The unaffordable housing market: Housing affordability drops to 8-year lows while mortgage rates surge. El Segundo housing euphoria.

The last year homes were this unaffordable to American families was back in 2008. If you remember in 2008 the market was in full on implosion mode. Of course that is now a distant memory and those 7,000,000+ foreclosures are simply a distant nightmare. The nightmare now turned dream of purchasing a $750,000 or $1 million crap shack is the ultimate goal in this manic market. While this is a dream for most the housing market is incredibly unaffordable. Housing affordability has dropped to an 8-year low because first, home prices are surging without wages keeping up and mortgage rates recently surged. Many families had been leveraging up in this low inventory market and locking into mega mortgages for a piece of the crap shack pie. With rates going up getting a piece of that action is now more expensive.

The unaffordable housing market

The housing market is unaffordable relative to what people make. In Los Angeles the majority of households rent and we’re talking about a county with 10+ million people. Those that are buying crap shacks are leveraging up with large down payments in many cases.

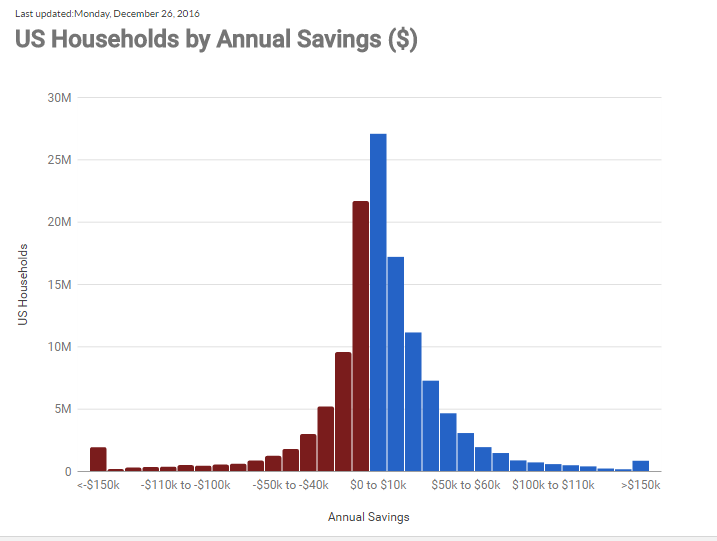

Here is some interesting information: 38% of US households spend more than they make:

You see this in California all the time. Everything is leveraged to the maximum degree. Leased foreign cars, massive mortgaged home, student debt, and credit cards that get used like dirty napkins on a daily basis. People are living beyond their means. All of this is contingent on things moving up and up. That is the crap shack ladder dream. What shattered the dream last time? The first ever drop in home prices on a national scale. That shook the psyche of the population and the invincibility of real estate as a no lose bet.

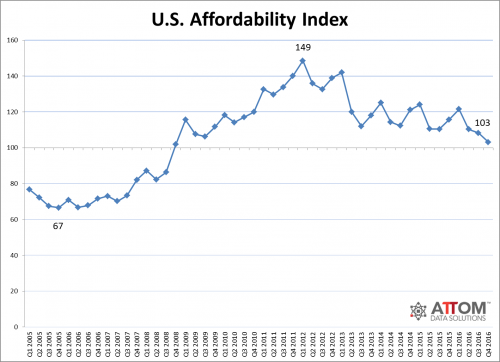

In California, people now assume that home prices are only going to go up. Of course housing affordability is horrific:

You need to go back to 2008 to find these numbers when the market was fully starting to adjust. People simply cannot afford homes with their current incomes. So debt becomes the vehicle to leverage into more expensive assets. All is well so long as things continue to rise. But as we painfully know, there is always the inevitable correction especially when it is clear we are in a mania.

Take for example the South Bay. We did an in-depth analysis of Torrance in the past. There is a blogger that is covering the El Segundo bubble. Take a look at this example:

“(El Segundo Bubble) Well, well, well. WTF?!

Remember when I wrote about 605 Sheldon? A great rental going for $4850? Well it’s now for sale at $1.47 million. I guess they didn’t pick up a renter but here’s where you can really see the gross disparity on how fucking stupid real estate prices are right now.

Let’s play it simple. First it takes a buyer that makes ~$270k/year to qualify for this house. That person also needs a nice nest-egg for a down payment. It will take roughly $300k to put 20% down and cover some closing costs.

You now have a $1.18 mil note. at 3.875% for 30 years you are writing a check for PMIT of ~$7350.

A person with half a brain and any semblance of common sense would say to them self, even at a 5% return I can earn $15K/year if I invest my $300K. plus I am saving at least $2450/month by renting this house. That’s cost savings equals another $29K/year.  So by renting I have $3750/month in extra cash flow PLUS I still have $300K in the bank.

If you buy this house you are an idiot and get what you deserve.â€

This is the analysis that many smart people are doing with current prices. It should be noted that the above home sold for $832,000 back in 2012. Now the asking price is $1.47 million.

And you wonder why you have a record number of adults living with adults in California? Or the fact that the homeownership rate is at generational lows. Housing is incredibly unaffordable to most at this point.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

132 Responses to “The unaffordable housing market: Housing affordability drops to 8-year lows while mortgage rates surge. El Segundo housing euphoria.”

Interesting! I read that San Francisco has the highest property crime in America, there is human waste on the streets, homelessness is epidemic, public urination is commonplace, and so are used syringe … and it has the most expensive real estate in America! Huh? I know property crime was epidemic in the RPV area of L.A. when I was there, and frequently there were people partying and parked on my neighborhood street late at night who weren’t from the neighborhood because they could see the lights of the city from there! There were frequently beer bottles, etc. (use your imagination) laying in the ivy the next day. It begs the question, why live there?

You shouldn’t just repeat what you read on Fox News.

“Skippy” skippy here is a bro with a lumberjack beard and a cool job in SF ! Hes obviously anti Trump

voted for obama twice and voted for the woman who’s husband masturbated on a young intern in the Oval office. You can fill in the rest about skippy the “bro”!

Ps keep watching cnn! Bro!

To be fair, I have every single one of those problems in Chicago too. It’s not just an expensive city by any means.

Despite all the comments from various protesting otherwise I challenge anyone to go to such neighborhoods as Noe Valley, Pacific Heights, Cow Hollow, The Marina, The Richmond. both Inner & Outer Sunset districts, Upper Haight, Presidio Heights, Glen Park, Dolores Heights, Parkside, Diamond Heights, The Castro, St. Francis Wood, Telegraph Hill, the vast majority of Bernal Heights & Potrero Hill and report back that these are not very clean, well maintained neighborhoods with low crime. Hell, SF is only 49 square miles and I just described the majority of it Other neighborhoods that were run down are gentrifying and falling into the same category. If you’re cherry picking the Tenderloin & the seedy parts of North Beach (most of North Beach is exclusive, pristine and offers amazing views of the city) to make your point then you’re misleading people who have never been there. Especially the Tenderloin, mostly for desperate people on drugs, impoverished, mentally ill and recent immigrants.

All US cities have much higher crime than first-world cities.

Total BS; maybe in a few select areas like the Tenderloin (that is shrinking as gentrification expands into what were previously the worst neighborhoods) but the city as a whole is very clean compared to most. Where did that tidbit come from?

