Is the new kind of real estate investor to blame for the falling home ownership rate? The current data on investor purchases, home ownership, and all cash purchases.

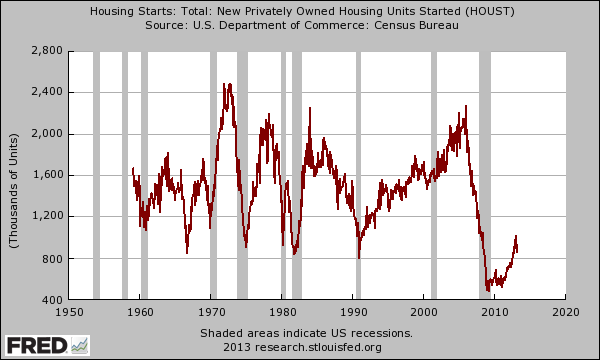

One piece of housing information that warrants a deeper analysis is the continually falling home ownership rate. Since the recession hit over 5,000,000 Americans have gone through the process of foreclosure. Yet for over a year now, the housing market has been recovering with lower interest rates, higher home prices, and a record low amount of inventory. Yet even on the national inventory front, it does look like some pressure is being released on this end. US housing starts are bouncing from the bottom and this will add much needed relief on the inventory side. However, this doesn’t answer why the home ownership rate has fallen so hard. Trying to explain the dichotomies in the housing market is like trying to wrap your head around dark matter. Sure, those that went through a foreclosure are likely now in rental housing. But as foreclosures become a smaller part of the market, why does the rate continue to fall like dominoes falling over one another with momentum? And the term “investor†has definitely shifted in the last few years. Let us take a look at the overall trends first.

The shift in investors

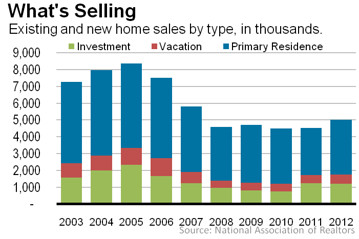

The peak year in home sales was in 2005 when over 8,000,000 new and existing home sales took place:

Keep in mind the above focuses on transactions. It was the case that some homes were being sold multiple times in one year given how hot the market was and how easy it was to get a loan (this applies to 2003 through 2007). But look at the amount of investment purchases in 2005 (over 2,000,000). Even in 2012 when investors essentially dominated the market, it was about 1,000,000. So why does it feel like investors are more dominant today? First the amount of supply is low:

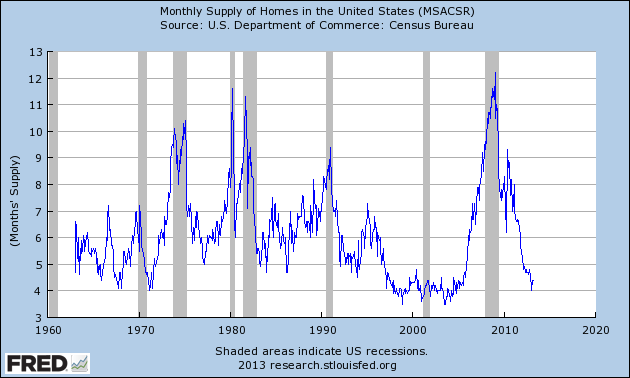

Months of housing supply is still near record lows (at 4 months of inventory). Yet overall sales are definitely picking up reaching 5,000,000 in 2012 and we are on pace for 5.4 to 5.6 million this year combining existing and new home sales. So why is the home ownership rate still falling? There are a few reasons:

-Shift in investors: Many prior investors were regular buyers purchasing second homes to either flip or try to rent. So you had many that had one, two, or more properties but the owner was one person.

-Foreclosures still occurring:Â People are still losing their homes.

-One and done transactions: Many of the modern day investors are big hedge funds. So you have one large entity owning 100, 500, 2000, or even more properties under one name.

I think the last item is probably the big difference here. The shift to all cash purchases shows big money has moved strongly into the rental business. Some of the big investors are looking at buy and hold strategies that will keep inventory off the market for a few years versus the buy and flip investors from the last housing boom.

