Home Shopping Crisis Network: When the Ballyhoo Years Turn Into Relics of Excess. Lessons from the Great Depression Part XVI: Items That Sold in the Credit Bubble.

During every bubble the excess capital that is created usually has to go to some form of conspicuous consumption. With the technology bubble we had groceries delivered to your home by van, sock puppets, and a Beanie Baby mania. It seems when money is flowing, those with the capital want to spend on conspicuous items and bid prices sky high. Those bean filled animals which sold for hundreds of dollars on eBay are now sold at your local liquor store for $5 with a coupon for a free Sprite.

Pets.com is a textbook example of what happens when bubbles burst. The company was founded in 1998 and had a mission of selling pet food and supplies to the public over the internet. When Pets.com went public in February of 2000 it raised a stunning $82.5 million.

The problem is that Pets.com was entering a crowded IPO field and venture capitalist were throwing money at anything with a dotcom at the end. Incredibly share prices at one point did hit $14 a share, a bit higher than the $11 initial share price. Yet by November of 2000 things went quickly south and the company filed for bankruptcy protection. Another company PetSmart.com took over some of the company’s assets as well as its domain. The dog days of summer were in full force.

Why is this important? Well during irrationally exuberant times certain products and services boom that in tight times, will simply have no method of surviving. I mean people would rather eat and feed their family and Fido will have to survive with the dried stuff for awhile if economic times get tough as they did with the subsequent recession. As you can see from the date of the collapse, this was a leading indicator of the recession which hit in 2001.

Today we’ll look at two items that are tanking in today’s tighter market and also look at the same behavior that happened during the Great Depression.

That is a Load of Croc

In 2002 an item that would become a cultural sensation was being sold at a local boat show in Fort Lauderdale Florida. Who would have thought that plastic shoes would have such a large market but from this early start, the footwear line known as Crocs would boom into a company with annual revenues of $847 million and have 5,300 employees.

Now I never really saw the appeal in these shoes since you can go to any local store and buy comparable shoes for half off. The main thing that these shoes had was holes that supposedly allowed your feet to breath. Whatever. The point being is that everyone in this country at one point seemed to be wearing these things. I’ve seen then priced at $40 to $60 which is absurd if you are a family of five and need to get one for everyone. But such are the things that manias are created from.

Well let us now take a look at what is going on with Crocs:

Crocs has been steadily declining for a year. At the max point of $75 a share which was reached only a year ago, the market cap of this plastic shoe company was $6.2 billion! Now given the economic conditions, the market cap is hovering at $416 million due to weaker sales. I mean these are the ancillary businesses that are going to get hit by this downturn. Either you buy your kid some Crocs or you buy food for a few days. People are opting to eat.

Another company that we will look at is Heelys. If you’re not too familiar with Heelys they are basically a shoe targeted at the youth market that has a retractable wheel that you can walk and slide on the ground with. Have you seen those kids that seem like they are ice skating around the mall but with regular shoes? Well this is what they were wearing. Let us now examine what has happened with this company:

The company is now down 85.9% from last year and off of their one year market cap high of $649 million. If you need any more evidence that conspicuous consumption is going down, you need not look any further than your smelly feet.

People also spent money on dressing up their homes. In a weird twist of home decorating gone awry, the New York Times (hat tip Exit and JH) has an article talking about granite countertops, some with traces of uranium! I always knew there was something suspicious about putting $10,000 into granite for your kitchen; many of these kitchens which aren’t even used.

“My first thought was, my pregnant daughter was coming for the weekend,†Dr. Sugarman said. When the technician told her to keep her daughter several feet from the countertops just to be safe, she said, “I had them ripped out that very day,†and sent to the state Department of Health for analysis. The granite, it turned out, contained high levels of uranium, which is not only radioactive but releases radon gas as it decays. “The health risk to me and my family was probably small,†Dr. Sugarman said, “but I felt it was an unnecessary risk.â€

Well it looks like some people may stop spending some dough on the emblem of housing excess. The boob job for the home may turn you into the Incredible Housing Hulk.

