The myth of buying a home and staying put: Tiny home in Pasadena reaching peak prices as square footage decreases.

Whenever we see an analysis of the benefits of buying a home there is always this underlying assumption that you will stay put in the same residence for a long duration. Of course, most people in places like California hop on and off the property ladder game multiple times. Repeat sales continually cut into equity gains and also cause buyers to experience new costs as they move into a new place. The assumption also is that you will always be selling into a rising market. That is not the case. Timing matters in a boom and bust market like California. We are seeing more homes being de-listed as sellers wait until next year as if a hidden trove of buyers will emerge ready to buy their crap shack at a hefty price. The market has suddenly softened. We also see many listing having price reductions which was nearly unheard of in 2013. Today we’ll examine Pasadena but also the underlying mentality that people somehow stay put for long durations in properties.

Smaller spaces with big costs

Pasadena has many homes built during the 1920s with HGTV upgrades. People love these kind of cosmetic touches and during booms, buyers eat this up. As markets get tighter, the pool of buyers dwindles as many realize that they may be buying at a high premium. Buyers in solid positions are questioning current prices on homes. Since these buyers are tentative, there is now talk about bringing less credit worthy buyers to get the game going again. That is yet to be seen.

Many of the homes on the market are currently listed at near peak prices, even getting close to what they were during the manic days of 2005 to 2007. Take a look at this place in Pasadena:

1616 Corson St Pasadena, CA 91106

2 beds, 1 bath, 780 square feet

This place is very small. Built in 1924 you will want to make sure major items like plumbing, roofs, and structure are up to par. I shook my head when I saw people waiving contingencies last year just so they could get their bid accepted on some of these crap shacks. This home at 780 square feet is small. The inside does have your typical cosmetic upgrades:

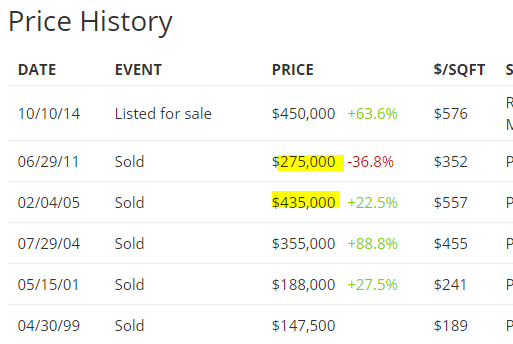

The place is listed at $450,000. I’m sure a working couple would view this as a “starter home†as they expand their family. It certainly will be cramped for two people and very cramped for three. If you think people view this home as a stay put kind of place, just look at recent sales history:

In the last 15 years this place has sold five times (six if it sells again this time). The biggest sucker here was the buyer in 2005. Paying $435,000 in 2005 only to see it go for $275,000 in 2011. In other words, people can lose big in California real estate although the current meme is that prices never go down. The current $450,000 list price is the highest ever for this place. Those that bought in 2011 have a lot of wiggle room and will certainly make a profit. The Zestimate has this place pegged at $397,596.

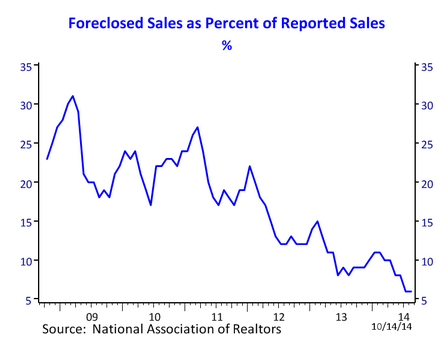

We are certainly seeing more delusion hit the market but also, there is a dwindling amount of distressed properties hitting the market:

I think this is an interesting short-term impact of pushing prices higher. What you may be seeing are people choosing to sell because things are better versus say a bank that ultimately wants to unload a property especially in a hot market (many of the great deals in the 2008 to 2010 went via auctions or bulk sales to investors so the general public never really got in on the best offers). People buy into the hype and suddenly think their home is “worth†what a previous owner sold their place for.

