Something happened in the latest home sales figures: Biggest national sales decline since April 2011.

The housing recovery has really been an odd one. It has been driven by low inventory, anxious builders, and an army of investors. In the end what has occurred is that the homeownership rate is near a generational low, we have 10 million new renter households over the last decade, and home prices are up on relatively low sales volume. How can there be big sales volume when inventory is so constrained? It is a good question to ask. In any market you will have periods of capitulation, where people simply give in. You see it happening in this market where people purchase crap shacks as if taking their medicine when they were a child. The place physically sucks and is overpriced but hey, you need to do it because mommy told you it was the right thing to do. We’ve been in a holding pattern for a couple of years yet last month, sales did take a rather big drop. It was the biggest drop since April 2011. Is this simply an anomaly or are people priced out?

The latest dip in home sales

It should be noted that sales volume drops before any impact is reflected in prices. This is simply the way things go in housing. In fact, you’ll need a good year or two of lackluster sales to really have any pull on prices. Any journey needs to take a first step and it is abundantly clear that housing values are being jacked up in manic ways in many areas.

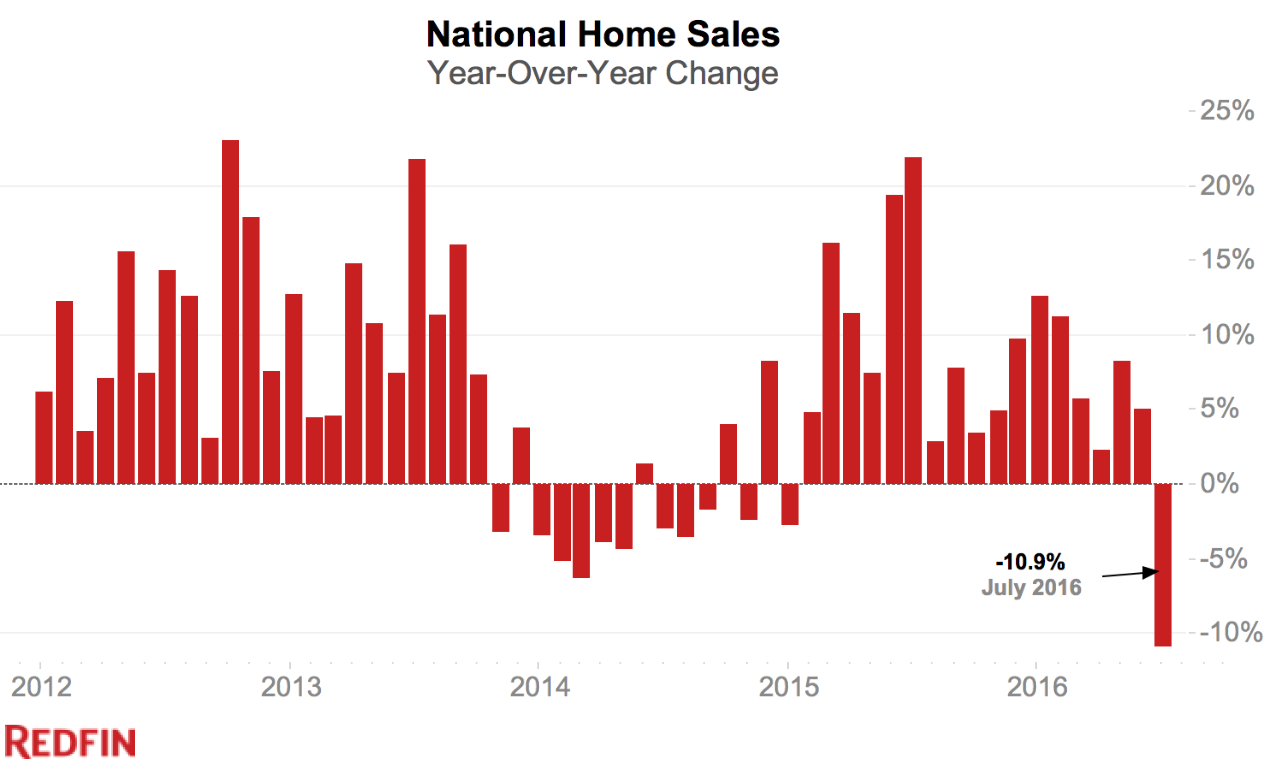

First, let us look at the drop in sales:

Clearly something occurred last month. Of course one month does not signify a trend. And this would be an odd time for it to occur since summer is generally a good month for home sales. The stock market seems fine and employment seems okay on the surface as well. But turning points usually happen when folks least expect it.