Now if you are wondering how things are, banks and S & L institutions are still failing. No need to go to your local institution for money since 2 more were taken over late this Friday by the FDIC. One was located in Newport Beach. Talk about the heart of the OC.

So where are people spending money? How about your local dollar store:

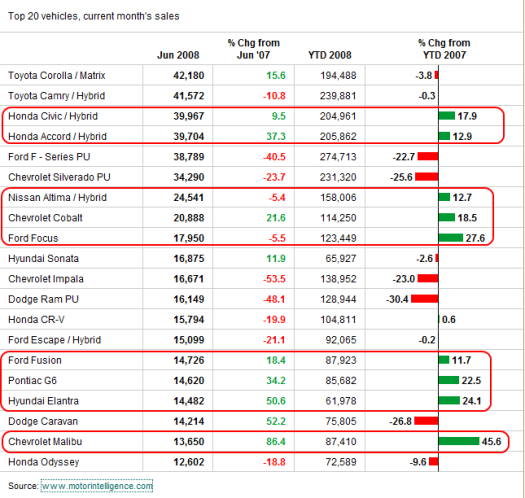

With 6,400 stores in 44 states, this is a major shift in consumer psychology. People are consuming less expensive items. This radical shift is showing that people are tightening their belts especially in lower to middle class families. But don’t think this isn’t impacting everyone. Look at the recent auto sales trends:

*Source: Wall Street Journal

People keep pointing that the U.S. consumer is still spending which they are. They are just spending on different products with much more affordable price tags. Yet this isn’t something new and even during the Roaring 20s, people had “enough bread and wanted circuses.”

This is part XVI in our Great Depression series. Here is a list of our previous 5 articles:

11. Understanding the Impact of Asset Deflation and Consumer Inflation.

12. Is the DOW now Tracking with the California Housing Market?

14. Bank Failures.

The Ballyhoo Years of the 1920s

The Roaring 20s shook up the foundation of our nation. Coolidge prosperity abound and everyone was in a spending mood. New fashion trends were being brought over from Europe and also more relaxed ideals. Yet during times of vast wealth, a mass trance takes over and everyone wants to spend this excess on something. Consumption items are there to fit the bill as we look at some historical references from Frederick Lewis Allen:

“Mah Jong was still popular during the winter of 1923-24-the winter when Calvin Coolidge was becoming accustomed to the White House, and the Bok Peace Prize was awarded, and the oil scandals broke, and Woodrow Wilson died, and General Dawes went overseas to preside over the reparations conference, and So Big outsold all other novels, and people were tiring of “Yes, We Have No Bananas,” and to the delight of every rotogravure editor the lid of the stone sarcophagus of King Tutankhamen’s tomb was raised at Luxor. Mah Jong was popular, but it had lost its novelty.

It was during that winter-on January 2, 1924, to be precise-that a young man in New York called on his aunt. The aunt had a relative who was addicted to the cross-word puzzles which appeared every Sunday in the magazine supplement of the New York World, and asked the young man whether there was by any chance a book of these puzzles; it might make a nice present for her relative. The young man, on due inquiry, found that there was no such thing as a book of them, although cross-word puzzles dated back at least to 1913 and had been published in the World for years. But as it happened, he himself (his name was Richard Simon) was at that very moment launching a book-publishing business with his friend Schuster- and with one girl as their entire staff. Simon had a bright idea, which he communicated to Schuster the next day: they would bring out a cross-word- puzzle book. The two young men asked Prosper Buranelli, F. Gregory Hartswick, and Margaret Petherbridge, the puzzle editors of the World, to prepare it; and despite a certain coolness on the part of the book-sellers, who told them that the public “wasn’t interested in puzzle books,” they brought it out in mid-April.”