I lived in San Francisco and my family is from there. That description above sounds spot on to me. I lived in the heart of the Tenderloin at Leavenworth and Geary and also in nice areas like North Beach etc. One grows accustomed quickly to watching other humans shit in the streets, the smell of a meth pipe burning and other such delicacies. I don’t see what that has to do with Fox new at all, it is a fact if you live in SF (and many other major metros–although SF I agree is particularly disgusting.)

The original post copied this Fox News editorial from yesterday:

http://www.foxnews.com/politics/2016/12/27/san-francisco-grapples-with-growing-crime-blight-after-years-liberal-policies.html

Having lived in S.F. for over two decades (inner and outer Sunset) I have to agree that it is one of the filthiest cities I’ve ever seen. The stench of urine and human feces permeate Market street, U.N. Plaza, Civic Center, the main Library and most of the Bart and Muni stops downtown. Downtown Oakland is cleaner by comparison… And Los Angeles generally is as well, except for a relatively small portion of skid row.

To be fair, SF was a dirty place 30 years ago with lots of creepy deranged people all over, and yes all major cities have it to one degree or another. Libtards call it “cosmopolitan”, lol!

I will cast a vote for San Diego being pretty nice, as well as Kyoto Japan, but they don’t have huge populations. Cities much above a million or so dont seem to have that good a quality of life IMO.

Bulls eye! Fecal matter abounds, even in the upscale part of SOMA. So do dirty needles, urine, schitzophrenics, petty theives, and now violent “youth” predators. And this is going on in SF suburbs too. I see it all the time in SF and in almost any neighborhood. It used to be a nice place but the Tenderloin has spread like spokes or spider legs to the rest of the City. Add the Detroitification to it… and we are gone, very soon.

We don’t shop in SF anymore bit go to the suburbs where its safer and more pleasant.

Day after Christmas, we were going to Union Square but we turned back for home halfway there due to our observation of the gathering and spread out “youths” aged 8 to 80 on MarketnSt., still in the Financial District. And of course, they were adding to the already deplorable conditions with more urine, dope and fecal matter. One shitbone started googling his surroundings, then he pulled a mask over his face, and we were done. Out of there, out of here.

Public transport? Not anymore due to all of the above issues on all local systems except for CalTrain.

I know several other couples and families who are preparing to leave, jobs be damned. That is the Detroitification that the Liomousine Liberals have forced on the working people.

If by “youths” you mean “dindus” yeah I’d skedaddle too.

(Dindu is short for the typical “youth’s” name, mr. Dindu Nuffin.)

JNS

It is called a moral crises. The economic crisis is the by product. Nobody can cure the effect without addressing the root of the problem – most kids these days are raised by single parents who are at work or in traffic. There is no adult supervision and society gets rotten to the core. The family is the nucleus of any society and what happens in the society and economy is a reflection of that.

No politician can fix this regardless of the political color. They can not (and are not willing) to address the root problem in US.

Seattle has also gotten dirty. I believe it is due to a combination of three things: 1) a higher proportion of rental houses to owner occupied, 2) The City of Seattle is having some financial hardship and street cleaning/ leaf clean up always seems to be first thing they cut 3) the outrageous prices residents have to pay for trash collection. Civic minded people used to pick up litter as they walked, now they have no where to put the litter because their own trash cans are full at home.

Smell-gundo is ridiculous but I can see the justification. As the beach went from crappy to glammy, so did ElSeg. A lot of Silicon Beach money there now.

I had a buddy get divorced in 1996, he had to sell the house and.got $150k for it. Bush’s bomb dropping in 03 revived Aerospace for a bit, then the tech companies moved in. Whole Foods and all that was built. In 2003 all those tall white buildings on Sepulveda and El Segundo were empty, now they are packed and you can see the pedestrian traffic at lunch.

El Segundo has changed dramatically and its expensive.

El Segundo…..Isn’t this town between an oil refinery and a sewage treatment plant? I personally wouldn’t want to live there.

“Smells like El Segundo” was a thing heard in the 90s when I lived down that way.

There’s only X amount of beach and tons of people want to live by it. The upshot is that people put up with some really lousy beaches just so they can say they live by the beach.

…which is why I refer to the place as: El Se-‘dung’-o

Le’ Smell-dung-O?

This is fun!

To quote a very old joke told by a night time talk show host:

“She said, ‘Kiss me where it stinks’.”

So he took her to El Segundo.

Oh damn Dweezil, you win LOL!

I have relatives who own in El Segundo. They bought in 2005 for $830k, now worth around $1.5m. I called them crazy then, now not so much. I’ve never smelled anything unpleasant there, but I will say that being immediately south of LAX would get to me, even with the free double windows given to many residents (which work well). Great schools, great walkable neighborhoods with a lot of housing eye candy, and that town knows how to party. Great place to visit on any big holiday. None of which is worth $1.5m.

This spring real estate market is going to go gangbusters, much to my chagrin. Watch for an explosive spring with multiple offers and slim inventory. I can see the momentum building right now during the holidays in Nor Cal. That’s right, no spring slowdown, I’ll bet Jim Taylor $10k if he’s up for it and can show proof of funds and sign a contract.

This is where Motel California and the other haters hate. Don’t kill the messenger. The market is building momentum not collapsing right now. That is where we are at in the cycle. I hate it more than you I bet, but I believe in calling a spade a spade and not living a disillusioned life.

LOL, i can not wait until this spring based on this post…..you’re really putting you neck out there!! And I’m not saying you are wrong but………

that being said, by 2010 everyone was shaking their collective heads at how stupid prices had gotten based on income and how “obvious” the bubble was and now here we are years away from that “fact” with incomes less (inflation adjusted) and houses costing more and you chime in with a “surge” is coming this spring.

I don’t know about JT but I would NEVER bet on the collective insanity of crowds.

Thanks Mumbo 🙂 I will not take his bet. Yet I see severe warning signs ahead pointing to Housing To Tank Hard Soon!

The truth is we don’t know what spring will look like. We don’t know what the new president is going to do (chances are, he doesn’t either) and his actions could be anything from laissez-faire hands-off etc that should be very good for RE to actually doing some of the things he’s said he’s going to do, IE protectionism, which would include things like extra taxes on foreign-owned RE and so on, which would make RE go down.

Alex,

“We don’t know what the new president is going to do”

i was just at another message board and some there seem to know EXACTLY what Trump is going to do and it goes along the lines of “he’s going to go around the world and line his pockets with $$$, and he is going to fuck over the American people”

Paraphrased of course but I’m reading this every where. The guy hasn’t spent 1 minute in office and yet these trolls know all. BTW it’s nice to have the white guy in the white house again for the ONLY reason that one can be critical of his policies and not be labeled racist.

I can’t tell you how many times i read or watched people whine that the person criticizing Obingo is doing so because they are racist………that’s how liberals shut down the discussion.

For anyone who would like to view some Trump untruths….it’s amazing how much the media has misrepresented this guy…..i was even a bit WTF….here’s some links.

https://www.youtube.com/watch?v=Gw8c2Cq-vpg

https://www.youtube.com/watch?v=qwJZGlC5lXM

Hi Alex, where did you hear that Trump will impose “extra taxes on foreign-owned RE”? I have heard no mention of this. I have heard, however, that most people expect him to do nothing with existing EB-5 immigration laws, so that Chinese investment could easily continue.