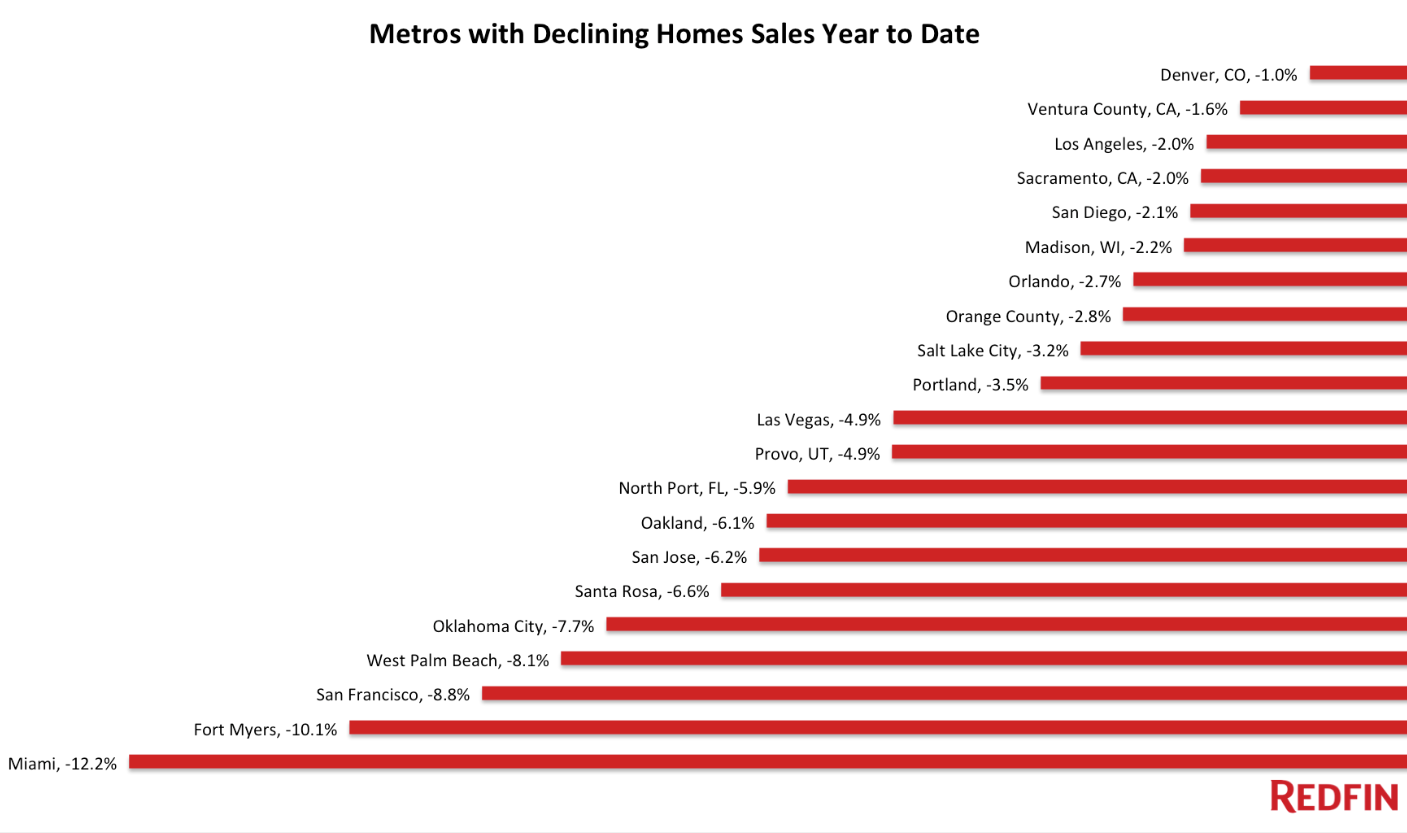

The drop here is the biggest in over five years. And we see this happening across many markets in the U.S.:

Lower sales volume simply means there will be more inventory if this pattern continues. More inventory means more choices for buyers and assuming the belief continues to hold that real estate never goes down, we may see this pattern continuing. But there is this virtuous circle effect going on at the moment. We’ve been on an upward slope when it comes to seeing home values going higher therefore inspiring more people to buy. From mansions to crap shacks, all home values seem to be moving strongly in one way. The housing fiasco now seems like ancient history.

So the major gains in home prices need to continue to keep this party going but what if things stall out? If anything the drop in sales is more of this realization. How many HGTV upgrades can people flip before the entire market is left with only granite countertops and stainless steel appliances? This might be a good ancillary market to follow. Quick, someone dig up a chart on stainless steel appliance sales per year.

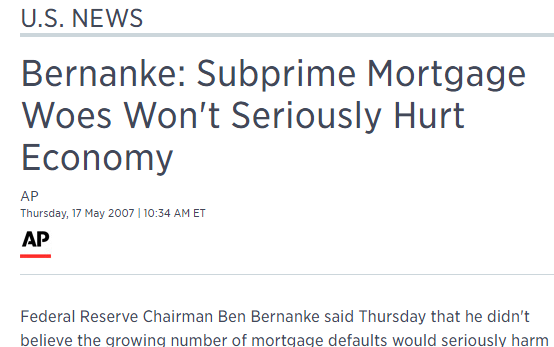

At some point something will give. People tend to have this blind faith in the Fed which by the way, missed the last housing bubble and largely set the stage for its expansion. I will remind you what the former Fed Chairman said back in 2007:

Things can change very quickly. We’ll have to see if this is simply an odd ball month or something bigger.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

108 Responses to “Something happened in the latest home sales figures: Biggest national sales decline since April 2011.”

NAR will tell you great stats on homes sales but never on bad news. Delisted homes (homes that never sold) at a all time high and days on the market is now explained by RE agents as meaningless?

Most people gauge the value of their home by listings and of course most agents buy the listing so the seller has little idea that the same agent will of course ask for huge price reductions when it doesn’t get showings.

This viscous cycle leads to your home sitting unsold and most likely a rather large loss if you can find a buyer. Most of the time the homes goes off market after may months or years, the RE industry doesn’t address that this issue is a disaster waiting to happen in the news.

Basically the USA housing market at 30 year 3.5% interest should be booming in every state, like 0% car loans if you don’t make enough money the interest rate means nothing.

Most, if not all arguments, fail to point out this fact: The Fed has created both a housing bubble and stock market bubble simultaneously, which makes both the Dot Com Crash and Recession a pimple in comparison.

Fool me once shame on you. Fool me twice shame on me. People have very short memories.

Well said!