As it turns out like the plastic shoes, initially these items start out as niche markets but some kind of hook is found to sell this item to the masses like exotic mortgages. If the timing and economy is right, they can become an overnight sensation and the crossword puzzle found this niche in the 1920s:

“Their promotion campaign was ingenious and proved to be prophetic, for from the very beginning they advertised their book by drawing the following parallel:

1921-Coue

1922-Mah Jong

1923-Bananas

1924 THE CROSS-WORD-PUZZLE BOOK

Within a month this odd-looking volume with a pencil attached to it had become a best seller. By the following winter its sales had mounted into the hundreds of thousands, other publishers were falling over themselves to get out books which would reap an advantage from the craze, it was a dull newspaper which did not have its daily puzzle, sales of dictionaries were bounding, there was a new demand for that ancient and honorable handmaid of the professional writer, Roget’s Thesaurus, a man had been sent to jail in New York for refusing to leave a restaurant after four hours of trying to solve a puzzle, and Mrs. Mary Zaba of Chicago was reported to be a “cross-word widow,” her husband apparently being so busy with puzzles that he had no time to support her. The newspapers carried the news that a Pittsburgh pastor had put the text of his sermon into a puzzle. The Baltimore and Ohio Railroad placed dictionaries in all the trains on its main line. A traveler between New York and Boston reported that 60 per cent of the passengers were trying to fill up the squares in their puzzles, and that in the dining-car five waiters were trying to think of a five-letter word which meant “serving to inspire fear.” Anybody you met on the street could tell you the name of the Egyptian sun-god or provide you with the two-letter word which meant a printer’s measure.”

Mah Jong was another craze that took over during this time. As with any fad, they are usually short lived and reach a climax only to slowly retreat. The crossword puzzle was no different. Slowly it retreated as the 1920s progressed.

“The cross-word puzzle craze gradually died down in 1925. It was followed by a minor epidemic of question-and-answer books; there was a time when ladies and gentlemen with vague memories faced frequent humiliation after dinner because they were unable to identify John Huss or tell what an ohm was. Not until after contract bridge was introduced in the United States in 1926 did they breathe easily. Despite the decline of the cross-word puzzle, however, it remained throughout the rest of the decade a daily feature in most newspapers; and Simon and Schuster, bringing out their sixteenth series in 1930, figured their total sales since early 1924 at nearly three- quarters of a million copies, and the grand total, including British and Canadian sales, at over two million.”

It doesn’t mean we are going to see a plastic shoe-less society in our time. All that is occurring is a shift in preference and the economy is forcing this move. Unlike the crossword puzzle which faded out simply because of other events, the above two items are fading because of the economy. It will be a challenge for these companies to maintain their profit margins when consumer are demanding more affordable items, cheaper more fuel economical cars, and eating out less with buying more food to cook at home. These things are happening. Given how our government is blind to much of this we need only look at a quote from John Kenneth Galbraith:

“Governments were either bemused as were the speculators or they deemed it unwise to be sane at a time when sanity exposed one to ridicule, condemnation for spoiling the game, or the threat of severe political retribution.”

No one wants to spoil the party by raining on a bailout parade. At least their Crocs will remain dry on Capitol Hill when the tears start flowing in November.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

14 Responses to “Home Shopping Crisis Network: When the Ballyhoo Years Turn Into Relics of Excess. Lessons from the Great Depression Part XVI: Items That Sold in the Credit Bubble.”

I appreciate your write-up on Crocs. Way back when I first saw these things, I said to myself, ‘Perfect, just perfect. This is yet another perfect product to draw in the sheeple.’ What I consistently fail to do, however, is buy the stock when it’s cheap and sell it later.

To hell with crossword puzzles. If I’m going to live in the 1920’s I wanna live with Clara Bow! What a beauty she was.

We still haven’t left the bubble economy completely behind, as all the techno-sheep are dutifully dropping $200- is that correct?- on the latest ugly iphone.

May I ask the gadget-lovers of the world just this one little question?

Why oh why do the same people who just HAVE to have a 60″ plasma TV screen dominating their great rooms ALSO want a phone they can watch movies on? Isn’t it a real downer to watch a film on a screen the size of some folks’ toenails after watching films on a big screen?

I mean, just what is the bloody point of having a phone you can watch movies and download music and play games on when you already have a house stuffed with gameboxes and $5000 AlienWare gaming computers and 3 massive plasma screen TVs with surround sound and about 6 other computers you have 37,000 songs downloaded onto?