Mumbo Jumbo, I stand firmly by my projection for a spring surge in Nor Cal. I promise you it sickens me as much as you.

As you well know, real estate is like a slow moving ship, it does not turn on a dime. The momentum I am seeing going into spring is undeniable.

You could have listed a property within 2.5 hours (by car) of Sacramento in any direction on Christmas eve at 6pm when everyone was sitting down to their turkeys and eggnog, and there would have been carloads of people leaving their families to tour the place that evening.

The house horniness is real right now. Doubled down on Cialis and red wine. Housing to Surge Hard in Spring of 2017!!!! (then likely crash at some unknown point in the future)

“This is where Motel California and the other haters hate.”

Nope. This is where commenters such as “Mr Miyagi” continue to take and make personal any suggestions that their opinions smell the same as just about any other asshole. It continues to be a slog of the same old set of posts and comments with not much of any new significance to offer.

It doesn’t matter to me how some uselessly safe bet turns out. I don’t have anything riding on it.

I live in the Bay Area…I rent a house in a nice neighborhood in Alameda. I can point you to many many listing in the area that have had decreases in prices of 20-100K in the last 4 months.

Plus there is an absolute ton of inventory coming online and these 800K 2bd 1bh houses built in the 50s and 60s don’t look as good to Indian and Asian buyers as all the 1mil condos/townhouses.

There is massive build out here in Alameda, Dublin, Walnut Creek, Pleasant Hill, Concord, Foster City, Daly City, Fremont, Hayward and Fremont…I don’t go to the South Bay but I’d image SJ is building…now that BART will open in East San Jose next year (it’s built they’re just working computer systems integration but the hard part is done). I’ve check out a few open houses in Dublin/Pleasanton near the BART…it’s all Indan and Asian families. They’re rather have a newer place and deal with the HOAs.

Here is one on the market since October…this is a GREAT Location for anyone that works in SF, Oakland and reserve commute to anywhere in the East Bay down to about Fremont (Cisco area).

https://www.redfin.com/CA/Alameda/1605-9th-St-94501/home/1927545

That’s been on the market for over 2months and dropped in price 60K already.

I can post about 3 dozen of these off the top my head in the core East Bay from Albany down to Hayward. I don’t follow the outer east bay….but I’d imagine it’s happening there.

Prices have absolutely peaked.

Indeed, in the San Jose area, there’s a concrete plan to get all the building projects started as possibly can, because the idea is, when the next crunch comes, the projects will be started and thus must be finished. Every vacant piece of land is being built on. The old San Jose Murky News site is now housing, and since the Bay 101 casino is moving, I’d not be the least surprised if that became a huge apartment or condo complex.

I dont know about that. I’m in the market now and I’m seeing more places coming onto the market – not selling – and then being taken off market. There is also a surge of properties bought in the 2006-2008 timeframe that have come onto the market as people head for the exits to try get out of their mortgages. January is a good time to buy as you will be spoiled for choice. SF is also not like the rest of america, its an international destination and city so you need to compare its costs to other places like London, Hong Kong, Stockholm, Paris, Sydney, Melbourne, etc. It isnt the typical american dream but neither are so many other international cities with $1mill crapshacks 🙂

Buying in residential suburbs now would be foolish as they will be the first to shed any gains and take far longer to recover. The chinese are desperately trying to get their money out and this trend will continue.

The only indicator I see of trouble is the uptick of defaults against auto loans.

I hate to agree with Mr. M but do, you even go back to 2014 when I found this forum and lots of people said that was as high as it could go due to affordability etc. and…well here we are.

@Miagi-san – as a renter but prospective home owner in San Diego, would you recommend continuing to rent vs buying a $900K home near Poway?

Throbert, I would strongly advise against buying any real estate right now. Even though I do suspect more upward pressure on prices temporarily before a correction, I think this is a terrible time to buy a house. The worst since 2006. Anyone who says buying makes economic sense right now is silly. Rents will be softening too. These rents are wholly unsustainable. Wait for a correction and buy then. Until then, patience my grasshopper.

El Segundo has always baffled me. It is surrounded on 3 sides by “non-desirable” things (LAX to the North, Hyperion Sewage Plant to the West and giant Chevron refinery to the South). The downtown area is pretty cool (Mayberry by the Sea) and supposedly the schools are very good. And prices are definitely expensive.

For 1.5M smackers, buying a house in Manhattan, Hermosa or South Redondo is likely a better play. It will be interesting to see what this sells for. One thing is for certain, the 2012 buyer hit it out of the park.

If you spend a bit more time in el segundo you’ll understand the draw. The neighborhoods are awesome. Everything feels safe. The downtown has a small town feel where everyone knows their neighbor’s name. There are a TON of bars and breweries. There are a ton of places to work (I used to work there).

As far as the plant and supposed smell, it’s pretty much nonexistent. I personally don’t care about the planes, but that’s cool if you do.

The school is one of the few good ones around.

Lastly the beach is clean and empty and surf-able.

Do I wish the water treatment plant wasn’t killing the views? Sure. But it’s free of the tourist-y BS of manhattan beach at least.

I lived in Westchester for a bit in the early 90s and as the locals put it, “The 405 is the DMZ”. My impression is the El Segundo, having a few more barriers in the way, is able to maintain being a rather nice place.

Somewhere around 24M people live in Southern California. Desirable beach locations are a small fraction. Since a small fraction of people make north of $250K per year, this small fraction of high income people support the big prices in beach locations.

However, there are still some affordable spots. Decent spots in north redondo or torrance can be had for around 650K.

“can be had for around $650K”

which is insane IMHO

@jt,

I recently read an article that expects CA’s population to increase by close to 4M people every decade for the next 3 decades. Desirable beach close socal RE is pure supply and demand. Get it while you still can!

There are probably some great mid-1920s predictions of what the mid-30s would be like.

yeah, like the last 3 decades of mostly scientist, doctors, lawyers, physicists…….facepalm.

Radio-controlled roads, robot maids, you name it, look at any issue of Popular Mechanics from the 1920s.

The birthrate in California is the lowest it’s been since the great deoression. If the incoming president keeps his promises, I can see a future where the state population would decrease.

I hear now that even “West” Lawndale (West of 405) is becoming more attractive as Redondo and Torrance home prices have risen dramatically. And as JT has posted, NONE of this should be a surprise given tens of millions of people here in SoCal, SOME with lots of money.

A friend of mine is a RE broker in WLA and he said that he has tons of buyers of all backgrounds (immigrants, high income millenials, multi-gen families, well-to-do families why currently live in flyover country who want to move to LA) waiting to buy but there is too little inventory.

Where the housing market goes from here is just a guess.

If a recession hits, prices usually go down.

If we are in an inflationary period, prices can go much higher.

Prices can even stall and sit in the same spot for a long time.

The most likely event is they grind higher slowly for quite some time. If this is the case, buying is better.

As far as the ElSegundo home above, the author forgot to adjust his analysis with the tax write off which brings buying vs renting much closer.

Pending home sales are down in 3 out of 4 regions due to higher mortgage rates.

