities have to be fixed agency debt; that is, little help is provided to the ticking time bomb of pay option ARM mortgages which will engulf the country in the next few years. The government is treading on a very murky line here. First, the public is getting agitated that trillions of dollars are being thrown at the agents that caused this mess in the first place. Little help is trickling down to the average person on shaky Main Street. This perception is correct given that the unemployment numbers are looking worse and worse as each monthly number is dished out. Why? The unemployment rate usually peaks months into an equity correction. And for most Americans, employment is the number one sign of a healthy economy. Was November 20th the bottom or only a head fake of things to come?

Even some areas in Los Angeles County are seeing zip codes coming in with five-figure prices. Maybe a stunner for some but many have geared up for this kind of massive price destruction. The bubble is in full burst mode. Keep in mind historically December is kind to the markets but not this time. Santa put a piece of coal in the stocking of most investment portfolios.

It is astounding that after all the money being hurled to banks and Wall Street institutions like NFL deep routes, not much has improved. Sure some crony capitalist are now off with nice severance packages but nothing has improved for the lot of most Americans. The housing market is still tanking. Sticking money into your mattress would have outperformed the stock markets of the globe! And to top it off we are now hearing echoes of a shopping tax-free holiday. Wasn’t it shopping for big homes, big cars, and big TVs that got us here in the first place?

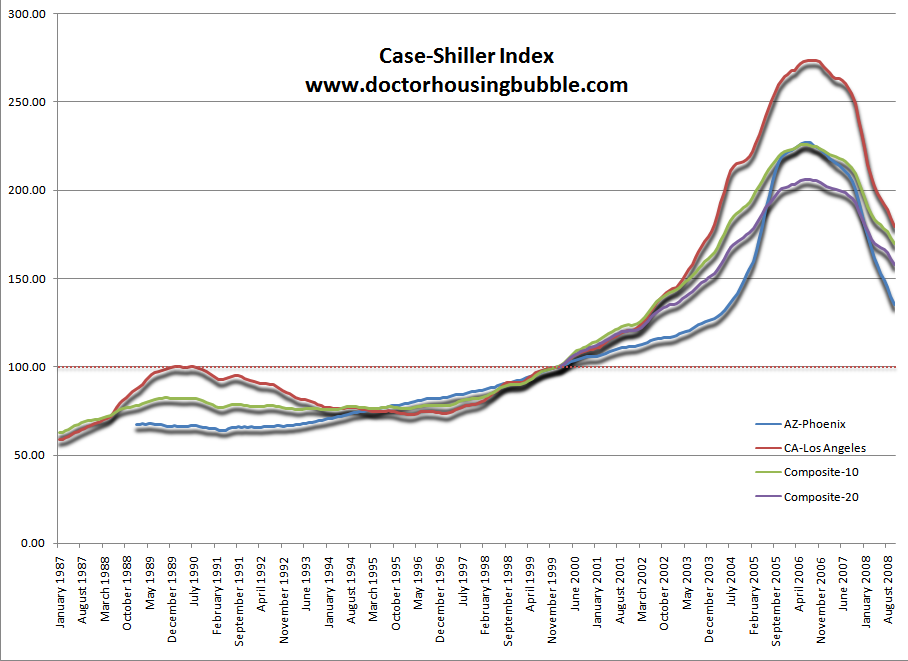

Case-Shiller 28 Months Down

*Click for sharper image

The number 28 may hold significance to you. It is the atomic number of nickel, a lunar month is roughly 28 days, and there are 28 dominoes in a standard set. Or it can also mean the number of months the Case-Shiller 20-City Composite Index has fallen. That is right, the overall index is now down for 28 straight months. Yet we still have people in the mainstream media with the gall to call for a housing bottom. How about we first have at least a few up months before we even start discussing any bottom?

With the above chart I have also added the LA and Phoenix metro areas. As you can see with Phoenix, the drop is almost a perfect vertical. The correction has been so stiff that Phoenix is quickly approaching a trend line. Los Angeles with a higher peak is still over priced and with 10 other reasons for a long-term housing correction, we are years away from a bottom in the state.

2008 has been the worst housing market on record. With the employment picture deteriorating, why are we to believe housing will stabilize anytime soon?

Mattress Investing

*Source:Â CBS MarketPlace

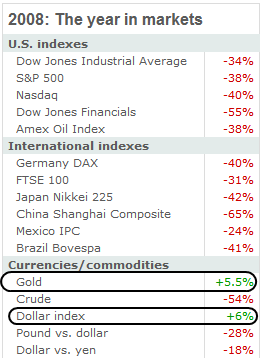

Take a long look at the above chart. 2008 has been horrific for global equity markets even after every imaginable government intervention known to humankind has been tossed at them. We bailed out banks, insurers, nationalized our mortgage giants, and even gave a tiny helping hand to domestic automakers. Even with this, global markets had one of their worst years on records.

Here is the real irony. Ben Bernanke and Hank Paulson are determined to annihilate the U.S. Dollar. Why? Simple. It is the only mathematical way we will ever work our way out of our massive debt. Every action they have taken is inflationary although the market in the short-term is reacting with deflation. The reason for this is you can’t force people to load up with more debt. They are already maxed out. Yet the one enemy of Bernanke and Paulson, the U.S. Dollar is one of the few areas up for the year! Bwahahahaha!

How long this will last is unknown. I assure you if you asked Americans if they are comfortable with a government policy that destroyed the U.S. Dollar’s value across the globe they would be in an uproar. Yet I’m not sure how many people are aware that the policies currently being taken are direct affronts to our own currency.