Take this place for example. What caused this place to rise $175,000 in three years (roughly $58,000 per year or what a typical family in California makes per year?). How is that justified? Of course you will hear that real estate is simply worth what someone else is willing to pay. Sure. We can agree on that. But this goes both ways and many people are not willing to pay current prices. Then we get the argument that prices always go up and you can see even in this one example, prices don’t always go up and this is very clear when you look at the 7,000,000 completed foreclosures since 2005.

So for these kind of homes, who is the target audience? A young professional couple is not going to stay put here long-term. So is this a starter home? If so, they are hoping that price appreciation will happen fast enough that they will be out shortly. Again, this home sold five times in 15 years (meaning people stayed put on average for only three years here!). After factoring in sales commission, you will need the market to go up by 6 percent to break even (twice the rate of headline inflation). Factor opportunity costs via renting and investing and you realize that you need to stay here longer to make a good amount of equity worth your time to property ladder into a bigger home (of course you can see that with booms and busts, you either make out big or lose big).

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “The myth of buying a home and staying put: Tiny home in Pasadena reaching peak prices as square footage decreases.”

So what else is new….

From a month ago: “Sales of New U.S. Homes Surged in August to Six-Year High”

http://www.bloomberg.com/news/2014-09-24/sales-of-new-u-s-homes-surged-in-august-to-six-year-high.html

Today: “Huge Downward Revision In August New Home Sales”

http://www.businessinsider.com/september-new-home-sales-october-24-2014-10

If you continue to revise down the previous month while overstating the current month, you get an amazing amount of “growth”. Pathetic.

http://www.bloomberg.com/news/2014-07-24/sales-of-u-s-new-homes-fell-in-june-after-record-may-revision.html

It is election year. Obama’s czars try to make the Democrats look good through numbers manipulation. If you can’t show anything good after 6 years, manipulate the numbers and there you have “recovereeee”….same as in 2012 when the low information voter fell for it.

Some things never change, therefore expect more of the same till the voters get smarter. If they get too smart and informed, then open the borders and bring more low information voters who don’t understand the system. Rinse and repeat…..

@flyover,

if you think there is a hill of beans difference between democrats and republicans i actually feel sorry for you. If you remember it was bush 2.0 in 2002 that had a press conference to announce his “ownership society” where he blamed the “high down payment” on why poor people couldn’t own homes and rolled out HIS PLAN to provide “tax payer funds” for a down payment so poor people could buy houses.

both parties are in on the swindle, don’t be confused into thinking otherwise….just sayin…..still don’t believe me? here’s Bush in his own words.

https://www.youtube.com/watch?v=QYvtvcBKgIQ

I think this has been posted here before but the comment about Bush’s Ownership Society begs a look.

http://www.vdare.com/articles/karl-rove-architect-of-the-minority-mortgage-meltdown

Putting aside the source’s perspective on multiculturalism and immigration, the suggestions made about the Bush administration’s role in housing are very thought provoking.

“@Interesting”,

I agree with what you say with one qualification: while the left is comprised ONLY of crazies, on the right, marginalized, with no real power there are some conservative constitutionalists anti NWO.

If you have in mind the progressive neocons and RINOs who have the REAL power over the GOP, I agree with you – no difference from Democrats. The reason for this situation is the fact that they are paid by the same banking cabal who promote all the wars and NWO.

I just wanted to add to what interesting commented, by saying ditto! Nothing else to add

One cannot blame the NAR or government for shoveling fake data then heavily revising the data later on. The NAR is a trade group. It is their job to create the illusion that if you don’t buy now you are 100% screwed for life.

For the government, this is about neither Democrat nor Republican. This is about incumbents running for reelection and staying on the cushy government gravy train. The last thing an elected official wants to admit is that the U.S. economy is hooked up to a ventilator providing life-support. The truth will get an elected official kicked out of office.