Happy New Year, Jim Taylor !

https://www.bloomberg.com/news/articles/2016-12-28/pending-u-s-existing-home-sales-fall-on-higher-mortgage-rates

Thanks Zigs 🙂

$650k affordable? Reminds me why we left LA. It starts to feel normal.

I agree, $650,000 is insane. Here in Sacramento, there’s lots of homes at or below $300,000 – and many people are still “house-poor.”

Only if cheap and easy financing is available for the average family. Insane prices are justified by vested RE interests under the guise of supply and demand. More like supply and demand for cheap debt.

The Federal Reserve made 650K houses “affordable” with their ultra low interest rates. Rates were in the low 3% range not too long ago, borrowing almost half a million dollars cost about $2000/month which is very similar to the monthly rent for your average LA 1 bedroom apartment. The monthly payment is what the VAST majority of people care about…whether this is good or bad is irrelevant.

Rates made all the difference. If interest rates were 8%, 650k houses would be VERY expensive. This is simple math.

And you also assume that the middle class household has the 100+K down payment to even reach rental “parody”. No way can current prices of real estate and other risky assets be sustained at 8% interest rates. Hence, the artificial supply and demand at currently abnormal rates.

“And you also assume that the middle class household has the 100+K down payment to even reach rental “parodyâ€.”

Sounds like you are assuming NO middle class household can come up with 100+K down payment. Some people actually sacrifice and save for years. Some people get help from parents or family. Some people are move up buyers and have equity from a previous sale. And there are others who put down less than 20%…they have since refied and gotten rid of PMI.

“No way can current prices of real estate and other risky assets be sustained at 8% interest rates. Hence, the artificial supply and demand at currently abnormal rates.”

I agree with you there; however, we won’t see 8% rates ANYTIME soon. So it’s a moot point. We’ve had low rates for the better part of a decade…this is the new normal.

I love how LB always underplays and discounts the massive down payment required to reach his rental parity. Take the example in this case in which $300,000 is the out of pocket cost and you still have a massive seven figures mortgage. Simple math, I agree. But of course someone that bought a house in the last few years is now twisting the narrative to fit into his situation.

Population increase? The population was increasing in 2007 to 2010 and prices still crashed. So there goes that argument. The Fed? The Fed in 2007 said there was no housing bubble and we know how that ended.

The giant down payment is a big deal. The median income in California is $60,000 for a household. Your standard home is now going for $500,000. Go back to say 2000 when a home was going for $200,000 but the standard household income was around $45,000. You still end up paying the underlying sticker price, either with low or high interest rates.

“Sounds like you are assuming NO middle class household can come up with 100+K down payment. Some people actually sacrifice and save for years. Some people get help from parents or family. Some people are move up buyers and have equity from a previous sale. And there are others who put down less than 20%…they have since refied and gotten rid of PMI.”

Whenever you’re done with your straw man argument, perhaps you can listen to reason. The chances of a the average median income household having 100K, either from themselves or family, as a conventional down payment is very unlikely. Therefore, buying real estate priced at 650K is as unlikely to reach rental parity. Not to mention that it represents a huge risk to pour into a single asset.

“I agree with you there; however, we won’t see 8% rates ANYTIME soon. So it’s a moot point. We’ve had low rates for the better part of a decade…this is the new normal.”

Another straw argument. I wasn’t arguing whether 8% rates are coming. I argued against your claim that the house price, elevated through cheap and easy credit, would remain this high at 8% rates. I believe that low rates can stave off the inevitable correction only for so long.

Jay – and in most cases, that $60k for the house hold is 4 people with incomes like mine. I don’t care who’s sautee’d the numbers, there are an utter fuckton of poor people here and they’re not all maids, gardeners etc.. an awful lot of them have degrees.

@Jay,

When did I ever say the El Segundo property was at rental parity. That’s right, I didn’t because it is not. The higher priced properties will not satisfy the rental parity equation. When we start talking about 650K properties in Torrance or North Redondo, I will broadcast a giant rental parity public service announcement.

Regarding median incomes and median home prices, I have said umpteen times those are useless numbers…especially in the desirable areas. Looking at the median income of recent buyers is a much better data point. As we all know 60K incomes won’t buy you much in LA, put two 60k incomes together and we’ll start talking.

“Regarding median incomes and median home prices, I have said umpteen times those are useless numbers…especially in the desirable areas. Looking at the median income of recent buyers is a much better data point. As we all know 60K incomes won’t buy you much in LA, put two 60k incomes together and we’ll start talking.”

Same old recycled RE selling point: [Insert city name] has become gentrified or has become as desirable destinations as London, Paris, or New York are. Yeah, Corona is so desirable that it now requires 5x the median household income to get into a SFR.

When the real estate market has been heavily distorted by speculators (cheap and easy credit) in recent years, using the median incomes of buyers as a metric is deceptive. Not only did prices grow faster than during the last boom, but the pool of qualified organic buyers shrunk tremendously as investors crowded them out.

To simplify the tax system and wean more taxpayers from itemizing deductions on Schedule A of their returns, the Trump plan would boost the standard deduction for joint filers to $30,000 (up from the current $12,600) and raise it to $15,000 for single filers, instead of $6,300 at present. For people with very high income, there would be a limit on all itemized deductions of $200,000 for married joint filers and $100,000 for singles.

There’s no mention here of limits on mortgage-interest deductions, so strictly from the perspective of a homeowner or buyer, nothing jumps out as objectionable. Simplicity is good. In fact, the original Trump tax plan exempted the mortgage-interest and charitable deductions from the sorts of modest limitations contained in Hillary Clinton’s proposal.

But here’s a key question: With a substantially increased standard deduction ($30,000 for joint filers and $15,000 for single files), how many homeowners would want to file for mortgage-interest or property-tax write-offs, as they do today? I asked the chief economist of the National Association of Home Builders, Robert Dietz, and he estimates that the number of itemizers might drop from the current 25 percent of taxpayers to 10 percent or even just 5 percent.

Housing to Tank Hard Q2 2017!

I think an epic housing fire sale and rent crater is coming based on structural demographics and fiscal reality.

Demographics-baby boomer die off

Demographics-criminal deportations

Demographics-no more Muslim African Chinese Indian welfare immigration

Demographics-welfare cuts no more welfare babies

Demographics-medicaid cuts granny moves in

Smitty – not only that but at least up where I am now, they’re building everywhere there’s any vacant land and there’s plenty. I even heard they’re going to take Vallco, a large mall, and turn that into mixed retail and housing. A large movie theater that went out of business in downtown San Jose may become “student” housing. Our Ross store closed because the site it’s on is going to become floor-level retail with a tall tower of housing above it. One of our kooky rich people is proposing setting up a lot of housing for homeless people using shipping containers along Lawrence Expressway. The truth of the matter is, the Santa Clara Valley has gobs and gobs of land with buildings on it that haven’t been used for decades, and so we don’t have to wreck any “natural” land to build enough to house 2X our current population. And officially there’s a push to get projects started so they’ll be underway when (not if, they said when) the next “crunch” comes, so they’ll have to be finished.