If you want to gauge housing demand for existing homes, don’t follow so much the net sales numbers month to month as much as the year over year purchase application data.

For purchase applications data to home sales follow year over year numbers from 2nd week of Jan to the first week of May.

That demand was 25% growth year over year .. but that doesn’t imply 25% in sales growth of course.

In fact that is really just a couple of hundred thousand homes bought more by mortgage buyers.

Cash buyers have been falling as a % of the market place for some time now but still 22%-25% of the market place in 2016 for existing home sales data.

So after 8 years into the cycle with the lowest interest rate post WWII

We are back to 1998 levels on mortgage demand with a 75%-78% mortgage demand to sales metric

Look for slight growth year over year and inventory is lower like what we saw in 2005 as affordability keeps inventory low but post 1996 we have never had over 6 months inventory outside the housing bust years.

So the housing inflation numbers are a problem that can’t be solved by soft buyer demand because we have that in this cycle but prices still rise because inventory is still below 6 months and no recession means no new distress property coming on to the market place

https://loganmohtashami.com/2016/08/21/mortgage-purchase-applications-data-2016/

What are the stats on incoming housing starts and new builds? I see a lot of starting construction and finishing construction of previous housing projects that had stalled during the recession. Will the influx of new homes help level out price increases and eventually rental prices?

Housing Starts are running at 1.2 million roughly. However, housing inflation is very heavy because the builders have only been building bigger and bigger homes and rentals while strong in this cycle have been highly luxury build outs but they have never been more rentals built than single family.

I recently wrote this thesis that build more homes won’t help affordability as long the builders keep on building bigger and bigger homes

Median sq foot 1,500 in 1974

Median sq foot over 2,500 in 2016

Why Building More Homes Won’t Help Housing Affordability

https://loganmohtashami.com/2016/07/25/why-building-more-homes-wont-help-housing-affordability/

Mr. Loan Officer,

In order for your propaganda to hold water, please enlighten us why the cash buyers are disappearing?

Sheep will always be sheared!

Cash buyers typically fall with the falling supply chain of distress property, so since 2014 cash buyer volumes as a whole has been falling all over the country because distress supply has been falling which runs with all the data tracked that matches conventional sales to distress.

2014 was 30% market share cash in a negative growth comp

2015 was 26% roughly cash buyer in a rising sales year 4.90 million to 5.30 million in total existing home sales

2016 so far has been tracking between 22%-26% is a slightly rising sales year for existing homes

The data is there in each report for existing home sales report.. First time home buyers have been trending at 30% roughly for years now, it’s the move up buyer that has gained some traction in 2015 and 2016

That runs with with mortgage purchase applications running at cycles highs but only back to 1998 levels so context is always key

“the lowest interest rate post WWII”

lowest overall interest rates in 5000 years. That simply can not be a sign of a health economy.

That must mean that U.S. real estate is at its most affordable in history. Right? Right? Right? Or least we should be thankful that it’s more affordable than it was in 2006. Right?

This entire exercise has been a giant levitation game, but as we can see buyers are growing weary and even big players are having second thoughts at buying at these inflated levels. The Fed has been able to keep things stitched together longer than many had imagined, but in the end all they have done is distort prices even further from true equilibrium, blowing more bubbles yet again. The song is winding down. The only real question is whether you will have a seat left when the music stops?

http://aaronlayman.com/2016/08/katy-texas-west-houston-real-estate-market-july-2016/

Thank you for your insights, Logan! Always appreciate your insightful postings, especially from someone inside the belly of the mortgage beast!

The greater Sacramento market is a total froth-festival. I am watching deals get overbid by flippers, then resisted at a premium after no work on the home has been done. This is a slow motion train wreck. There are even educated people that lived through the last crisis like I did and are defending these ‘reflips’ siting low inventory. Essentially justifying it. There is no slowdown at all here yet, still gangbusters. I watched this deal (overpriced at initial list of $225k) get bid up to $260k, then resisted arbitrarily for $290k shortly after with no work done on it. Unreal. This will end very badly at some point. Who knows when though. http://www.realtor.com/realestateandhomes-detail/2764-Ponderosa-Rd_Shingle-Springs_CA_95682_M13175-08587

$2XX,000 – now that’s a number I haven’t seen in quite some time.

It seems cheap but only by comparison. It is massively overpriced given the local economic factors. Also having to be next door to meth cooks and BHO labs builds in some affordability.

Definitely seeing a slowdown in Orange County (Orange & Tustin Ranch areas). Just saw a house that was listed for $800k in Orange (Santiago Canyon area) in very nice condition sell for $773k after over a month on the market with lots of staging and lots of work by the realtor. Now I’m seeing listings in Tustin Ranch sitting for over 3 months with very motivated sellers while being priced at market value. 6 months to a year ago, things were flying off the shelf. Looking forward to seeing if this will have any impact on the Irvine bubble.

I haven’t been paying attention to the OC real estate market in a couple years. Great to hear reality is setting in over there!

As for the slowdown, I first noticed it in areas outside the prime markets such as the high desert, particularly Victorville. A quadplex that was listed for $360,000 sat on the market for almost 10 months before selling for $350,000. It wasn’t the best investment home but considering how crazy real estate has been, especially for rentals, it was a good deal. The upside potential was it’s selling point but waiting 2 years to get the rent up to fair market value was not worth it to me so I passed. If I’m going to be waiting on a decent cash flow, I might as well wait on a true opportunity to come by. Either way, it sounds like opportunities galore in the near future.