When you buy 1000 properties, you don’t have it under individual names. It is registered likely under one entity. This is adding to the change. But also, a larger portion of Americans are renting because of their financial situation or because of a change in preferences. Many younger Americans are still trying to find their footing in this economy and many carry mountains of student debt. It will be interesting to see if younger Americans carry similar desires of home ownership as the previous generation.

The all cash buyers

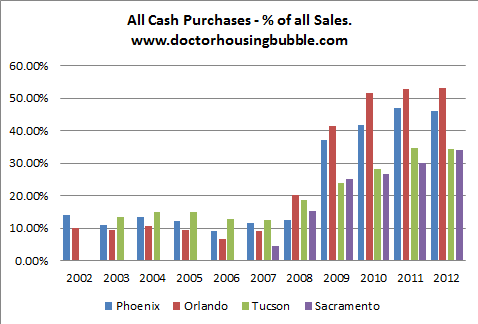

Another big point is the investors of the last boom did not have the capital to buy their investments. In fact, most were leveraging all the way. Although the last boom obviously saw more investor action, it was more of the mom and pop variety. We can see this with the all cash purchase activity:

Notice that in 2005, the peak of “investor†buying, all cash purchases were rather low in highly speculative markets. Orlando was below 10 percent in 2005 but in 2010, 2011, and 2012 the rate was above 50 percent for all cash purchases. You can see the boom of all cash investors. In Southern California, the figure has been above 30 percent for a couple of years now.

This is why you have an increase in home sales yet the overall home ownership rate continues to look like this:

There are a few reasons for the drop but it is clear that bulk buying of properties from Wall Street for renting purposes has caused supply to drop, prices to increase, and the home ownership rate for Americans to drop. As someone mentioned in an e-mail, what use is a great mortgage rate when investors are outbidding and overbidding regular buyers? We are now five months into the year and the trend continues to move on. We are seeing a shift in inventory nationwide and also, some larger investors are losing their appetite as yields get squeezed. However, housing starts have picked up significantly since the bottom:

This is crucial given the very low level of inventory. However housing starts are a leading indicator here because it will take some time before this inventory hits the market. I think the above information does add some clarity as to why the home ownership rate continues to decline in spite of rising home sales, higher home prices, and what appears to be another boom in the housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

35 Responses to “Is the new kind of real estate investor to blame for the falling home ownership rate? The current data on investor purchases, home ownership, and all cash purchases.”

From the many to the few….the trend continues.

CA gets enough people as renters rather than owners and Prop 13 may get killed.

Killed? Most certainly not.

Modified? Perhaps.

Will it make any real impact on home prices for today’s buyer? Nope..any changes will occur over the course of many years.

Lastly, just because there’s a majority, it does not mean majority rules in our Democracy. We saw this in action with the background checks legislation that was supported by over 80% of Americans, but got killed by Congress.

Also, home owners would be the ones with something actually to lose…their tax exemption. Renters have only a prospective gain, which isn’t a strong call to action.

Finally, each passing year that Prop 13 coasts along, the more turn-over occurs, limiting the effects of any Prop 13 modification legislation.

The proposed changes to prop 13 will have a very immediate effect. There are 1000s of she’ll companies that own multi-familry and commercial properties that are paying ridiculously low tax rates. Those properties may have changed hands several times since the 80s without a reassessment. I support Prop 13 in principal and especially for homeowners and small biz, but there are some very wealthy groups that benefit disproportionately, if addressed this wouldn’t lead to increased tax revenue.

As much as I hate Prop 13, that baby isn’t going anywhere anytime soon. Today’s buyers are paying market rate property taxes and likely will from here on out, they will not be affected. Even if renters outnumber owners in California, owners will always have the upper hand.

In the pro Prop 13 camp you have powerful corporations, homeowners, the wealthy, policy makers, lobbyists, etc. The same can’t be said for the repeal Prop 13 camp.