Hi Doc, another beauty with a freeway in your front yard and constant noise and soot. When I was out looking at homes, it was shocking to me how many of the homes for sale were across from a school, or along a busy street, or within earshot of a freeway, or terrible floorplan, or with 2 story Section8 apartment building next door, etc, etc. Only by going to house itself can all these things be revealed and then some nuisances wont reveal themselves till you close escrow and move in:)

I’m guessing that some Helicopter Moms would love living right across the street from their kids’ school. So that might be an amenity for some buyers.

Buyers for some insane reason buy the price many times, price doesn’t tell the story, buying a bad location or floor plan will bite you in the rear end?

SoCal is different. World famous Pasadena is not like other places. There are 500 million Chinese and Indians waiting for a chance to buy a 780 sq ft beauty like this in sunny SoCal. Compared to their home countries, this 780 sq foot dollhouse is a McMansion. They can cram 5 generations of family in this spacious home.

If you don’t buy now you will be forever priced out of world class SoCal. This time is different than the previous five SoCal housing busts.

“This time is different”

True indication of a top forming in the RE market.

You’re absolutely right. I showed this house to all my Asian relatives and they all peed themselves before fighting each other over who would get to contact the real estate agent first. They live in cramped urban apartments and cannot wait to get their hands on a cramped suburban single family home with a kitchen from back in the old country.

Extraordinary amount of Friday open houses today in LA.

OBSERVER….What is even more worrisome, most these agents see no traffic hour after hour?

Don’t worry so much. The houses all have multiple cash bidders already. Every single one of them by rich Chinese and trust fund kids with money to burn.

On that note… Zillow updated their price cut tracker today. Lets see: 42.7% of the homes listed on the market have had a price cut. It’s 2010 again. 😉

http://i.imgur.com/EoRexcU.png

People do tend to overestimate the amount of time they’ll stay in a home. Something unexpected always has a way of coming up plus many folks tend to be fickle.

“Of course you will hear that real estate is simply what someone is willing to pay.”

There’s a difference between what you’re willing to pay with money you’ve already earned and saved versus what you’re willing to pay with leveraged money that you’ve yet to earn.

My anecdotal evidence is based on the alerts I receive from my Zillow app on a zip code in S. Florida.

I must preface this by saying they may have changed an algorithm or something nee about the app.

But every morning over the last 4 months I would receive a push notification saying there were approximately 400 homes available in this zip code. (Sales and pre-foreclosures).

This last week that notification has jumped to nearly 800 homes listed.

This is just one very unscientific, barometer of activity in my area, so take it as you will.

But after all the investor activity down here, who knows how many are trying to get out.

best

JVP

First; foreclosures are no longer reported!

Second ; neither is lay offs by the BLS !

Enjoy your “democracy”.

a typical political smoke screen

Yes, there was a major housing crash in Ca. but does anybody know how often in, say, the past 25 years, housing prices have decreased, and the average percentage decrease?

LCaution…. A crash in housing is generally a regional or local event. LA could see a decrease but SF may not or vice a versa.

You should always buy for what makes sense for you. If you stay long term in a house doesn’t matter, ups and downs will always occur, sometimes within months not years.

Short term investing is tricky and takes a plan, Ca. is a market that can be forth with danger, but if you catch the right seller in trouble with a good zip code you can make a lot of money in CA. real estate. it takes money behind you and patience, most can’t play in that league.

Sounds like you want to buy a house you can afford and hope it pays dividend’s in the end. Even though interest rates are great and in 2015 new buyer programs will be available, buying a home in Ca. will probably mean fringe areas with lot of commute driving.

In the long run you will make some money on the sale, but I feel CA. going forward is for the well healed and most likely buyers should look at moving away from the mayhem if you can secure a good job, another subject of the real issue in this country?

We’re recently retired and have lived many years in a rent-controlled apartment. Unfortunately, the owners are older than we are and will probably sell in the next year or two at most. Although we are theoretically protected from eviction by a new owner, in practice there are many legal ways for a new owner to force us to leave with only 60 days notice.