I live in Victorville, and there is a new tract that opened right around the corner from me last March. So far only one home has sold. Granted they are really small homes with little to no yard, which makes absolutely no sense being that this is the desert and land is cheap, but they are not moving.

The High Desert MFDs will catch bids as OC/LA, IE and SD market continue to streak higher. They need some large employers up there, but money is active up there.

Good Point. If Yellin rises the interest rates a little in September or December even more sales will dropped.

Housing to Rebound in August 2016!!!!!!

The Houston area is being hit hard by the massive drop in energy jobs and huge number of firings. 2 years ago there was a 6 month waiting list to buy a house in nice areas like Cinco Ranch and cross Creek Ranch and The Woodlands. Now, there are over 18 houses for sale in my tiny neighborhood alone not including the entire Cinco Ranch or Cross Creek.

House sales in Houston fell 8.8% from what I read on the HAR web site and energy execs say more layoffs and bankruptcies in the energy sector are certain.

This makes sense, Dallas and Austin on the other hand have a different economy like Toyota marketing went to Plano Texas in Colin County near Dallas. Houston’s population is lower skilled than Austin, so a dropped in oil jobs would effect the market for housing.

Good article – it is important to note that Property Radar’s July 2016 report looked closely into this data and they have stated that “July 2016 had two fewer business days than July 2015. That calendar quirk was enough to depress July sales. When the missing days were taken into account, the sales decline was approximately 3.0 percent for the month and 5.0 percent for the year, in line with expectations”.

Lowered expectations has been the hallmark of this economic “recovery”. Lower revenues all around, yet asset values are near all time highs.

The Tank has Started!!

Dr,

I think the reason for the 10.9 percent decline in “year over year” July sales is because July 2015 had 23 days for recording sales, and July of 2016 had only 20 recording days. This probably accounts for the 10% drop since there were 15% LESS business days in July of 2016.

This sounds like something that would be a common occurance. Something the number crunchers would be aware of and take into account. But, we certainly never hear about it when the numbers go the other way.

I see what you are saying, but if that is the case shouldn’t June sales have been much higher? Or perhaps August will be. I still think sales may be depressed due to the election, they historically are especially in controversial elections.

This Venice crapbox (too small to qualify as a crapshack) — is listed at nearly $1.5 million: https://www.redfin.com/CA/Los-Angeles/579-Grand-Blvd-90291/home/6741555

732 sq ft.

2 bed/1 bath (2 bedrooms in 732 sq ft?)

Built in 1951.

the world has gone insane……so insane, I’m laughing my a$$ off….

1.5 million for a studio in Venice….

I need to talk my wife into selling now…..time to get out with profit….

Technically, aren’t all “studios” open concept! LOL!

The housing insanity has reached epic proportions!

Beam me up, Scotty!

Feels like the starving artist type of flat.

I’m not seeing a stove, a microwave or a refrigerator, am I missing something? Yeah, yeah, no one cooks anymore, but don’t they need to keep the Red Bull cold?

Actually, you’re right. That $1,500,000 “home” has:

– No refrigerator

– No stove top

– No oven

– No dishwasher

– No air conditioner

– No heater

– No garage

– No carport

– No driveway

Therefore, this is a 750 sq ft WAREHOUSE that costs $1,500,000. You can’t call it an office, even offices have refrigerators, cookware, air conditioning and heating.

You can’t call it a home, because you can’t live in it.

So it’s basically a decorated storage room, or a pretty warehouse.

Even at half the price, which is what it sold at in 2008, around $800,000 – it is still just a storage room.

Even at $50,000, it is still far overpriced, because it’s a storage closet. Only an IDIOT would buy this. Apparently, there are lots of IDIOTS who love wasting money on practically useless things that lose value over time, and have little value to begin with.

Amazing!

sells went down because there is not much inventory in Burbank. If inventory goes up, sells will go up.

Might have posted this here before, but a week or two ago I listened to a real estate show on bloomberg radio and they reported lowest number of cash buyers since 2008. The peak for cash buyers was either 2011 or 2012, I forget. Remember how good things were in 2008? We’re gonna need a bigger boat!

I read craigslist and I think there are now lots of labor shortages in LA and OC since thousands are leaving. The paper claim that more people are entering the job market and unemployment is up but many fields particularly in Leisure and Hospitality and constrution and lower skilled factory worked like warehousing. I think L and H is not growing that much but thousands are leaving OC and LA because of the high rent and moving to the inland empire.

In re to labor – I have a couple friends here in LA, LA LAnd, who own small construction related firms (carpentry, HVAC) and they are always lamenting on how hard it is to find skilled labor and technicians. This shocks me because we keep hearing about how many people are looking for work – apparently NOT skilled labor or tech’s.

Same in Connecticut, I have a friend who owns a house painting company and it has taken him years to find 3 skilled painters who work with him on all jobs. Other than that, he is left to picking up day workers at the Home Depot and hoping they can paint like they say they can.

Can any small business owners (that require SKILLED labor) share their stories?

I posted many times on this subject of shortage of skilled labor. Even in small towns with affordable housing is very hard to find skilled labor; not just skilled but dependable. In high cost of living areas that is a real challenge.

The type of people you can find are not dependable, they have a bad work ethic, lie all the time and steal any chance they have – in other words, the refuse and the low life who would scare any client to see them on their property (and I did not mention drinking and drugs). You can teach any employee the technical aspects of the job, but you can not teach an adult what his parents and the school were supposed to teach him in his formative years. That is the second most important reason builders are not building. The first most important is the cost of land in desirable areas where the demand for housing is.

Should be easy enough to find skilled and dependable people if they’re paid what they’re worth – but if the job is harder than another job that pays the same, why bother?