Politicians want money and will be looking for it where it lives. Property can’t leave the state. I think it will be a target that’s hard for them to resist despite various groups that won’t like it.

Thanks for the article.

Some people see prices rising (due to low inventory / supply-demand imbalance) and assume the economy is getting better. What most are NOT asking is “why is there an inventory shortage?†which is causing multiple offers and rising prices.

Two reasons – a great many homeowners are still so underwater on their mortgages that in order to sell, they would have to bring a large check to the closing table. For example, they owe $400k but if their house is only worth $250k they need to bring $150k to the closing. The average family doesn’t have an extra $50k, $100k, $200k, etc. to pay off the balance.

Secondly there still exists a huge shadow inventory that the banks are holding off market.

Combine these two most overlooked data and you get low inventory and higher prices.

This will surely have a happy ending – NOT!

Danny the people who are in negative equity, their negative equity is getting smaller all the time. The banks are feeding their REO’s in at an appropriate slow rate so property values will go up. Rest assured Danny, all will finish well for the banks. We don’t care about anybody else. We are bigger, and too big to fail. AG Holder said that we are also too big for him as well. We are fine, thank you.

Then you got folk like me: I have about 40K equity in my place (thanks to the Fed), but I’ve lost my taste for buying crappy CA real estate. I bought in 2005, for roughly 3.5 to 4.25 x my salary. If I had been given the chance then to buy something at 2.5 to 3x my salary, I would have the bulk of the loan paid off by now and would be ready to move up to the 360k range (or maybe a little more now that rates are so low), and thus ready to put my place up for sale. Since all I’ve seen is depreciation relative to my original investment, I just don’t have the ‘move up’ money required: appreciation=move up; depreciation=stay put.

So the tide receding a little, that peoples heads are just above the water line may not be the best trigger point for inventory creation.

I don’t understand why people expect their homes to regain the values of 2006. People overpaid for houses. Can someone explain why homeowners are expecting prices to recover to those distorted figures.

@Gerardo, unfortunately the reality is in parts of LA, OC, SD it has already surpassed 2006 prices. Thank you govt !

It seems the like individual is stuck at the bottom of a valley, fighting up hill against the Feds on one side and hedge funds on the another.

This is what happens with Fascist policies. The merger of state and corporate powers (Fed and Wall St) is what the Founding Fathers tried to prevent. I guess they never accounted for the shredding of the Constitution.

Maybe someday the people will rise up. Or maybe they will stay lemmings like now.

No doubt they never anticipated corporations achieving personhood, either.

@PapaNow did you end up getting that place in Rialto that you wanted? Or was it Fontana?

In Phoenix the average short sale and foreclosure goes for 60% to 70% of new housing. The normal should be 85% to 90% of new housing. Most new home buyers look at new housing and see this great discrepancy. It creates doubts that we have a “real” market. The builders are building as cheaply as possible for the highest price as possible. After all the press that has been written since the housing fall, people are more aware of what is going on. I know several potential first time home buyers, and they all think the housing market is being manipulated by the banks and hedge funds, like the stock market and are afraid to buy anything because they do not want to lose their investment. Until that changes there will never be enough confidence to create a real housing market.

Wow Jack, you must be surrounded by smart people over there in Pheonix – all I see here in Southern California is morons who believe that the housing market is back, this time for good, so they’re bidding like crazy

Home programs will be addressed to ramp up home ownership again.

New loan programs are on the horizon and loans and down payments will be within more peoples reach very soon.

The banks need high demand to get their balance sheets back in order before they pump and dump these properties back on the market.

Investors will be out, hedge funds will be out as soon as the regular buyers come back into the market. They need you for their Ponzi scheme.

Now that our manufacturing and jobs base has been decimated, Wall Street realizes that homeownership is out of the reach of most, as banks are reluctant to lend given the instability of the job market. Banks aren’t lenders anymore, just big investors living off the Federal Reserve. Wall Street wants to get into the landlord business as they see the long term value in real estate (inflation) and can raise rents on homes (inflation). This whole recovery is nothing nore than smoke and mirrors manufactured by the Federal Reserve. Remember, their job is to save the banks at all cost.