Get ready for spring! Once trump gets in office Dems are gonna blow the charges as they abandon ship. I guarantee this is all by design…it will make trump look like a fool and finally kill the Republican Party. Start making some popcorn….

Nice. So if things go well, Trump is a genius, and, if things blow up, Trump was set up. Looks like it’s win-win for you. lol

GH…trust me I am not in the Trump camp. Things will not go up, and if they do it will be short term and not due to Trump. Saying that I do believe the dems are making an effort to derail Trump and the repubs. It is genius and I would do the same thing if I saw America in terms of two parties, but I am educated, especially in the founding of this nation and know better.

Well Don, since you’re all educated and whatnot, please tell us specifically what the Dems are going to do.

Which branch of the gov’t will they use to do it? Keep in mind that they don’t have control of any…

Don – the Republican Party has already committed suicide. I read that this was happening anyway, that they’d go the way of the Whigs.

“The GOP as already committed suicide”. I bet some snowflakes wish that the Democratic Party would have committed this “suicide” that would have them in full control of the POTUS, Senate and House. Alex, I imagine that you are a great disappointment to your mother.

Ira – I’m gonna say that to a Democrat from the 1930s or 1940s, today’s democratic party has committed suicide also.

I was just talking with a friend and mentioning that two things puzzle me about the Democrats/liberals. One is they’re not for the 2nd amendment. The Republicans’ thing would be guns for all, as long as all = white Christian males. Logically, the Democrats would be for guns for everyone, and would push gun education strongly. After all, cars, cans of gasoline, pool chemicals, and Mom’s meatloaf improperly refrigerated are all at least as dangerous as a gun, which is why we educate people about these things.

The second thing that puzzles the hell out of me is the modern liberals’ lack of support or actual hostility to, Israel. They’ll cry a river over some corruption-ridden Indian reservation, but somehow it escapes them that the one civilized nation in the middle east, set up by people returning after being gone for 2000 years, people who, incidentally, half the world was trying to wipe out, and a nation that supplies the US with so much pure research and R&D, is somehow a bad guy. While a bunch of Indians drinking themselves to death are precious treasures.

As I’ve read more and learned more, the “furniture” in my mind has undergone a fair amount of re-arrangement. Jimmy Carter may have been a fine president here, is was crappy for Israel. Obama may have been a great president here but again, crappy for Israel and he’s just given Israel a final fuck-you.

Any party that could lose to the Republicans, as much of a farce as they’ve become by now, is indeed suicidal.

Alex, your parents do (if they are dead, would) regard you as a failure. The shame of the family. Alex, the success of poverty is oversold, the shame of poverty is not. My daughter knew where I stood(don’t show your face if you live in poverty), she makes 350k a year. Jewish parents want their children to be: MD’s Lawyers, or Engineers(CPA’s are considered to be Jewish engineers-if they are creative, of course). Maybe it is not your fault, maybe it is the fault of your parents in not instilling in you that you must be a winner and not a loser.

Ira how does a nasty piece of shit like you get away with ad hominem arguments on here as opposed to real logic?

From your confabulations I strongly suspect you’re sitting in a mobil home park and posting between huffs of crack.

Your daughter made $35 last year, after factoring the rehab visits, STD treatment, legal fees from trying to get child care from three different daddies etc.

Any “350K” she mumbles around here latest trick’s tool to you over her Obama Fone is mistaken; just because Twitchy Eddie took a bunch of monopoly money from the last house he robbed and took an orange crayon and wrote “K” after all the numbers.

Jeff, don’t claim to be educated or elitest in the least bit. Just my humble opinion and theory…I have been wrong before. Dems control the fed…at least for now. Fed policy will tank the econom and create a financial meltdown so bad no one will ever vote Republican again…we will see if I’m right…if I’m wrong by all means call me out.

I disagree. The Fed is beholden to corporate elites, not political parties. Rates would have gone up under HC regardless. It kept rates low throughout most of the GWB administration to juice up the economy. The Great Recession ensued under Obama. Trump would have as much right to blame Obama as blamed GWB for the economic downturn.

Don, you did claim to be educated. Your exact words were “…I am educated…”

I’m not sure that saying “Dems control the fed” is the most accurate way of putting things. Seems to me that the Fed is simply controlled by our oligarchs, who happen to control both Dems and Repubs. Note the religious affiliation of the head of the Fed – there is a very clear trend that’s almost completely unbroken.

I simply don’t buy into the idea that our two party political system offers two opposing viewpoints. I think that they’re both completely beholden to the 0.1%’ers. And you may be right in that they may choose to tank the economy, as those folks can make money while things are going up and while they’re going down.

Putting this into a Dem vs Repub debate is just buying into the tripe that the mainstream media is putting out as far as I’m concerned. Greenspan, Bernanke, Yellen – I’d say their policies have all been pretty similar, wouldn’t you? Did it matter whether the POTUS was a Dem or Repub?

Isn’t the real story the all cash buyers in the form of REIT’s, foreigners, and other people who have the money?

I understand that plenty of families are indeed paying these prices and signing up for mortgages. But I think the market all over the country, and much of the world, has been warped by the all cash folks. They’re basically betting on future rents more than stocks. After all, there’s no interest to be earned from banks. That’s been going on for 8 years now.

In my view, the only thing that can cause a crash at this point is a jobs crash. If rents go down, then the all-cashers look to get out en masse.

Mike,

You hit the nail on the head.

Remember as well, retirements/pension are HEAVILY invested in REIT’s. Any hiccups and that could spell disaster for pensions which would make all financial & real estate issues 100x worse. In the case of foreigners, a sizeable bubble has been building in China. Chinese citizens are investing in US real estate strictly as a hedge to keep money out of their governments reach. If the bubble pops over there they will have no problems selling houses for less than market to access that money if they need it. This would cause the “crash” that took place last time, but was caused by thousands of unqualified buyers.

Imagine a “perfect storm” worst case scenario…

Mortgages stall and are in trouble caused by a combination of rising rates & increased/all time high debt burden from the credit card/auto/student loan industry.

At some point the China bubble bursts and foreign investors start selling below market to pull out their money.

Finally pensions heavily invested in REIT’s take the biggest hit and approach insolvency faster than ever.

This could reap havoc on the financial sector like never seen before.

Keep in mind this is an idea, and I have been wrong plenty of times before.

But just sometimes I am correct.

Prepare for the worst, hope for the best.

China bubble already popped, thats why Aussie and Canadian economies and currencies are weak. Your perfect storm is here, right now, and most dont want to step out of their normalcy bias and see it. Same as 1999 dot bomb fiasco, same as mid 2000s housing bubble. Few with the stones to see the truth and make the call.

Junior, you are very perceptive. Invest accordingly and things will turn out for you. Good Luck!

Don….I think high housing prices are localized. There is still plenty of cheap land and housing in fly-over land. No bubble there. I own a house that is still 25% below peak 2007 prices.

Ru82, you are correct housing is localized. Problem with flyover country is jobs…

I would move to rural Utah in a heartbeat but there is no where to work.

As a LA resident let me tell you we are almost at the peak of this bubble.

Yes there aren’t as many toxic homes with unqualified buyers…

But…what middle class family can afford to buy a total shithole in the ghetto for 600-700k?

Housing will crash soon when we run out of people who can afford these inflated prices.