The condo unit behind mine did a remodeling. The unit was a 2/2 with some 1000+ sq ft total. Yet the remodel took seven months!

I asked why it was taking so long. I was told the contractor kept hiring cheap labor, and they were doing a bad job, so they kept having to bring in new workers and start over. Redoing what they’d already done.

Penny wise, pound foolish.

I have watch those small beach cottages in Dana Point go from mid 500s to 700 in about 18 months. Hard to tell when this will end. But, it is possible they hit the 800s within the next year. In 2013, they were in the 400s.

Shout out to A’s Burgers

A friend of mine bought a condo steps away from the beach with reasonably low HOA fees (I think about $200/month) in 2010 for $225,000. I can’t even begin to imagine what it’s worth now.

Gangbusters here in Carmel. The condo complex I live in have seen 2/2 900 sq.ft. units increasing from $340k in 2014 to $600k today. Completely wild and the increased rent in the complex as a result threaten to drive out anyone in the middle income brackets.

One day soon the residents of Pebble Beach and Carmel won’t have maids, painters or gardeners to call upon.

I predicted in 10 years that Denver would have higher housing prices than LA, people laugh that off. Its still possible.

HAHAHA.

I’ll take your bait. Don’t know anyone in their right mind in so cal who would move to Denver. And yes, I’ve been to Denver. No beach. Bunch of white Christian conservatives and wanna be hipsters. Yuck.

HAHAHA.

Don’t know anyone in their right mind would want to live in a third world hellhole like SoCal. And yes, we used to live in SoCal. It’s dirty, over crowded, mostly ghetto that is built on earthquake fault lines. Totally unsustainable since water and food must be brought in from hundreds of miles away. SoCal is filled with a bunch of third world trash, welfare bums and wanna be hipsters. Yuck.

Sales are down slightly this year in my neighborhood, but so is inventory. Prices are up about 10% YOY for model matches. This is North County Coastal San Diego.

Following Jim Taylor’s crash warning years ago and not buying has cost you about $250K in equity in my neighborhood. Keep up the great financial advice Jim!!!!!

You should sell to lock in those gains! After a couple years of paying mostly interest on that loan, paying taxes, maintenance and of course realtors’ fees; if you can sell at that inflated valuation, you might end up slightly ahead of where you were.

No way that is crazy talk. The house is awesome, cul-de-sac, private yard, 3 miles to the beach, my kids love their school and the house, great neighbors, and limited inventory in the area. We are not going anywhere unless I buy a bigger house in the same neighborhood. Trying to time markets rarely works and usually ends up being a bad move.

Sell and lock in your gains, what then? Get into a cheap rental and pray for the big crash and go all in the stock market. The Falconator is likely below rental parity, paying down significant principal, getting a break on taxes and doesn’t have to worry about timing the market. Staying put sounds like a win-win to me.

Significant principle doesn’t begin being paid down until 10 years into these 30 year loans. Then at that time, the savings from your interest duduction reduces as well. If you like the house, know you’ll be there a long time and it’s affordable, I’m happy for you. However, that isn’t the case with most buyers these days. Unfortunately most talk of impressive gains and really that is the root of the problem.

Observer, that’s not true with today’s ultra low rates.

As of today, a 30 year conventional loan is 3.4% which means your first mortgage payment will have 36% going to principal. At your magic 10 year mark, 51% of your payment goes to principal. How is this not significant?

Your argument was true when rates were much higher, lower rates changed everything!

10 years in and still only 51 percent goes towards paying principal proves my point.

I agree with the falconator and the Lord. I must be an optimist. If you are not forced to sell at the lows, the low mortgage rates today mean that you are paying over 1/3 of your payment to principle. The rest of the interest payment is tax deductible so it could mean that if you are in the 28% tax bracket, that your effective interest rate is .72*3.4% or 2.4%. Japan has had between 1% and 1.5% rates for over a decade. We could get there also. The problems happen if you have to sell during a housing crash. 2008-2009 was a bad time to sell. If they could have ridden it out until 2016, there wouldn’t have been a problem. Based on history, Jim will be correct someday. When it happens, just don’t sell and wait another 7 years. Easier said than done.

But the low rates means less to deduct so I pay more toward principal but getting less to deduct so we don’t to have our cake and eat it too. If rates were higher then prices would probably be lower so less principal to pay but the gummet would be giving me more back toward the monthly payment. It doesn’t matter how much I’m paying in principal anyway if it’s gonna be stuck in the house the entire time I’m living in it and looking at rental parity alls I care about is the monthly cost. If I move I have to use that principal to pay toward the next house so it’s still sitting there the whole time I can’t use it without it costing me.

And a 10%yoy increase will occur ad infinitum. I love the ghost equity braggers that think this will never end because this time is different. I knew lots of people that were bragging about how much money their home had increased not only yoy, but even month on month in value back in ’07 only to lose it all. But I’m sure this time it will be different.

It’s always amusing to see how many people will go ad hominem on Jim even though he never makes a derogatory remark towards anyone.

Go Jim!

“As of today, a 30 year conventional loan is 3.4% which means your first mortgage payment will have 36% going to principal. At your magic 10 year mark, 51% of your payment goes to principal. How is this not significant?”

The monthly ratio is tangental (although it actually proves Observer’s point) — it’s the aggregate which matters. At ten years, 33% of the term has been serviced, but only 23% has been paid toward total principal with 3.4% rate.