Dr. HB is also spot on about the decrease in homeownership. Homes are becoming business for generating income and not a place to live anymore. How sad is that?

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

Lot’s of interesting opinions here and in other threads, and lots of smart folks. So I have a question.

I bought a triplex beach property for $1.1MM exactly 12 months ago. I put down $475,000 and got a 30-year fixed rate loan for the rest at 4.375%. When I bought it the rents were way too low, and I’ve easily re-rented it with gross annual income is $75,600, and it’s still a little low. After ALL expenses, including my mortgage, insurance, taxes, management, repairs, etc., etc., etc., I profit about $15,000 annually — about 3%.

Let’s say — not so hypothetically — that I could sell this property now for $1,575,000.

Should I? Why or why not?

I’d say a lot depends on your strategy. Your cap rate is pretty low so increasing rental rates would help offset future repairs and vacancies. If you plan on acquiring other properties, and enjoy the job of being a landlord stick with it.

On the other hand, if you don’t enjoy the investment and you can sell it at the price you quoted you’ve almost doubled your money in 12 months (not including taxes and fees). Not too shabby 🙂

Doc, as much as I really appreciate all of your great articles, I’m not quite seeing the significance in this drop of the home ownership rate. So it went from 67 to an unsustainable 69 and now it’s at 65 percent, what’s the big deal?

That seems like a very minor change to me. And for almost 3 full decades (1970-1999) the home ownership rate was 65 percent, so what’s wrong with it staying there or a couple points below that?

This minor shift will not significantly impact the dominance of the home owners against renters. We’re far far away from getting close to 50:50, and even if we did get to 60:40 (I see no evidence for that happening) I don’t see that it would make a difference in terms of policy…

Here’s an observation:

The homeownership rate rose from 65% in 1995 to 69% in 2007 before dropping rapidly back to 65% today.

The stock participation rate rose from 57% in 1999 to 65% in 2007 before dropping to an all-time low of 52% today.

Historically the ownership of equities has been a pathway to wealth. Is the declining percentage of Americans that own equities a byproduct of increasing income inequality or is it the other way around?

It ‘feels’ like buy-to-rent investors have been priced out for a few months now, especially in Los Angeles. By priced out I don’t mean the investors don’t have the money to close escrow, but the numbers will no longer allow the property to cashflow. I say ‘feels’ because I don’t have any hard data to back it up yet. We’ll see if the percentage of cash-purchases to start declining as the summer season approaches.

IF there was pent-up-demand from owner-occupied buyers that were being outbid in 2012 it should start manifesting now if cash-purchases to subside.

Coincidentally (or not if you believe in conspiracy theories) we’re now exactly 7 years removed from when the foreclosure wave started (q2 2006) and 7 years is the length of time a foreclosure stays on a credit report. If those people can scrounge up the requisite downpayment, their credit should now be high enough to purchase a home.

Zero Hedge calls BS on the entire housing recovery, and as usual has the stats to back it up:

http://www.zerohedge.com/news/2012-10-15/us-households-are-not-deleveraing-they-are-simply-defaulting-bulk

Classic: “…there’s a bubble developing, and it’s in the central banks”:

http://blogs.marketwatch.com/thetell/2013/05/20/jeff-gundlach-were-drowning-in-central-banking/

You think?

This must be Bubble Monday.

http://money.cnn.com/2013/05/20/real_estate/amateur-investors/index.html

CNN reporting on amateur investors borrowing money from their 401(k) retirement funds to dive head first into real estate. I actually know of a number of people here in SoCal who have done exactly this.

The Federal Reserve and the Fed’s member banks must be overjoyed to know that people are dipping into their 401(k) retirement plans to purchase real estate at or above market value.

If it looks like a bubble, if it walks like a bubble, if it talks like a bubble, if it quacks like a bubble, then it must be a bubble.

This will not end well.

Wow, that is just unbelievable! If one is that greedy though, he/she deserves the (inevitable) outcome.