I noticed your picture has Canucks Crocs-My wife loves her Crocs, the real ones are more comfortable than the knock-offs. The prices are dropping as the trend cools off. Go Canucks Go!

Thankfully the Crocs fad never hit socal. Those things are ugly as hell. I do see tourists walking around HB with those things though. Makes for endless joke fodder.

Crocs did hit SoCal. Some USC football players were lounging around in them 2 years ago.

One more fad stock to add to the list is Hansen Natural. Their stock went up phenomenally when people could afford $2 Monster cans at the convenience stores, but with the double-headwinds of housing and high gas prices, their stock is fizzling. Thank goodness I got out at a small profit

I am seriously flashing back to San Francisco in the ’90s. Dear gods, Doc. What tulip-addicted nutcases this “new economy” has made of so many people.

Meanwhile, my husband just discovered that Lands’ End’s Croc knockoffs are great for his arthritic knees, i.e., worn ’round the house. $19. There can be good ideas in these frenzies of consumption; the question is, just how much good, and at what price tag.

But seriously. In an economy where people’s daily lives are so far removed from anything real, what can it provide but an escalating series of silly desires and acquisitions? This is why I’m devoted to our gardens. That literal grounding in reality, far from the hive of consumption and expenditures….

I suppose you know that story about Socrates. His students would observe how he’d go daily into the agora–the mall of the time, the marketplace–and walk around looking at everything, touching things, asking the price. They asked him, “How is it that you go into the agora each day to view the goods…yet you never buy?” “Oh,” he replied, “I get such a kick out of seeing all the things I don’t need.”

rose

All granite is radioactive to a greater or lesser extent, however, unless you are living in a cellar in a house built on a granite intrusion the danger is insignificantly small.

It’s worth considering that in many areas (such as Aberdeen in Scotland and Devon, England) people are living in granite built houses built on solid granite foundations without any ill effects – never mind the granite top kitchen.

The only danger that has been recognised is the pooling of the heavy gas Radon on basements, which although at just above the trace level, is enough to cause concern.

http://www.bre.co.uk/radon/reduce.html

Generally your articles are fantastic, but I think you missed the mark on this one. There was also the hula hoop, Rubik’s cube, the pet rock, Smurfs, and so on. Fads come and go as people want something new to amuse themselves. Trying to tie the death of these two fads to the economy is pushing it.

I have to agree with Liz to some extent.

We have always had fads for trivial items, in all times but the most depressed. In and of themselves, they are not an indicator of excess.

A better indicator is the prevalence of second home buying during the Great Real Estate Rampage. Let’s just be real, second homes are not for ordinary middle class folk, even upper middle class folk, especially when you can’t even deduct the mortgage interest on it. Yet numerous people of my acquaintance, who have large incomes but not a dime in savings and aren’t even funding their retirment accounts to the extent allowed, have second homes, which are often timeshares, the biggest burn of all.

Another indicator of excess is the over-improvement of existing homes. There used to be rules-of-thumb that you used to decide whether you should improve, or just buy something bigger. It was never considered wise to double the size of your house and spend half again its price to improve it, especially with faddy stuff that does not add to the value, or is really expensive relative to the value it adds. But I saw numerous really large lateral additions, $150K kitchens on houses barely worth $300K to begin with, and added stories. This doesn’t happen in normal times.

Usually love this series but how can you tell that Crocs and Wheelies sales are declining because of the economy? They just might be stupid fads that have already lasted too long.

How about trying to identify the next trend? That could be harder and confirms your hypothesis. I have a relative that owns a store selling such fad items. He says there is no clear and developing fad right now. I think you’re right but I think your argument is weak.

I look forward to the next installment.

Don’t forget the Beanie Babies craze, that seemed to go along with the Dot.com bubble days. Weren’t those stupid things going for hundreds of dollars? Maybe they still do. I don’t know. I know they still sell them. I just haven’t heard of people collecting them as an investment in a long time.

same here.

What I cant understand is how they do it!! how do you start a stupid trend!? What are people reading and who are they talking too! Ugh…..

I still dont understand consumer trends….

There is almost nothing of importance on the ballyhoo’s.

First of all, WHAT ARE THEY?

Leave a Reply