Observer and Hotel CA:

I’m not sure what agenda you have against housing, but some of the nonsense you are spouting off is laughable. To the average Joe, sending in a mortgage check and having half of it go to principal is a giant accomplishment. This is nothing more than forced savings, most of these slobs would blow every dollar and then some if this wasn’t the case. Any appreciation is just icing on the cake. Keep believing there is no inflation, supply and demand is a myth and desirable socal home prices should be supported by local incomes.

Like a broken clock, Jim Taylor will be right one of these days. But the opportunity cost and living in a constant world of unknowns is a heavy price to pay.

One more comment related to the Lord’s observation that 36% of the payment is going toward principal in the first year for a 30 year loan at 3.4%. In retrospect, being a first-time home buyer in the 80’s, I must have been crazy and desperate. At our 11% rate back then, only 4% of the first year payments were applied to principal. Today, as long as you don’t have to sell during a crash, a mortgage on a house truly is a significant forced savings. Back then, if I had or wanted to sell after a few years, I wouldn’t have had much equity. Today, I would have about 5X the equity for the same loan after a few years. Rates are at the lowest in US history now but Japanese mortgage rates are at 1% now so optimistically, we may not have seen the floor yet.

LB, the math showing at ten years in the provided scenario, 23% is paid to principal at 1/3rd completion of the term is not nonsense, it’s factual and meaningful, regardless of silly conspiratorial suggestions and false claims about what I believe.

Lol falconator. Why don’t you keep buying RE and make profits of 250k for each one. Seems like a great way to get rich. Why even waste your time here and share your ways of easy money making?

As much as I hate to focus on the messenger, it’s a fair question to ask because these guys repeatedly bring their personal situations into context. Why come here to berate the doubting Thomases? Seems like it would be a complete waste of time or maybe they also have doubts. It’s a very strange psychology, like a panic of convictions.

I think the Jim Taylor phenomenon began back in 2013 or 2014, so are you saying buy now in your neighborhood or be priced out by another $250K by 2018-2019?

Nope. I’m saying that believing in Jim Taylor has cost someone about $250K in appreciation in my neighborhood so far. In addition, using my loan as an example, I have paid down close to $40K since then, so I am plus close to $300K by not listening to Jimmy-boy.

I read this blog and a handful of other RE, financial and general sites – Citydata, Jim Klinge, Zerohedge, Calculated Risk, Early-Retirement, Piggington, and a few others. Been posting on them all for years. The fact that this Hotel Cal guy keeps repeating the bizarre mantra of “why are guys like me here” is just plain weird. Like these boards are supposed to be some exclusive club where differing viewpoints are discouraged. Just weird man. I have numerous other white collar pro friends with a lot of dough who surf most of these sites and post. It’s not a waste of time for us, we do it because it’s interesting.

I never make general predictions about RE. I will look at every neighborhood and evaluate it on its merits. For instance in my neighborhood the top end homes are selling for close to $1.4 mil. In that range and above, the DOM is higher, there is more inventory and in my opinion less headroom over the next 3-5 years. However there are plenty of homes in the $950K-1.1 mil range with tighter inventory and I believe more headroom over the next 3-5 years.

Also I stand by my belief that market timing rarely works in your favor. The forces at work in the RE and financial markets are beyond your knowledge and certainly your control. Your best bet in RE is to buy what you can afford in a quality area and let time works its magic. Your best bet in the stock market is to buy the whole market and let time work its magic. Or you can listen to one-trick ponies like Jim Taylor, yeah that’s it, that’s the winning ticket.

Hotel,

you’ve nailed it. Why do people who have won the game at the casino come here and crow about it? If my house went up $250K the last fucking place i would be ……WOULD BE HERE AT THIS BLOG.

WTF is wrong with these trolls…..i mean people?

You’re mischaracterizing the point of my question regarding why some people bother to read this blog. It has nothing to do with entertaining different perspectives and who participates in the discussions. It’s about the lack of confidence behind smug rhetoric. For example, such as the post you initiated about Jim Taylor, actively bullying another commenter of an opposing viewpoint, using your own personal situation as ammunition. That’s what’s truly bizarre and weird.

@ Falconator… better pray that you don’t lose your Job…I hope you don’t “really hope you did” that’d show you to stop braggin and patting yourself on the back… Here in the valley alot of people over 45 years are losing their job and having hard time finding another that pays more or less the same… and we have not hit the Recession so to speak…

I knew a guy who had a nice house with pool and a great job before 2008 happened. He always bragged about it… claiming he was to important and knowledgeable to ever be without a job… well… he lost the job, the house, got divorced, his daughter got knocked up, and his son started doing drugs in their great school that his kids loved….

just saying keep laughing of other people’s desperation of inflation housing just because you got it on time… Karma is bitashh

i love that “keep up the great financial advice” as if this market can’t be any more distorted.

who can give financial advice with interest rates the lowest in recorded history? This “market” is pure fucking gambling, true price discovery is all but non existent.

i happy for you that you won at the casino. I don’t have any money to gamble with so i’m stuck watching but sooner of later reality will prevail….as it did in 1991, 2000, and 2008

As Hotel CA said, no sense blaming the messenger. It does seem that when someone like myself, Lord or Falconator posts a positive perspective for purchasing real estate, some folks’ bitterness about their own situation gets aimed at them/us.

This is an open blog and what makes it interesting and educational, IMHO, is differing viewpoints with people of all ages/situations communicating their opinions and experiences in this crazy market we’ve been in the past 16 years or so.

I also have enjoyed the general lack of need to senselessly attack each other for having differing opinions on this site; and, hope it stays more in that direction.