Market-rate rents for an equivalent apartment are incredibly high – so high that even a huge mortgage probably makes sense. And we’ve realized that we don’t want to be forced to find a home w/ 60 days notice when we are in our 80s and infirm. (Apt. buildings change ownership; they can be emptied out for reconstruction or renovation, etc.) So we have decided that we need a home to live in until we die, one in which the monthly costs will be relatively fixed (yes, we know there will be repainting, a new roof or two, etc.), one from which we can’t be evicted.

We would much rather not buy in this market. Even getting a home that we would be modestly happy with means that we will need to be very frugal. We are trying to be realistic but are hoping for even a modest market correction.

And, yes, we do realize that for the cost of a modest home here, we could probably buy a mansion in many parts of the country. But our lives are built around the people and places that surround us. We do not want to start out all over again, in a part of the country we don’t like, just for the sake of an affordable home.

I think this is known as a Hobson’s Choice.

LCaution – Look into 55+ senior living communities. In the SF Bay Area, these condos are 1/2 the cost of comparable condos in the area. This can be a very affordable way to live in decent areas with great weather year round.

LCaution, I have been doing home loans for CA borrowers for 30 years now and in that time I have seen more periods of declining values (10+%) than I can remember. The big adjustments of 30+%, just twice. Once when Clinton came in, slashed military/defense spending and all the defense contractors left CA with those high paying jobs. (that could definitely happen again in 2016, after the huge run up in defense spending since 9/11) and then most recently in 2010/2012.

Two additional items related to your comment. I’ve noted with interest the almost daily bites in the LA Times of celebrities selling their mansions. Are they fleeing LA because their industry is fleeing and taking good jobs with it? And, another potentially major economic hit will happen in about a year or so to the LA area. When the new Panama Canal opens, it threatens business in the two largest U.S. ports, LA and Long Beach. The potential ripple effect on So. Cal. jobs is huge, possibly as damaging as the loss of aerospace and defense jobs. All of this would have me questioning the direction of real estate in So. Cal. especially at $760/square foot!

I don’t know if enough defense industry exists in CA anymore for a correction to be felt if defense industry gets budget cuts. It’s not 1991 anymore.

I knew someone whose grandfather was an engineer at an aerospace firm in LA. Gramps had a big pad in the Palisades. Apparently, aerospace from the 40’s – 80’s was like Silicon Valley now – engineers and execs got rich off of a seemingly never-ending boom. Now a lot of that stuff’s in Texas and N. Carolina and only the Dick Cheney’s of the world get rich off of defense.

@LCaution, SoCal home prices crashed in 1982, 1991, and 2008. SoCal home price crashes typically follow recessions although there was no housing price crash after the 2001 recession. The Federal Reserves’ interest rate manipulation started in 1999 so one could argue that SoCal home prices would have crashed in 2001 if it weren’t for the Federal Reserve.

After watching Bravo’s Million Dollar Listing L.A., Pasadena’s $600 sf price tag might look, to some folks, like a deal. After all, via Melrose Ave, Beverly Hills is only about 30 minutes away.

There is a lot wrong with this place, namely the freeway in the backyard. It might do for a single person or couple. I don’t have a good feel for the Pasadena market but Zillow claims the monthly rental to be $1935 per month. If this is accurate, we are easily at rental with 20% down.

Maybe we need to question why rents are so high in this city?

Value=value=value. Somewhere in the real estate BS is an underlying equation. Cost = Location +space+ quality( construction + amenities)= value. If the numbers don’t make sense there’s a reason and its time to run the other way. There are a few pockets where it still makes economic sense to buy. Dr. HB’s example isn’t one of them.