That’s odd – and here I thought that the law only allowed individuals to take out 401K savings for their initial home purchase, not for an investment.

It’s interesting to read past Dr. Housing Bubble articles, particularly this one, dated May 2011:

http://www.doctorhousingbubble.com/japanese-real-estate-bubble-bear-market-in-real-estate-is-making-its-way-to-the-united-states/

With the recent housing recovery, I find myself victim of confidently reason the recent recovery with fundamentals, having hindsight 20/20 ability.

For instance, I would confidently argue, the recent recovery due to low rates, driving investors into real estate, chasing higher yields, thus, propping up real estate prices. But, why did investors in Japan not behave the same way, as the above past article points out, in which Japan had decades of low interest rates but real estate continued it’s decline? Is one major factor simply due to Japan’s lack of shadow inventory? Or lack of foreign investors in Japan? Or lack of baby boomers retiring?

Also, reading the above DHB article shows what the sentiment was like two years ago, and how unpredictable the future is.

For instance, if someone were to comment back in 5/11/2011, “I believe by Q2 of 2013, housing median price would recover 5-10% YOY (in certain cities) due to “, imagine the backlash of responses. But yet, that is happening now. My conclusion is, not only can DHB, who spends more time studying housing than any of us, not predict housing (or make an argument predicting), the future could be drastically and INVERSELY different than fundamentals and historical comparisons at any present point in time.

Very true, if you look at the comments a user going by the name of “sand” was practically chased off the board for mentioning that he and several of his co-workers recently bought! Many predicted his home would be underwater soon! My feeling is that if you buy with a 3% 30 year fixed, you will be able to survive any future drops in the market.

@Jason

Hi Jason. Long time reader and contributor to this blog and last year after much contemplation I took the plunge; went house hunting and found a 3bed 2ba house in Baldwin Vista after seeing 15 homes, I made an offer on a house and was accepted. I purchased a home for near rental parity and affordable in an area I can live in the rest of my life. My 2 key parameters were: affordability and the fact that since I am self employed, I can perhaps live here the rest of my life. Its only been 6 months now, but I am very happy here. I even think prices can crash 20% sometime in the future but if prices increase by 7%-10% for the next couple years and then drop 20%, I have not lost anything in the mean time. (my fed withholding is $700 less per month also).

There was no shadow inventory in Japan. There was no governement intervention until the banks were smoldering ruins (like Lehman brothers). It’s more of a true market than ours is in the U.S.

@Jason,

This “recovery” is purely the result of interest rate changes.

Example:

May 2011, the 30 year mortgage interest rate was about 5%. Purchase a $450,000 home with a 20% cash down payment, the monthly mortgage is about $1935 per month.

May 2013, the 30 year mortgage interest rate is about 3.5%. Purchase a $540,000 home with a 20% cash down payment, the monthly mortgage is about $1935 per month.

Notice: the home selling price would have gone up by 20% in two years but the monthly mortgage did not change. The so-called “recovery” is an illusion created by mortgage interest rates dropping from 5% to 3.5%.

As soon as the banks get enough of the vintage 2003 to 2008 mortgages either purchased by all cash buyers, refinanced into FHA, resold to buyers with pristine credit or get the Federal Reserve to QE3 them (i.e. the Fed buys the garbage mortgage backed securities that no one wants), you will most likely seen inventory and interest rates both climb. Prices will then drop again as the “recovery” was all smoke and mirrors.

Believe it or not I am starting to see more short sales hit the MLS in the bay area again. They are still being bid up for huge money – offers same day as first open house. I remember in 2008 a few trickled in here and there, then boom massive supply. We could be very close to seeing supply pick up.

If this does happen I am sure prices will decline. Right now there area fair number of people that want to buy at any cost as they do not want to miss out. If a huge supply come on they will all be able to buy houses. Then the supply that comes on after that will be met with tepid demand. Once prices start heading down, many people that were thinking of buying won’t as they are scared it could go lower.

Look at this housing data from the Economist for many countries over the past 40 years – http://www.economist.com/blogs/dailychart/2011/11/global-house-prices

Leave a Reply