If I’m wrong I will eat crow.

Don Ciccio (I hope I don’t have to kiss your ring!) – http://crowbusters.com/recipes.html

Don – yep, same problem as bubble 1.0 – affordability. People cant afford the homes they’re currently in, so no new buyers will step up without fraud based loan programs. Doesnt matter if the loans exist or not, lack of affordability means the market is on borrowed time.

Bottom line, this bubble is all over but the crying.

Back in the day, it was Raytheon, Boeing, and Northrop. And Chevron. Everyone would go to lunch at The Patio and grab a Bigdog (32oz beer), or go over to the Wild Goose for a $4 steak and some ladies on blow.

Nowadays, almost all the Hughes legacy people are gone. So are most of the old spots. Now you have Rock N Brews, a walkable Sepulveda, and the malls on the corner of Rosecrans and Sepulveda.

Raytheon’s south campus on El Segundo Blvd is in the process of turning it’s park and parking lot into shopping. The city wants Hughes Way to connect to El Segundo Blvd, which currently dead ends at Raytheon’s back gate. All this is in process.

El Segundo is becoming quite the little city. They also have the most tax favorability in L.A. County.

I don’t know why everyone thinks it’s another bubble. Are prices high? Yes. Does it suck? Yes. But lending is stable, and cash buyers have influence. Not all cash buyers are filthy rich. Think of it like this. All it takes is one successful moment in life, something a lot of us may never have, but some do. An inheritance. A winning stock. An app that made a half a million. Whatever it is, that person buys a house in L.A. with it, life is easier with no mortgage, etc. I don’t think a lot of L.A. is filthy rich (some clearly are) but a lot of L.A. is successful. There is a big difference

Realist,

We are definitely in an EPIC bubble, I think this time real estate might not be the main attraction though., just a side show. Pensions are another story though…

I don’t know how anyone can say this isn’t a bubble….prices are back and in some cases beyond what was a BUBBLE……and there are less bread winner jobs now making less than then. I’ve said it once I’ve said it 1000 times, when this current bubble pops, and it will, i can’t wait to see all the skeletons in the closet that get exposed as to what is REALLY going on.

Even Trump has said we’re in a massive bubble and he was hoping it was going to crash BEFORE he got elected……too bad for Trump

I think the bubble this time is in bonds/debt, which is MUCH broader and larger than the bubble in securitized mortgages that existed back in 2006. The bond bubble bursting will effect everything including residential mortgages, commercial real estate, auto loans, stock buybacks, credit card debt, Treasuries, etc. etc. etc. This could cause a deflationary spiral.

A lot of people on here saying that prices are back or higher than where they where in 07. That is not true. There is a difference between real and nominal prices. CS is not inflation adjusted. Real prices are NOT back to their peaks and last I read were somewhere around 17% below the peak when adjusted.

That being said, this is a massive bubble. It is a global asset bubble. The other thing people keep incorrectly trumpeting is that ‘real estate is all local.’ No it’s not, read just about anyone ‘local’ headline from India to Kansas City and all of the say things are happening. Rising rents and RE valuations.

This is going to come tumbling down, who knows when or what the specific impetus will be.

Fair enough. However, my retort would be that they are going to print and monetize by absolutely any means necessary to keep things going. Anything to prevent chaos.

@Realist

The actions you suggest would indeed lead to the chaos that you’re trying to avert. The soundness of the dollar would be questioned, and with that the ability to borrow to maintain our daily lifestyles. Real estate would be the least of our concerns.

I’m on the side that it’s not a bubble. I’m not seeing the mania that was going on back in 2006. In 2006 people were taking $0 down loan, ARM, subprime, whatever they could get their hands on to buy a home thinking they can flip it for higher. Now, the majority of buyers are doing 30-yr fixed to lock in the low rate. Inventory is low. Sellers aren’t selling because they can rent it out for more. Where is the crash going to come from? Chinese pulling out due to failing Chinese economy? The reason they poured money over here in the first place was in anticipation of a failing Chinese economy.

“I’m on the side that it’s not a bubble. I’m not seeing the mania that was going on back in 2006. In 2006 people were taking $0 down loan, ARM, subprime, whatever they could get their hands on to buy a home thinking they can flip it for higher.”

Once again, the bubble is in the high prices, not in lending standards. The majority of bad loans were from prime borrowers, not subprime. You need to look deeper at the history of past downturns where price run-ups were caused by over-speculation — too much money chasing too few goods.

“Now, the majority of buyers are doing 30-yr fixed to lock in the low rate. Inventory is low. Sellers aren’t selling because they can rent it out for more. Where is the crash going to come from? Chinese pulling out due to failing Chinese economy? The reason they poured money over here in the first place was in anticipation of a failing Chinese economy.”

The current echo bubble is driven largely by investors who are borrowed billions to drive prices up. Smart investors get out when prices are too high, like they are now. Sam Zell’s company started selling his properties last year. Retail investors are those buy too high; many are flipping like in the previous downturn. Rents are already falling in large markets. Don’t pay attention to the media headlines that herald only sunshine and happiness when prices are at their highest.

Subprime is alive and well. Look at FHA loans. Look at REIT’s issuing low down payment loans.

How long do you think Chinese investors can drive up prices in the U.S. when their economy falters and their government increasingly clamps down on money laundering? Prices in Chinese-driven markets like Vancouver are already falling.

A lot of LA wants you (and everyone) to see that they are successful. A HUGE majority of LA lives paycheck to paycheck on an epic scale. And I mean people at every level of income even those making $250K+/year. I’ve seen it in friends, coworkers, employers, customers. People want to keep up the facade and stay ahead of the “Joneses” that they aren’t prepared for a substantial downturn. I have friends in the entertainment industry that make $500K one year and then can’t get a job to save their life the following. So what is viewed as success from the outside is just a financed lifestyle.

Is it a real estate bubble? In my eyes not specifically, it’s an everything-bubble created by years and years of zero interest rates. You’ve seen all the “savers” chase stock market returns thus a self fulfilling prophecy with stocks going up. What happens when grandma’s index fund takes a 10% wack?

I can’t say my timing has been right but if this house of cards falls it will take real estate and lives along with it.

just my two cents.

El segundo bubble…I can tell you about a young couple who moved in our area from San Jose last month. We live in another state and this is a rather upscale area of mostly retired paid for homes.

Anyway, I get to taking to this young man, he proceeds to tell me his wife and him make 350k a year and now work out of their new home now and don’t have to live in CA.

They put down 5% he said ( proud of it is how he put it) and carry a very high payment and like he said they make a lot of money? They also lease 3 cars. He then tells me, “looks like a fancy area” we will not be landscaping for a while and have little to no furniture. Also you might not see lights on at night this 4300 sq. ft home uses a lot of electric.

I went home and told my wife a short sale or bank owned will be coming soon, these kids say they make $350k a year and can’t afford to turn on LED lights. San Jose was to rich for their blood and here it is no different, they don’t know how to save or spend a dollar, no matter where some of these millennials end up they have no clue of hard times, I hope this never happens, but if and when the bank comes calling because the $350k job went away, than they will have more to worry about than saving energy?

Completely agree. Well stated. It different in certain ways this time, but overall its not. We are definitely in an “everything” bubble.