Corson is busy, and right near the highway, we rented a 10 streets up from the Corson house for a year, hood city. A dude was murdered in my alley off Wilson, and a kid was shot in the head in his car at the corner store one street over, and there was one other street murder about 6 streets from the Corson house – in a year. And once a handsome swat offer pounded on my door to inform me a convict was loose and shooting at officers so I should stay inside. I think the PC term is “diversity”. Nice people and POS people living side by side is beneficial to all… We moved to Altadena. Good luck with that house sellers.

Corson is south of the 210, which is supposed to be the safest, more prime area of Pasadena. Not Corson itself, as it’s too near the freeway, but just a couple of blocks south it’s supposed to be highly desirable.

As far as the ‘hood being only 10 blocks north of Corson, doesn’t the 210 provide an additional buffer? (The same way the 10 freeway buffers the northern half of Santa Monica from the scuzzier Pico area.)

Could this be your property, son of a landlord? Seems like a real stretch to discuss this location in terms of “prime,” “safest” and “desirable.”

Took a look at the map and the best I can say about this neighborhood is that it could be worse.

Teresa, I’d said that just a couple of blocks south is supposed to be highly desirable. You mean it’s not?

Three blocks south of Corson, and you’re on Colorado. I’d call south of Colorado highly desirable. Go south a few more blocks and you’re in San Marino.

If Pasadena is not prime south of the 210 (right beside the freeway excepted), what part of Pasadena is?

I see what you’re saying–if it’s 10 blocks south of a crime-ridden area, it’s also 10 blocks north of a prime, safe area. I suppose that’s true.

I think I have a more fine-grained sense of what constitutes a prime area of Pasadena. Living on top of Colorado doesn’t seem prime to me, but that’s just my opinion.

If you flip properties, you’d want to designate all or most of Pasadena prime. I think of prime Pasadena as San Rafael, Orange Grove near the Wrigley Mansion, the areas bordering San Marino around California, and parts of Hastings Ranch.

That doesn’t mean other parts aren’t livable, I just don’t think they merit prime pricing.

wow, sounds familiar. A close friend of mine lived in Villa Street a little east of Fair Oaks and in a 3 year period had 2 cases where police ran up her driveway looking for a criminal on the loose and once where police also pounded on her door asking her if she was harboring anyone inside. And police helicopters buzzing overhead with searchlight on countless times. Of course, North of 210 along Fair Oaks is bad, but it was scary!

What is comparable rent in the area for a 2br/1ba? Probably about the same amount.

http://losangeles.craigslist.org/sgv/apa/4712324523.html

$2,000, for 1,062 sq feet One street South and 10 streets West.

To LCaution。 You are talking about making a decision based on fear。 It will not turn out well。This fear of being turned out on the street on 60 days notice is irrational. The chances of it happening are less likely than being struck by a meteorite。You can purchase a house and be forced out by rising property taxes and/or repairs, or the gang bangers that moved in next door。 There will always be nice places to rent。Owning is no guaranty against rising costs。An old person is better off renting。

LCaution …Understand your plight family and close friends should always be part od your decision to move far away.

If I can make a suggestion, if both you and your wife are over 62 you may want to consider what is called a offer to purchase reverse mortgage program ( saved my friends parents with a a rev mort. loan in LAS Vegas a few years ago they love their home and are staying for life they were 74) at the time.

If you qualify you can stay in your home for life, you can receive money (take only a portion now) leave the rest in a growth credit line.

The only way you can lose this home is non payment of property taxes which in CA. you have to make sure you can make the payment or do a impound account against the equity loan to assure YOU NEVR DEFAULT!

Homeowners insurance and trying to rent the home for profit or leaving the home empty also won’t play well, looks like you are not that type. Anyway investigate it, it is a no recourse loan and if you stay forever in the end you beat the bank.

Make a deal on closing cost, many it you hard it is rolled into the loan so you probably can close with much reduce cost.

Good luck… ps blogger Jim looks like he does home loans maybe he also has a thought.

Southwest Pasadena, along the Arroyo is the nicest, most beautiful part of Pasadena. And the most wealthiest of course. I’m a Pasadena native, been here all 50 years of my life.

Leave a Reply