I love popping on here from time to time. We left LA and figure housing here on the Wasatch Front of Utah is about 1/10 the price. Recently we moved north to Ogden and the houses are dirt cheap. For a house on the hill 1,000 feet above the lake with incredible views I got a bit of a fixer for under $400k. We are the smallest house in the neighborhood, the only one under 4,000 square feet. Others are between 5,000 and 8,000 square feet. Some are estates. $1.5 million for a cruddy little place in Venice with almost no yard in a marginal neighborhood, it is looney tunes.

no offense but $400K in Ogden is fucking looney tunes as well. I can’t even imagine paying $400K for a home anywhere. That’s 10 X my income.

and WTF is going on with this site? it’s attacking my browser like mad???????

I’ve queried for existing and new sfh sales for July 2016, and the results from gov’t sources, housing industry, and various financial sites analyzing this topic universally show not a steep decline, but increases. I don’t know what to believe anymore.

@Falconflight – And the major stock market indexes have shown fantastic gains this year, almost like everyone forgot about the major corrections, or in some cases flash crashes in May of 2015, August 2015, and January 2016. I am relatively certain the music is about to stop by the end of 2016 in the financial markets, which will quickly spill over to real estate

Millennials are tapping home equity for vacations and emergency cash:

http://www.marketwatch.com/story/millennials-are-tapping-home-equity-for-vacations-and-emergency-cash-2016-08-24

But but but I thought lending standards were stricter than ever during the current RE cycle. Borrowing from Peter to pay Paul suggests very little discretionary income is left — especially after housing costs are deducted.

Idiots, but they know the government will bail them out, so maybe they aren’t dumb???

And, then you read all these comments from people who have convinced themselves that this time will be different, that that equity will continue to climb, that that job that pays the mortgage or your bills will be there tomorrow!!!

Low income workers getting priced out in Santa Cruz, perhaps like very other beach city in Kalifornication?

https://www.theguardian.com/us-news/2016/aug/24/california-homelessness-santa-cruz-housing-affordability

Wooo; wooo; intriguing news.

‘Real estate runs on money’ (not on population growth, nor ‘housing demand’ where so few can pay the prices owners believe their property to be worth) is one of the gems I picked up on DHB (here)

__________

My expectation is that this market segment will behave in the same fashion as any other market which has topped out. Supply will increase, volume will decrease for quite a while before prices begin to crumble.

Many of us think that the entire market pricing structure is driven by the high priced segment, as all other properties are priced based on compromises versus the ideal (location, size, commuting etc). When the top end crumbles, everything else will follow.

Prices as a lagging indicator makes sense. People with paper equity wealth should wait till the next up cycle to brag about their untold riches.

Jim Taylor is smiling soewhere…….

“Should be easy enough to find skilled and dependable people if they’re paid what they’re worth – but if the job is harder than another job that pays the same, why bother?”

Chris,

I agree with that. If you pay a lot, eventually you find the people you need. However there are problems with that:

1. For a remodel job, you have to bid really high so you don’t loose money; then you lose the contract, because someone else bid lower.

2. If you build a new house and you pay what a good skilled labor is worth, then the price of the house is so high that nobody will buy. Then you have to drop the price in order to sell it and you lose money.

There is no easy solution to the shortage of good skilled workers. All outcomes are bad for the workers, for the contractor and for the client. It is a real challenge to balance all factors I explained above.

i bought early in the heights area in houston texas,im sitting on $400,000 of home equity.before i got this house in 2011,i read a story on how people who bought early in harlem won the lottery and i said to myself i wanna be just like them.i wasn’t bitter i found their story aspiring,so i did my homework on the computer to find the next hot area and this is how im in the situation im in right now.they are spending $1.5 billion dollars to make downtown in to wonderland and the white oak music hall is a huge success.whole foods along with other companies are coming to the heights.it’s best to buy while oil is still down,because you wont have to deal with the bidding wars.people are still buying in the heights though,since its the most popular hood in houston.i got a letter from the harris county appraisal district and it says from 2011 to 2016 my appraised value of my house went up 1967%,im lucky i got my homestead.my house is 1,845 sqft and my mortgage is only $637.00 per month and my loan balance is $77,210 and i have a 3.39 interest rate on a 30 year loan.experts are saying in the next 10 years home values will really be up in houston.people are already saying they cant afford to buy here already and the situation will soon get worse,so buy now.

Huh hoh. Buy now or be forever priced out. Even if the local economy continues to deteriorate due to the commodity bust. Houston real estate prices can be fueled perpetually by hopium.

the heights area has many medical faculties,dentists etc.and the texas medical center is just a few minutes away and its the world’s biggest medical complex and its expanding.the developers are building expensive high rises not only for the rich people in america,people in the real estate industry here are going to foreign countries to tell them they should by here.what happened in london with the brexit situation,now more high networth foreigners has there eye on american real estate.i have read stories that real estate agents are getting more calls from foreigners wanting to buy real estate here.this one realtor said she has sold many homes before they have hit the market and since they have been sold early its not being reported by the houston home sales report.im in my 30’s im not thinking about 2017 im thinking about 10 and 20 years from now.houston,austin and dallas will be as expensive as the homes in the west coast and east coast,if you check out the home values in the popular hoods close to downtown it’s getting there.lots of people in texas are complaining that they cant afford the taxes on their homes and many renters cant afford to buy a house here,the situation is only gonna get worse texas is becoming just like california and that’s why im not selling my house,im just gonna rent it out.

Housing to Crank Hard in 2017!!!

Typical election year ripple….

The question is not if we are in a bubble or not. You have to in the middle of a frontal lobotomy procedure to not accept that there is a major real estate (among other sectors) bubble. The question in my mind has always been, when the market starts to turn, which it barely is it at the moment IMHO, will government intervention/meddling reverse the course again with insane dollar murdering monetary policy? That is the real question.