Sounds like the couple is house rich and cash poor. Also wonder if they got promised a big salary+bonus up front as a recruitment tool, only to find that gets yanked from them after 6-12 months – a number of sleazy companies do this to attract talent initially, then when they know you’ve adjusted your life accordingly they flip the script on you. Saw this happen to a guy I used to work with, he quit out of pride once his salary got reduced big time, been taking odd jobs since barely making ends meet – masters from harvard.

I read a while back that there are 78 million ‘hand to mouth rich’, i.e, high wage families who live paycheck to paycheck. I would envision many of them living in places like L.A., Orange County, and S.F. Bay area. Their entire paychecks, even though hefty go for rent/mortgage, the spa, private schools, expensive cars, expensive golf outings, and fancy indulgences! And they save nothing! Scary as well, I’ve read several articles that indicate California has the highest personal income taxes, the highest business and corporate taxes, that 1% of the State’s population pay 50% of the taxes, that if California were to use different accounting methods there would be a 1/2 trillion deficit accounting for all those pension accruals etc., and that many cities pay more than a 1/3 of their budgets to pensions, and this number keeps growing. A rude surprise is in store at some point for those who remain in LaLa land!

I think this might be right time for the good doctor to trot back out his epistle on the land use policies of our government and how it has brought us these hellacious property values. Miami is pricey beachfront property so builders went up. Not here. A beachfront bungalow here is almost a meme. I looked up a house in western New Jersey I lived in 30 years ago and was shocked to see a “Zillow value” that was an awful lot like what I sold the house for back then. Of course there’s plenty of land available there too. What’s going to happen here? Maybe 100 year mortgages, maybe everything is a rental from a hedge fund. I guess we’ll see.

The housing market is susceptible to rising long term interest rates which could conceivably materialize in a Trump presidency with deficit spending on infrastructure, failure to control entitlement spending and rising inflation. The last bubble was created by unregulated mortgage lending practices. The current housing reflation has been fanned by ARTIFICIALLY ultra low interest rates. This too may end. Save your money.

After Obama doubled the national debt from 10 Trillion to almost 20 Trillion, there are no more good solutions. Some solutions are bad and some very bad.

With the mountain of debt to be serviced, taxes are going to kill any economic initiative. There is a mountain of government debt, student debt, auto debt to be serviced. If you lower taxes, the deficit grows higher and put pressure on interest rate which kill the economy. Trump might mean well for the economy but he is kind of trapped under the mountain of debt created by Obama. At this point, it doesn’t mater what he is doing he will be doomed and criticized for it.

Unless he is doing something drastic to shake the system to the core, he doesn’t have any good options in the current system. However, all the establishment, democrats and republicans alike are too vested in the current system and benefiting from it to allow him to shake the system. As things stand, the middle class will continue to lose.

Bullseye…

I agree Flyover, Trump is going to have a rather rough go making any dent in the 20 trillion debt he takes on. The word Trillion alone was never in ones vocabulary billion seemed out of sight.

It will be a daunting task, I hope Mr. Trump again proves most wrong and at the end of his first 4 years we see some reversal but it is probably a long shot.

The middle class is just a long lost memory, today I like % numbers, the 10% are fine and not caring about the other 90% who all but are forgotten and flounder about year after year.

When voting comes around they get attention after election day they are a distant memory for the real players in the world.

Have a heathy new year, always remember, no matter how wealthy you can’t health?

“It will be a daunting task, I hope Mr. Trump again proves most wrong and at the end of his first 4 years we see some reversal but it is probably a long shot.”

Robert,

There are NO GOOD solutions to the current financial situation in US. The ROOT of the problem is twofold:

1. The FED and debt money system we live in. This is the main one, the second point being indirectly a byproduct of the first. In the current system, paying down debt means contraction of money supply. Depending on the size of this contraction you have recession or depression.

2. We have a moral crisis. Think about the family unit of 50 years ago for both whites and blacks. These days, most children are born to single moms. The economic crisis is a by product of the moral crisis. You can write volumes on this correlation and CAUSATION. It does not matter if someone agrees with it or not, it affects 90% of the society.

The first root can be addressed ONLY by what JFK attempted – eliminate the FED. Trump NEVER promised to do that. As long as you have a debt money system, the corruption of the society will continue and the economy will reflect this rot.

I agree that the prevalence of cash buyers is somewhat perplexing and sort of upends the notion of a classic bubble with levered owners. The reason this thing might not have a huge freefall though is that a lot of us are potential cash buyers lying in wait and many have not deployed cash yet. But ultimately I am convinced that the downward pressure on valuations (when this global monetary policy fueled frenzy unravels) will be the dominant factor and sideline cash buyers will be a drop in the pan against the backdrop of macro market pressures.

Real estate won’t lead us into economic contraction like last time, but when the recession hits real estate is in for a good pool-table rogering.

Hi Miyagi,

I’m kinda with you on this one. There’s a huge difference between owner-occupants with mortgages not being able to pay… and cash owners taking losses when rents decrease. There’s less bank credit involved.

I think the interesting question is… if we had a pie chart of the all cash people, who are they? Is 20% Chinese? 10%? 40%? What about the REIT’s? 30%?

If the REIT’s have an enormous percentage of major metropolitan areas, what does that mean? Do tons of retiree and pension funds play landlord to, um, themselves or other family members? Is that possible? What would that mean?

I can only envision one spark that could wreak havoc fairly quickly on real estate. If more and more tech jobs flee to India, Philippines, and elsewhere, that’ll mean a ton of salaries disappearing from the US. But it’s hard to gauge if something like this is imminent.

What do you think?

Hi Mike, I do not know the percentage of cash buyers, I’ve heard different numbers from different sources and don’t know what to believe. I suspect that most cash buyers are a result of equity from their downlegs (the property they sold.)

What I disagree with though and I hear from others on this site, is the notion that the cash people are buying with is not ‘real’ cash or on credit cards etc.. That is not even how it works. There is no such thing as someone borrowing illicit funds and closing a transaction all cash. These are conspiracy theories. You can’t close escrow for example unless you have seasoned funds etc. etc. No title company will do it. A cash buyer is a cash buyer. And there are a lot of cash buyers right now. What’s more pertinent though in my opinion is that there are even more of us on the sidelines with cash.

There needs to be a major price reset. It is insane what first time buyers have to lever into for shelter. That and for us investors there needs to be compensation for cleaning toilets. Anyone whose bought a rental in the last several years is cleaning toilets for free whether they know it or not yet. I don’t mind cleaning toilets (and far worse at move out–but I think I’d be edited by the moderator if I went into detail) but I need some compensation for it which I don’t think is unreasonable or greedy.

Cash buyers. For a long while SoCal MFD investors were squeezing out other potential buyers buy offering all cash. Once the property was tied up, they started the loan process, many times getting the appraisal completed and loan approval while in escrow. Granted, no formal financing contingency, but all the ballyhooed apt buyers just levered up after the acquired the property and did it again on another property. tertiary markets have warmed up again… this is not new… as are the claims that the beanstalk will grow to the clouds. I sold a rental property in Manhattan Beach back in the last upcycle. I was did right – what I did wrong was linear thinking as I never imagined the FED would do what they have done. Lots of linear thinking on this blog. You can overpay cash for real estate and survive… overpaying with high leverage is a different story. All that cash buying… they must have groves of dollar trees? LOL

What i would like to know is what % of these all cash buyers are owner occupied and what % are those buying to rent out.