Another curiosity is gold is up for the year. Even after the massive fall earlier in the year, this is another glowing area. People are fleeing to perceived safety. This happens in all bubbles after they burst and the U.S. Dollar still has this reputation. Give Bernanke another year and I’m sure things will be different.

Shopping Tax Free Holiday

I stand by my assertion of the Super Ignorant Investment Vehicle SIIV – each subsequent bailout is progressively dumber than the previous one. The new idea making the rounds is being put out by the National Retail Federation (NRF), which is a sales tax holiday. This fantastic idea is another knee-jerk reaction just like every other bailout we have seen. First, spending and “shopping” is a reason we are in this mess. As a country, we need to focus on production and move away from spending ourselves into oblivion. Next, if any thought went into this they would realize that many states rely on sales taxes for revenues. States like, oh, I don’t know, California:

27 percent of California’s revenue comes from sales taxes. The state can barely stay afloat as it is and we are talking about removing one of the biggest line items for a few days? Brilliant ideas once again!

You’ll love the wording in the letter:

“We urge you to act quickly on legislation to help stimulate consumer spending as one of the first priorities of your new administration,” the NRF said in the letter. “To be effective, any fiscal stimulus package must be enacted with great speed. It must be substantial. And it must be sustained. To accomplish this, the plan must include a longer-term investment designed to produce sustained economic growth through job creation as well as short-term economic stimulus aimed at increasing consumer spending.”

Don’t you love how they sneak in consumer spending a couple of times into the letter? Who is going to argue with job growth? Or sustained economic growth? Yet what in the world does encouraging debt strapped Americans to spend more have to do with job growth or sustained economic growth? It doesn’t. Another fabulous idea that goes into the SIIV.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

8 Responses to “Holiday Wealth Annihilation: 3 Trends Ending 2008; Housing Prices down for 28 Consecutive Months, Place 20 Percent of your Portfolio in the Mattress, and a Shopping Tax Holiday.”

The NRF reminds me of the NAR; self serving idiots.

That’s the BIG problem with this country-special interests. Every little group has its’ own agenda, and to hell with the rest of us. You can’t run a country like this. It’s absurd.

The reason the automakers are in trouble is because their lobbyists fought against recommendations to make more fuel efficient cars.

The REIC helped to inflate the bubble, and in doing so ruined their own means of making a living!

In example after example I could cite instances where government abdicated responsibility and allowed one industry or another to RUN things…to the eventual detriment of that very industry! The obvious problem is that OUR LEADERS SUCK. We don’t really even have leaders in the true sense of the word. We have puppets who take money from various lobbies and then allow the lobbies to make law and run the country. It could not be more backasswards.

I’m still for lynching them all.

How funny, i was just talking about AZ, as my longtime freind and “truthless bubble-buddy” told me his AZ “place” is on the market, I laughed out loud. True his garage still has a ferrari, austin, and a masaratti parked inside, but the numbers NEVER add-up with this guy.

From Wikipedia>

The median income for a household in the town was $150,228, and the median income for a family was $164,811. Males had a median income of $100,000 versus $52,302 for females. The per capita income for the town was $81,290. About 1.9% of families and 2.5% of the population were below the poverty line, including 1.5% of those under age 18 and 2.8% of those age 65 or over.

Based on median household income, Paradise Valley is the wealthiest city in Arizona.

Paradise Valley is home to twelve resorts, making it one of Arizona’s premiere tourist destinations. It has exclusive real estate, with a median home price at $1.74 million,[3] with many exceeding $5 million and some over $20 million.

>No way José! So a measly income of 150K I should be in a $1.7M home? How outta whack is this?

“To be effective, any fiscal stimulus package must be enacted with great speed.”

Like a true salesman using sleazeball salesmanship 101. “Don’t delay, buy now, supplies are running out”. “Buy now before you get priced out of housing forever”. “Bailout now before it’s too late”. As always the technique is to make sure you don’t take the time to THINK.

It’s bad enough we sell things this way, but we make policy this way now too. Here’s the alternate perspective, and the truth: The faster we spend any “bailout” or “STIMULUS” money, without having drawn up any plans, the more will be wasted, producing nothing of any lasting value to anyone.

Unfortunately the lobbyist have power and nothing the citizens want seems to matter.

I have only one word for 2009: FUBAR. Remember how gloomy 2007 seemed at the time but now we look back at it as the good ole days? 2008 will seem like a cakewalk to 2009.

~

I’m not negative by nature but besides a new administration, I don’t see anything fundamentally improving next year. However, if we are smart and come to terms with our misdeeds, we could lay the foundation for a real recovery and sustainable future. The biggest shot of morphine will not save the patient.

~

Have a Happy New Year Comrades!

Dr HB-

I’m so glad I found your blog a year ago. You saved me a lot of $ and stress by not buying a SoCal home this past year. I just got approved and am looking, but will likely hold off for another 12 months. I’m grateful for the education. Seriously, you should get a publicist and go up against the CNBC talking heads and set them straight. They couldn’t win against your facts. But hey, does their audience really want any reality!?!

Thank you and have a great 2009!

Thanks for another post Doctor.

Seems we used to accept busts after bubbles. Sure there was a lot of moaning, and the status quo bums were thrown out of office for the new bums, but we went on and took our lumps.

What amazes me now is the entire world looks upon the president elect as if he is the messiah. All he is going to do, all he can do, is spend money we don’t have, or God help us get us in another conflict.

http://bamapachyderm.com/archives/2008/12/09/here-we-go-again-2/

Please God yet 2009 be the year the people of this country wake up!!!

Happy New Year, Doctor and all!!!

Hey!

Fat., G. Ong

C.h.o…y !!!!!!!!!

Leave a Reply