You are playing baby checkers if you don’t think we are in a bubble. Obviously we are, let’s move on to the next logical progression of things.

I give all the stars to this comment, Mr. Miyagi. Dead on.

Bubble has already burst in some areas – just like the last one, there were places that were dead (rancho santa fe) while low end areas were still popping (north park, san diego). Same thing happening here.

Big wildcard is what the govt looks like when its apparent to all that its burst. An all repub govt will have a lot of pressure to let the chips fall where they may by their constituents. The more power the dems have, the more bailouts will happen – and they will be fake bailouts like before – save their buddies banks, give a few people some sweet deals so they have some good publicity to point to, while the majority will get to smell the glove and pay for the love.

Unfortunately, that’s the problem. Miyagi. They now know, beyond any shadow of a doubt, that we all know we are in a bubble. Now. In you want to protect Barack’s Chicago holdings and developer plans, and Mrs. Clinton’s, what exactly will you do to drive the sheep away from your cliff… what exactly will you do. That is what is being done. Nothing less.

Right. And I believe government will keep intervening and destroying the value of the dollar and keep at it until the market takes over it.

Bears, we all know eventually the Fed has to raise rates, well they just tipped their hand this morning, http://www.bloomberg.com/news/articles/2016-08-26/yellen-sides-with-fed-camp-professing-faith-in-price-forecasts

Could even be 2 rate hikes this year. We all know what that does to housing bubbles..

Do they though? They also signaled that negative interest rates were not off the table. It will go something like this…They will bump rates 1-2 times, then we will be in a recession, then they will slash rates and we will go negative with us other wacky stimulus or chopper dough in an attempt to stop the recession.

Yeah, what scares me is that the Fed holds so much in mortgage backed securities. They may try quite hard to keep real estate propped up.

The Fed also is considering buying companies’ debt…bailing them out…on a large scale…bigger than 2008 bailout of banks.

Is the Fed “tipping its hand” or just lying?

The Fed has hinted before that it would raise rates, only to then fail to do so.

It seems the Fed’s policy for a long time has been to hint that it will raise rates, to encourage more home buying. Then it fails to raise rates.

Then the Fed repeats the cycle of hinting, more home buying, no rate increase, more hinting, more home buying, no rate increase, more hinting …

The problem with this logic if the FED is thinking this way is that it hopes to have buyers on the hook and possibly under water so it gives them leverage to have banks seize their properties and pocket the principal the buyer just paid if the market corrects. Almost like a game of catch. If they can never have homes paid off they can at least take your principal to keep funding the FED.

By threatening to hike rates – but not actually raising rates, the Fed tends to bring in the weakest buyers – those who don’t know much history, don’t have much money, and are easy prey to high pressure sale tactics. They can only do that a few times before they get the boy who cried wolf treatment. This fed is a complete joke, they need to be disbanded, tried and hanged.

What $888,000 buys in Bel Air: https://www.redfin.com/CA/Los-Angeles/1718-N-Beverly-Glen-Blvd-90077/home/6830413

A 1/1 “fixer upper” — or “tear down and build your own dream home!”

And it being on a busy street — Beverly Glen — you’ll have the added convenience of easy access to a major artery! Just pull into rush hour traffic every morning, right outside your front door.

No Tank in Altadena — https://www.redfin.com/CA/Altadena/1779-Coolidge-Ave-91001/home/7265350

Listed for $739,000.

Sold for $805,000.

I suppose it’s the low inventory.

Its is definitely a bubble for sure fuelled by Fed policies

How and when it would end , no one for sure

But anyone with a small amount of common sense can definitely see its a bubble

With wage stagnation and flight of high paying job along with weak recovery… it’s gonna be a interesting mix

The hairbrainers will be upset by this but the greater Sacramento area continues to outdo itself in terms of froth. Literally every day the market roars louder.

For those suggesting there is some kind of a slowdown, there is absolutely no hint of this within 1-2 hours of Sacramento, CA (the markets I track most closely.)

Please control yourself, and don’t be upset. Some of you blow your top when someone reports anything other than blurting out, “REAL ESTATE TO TANK HARD SOON!!!!!” This is not an issue of whether or not the market is extremely overvalued, it is, but not only is there no slowdown, it is picking up daily. This market is just heating up here.

If it has wood siding and a pitched roof it is going pending instantly at any price.

We saw the same thing last time, high end was crapping out in the Bay and Sac valley showed up late to the party. But hey, maybe it’s different this time.

Just something to keep an eye on… it’s suddenly became a lot more expensive for UK people to ‘holiday’ in the USA.

Pound sterling got hammered after Brexit, and has flatlined since.

Also makes me wonder whether British interests might be more tempted to sell their US holdings, including real estate positions, to take advantage of a zoom in dollar value – although I have little knowledge as to UK corporate/individual positions in US/SoCal. I have Hotel California’s thoughts in mind from a few months back, but for British/UK.

———-

Hotel California

February 2, 2016 at 9:17 am

Another counter-trend could be the weakening Yuan. How great would it be to have purchased USD assets after exchanging RMB during the unsustainably artificial peg of yore, sell after massive RMB devaluation and exchange back to RMB. Quite possibly the arbitrage play of a few decades. It would provide a bit of cushion to even sell at a USD loss, therefore adding further room for downside movement.

A similar scenario has just begun with CAD/USD purchasers at the previous dip, and Canadian buyers were just as active in the past few years as were the Chinese, albeit geographical distribution of activity somewhat different.

Leave a Reply