Either way wouldn’t that buoy the market on the downside?

What Doc is showing us is one of the hot housing markets. There are thousands of housing markets in the US; some ‘hot’ and some ‘not’ according to Charles Hugh Smith.

http://www.oftwominds.com/blogdec16/hot-housing12-16.html

El Segundo, along with the entire Westside from Malibu to Palos Verdes is probably explained here

“Creative class wages are highest in the regions with strong GDP expansion and concentrations of GDP, capital and talent. Attracting the most productive workers requires hefty premiums in pay and benefits, as well as interesting work and opportunities for advancement.

That people will make sacrifices to live in these areas should not surprise us–including paying high housing costs. This willingness to pay high housing costs attracts institutional and overseas investors, a flood of capital seeking high returns that further pushes up the cost of housing.”

Interesting looking at the map. You can clearly see concentration of GDP is all near lakes or the ocean. Maybe a little in Colorado. However, housing and jobs are part of the equation but location is the other key part based on what I see here. Unless tourist attraction places ever come out of favor will we ever see a change in housing valuations in other areas of the country. In addition, Tornados, Hurricanes and flood zones probably create walls for development as well.

Major cities have always been located near water… and likely always will be.

That is pretty obvious based on the link. If water is near. Great.

The point I am trying to make is that there are many areas around the county where another center for growth could occur but does not appear to be happening quick enough or it never will, which begs the question. What is all the other small towns supposed to do to generate higher GDP? They could certainly sell themselves as business friendly, but unless you have a convincing location to setup shop for the mass it will need some serious help from business or innovation. If another major invention happened in Billings Montana or some unheard of place you think business would be willing to invest heavily there or tell them to come to a warmer climate with updated infrastructure? This would help indicate to the mass what people find is important about where we may want to prosper. Is moving IT to Montana worth the money or bringing them to an overheated market to only be subject to high costs? Who really is benefiting here anyways? This is the reason why the GDP may only stay concentrated in those cities on the map for some time to come.

2017… Dr. Housing Bubble, this continues to be a very worthwhile housing platform, most posters are well verse in their thoughts of not only housing but the well being of the country.

Thanks for your continuance data and insight on California and the nation as housing is such a driving force to our economy.

So, watch out for what happens with Trump and his proposed tax plan. There are two proposals in particular that I believe will have a significant effect on the housing market. I live in California, which as you know has one of the highest state individual income taxes in the country. The two proposals are as follows:

No state income tax deduction for federal income tax purposes as an itemized deduction

Increase the standard deduction to $30,000 for a married couple filing jointly.

The effect of these two proposals is to cut down substantially the number of people that will itemize their deductions. As you know, mortgage interest expense on a principal residence is an itemized deduction.

So, if a couple’s decision on whether to purchase or continue renting is based upon tax considerations, this will skew the needle in the direction of renting. The reason is that a couple’s tax benefit from the mortgage interest deduction starts AFTER $30,000. Given that the mortgage interest deduction itself is limited to interest on the firs $1.1 million of mortgage debt, this means that most people will get zero tax benefit from the mortgage interest deduction.

Other demand factors remaining constant, this should have the effect to reduce demand for housing, cause an increase in inventory and, eventually, a reduction in price.

So married/couples would get $30k off for deductions and for single it is $15k? The deduction makes sense for renters since large property lords likely want to keep the apartments 100% maximized while they start chipping away at this massive deduction. At the same time any small landlords might find this to be windfall for them as well. I would be curious to see how high rents will climb now that a new deduction maybe coming to town? That is 4 maybe 8 more years that securitized rents will be allowed to keep churning away.

I would be curious now what kind of income you would need to have if this deduction comes to pass? If the deduction is more a less a secret HUD subsidy to keep you from moving will they say you need 50%-60% to cover rent? But Don’t worry your next year subsidy will cover any future rent increases?

As for all other owners who bought low and still have a mortgage this could be a nice deduction.

Robert, good point about Trump’s plan. I may get a double whammy if this goes through, plus his change in effective rates for a given salary range.

Nothing I can do about it at this point as I’ve taken out the 30 yr mortgage on my home and don’t have the cash on hand to just pay it off…

I’ll be watching to see what actually transpires. Should be interesting!

The high state income tax states did not vote for Trump, so he will enjoy sticking it to them. Texas does not have an income tax. When you(NY and CA) are on the losing side, you do not have a seat at the table.

Happy New Year and what comes with it! Like robert, I agree that the Dr’s articles have been very insightful and the commenters have added to the discussion in a positive way. Unlike social media platforms, the comments have been polite (albeit with a few good natured barbs). Please keep up the good work and keep things civil even when Jim Taylor’s tanking hard predictions come true.

Agreed! I enjoy the Doctor’s articles, but especially everyone’s views in the comments. No matter if we agree or not everyone keeps it civil and has respect.

Housing to tank in 2017 & 2018.

Jim,

A few years ago, I too thought (and hoped) housing would tank hard in 2017. Based on the strength of the housing market (especially in desirable areas of CA), I will revise my prediction to “Housing to Tank Hard in 2020/2021.” You will likely need a nasty recession to really tank the market…and there are no signs of a big recession in the very near future. Happy New Year!

“and there are no signs of a big recession in the very near future”

Based on what? The mainstream media that practically crowned Clinton the next POTUS up till a few hours before her concession? A president-elect Clinton would have been the best sign for the alleged economic strength. But voters didn’t feel the same way.

What about the strengthening of the dollar vs. the other curencies???!!!…. When the profits are posted in US dollars are they going to be lower or higher? If lower, could a crash happen? If it does, is the RE immune to lower stock prices and higher interest rates???!!!! If the companies who borrowed to the max have to pay more in interest, are the profits going higher or lower???

Lol. This ought to ensure that there’s No tanking or correction during those years.

El Segundo’s “good schools” is simply not true. We strongly considered El Segundo more than once. Quality of schools torpedoed it. Everyone living there will tell you how awesome those schools are but if you do a bit of research you will find otherwise.

I have many friends there. Even the ones who inherited their homes don’t surf there. They go down to Manhattan. Good people there though. Or should I say “doe”?

Nobody knows what Trump will do. I don’t think he cares about his “legacy”. Interest rates will continue to rise. Obama’s placements on the Federal Reserver’s board clearly agreed to kick the can. Speculation that the Fed and The President Elect will bump heads (they always assume he won’t want to own the interest rate induces contraction) is simply not paying attention.

Agree on REITS. Look at all of the Wiseman “Experience Good Living” buildings in the fashionable part of LA. They’re empty. And for good reason. 4k for a tiny fake three bedroom with none of the old LA charm that used to attract renters. I have no idea what’s driving these but you can’t have all of these giant buildings empty. Seen it before in the late 80’s. They all became crack houses in the 90’s. And those neighborhoods are still pretty frightening. The only way I can explain these is REIT money. They don’t care what happens to investors with a 200k minimum buy in. They got their’s.

Happy New Year Jim!

Leave a Reply